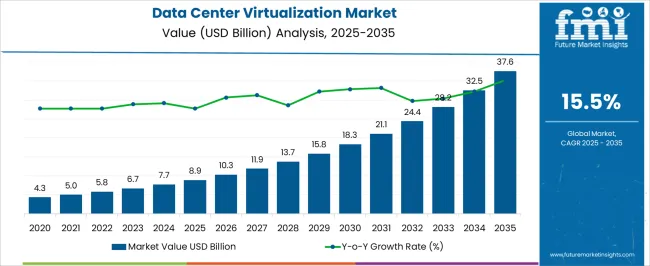

The data center virtualization market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 37.6 billion by 2035, registering a compound annual growth rate (CAGR) of 15.5% over the forecast period. A saturation point analysis shows that the market experiences strong growth, followed by a period of stabilization as it matures. Between 2025 and 2030, the market grows from USD 8.9 billion to USD 18.3 billion, contributing USD 9.4 billion in growth, with a CAGR of 15.5%. This early-phase growth is driven by the increasing demand for virtualization technologies in data centers, where businesses seek to optimize resource utilization, improve flexibility, and reduce operational costs.

During this period, the market is in an expansion phase, benefiting from the rapid digitalization and cloud adoption across industries. The first inflection point occurs around 2030, when the market reaches USD 18.3 billion, marking a shift to more incremental growth. From 2030 to 2035, the market continues to expand from USD 18.3 billion to USD 37.6 billion, contributing USD 19.3 billion in growth, with a slightly lower CAGR of 15.2%. This slower growth indicates that the market is approaching its saturation point, with many large enterprises already adopting virtualization, while growth continues due to innovation, particularly in hybrid and multi-cloud environments. Despite the deceleration, the market remains strong as emerging markets and technological advancements in data center virtualization drive continued expansion.

| Metric | Value |

|---|---|

| Data Center Virtualization Market Estimated Value in (2025 E) | USD 8.9 billion |

| Data Center Virtualization Market Forecast Value in (2035 F) | USD 37.6 billion |

| Forecast CAGR (2025 to 2035) | 15.5% |

The growing adoption of cloud-native architectures, containerization, and the push for reduced operational complexities in IT environments shape the current landscape. Corporate announcements and industry publications have consistently highlighted how businesses are embracing virtualization technologies to streamline workloads, improve disaster recovery capabilities, and ensure business continuity.

Regulatory focus on data sovereignty and security has also played a critical role in accelerating virtualization adoption across regions. The future outlook is supported by the rising deployment of software-defined data centers and the integration of AI and machine learning into IT operations.

As organizations modernize their legacy infrastructure, data center virtualization is expected to remain central to enterprise digital transformation strategies. Strategic investments, technology partnerships, and increasing demand for energy-efficient solutions are further expected to fuel long-term growth in this market.

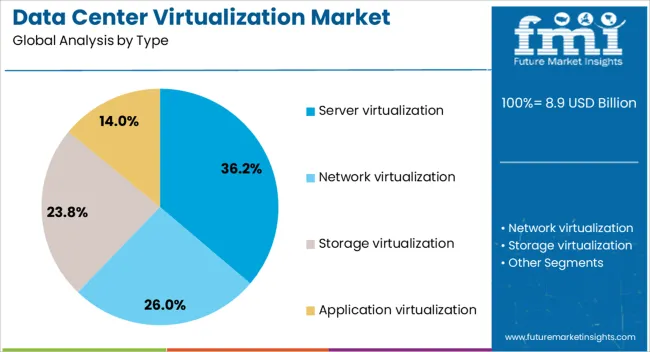

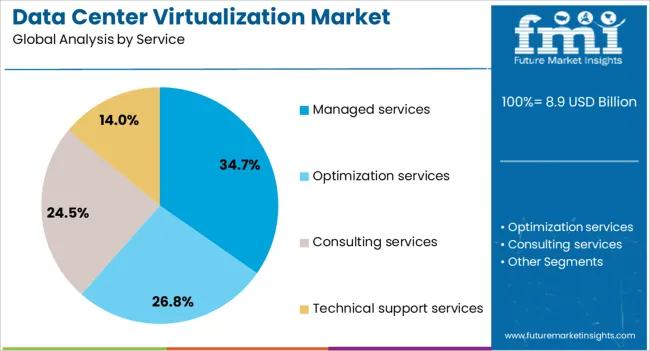

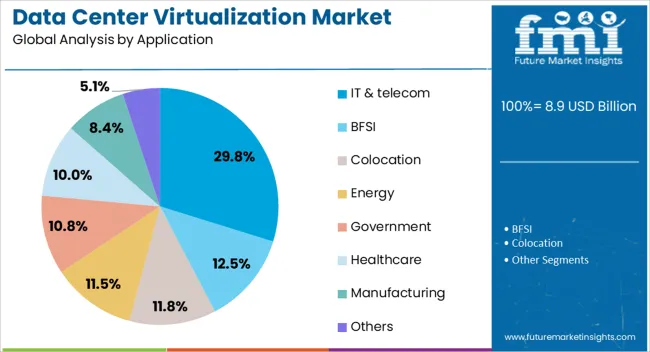

The data center virtualization market is segmented by type, service, application, and geographic regions. By type, the data center virtualization market is divided into Server virtualization, Network virtualization, Storage virtualization, and Application virtualization. In terms of service, the data center virtualization market is classified into Managed services, Optimization services, Consulting services, and Technical support services. Based on application, the data center virtualization market is segmented into IT & telecom, BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, and Others. Regionally, the data center virtualization industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The server virtualization segment is projected to hold 36.2% of the Data Center Virtualization market revenue share in 2025, making it the leading type segment. This leadership has been supported by the segment’s ability to optimize server utilization, reduce hardware dependency, and improve scalability within data centers. According to technology announcements and CIO interviews, enterprises have increasingly relied on server virtualization to lower capital expenditures while enhancing operational efficiency.

Its role in consolidating workloads, facilitating rapid deployment of applications, and supporting hybrid cloud models has further elevated its relevance. Improved security controls, faster provisioning, and seamless disaster recovery options have also influenced adoption.

The preference for server virtualization has continued to rise as it allows IT teams to manage resources more dynamically without compromising on performance. These factors, combined with strong vendor support and ecosystem maturity, have ensured the segment’s dominant position within the market.

The managed services segment is expected to account for 34.7% of the Data Center Virtualization market revenue share in 2025, making it the most prominent service segment. Growth in this segment has been attributed to enterprises increasingly outsourcing the management of complex virtualized infrastructures to improve efficiency and reduce internal IT burdens. Press releases from technology service providers have emphasized how managed services offer cost predictability, expert oversight, and faster deployment cycles for virtualization solutions.

As data centers evolve to include multi-cloud and hybrid environments, managed services have enabled businesses to maintain performance and compliance without extensive in-house capabilities. Adoption has been further driven by rising cybersecurity demands and the need for 24/7 monitoring, support, and infrastructure optimization.

The ability to scale services according to operational requirements and align with strategic digital transformation goals has reinforced the segment’s relevance. These advantages have collectively supported its leadership in the service category.

The IT and telecom application segment is projected to contribute 29.8% of the Data Center Virtualization market revenue share in 2025, leading all other application areas. This position has been supported by the industry's high demand for flexible, high-performance, and scalable infrastructure to support data-heavy operations.

Investor briefings and industry reports have highlighted that telecom operators and IT service providers have increasingly virtualized their core network functions and backend systems to enable faster service delivery and reduce infrastructure costs. The integration of 5G technologies, edge computing, and cloud-native platforms has required robust virtualized environments that can adapt in real time.

Furthermore, the need to manage massive volumes of data with minimal latency and enhanced security has made virtualization a critical component for this sector. Strategic partnerships, investments in private cloud infrastructure, and continuous innovation have contributed to the dominance of the IT and telecom segment in this market.

The data center virtualization market is growing as companies increasingly adopt virtualization technologies to optimize their IT infrastructure, improve efficiency, and reduce costs. Virtualization enables data centers to consolidate hardware, enhance resource utilization, and provide scalable computing environments. With the rise of cloud computing, hybrid environments, and the need for high availability, data center virtualization is becoming a key solution for businesses seeking flexible, agile, and efficient data management systems. While challenges such as security concerns and integration complexity persist, technological advancements continue to drive the market forward.

The data center virtualization market is primarily driven by the growing demand for cloud computing services and the need for scalable, flexible IT infrastructure. Virtualization allows organizations to maximize resource utilization by partitioning physical servers into multiple virtual machines, making it an ideal solution for managing the expanding workloads generated by cloud environments. As businesses move towards cloud-based operations, the ability to quickly scale resources and maintain high-performance computing environments is critical. Virtualization also helps improve disaster recovery, reduce downtime, and enhance operational agility, all of which are key benefits driving adoption. Furthermore, the increasing need for business continuity, cost reduction, and enhanced data center management is pushing organizations to invest in data center virtualization technologies.

A key challenge in the data center virtualization market is addressing security concerns related to virtualized environments. With the consolidation of multiple virtual machines on a single physical server, security risks, such as data breaches, cyberattacks, and unauthorized access, can increase. Protecting sensitive information in virtualized environments requires robust security protocols, encryption, and regular vulnerability assessments. Additionally, integrating virtualization technologies into existing IT infrastructures can be complex and time-consuming. Organizations may face compatibility issues when integrating new virtualization systems with legacy hardware or software. Furthermore, the high costs of implementing data center virtualization solutions and the need for skilled personnel to manage the infrastructure can be barriers to adoption, particularly for small and medium-sized enterprises.

The data center virtualization market presents significant opportunities with the rise of hybrid and multi-cloud architectures. Virtualization technology plays a critical role in enabling businesses to deploy a flexible IT infrastructure that can seamlessly operate across public and private clouds. By virtualizing their data centers, businesses can move workloads between different cloud environments to optimize performance, reduce costs, and improve resource allocation. Moreover, the increased adoption of edge computing is driving demand for virtualization solutions to manage decentralized IT infrastructures. Additionally, innovations in software-defined data centers (SDDC) and containerization technology are creating new avenues for businesses to improve their virtualized environments, streamline operations, and enhance scalability.

A key trend in the data center virtualization market is the increasing adoption of software-defined data centers (SDDC) and containerization. SDDCs allow for greater flexibility and control by abstracting and virtualizing the hardware and storage resources of a data center, enabling businesses to manage their entire infrastructure through software. Containerization, which involves running applications in lightweight, isolated environments, is becoming increasingly popular due to its efficiency and portability across different environments. As businesses look for ways to improve resource utilization, accelerate application deployment, and enhance scalability, virtualization technologies like SDDCs and containerization are increasingly integrated into data center architectures. These trends are shaping the future of data center virtualization, enabling organizations to build more dynamic, scalable, and agile infrastructures.

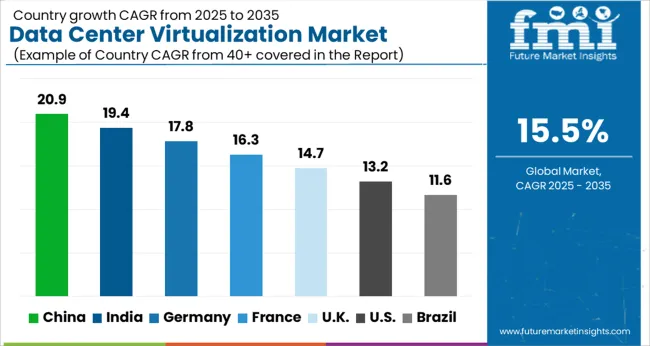

The data center virtualization market is projected to grow at a global CAGR of 15.5% from 2025 to 2035. China leads the market at 20.9%, followed by India at 19.4%, and Germany at 17.8%. The United Kingdom is expected to grow at 14.7%, while the United States shows a growth rate of 13.2%. The increasing adoption of cloud computing, the demand for cost-effective and scalable data management solutions, and the rapid growth of digital infrastructure in emerging markets like China and India are major drivers of growth. Developed economies such as the USA and UK are also experiencing steady growth, driven by the need for efficient data storage and management solutions. As the demand for virtualized infrastructure rises, the market is set to expand rapidly across these key regions. The analysis includes over 40 countries, with the leading markets shown below.

China is projected to grow at a CAGR of 20.9% through 2035, making it the leading market for data center virtualization. The rapid digitalization of industries, supported by government investments in cloud computing, is a key factor driving growth. China’s growing e-commerce, IT, and telecommunications sectors are expanding the demand for efficient data management solutions, propelling the adoption of data center virtualization. The increasing need for flexible, scalable, and cost-effective infrastructure for businesses is pushing the demand for virtualization technology. China’s vast population and expanding technological ecosystem are key to its market leadership.

India is projected to grow at a CAGR of 19.4% through 2035, driven by the increasing adoption of cloud computing and virtualization technologies across industries. As the country continues to expand its digital economy, businesses are investing in data management solutions to optimize their infrastructure. The government’s initiatives to promote digital transformation in sectors such as banking, healthcare, and manufacturing are also boosting the adoption of data center virtualization. As India embraces emerging technologies like 5G and artificial intelligence, the demand for efficient and scalable data storage and management solutions is expected to rise, further driving market growth.

Germany is expected to grow at a CAGR of 17.8% through 2035, driven by the country’s strong industrial base and increasing reliance on data-driven solutions. The growing demand for cloud-based services and digital transformation across industries is pushing the adoption of data center virtualization. Germany’s robust economy, with its focus on automation, manufacturing, and IT services, is a key driver for virtualization technology. As businesses look to enhance their operational efficiency and reduce IT costs, the adoption of data center virtualization is expected to rise significantly. The government’s support for digitalization is further fueling the market.

The United Kingdom is expected to grow at a CAGR of 14.7% through 2035, with demand for data center virtualization driven by increasing cloud computing adoption and the growing need for efficient IT infrastructure. The UK has a well-established IT services industry, and businesses are increasingly turning to virtualization to reduce costs, improve scalability, and enhance data security. As industries continue to embrace digital transformation, the adoption of virtualized infrastructure in data centers is expected to grow. The UK government’s push toward digital economy initiatives and the increasing need for efficient data management solutions further support market growth.

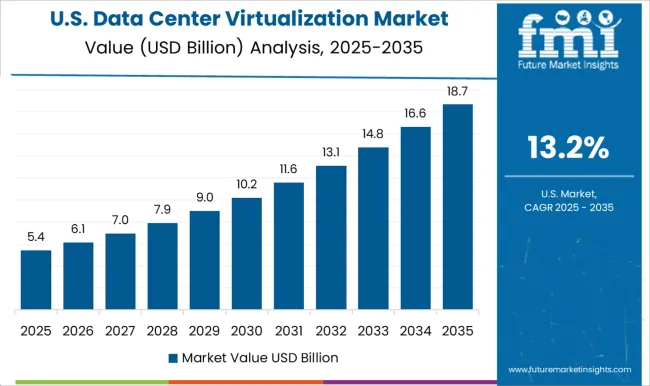

The United States is projected to grow at a CAGR of 13.2% through 2035, with strong demand for data center virtualization driven by advancements in cloud computing and the growing need for scalable infrastructure. As businesses across various industries move toward cloud-based solutions, the demand for efficient and flexible data management systems continues to rise. The USA has one of the largest IT sectors in the world, and with increasing data generation and the need for cost-effective IT infrastructure, the adoption of data center virtualization is expected to grow significantly. The USA is also witnessing a shift toward hybrid and multi-cloud environments, further boosting market growth.

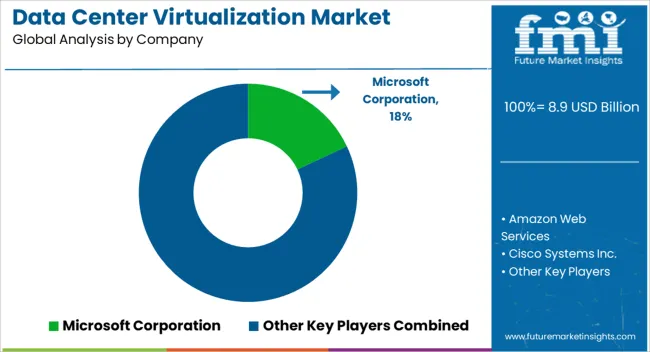

The data center virtualization market is driven by major players that provide solutions to enhance operational efficiency, scalability, and flexibility for data centers. Microsoft Corporation leads the market with its Azure cloud platform, offering robust virtualization solutions that support efficient resource management, seamless scalability, and improved data storage for enterprises. Amazon Web Services (AWS) provides market-leading cloud services with virtualization technologies designed to optimize resource utilization and improve IT infrastructure management, catering to a broad range of industries. Cisco Systems Inc. is a key player, providing networking and virtualization solutions that enable secure, efficient, and scalable data center operations. Their offerings integrate network, compute, and storage resources, enhancing overall performance and reducing operational costs.

IBM Corporation offers comprehensive virtualization solutions as part of its hybrid cloud platform, helping businesses modernize their IT infrastructures with a focus on automation, security, and performance optimization. Dell Inc. delivers end-to-end data center virtualization solutions, including hardware, software, and support services, which enable businesses to improve IT agility, reduce costs, and streamline management processes. Huawei Technology provides integrated virtualization solutions that optimize resource usage, scalability, and energy efficiency in data centers, supporting large-scale enterprise applications. AT&T offers virtualization solutions to enhance cloud infrastructure and enable businesses to run applications more efficiently across multiple platforms, focusing on flexibility and scalability. Citrix Systems Inc. is recognized for its virtualization software that enhances desktop and application performance, enabling remote work environments and improving overall data center performance. Nutanix provides hyper-converged infrastructure and virtualization solutions that simplify data center management, focusing on scalability, ease of use, and cost-efficiency. SAP SE offers data center virtualization solutions tailored to enterprise applications, improving resource utilization and enabling digital transformation.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Type | Server virtualization, Network virtualization, Storage virtualization, and Application virtualization |

| Service | Managed services, Optimization services, Consulting services, and Technical support services |

| Application | IT & telecom, BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Microsoft Corporation, Amazon Web Services, Cisco Systems Inc., IBM Corporation, Dell Inc., Huawei Technology, AT&T, Citrix Systems Inc., Nutanix, and SAP SE |

| Additional Attributes | Dollar sales by product type (hyper-converged infrastructure, virtualized storage, virtual machines, management software) and end-use segments (enterprise data centers, cloud service providers, managed service providers, telecoms). Demand dynamics are influenced by the increasing adoption of cloud computing, the rise in hybrid and multi-cloud environments, and the need for scalable, cost-efficient IT infrastructure solutions. Regional trends show strong growth in North America and Europe, driven by the increasing demand for cloud services and digital transformation in businesses, while Asia-Pacific is expanding due to the growing IT infrastructure investment in emerging markets. Innovation trends focus on enhancing automation, improving resource optimization, and reducing operational costs through AI-driven management solutions. |

The global data center virtualization market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the data center virtualization market is projected to reach USD 37.6 billion by 2035.

The data center virtualization market is expected to grow at a 15.5% CAGR between 2025 and 2035.

The key product types in data center virtualization market are server virtualization, network virtualization, storage virtualization and application virtualization.

In terms of service, managed services segment to command 34.7% share in the data center virtualization market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Data as a Service (DaaS) Market Analysis by Pricing Model, Deployment Type, End User, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA