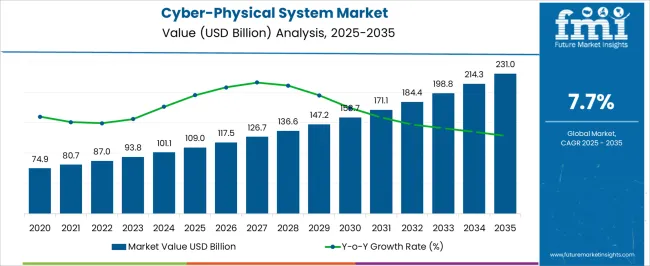

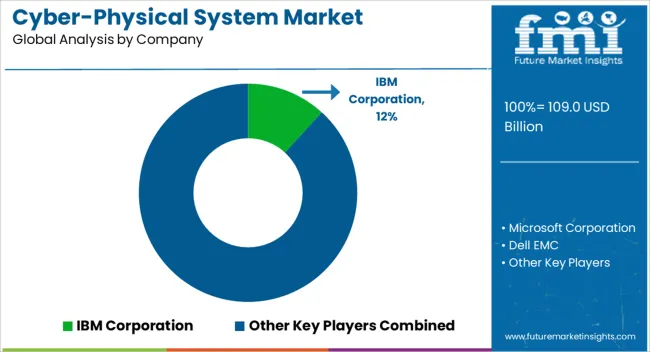

The Cyber-Physical System Market is estimated to be valued at USD 109.0 billion in 2025 and is projected to reach USD 231.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Cyber-Physical System Market Estimated Value in (2025 E) | USD 109.0 billion |

| Cyber-Physical System Market Forecast Value in (2035 F) | USD 231.0 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The cyber-physical system (CPS) market is advancing rapidly, supported by the convergence of digital technologies with physical processes across industries. Industry reports, government initiatives, and corporate disclosures have highlighted CPS as a key enabler of smart manufacturing, intelligent infrastructure, and resilient supply chains. The rising adoption of Industry 4.0 practices, integration of IoT-enabled devices, and deployment of real-time monitoring systems are accelerating CPS implementation.

Security considerations have become increasingly critical, as connected environments present heightened risks of cyberattacks targeting operational technology. Consequently, enterprises and governments are channeling significant investment toward CPS security and data protection.

On the technology front, advances in AI, digital twins, and predictive analytics are enhancing CPS performance, driving adoption across manufacturing, energy, healthcare, and transport sectors. Future growth is expected to be driven by the scaling of cloud-based CPS platforms, expansion of smart factories, and adoption of autonomous systems, with security, software solutions, and manufacturing applications at the core of segmental expansion.

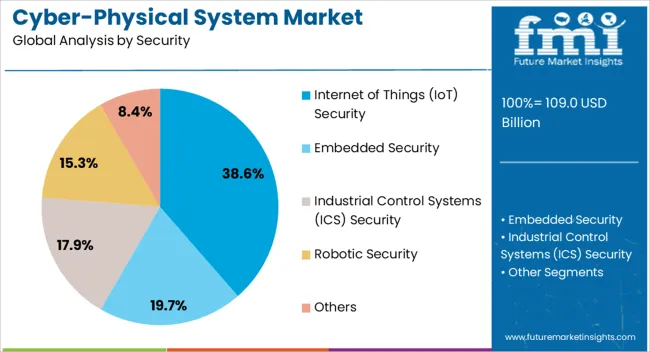

The Internet of Things (IoT) Security segment is projected to account for 38.6% of the cyber-physical system market revenue in 2025, maintaining its leadership position within the security landscape. This dominance has been supported by the proliferation of IoT devices across industrial and consumer applications, which has heightened vulnerability to cyberattacks and data breaches. Industry updates and security advisories have emphasized that IoT endpoints often serve as entry points for system compromise, driving demand for specialized CPS security frameworks.

Investment in IoT-focused encryption, authentication, and intrusion detection systems has grown, supported by regulatory requirements and international cybersecurity standards. Enterprises have prioritized IoT security as an essential layer for operational continuity, particularly in critical infrastructure sectors.

As the scale and complexity of IoT deployments increase, the IoT Security segment is expected to retain its leadership, driven by its role in mitigating systemic risks and enabling trust in connected CPS environments.

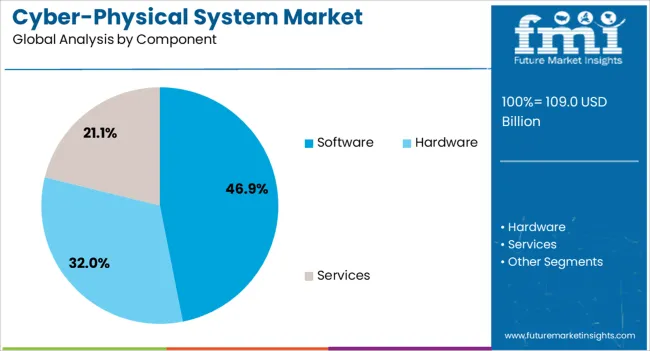

The Software segment is projected to contribute 46.9% of the cyber-physical system market revenue in 2025, establishing itself as the leading component category. Growth in this segment has been driven by the essential role of software in enabling communication, control, and optimization between physical assets and digital platforms. Advances in middleware, real-time analytics, and simulation tools have expanded the functionality of CPS, supporting predictive maintenance and autonomous decision-making.

Corporate disclosures and product launches have highlighted increasing investment in software platforms that integrate AI and machine learning to enhance system adaptability. Additionally, the flexibility of software allows scalability across industries, reducing implementation barriers and enabling customization for diverse end-use applications.

The growing demand for digital twins and virtualization technologies has reinforced software’s role at the center of CPS innovation. With continuous upgrades, open-source frameworks, and cloud-native architectures, the Software segment is expected to maintain its leadership in driving CPS adoption.

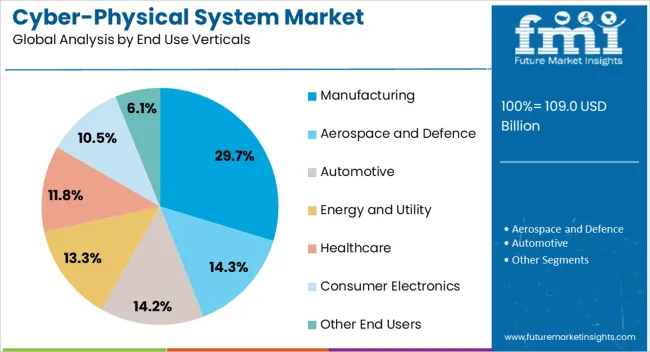

The Manufacturing segment is projected to account for 29.7% of the cyber-physical system market revenue in 2025, leading all end-use verticals. This prominence has been attributed to the integration of CPS in smart factories, where automation, robotics, and real-time monitoring are central to operational efficiency. Industry 4.0 initiatives have accelerated CPS deployment in manufacturing to optimize production lines, reduce downtime, and ensure quality assurance.

Press releases and industry case studies have noted significant investment in CPS-enabled predictive maintenance, supply chain visibility, and energy-efficient production systems. The manufacturing sector’s reliance on precision, speed, and safety has further supported adoption of CPS frameworks, particularly in automotive, electronics, and heavy machinery industries.

Additionally, the adoption of CPS has been linked to enhanced workforce safety and compliance with regulatory standards. With ongoing digital transformation initiatives and expanding adoption of autonomous and semi-autonomous production systems, the Manufacturing segment is expected to remain the most significant end-use vertical for CPS deployment.

Surging adoption of basic components of cyber-physical systems like memory units, sensors, storage devices, and monitoring devices computing units in many new sectors.

Energy and utility industries, in particular, are expected to spur substantial demand for cyber-physical systems due to their application in smart grid technology.

Cyber-physical systems have a crucial role in the development and optimization of autonomous cars and intelligent transportation systems. Increasing emphasis on raising the sales of electric vehicles is projected to fuel the demand for CPS for the creation of automated EVs.

Embedded cyber-physical systems are slated to acquire a 38.4% share in 2025. Factors governing the rapid sales of this security type include reducing prices of networking devices and IoT sensors are boosting the adoption of in-built or embedded security systems.

| Leading Security Segment | Embedded Security |

|---|---|

| Value Share (2025) | 38.4% |

Surging demand for cyber-physical embedded systems in EVs is further spurring the sales of cyber-physical systems in the automotive sector.

The automotive sector is projected to register a 37.7% share of the total revenue generated in 2025. Additionally, the segment is anticipated to observe lucrative growth over the forecast period.

| Leading End Use Vertical | Automotive |

|---|---|

| Value Share (2025) | 37.7% |

Rising demand for cyber-physical systems in Electronic Control Units (ECUs) in automotive is pushing the sales of cyber-physical systems. ECUs are increasingly deployed to control different mechanical subsystems like engines, brakes, steering, and suspension. This ensures maximum utilization of fuel or energy in automotives by discarding the use of surplus energy.

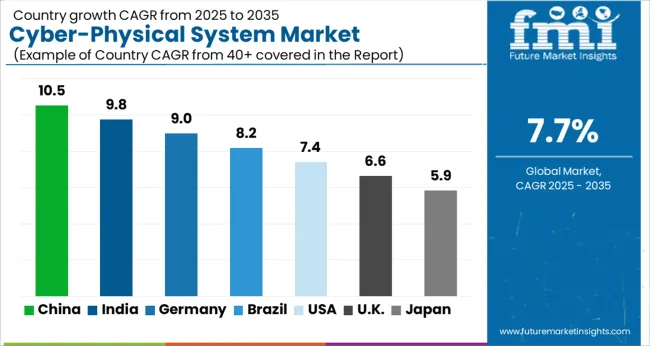

Quantitative insights related to growth projections of cyber-physical systems in the top five countries point to an interesting future for industry vendors. Companies are expected to experience robust growth in the United States, China, Australia and New Zealand. The last one is on the radar of several firms due to higher growth prospects emerging in Australia and New Zealand.

Based on the proceeding table, it can be concluded that Asia Pacific, except Japan and North America, are going to be destination areas for leading providers of cyber-physical systems.

The cyber-physical system market in the United States is flourishing at a 15.1% CAGR over the forecast period. Advanced infrastructure for the adoption of progressive technologies like artificial intelligence and IoT in several industries is building a conducive environment for the use of cyber-physical systems.

Significant presence of several world-renowned technology and IT companies, such as Microsoft, IBM, and others, in the United States is increasing the competitiveness of the industry.

Recently, success patterns have emerged for creating cyber-physical systems with Agile that are advancing the industry's growth. The market is expected to benefit from the launch of multidisciplinary projects to simulate, model, and analyze cyber-physical systems (CPS), to make these systems more robust and their analysis more effective and scalable. In April 2025, for instance, the Defense Award introduced the Purdue project to make cyber-physical systems stronger.

The demand for cyber-physical systems in Germany is increasing at a sluggish 3.3% CAGR during the forecast period. Despite the present maturity levels in Germany, the regional market is widely recognized as a prominent player in the whole of Europe.

The presence of developed infrastructure for automotive, manufacturing, energy, and utility sectors is increasing the adoption of cyber-physical systems in Germany.

Latest developments, such as the initiation of the Industry 4.0 project by the German government, are expected to improve the scope of cyber-physical systems in the country. IoT and cyber-physical systems form the technological base for this project.

In China, the cyber-physical system industry is projected to expand at a CAGR of 14.5% over the next ten years. The surging adoption of cyber-physical systems is fast replacing traditional industrial systems for streamlined integration of autonomous operations.

China’s leading position as a supplier and manufacturer of cyber-physical system hardware in the Asia Pacific is driven by the strong electronics manufacturing sector and low-cost labor availability.

Rising risks to national safety are further pushing cybersecurity experts and researchers to engage in an endless race to deal with digital vulnerabilities emerging in the private and public sectors.

Demand for cyber-physical system solutions and services in Japan is expected to register a steady 3.6% CAGR during the studied period. Growing demand for cyber-physical system services in various sectors, such as smart grids, smart factories, smart healthcare, and a few other industries.

Robust presence of favorable policies, MNCs, and reputable supplier network supporting the CPS industry.

The cyber-physical system market in Australia and New Zealand is poised to offer a lucrative environment for players. The industry is expected to expand at a robust 17% CAGR over the stipulated period.

The continuous entry of international cyber-physical system vendors and manufacturers in these two countries is enhancing the industry’s growth prospects. Additionally, strong investment by the government to promote IR 4.0 and boost the application of other future-oriented technologies across different sectors is accelerating the use of CPS.

Cyber-physical system sector is highly consolidated as few leading technology firms continue to wield their power over the global market. Several top manufacturers are heavily investing in research and development practices and product innovation to broaden the use cases of cyber-physical systems.

Research activities are also aimed at advancing core technologies like artificial intelligence (AI), the Internet of Things (IoT), and machine learning (ML). New players are attempting to accelerate their business transformation, facilitated by the latest technology, while increasing their customer base.

CPS vendors are collaborating with research institutions and solution providers to increase their industry share. This is resulting in faster development cycles, knowledge sharing, and integration of different platforms to provide comprehensive CPS solutions.

Latest Developments Uplifting the Cyber-Physical System Industry

Based on security, the industry is divided into embedded security, industrial control systems (ICS) security, robotic security, Internet of Things (IoT) security, and others

By component, the industry is categorized into hardware, software, and services

Various end-use verticals that deploy cyber-physical systems are aerospace and defense, automotive, energy and utility, healthcare, manufacturing, consumer electronics, and others

Industry analysis has been carried out in key countries of North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

The global cyber-physical system market is estimated to be valued at USD 109.0 billion in 2025.

The market size for the cyber-physical system market is projected to reach USD 231.0 billion by 2035.

The cyber-physical system market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in cyber-physical system market are internet of things (iot) security, embedded security, industrial control systems (ics) security, robotic security and others.

In terms of component, software segment to command 46.9% share in the cyber-physical system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA