The Australian Fungal Protein market is estimated to be worth USD 16.2 million by 2025 and is projected to reach a value of USD 50.8 million by 2035, growing at a CAGR of 12.1% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 16.2 million |

| Projected Value in 2035 | USD 50.8 million |

| Value-based CAGR from 2025 to 2035 | 12.1% |

In Australia, the market for fungal proteins consists of the manufacture, distribution, and consumption of mycoprotein, a fungi-derived protein. Mycoprotein is a high-quality, sustainable protein alternative made by fermentation using fungus like Fusarium venenatum. It is utilized in a variety of meat replacements and plant-based food items to meet the growing demand for healthier, more ecologically friendly options. The country is, therefore, best suited to fit into its agricultural food systems since it has adequate local expertise and advanced technology in place.

The significance of this market lies in the ability to address such critical issues as climate change, resource scarcity, and food security. Fungal protein requires less land, water, and energy than livestock farming and emits significantly fewer greenhouse gases.

In addition, nutritional benefits-high protein content, essential amino acids, and fiber-make it an attractive option for health-conscious consumers. With alternative proteins sweeping Australia, there is every expectation that the business of fungal proteins will become highly prominent in Australian sustainable food landscapes.

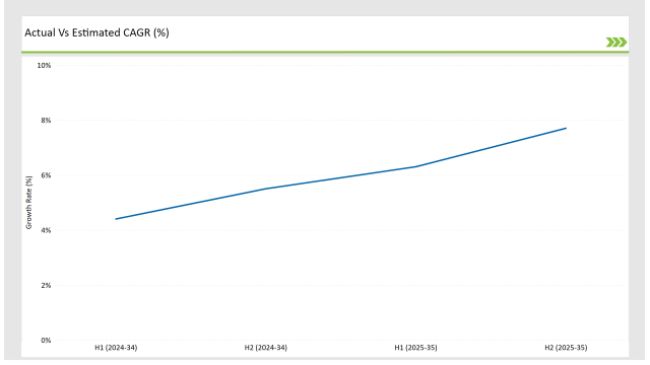

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Fungal Protein market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Fungal Protein sector is predicted to grow at a CAGR of 6.3% during the first half of 2025, increasing to 7.7% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 4.4% in H1 but is expected to rise to 5.5% in H2. This pattern reveals a decrease of 15basis points from the first half of 2024 to the first half of 2025, followed by an increase of 25 basis points in the second half of 2025 compared to the second half of 2024.

This study highlights the dynamic landscape of the Australian market for fungal proteins, with a changing regulatory environment, evolved consumer demand, advancements in product development-including innovations regarding natural flavor and texture enhancement-and many more. Knowing this semi-annual break has its importance for businesses that want to strategically position themselves according to the market, utilize the expected boom, and respond to emerging challenges within this rapidly growing sector.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Australian start-up Myco -Tech has partnered with an award-winning local craft brewery to develop new fungal protein-infused beer. The branded product, coined Myco Brew, will result in the firm's special fungal protein extract being blended by the brewery for a uniquely hop-forward recipe developed to answer a growing need within the Australian market for functional, nutritionally enhanced alcoholic beverages. |

| 2023 | The new isolate of fungal protein from Mycoprotein Australia was especially developed for the manufacturing of plant-based meat and meat analog products. Since demand for sustainable sources of proteins continues to rise in Australia, this new ingredient, called MycoTex, has enhanced texture, improved mouthfeel, and a superior nutritional profile, thereby allowing Australian food manufacturers to produce more authentic and satisfying meat-free products. |

Culinary Innovation: Integrating Fungal Protein into Australian Cuisine

Australian culinary culture is celebrating the combination of flavors with local ingredients by embracing fungal protein as a novel ingredient. Chefs and food innovators experiment with fungal protein in versatile dishes ranging from gourmet burgers and pasta to traditional Australian pies. Fungal protein offers great texture and a strong umami flavor profile, it's the one outstanding meat-free substitute in plant-based meals.

The trend has the potential to expand market sales through stretching this niche product into mainstream ingredient status that fits well into Australia's diverse food culture. Innovate uses of fungal protein in the culinary application enhance partnerships between the producers and foodservice industry as market opportunity expansion. Focus creation on unique recipes and localized flavor could make Australia a leader in the use of fungal protein-based gastronomy in driving adoption through both domestic and international markets.

Innovative Protein Extraction Techniques Revolutionizing the Australian Fungal Protein Market

The Australian Fungal Protein market is booming with innovative extraction technologies that are dramatically changing the game of the industry. The novel extraction technologies improve the quality and efficiency of protein extraction and lead to access to diversifying products and expansion of markets. Advanced fermentation processes are an example of the trend that exploits unique properties of various fungal strains.

Optimizing fermentation conditions and use of cutting-edge bioreactor technologies allows for the extraction of fungal proteins of improved nutritional profile, enhanced functional properties, and reduced production cost. This helps to introduce a greater number of products derived from fungal protein, which varies from high-performance sports nutrition to a range of specialized dietary supplements catering to different needs of consumers in Australia.

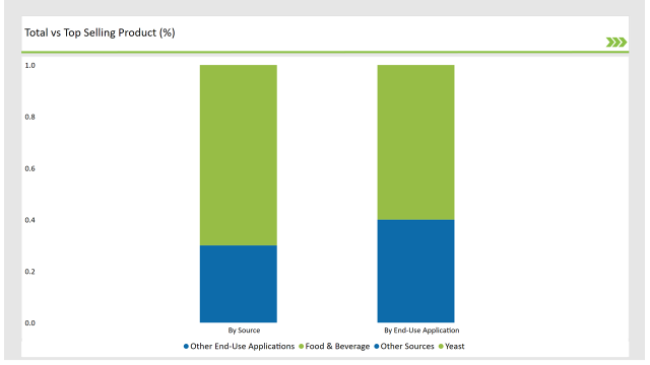

% share of Individual categories by End-Use Application and Source in 2025

The yeast source segment leads the fungal protein market in Australia, mainly because of its versatility, cost-effectiveness, and alignment with the country's evolving food and beverage preferences. Yeast-derived proteins are highly valued for their functional benefits, such as flavor enhancement, texture improvement, and superior protein quality. These attributes have made yeast proteins a popular choice for plant-based food manufacturers in Australia, where demand for meat alternatives and innovative food products continues to rise.

Yeast proteins also play a pivotal role in Australia’s booming fermentation-based food industry. With well-established expertise in brewing and baking-two sectors heavily reliant on yeast-Australia has the infrastructure and technical knowledge to efficiently scale up yeast-based protein production. The familiarity with yeast in existing supply chains simplifies its integration into new products, giving it an edge over other fungal protein sources.

The food and beverage segment leads the Australian market, taking into consideration the rising appetite for innovative and nutritious food products that appeal to changing consumer tastes in that nation. There is a dynamic F&B landscape in Australia that considers a thriving café culture, love for premium dining experiences, and an increasing demand for functional, plant-based alternatives, which mesh perfectly with the unique attributes presented by fungal protein.

Fungal protein versatility makes it a star across food categories. Its applications in the meat alternative burger, sausage, and nuggets ready-to-eat meals as well as high protein snacks all have excellent texture, mouthfeel, and flavor appeal. The features have led Australian food manufacturers to use this ingredient to stand out in a competitive market.

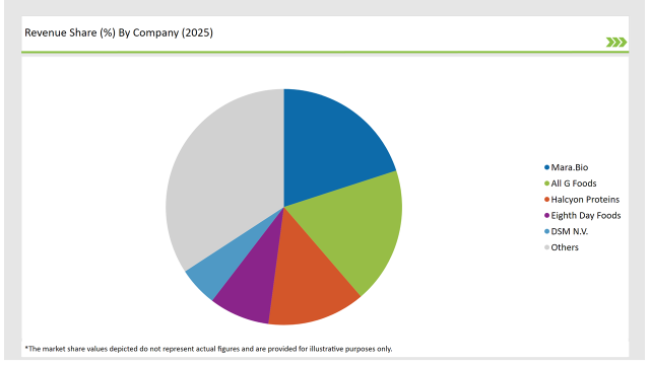

2025 Market share of Australia Fungal Protein manufacturers

Note: The above chart is indicative in nature

Tier 1 players in the Australian fungal protein market would include prominent global as well as local players, who have well-established operations, substantial market share, and strong R&D capabilities. All the leaders in innovation would invest heavily in advanced fermentation technologies, product diversification and collaborations with food manufacturers for cutting-edge solutions. Their extensive production scale-up and independent development of an extensive distribution network cement their major share in the market.

Tier 2 companies are emerging organizations that are creating their own space within the Australian fungal protein market. The companies develop products for specific applications, such as the meat-alternative plant-based foods segment, snacks, or beverages, and differentiate their products on the basis of unique value propositions that include enhanced flavor profiles or new product formats.

Tier 3 are the smallest producers: startup and local innovators in a new development. This tier seeks localized production focused at specific groups of consumers, such as creating novel offers that would have distinctiveness only within smaller regional markets.

As per source, the market is segmented into yeast, and fusariumvenenatum.

As per the end-use application, the market is bifurcated into food & beverage, animal nutrition, and pharmaceutical and biotechnology.

By 2025, the Australian Fungal Protein market is expected to grow at a CAGR of 12.1%.

By 2035, the sales value of the Australian Fungal Protein industry is expected to reach USD 50.8 million.

Key factors propelling the Australian Fungal Protein market include advancements in fungal protein production and processing, diversification of fungal protein applications, and shift towards plant-based protein alternatives.

Prominent players in Australia Fungal Protein manufacturing include Mara. Bio, All G Foods, Halcyon Proteins, Eighth Day Foods, DSM N.V., Archer Daniels Midland (ADM), Evonik Industries, DuPont Nutrition & Biosciences, Cargill, Inc., Corbion N.V., and Kerry Group, among others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA