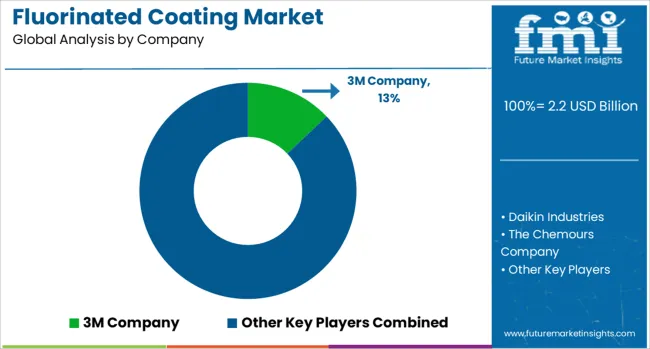

The Fluorinated Coating Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. Initial years show incremental growth from USD 2.2 billion in 2025 to approximately USD 2.5 billion by 2028, representing foundational expansion likely due to gradual uptake in various industrial applications. Between 2029 and 2032, market value rises more consistently, moving from USD 2.7 billion to USD 3.1 billion, indicating steady demand growth supported by advancements in fluorinated coating technologies and increased adoption in sectors such as automotive, aerospace, and electronics.

The latter half of the forecast period continues this upward trend, with values advancing from USD 3.2 billion in 2033 to USD 3.6 billion in 2035. This pattern highlights a gradual growth curve without sharp fluctuations, reflecting moderate market saturation and stable demand dynamics. The sustained CAGR of 4.9% indicates that while the market expands steadily, competitive pressures and alternative coatings may limit more aggressive growth. Overall, the development of the Fluorinated Coating Market suggests a reliable expansion driven by technological improvements and growing end-use industry requirements.

| Metric | Value |

|---|---|

| Fluorinated Coating Market Estimated Value in (2025 E) | USD 2.2 billion |

| Fluorinated Coating Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The fluorinated coating market is exhibiting steady expansion due to the increasing need for high-performance coatings that can endure extreme temperatures, harsh chemicals, and aggressive environmental conditions. These coatings are gaining traction across sectors such as automotive, aerospace, industrial equipment, and cookware manufacturing, where reliability and durability are critical.

The market’s momentum is being supported by the growing adoption of fluoropolymers for their non-stick, low-friction, and anti-corrosive properties, enabling longer lifecycle performance with reduced maintenance costs. Advancements in application technologies and evolving regulatory norms focused on sustainability have further driven the shift toward coatings that offer enhanced efficiency and low environmental impact.

Moreover, continued R&D investment by fluoropolymer manufacturers and the development of eco-friendly formulations are expected to pave the way for next-generation solutions. As infrastructure modernization, industrial automation, and global manufacturing scale up, fluorinated coatings are projected to play a pivotal role in delivering functional performance, cost-efficiency, and regulatory compliance.

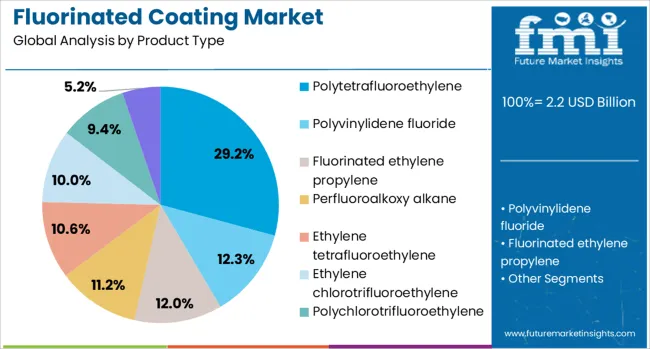

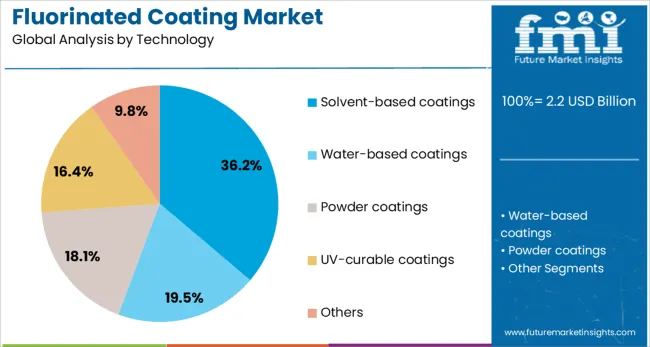

The fluorinated coating market is segmented by product type, technology, substrate performance attribute, and geographic regions. By product type, the fluorinated coating market is divided into Polytetrafluoroethylene, Polyvinylidene fluoride, Fluorinated ethylene propylene, Perfluoroalkoxy alkane, Ethylene tetrafluoroethylene, Ethylene chlorotrifluoroethylene, Polychlorotrifluoroethylene, and others. In terms of technology, the fluorinated coating market is classified into Solvent-based coatings, Water-based coatings, Powder coatings, UV-curable coatings, and others.

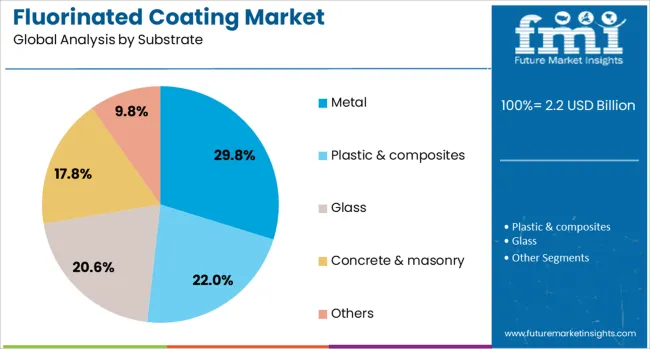

The substrate market for fluorinated coatings is segmented into Metal, plastic and composites, Glass, concrete and masonry, and others. The performance attributes of the fluorinated coating market are segmented into Chemical resistance, Weather resistance, Non-stick/low friction, Thermal stability, Electrical insulation, Corrosion protection, and others. Regionally, the fluorinated coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polytetrafluoroethylene is anticipated to hold 29.2% of the revenue share in the fluorinated coating market in 2025, marking it as the leading product type. The segment's growth is being supported by its unique material characteristics, including outstanding chemical inertness, thermal stability, and low surface energy.

These features have made it the preferred choice for applications demanding non-stick surfaces and resistance to wear under severe operating conditions. The ability of polytetrafluoroethylene to withstand wide temperature ranges without degrading and its compatibility with both metal and composite substrates have further increased its usage in manufacturing, aerospace, and food processing industries.

Additionally, improvements in dispersion techniques and coating adhesion technologies have expanded the applicability of this fluoropolymer in complex geometries. The segment's continued momentum is also being influenced by regulatory pressure to reduce maintenance-related emissions and extend equipment service life, all of which are being effectively addressed by coatings formulated with polytetrafluoroethylene.

Solvent-based coatings are projected to account for 36.2% of the revenue share in the fluorinated coating market in 2025, making them the leading technology segment. Their continued preference is being driven by superior film formation, adhesion performance, and fast curing properties, which are especially critical in industrial and automotive sectors.

The capacity of solvent-based systems to deliver high-gloss finishes and uniform coverage on irregular surfaces has supported widespread adoption in corrosion-resistant coatings. These formulations are also favored in applications where high performance under fluctuating environmental conditions is essential, such as offshore infrastructure and heavy machinery.

Technological enhancements in solvent chemistry have allowed manufacturers to meet environmental regulations while maintaining the functional benefits of solvent-based systems. The segment's resilience is further being enhanced by the availability of advanced application systems that ensure precise control over thickness and minimize waste, thereby reinforcing its value proposition in high-precision coating operations.

Metal substrates are expected to represent 29.8% of the revenue share in the fluorinated coating market in 2025, establishing them as the most significant substrate type. This prominence is being supported by the widespread use of metals across industrial machinery, automotive components, aerospace parts, and infrastructure elements that demand robust protection against oxidation and surface degradation.

Fluorinated coatings applied to metal offer exceptional resistance to corrosion, chemical abrasion, and thermal breakdown, which is critical in environments where performance reliability directly affects operational safety and cost. The growing push for lifecycle cost reduction and extended asset durability has further enhanced the appeal of metal-coated fluorinated systems.

Advancements in surface preparation and coating application methods have enabled stronger bonding between the substrate and coating layer, thereby improving long-term adhesion and protective capability. As regulatory focus intensifies on minimizing downtime and ensuring compliance with safety standards, the demand for fluorinated coatings on metal surfaces is anticipated to remain strong.

The market has been growing steadily due to its widespread application in industries requiring exceptional chemical resistance, weatherability, and low surface energy properties. Fluorinated coatings have been extensively used in automotive, aerospace, electronics, and architectural sectors to provide durable protection against corrosion, staining, and environmental degradation. The market growth has been supported by rising demand for lightweight and high-performance coatings that improve product longevity and reduce maintenance costs. Innovations in coating formulations, including advances in fluoropolymer technology and environmentally friendly solvents, have enhanced application versatility.

The automotive and aerospace sectors have been significant contributors to the fluorinated coating market due to their need for coatings that can withstand harsh operational environments. In automotive manufacturing, fluorinated coatings have been applied to exterior body parts, fuel system components, and underbody surfaces to provide corrosion resistance, UV protection, and low friction characteristics that enhance fuel efficiency. Aerospace applications require coatings that resist extreme temperatures, chemicals, and erosion while maintaining lightweight properties critical for performance and safety. The rising production of electric vehicles and aircraft has amplified the use of fluorinated coatings to meet stringent durability and environmental standards. Additionally, advancements in coating processes such as spray and dip coating have improved uniformity and adhesion, further increasing their utilization in these sectors.

Environmental regulations targeting volatile organic compounds and hazardous air pollutants have been shaping fluorinated coating formulations. The shift towards water-based and powder coatings has been driven by the need to reduce environmental impact and comply with increasingly strict emission standards. Research in fluoropolymer chemistry has enabled the creation of coatings with reduced fluorine content while maintaining performance characteristics such as chemical resistance and hydrophobicity. New application techniques, including ultraviolet curing and solvent-free processes, have improved energy efficiency and reduced hazardous waste generation. These technological advancements have supported market growth by appealing to manufacturers aiming for sustainability without compromising coating effectiveness. The development of eco-friendly fluorinated coatings has also opened opportunities in sensitive industries such as food processing and healthcare equipment.

The electronics industry has been adopting fluorinated coatings to protect sensitive components from moisture, dust, and corrosion, thereby improving device reliability and lifespan. Applications include protective layers for circuit boards, connectors, and display screens. The demand for compact and high-performance electronic devices has increased the need for coatings that provide excellent insulation and chemical resistance. In the architectural sector, fluorinated coatings have been employed to enhance façade materials, roofing, and window frames with weather-resistant and self-cleaning properties. These coatings help in maintaining aesthetic appeal and structural integrity over long periods, even under exposure to harsh environmental conditions. Growing urbanization and infrastructure development have propelled the use of fluorinated coatings in buildings and construction materials globally. This cross-sector adoption is expected to sustain the market's growth trajectory.

Despite the benefits, the fluorinated coating market has been facing challenges related to high production costs and regulatory restrictions on certain fluorinated compounds. The complexity of manufacturing processes and raw material expenses contribute to higher product prices compared to conventional coatings. Regulatory scrutiny, especially concerning per- and polyfluoroalkyl substances (PFAS), has led to restrictions and reformulations in some regions. These challenges have compelled manufacturers to innovate safer alternatives and optimize production methods to remain competitive. Opportunities have arisen in developing next-generation fluorinated coatings that balance performance with environmental compliance. Collaborations between industry players and research institutions have accelerated advancements in sustainable coatings technology. Market growth is anticipated to continue as new applications and eco-friendly products gain acceptance, particularly in markets prioritizing safety and long-term durability.

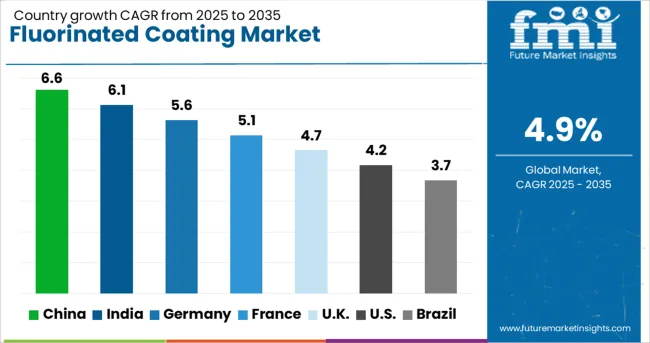

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

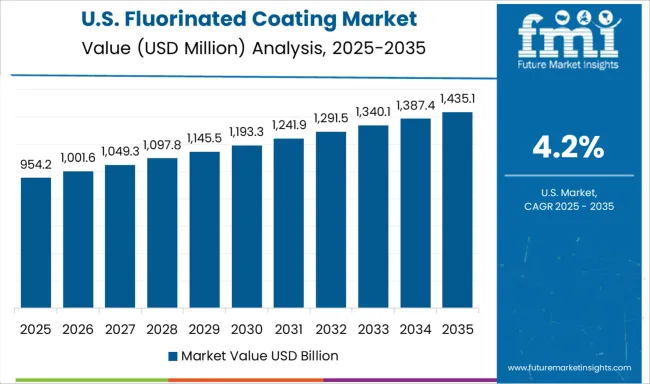

| USA | 4.2% |

| Brazil | 3.7% |

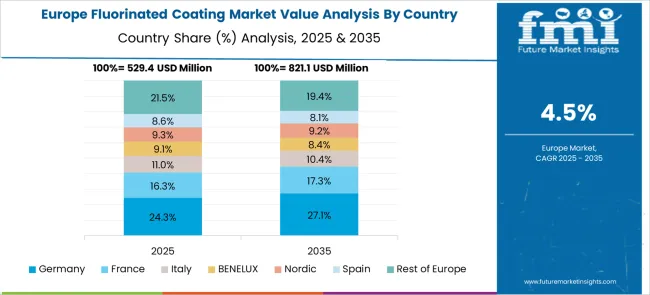

The market is projected to grow at a CAGR of 4.9% between 2025 and 2035, driven by demand for corrosion resistance, chemical protection, and enhanced durability in automotive, aerospace, and industrial sectors. China leads with a 6.6% CAGR, supported by rapid industrial growth and coating technology adoption. India follows at 6.1%, fueled by expanding manufacturing and infrastructure projects. Germany, at 5.6%, benefits from advanced coating formulations and stringent environmental regulations. The UK, growing at 4.7%, experiences steady demand in specialty coating applications. The USA, with a 4.2% CAGR, is driven by innovations in protective coatings and increasing replacement cycles. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 6.6% between 2025 and 2035. The growth is fueled by expanding applications in automotive, aerospace, and electronics manufacturing where chemical resistance and durability are critical. Leading domestic companies such as Donghua Group and Deyang Huaheng focus on improving coating formulations to enhance weather resistance and reduce environmental impact. Investments in advanced production facilities support scale-up to meet both domestic and export demands. Growth is also driven by increasing adoption in construction and infrastructure projects requiring corrosion protection. Collaborations with international technology providers are accelerating product innovation in high-performance coatings.

India’s market is projected to expand at a CAGR of 6.1% from 2025 to 2035. Demand is supported by rising industrial output in sectors such as chemicals, construction, and electronics. Key players like Asian Paints and AkzoNobel focus on developing fluoropolymer coatings with improved abrasion resistance and environmental compliance. Increasing infrastructure development and protective coating applications in pipelines are contributing to steady market growth. Growth is also supported by rising exports to Middle East and Southeast Asia markets. Regulatory emphasis on low-VOC coatings is influencing product development strategies.

Sales of fluorinated coatings in Germany are forecast to increase at a CAGR of 5.6% over 2025 to 2035. The market benefits from strong demand in automotive and aerospace manufacturing where high performance and corrosion resistance coatings are essential. Companies such as BASF and Henkel invest heavily in R&D to enhance coating durability and environmental safety. Adoption in renewable energy projects, including wind turbine blades, is boosting volume. The focus on eco-friendly coatings compliant with strict European regulations supports innovation. Collaboration with material science institutes accelerates product development.

The fluorinated coating demand in the United Kingdom is set to rise at a CAGR of 4.7% through 2035. Growth drivers include protective coatings for infrastructure and increasing use in industrial equipment. Key manufacturers such as AkzoNobel and PPG Industries emphasize the development of coatings that combine chemical resistance with reduced environmental impact. Market expansion is supported by the growth of offshore wind farms requiring specialized coatings for corrosion resistance. The construction sector also contributes with rising demand for durable architectural coatings.

Sales of fluorinated coatings in the United States are projected to expand at a CAGR of 4.2% during 2025 to 2035. Market growth is supported by demand in aerospace, automotive, and electronics manufacturing sectors. Leading companies including Chemours and PPG focus on innovating coatings with enhanced thermal stability and environmental compliance. Rising retrofit activities in industrial facilities and growing infrastructure projects contribute to sales growth. Increasing regulation on VOC emissions is accelerating development of eco-friendly coating products. Partnerships with technology firms support advancements in coating application methods.

The market exhibits substantial growth opportunities driven by rising industrial and consumer demand in emerging geographies such as Southeast Asia, Latin America, and parts of Eastern Europe. Industrial expansion, urban infrastructure development, and evolving consumer preferences in these regions are creating unmet demand across high-value and niche segments. Products and solutions offering eco-efficient, bio-based, or technologically advanced features are increasingly preferred, allowing manufacturers to differentiate and capture premium adoption. Strategic partnerships, co-development agreements, and integration within supply chains are emerging as effective routes to accelerate market penetration and secure long-term relationships with OEMs and industrial clients.

Regional presence remains a critical competitive lever, with leading companies leveraging both developed and emerging markets to balance revenue growth and risk. Expansion strategies include greenfield plants to serve local demand, mergers and acquisitions (M&A) to acquire established capabilities, and distribution networks tailored to regional supply chain dynamics. Compliance with regional regulatory frameworks, localization of production, and adherence to technical certifications are vital for sustaining operations and enhancing credibility. Barriers to entry are significant, including high capital intensity, stringent regulatory approvals, intellectual property protections, and complex technological requirements. Supply chain dependencies and the availability of key raw materials further challenge new entrants, reinforcing the advantage of established players with global production capabilities and diversified sourcing.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Product Type | Polytetrafluoroethylene, Polyvinylidene fluoride, Fluorinated ethylene propylene, Perfluoroalkoxy alkane, Ethylene tetrafluoroethylene, Ethylene chlorotrifluoroethylene, Polychlorotrifluoroethylene, and Others |

| Technology | Solvent-based coatings, Water-based coatings, Powder coatings, UV-curable coatings, and Others |

| Substrate | Metal, Plastic & composites, Glass, Concrete & masonry, and Others |

| Performance Attribute | Chemical resistance, Weather resistance, Non-stick/low friction, Thermal stability, Electrical insulation, Corrosion protection, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Daikin Industries, The Chemours Company, Solvay S.A., AkzoNobel N.V., AGC Inc., PPG Industries, Inc., Sherwin-Williams Company, Arkema, Dow, DuPont, Nippon Paint Holdings, Whitford Corporation, AGC Chemicals Americas, Jotun A/S, Beckers Group, Gujarat Fluorochemicals, Fluorotherm Polymers, and AFT Fluorotec |

| Additional Attributes | Dollar sales by coating type and end-use industry, demand dynamics across automotive, aerospace, electronics, and industrial manufacturing sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in low-temperature curing, enhanced chemical resistance, and environmentally friendly fluoropolymer formulations, environmental impact of solvent emissions, fluorocarbon waste, and coating disposal, and emerging use cases in corrosion protection for electric vehicles, flexible electronics, and sustainable packaging surfaces. |

The global fluorinated coating market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the fluorinated coating market is projected to reach USD 3.6 billion by 2035.

The fluorinated coating market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in fluorinated coating market are polytetrafluoroethylene, _pure ptfe coatings, _ptfe-based composite coatings, _modified ptfe coatings, polyvinylidene fluoride, _pvdf homopolymer coatings, _pvdf copolymer coatings, _modified pvdf coatings, fluorinated ethylene propylene, perfluoroalkoxy alkane, ethylene tetrafluoroethylene, ethylene chlorotrifluoroethylene, polychlorotrifluoroethylene and others.

In terms of technology, solvent-based coatings segment to command 36.2% share in the fluorinated coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluorinated Bottle Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Fluorinated Ethylene Propylene (FEP) Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Competitive Overview of Fluorinated Bottle Market Share

Fluorinated Containers Market Trends – Growth & Forecast 2024-2034

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

Fluorinated Solvents Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA