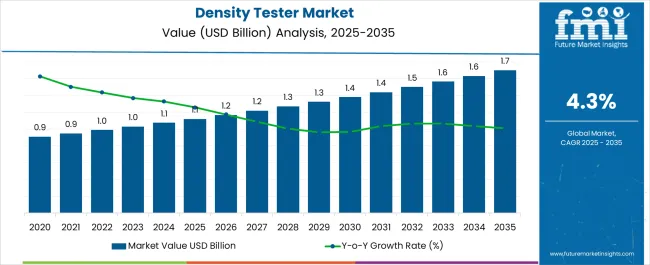

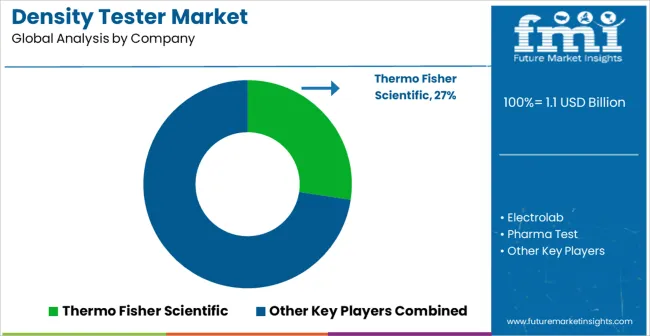

The Density Tester Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Density Tester Market Estimated Value in (2025 E) | USD 1.1 billion |

| Density Tester Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The Density Tester market is experiencing robust growth, driven by the rising demand for accurate and efficient quality control across manufacturing and processing industries. The market is being shaped by increasing requirements for real-time material density measurement, particularly in sectors such as chemicals, pharmaceuticals, food processing, and metals. Technological advancements enabling sensor integration and automation have enhanced measurement precision, repeatability, and operational efficiency.

The market growth is further supported by the shift toward inline and online testing systems that allow continuous monitoring of production processes, reducing waste and improving product quality. Rising adoption of electronic and sensor-based technologies has allowed manufacturers to minimize manual interventions, increase throughput, and comply with stringent regulatory standards.

Additionally, the expansion of industrial automation and smart manufacturing initiatives has created opportunities for density testers to be integrated with broader data analytics and quality management systems Overall, the market outlook is positive as industries increasingly prioritize accuracy, efficiency, and process optimization.

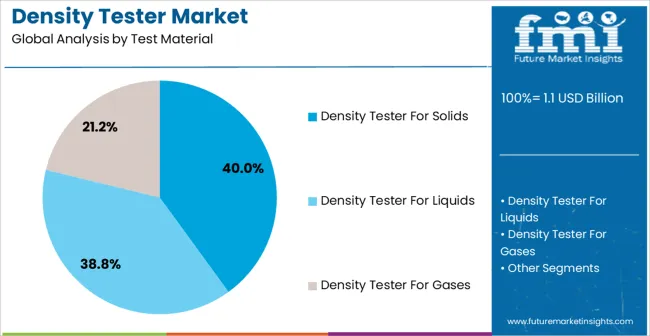

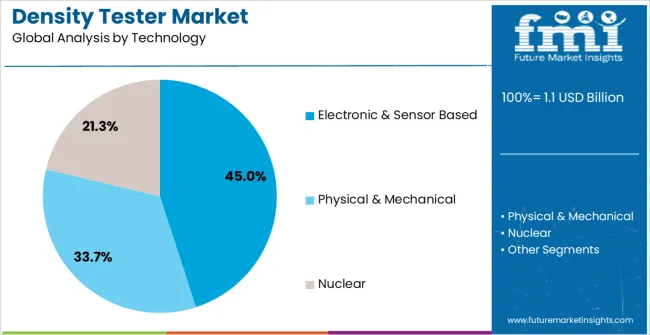

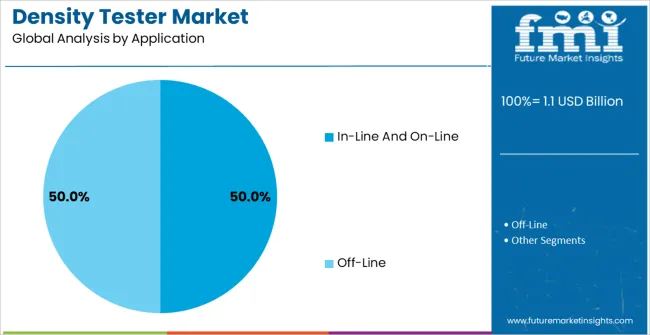

The density tester market is segmented by test material, technology, application, end use industry, and geographic regions. By test material, density tester market is divided into Density Tester For Solids, Density Tester For Liquids, and Density Tester For Gases. In terms of technology, density tester market is classified into Electronic & Sensor Based, Physical & Mechanical, and Nuclear. Based on application, density tester market is segmented into In-Line And On-Line and Off-Line. By end use industry, density tester market is segmented into Oil & Gas And Petrochemical, Chemicals, Food & Beverages, Pharmaceuticals, and Other Industrial. Regionally, the density tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Density Tester for Solids segment is projected to hold 40.00% of the overall market revenue in 2025, making it the leading segment in terms of test material. This dominance is being attributed to the widespread need for reliable and consistent density measurement in solid materials such as powders, granules, and pellets. Adoption has been driven by the requirement to maintain product quality and meet regulatory compliance in high-volume production environments.

The ability of these testers to provide precise measurements without destroying the sample has further reinforced their preference among manufacturers. The growth of the segment has also been supported by advancements in sensor technologies that enhance measurement accuracy and reduce operator dependency.

Furthermore, increasing investments in research and development of solid material processing and quality control equipment have created a favorable environment for this segment As industries continue to optimize production lines, the preference for solid material density testers is expected to remain strong due to their reliability, efficiency, and ease of integration into automated systems.

The Electronic and Sensor Based technology segment is anticipated to account for 45.00% of the Density Tester market revenue in 2025, positioning it as the leading technology type. This growth has been fueled by the increasing need for high-precision and automated measurement solutions across industrial applications. These technologies provide rapid, repeatable, and accurate results, reducing human error and ensuring compliance with quality standards.

The integration of sensors and electronic interfaces has enabled real-time monitoring, data logging, and seamless integration with process control systems, enhancing operational efficiency. Adoption has been particularly strong in industries where consistent product quality is critical, and where inline process adjustments are required. The development of compact, robust, and easy-to-calibrate systems has also contributed to the growth of this segment.

The scalability of these technologies across multiple production environments has ensured widespread acceptance As automation and smart manufacturing initiatives continue to expand, the Electronic and Sensor Based technology segment is expected to maintain its market leadership due to its efficiency, accuracy, and adaptability.

The In-Line and On-Line application segment is expected to capture 50.00% of the overall Density Tester market revenue in 2025, making it the leading application category. This leadership is being attributed to the growing preference for continuous process monitoring and real-time quality control in manufacturing operations. Inline and online density testing enables immediate detection of deviations, minimizing material waste and reducing the risk of producing out-of-spec products.

The adoption of this application has been supported by the increasing automation of production lines and the need for high throughput without compromising accuracy. Industries such as chemicals, pharmaceuticals, and food processing have particularly driven growth, as they require stringent process control and consistency. Additionally, the ability to integrate with digital monitoring and control systems has enhanced operational efficiency and decision-making capabilities.

The segment’s prominence is further reinforced by the demand for predictive maintenance and process optimization, which is facilitated by continuous monitoring Moving forward, the In-Line and On-Line application segment is expected to remain dominant as industries continue to prioritize real-time quality assurance and production efficiency.

Density Tester is a device used for measuring the density of solid, liquid and gaseous substances. Density is a vital physical indicator that provides indications regarding the quality, concentration, purity and other critical parameters of a substance. Density Tester is a device which measures, records and reports results of density tests conducted on different substances.

The density tester may report the values in a real-time setting or at a later time that is pre-determined. Many different density tester devices, also known as density meters, use different technologies for conducting density tests, depending on the state and type of the material to be tested.

For example, solids such as fine powders, flakes or granules are often tested using a tapped density tester. This type of density tester measures the tapped density (also known as bulk density) of powdered solids. Tapped density measurement using a density tester is of importance for analyzing flowability of powders.

Given the need of accurate measurement of important physical parameters such as density in industrial production set-ups, a wide variety of national and international standards are applicable to the density tester equipment and testing methods, based on the product to be measured and the conditions in which it is tested.

Apart from such physical devices, density tester technologies such electronic & sensor based (including ultrasonic density tester, microwave density tester etc.) and nuclear are also used.

Considering these aspects of the Density Tester, the study of the trends and forecasts of the Density Tester market becomes an important read.

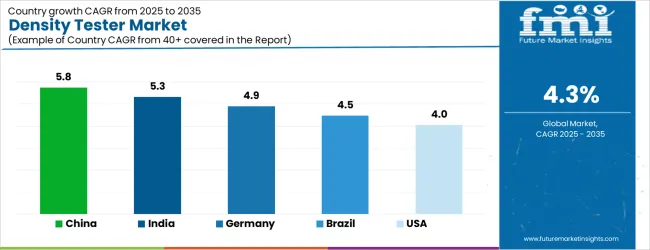

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.3% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.0% |

| U.K. | 3.6% |

| Japan | 3.2% |

The Density Tester Market is expected to register a CAGR of 4.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.8%, followed by India at 5.3%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.2%, yet still underscores a broadly positive trajectory for the global Density Tester Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.9%. The U.S. Density Tester Market is estimated to be valued at USD 400.7 million in 2025 and is anticipated to reach a valuation of USD 400.7 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 59.2 million and USD 30.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Test Material | Density Tester For Solids, Density Tester For Liquids, and Density Tester For Gases |

| Technology | Electronic & Sensor Based, Physical & Mechanical, and Nuclear |

| Application | In-Line And On-Line and Off-Line |

| End Use Industry | Oil & Gas And Petrochemical, Chemicals, Food & Beverages, Pharmaceuticals, and Other Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Electrolab, Pharma Test, Copley Scientific, Anton Paar, Mettler Toledo, Emerson Electric, Yokogawa Electric, Endress+Hauser, and KROHNE |

The global density tester market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the density tester market is projected to reach USD 1.7 billion by 2035.

The density tester market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in density tester market are density tester for solids, density tester for liquids and density tester for gases.

In terms of technology, electronic & sensor based segment to command 45.0% share in the density tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

LAN tester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

SCC Tester Market Size and Share Forecast Outlook 2025 to 2035

LED Tester Market

DSL Tester Market Growth – Trends & Forecast 2019-2027

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Gold Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

High Density Interconnect Market Size and Share Forecast Outlook 2025 to 2035

High Density Polyethylene HDPE Market Size and Share Forecast Outlook 2025 to 2035

High density Fiberboard (HDF) Market Size and Share Forecast Outlook 2025 to 2035

High Density (HD) Cell Banking Market Size and Share Forecast Outlook 2025 to 2035

High Density Polyethylene (HDPE) Bottle Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA