The UK Fungal Protein market was valued at around USD 199.9 million in 2024, registering Y-o-Y growth of 6.8%. Fungal Protein sales are projected to increase at a healthy CAGR of 7.5% attaining market value of USD 437.3 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 211.9 million |

| Industry Value (2035F) | USD 437.3 million |

| CAGR (2025 to 2035) | 7.5% |

The market for fungal protein in the UK is undergoing spectacular growth attributed to the escalating consumer interest in sustainable and plant-based protein options. Fungal protein is made from fermentation inputs such as yeast and mycelium and is considered to be one of the most nutritional food products with its protein content, fiber, and negative carbon imprint on the environment. It is widely used in the production of foody drinks that support a vegan, vegetarian, and flexitarian lifestyle that is gaining popularity in the UK.

Yeast is popular as it accounts for 70% of the market share by input source majorly due to its affordable price, industrial-scale potential, and application flexibility. Yeast protein is the main ingredient in plant-based meat snacks, protein-rich foods, and yeast-based functional foods. Based on the end-use application of the food and drinks sector, the food and beverage segment is the biggest player, taking 41% of the share. This includes its usage in vegan sausages, burgers, dairy-free cheese, and protein-enriched beverages.

Some of the major actors in the UK market include Marlow Foods (Quorn), 3F Bio, and Myco Technology all of which are involved in product development and cater to the consumers' requests for fungal protein. To this end, these firms have banked on breakthrough fermentation technology to enhance products' flavor, texture, and nutritional quality. Also, cooperation with food manufacturers and retailers means that the fungul protein is available all over the country.

The UK government's incentives on eating plant-based food together with the nation’s drive towards sustainable living add to the reasons for the introduction of fungal protein. Customers now choose more and more the line of goods that reflect their well-being and environmental concerns, thus besides the quality of products, the market as we are growing alone. Being rich in new ideas and designing ever-expanding product lines the UK fungal protein market becomes a promiscuous one for the more ventures involved in the process.

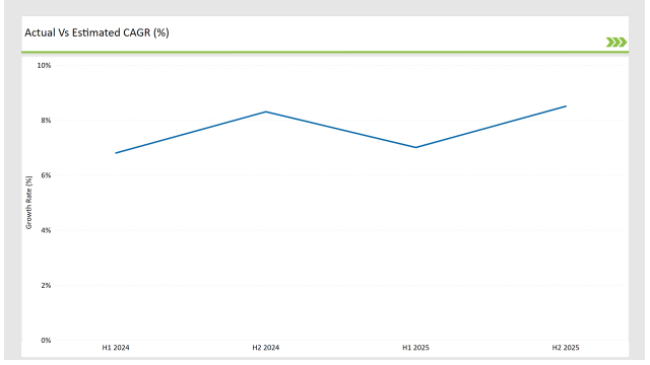

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Fungal Protein market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Marlow Foods (Quorn) introduced a new range of mycoprotein-based vegan sausages with enhanced flavor profiles. |

| May 2024 | 3F Bio announced the opening of a large-scale fungal protein fermentation facility in the UK to meet rising demand. |

| July 2024 | MycoTechnology partnered with a UK-based food manufacturer to supply fungal protein for plant-based dairy alternatives. |

| September 2024 | A study by the British Nutrition Foundation highlighted the health benefits of fungal protein, boosting consumer interest. |

| November 2024 | Marlow Foods expanded its retail distribution network to make mycoprotein products more accessible across major UK supermarkets. |

Patent-Free Mycoprotein Products

Mycoprotein is a buggy that drives fungal protein innovation in the UK. For example, companies such as Marlow Foods utilize the high fiber and protein content of mycoproteins to produce a wide range of products from vegan sausages to ready-to-eat meals. These meals are targeted towards people who are health conscious and prefer the texture of meat juices in plant-based dishes.

Implementing Operations at a Larger Scale

Construction of high-capacity fermentation plants is another important trend in the UK fungal protein market. Companies like 3F Bio are undertaking massive investments in ultra-modern facilities alongside their efforts for optimization of production rates. Apart from savings on running costs, these plants will provide the overall well-being and facilitate delivery of more health-friendly alternatives at lower prices.

Nutrition and Health on the Front Line

The increased interest in fungus protein's health benefits such as high protein and fiber content has led to its popularity among people dealing with nutrition issues. New research articles published recently that highlighted its importance for the recovery of lost muscle and the improvement of digestive health have raised its notoriety even further. As a result, the awareness and credibility of this product have been high and this trend of highlighting health in advertisements has become a manufacturers' marketing strategy.

% share of Individual categories by Source and Applications in 2025

Yeast represents a whopping 70% of the UK fungal protein market as far as input sources are concerned, making it the most versatile food component available. Its large-scale usage, cost competitiveness, and adaptability are reasons for its continuous success. In the arena of protein additives, yeast-based proteins grab a large share in pizza and other sauces, supplements. A company like 3F Bio is into research and development of yeast protein with the functional properties envisaged by food developers.

The food and beverage segment holds 41% of the UK fungal protein market. Fungal protein has become a choice for adding to meat substitutes, dairy-free cheeses, and protein-enriched beverages. Its fibrous structure and taste make it preferable for animals to remember human emotion. Fungal protein(represents) is made in imitation by sensory attributes that are not animal-based. Companies such as Myco Technology and Marlow Foods are driving this segment with innovative product solutions fitting the sustainable food paradigm.

2025 Market share of UK Fungal Protein suppliers

Note: above chart is indicative in nature

The UK fungal protein market is a little bit fragmented with a few companies pursuing stand-alone strategies across the value chain. Tier 1 manufacturers like Marlow Foods (Quorn), 3F Bio, and Myco Technology cover most of the market thanks to their strong distribution networks and established R&D Force. Secondly, Tier 2 firms target niche markets where they invent new products to stand out.

Companies actively address the competition by the exploration of new fermentation technology as well as product range increase. The partnerships with food manufacturers and retailers also enhance their presence in the sector. Sustainability initiatives and heath profits are the main factors that are expected to lead innovation and distribution of fungal protein in multiple uses, hence, its stay in the UK market is secure.

Yeast, and Fusarium Venenatum.

Food and Beverage, Animal Nutrition, Pharmaceutical and Biotechnology.

Within the forecast period, the UK Fungal Protein market is expected to grow at a CAGR of 7.5%.

By 2035, the sales value of the UK Fungal Protein industry is expected to reach USD 437.3 million.

The UK fungal protein market is driven by the growing consumer demand for plant-based, sustainable, and nutritious protein sources, as well as the industry's focus on innovation and product development to cater to evolving health and environmental concerns. Government support, versatility in applications, and the perceived health benefits of fungal proteins are additional key factors fueling the market's expansion in the UK.

Prominent players in the UK Fungal Protein manufacturing include Quorn Foods, Marlow Foods, Mycorena, Meati Foods, Enough, Planterra Foods, and Myco technology. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA