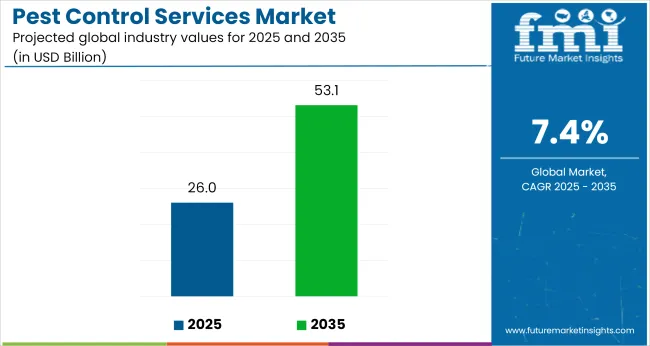

The global pest control services market is projected to expand significantly, from USD 26 billion in 2025 to USD 53.1 billion by 2035, registering a steady CAGR of 7.4% during the forecast period. The market continues to gain traction amid rising public health concerns, stricter regulatory oversight, and heightened sensitivity to sanitation across commercial, industrial, and residential zones.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 26 Billion |

| Market Size (2035) | USD 53.1 Billion |

| CAGR (2025 to 2035) | 7.4% |

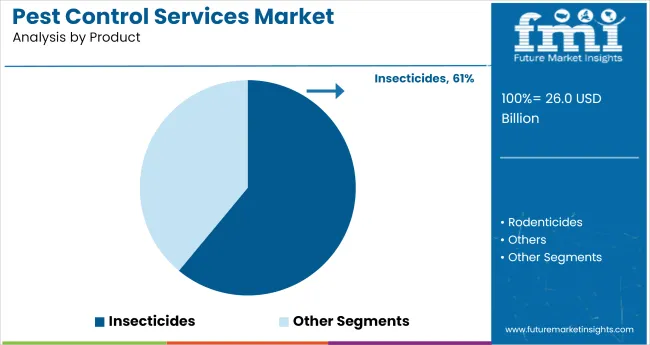

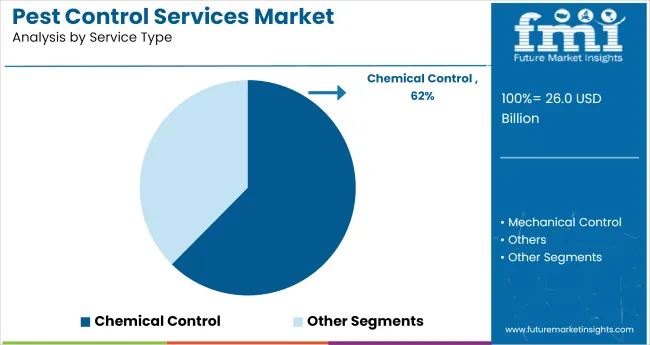

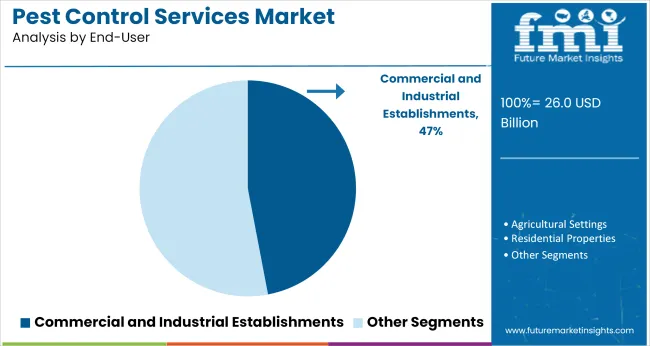

By product type, insecticides are expected to hold the dominant share at 61.0%, followed by biological agents. Chemical control services will continue leading by service type, with a 62% share in 2025. The commercial end-user segment leads at 47.0%, primarily due to recurring demand from hospitality, healthcare, and food manufacturing sectors.

The pest control services industry is witnessing transformative changes in response to health-centric and compliance-driven demands. According to a verified statement from Dominique Stumpf, CEO of the National Pest Management Association (NPMA), in an official April 3, 2025 press release,

“These impressive figures reflect the essential nature of pest management services and the industry's ability to adapt to changing economic conditions. With more than 17,000 pest control firms operating across the country and service revenue approaching USD 13 billion, our industry continues to demonstrate remarkable resilience and growth year over year.”

The pest control services market constitutes 3.2% of the broader environmental and facility services market, valued at over USD 1.1 trillion in 2025. It commands approximately 12% of the building maintenance services segment, reflecting growing demand from urban commercial and multifamily properties. Within the sanitation and public health ecosystem, pest control represents 9%, driven by regulatory mandates in food, healthcare, and hospitality sectors.

In the environmental monitoring space, it contributes around 5%, with adoption of digital tracking and IoT-based rodent and termite detection systems. As a specialized facilities sub-sector, pest control accounts for nearly 4.5% of total outsourced services spend in North America and Western Europe.

Insecticides, chemical services, and insect control dominate the pest control market, driven by commercial demand, urban infestations, and fast-acting treatments, with growing interest in organic and targeted pest management.

Insecticides hold a dominant 61.0% share in the pest control product segment in 2025, owing to their wide applicability across households, offices, agriculture, and commercial buildings. Their effectiveness against fast-breeding pests like ants, flies, mosquitoes, and cockroaches keeps demand high, particularly in urban settings.

Available in sprays, gels, baits, and fogging concentrates, they serve short- and long-term treatment cycles. Urbanization and rising health concerns due to vector-borne diseases drive insecticide usage. However, rising regulation on synthetic chemical residues is prompting a gradual shift to bio-based alternatives.

Chemical control services hold the highest 62% share in 2025, offering cost-efficient and fast-acting pest elimination solutions across urban and industrial environments. These include fumigation, pesticide spraying, baiting, and insect growth regulators. Despite dominance, synthetic chemical methods face scrutiny from regulators and consumers, especially in food-service zones.

This is pushing growth in organically certified pesticides and integrated pest management (IPM) techniques. Mechanical services-though currently niche-are expanding in schools, green buildings, and elderly care homes due to residue-free outcomes. The segment’s dual-track evolution (synthetic vs. organic) reflects both regulatory trends and consumer health awareness, especially in North America and Europe.

The commercial end-user segment represents a 47.0% share in 2025 and includes demand from sectors like hospitality, healthcare, retail, education, and warehousing. Commercial facilities rely on regular pest monitoring, preventive fumigation, and fast-response services to maintain health standards and comply with pest control regulations.

This segment benefits from multi-year service contracts, automated surveillance systems, and off-hour servicing models to minimize disruption. Residential end-users are rising due to increasing consumer awareness, with DIY pest control kits and subscription-based services gaining traction. Agricultural end-users seek specialized rodent and insect control, particularly for export-oriented crops and greenhouses under GAP (Good Agricultural Practices) certification.

Insect control dominates application-wise with a 73.6% share in 2025 due to growing incidence of dengue, malaria, chikungunya, and fly-borne illnesses. Services such as fogging, larvicide treatments, and perimeter sprays are widely deployed by municipalities, residential complexes, and schools. Indoor pest control includes gel baits and surface sprays for cockroach and ant infestations.

Outdoor services focus on mosquito breeding site eradication and fly trap deployment. Meanwhile, rodent control is gaining traction in logistics and food sectors. Termites and bed bugs remain stubborn infestations, especially in high-occupancy zones such as hotels and dormitories, demanding specialized thermal and chemical treatments.

Expert pest treatments with certified technicians and eco-conscious methods are dominating the pest control services market. Recurring inspection plans and low-impact treatments are shaping customer choices and service standards.

Heightened Demand for Expert Pest Interventions

Homeowners and businesses are increasingly opting for professional pest treatments to counter infestations of rodents, termites, and bedbugs. These services are being driven by the need to protect property and health. Pest control firms are expanding mobile response teams and year-round coverage. Accredited certification programs are being completed by technicians to ensure proper application of chemicals and safety procedures. Service packages now offer routine inspections, emergency calls, and seasonal treatments.

Integration of Eco-Conscious Treatment Methods

Clients are requesting greener methods that minimize chemical exposure. Pest control providers are adopting treatments such as heat-based elimination, targeted baiting, and botanical sprays. Training on conservation-conscious techniques is being provided to staff. Materials like insect growth regulators and food-grade diatomaceous earth are being used to limit harm to non-target species. This shift in service methods is also influencing pricing models and service transparency, as treatment reports describe chemical choices and environmental safeguards.

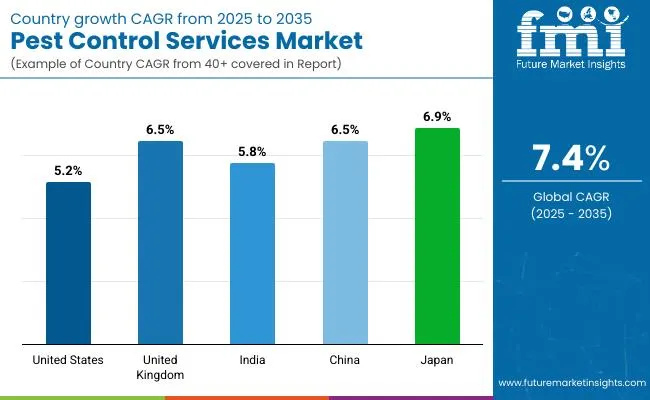

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| United Kingdom | 6.5% |

| India | 5.8% |

| China | 6.5% |

| Japan | 6.9% |

The global pest control services market is forecast to grow at a 7.4% CAGR from 2025 to 2035, yet major economies fall short of this pace. Japan leads among them at 6.9%, where aging buildings, humid summers, and rising food safety audits under HACCP protocols are pushing demand. China and the UK, both at 6.5%, are driven by regulatory tightening in urban housing and commercial kitchens.

India grows at 5.8%, constrained by unorganized operators handling over 55% of service volume. The United States, at 5.2%, reflects an OECD trend-mature markets relying on tech-enabled traps, ESG-aligned contracts, and facility-wide hygiene outsourcing. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Pest management services in the United States are projected to grow at a CAGR of 5.2% from 2025 to 2035, as infestations increase in climate-sensitive urban environments. Subterranean termites and rodents are becoming more prevalent in high-density metros and suburban sprawl zones. Facilities such as senior living centers and hospitals require low-toxicity, continuous monitoring services.

Online booking platforms have made it easier for households to schedule regular treatments. Commercial businesses in hospitality and foodservice are adopting multi-year service contracts. Demand continues to rise for eco-safe formulations, especially in schools, offices, and buildings with pet and child occupancy.

With a CAGR forecast of 6.5% between 2025 and 2035, pest control solutions across the United Kingdom are witnessing high traction in both residential and public-sector facilities. Aged infrastructure in cities like London and Glasgow is leading to increased rodent and damp-related pest complaints. Local councils and NHS-linked care facilities are outsourcing more routine pest management.

The industry is shifting toward chemical-free methods, especially in schools and housing associations. Demand is also rising from logistics, retail, and foodservice sites, where hygiene scoring standards remain high. Rising pest resistance has driven innovation in multi-step treatment protocols.

A CAGR of 5.8% from 2025 to 2035 reflects how pest control services are formalizing across India’s expanding real estate and commercial infrastructure. As vector-borne disease cases rise, gated housing societies, hospitals, and food warehouses are turning to certified vendors for year-round pest coverage.

The shift from informal sprayers to branded players is accelerating in tier-2 and tier-3 cities. E-commerce platforms now offer one-click bookings and subscription services. Hospitals and hotels lead in demand for odorless, non-staining treatments. Building maintenance companies increasingly include pest control in post-handover facility management packages.

At a projected CAGR of 6.5% between 2025 and 2035, pest control services in China are expanding rapidly through digital adoption and large-scale commercial compliance. Mega cities are experiencing higher pest loads due to warming weather, increased construction, and dense housing.

Developers are mandating pre-treatment and long-term pest service for new residential blocks. Export-oriented food and pharma manufacturers require globally certified pest protocols. AI-enabled traps and QR-based reporting are common in smart buildings. Services are scaling across the eastern provinces as logistics and cold chain facilities demand round-the-clock pest surveillance and reporting.

Forecasted to expand at a CAGR of 6.9% from 2025 to 2035, the pest control service industry in Japan is seeing rapid uptake of discreet, tech-enabled solutions. Ageing population clusters have created heightened demand for pest management in elder care homes. Flood-prone zones and humid summers amplify termite and mosquito activity.

Traditional wooden structures in Kyoto and smaller towns are especially susceptible. Precision tools like ultrasonic sensors and robotic sprayers are entering the market. Commercial establishments in foodservice and tourism seek odor-free, low-disruption services that match hospitality compliance codes.

The pest control services market is led by dominant players such as Rollins, Inc., Rentokil Initial PLC, and Ecolab, Inc., recognized for their global service networks, advanced pest management technologies, and strong brand trust across residential, commercial, and industrial sectors. Key players including Anticimex, Massey Services, Inc., and Arrow Exterminators emphasize integrated pest management (IPM), customer-centric models, and geographic expansion. Emerging players like Green Pest Solutions, Apex Pest Control, LLC, and Hulett Environmental Services target regional markets with eco-friendly methods, digital scheduling, and competitive pricing.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 26 Billion |

| Projected Market Size (2035) | USD 53.1 Billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion (Value), Million Treatments (Volume) |

| Product Segments (Segment 1) | Insecticides, Rodenticides, Other Products |

| Service Type Segments (Segment 2) | Chemical Control (Organic, Synthetic), Mechanical Control, Other Pest Control Services |

| End-User Segments (Segment 3) | Residential, Commercial & Industrial, Agricultural |

| Application Segments (Segment 4) | Rodent Control, Insect Control, Cockroaches, Ants, Bed Bugs, Termites, Mosquitoes, Wasps, Flies, Birds, Fleas, Others |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Saudi Arabia, UAE, South Africa |

| States Covered | California, Texas, Florida, New York, Illinois, Georgia, North Carolina, Pennsylvania, Ohio, Michigan |

| Key Players Influencing the Market | Rollins, Inc., Rentokil Initial PLC, Anticimex, Cook's Pest Control, Inc., ABC Home & Commercial Services, Ecolab, Inc., Truly Nolen of America, Massey Services, Arrow Exterminators, Plunkett's Pest Control, Hulett Environmental Services |

| Additional Attributes | Dollar by sales, share, product-wise revenue distribution, region-wise demand variation, fastest-growing application types, pest-specific service adoption patterns, and customer segment expansion insights for residential and industrial clients. |

The market is segmented into insecticides, rodenticides, and various other pest control products.

Services are categorized into chemical control (organic and synthetic), mechanical control, and other pest control services.

End-users include residential properties, commercial and industrial establishments, and agricultural settings.

Applications encompass rodent control, insect control, and treatment for pests such as cockroaches, ants, bed bugs, termites, mosquitoes, wasps, flies, birds, fleas, and others.

Regional analysis includes North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The market is expected to be valued at USD 26 billion in 2025.

The market is forecast to reach USD 53.1 billion by 2035.

The market is projected to grow at a CAGR of 7.4% over the forecast period.

Insecticides lead the Market with a 61% market share in 2025.

Rollins, Inc. is the leading company in the pest control services market with a 16% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

Pesticide Detection Market Analysis - Size, Share, and Forecast 2025 to 2035

Pesticides Packaging Market Growth & Industry Forecast 2025 to 2035

Pest Resistant Crops Market

Pest Control Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Pest Monitoring Management System Market Size and Share Forecast Outlook 2025 to 2035

Biorational Pesticide Market Size and Share Forecast Outlook 2025 to 2035

Neonicotinoid Pesticide Market Size and Share Forecast Outlook 2025 to 2035

Rodent Control Pesticides Market Size and Share Forecast Outlook 2025 to 2035

Home and Garden Pesticides Market Analysis by Type, Application, and Region from 2025 to 2035

Organophosphate Pesticides Market

Agri Natural Enemy Pest Control Market Analysis – Trends, Growth & Forecast 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA