The Global Fungal Protein Market is moderately consolidated. Multinational corporations dominate the market, mainly because of their superior production capabilities and established supply chains. Companies like Quorn Foods, MycoTechnology, and Marlow Foods account for 55% of the global share. They remain ahead in the game due to advanced fermentation technologies, proprietary research, and global distribution networks.

For instance, Quorn Foods has successfully positioned itself by having a wide variety of products including ready-to-eat meals and meat alternatives catering to health-conscious consumers in North America and Europe. MycoTechnology has centered its efforts on partnerships with the largest food manufacturers to incorporate fungal protein into mass-market products.

Regional leaders, such as Mycorena and The Protein Brewery, hold 30% of the market by focusing on region-specific consumer preferences and fostering partnerships with foodservice providers. Startups and niche brands, like Prime Roots, Mushlabs, and Air Protein, occupy the remaining 15%, innovating with allergen-free, vegan, and sustainable offerings.

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (Quorn Foods, MycoTechnology, Marlow Foods) | 55% |

| Regional Leaders (Mycorena, The Protein Brewery, Enough Foods) | 30% |

| Startups & Niche Brands (Prime Roots, Mushlabs, Air Protein, Better Nature) | 15% |

The fungal protein market is moderately consolidated by the presence of multinational corporations, regional leaders, and startups driving innovations in niche areas.

Yeast-based proteins are derived from different strains of Saccharomyces cerevisiae, which has become popular with the versatility it offers, nutritional profiles, and easier production. Yeast-based proteins are highly prized for their high protein content, favorable amino acid composition, and the ease with which they can be incorporated into a broad range of food, beverage, and animal feed applications.

Fusarium venenatum-based proteins will account for the remaining 30% of the market, as interest in this area is growing with its unique functional properties and its potential applications in niche markets, such as meat substitutes and sports nutrition products. The success of yeast-based proteins can be attributed to well-established production processes, cost-effectiveness, and widespread acceptance across various industries.

Food and beverages ended up holding the largest share in the market with a share of 41%.

This is attributed to growing demand in the human food industry for plant-based and clean-label protein sources as well as an upsurge of popularity for meat alternatives, dairy substitutes, functional food, and beverage products, which are fungal protein-based. The animal nutrition segment accounts for 33% of the market share, as fungal proteins are also being increasingly used in animal feed formulations to improve nutritional content and performance in animals.

26% of the market is comprised of pharmaceutical and biotechnology, which uses fungal proteins for diverse applications, such as the development of dietary supplements, nutraceuticals, and specialized pharmaceutical products. The diverse applications of fungal proteins in end use indicate their flexibility and the growing recognition of their potential to fulfill the changing needs of various industries.

In 2024, the global fungal protein market witnessed revolutionary growth through strategic innovations, partnerships, and expansions. The year saw a rise in product diversification, including allergen-free and high-protein innovations targeting fitness-conscious consumers. Companies also extended their reach in emerging markets in line with the local preferences and regulatory compliances. Environment-friendly packaging and carbon-neutral manufacturing were main factors in sustaining consumer retention, while joint ventures between start-ups and established companies provided for innovations, increasing the availability of products across regions

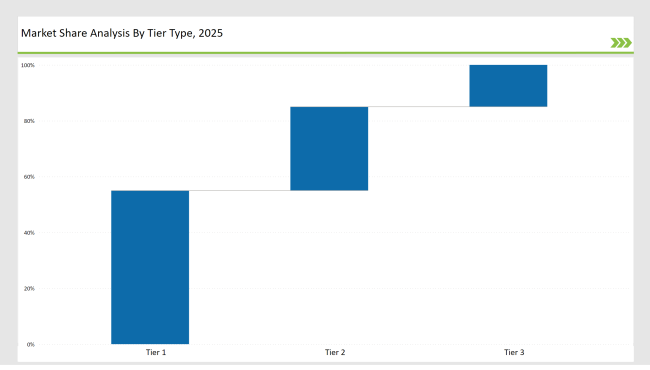

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Quorn Foods, MycoTechnology, Marlow Foods |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Mycorena, The Protein Brewery |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Prime Roots, Mushlabs, Better Nature |

| Brand | Key Focus |

|---|---|

| Quorn Foods | Invested in high-protein ready meals targeting the US fitness market. |

| MycoTechnology | Opened a cutting-edge facility to scale sustainable protein production. |

| Nature's Fynd | Introduced single-serve breakfast options for urban professionals in Asia. |

| Marlow Foods | Rolled out allergen-free fungal protein snacks in global markets. |

| The Protein Brewery | Launched affordable fungal protein blends for developing regions. |

| Better Nature | Developed fungal protein-enriched meal kits for e-commerce platforms. |

| Mycorena | Collaborated with IKEA for sustainable protein-based meatball innovations. |

| Mushlabs | Expanded into cosmetics with bioactive fungal protein ingredients. |

| Air Protein | Released limited-edition protein bars made from CO2-derived proteins. |

| Kernel Mycofoods | Expanded its production capacity to meet growing Latin American demand. |

The food and beverage segment are set to dominate over the next ten years, mainly with meat and dairy alternatives. Since there is growing evidence of the trend of increasing numbers of flexitarian consumers, improving texture, flavor, and nutritional profiles of fungal protein products would top the list for manufacturers. Such development of fungal protein-based burgers and yogurts targeted at regional palates in Asia and Latin America will give immense growth opportunities.

The fastest CAGR growth is expected from Asia Pacific due to rising disposable incomes and shifting dietary preferences in countries such as China, Japan, and India. Manufacturers will find opportunities in introducing cost-effective products that are relevant to the local culture, like fungal protein-based snacks infused with soy and wasabi flavors.

Online sales channels will become one of the drivers, especially for niche and premium fungal protein products. Direct-to-consumer (D2C) models with subscription options will allow brands to establish stronger customer relationships. For example, platforms offering personalized meal kits with fungal protein can increase loyalty and revenue.

Sustainable feed ingredient in the aquaculture and livestock industries would be the increased adoption of fungal protein. Manufacturers should develop relationships with large-scale aquaculture farms in Southeast Asia for the growing market. Bioactive fungal proteins will take center stage in nutraceuticals, more prominently in North America and Europe. Opportunities for manufacturers lie in high-protein supplements and therapeutic applications that can diversify a product line while targeting high-margin markets.

Companies like Quorn Foods, MycoTechnology, and Marlow Foods dominate, holding 55% of the market due to their global presence and advanced R&D.

Asia Pacific will grow at the fastest rate, with countries like China, Japan, and India driving demand due to changing dietary preferences.

Innovations include carbon-neutral production processes, new product launches like protein bars, and sustainable packaging initiatives.

Fungal proteins are sustainable alternatives to traditional feeds, particularly in aquaculture, where they reduce environmental impact.

Sustainability is a core driver, with consumers favouring brands that emphasize eco-friendly production and packaging practices.

Challenges include high production costs, limited consumer awareness in developing regions, and regulatory barriers for novel products.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fungal Protein Market Trends - Sustainable Nutrition & Industry Expansion 2024 to 2034

UK Fungal Protein Market Growth – Innovations, Trends & Forecast 2025–2035

Europe Fungal Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Key Companies & Market Share in the Protein A Resins Market

Market Share Distribution Among Fish Protein Manufacturers

Australia Fungal Protein Market Trends – Size, Share & Growth 2025–2035

Market Share Insights of Leading Protein Binding Assays Providers

Competitive Overview of Chickpea Protein Companies

Assessing Rapeseed Protein Market Share & Industry Trends

Industry Share Analysis for Protein Purification Resin Companies

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA