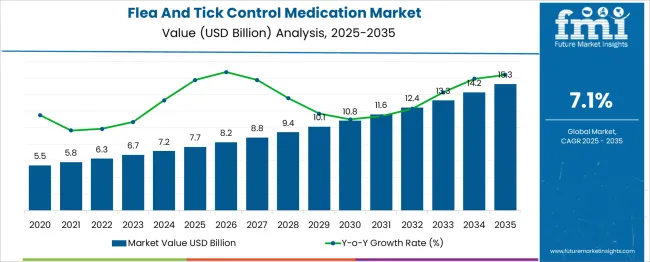

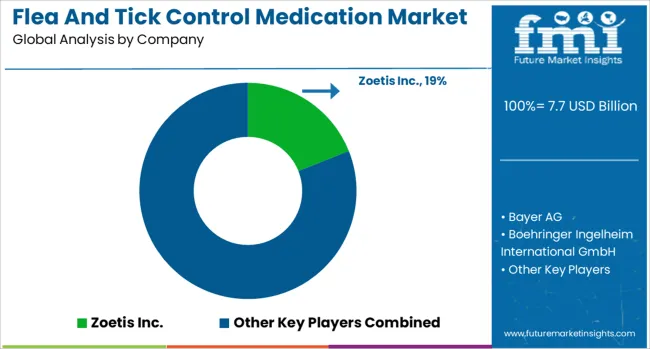

The Flea And Tick Control Medication Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 15.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. This consistent growth reflects a broader trend in companion animal healthcare and rising pet ownership worldwide. However, within this growth lies a notable redistribution of market share across key players, regions, and product segments.

Major incumbents like Elanco, Boehringer Ingelheim, and Zoetis are actively defending their positions, but face pressure from emerging generic manufacturers and region-specific brands, especially in high-growth markets like India, Brazil, and Southeast Asia. Topical treatments, which dominated with over 45% market share in 2025, are gradually losing ground to oral chewables and long-acting injectables, expected to collectively command more than 55% of the market by 2030. Additionally, e-commerce and direct-to-consumer veterinary platforms are reshaping distribution channels, eroding the influence of traditional vet clinic sales, particularly in North America and Europe. The emergence of natural and organic formulations is further fragmenting the market, siphoning share from synthetic-based products. While established players still control over 60% of the global market, sustained innovation and channel diversification will be critical to avoid gradual erosion by agile, cost-effective competitors.

| Metric | Value |

|---|---|

| Flea And Tick Control Medication Market Estimated Value in (2025 E) | USD 7.7 billion |

| Flea And Tick Control Medication Market Forecast Value in (2035 F) | USD 15.3 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The flea and tick control medication market is witnessing consistent growth, supported by increased pet ownership, heightened awareness around zoonotic diseases, and rising consumer expenditure on pet health. Companion animal care has become more preventive than reactive, with a growing emphasis on year-round parasite control to avoid infestations and vector-borne illnesses.

Regulatory reforms supporting over-the-counter access, coupled with veterinary endorsement of long-term treatment regimes, have strengthened retail channel performance. Pharmaceutical innovation has also enhanced formulation palatability and bioavailability, improving compliance among pet owners.

Moreover, the expansion of e-commerce and pet-specific platforms has eased product availability, while rising urbanization has amplified the need for indoor-outdoor parasite control solutions. Looking ahead, market growth is likely to be driven by broad-spectrum solutions, dual-action formulations, and increased demand for natural and organic ingredients in pet medications.

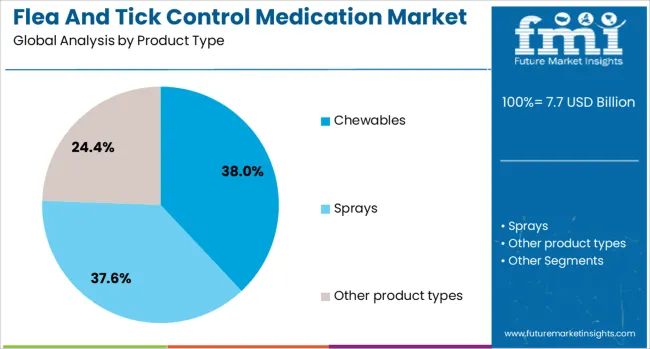

The flea and tick control medication market is segmented by product type, medication type, animal type, purchase channel, and geographic regions. The flea and tick control medication market is divided into Chewables, Sprays, and other product types. In terms of the type of medication, the flea and tick control medication market is classified into OTC and prescription. Based on the type of animal, the flea and tick control medication market is segmented into Dogs, Cats, and other animal types. The flea and tick control medication market is segmented by purchase channel into Veterinarian, Drug & pharmacy stores, Pet specialty stores, Supermarket/hypermarket, and Online. Other purchase channels. Regionally, the flea and tick control medication industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Chewables are anticipated to lead the product type segment, accounting for 38.00% of market revenue in 2025. This dominance is being driven by improved compliance among pets, as chewables are generally more palatable, easier to administer, and reduce the stress associated with topical applications.

Enhanced taste masking technologies and flavor-infused formulations have made chewables a preferred choice among pet owners for monthly or seasonal flea and tick control. The convenience of dosing without mess or residual application makes chewables ideal for indoor pets and homes with children.

Furthermore, extended-release formulations available in chewable format offer longer protection with fewer administrations, aligning with modern consumer preferences for ease and efficiency. As veterinary professionals increasingly recommend oral preventive care for systemic efficacy, chewables are being adopted as the first line of defense against parasitic infestations.

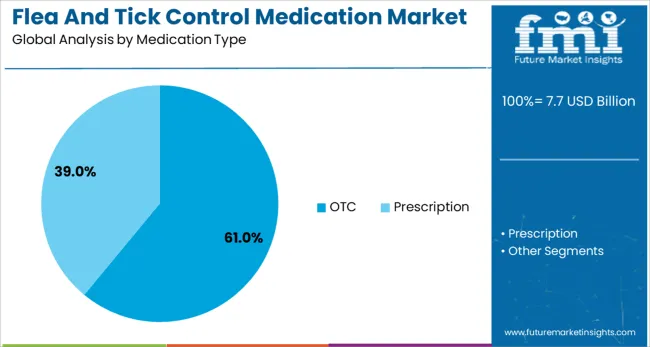

Over-the-counter (OTC) products are projected to dominate with 61.00% revenue share in 2025. This growth is being driven by increased pet parent confidence in self-administering basic preventive care, driven by extensive awareness campaigns and ease of access through retail and e-commerce platforms.

Regulatory streamlining has made many effective flea and tick control solutions available without prescriptions, reducing the dependency on clinic visits for routine care. Additionally, clear labeling, user-friendly dosage instructions, and veterinary-brand collaborations have reinforced consumer trust in OTC offerings.

With pet owners increasingly seeking cost-effective and time-saving treatment options, OTC medications fulfill both budgetary and convenience expectations. Their availability in subscription models and combo-packs further supports high repeat purchase rates, solidifying their market leadership.

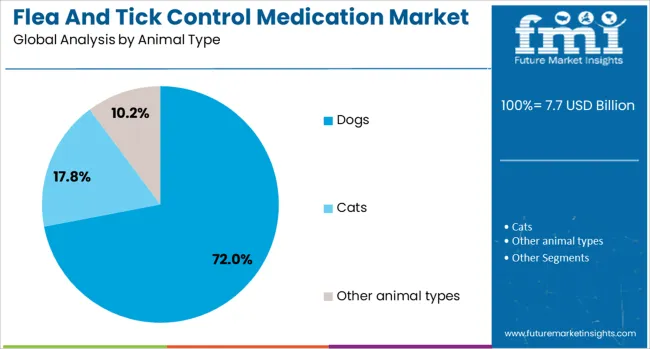

Dogs are expected to dominate the animal type segment, holding 72.00% of the market share in 2025. This leadership is being shaped by their larger population base among household pets, higher outdoor exposure, and increased susceptibility to flea and tick infestations.

Dog owners demonstrate a higher willingness to invest in preventive health measures, particularly in urban and semi-urban regions where outdoor recreational activities heighten the risk of parasite transmission. Veterinary focus on canine parasite-borne diseases like Lyme disease and ehrlichiosis has also spurred demand for routine control medications.

Moreover, breed-specific grooming routines, behavioral training, and regular vet visits have contributed to the sustained demand for canine-focused treatments. With growing emphasis on companion animal welfare and canine healthcare insurance coverage, dogs are expected to remain the focal point for innovation and adoption in flea and tick control products.

The flea and tick control medication market continues to grow as pet ownership increases and awareness of vector-borne diseases becomes more widespread. These medications play a key role in protecting domestic animals from parasites that can cause skin irritation, anemia, and disease transmission. Both over-the-counter and prescription products are available in topical, oral, and collar formats. As more households treat pets as family members, demand for year-round parasite control drives innovation, product diversity, and veterinary compliance across urban and rural pet populations.

The expanding pet population and the growing recognition of parasite-related health risks drive steady demand for flea and tick control solutions. Fleas and ticks not only affect animal health but can also transmit diseases to humans, prompting pet owners to seek preventive care throughout the year. Veterinary professionals increasingly recommend regular treatment protocols as part of basic animal healthcare. Education campaigns by clinics, retailers, and manufacturers have improved consumer understanding of parasite lifecycles and the importance of continuous control measures. In addition, adoption of pets from shelters or rescue organizations has surged, and new owners are often advised to use preventive medications from the outset. Across both dogs and cats, product uptake is encouraged by convenience-based formats such as long-lasting chews or waterproof topical solutions. As pets are increasingly seen as integral family members, parasite prevention is treated with the same urgency as other essential healthcare routines.

Over time, parasites can develop resistance to commonly used active ingredients in flea and tick medications, reducing the long-term effectiveness of certain formulations. This requires regular updates in product composition and introduces complexity for manufacturers seeking consistent efficacy. Moreover, maintaining owner compliance with treatment schedules remains a challenge, particularly with topical applications that require monthly reapplication. Pet owners may forget doses or avoid usage due to perceived side effects, messiness, or difficulty in administering pills. In multi-pet households, coordinating treatment for different animal sizes or species adds further complication. Non-adherence to full dosing regimens contributes to treatment gaps and the persistence of infestation cycles. Additionally, consumer confusion about product types—such as differences between preventive and active treatments—can result in misuse or underuse. Addressing these compliance barriers requires clearer product instructions, veterinarian guidance, and development of formats that simplify treatment without compromising safety or efficacy.

Outside of defense, tethered drones are being adopted in commercial sectors for applications requiring stable, continuous overhead observation. Large construction projects, critical infrastructure inspections, and major public events benefit from elevated monitoring capabilities without needing aircraft or free-flying drones. For instance, contractors can use tethered drones to monitor construction sites for safety compliance, progress tracking, and equipment management. Utilities and energy companies deploy them for substation surveillance or pipeline observation in remote areas, where reliability of visuals and secure data links are essential. Event organizers, especially for concerts or sports, use tethered drones for live broadcast and crowd monitoring due to their uninterrupted aerial presence. These drones can also act as temporary communication relays or lighting sources. As awareness grows around their operational reliability and cost-effectiveness compared to manned observation or continuous free-flight drones, new market segments are increasingly considering tethered drones as viable tools for fixed-location aerial insight.

Tethered drones, despite their operational advantages, face various regulatory uncertainties that affect market scalability. Their classification often falls between manned aerial systems and traditional drones, leading to inconsistent rules across regions. Some jurisdictions may still require airspace clearance or line-of-sight operations even though the drone is physically connected to the ground. In urban settings, deployment may be hindered by local ordinances restricting aerial activity or tether installation on public land. There are also challenges regarding data privacy when used for surveillance in civilian areas. Furthermore, operating near airports, secure facilities, or communication towers may require special permits or be entirely prohibited. Commercial users must navigate these regulatory hurdles carefully, which can delay deployment or limit operations in key locations. Without clear regulatory pathways or standardized guidelines, adoption among civilian, industrial, and municipal sectors remains slower than the technology’s capabilities might otherwise suggest.

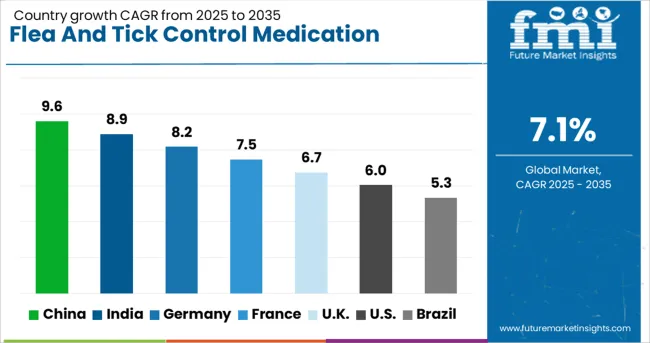

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global flea and tick control medication market is growing at a CAGR of 7.1%, driven by rising pet ownership, increasing awareness of animal health, and advancements in veterinary pharmaceuticals. China leads with 9.6% growth, supported by expanding pet care markets and improved access to veterinary services. India follows at 8.9%, fueled by a growing middle class, urbanization, and increasing expenditure on companion animals. Germany reports 8.2% growth, reflecting high pet ownership rates and strong regulatory oversight in veterinary medicine. The United Kingdom shows steady growth at 6.7%, with a focus on preventive care and premium pet healthcare products. The United States, at 6.0%, remains a mature but essential market, shaped by regulatory standards, product innovation, and rising demand for over-the-counter treatments. Market dynamics are influenced by efficacy, dosage convenience, and resistance management. This report includes insights on 40+ countries; the top countries are shown here for reference.

The flea and tick control medication market in China has reached a 9.6% CAGR, reflecting increased awareness among pet owners and veterinary service providers. Urban areas are experiencing higher pet ownership rates, especially among young households, which has led to demand for advanced pest protection treatments. Both oral and topical medications are popular, and local manufacturers are actively producing generic versions of internationally recognized brands. Veterinary clinics are offering bundled health packages that include monthly tick and flea prevention solutions. E-commerce platforms are playing a pivotal role in medication accessibility, with subscription-based services growing in popularity. Manufacturers are also introducing herbal and chemical-free alternatives to meet changing preferences.

India is observing strong momentum in the flea and tick control medication space, registering a 8.9% CAGR. As pet ownership increases in tier-1 and tier-2 cities, veterinary pharmacies are expanding their product lines to meet growing consumer demand. Brands are offering solutions tailored for India’s climate and parasite patterns, including combination treatments for both fleas and ticks. Veterinary colleges and clinics are running public education campaigns to promote regular parasite prevention. Mobile pet care services are also introducing doorstep treatments, making monthly dosage administration easier. Pet grooming parlors are partnering with pharmaceutical distributors to stock preventive sprays and medicated shampoos.

In Germany, flea and tick control medication market is growing at a 8.2% CAGR, supported by responsible pet care practices and a wide distribution network. Pet owners are increasingly using veterinarian-recommended treatments during the warmer months when tick activity peaks. There is high preference for vet-prescribed oral tablets and extended-release topical treatments that offer season-long protection. Regulatory frameworks ensure that only approved products reach pharmacies, maintaining quality standards. E-commerce stores and pharmacies are promoting monthly subscription plans for regular dosing. Germany’s large dog population is a significant contributor to demand, especially among countryside households and active outdoor pet owners.

The United Kingdom is showing a 6.7% CAGR in flea and tick control medication usage, driven by awareness campaigns and consistent veterinary consultation. Topical spot-on treatments are commonly preferred, especially for cats and smaller dogs. Veterinarians are advising routine parasite checks and preventive schedules during pet health visits. Pet insurance plans are also beginning to cover parasite prevention medications, increasing accessibility for more households. The presence of multiple pharmacy chains and online pet stores enables fast delivery of monthly treatments. There is a gradual shift towards products with less residue and better skin tolerance, reflecting evolving customer expectations.

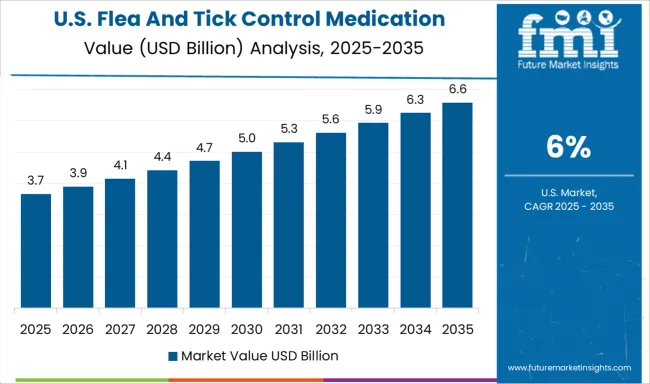

The flea and tick control medication market in the United States has reached a 6.0% CAGR, supported by year-round product availability and strong veterinary infrastructure. With higher pet ownership and awareness in suburban and rural areas, oral tablets and flea collars are frequently recommended by animal health professionals. Monthly combination treatments that prevent fleas, ticks, and heartworm are increasingly preferred by pet owners. Veterinarians are integrating digital reminders and mobile apps to help pet owners stay consistent with treatment cycles. Online pet pharmacies offer fast shipping and discount plans, while grooming centers stock over-the-counter pest control products.

The Flea and Tick Control Medication Market is driven by increasing pet ownership, heightened awareness of parasite-related diseases, and demand for convenient, long-lasting treatments. These medications are essential in protecting pets especially dogs and cats from discomfort and vector-borne illnesses like Lyme disease, ehrlichiosis, and tapeworm infections. Key companies such as Zoetis Inc., Elanco Animal Health, and Merck & Co., Inc. dominate the market with a wide portfolio of oral and topical formulations. Brands like Simparica, Advantage, and Bravecto offer extended protection, with many formulations shifting toward monthly or even quarterly dosages.

Central Garden & Pet Company, through Central Life Sciences, along with Ceva Santé Animale and Virbac S.A., provide veterinary-grade as well as over-the-counter options, targeting both professionals and pet owners. Retail-focused players like PetIQ, LLC and Hartz Mountain Corporation have expanded access via drugstore and e-commerce channels. Notably, the market has seen a shift toward combination treatments that address both internal and external parasites, reducing the need for multiple products. Formulations now also consider pet preferences, with soft chews and spot-on applicators tailored for ease of use. With a growing trend toward preventative care and year-round parasite protection, demand remains strong in both established and emerging markets. Additionally, concerns over resistance to older insecticides are prompting investment in novel active ingredients and delivery systems.

On July 10, 2025, Merck Animal Health announced FDA approval of BRAVECTO® QUANTUM, the first once-yearly injectable flea and tick treatment for dogs. Offering up to 12 months of protection, this innovation enhances pet owner compliance and expands Merck’s global parasiticide leadership. USA availability begins August 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Product Type | Chewables, Sprays, and Other product types |

| Medication Type | OTC and Prescription |

| Animal Type | Dogs, Cats, and Other animal types |

| Purchase Channel | Veterinarian, Drug & pharmacy stores, Pet specialty stores, Supermarket / hypermarket, Online, and Other purchase channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis Inc., Bayer AG, Boehringer Ingelheim International GmbH, Central Garden & Pet Company, Central Life Sciences, Ceva Santé Animale, Ecto Development LLC, Elanco Animal Health Incorporated, Hartz Mountain Corporation, Merck & Co., Inc., Penn Veterinary Supply, Inc., Promika LLC, PetIQ, LLC, and Virbac S.A. |

| Additional Attributes | Dollar sales vary by formulation and channel, with chewables dominating, while tablets and spot‑on treatments grow fastest. North America leads value, while Asia‑Pacific shows highest growth. Pricing fluctuates with active ingredient and regulatory costs. Growth accelerates via natural formulations, IoT-enabled delivery systems, and e-commerce access under pet‑health awareness trends. |

The global flea and tick control medication market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the flea and tick control medication market is projected to reach USD 15.3 billion by 2035.

The flea and tick control medication market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in flea and tick control medication market are chewables, sprays and other product types.

In terms of medication type, otc segment to command 61.0% share in the flea and tick control medication market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Growth – Trends & Forecast through 2034

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA