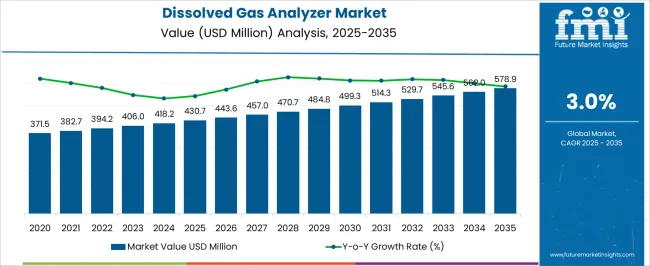

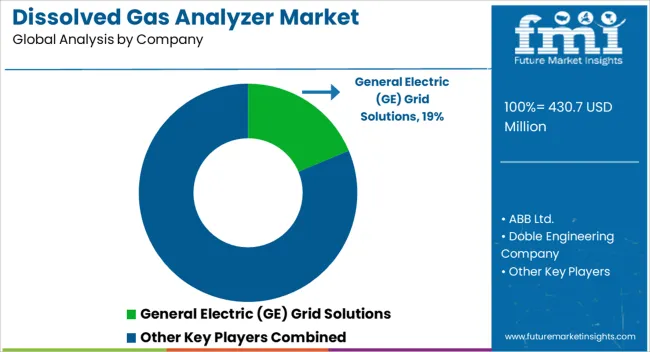

The dissolved gas analyzer market is estimated to be valued at USD 430.7 million in 2025 and is projected to reach USD 578.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period. A peak-to-trough analysis highlights the relative fluctuations in annual market growth and identifies periods of stronger versus weaker gains across the forecast horizon. From 2021 to 2025, the market increases from USD 371.5 million to USD 430.7 million, with incremental values reaching USD 382.7 million, USD 394.2 million, USD 406.0 million, and USD 418.2 million. This early phase shows a gradual climb, with troughs observed in years of slower adoption due to delayed capital expenditure or maintenance cycles in utilities and industrial segments, while peaks correspond to heightened demand for predictive maintenance and monitoring solutions.

Between 2026 and 2030, the values expand from USD 430.7 million to USD 484.8 million, passing through USD 443.6 million, USD 457.0 million, USD 470.7 million, and finally reaching USD 484.8 million. Peaks in this period align with infrastructure upgrades and regulatory compliance initiatives, whereas minor troughs reflect slower procurement cycles in certain regions. From 2031 to 2035, the market progresses from USD 499.3 million to 578.9 million, with intermediate values of USD 514.3 million, 529.7 million, 545.6 million, and 562.0 million, showing moderate oscillations but an overall upward trajectory.

| Metric | Value |

|---|---|

| Dissolved Gas Analyzer Market Estimated Value in (2025 E) | USD 430.7 million |

| Dissolved Gas Analyzer Market Forecast Value in (2035 F) | USD 578.9 million |

| Forecast CAGR (2025 to 2035) | 3.0% |

The dissolved gas analyzer (DGA) market is influenced by five key parent markets that drive its growth, adoption, and technological advancement across industrial and utility sectors. The power generation and electrical equipment market contributes the largest share, about 25-30%, as DGAs are critical for monitoring transformer health, detecting early insulation degradation, and preventing unplanned outages in power grids.

The oil and gas market adds roughly 20-24%, since dissolved gas analysis is employed in equipment such as compressors, turbines, and pipelines to detect potential failures and ensure safe operations under high pressure and temperature conditions. The industrial machinery and manufacturing market contributes around 15-18%, with DGAs applied in monitoring large motors, generators, and critical machinery to optimize maintenance schedules and extend equipment life. The energy storage and renewable systems market accounts for approximately 12-15%, where DGAs are used to evaluate transformer and battery health in solar, wind, and hybrid power installations to ensure operational reliability.

The electrical testing and diagnostic services market represents about 8-10%, as DGAs are integrated into condition monitoring programs, predictive maintenance solutions, and on-site testing services offered to utilities and industrial operators.

The dissolved gas analyzer market is expanding steadily, supported by rising investments in power infrastructure and the increasing need for transformer monitoring to prevent equipment failures. Industry updates and utility reports highlight that dissolved gas analysis is a critical diagnostic tool in detecting faults within oil-filled transformers, enabling predictive maintenance and reducing downtime.

Regulatory standards and grid reliability requirements have prompted utilities to adopt advanced multi-parameter monitoring systems, ensuring compliance and operational safety. Technological advancements, such as real-time data analytics and IoT-enabled sensors, have improved the accuracy and speed of gas detection, further boosting adoption.

Additionally, the global transition toward renewable energy integration has increased transformer loading and operational demands, heightening the necessity for proactive monitoring. With modernization of aging grids and expansion of high-voltage networks, demand for dissolved gas analyzers is projected to grow, with notable traction in segments emphasizing multi-gas capability, efficient extraction methods, and higher power ratings.

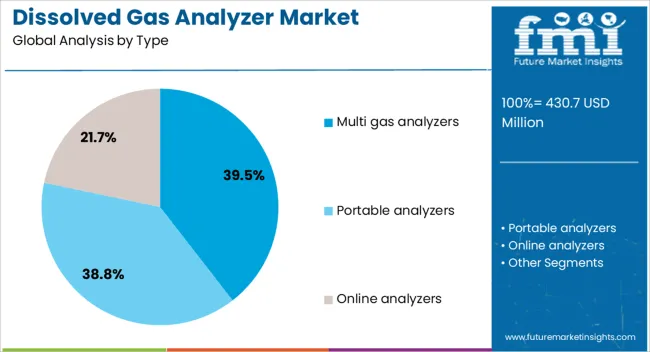

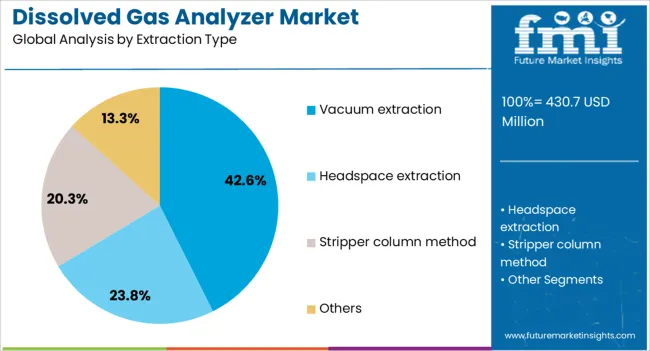

The dissolved gas analyzer market is segmented by type, extraction type, power rating, end use industry, and geographic regions. By type, dissolved gas analyzer market is divided into Multi gas analyzers, Portable analyzers, and Online analyzers. In terms of extraction type, dissolved gas analyzer market is classified into Vacuum extraction, Headspace extraction, Stripper column method, and Others.

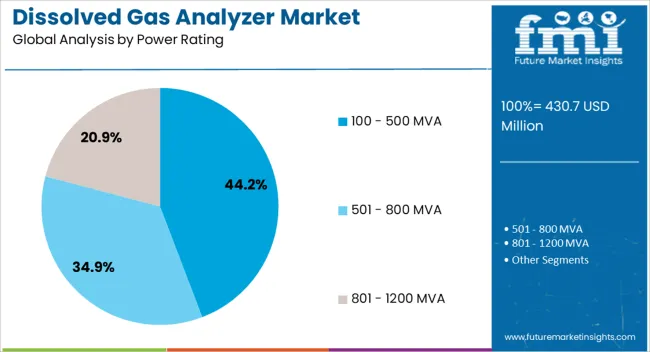

Based on power rating, dissolved gas analyzer market is segmented into 100 - 500 MVA, 501 - 800 MVA, and 801 - 1200 MVA. By end use industry, dissolved gas analyzer market is segmented into Energy & power, Chemical, Mining, Oil & gas, Pulp & paper, and Others. Regionally, the dissolved gas analyzer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Multi Gas Analyzers segment is projected to contribute 39.5% of the dissolved gas analyzer market revenue in 2025, maintaining its leading share. This segment’s growth is driven by the capability to simultaneously detect multiple fault gases, enabling a comprehensive assessment of transformer health.

Utilities and industrial operators have increasingly adopted these analyzers for their efficiency in identifying a broad spectrum of potential transformer issues in a single test cycle. The integration of multi-gas units with digital monitoring platforms has further enhanced their value by providing real-time diagnostics and predictive maintenance insights.

Additionally, these systems reduce the need for multiple instruments, lowering operational costs while improving diagnostic accuracy. As transformer fleets expand and aging assets require closer monitoring, the Multi Gas Analyzers segment is expected to remain a preferred choice for operators seeking reliable and consolidated testing solutions.

The Vacuum Extraction segment is forecasted to account for 42.6% of the dissolved gas analyzer market revenue in 2025, positioning it as the dominant extraction method. This technique has been favored for its high accuracy in isolating dissolved gases from transformer oil, ensuring precise measurements critical for fault detection.

Power utilities have increasingly specified vacuum extraction systems in procurement due to their ability to maintain gas integrity during testing. Industry feedback indicates that this method minimizes contamination risks and enhances repeatability of results, which is essential for trend analysis and long-term monitoring.

The robustness of vacuum extraction in field and laboratory settings has supported its adoption across large-scale transformer maintenance programs. As the demand for consistent and reliable diagnostics rises, especially in high-voltage networks, vacuum extraction is set to sustain its market leadership.

The 100 - 500 MVA segment is anticipated to hold 44.2% of the dissolved gas analyzer market revenue in 2025, securing its lead among power rating categories. Growth in this segment is linked to the prevalence of large power transformers in transmission and heavy industrial applications, where operational reliability is paramount.

These high-capacity units require stringent monitoring due to their critical role in grid stability and the high cost of unplanned outages. Dissolved gas analyzers designed for this power range have been optimized for sensitivity and durability, capable of withstanding demanding operational environments.

Utility asset management strategies have increasingly prioritized advanced monitoring solutions for transformers within this capacity range, ensuring early detection of faults and extending service life. With global grid expansion and the integration of renewable generation necessitating higher transformer capacities, the 100 - 500 MVA segment is expected to maintain robust demand for dissolved gas analysis solutions.

The dissolved gas analyzer (DGA) market is growing due to rising demand from power utilities and industrial facilities for predictive transformer maintenance. DGA devices detect fault gases in transformer oil, enabling early failure detection and reducing downtime. Adoption is driven by smart grid integration, aging infrastructure, and renewable energy projects. Challenges include high equipment costs, technical complexity, and regulatory compliance. Opportunities lie in online monitoring, portable analyzers, IoT connectivity, and predictive analytics. Manufacturers offering accurate, certified, and digitally integrated DGA solutions are best positioned to capture market growth across Asia-Pacific, North America, and Europe.

DGA devices detect fault gases such as hydrogen, methane, ethylene, and acetylene in transformer oil, providing early warning for potential failures. Growth is driven by increasing investments in electrical grids, renewable energy integration, and aging transformer infrastructure across Asia-Pacific, North America, and Europe. Utilities focus on minimizing unplanned downtime, extending transformer lifespan, and reducing operational costs. Adoption is further supported by advancements in online and portable DGA equipment, enabling real-time monitoring and data analysis. Manufacturers are developing smart analyzers with digital connectivity, predictive algorithms, and remote monitoring capabilities, positioning DGA technology as essential for modern power asset management globally.

Accurate measurement requires precise sensors, stable electronics, and sophisticated software algorithms, increasing production and service expenses. Compliance with regional electrical and safety standards, such as IEC, IEEE, and ANSI, adds complexity for manufacturers and utilities. Supply chain constraints for high-purity gas calibration standards and electronic components can impact delivery timelines. Utilities increasingly demand analyzers with certifications, calibration traceability, and reliable after-sales support. Companies investing in process optimization, sensor reliability, and user-friendly interfaces are better positioned to overcome operational and technical barriers. Meeting accuracy, safety, and regulatory requirements is crucial for sustained adoption of DGA technology in transformer monitoring worldwide.

Online DGA systems enable continuous transformer monitoring, predictive maintenance, and data-driven decision-making. Portable DGA devices support field inspections, reducing operational risks and downtime. Asia-Pacific, particularly China and India, exhibits strong growth due to large-scale power infrastructure expansion and increasing electricity demand. Manufacturers providing analyzers with cloud connectivity, IoT integration, and predictive analytics gain a competitive advantage. Opportunities also exist in retrofitting aging transformer fleets and offering service contracts for real-time monitoring. Companies integrating hardware, software, and analytics services are well-positioned to capture emerging demand in industrial, utility, and renewable energy applications globally.

Technological advancements in the DGA market include online monitoring systems, IoT-enabled analyzers, AI-driven fault prediction, and automated reporting. Integration with transformer management software allows utilities to schedule maintenance, reduce outages, and optimize operational efficiency. Miniaturization and portable devices enable field engineers to perform accurate measurements in real-time. Digital dashboards, cloud storage, and remote monitoring enhance data accessibility and decision-making. Companies are focusing on predictive maintenance solutions to extend transformer life and improve reliability. Manufacturers delivering certified, connected, and high-accuracy analyzers are positioned to meet evolving industry demands. Adoption of digital and automated monitoring systems is shaping the future of transformer diagnostics and asset management globally.

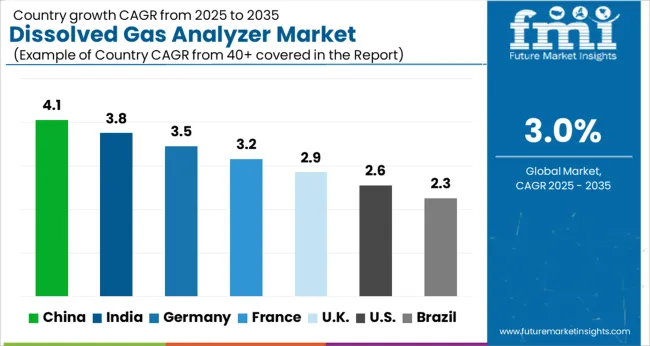

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global dissolved gas analyzer market is projected to expand at a CAGR of 3.0% from 2025 to 2035. China (4.1%) and India (3.8%) are the fastest-growing markets, supported by industrial modernization, power grid expansion, and rising demand for predictive maintenance. Germany (3.5%) emphasizes high-precision, automated monitoring for utilities and industrial plants, while the UK (2.9%) and USA (2.6%) show steady adoption across power generation and industrial applications. Growth drivers include transformer health monitoring, early fault detection, operational efficiency, and regulatory compliance. Manufacturers focus on IoT-enabled analyzers, automated diagnostics, and real-time monitoring solutions to capture market share. The analysis spans over 40+ countries, with the leading markets shown below.

The dissolved gas analyzer market in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by the rapid expansion of power generation and industrial sectors. The growing demand for monitoring transformer health and detecting early faults is creating strong adoption. Industrial facilities, power plants, and manufacturing units are increasingly investing in predictive maintenance solutions to minimize downtime and operational costs. The expansion of high-voltage transmission networks and integration of renewable energy projects further support market growth. Manufacturers are focusing on high-precision analyzers, automated diagnostic systems, and real-time monitoring solutions that provide accurate fault detection and analysis. Technological advancements, such as IoT-enabled analyzers, enhance efficiency and reduce human intervention.

The dissolved gas analyzer market in India is expected to grow at a CAGR of 3.8% from 2025 to 2035, fueled by modernization of power grids, industrial plants, and transmission infrastructure. The increasing focus on preventive maintenance, real-time monitoring, and early fault detection is driving demand. Rising electricity consumption, industrial automation, and expansion of energy networks require reliable transformer monitoring solutions to reduce failures and operational downtime. Manufacturers are offering analyzers with high sensitivity, rapid analysis, and integration with digital platforms for automated reporting. Government initiatives supporting grid reliability and industrial infrastructure development create additional growth opportunities. Industrial plants, utility companies, and energy service providers are key end users, while distribution through specialized suppliers and e-commerce channels improves accessibility.

The dissolved gas analyzer market in Germany is projected to grow at a CAGR of 3.5% from 2025 to 2035, driven by high standards for industrial and utility maintenance. Power utilities, industrial manufacturers, and energy plants are increasingly adopting analyzers to monitor transformer health, detect early faults, and improve operational efficiency. Advanced, precise, and automated diagnostic systems are gaining traction due to their ability to reduce maintenance costs and prevent failures. Germany’s focus on modern infrastructure, renewable energy integration, and reliable power transmission further supports market expansion. Manufacturers are emphasizing analyzers with enhanced accuracy, fast response times, and compatibility with digital platforms. Industrial service providers and utility companies prefer solutions that allow continuous monitoring, predictive analytics, and early-warning alerts.

The UK dissolved gas analyzer market is expected to grow at a CAGR of 2.9% from 2025 to 2035, supported by power generation, industrial maintenance, and transformer monitoring applications. Predictive maintenance and real-time fault detection are key drivers, enabling industrial plants and utilities to reduce downtime and extend equipment life. Manufacturers focus on analyzers that are reliable, user-friendly, and equipped with advanced sensors for accurate readings. Expansion of energy infrastructure, renovation of aging plants, and modernization of industrial facilities contribute to market growth. The adoption of automated and remote monitoring systems enhances operational efficiency, while regulatory compliance encourages the use of performance-driven analyzers. Distribution through specialized industrial suppliers, technical service providers, and online channels improves accessibility.

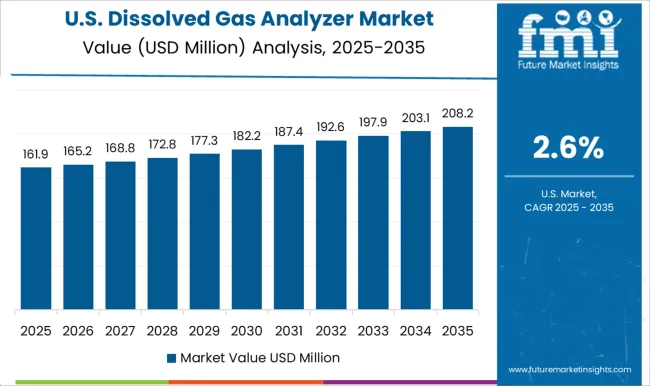

The USA dissolved gas analyzer market is projected to grow at a CAGR of 2.6% from 2025 to 2035, driven by industrial applications, energy sector modernization, and transformer monitoring requirements. Industrial plants, utilities, and energy service providers are increasingly adopting analyzers to detect faults early, reduce maintenance costs, and enhance operational efficiency. Manufacturers are focusing on high-precision, automated, and easy-to-use analyzers capable of continuous monitoring and real-time analysis. Replacement of aging transformers, expansion of power grids, and integration of renewable energy sources are key growth factors. Regulatory compliance and rising awareness about equipment reliability and safety further boost adoption. Distribution through specialized industrial suppliers, service providers, and online platforms ensures widespread accessibility.

Competition in the dissolved gas analyzer (DGA) market is defined by accuracy, detection speed, and integration with transformer monitoring systems. General Electric (GE) Grid Solutions competes with online and portable DGA solutions offering multi-gas detection, predictive analytics, and real-time transformer health monitoring for utilities and industrial clients. ABB Ltd. differentiates through compact and modular analyzers that integrate with digital substation architectures, emphasizing reliability and remote diagnostics. Doble Engineering Company focuses on precision and lab-grade performance, providing portable and online DGA instruments tailored for condition assessment, fault identification, and preventive maintenance. LumaSense Technologies, Inc. (now part of Advanced Energy) delivers fiber-optic and infrared-based solutions, targeting continuous monitoring, fast response, and high-sensitivity detection for transformers and high-voltage assets. Qualitrol Company LLC provides on-line DGA sensors with cloud connectivity, enabling predictive maintenance and integration with SCADA systems, emphasizing ease of installation and actionable insights. Siemens AG leverages industrial automation expertise to offer DGA analyzers that combine robust hardware with digital analytics, supporting large-scale utility networks. Weidmann Electrical Technology AG emphasizes high-precision gas detection for both laboratory and field applications, focusing on transformer insulation diagnostics and dielectric oil assessment. Strategies in the market focus on enhancing sensitivity to low-concentration gases, reducing maintenance requirements, and integrating DGA analyzers with condition monitoring platforms and IoT-enabled asset management systems. Product brochures highlight multi-gas measurement (hydrogen, methane, ethylene, acetylene, carbon monoxide, and carbon dioxide), online and portable analyzers, predictive diagnostic software, remote monitoring capability, calibration services, and compatibility with IEC and IEEE standards. Collectively, these offerings show a market where technological innovation, reliability, and data-driven insights define competitiveness, supporting utilities and industrial operators in maintaining transformer health and preventing costly failures.

| Item | Value |

|---|---|

| Quantitative Units | USD 430.7 Million |

| Type | Multi gas analyzers, Portable analyzers, and Online analyzers |

| Extraction Type | Vacuum extraction, Headspace extraction, Stripper column method, and Others |

| Power Rating | 100 - 500 MVA, 501 - 800 MVA, and 801 - 1200 MVA |

| End Use Industry | Energy & power, Chemical, Mining, Oil & gas, Pulp & paper, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric (GE) Grid Solutions, ABB Ltd., Doble Engineering Company, LumaSense Technologies, Inc. (now part of Advanced Energy), Qualitrol Company LLC, Siemens AG, and Weidmann Electrical Technology AG |

| Additional Attributes | Dollar sales by analyzer type (portable, online, laboratory), gas detection method (infrared, thermal conductivity, photoacoustic), and application (power transformers, switchgear, industrial equipment). Demand is driven by transformer aging management, predictive maintenance adoption, and grid modernization initiatives. Regional trends highlight growth in North America, Europe, and Asia-Pacific, supported by smart grid deployment, industrial expansion, and aging electrical infrastructure replacement programs. |

The global dissolved gas analyzer market is estimated to be valued at USD 430.7 million in 2025.

The market size for the dissolved gas analyzer market is projected to reach USD 578.9 million by 2035.

The dissolved gas analyzer market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in dissolved gas analyzer market are multi gas analyzers, portable analyzers and online analyzers.

In terms of extraction type, vacuum extraction segment to command 42.6% share in the dissolved gas analyzer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dissolved Oxygen Meters and Controllers Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA