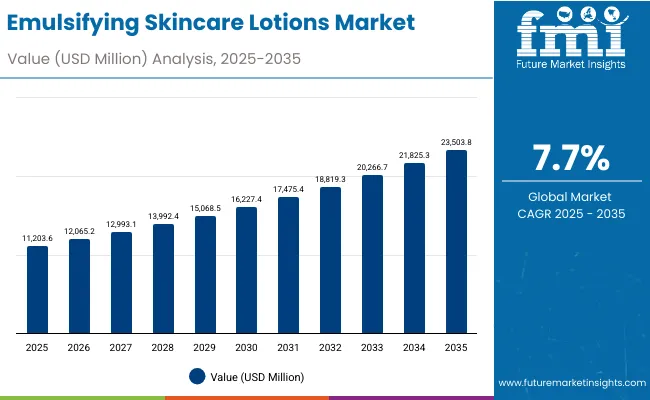

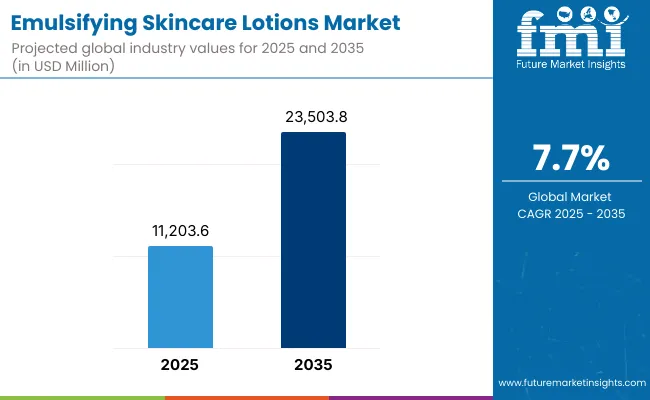

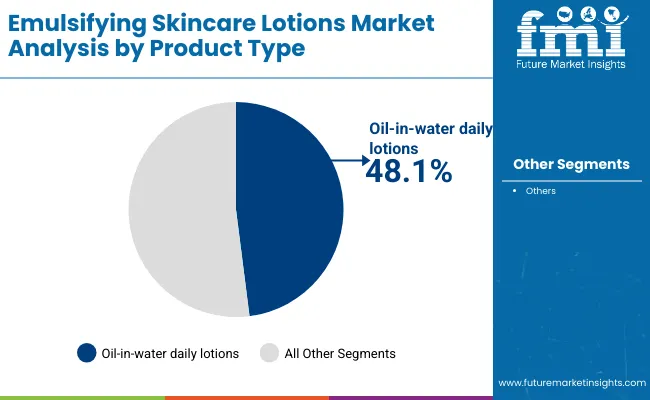

The Emulsifying Skincare Lotions Market is projected to grow from USD 11,203.6 million in 2025 to USD 23,503.8 million by 2035, registering a robust CAGR of 7.7% during the forecast period. Among product types, water-in-oil intensive lotions will dominate with a 51.9% market share in 2025, while oil-in-water daily lotions will contribute 48.1% of global value.

Emulsifying Skincare Lotions Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value (2025E) | USD 11,203.6 million |

| Market Forecast Value (2035F) | USD 23,503.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The market is expected to nearly double in value (2.1× growth) between 2025 and 2035, reflecting a decade-long increase of USD 12,300 million in absolute terms. During the initial five-year period from 2025 to 2030, market value expands from USD 11,203.6 million to USD 16,227.4 million, adding approximately USD 5,023.8 million, which accounts for around 41% of total decade growth. This phase marks consistent adoption of emulsifying technologies in moisturizing, barrier repair, and anti-aging formulations, with polyglyceryl esters gaining traction as multifunctional and PEG-free emulsifiers.

The second half of the decadefrom 2030 to 2035contributes a further USD 7,276.4 million, representing 59% of cumulative growth. This acceleration is driven by advances in bio-based emulsifiers, higher demand for moisturizing and barrier care lotions, and expansion of e-commerce and pharmacy channels.

From 2020 to 2024, the Emulsifying Skincare Lotions Market expanded steadily as consumers shifted toward lightweight, daily hydration formats and multifunctional emulsions combining moisturizing and anti-aging benefits. Demand was led by mass-market and dermocosmetic brands offering oil-in-water formulations for sensitive and combination skin types. During this period, brand competition centered on ingredient transparency, PEG-free emulsifiers, and sustainable sourcing of ester blends, while digital beauty channels began shaping consumer access and brand loyalty.

In 2025, global demand for emulsifying lotions is valued at USD 11.2 billion, with long-term growth driven by bio-based emulsifiers and clinical skincare claims. Leading players are pivoting toward hybrid emulsifier systems (such as polyglyceryl esters and lecithin-based blends) to deliver stability, sensory appeal, and barrier repair. Emerging entrants and dermocosmetic brands are expanding through e-commerce and pharmacy networks, while clean-beauty and sensitive-skin formulations accelerate adoption. The competitive edge is shifting toward performance-driven emulsions supported by dermatological efficacy and sustainability positioning.

Consumers are increasingly favoring emulsifying lotions that combine hydration with dermatological repair and protection. The surge in sensitive-skin prevalence, driven by pollution, stress, and over-exfoliation, has accelerated the use of gentle emulsifiers like polyglyceryl esters and lecithin. These ingredients support moisture retention without irritation, while brands leverage dermatologist-endorsed and hypoallergenic claims to capture loyalty in both premium and mass segments.

E-commerce and pharmacy chains are transforming how emulsifying skincare products reach consumers. Online platforms enable personalization, ingredient education, and subscription-based sales, particularly for daily-use lotions. Meanwhile, pharmacies and specialty drugstores build trust through clinical-grade positioning and cross-category bundling with serums and SPF care. This dual-channel expansion enhances accessibility and drives consistent repeat purchases across regions.

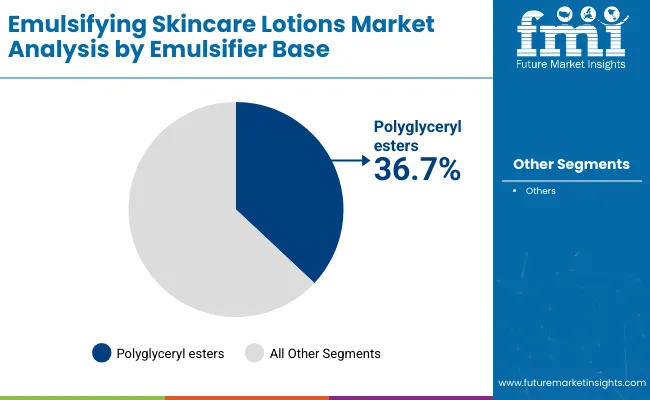

The Emulsifying Skincare Lotions Market is segmented by product type, emulsifier base, function, distribution channel, end user, and region. By product type, the market includes oil-in-water daily lotions and water-in-oil intensive lotions, catering to varying hydration needs and skin types. Based on emulsifier base, segmentation covers polyglyceryl esters, lecithin-based emulsifiers, fatty alcohol/ester blends, and sucrose esters, which define the formulation stability and sensory performance. By function, the market encompasses moisturizing and barrier care, anti-aging active delivery, brightening and tone-evening, and SPF day lotions (non-tinted). Distribution channels include e-commerce, pharmacies & drugstores, specialty beauty retail, and supermarkets & hypermarkets, reflecting the blend of clinical and mass-market positioning. By end user, the market targets women, men, unisex family care, and sensitive-skin users across diverse geographies. Regionally, the study covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with notable growth in China, India, Japan, Germany, the UK, and the USA

| Product Type | Value Share% 2025 |

|---|---|

| Oil-in-water daily lotions | 48.1% |

| Others | 51.9% |

The water-in-oil intensive lotions segment is projected to contribute 51.9% of the Emulsifying Skincare Lotions Market revenue in 2025, maintaining its lead as the dominant product category. This is driven by the rising demand for rich, long-lasting moisturizers designed for dry and sensitive skin types. These formulations provide superior hydration, enhanced barrier repair, and protection against environmental stressors. Their thicker, emollient texture appeals to consumers seeking intensive nourishment and all-weather skin protection.

Growth in this segment is further supported by the use of advanced emulsifying agents such as lecithin and sucrose esters, which enhance texture, stability, and sensory performance. With premium skincare brands focusing on clinical efficacy and dermocosmetic positioning, water-in-oil intensive lotions are expected to remain the backbone of product portfolios across pharmacy, dermatology, and professional skincare lines.

| Emulsifier Base | Value Share% 2025 |

|---|---|

| Polyglyceryl esters | 36.7% |

| Others | 63.3% |

The polyglyceryl esters segment is expected to play a leading role in the Emulsifying Skincare Lotions Market, accounting for 36.7% of the total value in 2025. The strong growth of this segment is attributed to the clean beauty movement and the global transition toward PEG-free, plant-based, and biodegradable emulsifiers. Polyglyceryl esters provide mild yet efficient emulsification properties, ensuring product stability while maintaining skin compatibility.

These emulsifiers are particularly favored in moisturizing and barrier care formulations, where they help maintain smooth texture and lightweight absorption. With growing consumer awareness around ingredient safety and environmental sustainability, manufacturers are increasingly adopting polyglyceryl esters as a natural alternative to synthetic surfactants. The segment is projected to expand across both mass and premium skincare categories as brands enhance their eco-certification and dermatological claims.

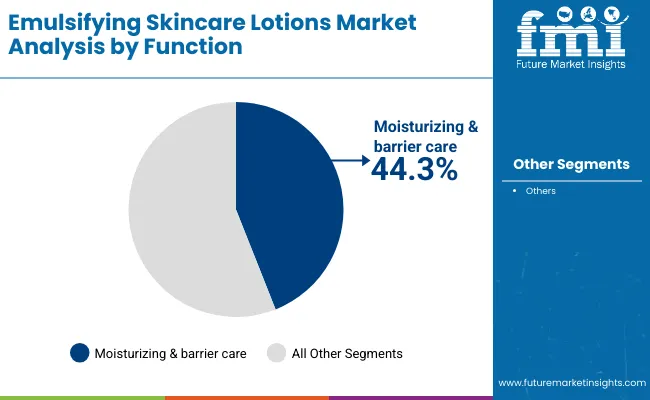

| Function | Value Share% 2025 |

|---|---|

| Moisturizing & barrier care | 44.3% |

| Others | 55.7% |

The moisturizing and barrier care segment is projected to contribute 44.3% of the Emulsifying Skincare Lotions Market revenue in 2025, reflecting the sustained consumer focus on hydration and skin resilience. This function leads due to the increased incidence of dryness, sensitivity, and compromised skin barriers associated with environmental stress and frequent cleansing.

Brands are responding with emulsion systems that restore the skin’s lipid matrix, incorporating ceramides, natural oils, and humectants within stable emulsifying bases. The category is further strengthened by growing dermatologist endorsements, expansion of pharmacy-led skincare ranges, and consumer inclination toward multi-functional lotions that combine hydration, repair, and protection. As wellness-driven beauty trends evolve, moisturizing and barrier care products will remain a cornerstone of growth across all regions and consumer demographics.

Rising Demand for Sensitive-Skin and Barrier-Repair Formulations

The growing prevalence of sensitive skin and irritation-related conditions is a key driver for the Emulsifying Skincare Lotions Market. Consumers are increasingly shifting toward mild, dermatologist-tested formulations with non-ionic emulsifiers like polyglyceryl esters and lecithin. These ingredients provide superior emulsion stability while maintaining skin compatibility and hydration. Brands are leveraging clean-label and hypoallergenic claims to attract consumers seeking products that repair the skin barrier, reduce redness, and strengthen long-term moisture retention, especially across urban markets in Asia and Europe.

Expansion of E-commerce and Pharmacy Retail Networks

Digital transformation and the rapid rise of online beauty retail have created new growth avenues for emulsifying skincare lotions. E-commerce platforms allow personalized recommendations and subscription-based sales for daily-use skincare. Simultaneously, pharmacies and drugstores are expanding clinical-grade skincare assortments, blending therapeutic and cosmetic positioning. This dual-channel accessibility drives higher consumer trust and repeat purchases. The integration of online dermatology consultations and omnichannel brand strategies further accelerates lotion sales across both premium and mass-market categories.

High Formulation Complexity and Stability Challenges

One of the main restraints in the Emulsifying Skincare Lotions Market lies in the complex formulation process required to maintain stable emulsions over time. Achieving the right balance between oil, water, and emulsifier ratios can be difficult, particularly when using natural or bio-based ingredients. These formulations are more prone to separation and microbial instability, necessitating advanced preservation systems and process optimization. As brands move toward clean-label and PEG-free compositions, production costs and R&D requirements increase, limiting scalability for small and mid-sized manufacturers.

Shift Toward Bio-Based and PEG-Free Emulsifier Systems

A major trend shaping the Emulsifying Skincare Lotions Market is the transition toward natural, bio-based, and PEG-free emulsifier systems that align with sustainability and clean-beauty values. Manufacturers are increasingly adopting polyglyceryl, sucrose, and lecithin esters to replace synthetic surfactants, enhancing biodegradability and reducing irritation potential. This trend reflects consumer preference for eco-certified ingredients and transparent labeling. Additionally, innovations in cold-process emulsification are helping brands lower energy use while preserving ingredient efficacy, making the trend both environmentally and economically advantageous.

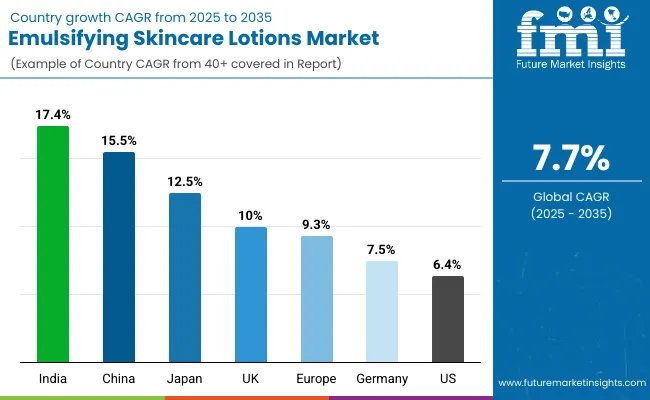

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.5% |

| USA | 6.4% |

| India | 17.4% |

| UK | 10.0% |

| Germany | 7.5% |

| Japan | 12.5% |

| Europe | 9.3% |

The Emulsifying Skincare Lotions Market demonstrates distinct regional growth patterns shaped by differences in consumer demographics, dermatological awareness, and retail ecosystem maturity. Asia-Pacific stands out as the fastest-growing region, led by India (17.4% CAGR) and China (15.5% CAGR). Growth here is driven by expanding middle-class populations, increasing skincare awareness, and rising demand for multifunctional, affordable emulsifying lotions. China’s market is propelled by its robust online retail landscape and innovation in bio-based emulsifiers, while India’s momentum stems from domestic beauty brands entering the clean-label and pharmacy skincare segments.

Japan (12.5% CAGR) shows steady growth, supported by strong R&D in emulsification science and consumer preference for light-textured, high-efficacy lotions suited to humid climates. The European market maintains a balanced profile, with the UK (10.0%) and Germany (7.5%) driving demand for dermocosmetic and sensitive-skin formulations. European brands lead in sustainability compliance, favoring PEG-free and plant-derived emulsifiers that align with environmental certification norms.

The USA market expands at a moderate 6.4% CAGR, reflecting maturity in the premium skincare sector and growing adoption of dermatologist-recommended emulsifying lotions across pharmacy and e-commerce channels. Growth in the USA is primarily driven by the shift toward functional skincare, including barrier-repair and hydration-boosting products. Overall, Europe (9.3% CAGR) remains a leader in innovation and regulatory advancement, while Asia-Pacific leads in consumption volume and digital-driven growth, positioning the region as the global powerhouse for emulsifying skincare lotion adoption through 2035.

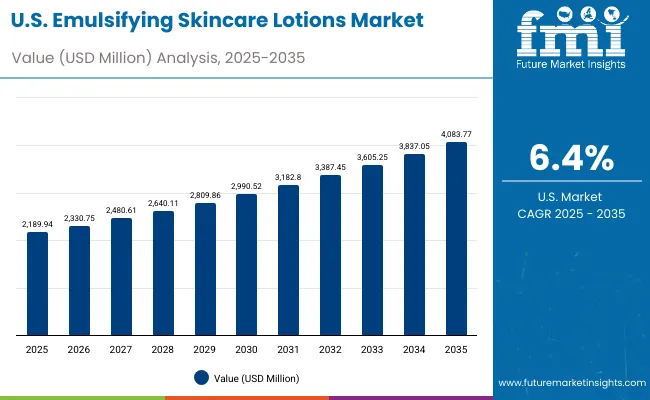

| Year | USA Emulsifying Skincare Lotions Market (USD Million) |

|---|---|

| 2025 | 2189.94 |

| 2026 | 2330.75 |

| 2027 | 2480.61 |

| 2028 | 2640.11 |

| 2029 | 2809.86 |

| 2030 | 2990.52 |

| 2031 | 3182.80 |

| 2032 | 3387.45 |

| 2033 | 3605.25 |

| 2034 | 3837.05 |

| 2035 | 4083.77 |

The Emulsifying Skincare Lotions Market in the United States is projected to grow at a CAGR of 6.4% during 2025-2035, supported by rising demand for dermatologist-endorsed skincare and premium daily hydration products. Growth is driven by consumer preference for multi-functional lotions combining moisturization, anti-aging, and sun protection benefits. The increasing use of dermocosmetic formulations with clean-label and PEG-free emulsifiers is also shaping brand innovation. E-commerce and pharmacy channels continue to expand, offering consumers greater access to targeted and clinical-grade skincare.

The Emulsifying Skincare Lotions Market in the United Kingdom is expected to grow at a CAGR of 10.0% through 2035, supported by strong consumer demand for hydrating and sensitive-skin formulations. British consumers are increasingly drawn to dermocosmetic and pharmacy-endorsed brands that emphasize sustainability and transparency. Local skincare firms are partnering with dermatologists and cosmetic chemists to introduce emulsions that combine soothing botanical actives with non-irritating emulsifiers. Government-backed initiatives promoting clean beauty innovation and recyclable packaging are fostering R&D collaboration between universities and skincare manufacturers.

India is witnessing rapid growth in the Emulsifying Skincare Lotions Market, forecast to expand at a CAGR of 17.4% during 2025-2035, the highest among developing nations. Demand is driven by rising middle-class incomes, increasing skincare awareness, and wider adoption of daily-use moisturizing lotions. Domestic and global brands are localizing formulations using lightweight emulsions that suit humid climates. Tier-2 and Tier-3 cities are experiencing strong retail penetration through pharmacy and e-commerce platforms. Educational and professional skincare institutions are introducing training programs in cosmetic formulation and product testing, expanding skilled manpower in this space.

The Emulsifying Skincare Lotions Market in China is expected to grow at a CAGR of 15.5%, one of the fastest globally. Rapid adoption of premium hydration and brightening lotions is driven by digital retail expansion, influencer marketing, and strong consumer awareness of ingredient efficacy. Domestic manufacturers are developing bio-based emulsifier systems and lightweight water-in-oil lotions suited to diverse climates and skin tones. Government-led quality certification programs and the popularity of dermatologist-affiliated skincare brands further enhance consumer trust.

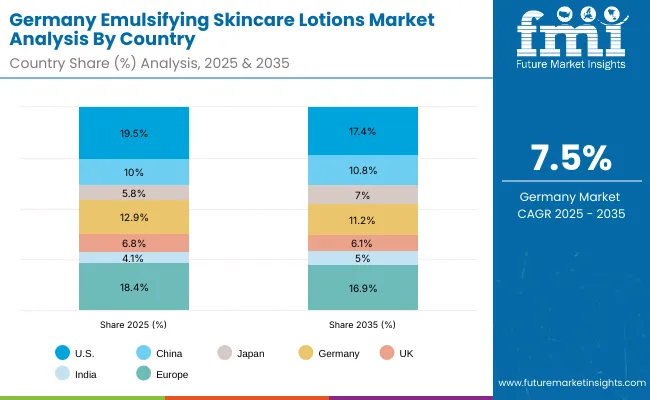

| Country | 2025 Share (%) |

|---|---|

| USA | 19.5% |

| China | 10.0% |

| Japan | 5.8% |

| Germany | 12.9% |

| UK | 6.8% |

| India | 4.1% |

| Europe | 18.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.4% |

| China | 10.8% |

| Japan | 7.0% |

| Germany | 11.2% |

| UK | 6.1% |

| India | 5.0% |

| Europe | 16.9% |

The Emulsifying Skincare Lotions Market in Germany is projected to grow at a CAGR of 7.5% during 2025-2035, driven by the country’s strong dermatological research base, high consumer awareness, and strict product safety standards under EU cosmetic regulations. German consumers increasingly prefer clinically tested emulsifying lotions that offer long-lasting hydration and are free from parabens, PEGs, and silicones. The country’s mature skincare ecosystem, anchored by brands such as Eucerin, Nivea, and La Roche-Posay, continues to set global benchmarks in dermocosmetic formulation and efficacy testing.

Growth is further supported by the expansion of pharmacy-led skincare retail chains and the integration of sustainable emulsifier systems derived from plant-based esters and lecithins. These formulations align with Germany’s broader sustainability goals and consumer preference for eco-certified and dermatologically safe products. Innovation is also evident in the rising adoption of cold-process emulsification, reducing energy consumption in manufacturing.

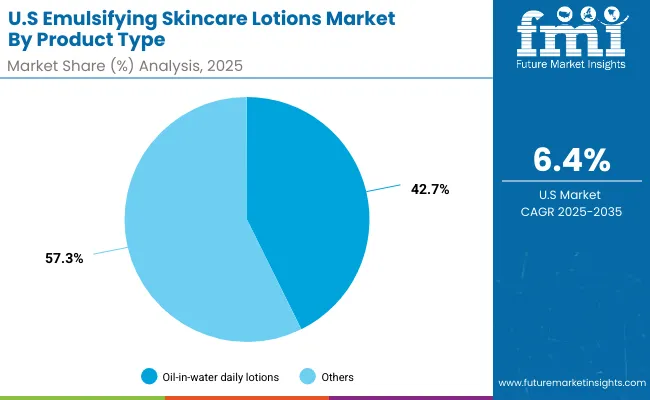

| USA By Product Type | Value Share% 2025 |

|---|---|

| Oil-in-water daily lotions | 42.7% |

| Others | 57.3% |

The Emulsifying Skincare Lotions Market in the United States is projected to maintain a steady growth trajectory through 2035, driven by increasing demand for multi-functional and dermatologist-endorsed skincare products. In 2025, water-in-oil intensive lotions dominate with a 57.3% share, reflecting consumer preference for richer, long-lasting hydration suitable for dry and mature skin. Meanwhile, oil-in-water daily lotions continue to attract urban consumers seeking lightweight, quick-absorption products for everyday use.

Growth is further supported by the expansion of pharmacy and mass-retail skincare categories, the influence of clinical brands such as Neutrogena, CeraVe, and Aveeno, and a strong consumer shift toward clean-label, PEG-free emulsifier bases. Online and direct-to-consumer platforms are reinforcing brand accessibility, while dermatology partnerships and product trials continue to build credibility.

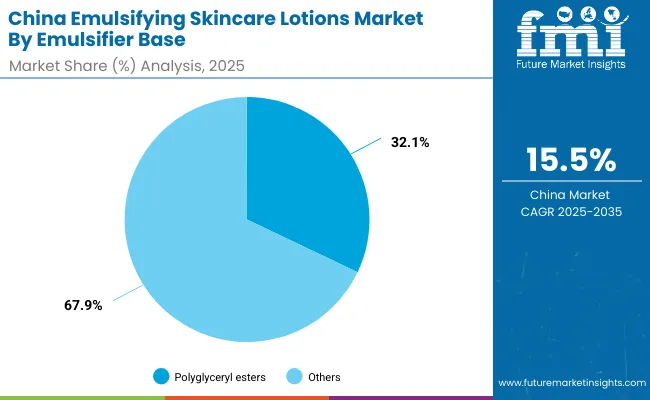

| China By Emulsifier Base | Value Share% 2025 |

|---|---|

| Polyglyceryl esters | 32.1% |

| Others | 67.9% |

The Emulsifying Skincare Lotions Market in China presents a major growth opportunity, expanding at a CAGR of 15.5% during 2025-2035. The market’s acceleration is fueled by digital retail ecosystems, rising disposable incomes, and growing interest in natural and functional skincare. Polyglyceryl esters are gaining traction as preferred emulsifiers due to their eco-friendly, non-irritating, and biodegradable profiles, aligning with China’s emerging clean-beauty standards.

Local brands are rapidly innovating with plant-based emulsions, botanical actives, and hybrid lotion-serum textures to attract tech-savvy and ingredient-conscious consumers. The country’s manufacturing strength and cost efficiency support mass-scale production, while cross-border collaborations with European labs enhance formulation quality.

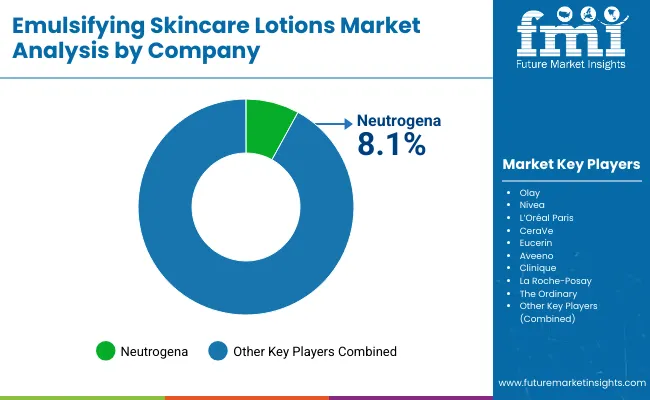

| Company | Global Value Share 2025 |

|---|---|

| Neutrogena | 8.1% |

| Others | 91.9% |

The Emulsifying Skincare Lotions Market is moderately fragmented, characterized by the presence of multinational skincare leaders, mid-sized dermocosmetic innovators, and niche clean-beauty brands. Global giants such as Neutrogena, Nivea, L’Oréal Paris, and CeraVe hold significant market share, driven by their clinically validated formulations, strong dermatologist partnerships, and wide distribution across pharmacies, e-commerce, and retail chains. Their strategies increasingly focus on barrier-repair science, microbiome care, and sustainability certifications, supported by ongoing innovation in PEG-free emulsifiers and cold-process manufacturing.

Mid-sized brands such as Aveeno, Eucerin, Clinique, and La Roche-Posay are enhancing market penetration through product diversification in sensitive-skin, anti-aging, and brightening lotion categories. These companies are actively developing multi-phase emulsions and hybrid skincare systems that blend hydration, protection, and dermatological efficacy. They are also leveraging online dermatologist consultations and personalized recommendation tools to strengthen consumer engagement.

Emerging and niche brands such as The Ordinary and regionally focused pharmacy labels are carving out share by offering transparent ingredient lists, minimalist formulations, and strong price-to-performance value. Their competitive strength lies in customization, transparency, and agile reformulation, which cater to consumer demand for authenticity and sustainability.

Overall, competitive differentiation in this market is shifting from traditional brand loyalty to formulation credibility and eco-conscious innovation. Players investing in bio-based emulsifier systems, clinical testing, and circular packaging are gaining strategic advantage, especially in regulated markets like the EU and North America.

Key Developments in Emulsifying Skincare Lotions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 11,203.6 Million |

| Product Type | Oil-in-water daily lotions, Water-in-oil intensive lotions, Cold-process lotions, Sensitive/PEG-free lotions |

| Emulsifier Base | Polyglyceryl esters, Lecithin-based, Fatty alcohol/ester blends, Sucrose esters |

| Function | Moisturizing & barrier care, Anti-aging active delivery, Brightening/tone-evening, SPF day lotions (non-tinted) |

| Channel | E-commerce, Pharmacies & drugstores, Specialty beauty retail, Supermarkets & hypermarkets |

| End User | Women, Men, Unisex family care, Sensitive-skin users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Neutrogena, Olay, Nivea, L’Oréal Paris, CeraVe, Eucerin, Aveeno, Clinique, La Roche- Posay, The Ordinary |

| Additional Attributes | Dollar sales by product type and emulsifier base, adoption trends in moisturizing and barrier-repair skincare, rising demand for clean-label and PEG-free emulsifying agents, segment-specific growth in pharmacy-led and e-commerce skincare retail, value contribution from functional categories such as anti-aging and brightening lotions, integration of bio-based and cold-process emulsification technologies, regional trends influenced by dermatological awareness and sustainable formulation mandates, and innovations in polyglyceryl, lecithin, and sucrose ester systems for enhanced texture stability and skin compatibility. |

The global Emulsifying Skincare Lotions Market is estimated to be valued at USD 11,203.6 million in 2025.

The market size for the Emulsifying Skincare Lotions Market is projected to reach USD 23,503.8 million by 2035.

The Emulsifying Skincare Lotions Market is expected to grow at 7.7% CAGR between 2025 and 2035.

The key product types in the Emulsifying Skincare Lotions Market are oil-in-water daily lotions, water-in-oil intensive lotions, cold-process lotions, and sensitive/PEG-free lotions.

In terms of formulation base, the water-in-oil intensive lotions segment is expected to command a significant share of 51.9% in the Emulsifying Skincare Lotions Market in 2025, driven by high demand for rich, long-lasting hydration and barrier-repair benefits.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA