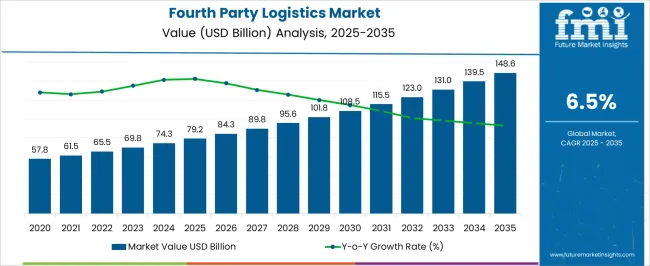

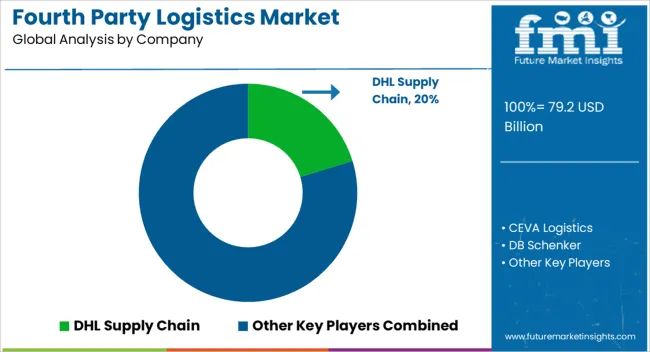

The fourth party logistics market is estimated to be valued at USD 79.2 billion in 2025 and is projected to reach USD 148.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. This expansion reflects the rising demand for integrated supply chain management services, where businesses increasingly rely on specialized providers to handle complex logistics networks. As global trade volumes grow and operational efficiency becomes a critical requirement, fourth party logistics providers are positioned to play a stronger role in optimizing distribution, procurement, and transportation strategies across industries.

By 2035, the absolute dollar opportunity of nearly USD 70 billion highlights the considerable growth potential for stakeholders in this sector. The reliance on fourth party logistics is anticipated to intensify, as companies seek partners capable of providing end-to-end visibility, streamlined operations, and cost efficiencies. With businesses under mounting pressure to meet customer expectations while controlling logistics costs, the market is projected to experience continuous expansion.

| Metric | Value |

|---|---|

| Fourth Party Logistics Market Estimated Value in (2025 E) | USD 79.2 billion |

| Fourth Party Logistics Market Forecast Value in (2035 F) | USD 148.6 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The fourth party logistics market sits as a specialized layer within the logistics and supply chain management market, currently accounting for around 6-7% of the total share. Unlike third party logistics, where the focus lies on operational tasks such as transportation and warehousing, fourth party logistics integrates strategy, technology, and complete supply chain oversight. In the freight forwarding market, its share is relatively smaller at 2-3%, but the rise of globalized trade and the demand for optimized shipping solutions are expected to push adoption upward.

The ability of fourth party providers to coordinate multiple logistics partners is making them increasingly vital to complex, multinational supply chains. Within the transportation and distribution market, fourth party logistics services capture nearly 4-5%, as they ensure end-to-end visibility and efficiency across modes such as road, rail, sea, and air. In warehousing and inventory management, the share is around 3-4%, driven by the integration of smart technologies and predictive analytics to balance stock levels across networks. Meanwhile, in the e-commerce logistics market, where speed and scalability are critical, fourth party logistics services hold close to 5-6%.

By managing multiple service providers, automating processes, and leveraging digital platforms, they play an indispensable role in streamlining last-mile delivery and returns. Altogether, these parent markets demonstrate that fourth party logistics is becoming a strategic necessity rather than a service extension, shaping the future of supply chain orchestration.

The Fourth Party Logistics (4PL) market is gaining traction as enterprises seek end-to-end supply chain solutions that emphasize integration, cost-efficiency, and strategic control. Unlike traditional 3PL models, 4PL providers serve as single points of contact, coordinating multiple logistics functions across vendors and platforms.

The growing complexity of global trade, coupled with mounting pressure to reduce operational costs and enhance visibility, is accelerating demand for 4PL services. Digital transformation via AI, cloud-based TMS, and real-time analytics is enabling better orchestration of multi-tier supply chains, particularly for large-scale manufacturers and retailers.

The trend toward outsourcing supply chain management to specialized integrators is expected to continue, driven by a need for resilience, agility, and continuous process improvement.

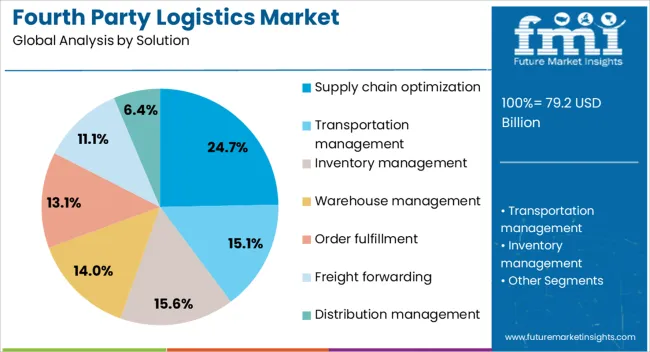

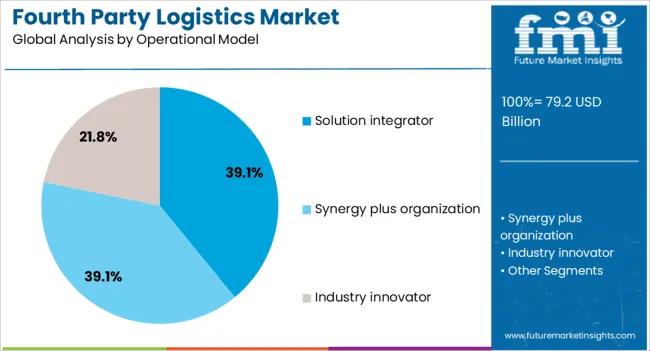

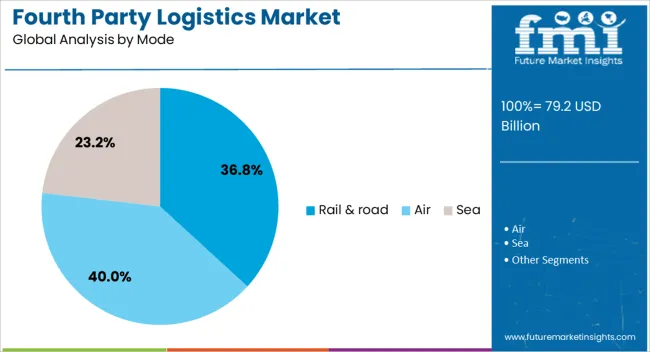

The fourth party logistics market is segmented by solution, operational model, mode, end user, and geographic regions. By solution, fourth party logistics market is divided into Supply chain optimization, Transportation management, Inventory management, Warehouse management, Order fulfillment, Freight forwarding, and Distribution management. In terms of operational model, fourth party logistics market is classified into Solution integrator, Synergy plus organization, and Industry innovator.

Based on mode, fourth party logistics market is segmented into Rail & road, Air, and Sea. By end user, fourth party logistics market is segmented into Automotive, Food & beverage, Healthcare, Retail, Manufacturing, and Others. Regionally, the fourth party logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The supply chain optimization segment is set to lead with a 24.70% share in the 4PL market by 2025. Its growth is fueled by increasing reliance on data-driven planning, end-to-end network design, and predictive demand-supply balancing.

Enterprises are investing in comprehensive optimization solutions to tackle bottlenecks, reduce lead times, and manage inventory more efficiently across geographies. 4PL providers play a critical role in integrating advanced tools like control towers, AI-driven simulations, and digital twins into client operations.

With volatile demand patterns and growing e-commerce complexity, optimization services are transitioning from optional enhancements to strategic necessities, boosting their market prominence.

Solution integrators are forecast to dominate with a 39.10% share of the operational model segment in 2025. This leadership stems from their ability to unify diverse logistics functions warehousing, transportation, procurement under a single umbrella.

These integrators act as strategic partners, managing end-to-end execution while driving innovation, vendor coordination, and compliance. The shift from transactional to consultative logistics is placing solution integrators at the core of transformation initiatives for large enterprises.

Their deep domain expertise, coupled with neutrality in vendor selection, ensures optimized performance across the supply chain ecosystem. As businesses scale and diversify their supplier networks, the need for centralized, tech-enabled oversight is expected to propel growth in this model.

The rail & road segment is projected to hold a 36.80% share of the 4PL market by 2025, making it the leading mode of transportation. This dominance reflects the segment’s cost-efficiency, high capacity, and coverage for both short- and long-haul freight.

Road transport remains vital for first-mile and last-mile delivery, while rail offers fuel-efficient bulk movement over inland networks. 4PL providers are optimizing intermodal strategies that blend rail and road to achieve both speed and sustainability objectives.

Government investments in transport infrastructure, cross-border corridor development, and smart freight tracking are enhancing the viability of this mode. As pressure mounts to decarbonize logistics, integrated rail-road networks are expected to become central to 4PL deployment strategies.

The fourth party logistics market is driven by rising demand for integrated supply chain management across industries. Opportunities are emerging from digital platforms and partnerships, while asset-light models are shaping industry practices. However, managing complexity and winning client trust remain persistent challenges. Despite these hurdles, the market is expected to grow steadily as global trade networks expand and businesses increasingly prioritize efficiency, visibility, and resilience in logistics management.

The demand for fourth party logistics (4PL) services is increasing as businesses seek integrated solutions to manage complex supply chains. Companies face challenges from globalization, multi-modal transportation, and rising customer expectations for faster deliveries. Unlike traditional providers, 4PL offers an end-to-end approach by consolidating services from multiple third-party logistics firms, ensuring efficiency and visibility across the supply chain. Manufacturers, retailers, and e-commerce players are increasingly relying on 4PL providers to reduce costs, improve coordination, and manage risks associated with global trade operations.

Significant opportunities exist for 4PL providers through digital supply chain platforms and strategic collaborations. Integration of AI, IoT, and blockchain is enabling real-time monitoring, predictive analytics, and transparent transactions, which strengthen client trust. Strategic partnerships with technology providers and transport operators are creating new service capabilities and expanding market reach. As e-commerce and omnichannel retailing expand, 4PL companies can capture opportunities by providing scalable, customized solutions. Firms that combine technology with consulting expertise are well-positioned to become indispensable partners in modern supply chain management.

A growing trend in the 4PL market is the adoption of asset-light models, where providers act as coordinators rather than asset owners. By leveraging partnerships with 3PL firms and transportation networks, 4PL companies can focus on strategy, process optimization, and technological integration without bearing the burden of asset-heavy operations. This approach provides scalability and flexibility to adapt to market fluctuations. As more businesses prioritize supply chain visibility and resilience, asset-light 4PL firms are becoming attractive partners, especially in sectors with high volatility such as retail and consumer goods.

Challenges for the commercial vehicle retarder market include high upfront costs and limited awareness among smaller fleet operators. The expense of installation and integration often deters adoption in cost-sensitive markets, despite long-term benefits. Maintenance complexity and the need for skilled technicians also restrict widespread usage. Competition from traditional braking systems, perceived as sufficient by some operators, further slows penetration. In my assessment, success will depend on educating operators about lifecycle savings and safety benefits while offering cost-efficient solutions that lower the entry barrier for diverse fleet owners.

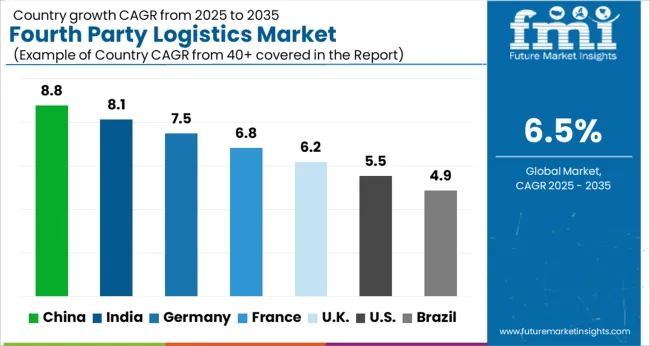

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

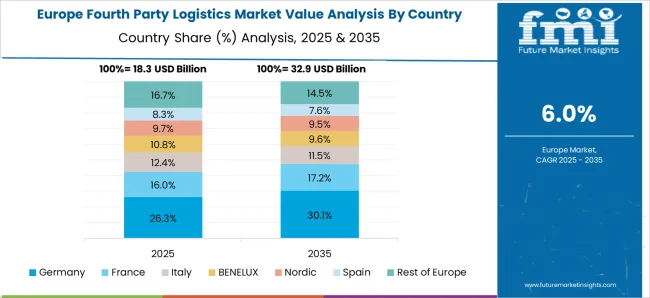

The global fourth party logistics market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with a growth rate of 8.8%, followed by India at 8.1% and Germany at 7.5%. The United Kingdom records a growth rate of 6.2%, while the United States shows the slowest growth at 5.5%. Expansion is supported by the shift toward integrated supply chain solutions, rising outsourcing by manufacturers, and greater reliance on digital platforms for freight management. Emerging economies such as China and India benefit from manufacturing expansion and evolving e-commerce ecosystems, while developed economies like the USA, UK, and Germany focus on efficiency, automation, and value-added logistics partnerships. This report includes insights on 40+ countries; the top markets are shown here for reference.

The fourth party logistics market in China is expanding at 8.8% CAGR, the highest among key regions. Growth is reinforced by rapid manufacturing output, expanding international trade, and large-scale supply chain modernization programs. Chinese firms are increasingly outsourcing their logistics requirements to achieve cost efficiency and operational agility. The integration of advanced digital platforms for transport visibility, freight brokerage, and warehouse management enhances competitiveness in this space. Domestic providers are also collaborating with global logistics operators to strengthen international reach. Government support for digital supply chains and infrastructure improvement continues to push adoption.

The fourth party logistics market in India is advancing at 8.1% CAGR, driven by a surge in retail, manufacturing, and digital commerce. Indian firms increasingly rely on external logistics service providers to manage complex distribution networks across the country. Cost competitiveness, faster delivery expectations, and high-volume trade activity are fueling this demand. The rollout of the Goods and Services Tax (GST) simplified interstate logistics, further encouraging reliance on integrated 4PL systems. Collaborations between local operators and global service providers are enhancing the adoption of advanced tracking, transport optimization, and predictive analytics.

The fourth party logistics market in Germany is growing at 7.5% CAGR, supported by its role as Europe’s industrial and export hub. German manufacturers are leveraging 4PL solutions for cost reduction, efficiency, and compliance with environmental standards. Automotive, chemicals, and machinery sectors are strong adopters, seeking streamlined logistics processes and value-added services. With growing international trade routes and increased pressure to modernize logistics, demand for digital freight management systems and predictive modeling is rising. Germany’s established logistics infrastructure provides a strong foundation for advanced 4PL services.

The fourth party logistics market in the United Kingdom is expanding at 6.2% CAGR, supported by demand for efficiency and resilience in the supply chain. Post-Brexit trade complexities and evolving regulations have created opportunities for 4PL service providers to handle compliance, customs, and risk management. E-commerce growth continues to influence reliance on digital logistics platforms, while manufacturers seek integrated solutions to manage fragmented supply networks. The trend toward outsourcing and digitization positions the UK as a growing yet competitive market for global and regional logistics operators.

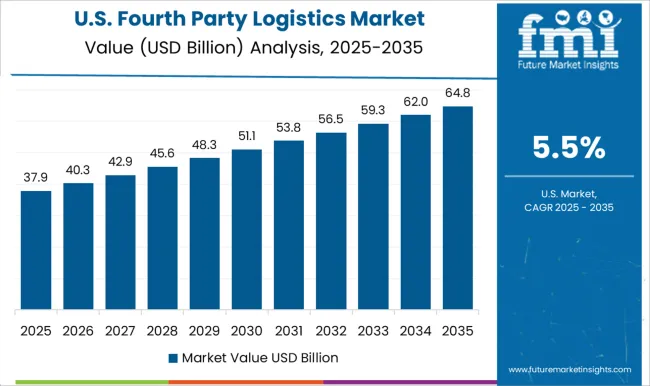

The fourth party logistics market in the United States is growing at 5.5% CAGR, the slowest among the leading countries but still significant in scale. USA manufacturers and retailers increasingly use 4PL providers to consolidate supply chains, reduce costs, and improve visibility. High reliance on digital platforms for fleet management, freight brokerage, and real-time tracking supports steady growth. While the market is mature, opportunities lie in niche areas such as cold chain, pharmaceuticals, and e-commerce logistics. The need for risk management and resilience after pandemic-related disruptions also strengthens adoption.

The fourth party logistics market is shaped by providers seeking control over entire supply chains rather than individual segments. DHL Supply Chain, CEVA Logistics, and Kuehne+Nagel position themselves as orchestrators of complex networks, with brochures highlighting end-to-end visibility platforms and integrated vendor management. DB Schenker and DSV Panalpina stress their global freight forwarding expertise, presenting strategies centered on agility and scalable logistics solutions. Maersk extends beyond shipping, marketing itself as a one-stop orchestrator, while Geodis and UPS Supply Chain Solutions emphasize optimization of multimodal flows. XPO Logistics and TMC (a C.H. Robinson division) showcase strong digital control towers, leveraging predictive analytics to differentiate their offerings. Product brochures demonstrate strategies of integration, technology enablement, and tailored industry focus. DHL’s literature focuses on retail and e-commerce, while CEVA highlights automotive and healthcare verticals. DB Schenker presents detailed case studies on aerospace and industrial supply chains, reinforcing credibility. Maersk’s material underlines maritime dominance backed by inland connectivity, while UPS and Geodis focus on warehousing integration. XPO Logistics positions its brochures around predictive freight management tools. TMC highlights cloud-based solutions ensuring collaboration across global partners. Competition rests on the ability to present logistics as a strategic partner service, with product literature shaping perceptions by balancing global reach, digital control, and cost efficiency for decision-makers.

| Item | Value |

|---|---|

| Quantitative Units | USD 79.2 Billion |

| Solution | Supply chain optimization, Transportation management, Inventory management, Warehouse management, Order fulfillment, Freight forwarding, and Distribution management |

| Operational Model | Solution integrator, Synergy plus organization, and Industry innovator |

| Mode | Rail & road, Air, and Sea |

| End User | Automotive, Food & beverage, Healthcare, Retail, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, CEVA Logistics, DB Schenker, DSV Panalpina, Geodis, Kuehne+Nagel, Maersk (A.P. Moller - Maersk), TMC, a division of C.H. Robinson, UPS Supply Chain Solutions, and XPO Logistics |

| Additional Attributes | Dollar sales by grade type (unfilled, reinforced, flame-retardant) and form (sheet, rod, film, granule) are key metrics. Trends include rising demand in aerospace, automotive, and medical devices for high-strength, heat-resistant polymers. Regional adoption, advancements in processing technologies, and preference for lightweight engineering materials are driving market growth. |

The global fourth party logistics market is estimated to be valued at USD 79.2 billion in 2025.

The market size for the fourth party logistics market is projected to reach USD 148.6 billion by 2035.

The fourth party logistics market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in fourth party logistics market are supply chain optimization, transportation management, inventory management, warehouse management, order fulfillment, freight forwarding and distribution management.

In terms of operational model, solution integrator segment to command 39.1% share in the fourth party logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Third Party Administration (TPA) Service Market Size and Share Forecast Outlook 2025 to 2035

Third-Party Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Third Party Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA