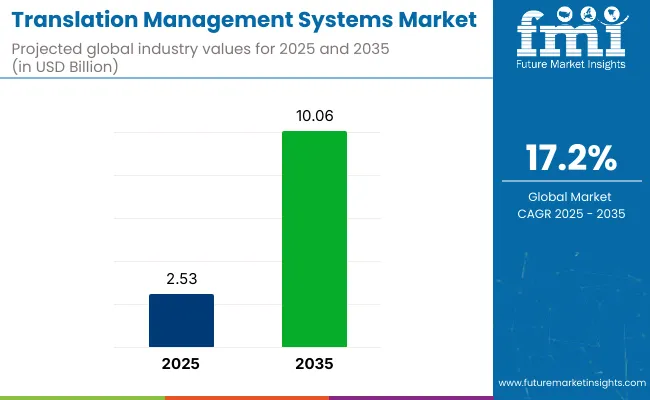

The translation management systems market is expected to grow from USD 2.53 billion in 2025 to USD 10.06 billion by 2035, representing a CAGR of 17.2% during this forecast period. Translation management systems (TMS) enable businesses to streamline and automate the translation and localization of content across multiple languages, ensuring consistency and efficiency in global communication. The growing need for businesses to reach a global audience and provide localized content is driving the demand for TMS solutions.

The translation management systems (TMS) market holds a growing yet focused share within its broader parent markets. In the global language services market, TMS accounts for approximately 5-7%, as it underpins the technology behind large-scale translation workflows. Within the localization services market, its share is higher at around 10-12%, since TMS platforms are core to managing multilingual content across digital platforms.

In the enterprise software market, TMS holds a niche share of about 0.5-1%, serving content-heavy industries like e-commerce, legal, and tech. In the content management market, it contributes roughly 1-2% by integrating with CMS platforms to automate global content delivery. Within the AI in language processing market, TMS comprises about 2-3%, driven by AI-powered translation and automation features.

Recent developments in this market include the integration of artificial intelligence (AI) and machine learning into TMS solutions, enhancing translation accuracy and speed. These innovations are improving the overall effectiveness of TMS, reducing human error and cost while providing faster turnaround times for translations.

In January 2025, Acolad was awarded two significant contracts by the Translation Centre for the Bodies of the European Union. These contracts involve delivering translations in 23 EU languages, supporting the Single Market Transparency Directive, and reinforcing Acolad’s leadership in regulatory translation excellence. This was officially announced in the company's press release.

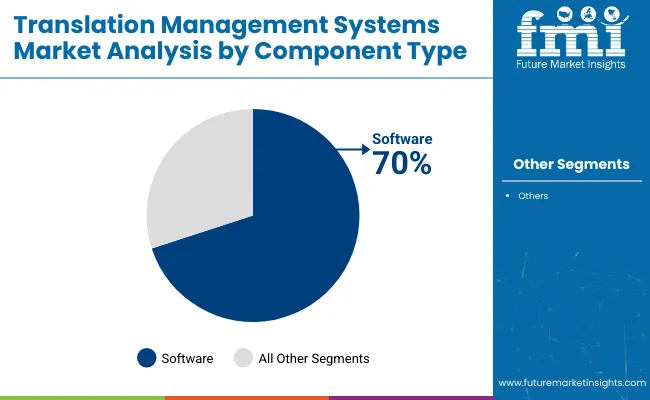

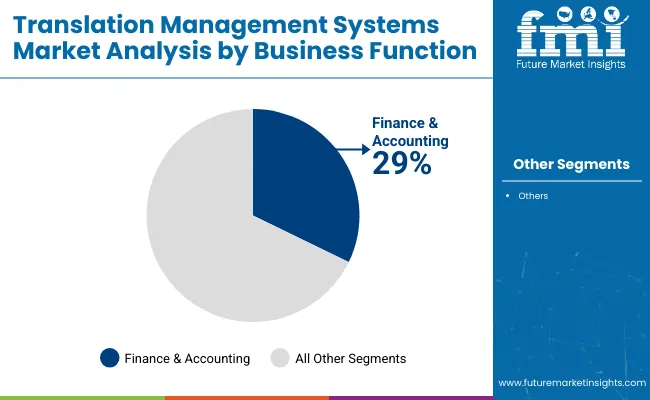

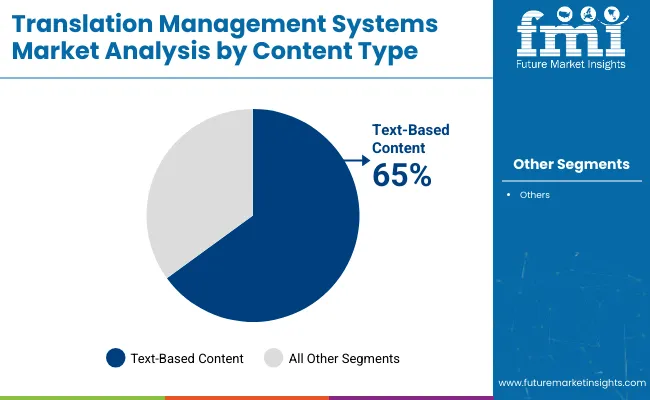

Software, finance & accounting, text-based content, translation applications, and IT & ITeS end users are projected to dominate the Market in 2025, driven by digital globalization trends.

The software segment is forecasted to dominate the component type category with a 70% market share in 2025, driven by the growing reliance on SaaS-based translation platforms. These platforms offer integrated features such as translation memory, localization management, and real-time collaboration tools.

The finance & accounting segment is projected to lead with a 29% market share in 2025, propelled by the need for precise translation of complex financial documents. Multinational corporations demand specialized TMS for translating reports, tax filings, audit documents, and contractual agreements.

Text-based content is expected to dominate with a 65% market share in 2025, owing to continued high demand for website, document, and technical manual localization. Sectors like legal, technical, and regulatory services prioritize precise text translation over multimedia content.

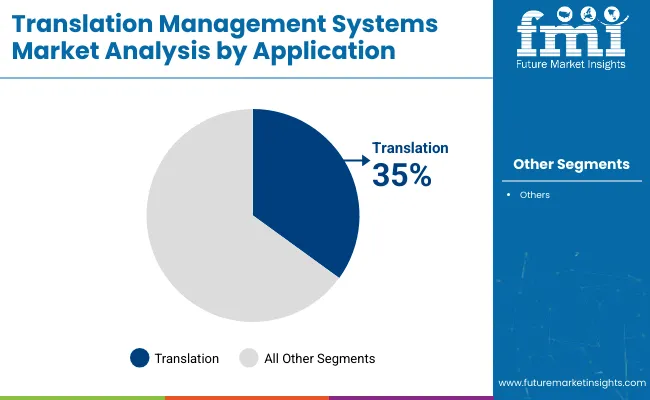

The translation application segment is set to lead with a 35% market share in 2025, as businesses prioritize multilingual content translation across industries. Core applications include document translation, software localization, and customer-facing content adaptation for global markets.

The IT & ITeS industry is expected to dominate with a 30% market share in 2025, driven by the sector’s expansive need for multilingual software and technical content localization. Global delivery models require translation of app interfaces, user manuals, helpdesk documentation, and source code comments for diverse markets.

The market is advancing due to rising multilingual content needs and automation benefits, while integration challenges and data confidentiality concerns are limiting broader enterprise adoption.

Automation and global content demands are accelerating platform adoption

As businesses expand across regions, the need to manage, localize, and deliver multilingual content efficiently is being met through translation management systems (TMS). These platforms are enabling real-time collaboration between linguists, AI-powered engines, and content managers, reducing manual workloads and speeding up time-to-market.

Automation features like translation memory, glossaries, and machine learning integrations are improving consistency and cost-efficiency in large-scale localization workflows. E-commerce, legal, life sciences, and media sectors are increasingly relying on TMS platforms to maintain brand voice across global markets.

Integration issues and data security risks are slowing enterprise-scale deployment

Despite clear efficiency benefits, many enterprises are encountering obstacles in integrating translation management systems with their existing CMS, CRM, and product information systems. Custom API development and workflow reconfiguration often require additional investment, which can delay deployment.

Moreover, the handling of sensitive and proprietary information during translation-particularly in legal, healthcare, and financial services-raises concerns about data privacy and regulatory compliance. Without clear security protocols or region-specific hosting options, businesses remain hesitant to adopt TMS platforms at scale.

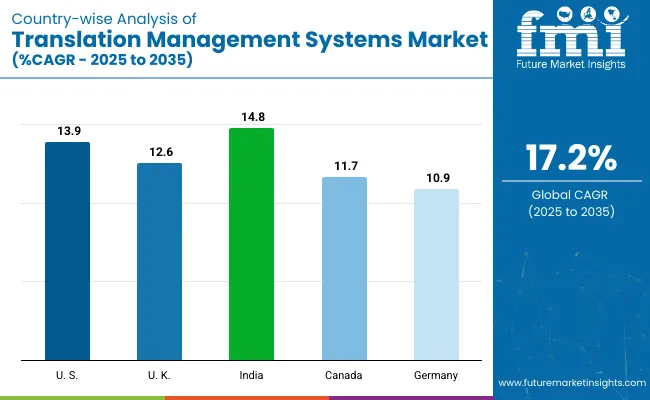

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 13.9% |

| UK | 12.6% |

| India | 14.8% |

| Canada | 11.7% |

| Germany | 10.9% |

The TMS market is experiencing accelerated growth globally, driven by the surge in cross-border digital content, regulatory localization needs, and AI-based workflow optimization. India leads the growth among key players with a 14.8% CAGR, supported by digital transformation and multilingual tech enablement.

The USA (13.9%) and UK (12.6%) continue to shape the high-value enterprise TMS landscape through SaaS innovation and regulatory compliance demands. Canada (11.7%) and Germany (10.9%) reflect stable growth within mature markets with increasing use across government, healthcare, and e-commerce sectors.

Countries in the OECD bloc such as the USA, Germany, and Canada prioritize high-standard localization for legal, medical, and enterprise software domains. India, a BRICS and Emerging Market, is leveraging its linguistic diversity and outsourcing ecosystem to create scalable, cost-effective TMS solutions. The UK’s policy alignment post-Brexit further drives demand for independently governed translation frameworks.

The report covers extensive insights across 40+ countries. The five profiled below represent leading markets shaping the TMS ecosystem.

The USA TMS market is growing at a 13.9% CAGR, anchored in SaaS leadership, enterprise globalization, and stringent localization standards across sectors. As an OECD member and Agri-food Tech Pioneer, the USA is adopting AI-driven TMS solutions in legal tech, life sciences, and cloud-based customer support. Major tech firms, media platforms, and government agencies are driving the adoption of integrated translation pipelines.

The UK market is expanding at a 12.6% CAGR, with demand fueled by post-Brexit regulatory divergence, public-sector localization needs, and expanding media exports. The government and private sectors alike are investing in scalable, secure TMS platforms to meet multilingual service delivery and compliance. As a mature OECD economy, the UK combines advanced NLP research with pragmatic deployment across education, immigration, and broadcasting.

India is leading global growth with a 14.8% CAGR, driven by a massive multilingual population, expanding e-governance, and global outsourcing of content localization. As a BRICS country and Protein-Transition Market, India offers a cost-effective ecosystem for AI training datasets, language modeling, and outsourced TMS operations. Adoption is surging in fintech, edtech, and healthcare sectors, where inclusive language strategies are prioritized.

Canada’s TMS market is growing at 11.7% CAGR, shaped by federal bilingualism, growing immigrant population needs, and content localization in healthcare and education. As part of the OECD and NAFTA/USMCA, Canada’s market supports cross-border content harmonization with the USA and emphasizes quality control and compliance for public services.

Germany is expanding at 10.9% CAGR, reflecting steady uptake of AI-based TMS in manufacturing, pharma, and regulatory sectors. A leader in the EU27 and among Sustainability-Focused Nations, Germany prioritizes data security, traceability, and compliance across multilingual software platforms. Enterprise digital transformation, combined with cross-border e-commerce, continues to drive market expansion.

The market is categorized into three tiers. Dominant players such as Google, Microsoft, Oracle, and SAP lead the market by offering enterprise-grade, AI-powered localization platforms with extensive API integration and global scalability. Key players like Lionbridge, TransPerfect, RWS Group, and LanguageLine Solutions focus on providing industry-specific TMS solutions by combining human translation expertise with advanced system capabilities.

Emerging players such as Smartcat, Transifex, Translate Plus, Localize Corporation, Acolad Group, Babylon Software, and Centific are recognized for their cloud-native architectures, collaborative features, and developer-friendly tools. While dominant players capture large-scale deployments, key and emerging vendors drive innovation through niche specialization and vertical-focused solutions.

Recent Translation Management Systems Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.53 billion |

| Projected Market Size (2035) | USD 10.06 billion |

| CAGR (2025 to 2035) | 17.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Component Types Analyzed (Segment 1) | Software (translation software, localization software, terminology management software, quality assurance software, analytics and reporting, others) and services (professional services, managed services) |

| Business Function Analyzed (Segment 2) | Finance & accounting, sales & marketing, legal, human resources, others |

| Content Type Analyzed (Segment 3) | Audio-based content, text-based content, video-based content |

| Application Types Analyzed (Segment 4) | Terminology management, translation, project management, quality assurance, billing & invoicing analysis, resource management, others |

| End-Use Types Analyzed (Segment 5) | Retail & e-commerce, media & entertainment, IT & ITeS, healthcare & life sciences, BFSI, manufacturing, others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Market | Acolad Group, Babylon Software, Centific, Google LLC, LanguageLine Solutions, Lionbridge, Localize Corporation, Microsoft Corporation, Oracle Corporation, RWS Group, SAP SE, Smartcat, Transifex, Translate Plus, TransPerfect |

| Additional Attributes | dollar sales, CAGR trends, market segmentation by function, content type, and end use, regional demand, competitive landscape, service and software differentiation |

The segmentation is into software (translation software, localization software, terminology management software, quality assurance software, analytics and reporting, others) and services (professional services and managed services).

The segmentation is into finance & accounting, sales & marketing, legal, human resources, and others.

The segmentation is into audio-based content, text-based content, and video-based content.

The segmentation is into terminology management, translation, project management, quality assurance, billing & invoicing analysis, resource management, and others.

The segmentation is into retail & e-commerce, media & entertainment, IT & ITeS, healthcare & life sciences, BFSI, manufacturing, and others.

The market is expected to reach USD 2.53 billion in 2025.

Sales in the market are projected to grow steadily, reaching approximately USD 10.06 billion by 2035.

India is anticipated to lead with a CAGR of 14.8% during the forecast period.

The software segment dominates the industry by component type with 54% market share.

TransPerfect is the leading key player with 20% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Home Energy Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Battlefield Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

AGV Intelligent Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Fluid Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Component Content Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Advanced Distribution Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA