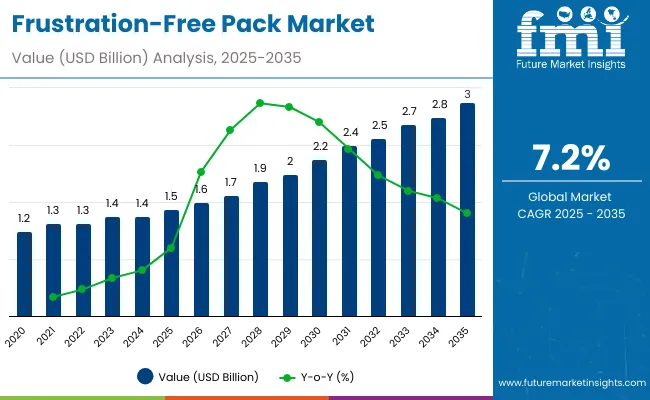

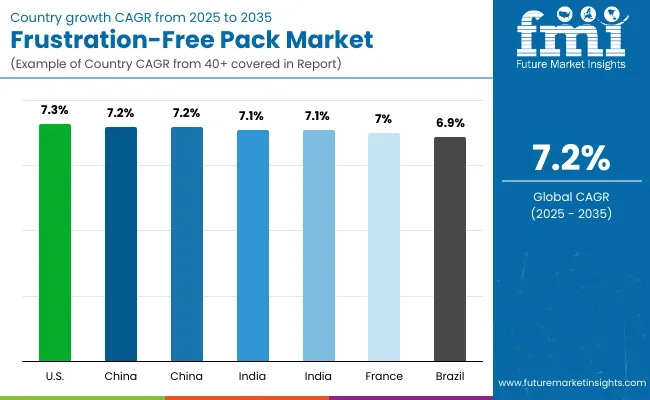

The frustration-free pack market will expand from USD 1.5 billion in 2025 to USD 3.0 billion by 2035, advancing at a CAGR of 7.2%. Growth is supported by consumer demand for easy-to-open, recyclable packaging and global e-commerce expansion. These packs enhance convenience, reduce waste, and improve logistics efficiency.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 3.0 billion |

| CAGR (2025 to 2035) | 7.2% |

Between 2025 and 2030, the market will add USD 0.6 billion, largely driven by consumer electronics and online retail shipments. From 2030 to 2035, another USD 0.9 billion will be added through food, beverages, and healthcare packaging. Corrugated cardboard, 100% recyclable packaging, and automation-ready formats will anchor growth, with Asia-Pacific leading expansion.

From 2020 to 2024, frustration-free packs gained momentum as Amazon and other e-commerce leaders set standards for easy-to-open and recyclable packaging. Corrugated cardboard and moldedfiber replaced plastics in shipping, while certification standards reinforced market credibility. Brands emphasized reduced packaging waste and improved unboxing experiences.

By 2035, the market will reach USD 3.0 billion at 7.2% CAGR. Corrugated cardboard and boxes will remain dominant, aligned with recyclability and strength. E-commerce and retail will anchor demand, accounting for nearly half of market share. Asia-Pacific will lead expansion, with Japan and South Korea driving innovation in eco-friendly packaging. North America and Europe will prioritize compliance with circular economy mandates.

The frustration-free pack market is expanding due to rapid e-commerce growth and consumer demand for sustainability. Packaging designed to be recyclable, easy-to-open, and protective reduces damage and return rates. Retailers adopt these solutions to comply with EPR schemes and meet consumer expectations.

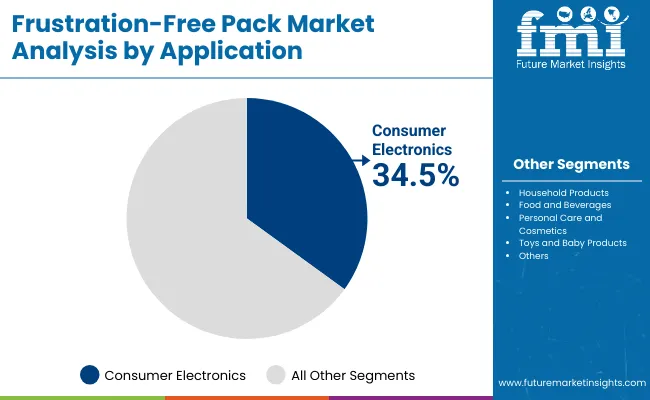

Consumer electronics dominate applications, supported by high-value shipments requiring secure and frustration-free packaging. Food and beverages, healthcare, and personal care also expand adoption. Advancements in lightweight corrugated and moldedfiber, combined with automation-ready design, ensure scalability. With alignment of consumer convenience, regulatory mandates, and brand sustainability, the market’s growth is reinforced globally.

The frustration-free pack market is segmented by material, packaging type, application, certification/standard, end-use industry, and region. Material types include corrugated cardboard, paperboard, moldedfiber, recycled plastics, and bio-based plastics. Packaging types cover boxes, mailers, pouches, protective inserts, and trays. Applications span consumer electronics, household products, food and beverages, personal care, and toys. Certification includes recyclable, easy-to-open, reduced material, and no plastic. End-use industries include e-commerce, consumer goods, food, electronics, and healthcare across major regions.

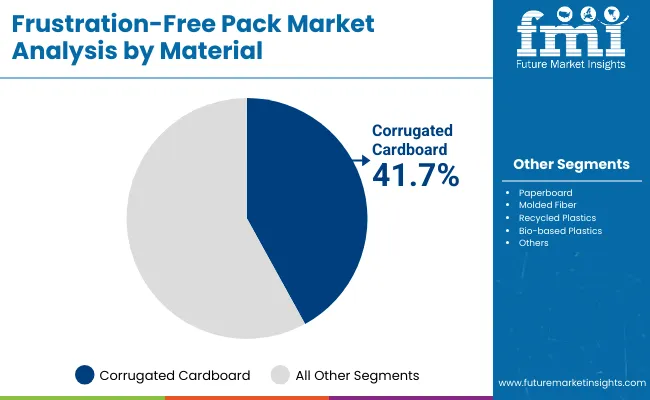

Corrugated cardboard will hold 41.7% share in 2025 due to its durability, recyclability, and cost-efficiency. Widely used in e-commerce and grocery logistics, corrugated packaging provides strength and consistent protection. Retailers favor its universal recyclability, while manufacturers prioritize FSC-certified sourcing and compatibility with automated packaging lines. This makes corrugated cardboard indispensable in large-scale shipping and distribution networks.

Future adoption will focus on lightweight corrugated grades to minimize material use while maintaining strength. Digital and flexographic printing will expand branding potential, particularly for online retail packaging. Corrugated cardboard innovations, such as PFAS-free coatings and water-based inks, will ensure compliance with sustainability mandates. By 2035, corrugated cardboard will remain the material backbone of frustration-free packaging worldwide.

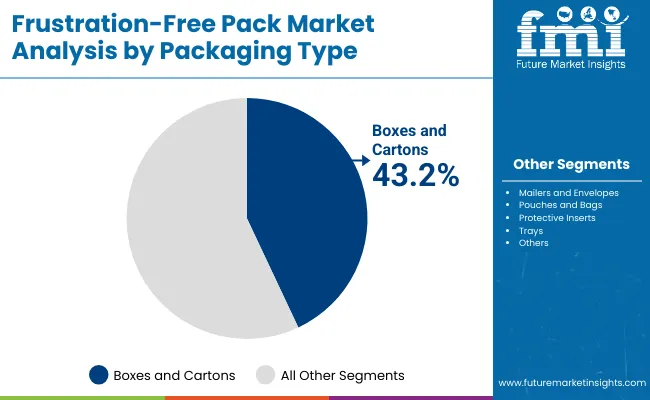

Boxes and cartons will account for 43.2% of demand in 2025, serving as the most versatile packaging type across industries. Their structural integrity, adaptability, and branding flexibility make them the default choice for consumer electronics, groceries, and household goods. Retailers prefer boxes for stacking, automation, and shipping efficiency, supporting their dominance globally.

Growth will accelerate with the adoption of right-sizing technologies and automated box-making systems. Boxes and cartons will evolve with better strength-to-weight ratios and curbside recyclability features. By 2035, boxes and cartons will continue to anchor the segment, providing both sustainability and operational performance advantages.

Consumer electronics will hold 34.5% share in 2025, driven by high-value shipments requiring secure, protective, and frustration-free designs. Retailers emphasize packaging that reduces returns, protects fragile devices, and aligns with eco-friendly standards. Unboxing experience also plays a role, with electronics brands adopting sleek yet recyclable formats.

Future growth will be shaped by smart devices, wearables, and premium electronics demanding tailored packaging solutions. Molded inserts, corrugated designs, and customizable branding will enhance adoption. As electronics account for a significant portion of e-commerce shipments, frustration-free packaging will remain integral to this application through 2035.

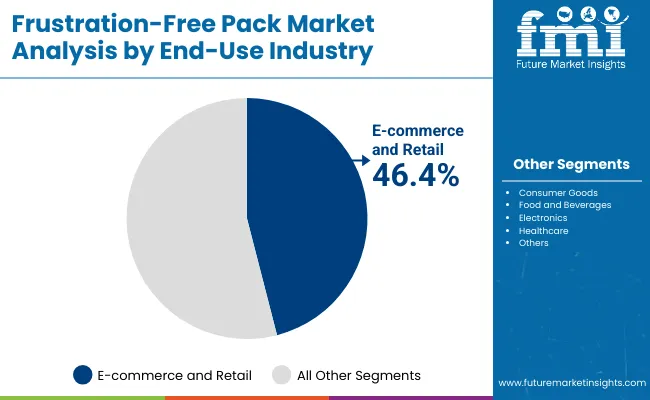

E-commerce and retail will represent 46.4% share in 2025, making it the largest end-use industry. The rise of online shopping and click-and-collect formats drives strong demand for easy-to-handle, recyclable packaging. Retailers emphasize consumer-friendly designs that minimize waste and enhance logistics efficiency, reinforcing adoption across developed and emerging markets.

By 2035, e-commerce will dominate with higher volumes, pushing right-sized, lightweight packaging into mainstream use. Automation-ready designs and recyclable materials will further anchor growth. Frustration-free packaging will become an industry standard, critical for reducing supply chain inefficiencies and strengthening consumer loyalty worldwide.

The frustration-free pack market is driven by surging e-commerce volumes, consumer preference for convenience, and sustainability mandates. Packaging designed for easy handling reduces waste, improves shipping efficiency, and enhances consumer satisfaction. Corrugated cardboard and recyclable boxes remain central to meeting ESG goals, while food and electronics industries push further adoption. Brands increasingly leverage frustration-free designs to differentiate customer experience and comply with strict regulatory frameworks worldwide. Growth is restrained by high material costs for advanced corrugated and moldedfiber packaging.

Developing countries often lack robust recycling infrastructure, limiting adoption. Transition to recyclable solutions also increases capital expenses for automation and tooling. Supply chain bottlenecks in sourcing bio-based plastics and certified fiber further challenge scalability. Additionally, competitive pricing pressures from traditional plastic packaging slow adoption in cost-sensitive sectors such as groceries and mass-market goods. These restraints limit full-scale transitions, especially in emerging economies. Significant opportunities exist in healthcare, electronics, and premium consumer goods. Packaging for pharmaceuticals and medical devices can expand with recyclable, tamper-evident designs.

Electronics brands seek right-sized, lightweight packaging that enhances branding. E-commerce and logistics providers prioritize digital tracking and automation integration. Partnerships between packaging producers and retailers enable innovation at scale. Emerging markets provide untapped potential, with governments introducing plastic bans and sustainability mandates. These factors make frustration-free packaging a key opportunity area for long-term growth and competitive advantage. Key trends include the rise of PFAS-free coatings, lightweight corrugated grades, and automation-ready packaging solutions.

FSC-certified sourcing is expanding as retailers prioritize traceable and sustainable materials. Digital print customization improves branding for e-commerce shipments. Technology integration, such as QR codes and smart labels, enhances consumer engagement and logistics traceability. Retailers emphasize packaging that supports circular economy targets, focusing on recyclable and reusable formats. Together, these trends are reshaping packaging strategies globally, making frustration-free packs a cornerstone of sustainable supply chains.

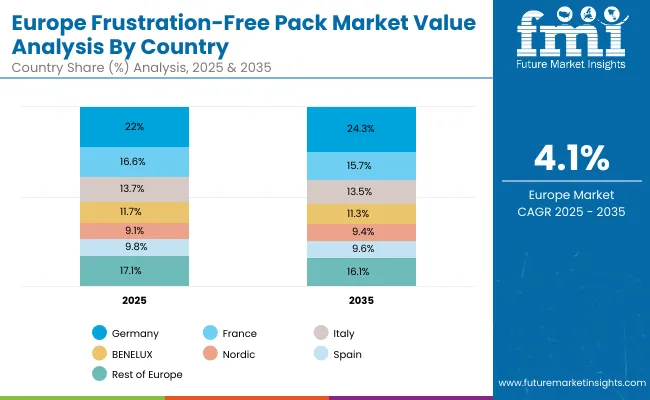

The frustration-free pack market is expanding worldwide as e-commerce and sustainability mandates converge. Asia-Pacific leads growth, with Japan and South Korea accelerating adoption. North America and Europe emphasize recyclability compliance and automation, while Latin America and the Middle East adopt eco-packaging through exports and retail logistics.

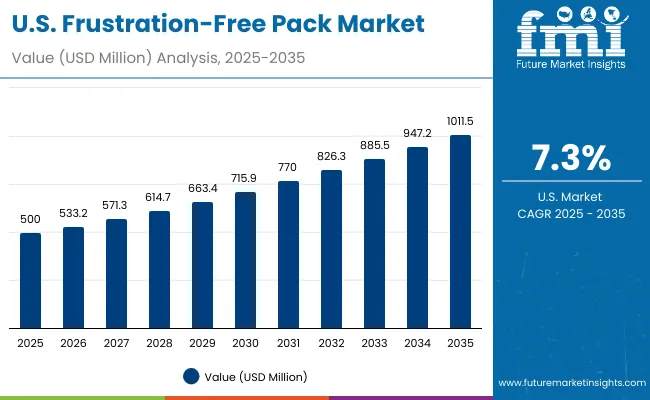

The USA market will expand at 7.3% CAGR, supported by e-commerce giants and consumer electronics driving packaging innovation. Companies are investing in protective formats that ensure safer deliveries and improved shipping efficiency across large networks. Retailers emphasize recyclable packaging to strengthen compliance and respond to consumer sustainability preferences. Growth is also reinforced by heightened demand for high-performance designs tailored to electronics and logistics, ensuring the USA maintains its leadership in advanced packaging adoption.

Germany is forecast to grow at 7.1% CAGR, driven by strict VerpackG laws that strengthen recyclable packaging adoption. Retailers and electronics manufacturers are the main adopters, seeking solutions that enhance compliance and meet consumer demand for sustainable goods. FSC-certified sourcing reinforces trust and provides assurance on traceability, supporting premium adoption. With strong regulatory enforcement and sustainability-driven retail participation, Germany is cementing its role as a frontrunner in eco-compliant packaging adoption across Europe’s most influential markets.

The UK will expand at 7.2% CAGR, with growth supported by Extended Producer Responsibility (EPR) and Plastic Tax rules. E-commerce platforms and grocery chains anchor packaging demand, as retailers adopt recyclable solutions to meet compliance. Investment in eco-packaging continues to increase, helping brands strengthen sustainability positioning while meeting tax-driven obligations. With retail and e-commerce sectors leading transitions, the UK is establishing itself as a key market for recyclable and responsible packaging innovation across Europe.

China’s market is set to grow at 7.2% CAGR, driven by strong demand from leading e-commerce platforms. Electronics and consumer goods remain at the center of adoption, requiring durable and compliant packaging solutions. Export-driven adoption is increasing as manufacturers align with EU and USA compliance requirements, reinforcing the nation’s global role. With large-scale production capacity ensuring cost competitiveness, China continues to dominate packaging adoption at scale while meeting both domestic and international standards.

India will expand at 7.1% CAGR, supported by the growth of organized retail, nationwide plastic bans, and rising consumption of food and electronics. Retail expansion strengthens the demand for recyclable formats, particularly in food packaging, where quick-commerce drives usage. Regulatory mandates banning plastic accelerate adoption across multiple sectors, enforcing transitions to compostable and recyclable packaging. Electronics adoption is also scaling, reinforcing sustainable packaging use in consumer-driven categories, making India an emerging growth market for eco-packaging solutions.

Japan is projected to lead with a 7.8% CAGR, supported by advanced logistics infrastructure and strong sustainability frameworks. Electronics and premium consumer goods dominate packaging adoption, emphasizing recyclable, high-performance solutions. Retailers are enforcing stricter recyclability standards, creating opportunities for eco-packaging innovation. With a strong focus on premium quality, logistics efficiency, and sustainability, Japan sets benchmarks in Asia for packaging design and compliance, reinforcing its global leadership in packaging transformation.

South Korea will expand at 7.7% CAGR, with growth supported by e-commerce platforms and consumer goods brands. Retailers are shifting toward recyclable packaging, reflecting growing consumer demand for sustainable solutions. Export-driven adoption is also strengthening, as manufacturers align with global compliance requirements, particularly in EU and USA markets. By combining e-commerce strength, innovation, and export competitiveness, South Korea is establishing itself as a vital hub for sustainable packaging innovation in Asia.

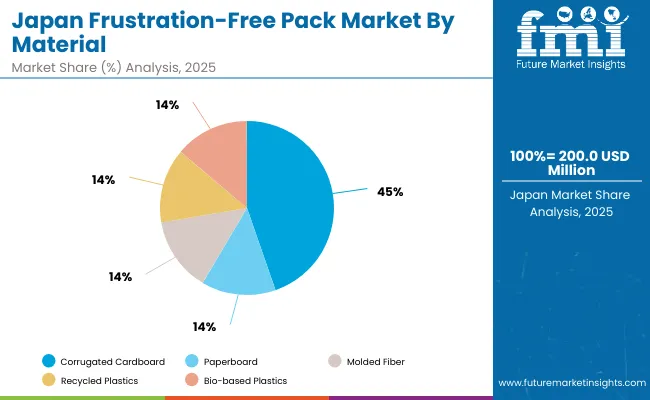

Japan’s frustration-free pack market, valued at USD 200 million in 2025, is led by corrugated cardboard, holding 42.8% share due to its durability, lightweight properties, and recyclability in e-commerce logistics. Paperboard follows with 18%, offering cost-effectiveness and versatility for retail and subscription packaging. Moldedfiber contributes 16.4%, driven by eco-conscious brands seeking sustainable alternatives. Recycled plastics, at 14.2%, are used for protective and lightweight secondary packaging. Bio-based plastics account for 8.5%, reflecting innovation in compostable packaging. This segmentation reflects Japan’s strong orientation toward paper-based formats, shaped by consumer demand for sustainable yet protective packaging solutions across e-commerce and retail applications.

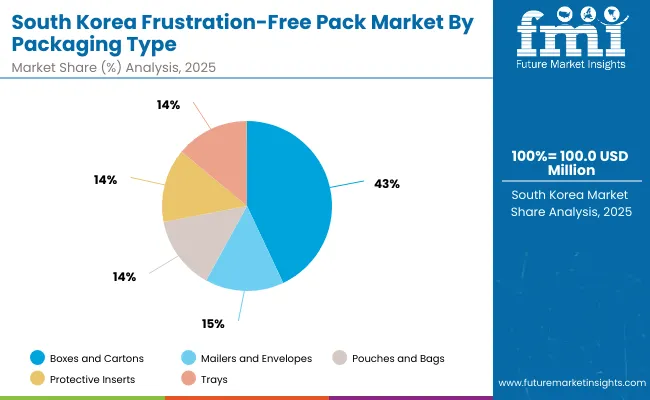

South Korea’s frustration-free pack market, valued at USD 100 million in 2025, is dominated by boxes and cartons, which capture 44.9% share, driven by their pivotal role in e-commerce delivery and retail-ready packaging. Mailers and envelopes follow with 16.8%, offering lightweight, space-efficient formats for online retail. Pouches and bags, at 15.8%, cater to consumer goods requiring flexible, easy-to-open designs. Protective inserts contribute 14%, essential for electronics and fragile shipments. Trays account for 8.4%, used in food and household goods packaging. This structure emphasizes South Korea’s consumer preference for efficient, protective, and sustainable formats supporting online commerce and regulatory packaging standards.

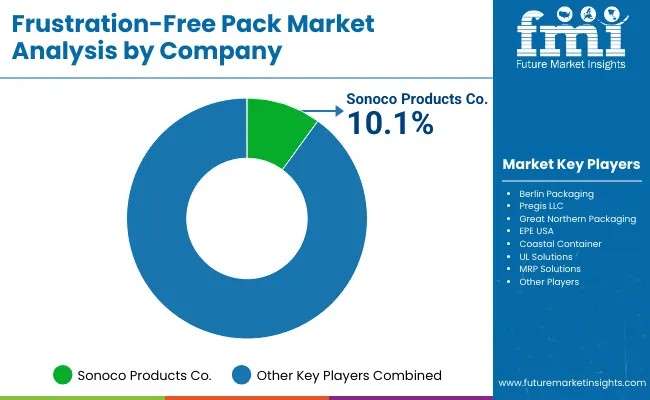

The market is moderately consolidated with leaders including Sonoco Products Company, Berlin Packaging, Pregis LLC, Great Northern Packaging, EPE USA, Coastal Container, UL Solutions, and MRP Solutions. These players invest in recyclable materials, automation, and FSC-certified sourcing.

Sonoco and Berlin Packaging dominate global reach, while Pregis and Great Northern provide protective packaging expertise. EPE USA and Coastal Container focus on customized, regional supply. UL Solutions and MRP Solutions emphasize compliance and innovation. Competition centers on recyclability, reduced waste, and automation, with companies increasingly collaborating with e-commerce leaders for scalable packaging solutions.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Material | Corrugated Cardboard, Paperboard, Molded Fiber, Recycled Plastics, Bio-based Plastics |

| By Packaging Type | Boxes and Cartons, Mailers and Envelopes, Pouches and Bags, Protective Inserts, Trays |

| By Application | Consumer Electronics, Household Products, Food & Beverages, Personal Care & Cosmetics, Toys & Baby Products |

| By Certification/Standard | 100% Recyclable, Easy-to-Open, Reduced Packaging Material, No Plastic Packaging |

| By End-Use Industry | E-commerce & Retail, Consumer Goods, Food & Beverages, Electronics, Healthcare |

| Key Companies Profiled | Sonoco Products Company, Berlin Packaging, Pregis LLC, Great Northern Packaging, EPE USA, Coastal Container, UL Solutions, MRP Solutions |

| Additional Attributes | Growth driven by e-commerce expansion, recyclability mandates, and consumer convenience. |

The market will be valued at USD 1.5 billion in 2025.

The market will reach USD 3.0 billion by 2035.

The market will grow at a CAGR of 7.2% during 2025-2035.

Corrugated cardboard will lead with a 41.7% share in 2025.

E-commerce and retail will anchor demand with a 46.4% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Package Pumping Station Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Package Testing Silicone Rubber Socket Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaged Coconut Water Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Pack Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA