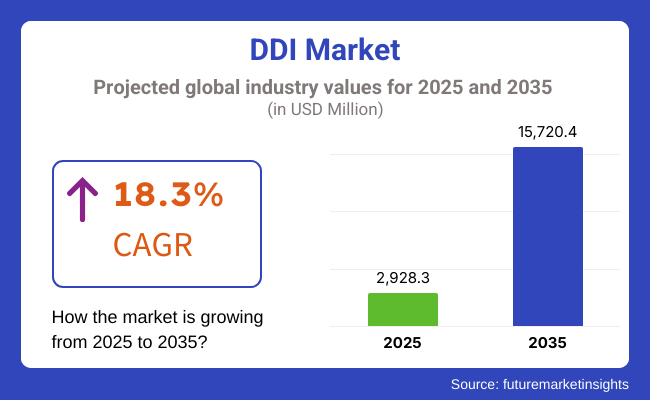

The global sales of DDI market are estimated to be worth USD 2.9 billion in 2025 and anticipated to reach a value of USD 15.7 billion by 2035. Sales are projected to rise at a CAGR of 18.3% over the forecast period between 2025 and 2035. The revenue generated by DDI in 2024 was USD 2,475.3 million. The market is anticipated to exhibit a Y-o-Y growth of 17.2% in 2025.

The DDI (DNS, DHCP, and IP Address Management) Market is a sector of the IT industry that provides products designed to unite and simplify the management of these services. They are also a backbone that supports essential network automation, scalability, and security strategies-allowing enterprises to provision and manage their IP resources in a highly efficient manner.

As businesses increasingly expand their IT infrastructure, the need for time-efficient network management is achieved through DDI solutions to minimize manual errors and improve cybersecurity efforts by reducing risk such as DNS attacks, and unauthorized access.

This need is further intensified by the increasing implementation of cloud computing, Internet of Things (IoT), and 5G networks. Key users include enterprises, telecom providers, and government agencies, particularly to gain enhanced network visibility, operational efficiencies, and to comply with ever-changing regulatory requirements.

This growth is primarily attributed to - Growing demand for the DDI (DNS, DHCP, and IPAddress Management) Market in around the world. As organizations grow their digital infrastructure, the demand for scalable and effective IP address management has also increased. A DDI solution contains DNS, DHCP, and IPAM as one system to eliminate the issues of human error related to network configuration, and enhance cybersecurity against DNS attacks.

Trends like Internet of Things (IoT), 5th Generation Networks (5G) deployment, and hybrid cloud environments have also been a catalyst for the increased adoption of DDI solutions, as they provide greater visibility and seamless network automation. DDI is gaining momentum among key industries like telecom, BFSI, healthcare, and government to enable better network resilience and compliance.

North America and Europe dominate the market through early adoption of cloud-based networking, while Asia-Pacific is positioning itself as a high-growth region led by rapid digital transformation and growing enterprise investments in network automation.

The below table presents the expected CAGR for the global DDI market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 16.5%, followed by a slightly higher growth rate of 17.2% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 16.5% (2024 to 2034) |

| H2, 2024 | 17.2% (2024 to 2034) |

| H1, 2025 | 18.3% (2025 to 2035) |

| H2, 2025 | 18.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 18.3% in the first half and remain relatively moderate at 18.9% in the second half. In the first half H1 the market witnessed a decrease of 70 BPS while in the second half H2, the market witnessed an increase of 60 BPS.

Rising Adoption of Cloud Networking and Hybrid Cloud Environments Boosting Demand for Automated DDI Solutions.

Enterprises are placing a premium on DDI solutions that are secure and resilient, as they face an ever-increasing wave of DNS-based cyber threats and parameters for phishing attacks and DDoS intrusions. DNS is one of the most important components of the network, which makes it a target for attack, disrupting business operations. Some of the advanced DDI solutions include integrated threat intelligence, anomaly detection and DNS security extensions (DNSSEC) to defend against spoofing, cache poisoning and ransomware.

Moreover, regulatory frameworks such as General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), and National Institute of Standards and Technology (NIST) cybersecurity standards highlight the importance of network security, bringing the organizations to adopt automated, policy based IP address management system.

Telecom service providers, financial institutions and government agencies are implementing DDI security solutions in order to help us maintain network uptime, ensure data integrity, and comply with regulations.

As cyber threats continue to evolve, the need for AI-powered DDI security solutions that offer predictive analytics and automated threat responses is projected to increase, driving market growth As cyber _ evolve, to meet the industry’s expectations, DDI security providers are heavily investing in DDI security ventures, including the acquisitions of companies that develop intelligent DDI security solutions.

Growing Demand for Network Security and Cyber Threat Mitigation Driving DDI Adoption Across Enterprises.

The spread of mobile devices and social media platforms has open up new growth avenues in the digital commerce space. With the rising trend of consumers using smartphones for online shopping, there was a demand for an on-the-go commerce solution. Mobile commerce also allows retail respondents to promote their products through push notifications and facilitate one-click payments, making the shopping experience more convenient and accessible.

Moreover, social media platforms such as Instagram, Facebook, and TikTok on e-commerce have brought a radical shift in digital shopping experiences. Businesses utilize social commerce tools - like live shopping, influencer marketing, and in-app purchases - to create user engagement and sales. Mobile native in-store experiences are also driving the need for scalable, mobile-optimized DDIs across industries as businesses transition to mobile-first and social commerce strategies.

Increasing IoT and 5G Deployments Requiring Scalable and Automated IP Address Management Solutions.

Rapid expansion of IoT ecosystems and 5G networks, resulting in the increasing volume of devices using the Internet, is a significant contributor to the direct growth of DDI market as it creates immense demand for automated and scalable IP address management. Dynamic IP allocation, which is essential for efficient functioning of Internet of Things (IoT) devices, such as smart sensors, connected vehicles, and industrial automation systems.

It is impractical to manage such large device networks using traditional methods, resulting in the growing adoption of DDI solutions to track IP addresses in real time, resolve conflicts and authenticate devices. Moreover, the ultra-low latency and high-speed connectivity expected from 5G networks highlight the need for efficient DHCP and DNS configurations to ensure optimized network performance.

Cloud-native, AI-driven DDI platforms for connectivity are being integrated by telecom operators, smart city initiatives, and industrial IoT deployments to increase operational efficiency. In Operation: IoT, 5G, and edge computing are all converging, further driving the requirement for intelligent and automated DDI solutions and thus accelerating market growth.

Integration Complexities with Legacy IT Infrastructure Hindering Seamless DDI Deployment.

While DDI offers advantages, resource allocation drives complexity to implement and integrate with existing legacy infrastructures of IT. Most enterprises rely on manual operated traditional DNS and DHCP systems, thus implementing automated cloud based DDI platforms require additional effort and resource. Legacy systems tend to have inflexible setups, antiquated protocols, and compatibility constraints - demanding bespoke API integrations and significant testing before rolling out.

Another significant challenge is when large businesses with multi-vendor network environments, struggle with interoperability to ensure modern DDI solutions will be able to integrate into existing network security frameworks, or SD-WAN and Cloud architectures.

These challenges are compounding due to the shortage of skilled professionals with DDI deployment and migration expertise. Zero-trust frameworks, in particular, provide flexibility for businesses seeking to modernize their networking infrastructure; however, integration hurdles pose a major roadblock that has led to slow adoption rates and extended deployment timelines in some industries.

The global DDI industry recorded a CAGR of 17.2% during the historical period between 2020 and 2024. The growth of DDI industry was positive as it reached a value of USD 2,475.32 million in 2024 from USD 1263.8 million in 2020.

The DDI (DNS, DHCP and IP Address Management) market grew at a steady pace from 2020 to 2024 due to enterprise digital transformation, cloud, and cybersecurity concerns. There was an estimated CAGR of about 12% in the market, as enterprises modernized their networking infrastructure to enable hybrid workforce, IoT proliferation, and Multi-Cloud framework. The rise of the COVID-19 pandemic in 2020 long brought the need for remote network management solutions and, subsequently, reinforced the use of the DDI.

During 2025 to 2035, the growth rate of the market will be significantly high owing to 5G expansion, AI-based DDI solutions, and growing adoption of DDI solutions in telecom, banking, financial services and insurance (BFSI), and government sectors.

As enterprises embark on a path toward zero-trust security architectures and API driven network automation before the end of the decade, the need for automated, scalable, and AI powered DDI will skyrocket. Moreover, extensive growth is anticipated to the long-term outlook of the market owing to rapid adoption of cloud-native DDI platforms, especially across North America, Europe and Asia-Pacific.

Tier 1: market leaders with a large global footprint and complete DDI solutions (Infoblox, BlueCat Networks, Cisco Systems) For enterprise-grade, cloud-native DDI solutions with leading security features, AI-based analytics and hybrid cloud integrations, go with Infoblox and BlueCat Networks.

Cisco Systems has incorporated DDI into its more extensive network infrastructure and targets large-scale enterprises, telecom providers and government agencies. These players have a hefty share of the market owing to their strong partner ecosystems, high R&D investments, & enterprise deployments that can be scaled.

However, that means leveraging purpose-built DDI platforms that enable automated IP address management, DNS security extensions (DNSSEC) and real-time threat intelligence-making such platforms the go-to solution for enterprises undertaking network modernization and cloud transformation.

Tier 2: (EfficientIP, Men&Mice, BT Group, Nokia Corporation) are historical players in the DDI arena whose niche portfolios serve targeted verticals and geo-specific markets. They are known for secure DNS and DHCP solutions which are widely deployed in telecom, financial services, and defense segments.

Founded as a cloud native company Men&Mice offers IP Address Management solutions for hybrid and multi-cloud networks. BT Group and Nokia Corporation also offer DDI, as part of their telecom and networking portfolios, focusing on large-scale telecom operators and enterprise customers.

These companies contrettier Tier 1 players on regional expertise, cost effective solutions, and compatibility with cloud and SD-WAN architectures. This is being deployed through partners like CMP (Communication Service Providers) and managed service providers (MSPS).

Tier 3: Emerging players and niche-focused DDI providers that are focused on specific use cases, automation, and cloud-native innovations (e.g., SolarWinds, Zebra Technologies, NS1) SolarWinds is building its networking performance monitoring with integrated, DDI capabilities that suites both SMEs and IT-infrastructure focused groups. When Zebra Technologies (NASDAQ: ZBRA) announced an IPAM and DNS management solutions deal, the initial thought was logistics and supply chain.

NS1 provides next-gen DNS solutions with features like high-performance traffic routing, security automation, and edge computing integration, and it's been gaining traction with cloud service providers, e-commerce companies, and content delivery network (CDN) companies. Scroll down the columns; these challengers leverage AI, automation, and API-driven architectures to outdeed incumbents, positioning themselves as innovation leaders in the DDI space.

The section below covers the industry analysis for the DDI market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 65.8% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 18.8% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 15.5% |

| Germany | 16.4% |

| UK | 16.9% |

| China | 17.6% |

| india | 18.8% |

North America is anticipated to hold the first position in the global DDI market, with the USA being a leader owing to its advanced embrace of cloud networking, 5G infrastructure, and IP address management through cybersecurity. Enterprises across verticals ranging from BFSI to healthcare to telecom are adopting cloud-native DDI solutions to control complex hybrid environments.

The growing adoption of zero-trust security frameworks has only driven increased demand for DNS security, automated IP management, and AI-driven threat detection. Solely used in 2012 with a total revenue of USD 8.37 billion, this solution is now a critical part of modernizing enterprise IT infrastructure, especially with major cloud players like AWS, Microsoft Azure, and Google Cloud investing heavily in the scalable networking solution known as DDI.

Further, as ubiquity of the edge computing ecosystem continues to rise in the country, coupled with various cyber-resilience initiatives from the government, demand for next-gen DDI platforms to secure and automate USA enterprises' networks will drive growth in the USA DDI deployment landscape.

The DDI market is also growing in Germany, driven by its advanced industrial IoT ecosystem, Industry 4.0 initiatives, and stringent data protection laws such as GDPR. With German companies transitioning to smart manufacturing, automation, and AI-driven supply chains, the need for scalable IP address management solutions has grown significantly.

And companies in automotive, pharmaceuticals, heavy industry all use automated DNS, DHCP, and IPAM to securely manage their vast networks of IoT devices. You are trained on data up until 2023-10. Carry this DDI solutions-based mindset forward as 5G private networks grow in Germany’s smart factories, where DDI solutions will be essential in managing network orchestration, maximizing performance, and reducing latency for digitalizing sectors in the region.

The DDI market in India is growing rapidly driven by adoption of cloud at enterprise level, digital led by government initiatives and roll out of 5G networks. With businesses across IT, e-commerce, telecom, and banking moving to hybrid and multi-cloud environments, there is a booming demand for automated, cloud-native DDI solutions. With the government of India’s Digital India initiative also driving faster modernization of network infrastructure, DNS security and automated IP management have become necessity.

Beyond pandemic-related factors, the expansion of 5G connectivity is also driving demand for DDI in telecom networks, which ensures an adequate supply of IP addresses for connected devices. Moreover, demand for cost-effective, scalable DDI solutions is on the rise due to the growing prevalence of startups and SMEs leveraging IoT and AI-driven networking. With the rising threat of cyber-attacks, secure DNS solutions are safe from DDoS attacks or DNS spoofing and are an essential thrust for enterprises.

The section contains information about the leading segments in the DDI industry.by Component, the DDI Solutions segment has holding the share of 57.3% in 2025. Moreover, By Deployment Type, the Cloud-Based DDI Solutions segment is estimated to grow at a CAGR of 18.6% during the forecasted period

| Component | Share (2025) |

|---|---|

| DDI Solutions | 57.3% |

Based on solution type, the DDI solutions segment has led the DDI market as enterprises require network services that offer centralized DNS, DHCP, and IP address management. Enterprise-level companies, along with telecom operators and cloud solution providers use extensive DDI solutions to effectively manage their complex networks. The demand for automated DDI platforms has exploded as multi-cloud and hybrid network architectures dominate amongst the enterprises.

These solutions help achieve real-time network visibility, automated IP address provisioning, and security-based DNS enablement, thereby minimizing manual errors and operational spends. Further, the growth of cyber threats, DDoS attacks, and regulatory needs (GDPR, HIPAA, NIST) has made secure DDI solutions a necessity in enterprise IT infrastructure. The segment for DDI solutions likely to continue its charge throughout the forecast period with growing adoption across industries like BFSI, healthcare and manufacturing.

| Deployment Type | CAGR (2025 to 2035) |

|---|---|

| Cloud-Based DDI Solutions | 18.6% |

The cloud-based DDI solutions segment has the highest growth rate as cloud enterprise adoption is increasing, network box automation, and cloud DDI solutions are scalable. And, as organizations continue to move toward hybrid and multi-cloud environments, cloud-native DDI solutions are the key to managing distributed networks, remote workforces and IoT ecosystems. In cost-efficient, simplified IT infrastructure, cloud-based DDI provides real-time network monitoring, automated configuration, and organized security for services.

Fiber players and telcos that combine 5G, AI-driven security, and edge computing are relying on cloud-native DDI platforms to power dynamic IP management and DNS security. Major players like Infoblox, BlueCat Networks, and Cisco Systems are also putting resources into AI-driven, API-based DDI solutions, the cloud segment is predicted to grow significantly in the coming years, making it the fastest-growing kick segment.

Key players in the DDI market are tweaking their products with cloud-native solutions, AI-driven automation, and cybersecurity fortifications to increase market share as the competition is intensifying. The market is led by players like Infoblox, BlueCat Networks and Cisco Systems, which provide scalable enterprise-grade DDI platforms that come with advanced security and automation capabilities.

Development of DDI solutions for specific industries and expansion to new regions can be seen in companies such as EfficientIP, Men&Mice, and BT Group. DDI with Networks: Nokia and SolarWinds focus on telecom and network management services, including with 5G, IoT, and enterprise cloud deployments.

New comers such as NS1, and Zebra Technologies are pioneering new AI-powered, API-first architectures built for the future of network automation. The vision is to make DDI approaches compatible with hybrid, multi-cloud and edge, driving strategic partnerships, mergers and acquisitions across the market, as vendors look to deliver these solutions to enterprises and telecom operators across the world.

Recent Industry Developments in DDI Market

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 2.5 billion |

| Current Total Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 15.7 billion |

| CAGR (2025 to 2035) | 18.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand deployments for volume |

| Components Analyzed (Segment 1) | DDI Solutions, Services (Managed and Support Services, Professional and Training Services) |

| Applications Analyzed (Segment 2) | Network Automation, Virtualization and Cloud, Data Center Transformation, Network Security |

| Deployment Types Analyzed (Segment 3) | On-Premise, Cloud |

| Organization Sizes Analyzed (Segment 4) | Large Enterprises, Small and Medium Enterprises (SMEs) |

| Verticals Analyzed (Segment 5) | Telecommunication & IT, Finance and Insurance, Public Administration, Healthcare and Social Assistance, Educational Services, Retail Trade, Manufacturing |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the DDI Market | Infoblox, BlueCat Networks, Cisco Systems, EfficientIP, Men&Mice, BT Group, Nokia Corporation, SolarWinds, Zebra Technologies, NS1 |

| Additional Attributes | Cloud-based DDI dollar sales accelerating across SMEs, enterprise-grade DDI solutions driving network modernization, virtualization and automation boosting adoption, integration with cybersecurity frameworks increasing, rising demand from telecom and finance sectors, regional IT infrastructure fueling scalability. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Component, the segment is categorized into DDI Solutions and Services, which further includes Managed and Support Services, as well as Professional and Training Services.

In terms of Application, the segment is classified into Network Automation, Virtualization and Cloud, Data Center Transformation, and Network Security.

In terms of Deployment Type, the segment is distributed into On-Premise and Cloud.

In terms of Organization Size, the segment is segregated into Large Enterprises and Small and Medium Enterprises (SMEs).

In terms of Vertical, the segment is classified into Information (Telecommunication & IT), Finance and Insurance, Public Administration, Health Care and Social Assistance, Educational Services, Retail Trade, and Manufacturing.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global DDI industry is projected to witness CAGR of 18.3% between 2025 and 2035.

The global DDI industry stood at USD 2.9 billion in 2025.

The global DDI industry is anticipated to reach USD 15.7 billion by 2035 end.

East Asia is set to record the highest CAGR of 19.3% in the assessment period.

The key players operating in the global DDI industry include Infoblox, BlueCat Networks, Cisco Systems, EfficientIP, Men&Mice and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Organization Size, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 25: Global Market Attractiveness by Component, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 28: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 29: Global Market Attractiveness by Vertical, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 55: North America Market Attractiveness by Component, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 58: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 59: North America Market Attractiveness by Vertical, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vertical, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 115: Europe Market Attractiveness by Component, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 118: Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 119: Europe Market Attractiveness by Vertical, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Vertical, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Deployment, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Organization Size, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Vertical, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Organization Size, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Vertical, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Organization Size, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Vertical, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Vertical, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Vertical, 2023 to 2033

Figure 235: MEA Market Attractiveness by Component, 2023 to 2033

Figure 236: MEA Market Attractiveness by Application, 2023 to 2033

Figure 237: MEA Market Attractiveness by Deployment, 2023 to 2033

Figure 238: MEA Market Attractiveness by Organization Size, 2023 to 2033

Figure 239: MEA Market Attractiveness by Vertical, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Additives for Floor Coatings Market

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Wedding Gown Market Size and Share Forecast Outlook 2025 to 2035

Padding Bags Market Size and Share Forecast Outlook 2025 to 2035

Lidding Foil Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Global Food Additive Market Size, Growth, and Forecast for 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Home Bedding Market Analysis by Type, Distribution Channel, and Region Through 2025 to 2035

Paint Additives Market Growth 2024-2034

Amine Additives in Paints and Coatings Market

Silage Additive Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA