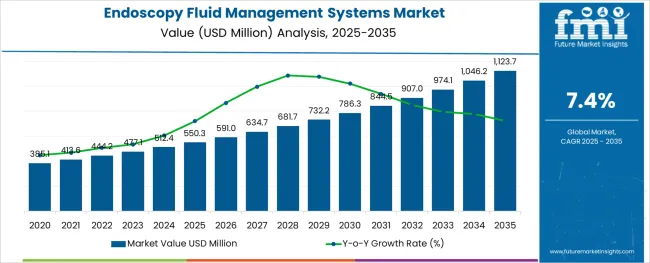

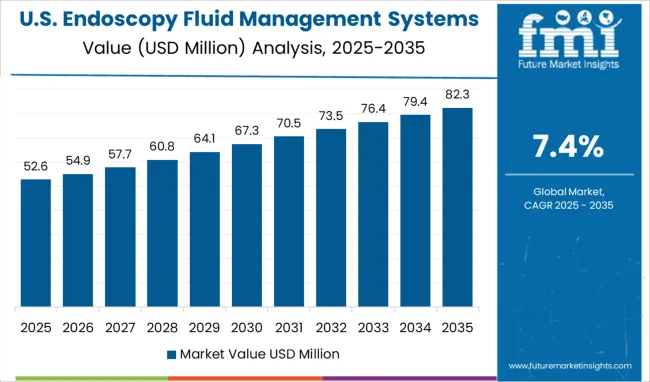

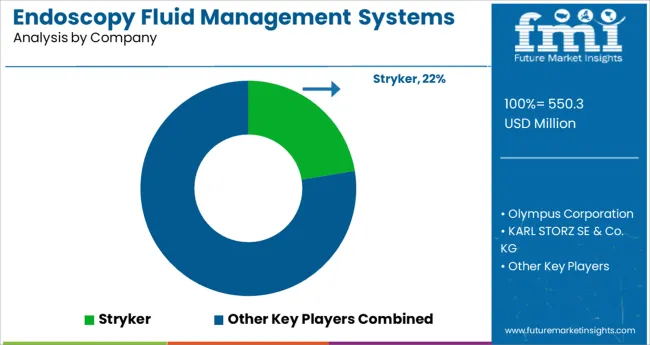

The Endoscopy Fluid Management Systems Market is estimated to be valued at USD 550.3 million in 2025 and is projected to reach USD 1,123.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

The endoscopy fluid management systems market is expanding steadily due to the increasing demand for advanced surgical equipment that improves patient outcomes during minimally invasive procedures. The rising number of laparoscopic surgeries worldwide has accelerated the adoption of efficient fluid management solutions that ensure clear visibility and safe operative environments. Innovations in technology have resulted in systems that offer precise control, enhanced suction, and irrigation capabilities.

Hospitals are increasingly investing in such equipment to reduce procedure times and improve clinical efficiency. The growing emphasis on infection control and safety standards has also supported the uptake of reliable fluid management systems.

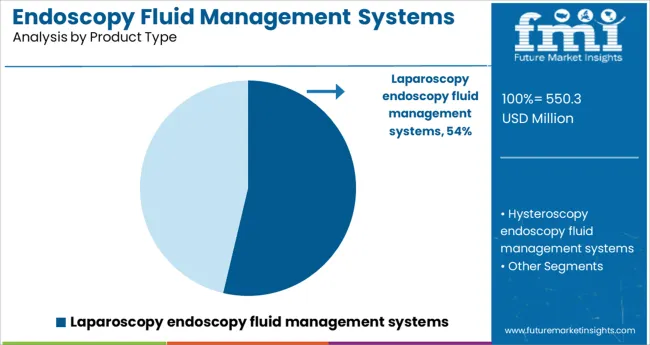

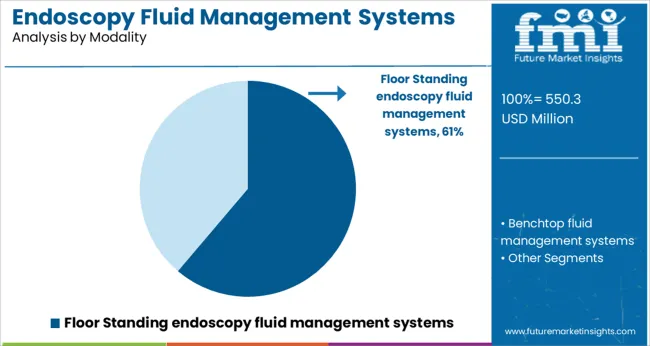

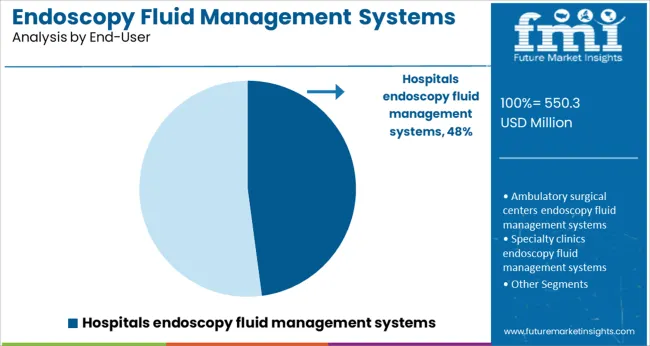

The market outlook remains positive as surgical centers and hospitals continue to upgrade their endoscopy infrastructure. Segment growth is expected to be driven by laparoscopy endoscopy fluid management systems as the dominant product type, floor standing systems as the preferred modality, and hospitals as the primary end-user.

The market is segmented by Product Type, Modality, and End-User and region. By Product Type, the market is divided into Laparoscopy endoscopy fluid management systems and Hysteroscopy endoscopy fluid management systems. In terms of Modality, the market is classified into Floor Standing endoscopy fluid management systems and Benchtop fluid management systems.

Based on End-User, the market is segmented into Hospitals endoscopy fluid management systems, Ambulatory surgical centers endoscopy fluid management systems, Specialty clinics endoscopy fluid management systems, and Diagnostic centers endoscopy fluid management systems. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The laparoscopy endoscopy fluid management systems segment is projected to hold 53.7% of the market revenue in 2025, establishing it as the leading product type. The growth in this segment has been driven by the increasing prevalence of minimally invasive surgeries requiring efficient fluid handling to maintain optimal operative conditions. These systems facilitate better visualization by regulating irrigation and suction effectively during laparoscopic procedures.

Clinical teams have prioritized these systems to enhance surgical precision and patient safety. Additionally, the expanding number of laparoscopic surgeries globally has increased demand for specialized fluid management equipment.

The segment’s ability to integrate with other laparoscopic instruments and provide automated functions has further supported its adoption.

The floor standing endoscopy fluid management systems segment is expected to account for 61.2% of the market revenue in 2025, leading the modality category. These systems are favored for their stability, larger fluid capacity, and suitability in high-volume surgical centers. Their robust design allows for continuous operation during lengthy procedures without interruption.

Healthcare facilities have invested in floor standing systems to support a broad range of endoscopic surgeries with varying fluid management requirements. The ease of maintenance and compatibility with multiple endoscopic devices have made this modality popular among hospitals.

As hospitals focus on improving surgical workflow and minimizing downtime, the floor standing systems segment is poised to maintain its dominant market position.

Hospitals are projected to represent 47.9% of the endoscopy fluid management systems market revenue in 2025, reinforcing their position as the primary end-user. This dominance is driven by hospitals’ need for comprehensive and reliable fluid management solutions to support diverse endoscopic procedures. Hospitals typically perform higher volumes of surgeries requiring precise fluid control to reduce complications and improve patient outcomes.

Investment in advanced surgical infrastructure and adherence to strict safety protocols have fueled the demand for state-of-the-art fluid management systems.

Furthermore, hospitals’ capacity to adopt technologically sophisticated equipment and provide specialized staff training has contributed to their leadership in this market. As the number of minimally invasive surgeries continues to rise, hospitals will remain the key end-users of these systems.

| Particulars | Details |

|---|---|

| H1, 2024 | 7.16% |

| H1, 2025 Projected | 7.43% |

| H1, 2025 Outlook | 7.23% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 20 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (+) 07 ↑ |

On the regional front, North America and Asia Pacific are likely to emerge as the kingpins, registering market shares worth 42% and 28% in 2025 respectively. The ever increasing demand for minimally invasive surgeries is primarily responsible for this elevated growth rate.

A comparative analysis has been done by Future Market Insights on the growth rate of endoscopy fluid management systems market within the duration of H1-2025 and H1-2024. The variation between the BPS values observed within this market in H1, 2025 - outlook over H1, 2025 projected reflects a decline of 20 BPS units.

However A positive BPS growth in H1-2025 over H1-2024 by 07 Basis Point Share (BPS) is demonstrated by the market.

Endoscopy Fluid Management Systems offer a number of benefits such as clear visibility of surgical site, reduced tissue adherence to endoscopic tools, faster electrosurgical effects and cost affordability over alternative methods, thus resulting in favourable BPS change.

Additionally development and introduction of new FDA approved high performance and cutting edge technologies are expected to further boost the market growth and provide opportunistic growth prospects to the market players in the forecast duration.

The growth of the market is backed by a higher inclination towards minimally-invasive procedures. Coupled with this, the rising incidence of chronic ailments and cases of accidents has been creating growth prospects for the market. The market registered a 5.9% CAGR between 2020 to 2024.

Advancements witnessed in the last couple of years in conducting minimally-invasive procedures are indicative of impressive developments in surgical equipment. In addition to this, R&D activities are leading to technological advancements in fluid management systems. Government funds and grants are driving the market at a global level for nonsurgical procedures and leading to an increase in ESRD patient base.

Overall, the demand for endoscopy fluid management systems is anticipated to rise at a CAGR of around 7.4% through 2035, accounting for 4% share in the global fluid management systems market.

For diagnosing and treating chronic and acute diseases, doctors, at times, prescribe surgeries. Minimally invasive surgeries are done with the help of endoscopes along with endoscope procedure kits. During such procedures, endoscopy fluid management systems are used as irrigation pumps.

According to the Centers for Disease Control and Prevention (CDC), six in ten Americans live with at least one chronic disease. Globally, endoscopic systems have been witnessing high demand, owing to the rising prevalence of chronic diseases. North America has been registering high demand for endoscopic fluid management systems, owing to the large number of expert surgeons practicing in the region.

Endoscopic fluid management systems help reduce bleeding in internal cavities during endoscopic surgeries. They are integrated with endoscopy visualization systems & other endoscopic instruments. According to Cancer Research UK, there were 385.1 million new cases of cancer worldwide in 2020.

The four most common cancers occurring worldwide are lung, female breast, bowel, and prostate cancer. These four accounts for more than four in ten of all cancers diagnosed worldwide. Worldwide there will be 27.5 million new cases of cancer each year by 2040. Hence, endoscopic surgeries to cure such cancers will enhance deployment of endoscopic fluid management systems.

As healthcare infrastructure expands across developing countries, governments are attempting to reduce financial barriers to facilitate extensive R&D across various domains.

This trend has boded well for endoscopy fluid management systems. Countries such as China, India, Brazil and Mexico, for instance, are preferred destinations for healthcare tourism.

Moreover, countries across the Asia Pacific, including China and India, possess the world’s largest population base, collectively comprising over 60% of the total number of people across the globe. Also, they also constitute a large patient base for renal, gastrointestinal and respiratory ailments, areas which extensively require endoscopic surgery.

Also, as patients in emerging economic experience elevated living standards, they are in a position to afford cost-intensive treatments and surgeries. This is encouraging several small, medium and large-scale manufacturers to establish base across these regions.

As per FMIs analysis, in the coming years, Asia Pacific is projected to be highly lucrative for the overall endoscopy fluid management systems market growth.

Rising awareness regarding minimally invasive endoscopic surgeries and irrigation pumps and affinity towards the products manufactured by local companies in India have collectively increased revenue opportunities.

Furthermore, the rising prevalence of chronic diseases in India is adding to the market expansion. According to the first Longitudinal Ageing Study in India (LASI) released by the Union Ministry of Family and Health Welfare in India on January 6, 2024, two in every three senior citizens in India suffer from some chronic disease.

Overall, the APAC region is projected to accumulate a market share of 7.4% in 2025.

The North American Endoscopy fluid management systems industry is poised to capture a market share of 7.7% in 2025. The systems are helpful in maintaining precise pressure so as to reduce bleeding in internal cavities during endoscopic procedures.

From a market point of view, using high-tech devices improves treatment compliance, which could drive higher unit sales and subsequently, revenue.

The high share is due to the presence of skilled medical professionals, outstanding healthcare infrastructure, advancements in technology, and the presence of prominent market players in the country. In addition to this, healthcare reimbursement policies are also augmenting market growth.

For instance, President Joe Biden’s healthcare plan will insure more than 97% of Americans owing to the introduction of a Medicare-like public option for Individuals and Families. His plan also includes strengthening the Affordable Care Act (ACA) by increasing marketplace subsidies.

By product, endoscopic fluid management systems are expected to capture the dominant market share in 2025 and beyond. Increased demand for precision based surgeries to ensure minimal trauma during intensive surgical procedures is driving adoption.

As the incidence of various renal, gastrointestinal, respiratory and cardiac disorders increase, patients are opting for highly precise yet minimally invasive surgeries has led hospitals and clinics to deploy advanced endoscopic fluid management systems.

Hospitals are expected to make maximum usage of endoscopy fluid management systems, given the ever increasing volume of patient admissions for various laparoscopic and other internal surgeries.

Moreover, hospitals also partner with various laboratories and research institutions to conduct studies on surgical procedures, requiring them to use endoscopy fluid management systems.

The global endoscopy fluid management systems market is on a rise owing to the manufacturers who are investing in the research & development of new valves as per changing industry standards across multiple industry verticals.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, Poland, China, Japan, India, Australia, Saudi Arabia, South Africa, Egypt |

| Key Market Segments Covered | Modality, End User, Product Type, Region |

| Key Companies Profiled | Karl Storz GmbH & Co KG; Olympus Corporation; Richard Wolf GmbH; Smith & Nephew; Stryker Corporation; DePuy Synthes (Johnson & Johnson Services Inc.); Cantel Medical Corporation,; Medtronics Plc.; B. Braun Medical Inc.; Hologic Inc. |

| Pricing | Available upon Request |

The global endoscopy fluid management systems market is estimated to be valued at USD 550.3 million in 2025.

It is projected to reach USD 1,123.7 million by 2035.

The market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types are laparoscopy endoscopy fluid management systems and hysteroscopy endoscopy fluid management systems.

floor standing endoscopy fluid management systems segment is expected to dominate with a 61.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluid Bed Systems Market

Endoscopy Video Systems Market Size and Share Forecast Outlook 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fluid Waste Disposal Systems Market

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Battlefield Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Translation Management Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

AGV Intelligent Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Component Content Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA