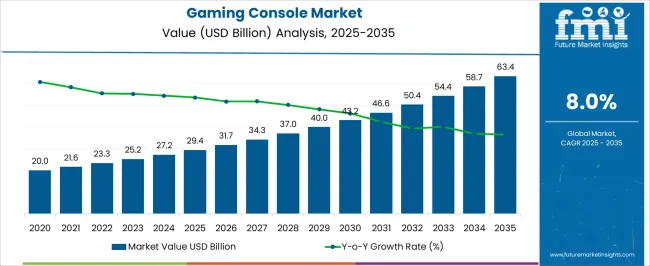

The Gaming Console Market is estimated to be valued at USD 29.4 billion in 2025 and is projected to reach USD 63.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. Between 2025 and 2030, the market grows from USD 29.4 billion to USD 40.0 billion, contributing USD 10.6 billion in growth, with a CAGR of 7.4%.

This early-stage growth is driven by strong consumer demand for next-generation gaming consoles, with increasing adoption of 4K and 8K gaming, along with advancements in virtual reality (VR) and augmented reality (AR) gaming experiences. The expanding gaming ecosystem, including cloud gaming and enhanced multiplayer experiences, further fuels this growth. From 2030 to 2035, the market continues to expand from USD 40.0 billion to USD 63.4 billion, contributing USD 23.4 billion in growth, with a CAGR of 9.3%.

The latter phase sees stronger growth due to the continued adoption of gaming consoles across global markets, along with the rise of subscription services, digital downloads, and immersive gaming experiences. As the gaming console market matures, increasing disposable income, especially in emerging markets, along with innovations in gaming technology, will continue to drive demand. The USD 34 billion absolute dollar opportunity highlights the significant growth potential driven by both new technological advancements and the expanding global gaming audience.

| Metric | Value |

|---|---|

| Gaming Console Market Estimated Value in (2025 E) | USD 29.4 billion |

| Gaming Console Market Forecast Value in (2035 F) | USD 63.4 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The gaming console market continues to expand rapidly as consumer interest in interactive entertainment grows globally. Advancements in console technology have enhanced gaming experiences through improved graphics, processing power, and connectivity.

The rise of online multiplayer games and digital content platforms has contributed significantly to increasing console adoption. Demand is particularly strong in residential settings where gaming has become a popular form of leisure and social interaction.

Additionally, developers are creating diverse game titles appealing to broad demographics, further driving console sales. Increasing disposable income and lifestyle shifts toward at-home entertainment have supported growth. Future market expansion is expected to be driven by innovation in hardware, integration of virtual reality features, and growing e-sports popularity. Segmental growth is anticipated to be led by the Home Console type, Gaming as the primary application, and Residential as the main end-use environment.

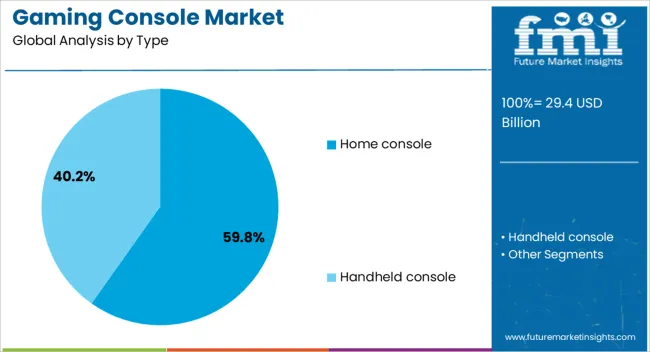

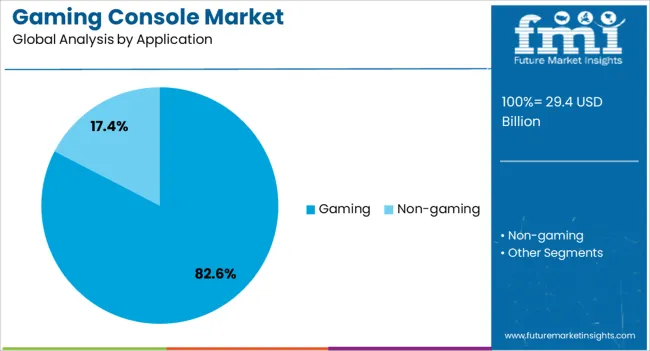

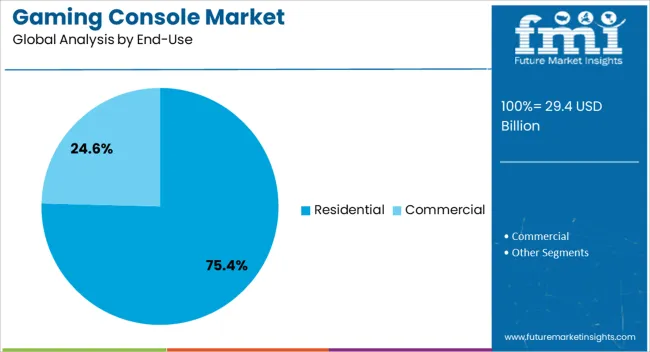

The gaming console market is segmented by type, application, end-use, and geographic regions. By type, the gaming console market is divided into Home consoles and Handheld consoles. In terms of application, the gaming console market is classified into Gaming and Non-gaming. The end-use of the gaming console market is segmented into Residential and Commercial. Regionally, the gaming console industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Home Console segment is projected to hold 59.8% of the gaming console market revenue in 2025, maintaining its dominance in the device type category. This segment’s growth has been influenced by consumer preference for powerful, dedicated gaming systems offering immersive experiences.

Home consoles provide high-resolution graphics, extensive game libraries, and connectivity options that appeal to serious gamers and families alike. The convenience of playing from the comfort of home combined with frequent software updates and exclusive game releases has strengthened this segment.

Additionally, manufacturers’ investments in enhancing user interfaces and controller designs have increased user engagement. As home entertainment continues to evolve, the Home Console segment is expected to sustain its market leadership.

The Gaming application segment is expected to account for 82.6% of the market revenue in 2025, underscoring its role as the core use of gaming consoles. This dominance is driven by the growing global community of gamers seeking diverse and interactive content.

Gaming consoles have evolved to support multiple genres, including action, adventure, sports, and role-playing, appealing to wide audiences. The rise of online and e-sports platforms has created new engagement opportunities and revenue streams linked to gaming applications.

Consumer trends show increasing time spent on gaming activities for recreation and socialization. With continuous innovation in game development and platform capabilities, the Gaming application segment is expected to remain the primary driver of the market.

The Residential segment is projected to contribute 75.4% of the gaming console market revenue in 2025, maintaining its position as the leading end-use segment. Growth in this segment is largely due to the expanding base of consumers using gaming consoles for entertainment at home.

The shift towards home-based leisure activities and digital media consumption has encouraged households to invest in gaming hardware. Residential users benefit from features such as multiplayer modes, streaming capabilities, and parental controls that cater to family settings.

Furthermore, the growth of broadband internet access has enabled seamless online gaming experiences, supporting the segment’s expansion. As digital entertainment becomes increasingly integrated into daily life, the Residential segment is expected to continue its strong market performance.

The gaming console market is expanding due to the growing popularity of interactive and immersive gaming experiences. The demand for gaming consoles is driven by innovations in hardware, graphics, and exclusive game titles. With the rise of online gaming, virtual reality (VR), and enhanced multiplayer experiences, consoles have become a major platform for entertainment. The increasing adoption of next-generation consoles, along with evolving consumer preferences for high-quality graphics and gameplay, continues to fuel market growth. Despite challenges such as competition from PC gaming and mobile platforms, the market remains strong, offering significant growth potential.

A significant challenge for the gaming console market is the growing competition from mobile gaming and PC gaming platforms. Mobile gaming, fueled by the increasing capabilities of smartphones and tablets, has become a dominant force, offering convenience and a wide range of games at an affordable price. PC gaming platforms also continue to improve in terms of graphics, processing power, and customization, drawing gamers away from traditional consoles. These alternatives offer competitive gaming experiences without the need for dedicated hardware. As mobile and PC gaming continue to expand, console manufacturers must innovate and offer unique value propositions to maintain their position in the market.

A significant challenge for the gaming console market is the growing competition from mobile gaming and PC gaming platforms. Mobile gaming, fueled by the increasing capabilities of smartphones and tablets, has become a dominant force, offering convenience and a wide range of games at an affordable price. PC gaming platforms also continue to improve in terms of graphics, processing power, and customization, drawing gamers away from traditional consoles. These alternatives offer competitive gaming experiences without the need for dedicated hardware. As mobile and PC gaming continue to expand, console manufacturers must innovate and offer unique value propositions to maintain their position in the market.

The gaming console market presents significant opportunities, particularly in the areas of virtual reality (VR) and cloud gaming. As VR technology becomes more affordable and accessible, gaming consoles are increasingly integrating VR capabilities, providing users with a truly immersive experience. This opens new avenues for content creation, as developers focus on creating VR-compatible games. Additionally, cloud gaming services are gaining traction, allowing users to stream games directly to their consoles without needing to download or install them. This technology reduces hardware limitations and offers players instant access to a vast library of games, making it an exciting opportunity for console manufacturers to explore as it continues to gain popularity across various regions.

A key trend in the gaming console market is the integration of cross-platform play and streaming capabilities. As gaming becomes more social, players now expect the ability to play with friends across different platforms, regardless of whether they own the same console. This trend is driving the adoption of cross-platform multiplayer games and creating more seamless gaming experiences. Moreover, streaming services, such as those offered by platforms like Twitch and YouTube, are being integrated directly into gaming consoles, allowing users to stream their gameplay to a broader audience. These trends are shaping the future of the gaming console market, as manufacturers increasingly focus on connectivity, user engagement, and access to a broader range of entertainment options.

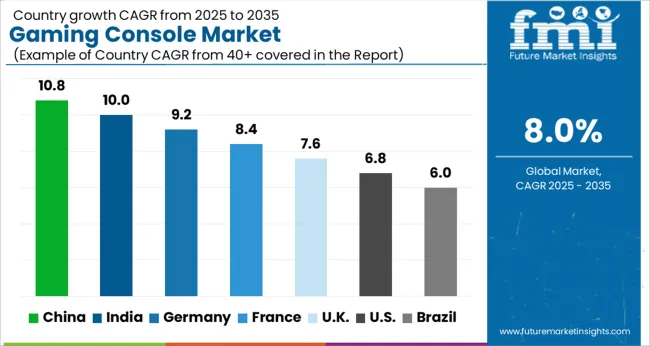

The gaming console market is projected to grow at a global CAGR of 8.0% from 2025 to 2035. China leads the market with 10.8%, followed by India at 10.0%. France is projected to grow at 8.4%, while the UK shows a growth rate of 7.6% and the USA at 6.8%. The demand for gaming consoles in China and India is driven by their growing gaming communities, rising disposable incomes, and increasing interest in digital entertainment. In developed markets like France, the UK, and the USA, steady growth is fueled by demand for the latest gaming technology, online gaming services, and cloud-based platforms. The analysis spans 40+ countries, with the leading markets highlighted below.

China is projected to grow at a CAGR of 10.8% through 2035, driven by the rapid growth in gaming adoption and rising interest in esports. The expanding digital entertainment ecosystem, coupled with the country’s growing disposable income, is leading to increased console sales. China’s gaming market is one of the largest in the world, with a huge base of gamers. The adoption of consoles in gaming cafes and online gaming platforms is fueling this growth. The availability of next-generation gaming consoles and their integration with cloud-based gaming services are contributing to market expansion.

India is projected to grow at a CAGR of 10.0% through 2035, fueled by the rapid rise of gaming culture and increasing access to affordable consoles. India’s young population, increasing internet penetration, and growing number of gaming events are contributing to a surge in demand for gaming consoles. The rising disposable income and the popularity of mobile gaming are also playing a role in driving this demand. As gaming becomes a mainstream form of entertainment, both for individuals and families, the market for gaming consoles is set to expand significantly.

France is projected to grow at a CAGR of 8.4% through 2035, driven by strong demand in the gaming sector and the increasing number of gaming enthusiasts. France has a long-standing gaming culture, and the market for gaming consoles continues to evolve with the release of new, more powerful consoles and games. With the rise in esports and gaming tournaments, more individuals are investing in high-performance gaming systems. The increase in broadband and 5G penetration enables seamless online gaming, further driving the market for gaming consoles.

The United Kingdom is projected to grow at a CAGR of 7.6% through 2035, with the rise of gaming culture, high-tech gaming systems, and cloud gaming contributing to market growth. The UK has a mature gaming market, with high participation in console gaming and esports events. As the demand for immersive gaming experiences grows, more individuals are opting for high-performance gaming consoles that support virtual reality and cloud gaming. The UK is also witnessing a rise in cross-platform gaming, further driving demand for consoles in both the home and professional gaming sectors.

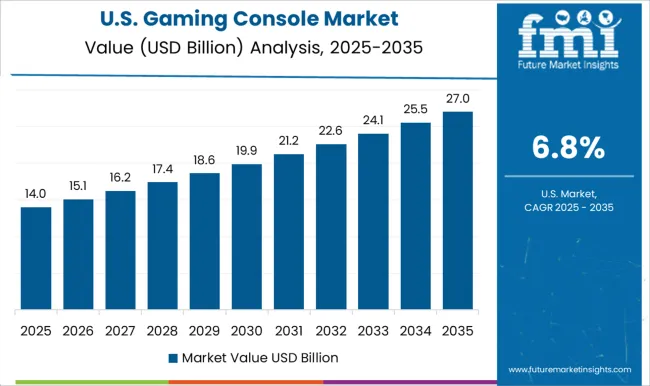

The United States is projected to grow at a CAGR of 6.8% through 2035, driven by the growing gaming community and the increasing popularity of next-generation gaming consoles. The USA market is a leader in terms of gaming innovation, with cutting-edge gaming technology and platforms pushing the demand for consoles. As cloud gaming and esports continue to grow, there is increasing demand for consoles capable of supporting these high-performance applications. The rise in streaming services and exclusive gaming content on consoles further boosts adoption in the USA

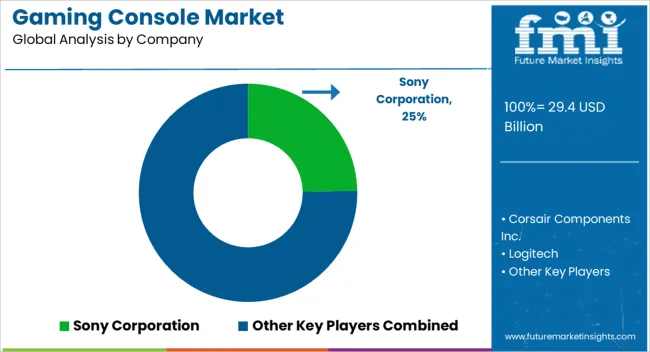

The gaming console market is dominated by three players--Sony (PlayStation), Nintendo, and Microsoft (Xbox), each leveraging unique strategies to sharpen competitive edges. Sony leads with its robust hardware ecosystem, compelling exclusive franchises, and a growing digital services portfolio. PlayStation Plus and PlayStation VR allow Sony to deepen user engagement and build recurring revenue. Nintendo continues to capitalize on innovation and accessibility through its hybrid console approach. The Switch 2, launched in 2025, combines enhanced specs with portability and a broader third-party game lineup, signaling a shift from Nintendo’s traditional exclusive-driven strategy toward wider market appeal. Microsoft, by contrast, focuses on subscription and cloud-based models. Game Pass, xCloud, and strategic studio acquisitions such as Bethesda and Activision Blizzard enable Xbox to move beyond hardware-centric competition by offering vast game libraries across devices and reducing reliance on platform exclusivity.

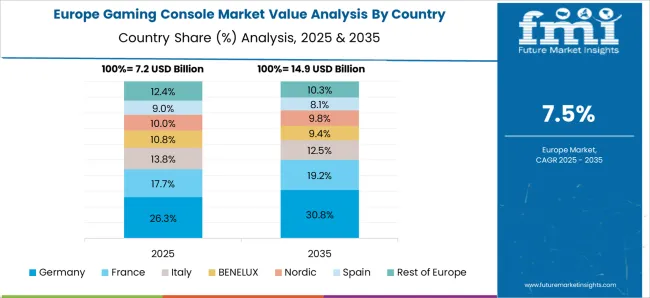

Market share highlights the balance of power, with PlayStation at approximately 45 percent, Nintendo at 27 percent, and Xbox at 23 percent, leaving niche players with around 5%. Regionally, the Asia-Pacific market leads with nearly half of global console demand, driven by a growing gaming population, rising incomes, and strong infrastructure in countries such as China, Japan, and India. North America and Europe remain significant contributors, boosted by e-sports growth and digital adoption.

New disruptors are emerging in the form of cloud gaming platforms and hybrid handheld PCs like the ASUS ROG Ally, which challenge traditional console models and emphasize portability and connectivity. At the same time, macroeconomic pressures such as tariffs and higher production costs have prompted price adjustments across the industry. Sony has raised PS5 prices, with similar measures followed by Microsoft and Nintendo to manage manufacturing challenges.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.4 Billion |

| Type | Home console and Handheld console |

| Application | Gaming and Non-gaming |

| End-Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sony Corporation, Corsair Components Inc., Logitech, Mad Catz Global Limited, Microsoft Corporation, NEC Corporation, Nintendo, NVIDIA Corporation, Panasonic Corporation, Razer Inc., Samsung Electronics Corporation, Sega Corporation, and Valve Corporation |

| Additional Attributes | Dollar sales by product type (consoles, peripherals, gaming subscriptions) and end-use segments (consumer gaming, professional esports, gaming accessories). Demand dynamics are influenced by the growing popularity of online gaming, increasing interest in VR and AR gaming experiences, and the rise of streaming services like Game Pass and PlayStation Now. Regional trends show strong growth in North America and Europe, driven by the adoption of next-gen gaming consoles and online platforms, while Asia-Pacific continues to lead in gaming hardware production and mobile gaming. |

The global gaming console market is estimated to be valued at USD 29.4 billion in 2025.

The market size for the gaming console market is projected to reach USD 63.4 billion by 2035.

The gaming console market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in gaming console market are home console, handheld console, _portable and _non-portable.

In terms of application, gaming segment to command 82.6% share in the gaming console market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Gaming Laptop Market Size and Share Forecast Outlook 2025 to 2035

Gaming Gadgets Market Size and Share Forecast Outlook 2025 to 2035

Gaming Monitors Market Analysis - Size, Share & Forecast 2025 to 2035

Gaming Hardware Market Analysis by Gaming Platform, Product Type, End-user, and Region Through 2035

Game Consoles Market Size and Share Forecast Outlook 2025 to 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Boat Console Market

Mixing Console Market by Type, Sales Channel, Application & Region Forecast till 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Console Box Market

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA