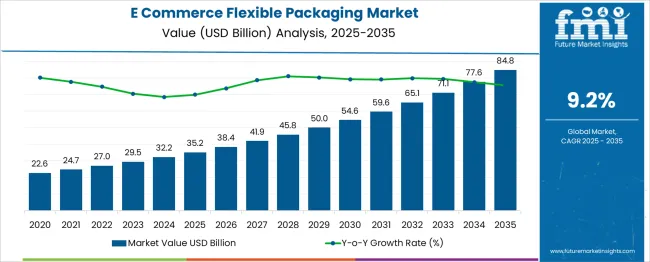

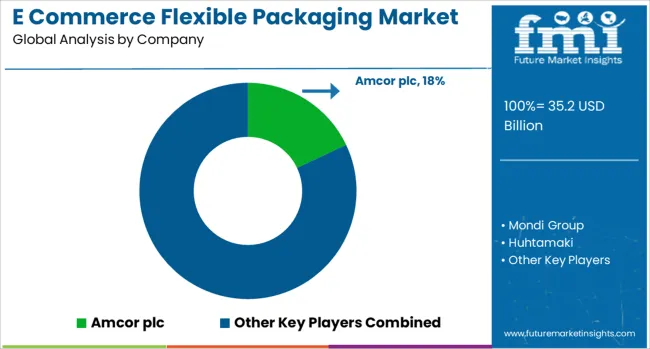

The eCommerce flexible packaging market is estimated to be valued at USD 35.2 billion in 2025 and is projected to reach USD 84.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. A year-on-year (YoY) growth analysis reveals strong and consistent performance throughout the forecast period, reflecting rising consumer demand for convenient, lightweight, and sustainable packaging solutions driven by the rapid expansion of e-commerce. From 2025 to 2026, the market is expected to increase from USD 35.2 billion to 38.4 billion, a YoY growth of approximately 9.1%.

This upward trend continues steadily, with YoY growth hovering between 8.8% and 9.4% each year. By 2030, the market is projected to reach USD 50.0 billion, nearly a 42% increase over five years. Between 2030 and 2035, the market gains momentum, rising to USD 84.8 billion, with average annual additions of over USD 5.5 billion. This consistent YoY growth is fueled by the shift in consumer behavior toward online shopping, the demand for customized and protective packaging, and rising environmental concerns that push brands toward recyclable and flexible packaging materials. Additionally, technological innovations in barrier properties and printing further enhance the value proposition, ensuring sustained expansion across the global e-commerce ecosystem.

| Metric | Value |

|---|---|

| E Commerce Flexible Packaging Market Estimated Value in (2025 E) | USD 35.2 billion |

| E Commerce Flexible Packaging Market Forecast Value in (2035 F) | USD 84.8 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The E-commerce Flexible Packaging market is a key segment within the broader flexible packaging industry, which itself is a part of the global packaging market valued at over USD 1.2 trillion. Flexible packaging, including pouches, mailers, wraps, and films, is known for its lightweight, space-saving, and cost-efficient properties. As of 2025, the flexible packaging market is valued at over USD 300 billion, with e-commerce applications accounting for approximately 10–12% of the total share, translating to around USD 35–36 billion.

This share is growing rapidly due to the exponential rise of online retail, particularly in categories like fashion, electronics, cosmetics, and personal care. E-commerce flexible packaging includes features tailored to online fulfillment, such as tamper-evidence, reusability, and sustainable material use qualities increasingly demanded by both brands and consumers. Driving forces in the parent market include eco-efficiency mandates, the need for logistics-friendly materials, and rising consumer expectations for convenience and aesthetics. The flexible packaging industry is transitioning from rigid formats toward eco-friendly, customizable options that reduce shipping costs and carbon footprints. Key players in the parent market include Amcor, Mondi Group, Berry Global, Sealed Air, and Huhtamaki, many of which are heavily investing in product innovations designed specifically for the booming e-commerce sector.

The E Commerce Flexible Packaging market is undergoing accelerated transformation, driven by the increasing shift toward digital retail, demand for sustainable packaging, and the need for protective, lightweight materials that align with rapid fulfillment requirements. This market is being shaped by evolving consumer expectations for convenience, secure delivery, and eco-conscious packaging, particularly as online retail platforms continue to scale across diverse geographies.

Growth has been supported by technological advances in barrier films, smart labeling, and recyclable materials, allowing brands to enhance both protection and sustainability. The rise of direct-to-consumer models and subscription-based commerce has further intensified the need for customized, durable, and cost-efficient packaging solutions.

Additionally, stringent regulations related to packaging waste and carbon emissions are influencing companies to innovate with flexible formats that reduce volume and improve supply chain efficiency. These combined dynamics are expected to maintain the momentum of the E Commerce Flexible Packaging market over the forecast period, with a clear focus on functionality, adaptability, and environmental responsibility..

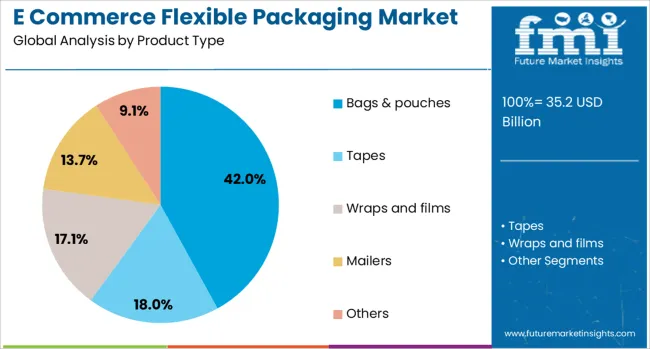

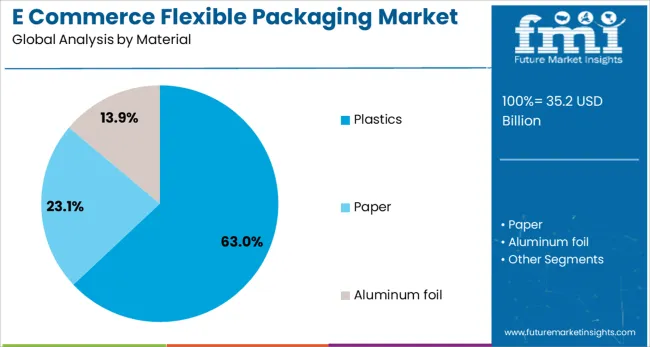

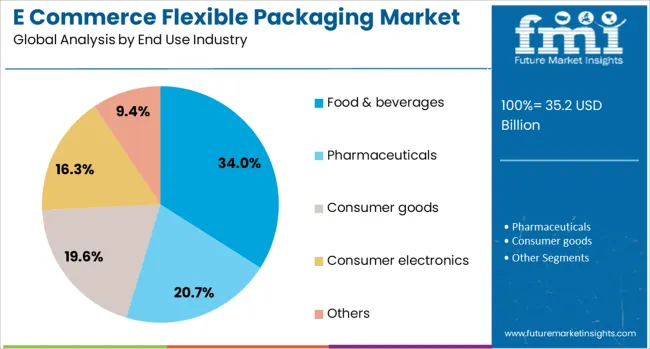

The eCommerce flexible packaging market is segmented by product type, material, and end-use industry and geographic regions. By product type, the e-commerce flexible packaging market is divided into Bags & pouches, Tapes, Wraps and films, Mailers, and Others. In terms of material, the e-commerce flexible packaging market is classified into Plastics, Paper, and Aluminum foil. Based on end-use industry, the e-commerce flexible packaging market is segmented into Food & beverages, Pharmaceuticals, Consumer goods, Consumer electronics, and Others. Regionally, the e-commerce flexible packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bags and pouches segment is projected to hold 42% of the E Commerce Flexible Packaging market revenue share in 2025, making it the leading product type. This segment has gained preference due to its lightweight nature, ease of storage, and excellent product-to-package ratio, which significantly reduces shipping costs.

Its ability to provide strong barrier protection against moisture, oxygen, and external contaminants has made it particularly suited for e-commerce logistics where prolonged shelf life and damage prevention are essential. The versatility of bags and pouches in accommodating various product sizes and formats has supported widespread adoption across industries ranging from food and cosmetics to apparel and electronics.

Their compatibility with tamper-evident and resealable closures has further enhanced their value in the e-commerce ecosystem. The efficiency in manufacturing, low material consumption, and adaptability to sustainable film solutions have also contributed to their dominant position, as brands seek to align their packaging with environmental goals without compromising performance..

The plastics segment is expected to account for 63% of the E Commerce Flexible Packaging market revenue share in 2025, emerging as the most widely used material. The continued reliance on plastics has been driven by its durability, lightweight composition, and cost-effectiveness, which align with the needs of high-volume e-commerce packaging. Plastics have been favored for their superior barrier properties, which ensure product integrity during transit and storage.

Their compatibility with flexible film technologies and advanced printing solutions has enabled custom branding and enhanced visual appeal, making them suitable for direct-to-consumer shipments. The recyclability and reusability of certain plastic materials have improved with recent innovations, addressing growing concerns around environmental impact.

As global e-commerce operations expand, particularly in food, personal care, and consumer electronics, plastic-based flexible packaging remains essential for ensuring efficiency, protection, and product differentiation. Continuous investments in biodegradable and post-consumer recycled plastic formats are also supporting the segment’s sustained leadership..

The food and beverages segment is anticipated to capture 34% of the E Commerce Flexible Packaging market revenue share in 2025, positioning it as the dominant end use industry. The increased reliance on online grocery shopping, meal kit deliveries, and direct-to-consumer beverage services has been a key factor driving this segment’s expansion. Flexible packaging formats have been selected for their ability to maintain freshness, ensure hygiene, and provide tamper resistance, which are critical for perishable and consumable goods.

Food-grade films and vacuum-seal solutions have enabled longer shelf life and minimized food waste during transport. The ability to design lightweight, portion-controlled packaging has also aligned with consumer convenience and sustainability preferences.

The segment’s growth has been further strengthened by regulatory compliance demands for food-safe materials and traceability. As brands seek to differentiate in a crowded digital marketplace, the integration of visual branding, QR codes, and recyclable materials into flexible packaging has elevated its strategic importance within the food and beverages industry..

The global e-commerce flexible packaging market reached approximately USD 32 billion in 2024 and is projected to grow robustly at around 8.9 percent annually through the early 2030s. Growth is driven by rising online sales, the use of lightweight materials reducing shipping costs, and consumer demand for branded unboxing experiences. Sustainability trends are accelerating the shift to recyclable paper, compostable plastics, and mono‑polymer films. Smart packaging features such as QR codes and NFC add value. While Asia‑Pacific leads in market share and growth tempo, North America and Europe show strong innovation and a regulatory push toward green packaging.

Flexible packaging provides clear advantages for e-commerce logistics by offering lightweight, space-efficient formats that reduce transportation costs and warehouse footprint. Unlike rigid boxes, mailers, pouches, and film wraps can conform to a product's shape, minimizing wasted air space and material usage. These attributes improve parcel throughput in automated fulfillment centers and reduce carbon emissions per shipment. As fulfillment centers adopt robotic packing and same-day dispatch models, flexible packaging is favored for its speed and adaptability. The ability to incorporate return features or protective barriers within a single material layer also simplifies reverse logistics and enhances consumer satisfaction. Optimizing packaging not only drives operational efficiency but also aligns with cost-saving goals across the retail supply chain.

As consumers increasingly expect premium, personalized experiences from their online purchases, flexible packaging has become a key branding tool. Digital printing technologies now allow short-run, high-resolution customization, enabling seasonal campaigns, region-specific versions, or influencer collaborations with quick turnaround. In e-commerce, where the package is often the first physical touchpoint, companies are leveraging design to create memorable unboxing moments. Matte coatings, peel-away layers, and resealable closures contribute to a tactile, premium experience. Custom packaging also plays a role in building loyalty and social media engagement, as consumers often share aesthetically pleasing unboxing moments online. Brands that treat packaging as a marketing channel rather than a shipping necessity gain long-term value from each delivery. The shift toward flexible packaging as a brand storytelling medium adds competitive depth beyond cost and protection.

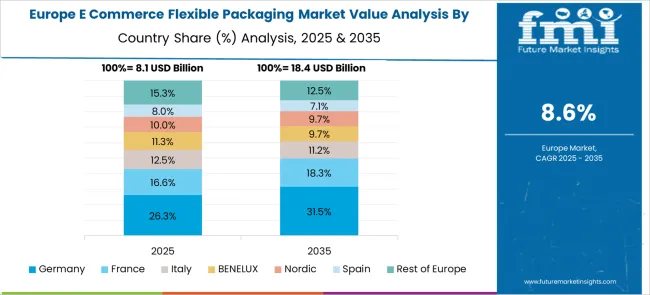

While global e-commerce adoption continues, regional dynamics shape how flexible packaging evolves. In Asia-Pacific, rapid smartphone-driven retail growth creates demand for protective yet cost-effective mailers and pouches across diverse climates and income levels. North America prioritizes packaging that integrates advanced functionality such as anti-counterfeit features and digital engagement, reflecting its mature e-commerce and direct-to-consumer culture. In Europe, regulatory leadership around waste reduction is accelerating the use of paper-based and mono-material films. Applications are expanding beyond traditional soft goods into categories like electronics, food, health supplements, and pharmaceuticals. This diversification demands innovation in barrier properties, security features, and moisture resistance. As retailers and logistics providers seek packaging that meets cross-sector performance needs, suppliers must deliver both material versatility and compliance readiness.

E-commerce packaging needs have shifted with the growth of direct-to-consumer brands and last-mile fulfillment networks. Packaging must now serve multiple roles: protect contents during transit, visually represent brand values, and accommodate high-speed packing operations. Flexible formats, such as pouches and mailers, are increasingly selected for their compatibility with automated packing lines and their ability to compress and conform during shipping. Subscription models and replenishable goods demand packaging that is both compact and user-friendly. As same-day and micro-fulfillment services expand, brands require packaging formats that are easy to store, quick to seal, and provide protection without excess bulk. Flexible solutions meet these demands while offering design flexibility that reinforces customer engagement across recurring delivery cycles.

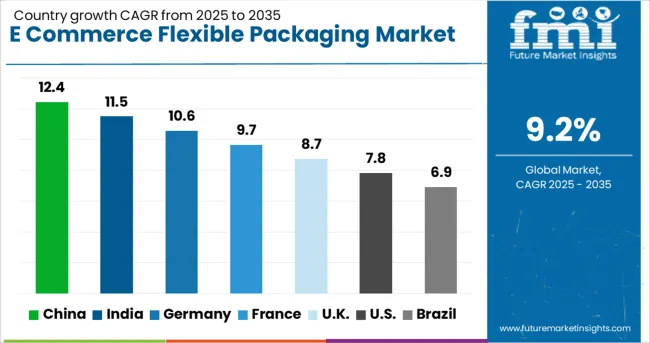

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The global e-commerce flexible packaging market is expected to grow at a CAGR of 9.2% through 2035, driven by the surge in online shopping and sustainable packaging needs. Among BRICS nations, China leads with a remarkable 12.4% growth rate, backed by its massive e-commerce infrastructure and large-scale production capabilities. India follows closely at 11.5%, supported by rapid digitization, expanding retail logistics, and investments in packaging technology. Within the OECD region, Germany shows robust 10.6% growth, emphasizing sustainable material innovation and advanced packaging lines. The United Kingdom reports steady expansion at 8.7%, influenced by strong e-commerce penetration and eco-regulatory compliance. The United States, a mature market growing at 7.8%, focuses on recyclability, automation, and integrated supply chain solutions. These countries reflect varied yet complementary strengths in shaping the future of flexible packaging in global e-commerce. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has achieved a CAGR of 12.4% in the e commerce flexible packaging market, driven by high-volume online retail activity and rapid warehouse expansion. Domestic e-commerce giants have increased demand for lightweight, durable, and tamper-evident packaging that supports long-distance shipping and rapid order fulfillment. The shift toward environment-friendly materials has encouraged producers to offer recyclable and mono-material packaging formats. Packaging converters in China are also investing in digital printing and short-run customization capabilities to meet the branding needs of SME e-retailers. The country’s massive logistics network, including tier 2 and tier 3 city connectivity, enhances scalability of flexible packaging solutions. Additionally, automation in packaging lines and integration with e-fulfillment centers has supported throughput improvements. Cross-border e-commerce growth further elevates the need for export-compliant packaging that adheres to international standards for durability and labeling.

India has posted a CAGR of 11.5% in the e commerce flexible packaging market, fueled by rising digital adoption and expanding middle-class online shoppers. E-retailers require cost-effective and resilient packaging formats for tiered delivery models, especially across rural and semi-urban areas. Indian packaging firms are increasing output of pouches, poly mailers, and bubble wraps with better seal integrity and printability. The push for plastic waste reduction is encouraging a shift to recyclable laminates and reduced-layer film structures. Customized order sizes and batch-level SKU differentiation have also prompted flexible packaging manufacturers to enhance their agility and inventory response times. Government-led digital infrastructure projects and logistics upgrades in remote regions further support volume growth. Domestic online marketplaces are actively partnering with packaging providers for localized packaging innovations that suit regional shipping and climate challenges.

Germany has witnessed a CAGR of 10.6% in the e commerce flexible packaging market, largely driven by demand for eco-certified and premium quality materials in packaging. German consumers and retailers place high value on packaging sustainability, prompting use of biodegradable films, compostable laminates, and reusable mailers. Regulatory emphasis on extended producer responsibility has further catalyzed innovation in recyclable and single-polymer solutions. Packaging converters are investing in solvent-free lamination, water-based inks, and minimalistic designs to meet evolving compliance and consumer standards. Integration of packaging automation with warehouse robotics is increasing throughput, especially in high-frequency distribution centers. Customized flexible packaging is becoming central to premium unboxing experiences for niche e-commerce categories like beauty, fashion, and electronics.

The United Kingdom has recorded a CAGR of 8.7% in the e commerce flexible packaging market, backed by strong parcel volumes and evolving consumer expectations. Online retailers are emphasizing lightweight packaging that reduces postal costs while maintaining product protection. Flexible packaging producers in the UK are focused on developing mono-materials that facilitate recyclability in local systems. Demand for tamper-evident and resealable designs is growing, especially in personal care, pharmaceuticals, and food categories. Retailers are also exploring low-carbon packaging logistics, using formats that reduce cubic volume and optimize stacking. Innovations in temperature-stable flexible films are seeing increased application for shipping perishable items. Partnerships between logistics providers and packaging firms are accelerating deployment of warehouse-friendly packaging formats suited for next-day and same-day delivery models.

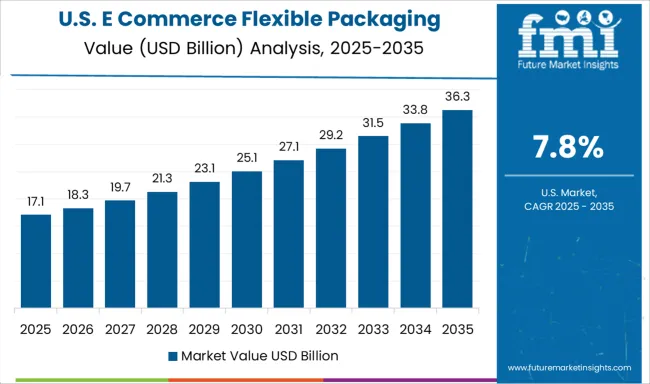

The United States has reported a CAGR of 7.8% in the e commerce flexible packaging market, shaped by demand for convenience, branding, and last-mile efficiency. Major e-commerce platforms require high-speed, adaptable packaging lines capable of handling diverse SKUs and order volumes. Flexible packaging types such as poly mailers, padded bags, and resealable pouches are widely used for electronics, fashion, and home goods. USA-based converters are investing in recyclable film structures and curbside-acceptable materials, aligning with brand pledges to reduce plastic waste. Digital printing has become integral to personalization, while tamper-proof sealing and track-and-trace labeling are now common. Warehouse automation trends are also pushing packaging firms to create formats that are compatible with robotic pick-and-pack systems and smart conveyors. Integration with e-retail software platforms is helping streamline packaging workflows across fulfillment sites.

The e-commerce flexible packaging market has grown steadily due to rising demand for durable, lightweight, and space-efficient packaging options that support direct-to-door delivery models. With a shift toward online shopping across personal care, apparel, electronics, and food products, businesses are opting for formats such as pouches, poly mailers, and film wraps that offer protection during transit and reduce overall freight costs. The need for packaging that can preserve product quality while withstanding pressure from handling and stacking is central to market growth. Amcor plc holds a strong position in the market with its wide range of flexible packaging materials, offering reliable sealing and print-quality features tailored for e-commerce requirements. Its solutions are widely used across sectors needing high moisture, odor, or light barriers.

Mondi Group provides flexible mailers and paper-based packaging formats with high tear resistance and customizable print options for brand visibility. Their solutions help improve package integrity while keeping shipping volumes compact. Huhtamaki and Sealed Air Corporation both focus on providing formats that offer cushioning, reduced material bulk, and easy handling ideal for electronics and fragile goods. Constantia Flexibles supplies film-based mailers and pouches well-suited for premium consumer goods, often used where product presentation and long shelf life are critical. As order fulfillment becomes more time-sensitive and cost-conscious, suppliers that offer fit-for-purpose, dependable packaging formats are set to lead the evolving e-commerce supply chain landscape.

Amcor partnered with Mediacor to launch a 2 L AmPrima® spouted pouch for Nana cleaning products in July 2025. It’s recycle‑ready in Europe, cuts plastic usage by up to 80%, lowers carbon footprint by 64%, and is ISTA 6A certified for durable e‑commerce transport.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.2 Billion |

| Product Type | Bags & pouches, Tapes, Wraps and films, Mailers, and Others |

| Material | Plastics, Paper, and Aluminum foil |

| End Use Industry | Food & beverages, Pharmaceuticals, Consumer goods, Consumer electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc, Mondi Group, Huhtamaki, Sealed Air Corporation, and Constantia Flexibles |

| Additional Attributes | Dollar sales by packaging type include pouches, mailers, films, wraps used across food & beverage, personal care, electronics in North America, Europe, and Asia‑Pacific. Demand is driven by e‑commerce growth, sustainability mandates, and customization. Innovation focuses on recyclable materials, digital printing, and smart packaging. Costs depend on material type, printing complexity, and logistics efficiency. |

The global e commerce flexible packaging market is estimated to be valued at USD 35.2 billion in 2025.

The market size for the e commerce flexible packaging market is projected to reach USD 84.8 billion by 2035.

The e commerce flexible packaging market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in e commerce flexible packaging market are bags & pouches, tapes, wraps and films, mailers and others.

In terms of material, plastics segment to command 63.0% share in the e commerce flexible packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Employee Benefits Strategy and Consulting Market Size and Share Forecast Outlook 2025 to 2035

Eco-Friendly Webbing Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

eMMC Master Control Chip Market Size and Share Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Electronic Speed Controller (ESC) for Drones and UAVs Market Size and Share Forecast Outlook 2025 to 2035

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

EV Charger Tester Market Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

EMC Electromagnetic Compatibility Test Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Engine-Driven Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Electrochemical CO Sensor for Portable Device Market Size and Share Forecast Outlook 2025 to 2035

Emergency Backpack Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Window and Door Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Emergency Transfer Vacuum Mattress Market Size and Share Forecast Outlook 2025 to 2035

Electromyographic Rehabilitation Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA