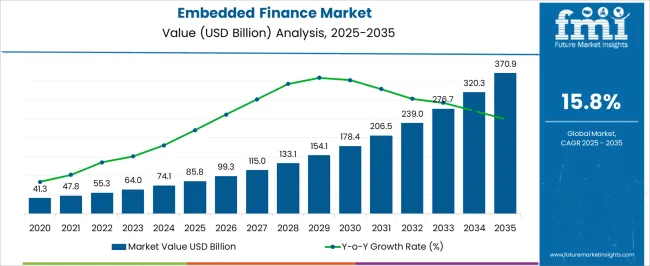

The Embedded Finance Market is estimated to be valued at USD 85.8 billion in 2025 and is projected to reach USD 370.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.8% over the forecast period.

| Metric | Value |

|---|---|

| Embedded Finance Market Estimated Value in (2025 E) | USD 85.8 billion |

| Embedded Finance Market Forecast Value in (2035 F) | USD 370.9 billion |

| Forecast CAGR (2025 to 2035) | 15.8% |

The embedded finance market is expanding rapidly due to the rising integration of financial services into non financial digital platforms, creating seamless user experiences and unlocking new revenue streams. Increasing adoption of digital ecosystems, from e commerce to ride hailing, is driving the inclusion of banking, payments, and lending directly within platforms consumers already use.

This trend is supported by advancements in APIs, cloud infrastructure, and regulatory frameworks that encourage financial inclusion and innovation. Businesses are leveraging embedded finance to reduce friction in transactions, enhance customer engagement, and gain deeper insights into consumer behavior.

The outlook remains promising as partnerships between technology providers, financial institutions, and digital service companies continue to evolve, shaping a market defined by convenience, accessibility, and data driven financial solutions.

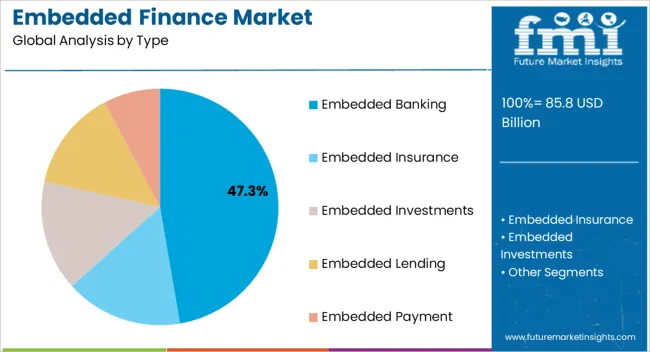

The embedded banking segment is expected to represent 47.30% of the overall market by 2025, positioning it as the leading type. This growth is being driven by the integration of banking features such as digital accounts, cards, and payment services directly within non financial platforms.

The demand for frictionless financial services that reduce the need for third party banking interactions has been a key growth catalyst. Businesses adopting embedded banking have gained the ability to enhance customer loyalty, increase transaction volumes, and generate recurring revenue.

Regulatory support for open banking and rising consumer preference for simplified financial solutions have further strengthened the position of this segment, making embedded banking the cornerstone of the embedded finance landscape.

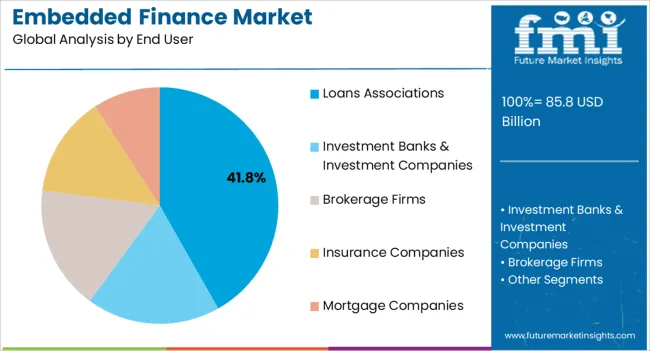

The loans associations segment is projected to hold 41.80% of the market by 2025, establishing it as the dominant end user category. Growth in this segment is being fueled by the increasing need for credit accessibility, particularly for underbanked populations and small businesses.

Embedded loan solutions have enabled faster approval processes, automated risk assessments, and improved customer experience within digital platforms. Associations and organizations providing loans are adopting embedded finance to expand outreach, reduce operational costs, and improve repayment efficiencies.

As digital ecosystems prioritize inclusivity and streamlined lending, the loans associations segment continues to lead, benefiting from both technological innovation and evolving credit demand across global markets.

Concepts like UPIs, consumer lending, SME lending, and insurance are helping the embedded finance market grow. These concepts are also expected to push the market upward in the forecast period, digitizing multiple sectors from finance to retail.

The key factors driving the growth of the embedded finance market are growing digitization in multiple spaces, acceptance of UPI payments, and increased consumer and SME lending.

Embedded finance can be known as financial services that are not integrated with banks.

The use of these services has increased lately due to the transformation of each sector and the fourth industrial revolution, also known as Industry 4.0. Covid-19 has also pushed the cashless economy and increased the consumption of embedded finance.

SME lending is another growing sector, accelerating the growth of the embedded finance market worldwide. Small and medium-sized enterprises seek financial aid to expand their distribution channels and supply chains; especially the covid-19 has impacted these SMEs adversely. To recover from the damage, these small and medium enterprises seek financial help, a loan against a business, or any other type of loan. This pushes the sales of embedded finance solutions and services.

Multiple investment schemes drawn up by governments and private players are also spreading awareness among people about alternative investment plans. Apart from this, the digitization of multiple sectors leads to cashless transactions, fueling the sales of embedded finance services. For instance,

Cashless transactions have skyrocketed in India due to covid-19 and demonetization. The UPI payments are now used largely, integrating with multiple platforms like Paytm, Google Pay, and Phone Pay. Low-cost EMIs are another important factor that drives the sales of consumer lending.

The B2B operations integrate with fintech services to improve financial management, increasing the sales of embedded finance solutions. Another key factor that pushes the market growth is the high penetration of the internet and 4G/5G services in developed and developing regions.

The only restraint to the market is the unavailability of the internet, including the incompetency of the workforce. New risks involving financial transactions that lead up to fraud and malicious activities are also hindering the growth of the embedded finance market.

| Countries | Revenue Share % (2025) |

|---|---|

| The United States | 22.3% |

| Germany | 12.3% |

| Japan | 7.1% |

| Australia | 3.2% |

| North America | 32.5% |

| Europe | 25.4% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 370.9.7% |

| India | 19.5% |

| The United Kingdom | 16.3% |

The embedded finance market is divided into regions such as North America, Latin America, Asia Pacific, the Middle East and Africa (MEA), and Europe. The foremost market is the United States, thriving at a CAGR of 16.1% between 2025 and 2035. The United States held a market share of 22.3% in 2002 while North America region held a market share of 32.5

The region is expected to hold a market revenue of USD 370.9 billion by the end of 2035. Factors behind this region's high sales of embedded finance solutions and services are increased investment, payment, and loan digitization. Apart from this, China is the second high-growth market for embedded finance market, thriving at a CAGR of 15.8% and might hold a value of USD 370.9 billion by 2035.

Japan region is estimated to hold USD 13.8 billion by the end of 2035 as it thrives on a promising CAGR of 14.7% between 2025 and 2035. The United Kingdom also grows along with Japan and the forecasted value is USD 10.5 billion (2035) at a CAGR of 15.3% between 2025 and 2035.

| Category | By Type |

|---|---|

| Leading Segment | Embedded Banking |

| Market Share (2025) | 32.1% |

| Category | By End User Type |

|---|---|

| Leading Segment | Investment Banks and Investment Companies |

| Market Share (2025) | 27.2% |

The embedded finance market is categorized by type and end user. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a stronghold in multiple regions.

The type category is segmented into embedded banking, embedded insurance, embedded investments, embedded lending, and embedded payments. The end user category is segmented into loan associations, investment banks & investments companies, brokerage firms, insurance companies, and mortgage companies.

By type, the FMI study finds that the embedded banking type has a high sales potential through 2035. The adoption of embedded held a market share of 32.1% in 2025. Its growth is attributed to the rapid digitization of banking services and private banks, enhancing and transforming the customer experience.

In the future, sales of embedded banking services are estimated to grow in proportion to the need for easy processes and smooth transactions. This pushes the sales of embedded finance systems in new markets.

By the end, the user, investment banks & investment companies segment is the big segment in the embedded finance market and is expected to hold a notable portion in the forecast period. The segment held a market share of 27.2% in 2025.

Factors behind the growth of this segment are rising start-ups and demand for high investments. The increased consumption through investment services and integration of embedded fintech services is increasing the sales of embedded finance solutions.

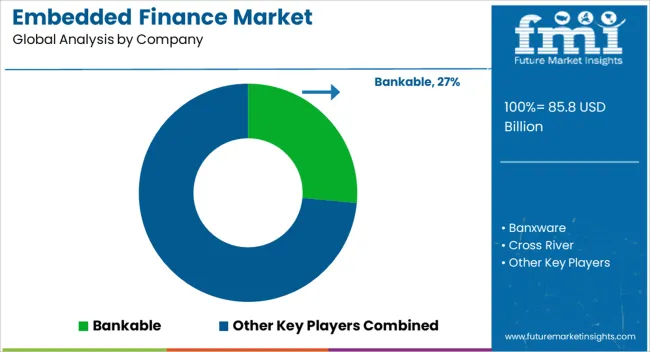

The competitive landscape of embedded finance is diversified and makes the market exclusive for new players. Companies also collaborate and merge with other companies, which enhances operability. The vendors focus on expanding their supply chain and distribution channels.

Market Developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 85.8 billion |

| Projected Market Size (2035) | USD 370.9 billion |

| CAGR (2025 to 2035) | 15.8% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million transactions for volume |

| Types Analyzed (Segment 1) | Embedded Banking, Embedded Insurance, Embedded Investments, Embedded Lending, Embedded Payment |

| End Users Analyzed (Segment 2) | Loan Associations, Investment Banks & Investment Companies, Brokerage Firms, Insurance Companies, Mortgage Companies |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Embedded Finance Market | Bankable, Banxware, Cross River, Finix, Flywire, Resolve, Parafin, TreviPay, Balance, Stripe |

| Additional Attributes | Digital transformation in banking-as-a-service (BaaS), Use cases across e-commerce, SaaS, and gig platforms, Cross-sector partnerships in embedded finance rollouts, Fintech innovation in APIs and open banking compliance, Regulatory implications and market entry challenges |

| Customization and Pricing | Customization and Pricing Available on Request |

The global embedded finance market is estimated to be valued at USD 85.8 billion in 2025.

The market size for the embedded finance market is projected to reach USD 370.9 billion by 2035.

The embedded finance market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in embedded finance market are embedded banking, embedded insurance, embedded investments, embedded lending and embedded payment.

In terms of end user, loans associations segment to command 41.8% share in the embedded finance market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA