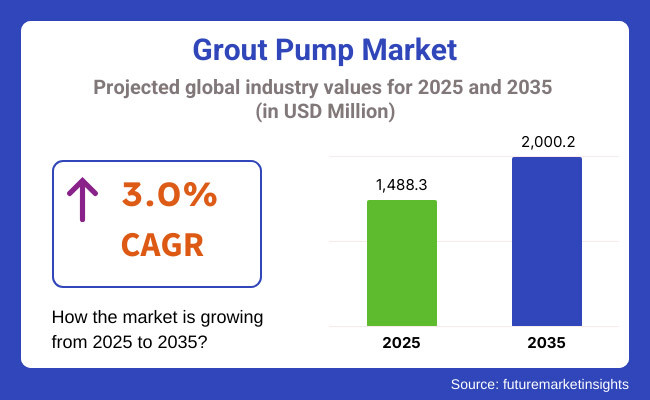

The global grout pump market is projected to be valued at USD 1,488.3 million in 2025 and is anticipated to reach USD 2,000.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.0% during the forecast period. Growth is expected to be driven by continued investments in tunneling, mining, and foundation reinforcement projects where grouting is a critical process for void filling, structural integrity, and soil stabilization.

In March 2024, a new grout pump was introduced by WAGS Engineering, designed for medium-scale civil engineering applications. According to the company’s product release, the unit was engineered to handle high-viscosity grouts and chemically aggressive materials while offering improved operational consistency under varying field conditions. The model was developed in response to user feedback requesting lower maintenance and enhanced output control, particularly for remediation, water-stop injection, and deep-soil anchoring tasks.

Adoption of peristaltic pump technology in abrasive grouting environments has also been observed, with Watson-Marlow Fluid Technology Solutions (WMFTS) reporting successful deployment of its Bredel pumps in ceramic and mineral processing operations. As stated in the company’s 2024 case study, the pumps delivered continuous flow despite high particulate loads, eliminating the need for ancillary seals or valves and reducing wear-related downtime significantly.

Grouting solutions have gained traction in metro tunnel lining and diaphragm wall stabilization across South and East Asia, where precision dosing of cementitious and chemical grouts remains vital. Manufacturers have responded by incorporating low-pulsation flow delivery and adjustable-rate mechanisms into positive displacement pumps to meet the stringent requirements of underground infrastructure projects.

Procurement trends indicate a shift toward modular and portable grout pumps, particularly among contractors in mining, slope stabilization, and dam rehabilitation. These configurations have been preferred for remote site operations and multi-use deployment.

In Europe, grout pumps have been increasingly utilized for the structural rehabilitation of bridges and aging concrete tanks, with OEMs integrating components such as pressure relief valves and backflow preventers to enhance system safety and reliability. Demand is expected to remain stable, driven by asset renewal programs and geotechnical initiatives worldwide.

Electric drive grout pumps accounted for 47% of the global market share in 2025 and are projected to grow at a CAGR of 3.2% through 2035. Their adoption was supported by increasing preference for energy-efficient and low-emission equipment in enclosed or urban construction sites.

In 2025, electric pumps were widely deployed in tunneling, foundation reinforcement, dam grouting, and structural crack filling applications. Contractors favored electric variants for their consistent pressure output, reduced noise levels, and minimal maintenance compared to diesel or pneumatic alternatives.

Integration with automated flow control systems and variable frequency drives (VFDs) enabled precise material dosing, making electric grout pumps suitable for critical operations such as micro-tunneling and high-precision anchoring. As construction regulations tightened around emission standards and site safety, electric pumps found growing acceptance in Europe, North America, and parts of East Asia.

Infrastructure and mining applications accounted for 39% of the global grout pump market in 2025 and are forecast to grow at a CAGR of 3.1% through 2035. These sectors required reliable grouting equipment for underground tunnel stabilization, shaft sinking, slope anchoring, and dam curtain formation.

In 2025, major infrastructure projects such as metro expansions, hydropower stations, and mine development in South Asia, South America, and Africa supported sustained procurement of medium- to high-pressure grout pumps. Contractors employed both single and double-acting piston pumps depending on material viscosity and output requirements.

Equipment performance in high-abrasion environments remained a key consideration, prompting manufacturers to focus on durable plunger seals, abrasion-resistant liners, and maintenance-friendly designs. Public investments in transportation corridors, energy transmission infrastructure, and raw material extraction projects further ensured stable demand from infrastructure and mining segments.

Challenge

High Equipment and Maintenance Costs

One of the major challenges faced in the grout pump market is high equipment and maintenance cost. Grout pumps with high automation and high-pressure pumps fall under the capital-intensive category, deterring small-scale contractors.

Additionally, that abrasive grouting substance nature gradually impedes the durability, hence, the maintenance cost escalates. The operational and maintenance requirements for grout pumps necessitate trained personnel, adding another layer of costs to the project, something that is especially challenging in developing economies where technical talent is limited.

Opportunity

Technological Advancements in Pumping Efficiency

Grout pumps show constant innovation in technology, which is a major growth opportunity for the global grout pump market. Innovations such as improved and energy-efficient grout pumps with automatic control systems and remote monitoring are being facilitated by manufacturers, who are designing machines that will last longer.

With technologies such as IoT-enabled monitoring, it provides real-time performance monitoring along with predictive maintenance, helping to reduce downtime and operational costs. Second, the increasing use of eco-friendly grouting compounds and green pumping deployments comply with global sustainability goals, and that has also exorbitantly attracted new construction and infrastructure projects towards grout pumps. The use of These high-tech grout pumps will continue to rise steadily with industries further embracing automation and precision engineering.

The specific market for grout pumps in the USA is on the rise as a result of rising construction, growth in infrastructure investments, and heightened demand for effective concrete and foundation repair. Commercial applications as well as government infrastructure rehabilitation funds are driving demand for the market. Technological improvements in grout pump efficiency and automation are also driving the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.8% |

In the UK, grout pump industry is supplemented by public infrastructure investment, urban renewal activities, and increased demand for waterproofing and soil support solutions. The industry is also influenced by the demand for high-performance grouting equipment to be applied in tunneling, underground construction, and bridge maintenance. Increasing environmental and safety regulations are inducing the use of effective and low-emission grout pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.7% |

The EU grout pump market is experiencing growth thanks to mega-infrastructure overhaul works, growing underground construction investments, and development of cementitious and epoxy grouts. Germany, France, and Italy are in the lead as far as adoption of grout pumps is concerned, influenced by growing transport systems, business offices, and alternative energy installations such as wind power farms located at sea. As well, pressures from regulatory aspects for energy-conserving and environmental-friendly construction are driving the innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

Japan grout pump market is driven by seismic retrofitting activities, maintenance of old infrastructure and high degree of stress on state-of-the-art construction technologies. High-precision grout pumps in seismic retrofitting operations, particularly tunnel construction and underground subway expansion, are very much in demand, with a focus on both minimizing the worst problem of the construction downtime and achieving the best operational efficiency. In addition, the proliferation of earthquake-resistant construction and smart infrastructure in the country is further propelling growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

There will be growth in the market due to high-speed urbanization, high-rise development, and increasing investments in water and wastewater treatment facilities in South Korea. Growing focus by the government on smart cities development and underground infrastructure development is expected to create potential growth opportunities for affordable and durable grouting solutions. Furthermore, the robotic and automated grouting solutions are gaining significant traction in the construction sector in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

The Grout Pump Market is witnessing robust growth, driven by the increasing demand for construction, mining, and infrastructure projects. Grout pumps play a crucial role in foundation stabilization, tunneling, waterproofing, and structural reinforcement. With advancements in pump efficiency, automation, and material compatibility, companies are focusing on delivering high-performance, low-maintenance, and cost-effective solutions.

The market is further propelled by urbanization, rising investments in commercial and residential construction, and technological innovations in grout mixing and pumping systems. Leading players are emphasizing product diversification, distribution network expansion, and strategic collaborations to maintain a competitive edge.

Metro Industries (18-22%)

Being a market leader in grout pump production, Metro Industries specializes in heavy-duty, high-performance pumping equipment for mega-construction projects. Metro Industries invests in automated grout mixing equipment and technologies that improve durability to serve infrastructure and tunneling sectors.

Wastecorp (14-18%):

One of the leading players in industrial and construction pumping solutions, Wastecorp specializes in flexible grout pump systems to be used across mining and dam building to sewer management. It is building up its global presence with environment-friendly and energy-saving pump designs.

Kenrich Products (10-14%)

Specializing in compact and portable grout pumps, Kenrich caters to smaller-scale projects, including slab lifting, foundation repair, and waterproofing. The company continues to innovate in user-friendly designs and low-maintenance pump systems.

Lianhe RongDa (8-12%)

A prominent supplier in China and global markets, Lianhe RongDa focuses on affordable, durable hydraulic and electric grout pumps. The company is increasing its presence in infrastructure and commercial construction projects worldwide.

Airplaco (6-10%)

Known for its pneumatic and hydraulic grout pumps, Airplaco supplies solutions for shotcrete, mining, and geotechnical applications. The company prioritizes versatility and advanced control mechanisms in its product development.

Other Key Players (30-40% Combined)

The Grout Pump Market is also supported by several regional and niche manufacturers, including:

The overall market size for grout pump market was USD 1,488.3 Million in 2025.

The grout pump market is expected to reach USD 2,000.2 million in 2035.

The rising demand in infrastructure development projects fuels Grout Pump Market during the forecast period.

The top 5 countries which drives the development of Grout Pump Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of application, metallurgy to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Piston Grouting Pump Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grout Pumps Market

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Grouting Machine Market

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA