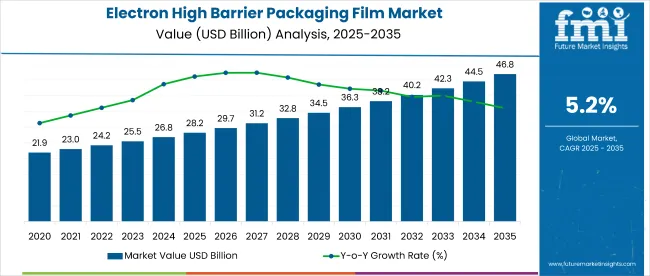

The global electron high barrier packaging film market is estimated at USD 28.2 billion in 2025 and is projected to reach USD 46.8 billion by 2035, expanding at a CAGR of 5.2% during the forecast period (FMI, 2025).

In 2025, the broader flexible packaging films category is expected to be valued at approximately USD 161 billion, placing electron high barrier variants at a 17.5% share of the parent market.

Rising demand for extended shelf-life packaging in perishable goods has driven consistent investment in electron high barrier films. Adoption has accelerated due to escalating moisture and oxygen sensitivity across fresh produce, meat, and pharmaceutical applications.

This trend has been further reinforced by regulatory pressures mandating reduction of multilayer plastic waste, prompting manufacturers to switch to high-barrier mono-material alternatives. Demand consolidation has been most notable in North America and Western Europe, where stringent shelf-life labeling and transportation standards amplify the need for oxygen and aroma barrier packaging.

However, manufacturing complexity and high capital expenditure remain critical restraints. The electron beam curing and vacuum deposition techniques used in production pose substantial cost barriers for small and mid-size converters. Inconsistent raw material supply, particularly for high-performance resins and metallization layers, continues to disrupt throughput and delay fulfillment across emerging markets.

Furthermore, recyclability challenges linked to aluminum oxide and EVOH-based barrier structures threaten compliance with circular packaging goals.

Hidden disruption is expected from hybrid barrier coating technologies combining bio-based layers with vapor-deposited oxides, forecast to account for 9-12% of new installations by 2028. These systems reduce material thickness by up to 40% without compromising barrier efficacy, encouraging faster market adoption by cost-sensitive converters in Asia-Pacific.

The electron high barrier packaging film market has been segmented by Material; by Film Structure; by Thickness; by Application; by End Use; and by Region, covering North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; and Middle East & Africa.

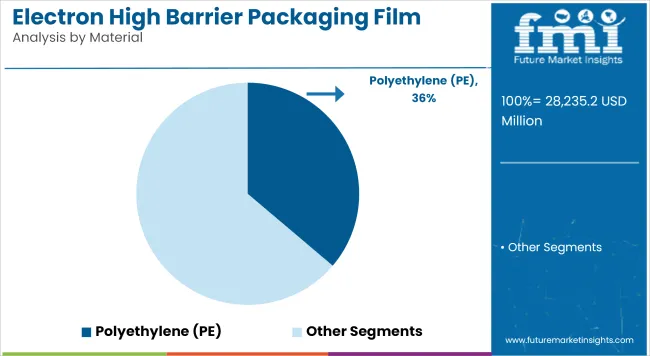

Polyethylene (PE) accounted for 36% of global revenues in 2025, outpacing EVOH and polyamide by a margin of over 12 percentage points. Its dominance stems from cost-efficiency, wide sealing temperature range, and compatibility with both food and pharmaceutical barrier formats.

While PE adoption remains steady, clarity and barrier retention under humid conditions remain technical hurdles. In contrast, EVOH offers higher oxygen resistance but is more vulnerable to moisture absorption.

A shift toward PE-EVOH co-extrusions with nanocoatings is underway, expected to raise PE’s composite adoption by 8-10% through 2030. Film converters benefit from enhanced recyclability, enabling compliance with single-material mandates.

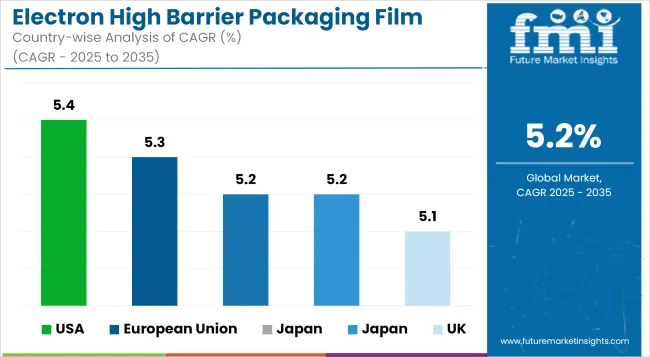

The USA market is projected to expand from USD 5.8 billion in 2025 to nearly USD 9.8 billion by 2035, growing at a CAGR of 5.4%. Regulatory emphasis on food safety and labeling accuracy, alongside rising demand for vacuum-sealed and MAP-compliant films, has reinforced market maturity. The USDA’s focus on reducing food waste through better packaging shelf-life support further favors barrier film adoption.

Consumers show preference for single-serve and resealable pouch formats in protein and snack categories. Transparency around recyclable claims remains a decision trigger in retail aisles.

The EU market is set to grow at a 5.3% CAGR from 2025 to 2035. Adoption has been catalyzed by the EU Packaging and Packaging Waste Regulation (PPWR), which mandates recyclability and limits multilayer formats by 2030. Western European countries account for over 70% of regional demand, with food processors driving high-barrier film upgrades.

Consumer pushback on overpackaging has forced manufacturers to adopt downgauging and high-efficiency substrates. Pouch and thermoform film adoption is strongest in Germany, France, and Italy.

Japan’s electron high barrier packaging film market will register a 5.2% CAGR through 2035. Aging demographics and a rising preference for smaller, shelf-stable portions continue to drive demand for high-barrier pouches and thermoformed trays.

Strict hygiene regulations, coupled with space-efficient packaging norms in convenience stores, support premiumization of functional barrier materials. However, cost pressures persist across local converters due to import dependence on multilayer substrates.

South Korea is projected to grow at a CAGR of 5.2% between 2025 and 2035. Market drivers include fast-paced foodservice innovation and increasing adoption of pre-portioned and HMR (home meal replacement) categories. The government’s Extended Producer Responsibility (EPR) system enforces strict recycling quotas, pushing demand for mono-material barrier packaging.

South Korean converters are increasingly investing in nano-coating technologies and solvent-free lamination lines to meet both functional and regulatory demands.

The UK market is forecast to grow at a CAGR of 5.1% from 2025 to 2035. The Plastic Packaging Tax (PPT) and retailer-led recyclability targets have accelerated the transition from metallized PET to recyclable high-barrier alternatives.

Ready meal and chilled food segments continue to lead barrier film adoption, with modified atmosphere packaging (MAP) seeing higher penetration in private-label brands. However, post-Brexit compliance cost and raw material sourcing delays remain structural friction points.

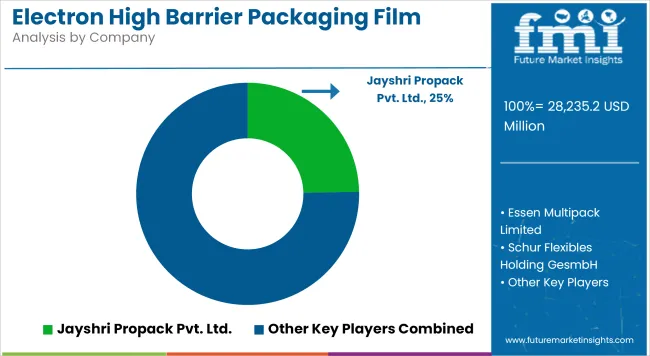

The players in the electron high barrier packaging film market are focusing on material simplification and recyclability to secure regulatory alignment and cost advantages. Multinational converters such as Amcor, Mondi, and Sealed Air are accelerating the development of mono-material barrier laminates and shifting away from complex multi-substrate structures. Meanwhile, regional specialists like Jayshri Propack and Essen Multipack have captured strategic shares through high-barrier retort pouch offerings tailored for local food processors.

Competition has intensified around coating innovation-particularly in plasma-deposited oxide layers and solvent-free adhesive systems-to achieve thinner, recyclable films without compromising on barrier integrity. Several companies have realigned their portfolios to favor high-barrier films compatible with polyethylene (PE) and polypropylene (PP), targeting compliance with upcoming packaging waste directives across the EU and North America.

Startups and mid-tier players have introduced disruption via plasma-enhanced atomic layer deposition (PEALD) and nanocoating systems that cut film gauge by up to 40% while retaining moisture and oxygen protection. These systems, though capital intensive, are being adopted by private-label food and pharma suppliers seeking competitive shelf-life extension.

Over the forecast period, firms investing in scalable barrier technologies and mono-material formats will consolidate lead positions, while laggards tied to legacy multilayer PET structures risk exclusion from high-margin end uses.

| Attribute | Details |

|---|---|

| Base Year | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Units | USD Billion |

| Market Segments | By Material, Film Structure, Thickness, Application, End Use |

| Key Regions | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Key Countries | United States, United Kingdom, Germany, France, Japan, South Korea |

| Companies Covered | Jayshri Propack, Amcor Plc, Mondi Group, Sealed Air, Uflex, Winpak, Schur Flexibles, Essen Multipack, Mitsubishi Chemical, Toppan Printing |

| Delivery Format | PDF with data tables and charts |

The market is valued at USD 28.2 billion in 2025 and projected to reach USD 46.8 billion by 2035.

The market is forecast to grow at a CAGR of 5.2% during the period.

Polyethylene (PE) dominates with a 36% share in 2025.

Pouches are the leading application, accounting for over 38% of the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electron Probe Microanalyzers (EPMA) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA