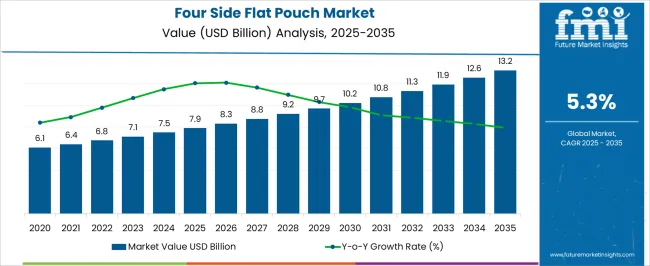

The Four Side Flat Pouch Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. Over the first five years, the market will add USD 2.3 billion in value, reflecting a CAGR close to the long-term projection of 5.3%. This period will be characterized by increased demand for compact, durable, and lightweight packaging solutions that provide effective product protection and extended shelf life. From 2025 to 2027, growth is driven largely by higher consumption in packaged foods and convenience products, pushing the market from USD 7.9 billion to USD 8.8 billion.

Between 2028 and 2030, the value rises further to USD 10.2 billion, supported by the broader acceptance of flexible formats in healthcare and cosmetic products, where branding and portability are important. The market’s consistent rise during this period is also aided by the ability of four side flat pouches to maintain product freshness and withstand distribution stresses. By 2030, the segment will have reinforced its position as a preferred choice for manufacturers seeking functional, attractive, and cost-efficient packaging across multiple end-use industries.

| Metric | Value |

|---|---|

| Four Side Flat Pouch Market Estimated Value in (2025 E) | USD 7.9 billion |

| Four Side Flat Pouch Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The four side flat pouch market is witnessing steady growth, fueled by rising demand for compact, secure, and visually distinct packaging formats across food, pharmaceutical, and personal care sectors. Manufacturers are increasingly shifting to space-efficient and shelf-stable solutions that support product visibility and branding while enhancing durability.

Improvements in lamination technology and sealing integrity are enabling longer shelf lives and leak-proof formats, which are particularly valuable in high-moisture or perishable applications. Sustainability goals are also playing a role, with rising preference for lightweight packaging formats that reduce material usage and emissions.

Regulatory compliance with food-grade and pharmaceutical-grade barrier standards continues to influence material and closure innovations. Growth opportunities are expected to be driven by smart packaging integration, user convenience features, and the adoption of recyclable and bio-based films in multilayer structures.

The four side flat pouch market is segmented by material, product type, closure type, end-use industry, and geographic regions. The market for the four-sided flat pouch is divided into Plastic, Aluminum foil, Paper, and Composite. In terms of product type, the four-sided flat pouch market is classified into Multi-layer laminated pouches and Single-layer pouches. Based on the closure type, the four-sided flat pouch market is segmented into Zipper/resealable, Tear notch, and Heat-sealed. The end-use industry of the four-sided flat pouch market is segmented into Food & beverages, Pharmaceuticals, Cosmetics & personal care, Chemical & industrial, and Others. Regionally, the four side flat pouch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

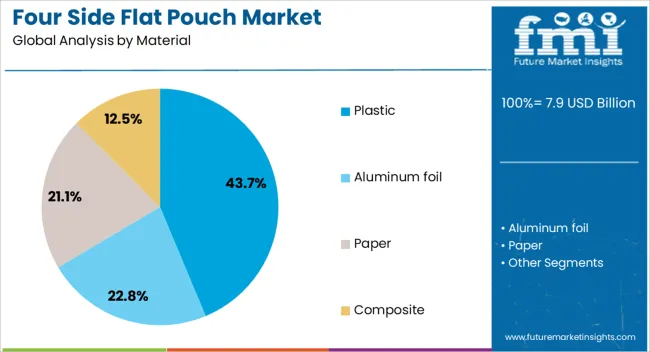

Plastic is anticipated to account for 43.7% of the market revenue in 2025, making it the most widely used material in four side flat pouch production. This segment’s leadership is being driven by the versatility, cost-effectiveness, and strong barrier properties that plastics provide across diverse applications.

Plastic substrates offer excellent compatibility with printing, lamination, and heat sealing processes, making them ideal for maintaining product freshness and visual appeal. In addition, plastic-based films allow manufacturers to integrate resealable and tamper-evident features without compromising the pouch’s structure.

Ongoing advancements in recyclable and mono-material plastic films are expected to support continued demand, particularly as brands seek to balance performance with circular economy goals.

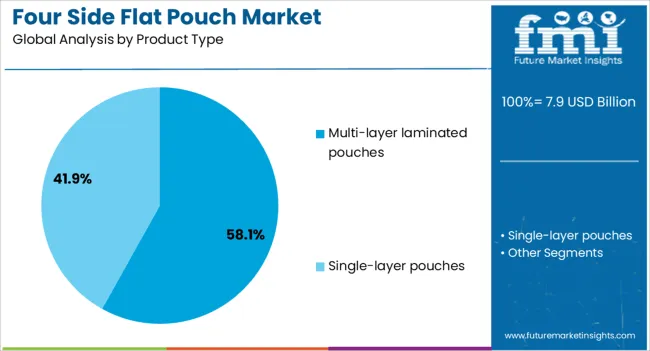

Multi-layer laminated pouches are projected to hold 58.1% of the total revenue share in 2025, establishing them as the dominant product type. Their prominence is linked to superior barrier protection, puncture resistance, and the ability to combine various materials to optimize performance.

These pouches offer high visual quality, durability, and print compatibility, all of which are essential for retail-facing products. Their structure allows for better preservation of aroma, flavor, and active ingredients, especially in food and pharma categories.

The increased adoption of multilayer formats is further supported by their ability to meet regulatory compliance for safety, labeling, and shelf-life requirements. As manufacturers focus on combining convenience and compliance, this product type remains the preferred choice across high-demand applications.

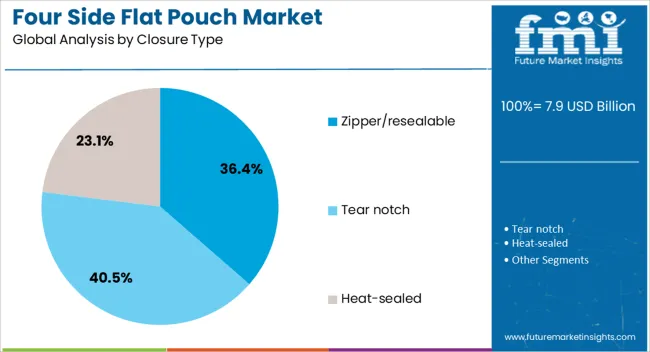

Zipper/resealable closures are expected to contribute 36.4% of the revenue in the four side flat pouch market by 2025, ranking as the leading closure type. This growth is being supported by the rising consumer preference for packaging that enhances usability, maintains product freshness, and enables multiple uses.

Zipper closures offer a secure seal while allowing easy opening and reclosing, which is particularly valued in snacks, supplements, and household items. Their integration helps reduce food waste and contributes to packaging sustainability by eliminating the need for secondary containers.

With increased adoption in premium and functional packaging lines, zipper systems are also seen as a differentiator for brand positioning. Ongoing design improvements are focused on improving ergonomic function, strength, and compatibility with recyclable films, ensuring continued growth for this closure format.

The four side flat pouch market is witnessing steady growth as food, pharmaceutical, and personal care brands seek durable, lightweight, and space-efficient packaging. These pouches offer excellent barrier protection, product visibility, and extended shelf life, making them ideal for both retail and e-commerce channels. Demand is driven by convenience, cost efficiency, and customizable printing options that enhance brand visibility. While recyclability and material costs remain key challenges, innovations in eco-friendly films and printing technology are expanding opportunities for sustainable and premium packaging solutions.

Food and beverage brands are increasingly turning to four side flat pouches for packaging products like dry snacks, coffee, spices, and ready-to-eat meals. These pouches provide strong moisture, oxygen, and light barriers, ensuring freshness and extended shelf life. Their compact, flat design also improves storage efficiency and reduces transportation costs compared to rigid packaging formats. In addition, high-quality printing options allow for vibrant graphics and brand messaging, enhancing shelf appeal in competitive retail environments. The versatility of pouch sizes and resealable closures further supports consumer convenience, making them suitable for both single-serve and bulk packaging needs. As global demand for packaged and processed food continues to rise, four side flat pouches are increasingly becoming a preferred choice for brands looking to combine product protection with attractive presentation, particularly in markets with strong retail competition.

Despite their benefits, four side flat pouches face challenges related to sustainability and recyclability. Many pouches are made from multi-layer laminates combining plastic, aluminum, and paper, which provide excellent barrier properties but are difficult to recycle in conventional waste streams. With tightening environmental regulations and growing consumer preference for eco-friendly packaging, manufacturers are under pressure to develop mono-material or compostable alternatives. Transitioning to sustainable materials, however, involves higher costs, potential trade-offs in barrier performance, and changes in production processes. Brands that successfully balance environmental responsibility with functionality can differentiate themselves in the marketplace. Collaborations with material science companies and recycling initiatives are becoming common as the industry seeks viable solutions. Until scalable, cost-effective recycling systems are in place, the challenge of reducing environmental impact will remain a significant factor influencing product development and adoption in certain regions.

Four side flat pouches are finding growing use in premium and niche markets such as specialty coffee, organic snacks, nutraceuticals, and high-end pet food. These products often require packaging that communicates quality, authenticity, and freshness while ensuring long shelf life. The large printable surface of the pouch allows brands to use bold designs, matte or glossy finishes, and metallic accents to create a distinctive look. For niche segments, smaller production runs and custom printing are possible, allowing brands to cater to specific consumer preferences or seasonal promotions. In e-commerce, four side flat pouches are favored for their durability and lightweight nature, which helps reduce shipping costs while maintaining product integrity. As consumer demand shifts toward artisanal, organic, and health-oriented products, premium packaging formats like four side flat pouches will play a key role in influencing purchase decisions and strengthening brand positioning.

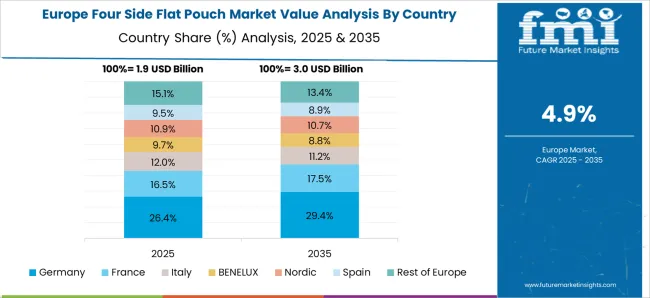

Asia Pacific is emerging as the fastest-growing region for four side flat pouch adoption, driven by expanding urban populations, rising disposable incomes, and rapid growth in modern retail and e-commerce platforms. Countries such as China, India, and Indonesia are experiencing increased demand for packaged food, pharmaceuticals, and personal care products, creating opportunities for flexible packaging manufacturers. North America and Europe maintain strong markets, supported by established retail networks, advanced printing technologies, and consumer preference for convenience packaging. In Latin America and the Middle East, growing supermarket penetration and the shift toward branded packaged goods are fueling uptake. Regional suppliers are focusing on localized designs, language customization, and culturally relevant branding to attract diverse consumer bases. As cross-border e-commerce grows, manufacturers are also adapting pouch specifications to meet international shipping standards, further boosting demand across different geographic markets.

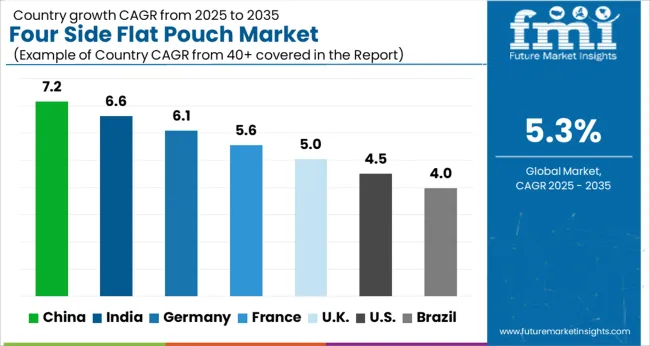

The global four side flat pouch market is growing steadily at a 5.3% CAGR, driven by increasing demand for flexible packaging solutions. Among BRICS nations, China and India both lead with 7% growth, supported by expanding food and pharmaceutical industries. Germany reports 6% growth, reflecting strong regulatory frameworks and adoption of sustainable packaging materials. The United Kingdom and the United States, representing mature markets, each show 5% growth, fueled by consumer preference for convenience and eco-friendly packaging. These countries collectively influence market trends through innovations in material durability, barrier properties, and printing technologies. This report includes insights on 40+ countries; the top countries are shown here for reference.

The four side flat pouch market in China is growing at a strong 7% CAGR, driven by rising demand from the food and pharmaceutical packaging sectors. Urbanization and increasing consumer preference for convenient, lightweight packaging fuel market expansion. Chinese manufacturers focus on improving pouch barrier properties and printing quality to meet export standards and domestic needs. Innovations in sustainable materials and biodegradable films are gaining traction due to government regulations and environmental awareness. E-commerce growth also supports demand for flexible packaging solutions that ensure product safety during shipping. Despite fierce competition from local and international brands, Chinese companies leverage cost advantages and large-scale production to capture market share. Compared to Western countries, China’s market is characterized by faster product innovation cycles and diversified applications, including personal care and pet food packaging. The packaging industry’s close integration with supply chains facilitates rapid adoption of four side flat pouches across multiple sectors.

Four side flat pouch market is expanding at a 7% CAGR, fueled by increasing consumption of packaged foods and rising awareness about hygiene and convenience. The fast-growing retail sector and the popularity of ready-to-eat and ready-to-cook meals encourage adoption of flat pouch packaging. Indian manufacturers are investing in barrier films to extend product shelf life, catering to the diverse climate conditions across the country. Compared to China, India faces challenges such as supply chain fragmentation and fluctuating raw material costs, but government initiatives to support domestic manufacturing boost market potential. Additionally, rising health consciousness among consumers increases demand for pouches in pharmaceutical and personal care products. The rise of modern retail outlets and online grocery platforms further expands the market reach. Growing emphasis on eco-friendly packaging also drives research into recyclable and compostable pouch materials.

Germany’s market for four side flat pouches grows at 6% CAGR, supported by stringent environmental regulations and high consumer expectations for quality and sustainability. The packaging industry emphasizes recyclable and compostable materials, aligning with Europe’s circular economy goals. German companies invest heavily in innovative pouch designs that improve convenience and preserve product freshness, particularly in food and beverage segments. Compared to Asian markets, Germany has slower growth but higher product standards and a strong preference for eco-friendly solutions. The pharmaceutical sector also drives demand with pouches used for unit-dose packaging and moisture protection. Strong retail chains and organic food markets prioritize sustainable packaging formats, which increases adoption of flat pouches made from renewable materials. Research institutions collaborate with manufacturers to develop biodegradable barrier films that meet regulatory requirements while maintaining product safety.

The United Kingdom experiences steady growth at a 5% CAGR in the four side flat pouch market, driven by increasing consumer demand for convenience and sustainability. Food manufacturers increasingly use flat pouches for snacks, pet food, and frozen products due to their compact design and resealability. The UK market sees a strong trend toward reducing plastic waste, with manufacturers shifting to recycled and recyclable pouch materials. Compared to Germany, growth is slightly slower but innovation in compostable packaging is gaining momentum. Retailers and brands emphasize transparent labeling and eco-friendly certifications, appealing to environmentally conscious consumers. The pharmaceutical and personal care sectors also contribute to demand, using flat pouches for single-dose packaging and travel-sized products. Government policies promoting packaging waste reduction support the transition to sustainable flexible packaging formats.

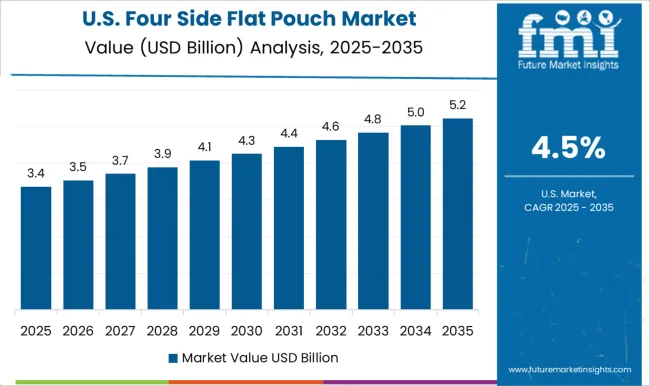

The United States market for four side flat pouches grows steadily at 5% CAGR, driven by diverse applications across food, pharmaceutical, and personal care industries. Convenience and portability are major factors behind the adoption of flat pouch packaging for snacks, supplements, and single-serve products. USA manufacturers invest in high-barrier films to extend shelf life and protect sensitive products from moisture and oxygen. Compared to European countries, the USA market favors innovative packaging features such as easy-tear notches and child-resistant closures. Sustainability concerns are rising, with companies increasingly adopting recyclable and compostable materials, although growth in this area lags behind Europe. Online retail growth also propels demand for packaging that withstands shipping stress. Regulatory pressures and consumer preference for eco-friendly packaging drive research in bio-based films and multi-layer recyclable pouches to reduce environmental impact.

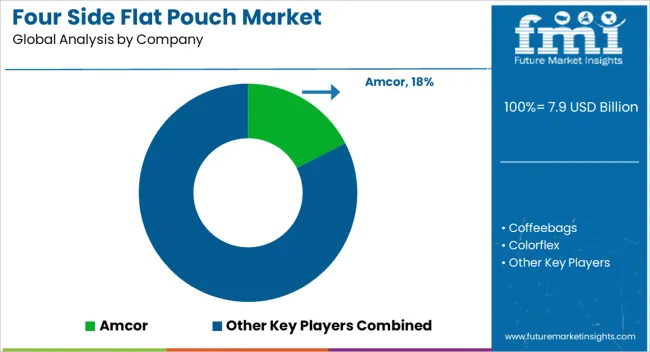

The four side flat pouch market is driven by increasing demand for durable, lightweight, and visually appealing packaging solutions across food, beverage, pharmaceuticals, pet care, and household products. Leading players include Amcor, Coffeebags, Colorflex, Constantia Flexibles Group, Coveris Holdings, Frain Group, Haipak, Huhtamaki, MaxPax, Pakona, Printpack, ProAmpac, Smart Pouches, SN German Pouches Pack Technology, Swiss Pac, TedPack, Winpak, and XiangHong Packing Machinery.

These companies compete on innovation in materials, printing quality, barrier protection, and eco-friendly alternatives to meet evolving consumer and regulatory requirements. Four side flat pouches sealed on all four edges offer excellent product protection, extended shelf life, and efficient storage and transportation benefits. They are widely used for packaging coffee, tea, spices, dry foods, powdered drink mixes, and medical supplies. Market growth is fueled by rising e-commerce shipments, where puncture resistance and moisture protection are crucial, as well as by premium product segments seeking high-end printing finishes and metallic effects to enhance shelf appeal. Sustainability is a major competitive battleground.

Players like Amcor, Constantia Flexibles, and Huhtamaki are heavily investing in recyclable mono-material pouches and compostable films to meet consumer preferences for greener packaging. Meanwhile, machinery suppliers such as Pakona and XiangHong Packing Machinery are enhancing automation capabilities to improve production speeds, reduce downtime, and accommodate smaller batch sizes for customized orders.

Future market growth will likely hinge on high-barrier bio-based films, digital printing for brand personalization, and integration of smart packaging features such as QR codes for traceability. Strategic partnerships between material innovators, converters, and filling machine manufacturers are expected to accelerate the shift toward more sustainable and functional four side flat pouch solutions.

Amcor dominates with high-barrier, recyclable packaging and lightweight designs. It leverages smart manufacturing and global production networks, and drives innovation through selective acquisitions. Coveris focuses on delivering high-performance, aesthetically appealing pouches aimed at premium retail applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Material | Plastic, Aluminum foil, Paper, and Composite |

| Product Type | Multi-layer laminated pouches and Single-layer pouches |

| Closure Type | Zipper/resealable, Tear notch, and Heat-sealed |

| End-Use Industry | Food & beverages, Pharmaceuticals, Cosmetics & personal care, Chemical & industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Coffeebags, Colorflex, Constantia Flexibles Group, Coveris Holdings, Frain Group, Haipak, Huhtamaki, MaxPax, Pakona, Printpack, Proampac, Smart Pouches, SN German Pouches Pack Technology, Swiss Pac, TedPack, Winpak, and XiangHong Packing Machinery |

| Additional Attributes | Dollar sales vary by material, including polyethylene, polypropylene, and aluminum; by product type, such as stand-up, zip-lock, and standard four-side pouches; by application, serving food & beverages, personal care, pharmaceuticals, and industrial sectors; and by region, with North America, Europe, and Asia-Pacific leading. Growth is fueled by convenience, lightweight cost savings, branding space, and sustainability innovation. |

The global four side flat pouch market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the four side flat pouch market is projected to reach USD 13.2 billion by 2035.

The four side flat pouch market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in four side flat pouch market are plastic, _polyethylene (pe), _polypropylene (pp), _polyethylene terephthalate (pet), _others, aluminum foil, paper and composite.

In terms of product type, multi-layer laminated pouches segment to command 58.1% share in the four side flat pouch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Four Way Shuttle Rack Market Size and Share Forecast Outlook 2025 to 2035

Fourth Party Logistics Market Size and Share Forecast Outlook 2025 to 2035

Four Side-Sealed Pouches Market

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Side Load Case Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Side Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Side Gusset/Quad Seal Bag Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Side Gusset/Quad Seal Bag Sector

Side Weld Bags Market

Side Sealer Machines Market

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Insider Threat Protection Market Analysis Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA