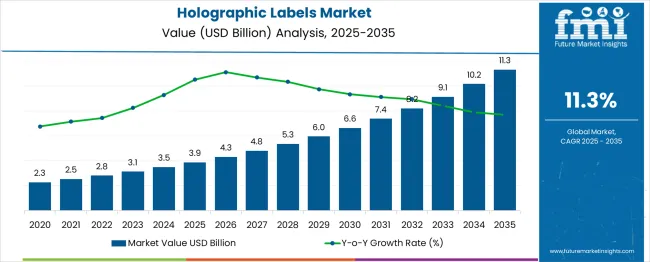

The holographic labels market is valued at USD 3.9 billion in 2025 and is forecast to reach USD 11.3 billion by 2035, registering a CAGR of 11.3%. Rolling CAGR analysis indicates a strong and consistent compounding effect, as the market nearly triples in size over the forecast horizon. Early years of growth are expected to be supported by rising adoption of holographic solutions in packaging and product authentication, while later years will benefit from wider acceptance in high value industries such as pharmaceuticals, electronics, and luxury goods.

The rolling CAGR trend reflects acceleration, highlighting long-term scalability and resilience of demand. This trajectory confirms stable momentum, with compounded gains building predictable revenue growth throughout the decade.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.9 billion |

| Forecast Value in (2035F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The market has expanded steadily due to rising adoption in packaging, brand authentication, and anti-counterfeiting applications. YoY analysis reveals certain dips in growth that can be directly linked to market restraints. In specific years, raw material shortages, particularly in specialty films and adhesives required for holographic printing, created supply chain bottlenecks that slowed production and delivery schedules.

Economic downturns also contributed to weaker market performance, as reduced consumer spending affected demand in sectors such as luxury goods, electronics, and cosmetics, which heavily rely on holographic labeling for brand differentiation.

Regulatory changes have further influenced market volatility, especially in regions where packaging and labeling compliance standards have been tightened. For instance, revisions to labeling requirements and restrictions on certain materials occasionally delayed adoption or increased production costs, leading to temporary dips in YoY growth.

Despite these constraints, the market has demonstrated resilience by recovering quickly when supply chains stabilized and consumer demand strengthened. The correlation between YoY dips and such restraints underscores the importance of monitoring raw material availability, macroeconomic conditions, and regulatory landscapes, as these factors remain critical in shaping the future trajectory of the market.

Market expansion is being supported by the increasing global concern about counterfeit products and the corresponding demand for effective brand protection solutions. Modern manufacturers are increasingly focused on implementing authentication measures that can protect against product piracy, unauthorized distribution, and brand reputation damage. Holographic labels' proven efficacy in providing tamper-evident features and unique visual authentication makes them a preferred choice in premium packaging applications.

The growing focus on product differentiation and premium branding is driving demand for holographic labels that combine security features with decorative appeal. Consumer preference for authentic products that offer visual verification of genuineness is creating opportunities for innovative holographic solutions. The rising influence of e-commerce platforms and the need for supply chain transparency is also contributing to increased adoption across different industries and product categories.

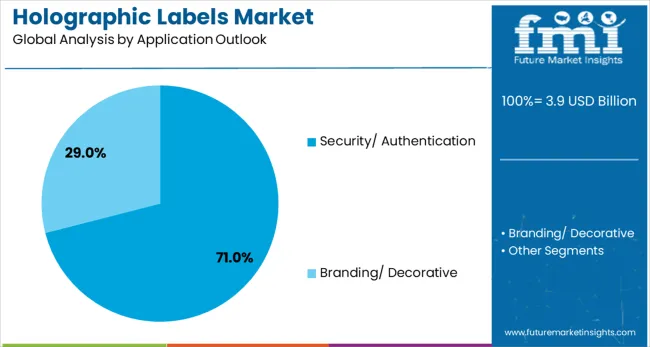

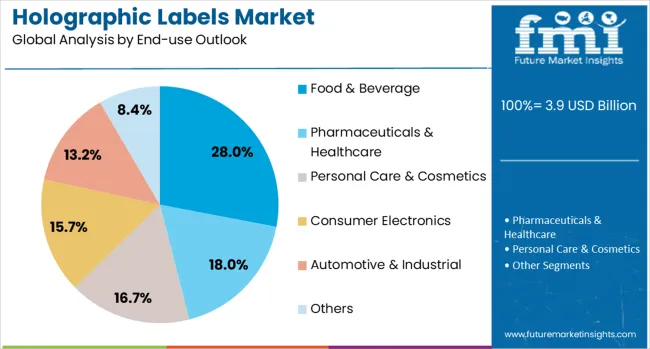

The market is segmented by material outlook, application outlook, end-use outlook, and region. By material outlook, the market is divided into PET, BOPP/PP, paper, PVC, and others. Based on application outlook, the market is categorized into security/authentication and branding/decorative. In terms of end-use outlook, the market is segmented into food & beverage, pharmaceuticals & healthcare, personal care & cosmetics, consumer electronics, automotive & industrial, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The security/authentication application is projected to account for 71% of the holographic labels market in 2025, reaffirming its position as the category's primary driver. Manufacturers increasingly understand the critical importance of protecting their products from counterfeiting, unauthorized reproduction, and brand dilution. Holographic labels' sophisticated security features, including unique optical effects, tamper-evident properties, and difficulty in replication, directly address these concerns by providing reliable product authentication solutions.

This application forms the foundation of most product positioning, as it represents the most critical and value-adding benefit of holographic labels in industrial applications. Government regulations and industry standards continue to strengthen requirements for anti-counterfeiting measures across various sectors. With global trade exposing brands to more counterfeiting risks, security and authentication applications align with both regulatory compliance and brand protection goals. The broad adoption across high-value product categories ensures dominance, making it the central growth driver of holographic labels demand.

PET materials are projected to represent 53% of holographic labels demand in 2025, underscoring their role as the preferred substrate for high-quality holographic applications. Manufacturers tend to favor PET for its exceptional optical clarity, dimensional stability, and superior capabilities for reproducing holographic effects. Positioned as premium packaging solutions, PET-based holographic labels offer both exceptional visual appeal and reliable performance characteristics including chemical resistance and durability.

The segment is supported by the growing demand for high-definition holographic effects that require superior substrate properties. Additionally, brands are increasingly combining PET holographic labels with advanced printing technologies and finishing processes, enhancing visual impact and justifying premium positioning. As quality-conscious consumers and brand owners prioritize visual excellence and authentication reliability, PET-based holographic labels will continue to dominate demand, reinforcing their premium status within the packaging materials market.

The food & beverage end-use segment is forecasted to contribute 28% of the holographic labels market in 2025, reflecting the growing intersection of brand protection and consumer goods packaging. Food and beverage manufacturers are increasingly attentive to product authentication requirements, preferring holographic labels that combine anti-counterfeiting features with attractive shelf appeal. This aligns with consumer safety concerns and regulatory requirements that emphasize product authenticity and supply chain transparency.

Premium positioning and brand differentiation provide competitive advantages in crowded retail environments, reassuring consumers about product quality and authenticity. The segment also benefits from manufacturers willingness to invest in premium packaging solutions that combine security features with marketing benefits. With heightened regulatory oversight and rising awareness of food safety issues, holographic labels serve as powerful differentiators in the food & beverage sector, making them a critical component of modern packaging strategies.

The market is advancing rapidly due to increasing concerns about product counterfeiting and growing demand for brand protection solutions. The market faces challenges including high production costs, technical complexity of manufacturing processes, and competition from other anti-counterfeiting technologies. Innovation in holographic technologies and eco-friendly material development continue to influence product advancement and market expansion patterns.

The growing adoption of e-commerce platforms is enabling brands to implement digital authentication systems that complement holographic labels. Online channels require enhanced product verification methods to build consumer trust and prevent counterfeit products from entering digital marketplaces. Integration of QR codes, NFC technology, and blockchain verification with holographic labels is driving innovation and creating new authentication ecosystems.

Modern holographic label manufacturers are incorporating advanced technologies such as micro-optics, nano-structures, and multi-layer security features to enhance authentication capabilities. These technologies improve the security level of holographic labels while making counterfeiting more difficult and expensive. Advanced manufacturing techniques also enable customization options that deliver unique brand identity elements in addition to security functions.

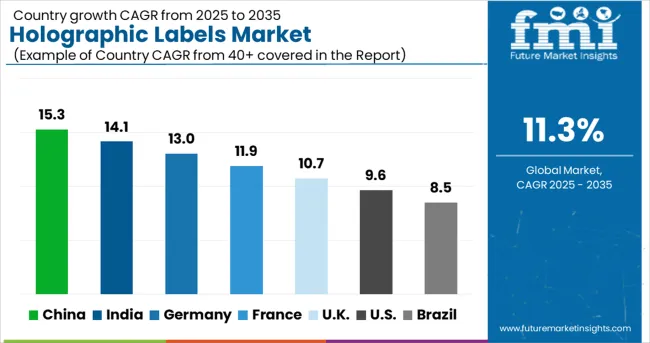

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 15.3% |

| India | 14.1% |

| Germany | 13.0% |

| France | 11.9% |

| UK | 10.7% |

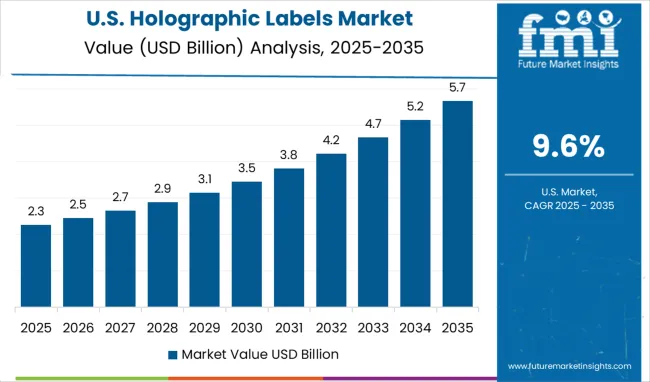

| USA | 9.6% |

| Brazil | 8.5% |

The global market is projected to grow at a CAGR of 11.3% between 2025 and 2035, driven by rising demand for anti-counterfeiting solutions and increasing adoption in packaging and security applications. China leads with 15.3% growth, supported by expanding manufacturing industries and growing need for brand protection. India follows at 14.1%, reflecting rapid growth in consumer goods and pharmaceuticals, along with heightened focus on product authenticity. Germany records 13.0%, driven by strong demand in automotive and industrial sectors for high-security labeling. France is projected at 11.9%, supported by adoption of innovative packaging technologies across retail and luxury goods. The UK grows at 10.7% with focus on secure labeling solutions, while the USA expands at 9.6%, influenced by regulatory compliance and increasing use of holographic labels in healthcare and consumer products.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to record the highest CAGR of 15.3% between 2025 and 2035, driven by strong adoption of holographic labels in consumer goods, food packaging, and electronics. Counterfeit activities have been widespread, and government regulations have mandated use of advanced authentication systems, pushing demand for holographic security solutions. Domestic manufacturers such as Jinya New Materials and Suzhou Image Technology have scaled production capacities, while international companies have strengthened distribution networks. The shift toward premium packaging in FMCG and e-commerce sectors has further accelerated adoption. Investments in advanced printing technologies and high-resolution holograms are expected to expand market penetration across industries in the coming years.

India is projected to grow at a CAGR of 14.1% between 2025 and 2035, supported by rising concerns over counterfeit pharmaceuticals, packaged foods, and electronics. Government-led initiatives promoting product authentication and consumer awareness have strengthened market acceptance. Domestic manufacturers such as UFlex Limited have introduced innovative holographic designs, while multinational players have expanded their presence through collaborations. Demand has been further influenced by growth in organized retail and digital marketplaces where product authentication is critical. Indian manufacturers have also focused on cost-effective production and wide-scale availability to serve both small and large enterprises. Continuous technological advancement in holographic printing is expected to reinforce long-term growth.

Germany is expected to expand at a CAGR of 13.0% from 2025 to 2035, driven by demand in pharmaceuticals, automotive parts, and high-value goods packaging. Stringent EU directives on product authentication have accelerated adoption of holographic security labels. Companies such as Huhtamaki and CCL Industries have invested in advanced holographic printing, tamper-evident technologies, and high-security features to support compliance. The increasing role of Industry 4.0 and digital supply chain tracking has further supported demand. German manufacturers and research institutions have collaborated to integrate holographic features with digital QR codes and blockchain-based authentication systems. Market growth is expected to remain stable as industries prioritize anti-counterfeit strategies.

France is projected to grow at a CAGR of 11.9% between 2025 and 2035, shaped by growing applications in cosmetics, wine labeling, and luxury packaging. Rising consumer preference for authenticity and premium packaging has driven adoption of holographic labels. Companies such as NovaVision and Creative Labels Inc. have introduced customizable holographic solutions targeting luxury goods and personal care products. Regulatory frameworks focusing on anti-counterfeit measures in pharmaceuticals and beverages have also boosted adoption. Growth in the French e-commerce sector has pushed demand for secure labeling solutions to protect supply chain integrity. Integration of holographic labels with digital verification platforms is emerging as a notable trend.

The holographic labels market in the United Kingdom is projected to expand at a CAGR of 10.7% between 2025 and 2035, supported by demand for product authentication across healthcare, food packaging, and premium beverages. BSI standards and government guidelines on anti-counterfeit practices have accelerated adoption. Local players and global providers such as Intertronix and CCL Industries have invested in holographic printing technologies to enhance product authenticity. Increased demand from the beverage sector, particularly spirits and wines, has created a strong niche market for premium holographic labeling. Integration with serialization and track-and-trace systems is being increasingly adopted in the UK market to enhance supply chain transparency.

The market in the United States is forecasted to expand at a CAGR of 9.6% from 2025 to 2035, supported by rising demand for brand protection, anti-counterfeit solutions, and packaging innovations. Increasing cases of counterfeit products in pharmaceuticals, electronics, and luxury goods have led manufacturers to integrate holographic security labels as a preventive measure. Leading players such as Avery Dennison Corporation and CCL Industries have expanded offerings in tamper-evident and customizable holographic designs to serve diverse sectors. Regulatory pressures on product authenticity and consumer safety have accelerated adoption across industries. Strong presence of e-commerce platforms and the need for supply chain traceability have further strengthened market growth, with companies investing in advanced printing and digital authentication technologies.

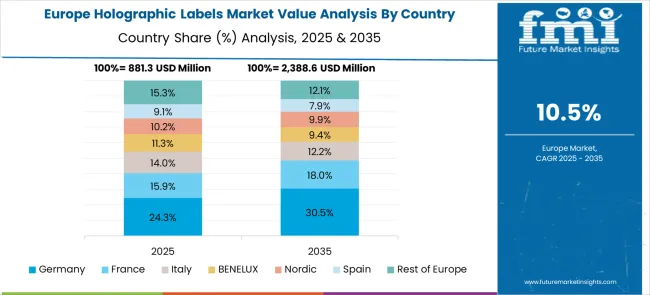

The market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced manufacturing capabilities and consumer appreciation for high-quality packaging solutions, supported by companies leveraging precision engineering to develop effective holographic labels that combat counterfeiting and enhance brand differentiation, backed by robust automotive and consumer electronics industries requiring premium authentication solutions.

France represents a significant market driven by its luxury goods heritage and sophisticated understanding of brand protection science, with companies pioneering premium holographic labels that combine French packaging artistry with advanced security features for enhanced product authentication and visual appeal benefits in cosmetics, pharmaceuticals, and luxury consumer goods sectors.

The UK exhibits considerable growth through its focus on innovative packaging solutions and regulatory compliance requirements, with manufacturers leading the development of advanced holographic technologies and comprehensive brand protection strategies. Germany and France show expanding interest in eco-friendly holographic solutions, particularly in premium applications targeting environmental responsibility and circular economy principles. BENELUX countries contribute through their focus on high-tech manufacturing and precision labeling applications, while Eastern Europe and Nordic regions display growing potential driven by increasing manufacturing activities and expanding access to premium packaging technologies across diverse industrial applications.

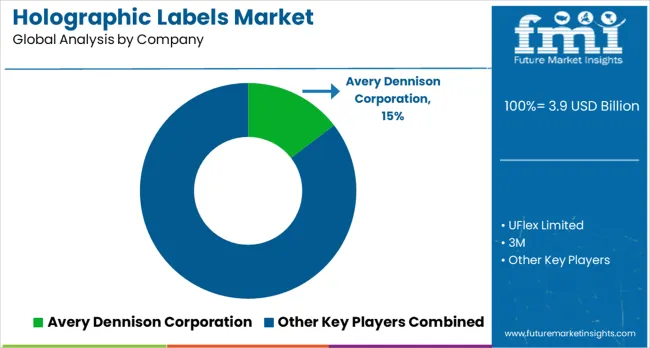

Avery Dennison Corporation, 3M, Huhtamaki, and CCL Industries command significant market presence, offering high-volume production and advanced holographic printing that serves industries from consumer goods to pharmaceuticals. Their strength lies in combining branding and security, supported by global distribution and proven manufacturing reliability. UFlex Limited, Creative Labels Inc., and Matrix Technologies compete by addressing client-specific needs through flexible production and cost-effective customization. UFlex has built recognition in developing markets with large-scale yet adaptable solutions, while Creative Labels and Matrix Technologies provide design agility and fast turnaround for businesses seeking differentiation in competitive retail segments.

Smaller and highly specialized companies including NovaVision, Jinya New Materials, Suzhou Image Technology, Skunkworx Packaging, Intertronix, and Hira Holovision focus heavily on the security segment. Their offerings highlight tamper-evident technologies, multi-dimensional holograms, and covert authentication elements. These players gain traction by catering to sensitive applications such as government IDs, legal documents, and luxury product packaging where advanced anti-counterfeiting features are essential.

Competition in this market is defined by the ability to balance visual appeal with strong protective features. Global corporations compete through scale, integrated branding, and extensive client networks, while regional and niche providers strengthen their positions by offering advanced security features and specialized services. Innovation in holographic technology, particularly in authentication and track-and-trace solutions, remains the central factor driving competitive positioning across all market tiers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.9 billion |

| Material Outlook | PET, BOPP/PP, Paper, PVC, Others |

| Application Outlook | Security/Authentication, Branding/Decorative |

| End-use Outlook | Food & Beverage, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Consumer Electronics, Automotive & Industrial, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Avery Dennison Corporation, UFlex Limited, 3M, Huhtamaki, CCL Industries, Creative Labels Inc., Matrix Technologies, NovaVision LLC, Jinya New Materials Co. Ltd, Suzhou Image Technology Co. Ltd, Skunkworx Packaging, and Intertronix |

| Additional Attributes | Dollar sales by holographic technology type and security level, regional demand trends, competitive landscape, buyer preferences for material types versus security features, integration with anti-counterfeiting positioning, innovations in nano-structures, advanced authentication, and green manufacturing practices |

The global holographic labels market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the holographic labels market is projected to reach USD 11.3 billion by 2035.

The holographic labels market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in holographic labels market are pet, bopp/ pp, paper, pvc and others.

In terms of application outlook, security/ authentication segment to command 71.0% share in the holographic labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Holographic Blister Foil Market Forecast Outlook 2025 to 2035

Holographic Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Holographic Display Market Size and Share Forecast Outlook 2025 to 2035

Holographic Tear Tape Market

Labels Market Forecast and Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Labels Companies

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

HAZMAT Labels Market Growth and Forecast 2025 to 2035

In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

QR Code Labels Market Size and Share Forecast Outlook 2025 to 2035

Braille Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA