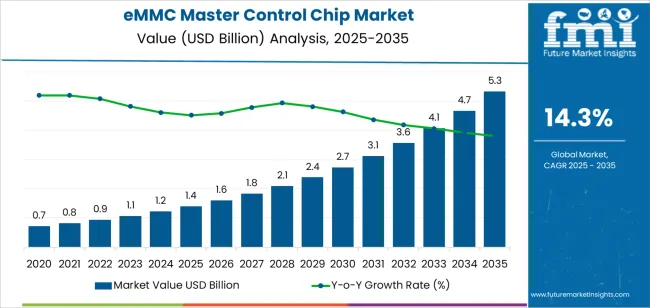

In 2025, the global eMMC master control chip market stands at USD 1.4 billion and is expected to rise to USD 5.4 billion by 2035, registering a CAGR of 14.3% and generating an absolute dollar opportunity of USD 4.0 billion. The early years of the forecast period reflect strong momentum as demand increases for compact, affordable embedded storage across smartphones, IoT systems, home electronics, and lightweight computing devices. During this phase, manufacturers enhance controller design to support higher data speeds, better power management, and improved compatibility with evolving NAND flash technologies.

Acceleration is most evident between 2025 and 2030, when global electronics output expands and connected device shipments climb, lifting annual growth rates. This period is marked by rapid shifts toward more capable controller firmware and compact board layouts aimed at broader consumer and industrial adoption. From 2030 to 2033, the market enters a moderate acceleration pattern as performance requirements diversify and competing storage technologies, notably UFS, begin influencing design choices in higher-tier devices.

A gradual deceleration sets in after 2033 as eMMC technology becomes more concentrated in value-focused and embedded-use categories, including industrial IoT, entry-level mobiles, and automotive modules. Even with slower year-over-year gains, demand remains stable, supported by the technology’s low power needs, proven reliability, and ease of system integration. Improvements in error correction, temperature regulation, and long-term data retention continue to reinforce the relevance of eMMC controllers through 2035.

Between 2025 and 2030, the eMMC Master Control Chip Market is projected to expand from USD 1.4 billion to USD 2.8 billion, with global shipment volumes increasing from roughly 1.4 billion units to 2.8 billion units. The growth volatility index (GVI) for this period is 1.3, reflecting a pronounced acceleration phase driven by rising demand for embedded memory solutions in smartphones, IoT devices, smart appliances, low-cost tablets, and automotive infotainment systems. Performance requirements such as HS400 interface speeds, improved random read/write performance, enhanced wear-leveling algorithms, and advanced bad-block management are driving OEM procurement. The shift toward mid-range devices in emerging markets and sustained demand in automotive-grade storage (operational reliability from –40 °C to 105 °C) will account for more than 60 % of incremental market growth.

From 2030 to 2035, the market is expected to advance from USD 2.8 billion to USD 5.4 billion, with annual shipments rising to approximately 4.7–5.4 billion units. The GVI declines to 0.8, indicating moderated yet robust growth as eMMC continues to serve high-volume, cost-sensitive device categories despite competition from UFS solutions. Market expansion will be driven by next-generation controllers with improved ECC engines, enhanced firmware optimization for 3D NAND, and power-loss protection features tailored to industrial and automotive applications. Manufacturing expansion across East Asia and newly built semiconductor packaging hubs in Southeast Asia and India will contribute 12–15% of global capacity additions by 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 billion |

| Market Forecast Value (2035) | USD 5.4 billion |

| Forecast CAGR (2025–2035) | 14.3% |

Demand for eMMC master control chips is rising as manufacturers require compact, integrated storage solutions for smartphones, tablets, wearables, smart home devices, and industrial controllers. eMMC integrates NAND flash and a controller in a single package, reducing board complexity while ensuring stable read–write performance for mid-range applications. Master control chips manage error correction, wear leveling, and bad-block handling, enabling consistent endurance across varying workloads. As OEMs extend product cycles and support over-the-air updates, stable storage performance becomes essential for maintaining device responsiveness. Manufacturers refine process nodes, firmware algorithms, and power-management logic to improve throughput and reliability in compact embedded designs. Broader adoption in automotive infotainment and low-cost IoT modules further reinforces market growth.

Market expansion is also supported by the demand for cost-efficient, predictable storage architectures in devices not requiring the high bandwidth of UFS or PCIe-based solutions. eMMC provides a favorable balance of density, stability, and integration simplicity for mass-market electronics. Vendors strengthen security features such as RPMB partitions and hardware-level encryption to support sectors with tighter data-protection requirements. Supply-chain resilience efforts encourage multilayer sourcing of controller ICs, pushing manufacturers to enhance testing, temperature tolerance, and compatibility across diverse NAND types. Although competition from UFS increases in premium devices, the longevity of eMMC in industrial, automotive, and educational hardware ensures stable demand. Continuous improvements in controller intelligence and endurance optimization keep eMMC master control chips relevant across global embedded-storage markets.

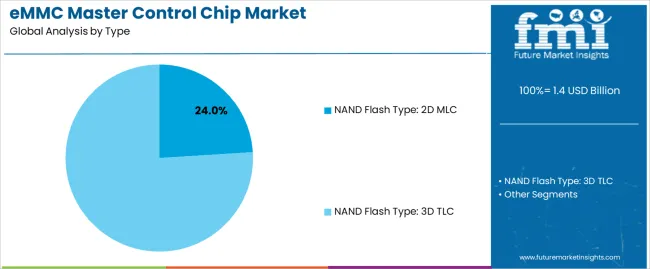

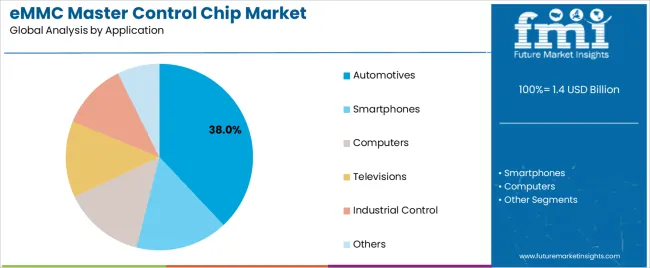

The eMMC master control chip market is segmented by type, application, and region. By type, the market is divided into NAND Flash Type: 2D MLC and NAND Flash Type: 3D TLC. Based on application, it is categorized into automotives, smartphones, computers, televisions, industrial control, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments reflect endurance expectations, storage density needs, and regional electronics production patterns that influence controller selection across embedded systems.

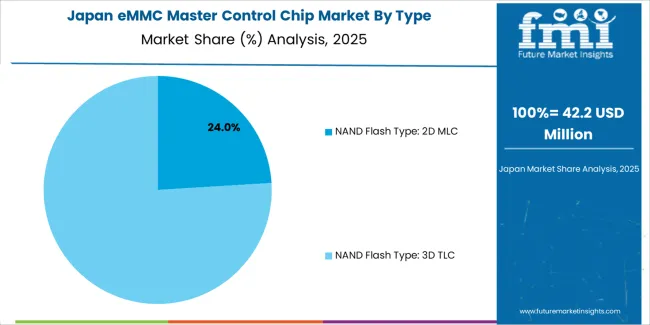

The NAND Flash Type: 2D MLC segment accounts for approximately 24.0% of the global eMMC master control chip market in 2025, making it the leading type category. This position is supported by the durability and stable write-cycle behavior of multi-level cell memory, which aligns with embedded applications requiring long operational life. The characteristics of 2D MLC storage allow predictable performance under steady workloads, making it suitable for devices exposed to extended temperature ranges or continuous data logging.

Manufacturers rely on 2D MLC controllers for products that must maintain functional reliability over multi-year duty cycles, including industrial modules, vehicle subsystems, and fixed-purpose computing boards. Controller developers strengthen these systems through improved wear management, data-path integrity checks, and refined voltage-calibration schemes that extend flash longevity. The segment also benefits from predictable supply chains and mature fabrication processes that maintain consistent performance parameters across production batches. Adoption remains strong in East Asia and Europe, where industrial electronics and automotive electronics suppliers emphasize predictable memory endurance. The 2D MLC category retains its lead because it remains well suited for embedded environments where stability, controlled degradation, and long-term data retention carry priority over high-density storage goals.

The automotives segment represents about 38.0% of the total eMMC master control chip market in 2025, making it the leading application category. This reflects the rising dependence of modern vehicles on embedded storage for navigation systems, digital dashboards, battery-management modules, advanced driver-assistance functions, and telematics. Automotive platforms require memory controllers capable of stable performance under vibration, voltage variation, and extended thermal loads typical of vehicle operation. eMMC controllers help maintain data integrity, deliver consistent bandwidth, and support reliable boot behavior essential for safety-related subsystems.

Manufacturers design automotive-grade controllers with reinforced error-correction routines, persistent write-protection features, and firmware capable of detecting emerging flash wear patterns. Growth in this segment is tied to the increasing software content in vehicles produced across East Asia, Europe, and North America, where automakers continue shifting toward centralized computing architectures. The segment benefits from the need for long lifecycle components and controlled revision management, which are important for maintaining compatibility across vehicle production lines. eMMC controllers remain a preferred choice in this environment because they offer predictable endurance metrics, stable read latency, and long-term supply consistency. These attributes ensure dependable performance across automotive electronics that rely on embedded non-volatile memory.

The eMMC master control chip market is expanding as smartphones, tablets, IoT devices and embedded systems continue to rely on compact, integrated storage solutions. These controllers manage data read-write operations, wear-leveling, error correction and overall NAND flash performance. Growth is supported by stable demand for mid-range consumer electronics, automotive infotainment upgrades and industrial devices that favour eMMC over more complex storage formats. Constraints include competition from UFS and NVMe-based solutions, supply-chain volatility for NAND components and limited scalability for high-performance applications. Manufacturers are enhancing firmware algorithms, endurance management and security features to maintain relevance across sectors.

Demand grows as consumer electronics and embedded devices require reliable, affordable storage with compact footprints. Mid-range smartphones, smart TVs, wearables and IoT modules often favour eMMC because it balances cost, speed and integration simplicity. Automotive systems, including infotainment and diagnostics modules, also use eMMC due to its durability and predictable performance. As product designers focus on power efficiency and stable throughput rather than peak performance, master control chips that support consistent operation and extended flash lifespan are increasingly preferred.

Adoption is restrained by performance ceilings that make eMMC less suitable for high-end devices. Competing standards such as UFS offer faster data transfer and lower latency, drawing market share from eMMC in smartphones and advanced consumer electronics. Price fluctuations in NAND and controller components also influence procurement strategies. Limited flexibility for parallel processing workloads reduces suitability for compute-intensive environments. Some manufacturers are reallocating development resources toward emerging storage interfaces, which slows innovation pace in the eMMC segment.

Trends include improved error-correction algorithms, enhanced wear-leveling designs and stronger security functions to meet rising data-protection requirements. Controllers are being optimized for smaller process nodes and lower power consumption to suit compact IoT and industrial devices. Automotive-grade eMMC with extended temperature tolerance and higher reliability is gaining traction. Manufacturers are also offering adaptive firmware platforms that support multiple NAND types and capacity tiers. As demand persists in cost-focused and long-lifecycle applications, eMMC controllers continue to evolve toward greater efficiency and durability rather than speed-driven performance.

| Country | CAGR (%) |

|---|---|

| China | 19.3% |

| India | 17.9% |

| Germany | 16.4% |

| Brazil | 15.0% |

| USA | 13.6% |

| UK | 12.2% |

| Japan | 10.7% |

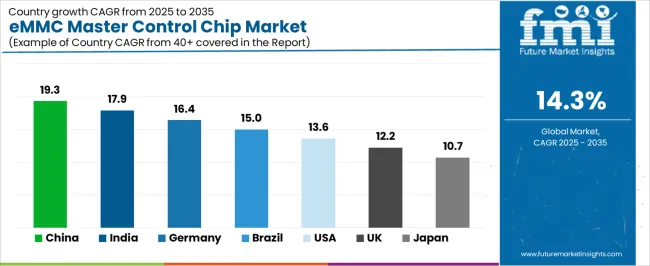

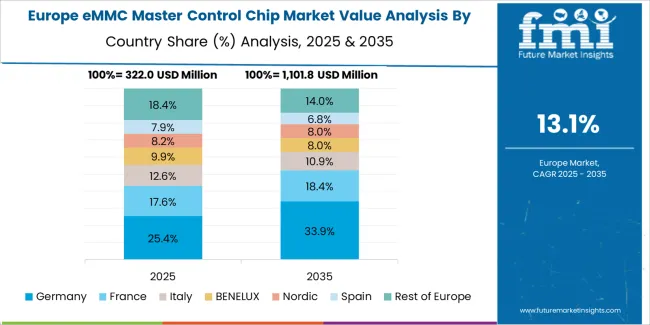

The eMMC Master Control Chip Market is expanding rapidly worldwide, with China leading at a 19.3% CAGR through 2035, driven by strong semiconductor manufacturing growth, rising demand for mobile and IoT devices, and aggressive investment in memory controller innovation. India follows at 17.9%, supported by emerging electronics manufacturing, government incentives for semiconductor development, and increasing smartphone penetration. Germany records 16.4%, reflecting advanced engineering, automotive electronics demand, and rising adoption of embedded storage solutions. Brazil grows at 15.0%, fueled by expanding consumer electronics markets and digital infrastructure upgrades. The USA, at 13.6%, remains an innovation hub focused on advanced memory architectures, while the UK (12.2%) and Japan (10.7%) emphasize high-reliability controllers, industrial-grade storage, and next-generation embedded memory integration.

China is projected to grow at a CAGR of 19.3% through 2035 in the eMMC master control chip market. Rapid expansion of consumer electronics manufacturing and stronger domestic semiconductor activity accelerate demand for high-density controllers. Producers refine firmware algorithms, error-correction modules, and low-power architectures supporting mobile devices. Growing deployment across tablets, smart appliances, and edge-computing units enhances procurement. Local fabs strengthen process capability, enabling improved performance and stable mass production. Partnerships with device assemblers promote continuous integration. Market development aligns with rising storage requirements across 5G terminals, education devices, logistics tools, and industrial handheld units nationwide.

India is forecast to grow at a CAGR of 17.9% through 2035 in the eMMC master control chip market. Rising smartphone assembly, growth in consumer electronics parks, and expanding IoT device adoption strengthen controller demand. Domestic developers work on efficient wear-leveling algorithms, stable voltage regulation, and low-latency paths supporting varied device categories. Government electronics programs promote increased semiconductor localization. Wider acceptance of digital devices across education, logistics, and retail sectors supports broader use of eMMC storage. Contract manufacturers adopt cost-efficient controllers to streamline procurement and maintain predictable component availability. Market expansion aligns with increasing national demand for embedded storage solutions.

Germany is expected to grow at a CAGR of 16.4% through 2035 in the eMMC master control chip market. Demand from automotive electronics, industrial modules, and consumer devices supports high controller usage. Producers focus on stable wear-leveling performance, thermal resilience, and robust error management for harsh environments. Integration with embedded platforms across machinery and sensors reinforces ongoing demand. Engineering firms prioritize predictable performance aligned with long-term equipment life cycles. Data-logging devices and compact industrial terminals incorporate eMMC controllers to optimize durability. Market adoption increases as manufacturers emphasize reliable embedded storage supporting regulated applications across national industrial and automotive networks.

Brazil is projected to grow at a CAGR of 15.0% through 2035 in the eMMC master control chip market. Expansion of local electronics assembly and increased demand for affordable devices strengthen procurement. Manufacturers apply controllers in smart appliances, education devices, and handheld logistics tools. Local distributors collaborate with global vendors to provide stable supply for mid-range electronics. Developers prioritize balanced performance and cost alignment to suit national device requirements. Growth in e-commerce, telecommunications, and commercial mobility applications raises demand for embedded storage. Market progression reflects increased adoption across regional assembly hubs focused on developing competitive consumer and industrial digital products.

USA is set to grow at a CAGR of 13.6% through 2035 in the eMMC master control chip market. Adoption across industrial controls, consumer devices, and mid-range computing platforms increases controller use. Developers refine error-correction strength, voltage efficiency, and stable bandwidth to meet varied performance targets. Contract manufacturers integrate controllers into handheld terminals, wearables, and household devices. Demand for compact, low-power memory solutions grows alongside IoT deployment across commercial sectors. Engineering teams emphasize secure firmware design supporting regulated environments. Market activity rises as companies expand embedded architectures improving reliability and cost efficiency for large-scale deployments across national digital infrastructure.

UK markets are projected to grow at a CAGR of 12.2% through 2035 in the eMMC master control chip sector. Increased use of embedded storage across smart meters, transport systems, and household electronics supports consistent demand. Vendors enhance endurance, data-path stability, and firmware reliability suited to regulated applications. Integration with compact platforms for healthcare and education devices strengthens adoption. Local design teams evaluate controllers based on predictable performance and ease of integration. Growth in connected infrastructure and public-sector digitization encourages expanded controller usage across varied project scopes. Market outlook remains aligned with growing national emphasis on embedded system development.

Japan is forecast to grow at a CAGR of 10.7% through 2035 in the eMMC master control chip market. Strong demand for compact electronics, robotics modules, and industrial controls drives adoption of efficient controllers. Domestic manufacturers emphasize thermal stability, low-latency data access, and precision in firmware tuning. Growth in smart appliances, health devices, and lightweight consumer products boosts integration. Engineering teams prefer controllers with consistent long-term endurance and predictable behavior under continuous operation. Expansion of robotics and automation platforms further broadens controller usage across national industries. Market movement aligns with strong focus on compact, reliable, and energy-efficient memory technologies supporting domestic manufacturing.

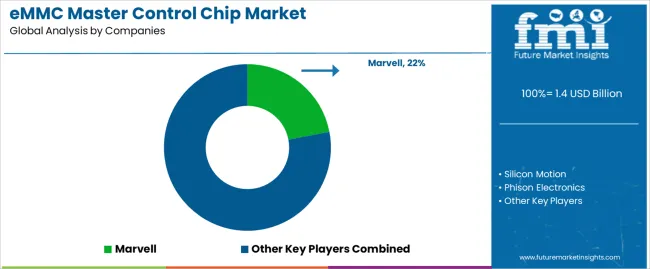

The global eMMC master control chip market shows moderate concentration, driven by established storage controller developers and an expanding group of regional suppliers. Marvell holds a strong position through advanced architectures that emphasize reliable flash management, low power consumption, and secure firmware operation. Silicon Motion and Phison Electronics maintain significant market presence with high-volume controllers widely adopted in smartphones, tablets, and consumer electronics. Their designs focus on stable throughput, efficient wear leveling, and compatibility with a broad range of NAND types. Maxio Technology (Hangzhou) and Jiangsu Huacun Electronic Technology strengthen China’s domestic supply base by offering controllers optimized for mid-range devices and embedded systems. These companies contribute to reduced dependence on foreign suppliers while expanding industrial and consumer product integration.

YEESTOR Microelectronics and Longsys extend competitiveness by combining controller design with in-house packaging and testing capabilities, improving production flexibility and cost efficiency. TWSC and Kowin provide accessible solutions aimed at value-oriented devices and embedded computing platforms. Hosinglobal and Eigenbit Technology support niche segments requiring predictable latency, long endurance, and stable thermal performance for industrial and automotive environments. Competition across this market is shaped by firmware stability, flash compatibility, and performance retention under heavy write workloads. Strategic differentiation relies on controller efficiency at smaller process nodes, enhanced data integrity features, and long lifecycle support. As embedded storage requirements expand in IoT, edge computing, and automotive electronics, suppliers offering robust reliability and optimized energy performance are positioned for sustained advantage.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | NAND Flash Type: 2D MLC, NAND Flash Type: 3D TLC |

| Application | Automotives, Smartphones, Computers, Televisions, Industrial Control, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Marvell, Silicon Motion, Phison Electronics, Maxio Technology (Hangzhou), Jiangsu Huacun Electronic Technology, YEESTOR Microelectronics, Longsys, TWSC, Kowin, Hosinglobal, Eigenbit Technology |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across East Asia, Europe, and North America, competitive landscape of controller IC suppliers, endurance and thermal-performance requirements, integration with IoT, automotive, and embedded platforms |

The global eMMC master control chip market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the eMMC master control chip market is projected to reach USD 5.3 billion by 2035.

The eMMC master control chip market is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in eMMC master control chip market are nand flash type: 2d mlc and nand flash type: 3d tlc.

In terms of application, automotives segment to command 38.0% share in the eMMC master control chip market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Master Recharge API Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Master Recharge API Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Stigmasterol-Rich Plant Sterols Market Analysis by Source and Application others Through 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Oxygen Scavenger Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Booster and Master Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Chip Antenna Market

Biochips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA