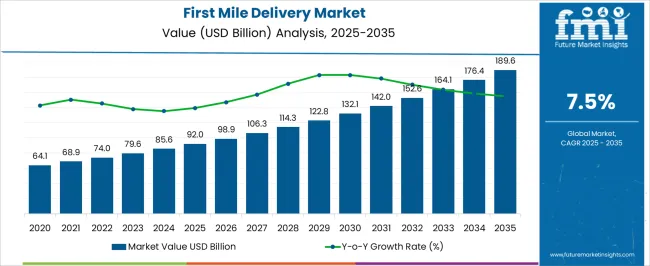

The first mile delivery market is projected at USD 92.0 billion in 2025 and anticipated to reach USD 189.6 billion by 2035, expanding at a CAGR of 7.5 percent and creating significant opportunities across logistics and retail ecosystems. In the first five-year block from 2025 to 2030, the market is expected to grow from USD 92.0 billion to USD 132.1 billion, supported by the rapid rise of e-commerce, demand for efficient supplier-to-warehouse transport, and technology integration in fleet management.

The second block, from 2030 to 2035, shows further expansion to USD 189.6 billion, driven by automation, digitized order tracking, and strong investments in logistics infrastructure across emerging economies. The period between 2025 and 2030 highlights how predictive analytics, route optimization, and partnerships between logistics providers and retailers improve speed and reliability in early-stage delivery networks. Beyond 2030, the focus shifts toward electrification of fleets, drone-based deliveries in selected regions, and digital twins for warehouse-to-distribution center operations, setting the foundation for long-term growth.

This block analysis underscores the steady pace of expansion, where early adoption of digital solutions shapes the first phase, while sustainability practices, fleet electrification, and large-scale infrastructural improvements define the latter phase, ensuring resilience and competitiveness in the supply chain.

| Metric | Value |

|---|---|

| First Mile Delivery Market Estimated Value in (2025 E) | USD 92.0 billion |

| First Mile Delivery Market Forecast Value in (2035 F) | USD 189.6 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The first mile delivery market is influenced by five interconnected parent markets that collectively define its expansion and operational framework. The e-commerce and retail market holds the largest share at 34%, as rapid order fulfillment from suppliers to warehouses and distribution hubs is crucial for meeting consumer expectations. The logistics and transportation services market contributes 26%, supported by investments in fleet management, route optimization, and multimodal transport solutions that enable efficient first-stage delivery. The warehousing and inventory management market accounts for 18%, with rising adoption of automated systems and digital tracking that streamline the movement of goods from suppliers into storage networks.

The manufacturing and supplier market provides 12%, as manufacturers depend on timely pickups and smooth transitions into logistics pipelines to prevent bottlenecks and maintain production continuity. Lastly, the technology and digital platforms market represents 10%, driven by innovations in real-time tracking, predictive analytics, and IoT-enabled solutions that enhance transparency and reliability in the early supply chain stages.

eCcommerce, logistics, and warehousing represent nearly 80% of overall demand, underscoring that retail growth, efficient transport, and streamlined inventory handling remain the primary forces shaping the outlook of the first mile delivery market worldwide.

The first mile delivery market is witnessing robust growth driven by the rapid expansion of e commerce, globalization of supply chains, and increased demand for time sensitive shipments. Businesses across industries are prioritizing streamlined logistics operations to ensure efficient movement of goods from manufacturing units and warehouses to distribution centers.

Technological advancements in fleet management, real time tracking, and route optimization are significantly improving first mile delivery performance. Regulatory pressure for reducing carbon emissions is also prompting investments in electric delivery vehicles and sustainable practices.

As manufacturing, retail, and agricultural sectors continue to scale up production and regional distribution, the need for reliable and fast first mile operations is intensifying. The market outlook remains strong as companies focus on cost efficiency, transparency, and automation to meet consumer and business expectations for faster and more accountable deliveries.

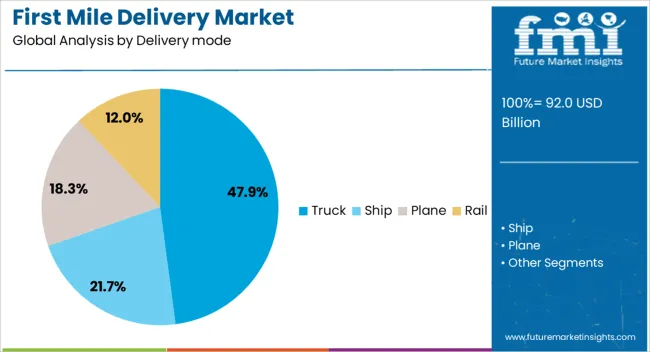

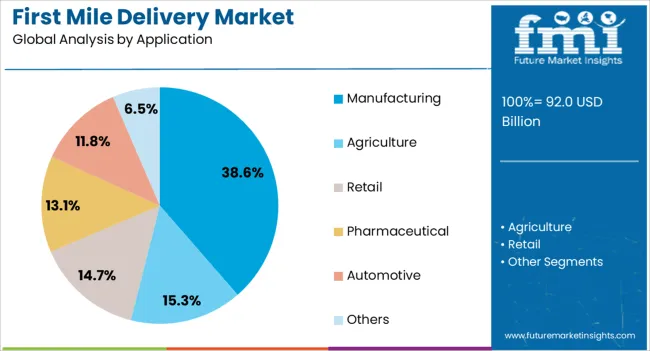

The first mile delivery market is segmented by delivery mode, application, goods, sourcing, and geographic regions. By delivery mode, first mile delivery market is divided into Truck, Ship, Plane, and Rail. In terms of application, first mile delivery market is classified into Manufacturing, Agriculture, Retail, Pharmaceutical, Automotive, and Others. Based on goods, first mile delivery market is segmented into Perishables, Non-perishables, and Hazardous Materials. By sourcing, first mile delivery market is segmented into Inhouse and Outsource. Regionally, the first mile delivery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The truck delivery mode segment is projected to represent 47.90% of the total market revenue by 2025 within the delivery mode category, making it the leading segment. This dominance is supported by the flexibility, capacity, and extensive reach that trucking provides for both urban and rural first mile operations.

Trucks are capable of handling a wide variety of goods and can navigate diverse terrains, making them the preferred option for manufacturers and logistics providers. Infrastructure readiness and ongoing investments in intelligent transport systems further enhance the efficiency of truck based delivery.

As enterprises aim to optimize cost and timing for bulk shipments and regional distribution, the truck segment continues to hold the largest share due to its scalability and adaptability.

The manufacturing segment is expected to contribute 38.60% of the total market revenue by 2025 within the application category, maintaining its lead in the sector. This growth is driven by the increased production of consumer goods, electronics, and industrial components requiring efficient first mile movement to distribution hubs.

Manufacturers are increasingly adopting just in time and lean supply chain strategies, necessitating dependable first mile delivery systems. Integration of tracking technologies, digitized dispatch systems, and warehouse automation tools has further strengthened the role of first mile logistics in manufacturing.

With growing emphasis on minimizing inventory holding costs and ensuring uninterrupted supply chain flow, this segment continues to drive demand for high performance delivery networks.

The first mile delivery market is shaped by e-commerce expansion, infrastructure investment, digital integration, and rising cost challenges. Growth relies on balancing efficiency, affordability, and scalability in competitive logistics networks.

The first mile delivery market is experiencing rapid growth due to the expansion of e-commerce and online retail ecosystems. Retailers and digital platforms rely on efficient supplier-to-warehouse logistics to manage the surge in orders and reduce turnaround times. Increased consumer expectations for fast delivery are forcing logistics providers to enhance early-stage operations with improved coordination between suppliers, warehouses, and retailers. Partnerships between e-commerce giants and logistics companies are strengthening infrastructure, while small and medium sellers are increasingly depending on integrated delivery networks. As e-commerce continues to diversify into categories like groceries, fashion, and electronics, first mile delivery solutions are becoming indispensable for maintaining efficiency, speed, and competitiveness in global supply chains.

Infrastructure expansion is a critical factor shaping the trajectory of first mile delivery services. Investment in regional distribution centers, highways, and industrial corridors has provided stronger connectivity between suppliers and hubs. Governments and private enterprises are focusing on improving transport systems and multimodal links, which are central to achieving timely first-stage movement of goods. Warehousing projects near urban and semi-urban areas are boosting efficiency, reducing congestion, and lowering last-minute delays. Logistics companies are capitalizing on these investments by deploying advanced vehicle fleets and flexible scheduling models. The development of better infrastructure ensures that goods transition smoothly from manufacturers to distribution points, reducing inefficiencies that previously constrained early-stage delivery operations.

Digital platforms and analytics have emerged as key enablers in the first mile delivery market. Logistics operators now use predictive analytics, real-time tracking, and IoT-based systems to optimize routes and reduce costs. Cloud-based platforms connect suppliers, warehouses, and carriers, ensuring better coordination and visibility. Data-driven insights are helping companies manage seasonal spikes, forecast demand, and improve capacity utilization. Automated scheduling and digital order matching allow faster allocation of vehicles, reducing idle time and operational inefficiencies. These platforms not only improve speed but also enhance transparency and customer trust. By integrating digital solutions, logistics providers achieve stronger control over first mile processes, which sets the stage for timely last mile delivery success.

Despite strong growth, the first mile delivery market faces challenges related to cost pressures and intense competition. Rising fuel expenses, labor shortages, and high fleet maintenance costs have put pressure on margins. Logistics providers are under constant demand to offer affordable services while ensuring reliability.

Competition between established logistics firms, regional players, and tech-driven startups has intensified, forcing companies to differentiate through service quality, partnerships, and scalability. Retailers and e-commerce firms are also negotiating aggressively to bring down costs, which further impacts profitability. To counter these challenges, logistics firms are focusing on network optimization, collaborative models, and fleet diversification to sustain efficiency in a highly competitive market landscape.

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

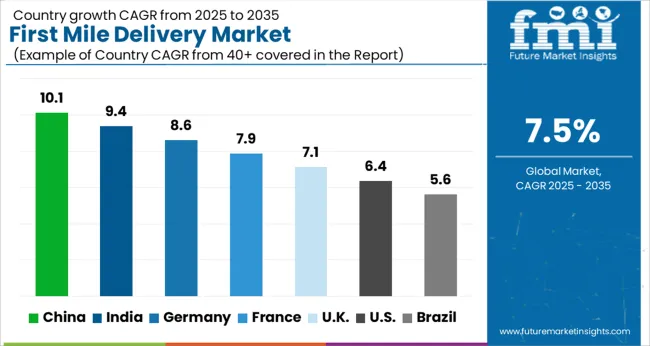

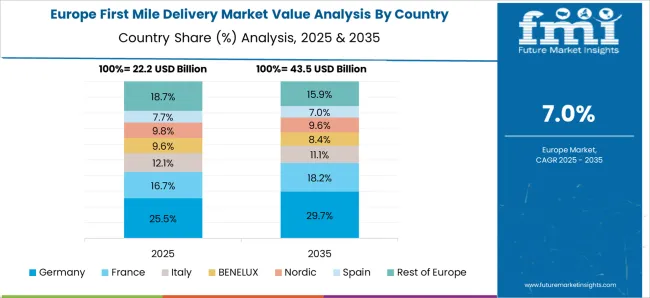

The global first mile delivery market is projected to grow at a CAGR of 7.5% from 2025 to 2035. China leads with 10.1%, followed by India at 9.4%, Germany at 8.6%, France at 7.9%, the UK at 7.1%, and the USA at 6.4%. Growth is being fueled by the expansion of e-commerce, investments in logistics infrastructure, and rising consumer expectations for faster order fulfillment. BRICS economies such as China and India dominate growth through large-scale warehousing projects, supplier integration, and high demand for digital-first logistics solutions. OECD members like Germany, France, the UK, and the USA focus on automation, fleet diversification, and regulatory compliance to enhance efficiency and reduce operational bottlenecks. Investments in predictive analytics, route optimization, and multimodal transport systems are redefining how goods move from suppliers to warehouses, making first mile operations a critical enabler of global supply chain competitiveness. The analysis spans over 40+ countries, with the leading markets shown below.

The first mile delivery market in China is projected to grow at a CAGR of 10.1% from 2025 to 2035. Supplier to warehouse flows are being scaled through mega fulfillment parks, bonded zones, and near port consolidation that cut dwell time. Marketplace sellers favor contracted pick ups with guaranteed cut off windows, which raises platform dependence on integrated carriers. Rail sea intermodal links support steady transfer of bulk SKUs into regional hubs, while cold chain routes for grocery and pharma expand loading bay capacity. Digital tendering and slot booking improve dock utilization and reduce detention. In this view, China is positioned to set the pace for process standardization and cost per parcel efficiency through the period.

The first mile delivery market in India is expected to rise at a CAGR of 9.4% between 2025 and 2035. Regional warehousing around tier 2 and tier 3 cities is being prioritized to shorten stem miles from suppliers. UPI payments and GST backed e waybill visibility support predictable dispatches for MSME sellers. Highway upgrades under national programs improve truck turnarounds, and dedicated freight corridors enable time bound movement into metro distribution centers. Marketplaces and brands favor milk run models that aggregate supplier loads for better vehicle fill. Temperature controlled corridors for perishables and pharma are opening new routes for specialized carriers. With compliance and digital paperwork improving, India is anticipated to post strong share gains in early stage logistics.

The first mile delivery market in Germany is projected to expand at a CAGR of 8.6% from 2025 to 2035. Automotive, machinery, and chemicals suppliers require strict ASN accuracy and time definite pick ups, which benefits carriers with EDI ready systems. Consolidation at inland terminals near Rhine Ruhr and Bavaria concentrates flows before linehaul to national hubs. Contract logistics providers deploy cross dock operations that cut handling touches and error rates. Fleet diversification toward smaller trucks for urban approaches and larger units for corridor haul improves cost per ton performance. Packaging compliance and reusable totes reduce damages and improve scan fidelity at gates. Germany is expected to maintain high service benchmarks that influence broader EU practices.

The first mile delivery market in the United Kingdom is anticipated to grow at a CAGR of 7.1% during 2025 to 2035. Retailers emphasize supplier appointment booking, pallet standardization, and dwell time KPIs to stabilize warehouse intake. Coastal freeports and regional hubs in the Midlands provide consolidation for import driven categories. Contracted hauliers employ dynamic routing that adapts to bridge closures and weather events, keeping service levels consistent. Grocer led supplier collection programs expand, shifting responsibility upstream and improving trailer fill. Returns consolidation near hubs reduces backhaul empties and supports circular flows. With strong focus on compliance and predictable slots, the UK is positioned for steady efficiency gains in early stage movements.

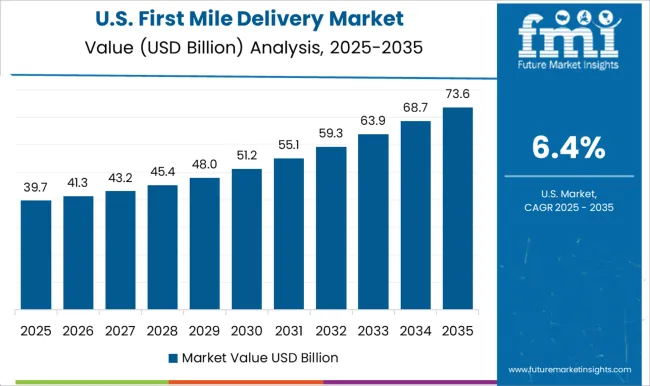

The first mile delivery market in the United States is expected to grow at a CAGR of 6.4% from 2025 to 2035. Large retailers and 3PLs rely on vendor compliance guides that dictate carton labeling, advance ship notices, and pickup windows, which improves dock throughput. Inland ports and transload sites near West and Gulf coasts convert boxes to domestic equipment for rapid interior distribution. Dedicated contract carriage supports reliable supplier sweeps in automotive, cold chain, and consumer electronics. Network design shifts add micro fulfillment near population centers, shortening handoffs between first mile and middle mile. Labor availability and fuel costs remain watch points, pushing operators toward better planning and drop trailer programs.

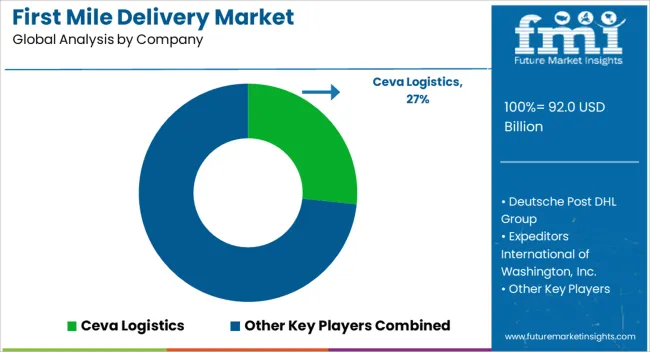

The first mile delivery market is shaped by global logistics providers, regional courier companies, and specialized last-mile and supply chain solution providers focusing on parcel and freight collection from origin points. Leading players such as DHL, FedEx, UPS, and SF Express maintain strong positions by offering diversified portfolios of first mile services, including warehousing, pickup scheduling, and integration with e-commerce platforms. Competitive differentiation is largely driven by network reach, pickup efficiency, reliability, real-time tracking, and technology-enabled routing solutions. Regional players, particularly in Asia-Pacific and Europe, compete by offering localized services, flexible pickup options, and cost-effective solutions tailored for small and medium enterprises as well as e-commerce merchants.

Strategic partnerships with e-commerce platforms, manufacturers, and retail chains enhance market penetration and operational efficiency. Innovation in automated sorting, IoT-enabled tracking, and AI-driven route optimization further strengthens competitive positioning. Companies prioritizing regulatory compliance, environmental sustainability, and robust service networks are well-positioned to capture significant market share. Overall, firms combining technological expertise, extensive logistics infrastructure, and responsive customer service are expected to benefit from the growing demand for efficient and reliable first mile delivery solutions globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 92.0 Billion |

| Delivery mode | Truck, Ship, Plane, and Rail |

| Application | Manufacturing, Agriculture, Retail, Pharmaceutical, Automotive, and Others |

| Goods | Perishables, Non-perishables, and Hazardous Materials |

| Sourcing | Inhouse and Outsource |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ceva Logistics, Deutsche Post DHL Group, Expeditors International of Washington, Inc., FedEx Corporation, Geodis, J.B. Hunt Transport Services, Inc., Kuehne + Nagel International AG, Ryder System, Inc., United Parcel Service, Inc. (UPS), and XPO Logistics, Inc |

| Additional Attributes | Dollar sales, share, regional logistics demand, e-commerce growth, infrastructure readiness, fleet costs, digital integration trends, competitive benchmarks, and future expansion opportunities. |

The global first mile delivery market is estimated to be valued at USD 92.0 billion in 2025.

The market size for the first mile delivery market is projected to reach USD 189.6 billion by 2035.

The first mile delivery market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in first mile delivery market are truck, ship, plane and rail.

In terms of application, manufacturing segment to command 38.6% share in the first mile delivery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

First Mile Logistics Delivery Software Market Size and Share Forecast Outlook 2025 to 2035

First Generation Biofuel Market Size and Share Forecast Outlook 2025 to 2035

SMT First Article Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

China First Aid Market Insights – Growth & Forecast 2022-2032

Chamomile Extracts for Soothing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chamomile Oil Market Size, Growth, and Forecast for 2025 to 2035

Chamomile Seeds Market – Growth & Demand 2025 to 2035

Last Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Last Mile Delivery Software Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Middle Mile Delivery Market Size and Share Forecast Outlook 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Electric Last Mile Delivery Vehicle Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA