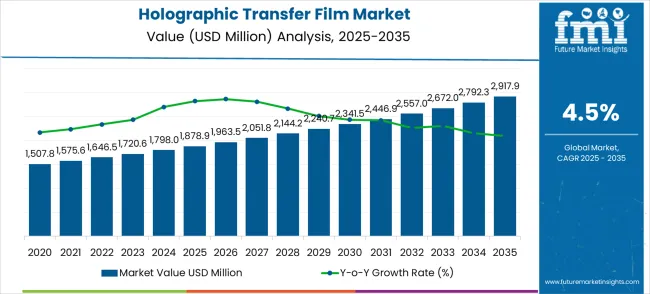

The holographic transfer film market reaches USD 1,878.9 million in 2025 and is expected to grow to USD 2,917.9 million by 2035, with a CAGR of 4.5%. From 2021 to 2022, the market increases from USD 1,507.8 million to USD 1,575.6 million, reflecting a steady YoY growth driven by rising demand in packaging, security, and decorative applications. Between 2022 and 2024, the market continues to progress from USD 1,646.5 million to USD 1,798.0 million, fueled by the increased use of holographic films in anti-counterfeit measures and brand protection across industries like cosmetics, pharmaceuticals, and consumer goods.

Between 2026 and 2030, the market experiences stronger growth, advancing from USD 1,878.9 million to USD 2,640.0 million, passing through USD 1,963.5 million in 2026, USD 2,051.8 million in 2027, and USD 2,144.2 million in 2028. This period is marked by the expanding use of holographic films in digital displays, advertising, and product labeling. The automotive, retail, and electronics sectors contribute significantly to the growth, driven by advancements in printing and coating technologies. By 2035, the market will reach USD 2,917.9 million, reflecting consistent growth across industries, with continued adoption of holographic films in high-end packaging and security applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,878.9 million |

| Forecast Value in (2035F) | USD 2,917.9 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The packaging industry dominates the market with a share of 40-45%, as brands in the food & beverage, cosmetics, and luxury goods sectors increasingly adopt holographic films for premium, visually engaging packaging solutions that enhance product appeal. The security and anti-counterfeiting segment follows closely, accounting for 20-25% of the market, as holographic films are widely used for protecting government documents, ID cards, and branded products against counterfeiting. Their unique optical properties make them difficult to replicate, offering reliable solutions for product authentication. The consumer electronics sector holds approximately 15-18%, as holographic transfer films are applied to mobile phones, laptops, and other devices for aesthetic purposes and added scratch resistance. The automotive and aerospace industries contribute around 8-10%, utilizing these films for decorative elements, such as interior trims and dashboard accents, to elevate the visual appeal of vehicles and aircraft. The textile and fashion market accounts for 7-10%, with holographic films being used to create eye-catching designs on fabrics, particularly for high-end fashion lines and accessories.

Market expansion is being supported by the increasing threat of counterfeiting and the corresponding need for sophisticated security solutions that can provide visual authentication, prevent product forgery, and maintain brand integrity across various high-value products and sensitive applications. Modern manufacturers and brand owners are increasingly focused on implementing security solutions that can deter counterfeiting, enable product authentication, and provide reliable verification methods in complex supply chains. Holographic transfer films' proven ability to deliver visual security features, support anti-counterfeiting objectives, and enhance product authenticity makes them essential components for contemporary brand protection and product security strategies.

The growing emphasis on consumer safety and brand protection is driving demand for holographic transfer films that can support product authentication, prevent unauthorized reproduction, and enable comprehensive security verification. Manufacturers' preference for security solutions that combine visual appeal with anti-counterfeiting effectiveness and cost-efficient application is creating opportunities for innovative holographic transfer film implementations. The rising influence of e-commerce and trade is also contributing to increased adoption of holographic transfer films that can provide reliable security features without compromising product aesthetics or manufacturing efficiency.

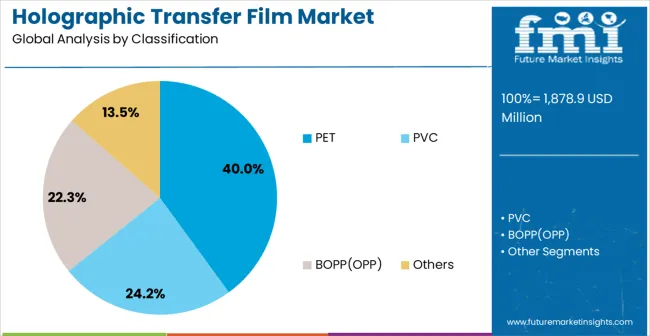

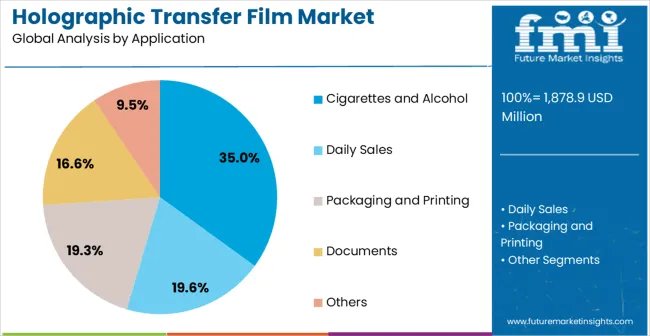

The market is segmented by product, application, and region. By product, the market is divided into PET, PVC, BOPP(OPP), and others. Based on application, the market is categorized into cigarettes and alcohol, daily sales, packaging and printing, documents, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

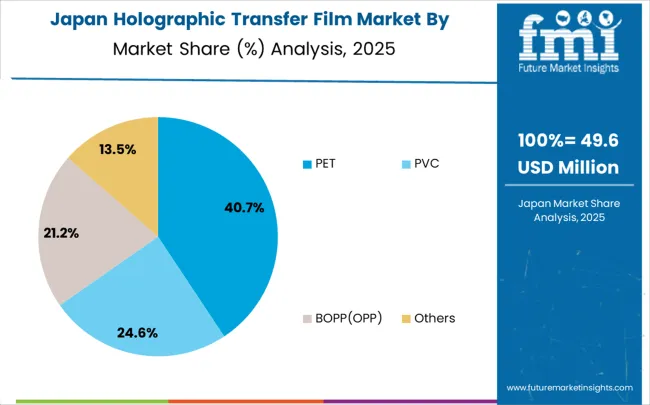

The PET segment is projected to maintain its leading position in the holographic transfer film market in 2025, capturing 40% of the market share. PET-based holographic transfer films are increasingly favored by manufacturers and security printing specialists due to their superior optical properties, excellent dimensional stability, and versatility across various product categories and security applications. PET technology’s proven performance characteristics ensure reliable holographic reproduction and the consistent application of security features in diverse packaging and authentication applications. As the cornerstone of modern holographic security systems, PET substrate films offer the greatest technical versatility and established performance, strengthening their adoption among security professionals and packaging converters. PET-based films are crucial to maintaining optical quality and processing reliability in holographic applications, making them a central element of comprehensive security strategies.

The cigarettes and alcohol application segment is projected to represent the largest share of holographic transfer film demand in 2025, accounting for 35% of the market. Holographic films are essential in the tobacco and alcoholic beverage industries for product authentication, counterfeiting prevention, and excise tax compliance. Manufacturers in these sectors prefer holographic transfer films for their ability to meet high-value product protection requirements, regulatory compliance needs, and to provide visually appealing security features that bolster brand differentiation and consumer confidence. Continuous innovations in security technologies and the availability of specialized holographic features further enhance their anti-counterfeiting effectiveness. As counterfeiting threats and regulatory requirements grow, tobacco and alcohol manufacturers are investing in comprehensive security programs, ensuring that holographic transfer films will remain essential components in protecting brands and complying with regulatory standards.

The holographic transfer film market is advancing steadily due to increasing counterfeiting threats and growing adoption of visual security technologies that provide enhanced brand protection and product authentication across diverse high-value product categories. The market faces challenges, including high production costs and equipment requirements, technical complexity in holographic design and manufacturing, and competition from alternative anti-counterfeiting technologies. Innovation in digital holography and smart security features continues to influence product development and market expansion patterns.

The growing adoption of advanced holographic imaging technologies and digital security integration is enabling manufacturers to achieve superior security effectiveness, enhanced visual appeal, and comprehensive authentication capabilities for improved brand protection. Advanced holographic systems provide improved anti-counterfeiting performance while allowing more sophisticated security features and consistent optical quality across various product applications and manufacturing processes. Manufacturers are increasingly recognizing the competitive advantages of advanced holographic capabilities for security differentiation and brand enhancement.

Modern holographic transfer film manufacturers are incorporating smart authentication technologies and track-and-trace systems to enhance security verification, enable supply chain transparency, and provide comprehensive product authentication through digital connectivity and data integration. These technologies improve security effectiveness while enabling new applications, including mobile authentication and blockchain verification. Advanced digital integration also allows manufacturers to support comprehensive security management and product tracking beyond traditional visual authentication approaches.

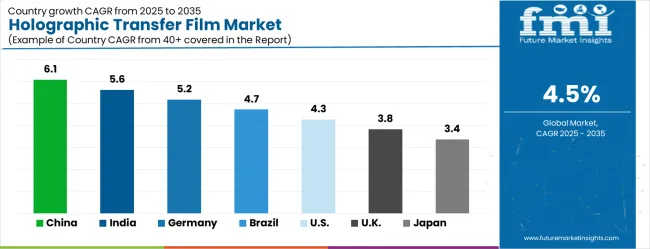

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| USA | 4.3% |

| UK | 3.8% |

| Japan | 3.4% |

The holographic transfer film market is experiencing solid growth globally, with China leading at a 6.1% CAGR through 2035, driven by the expanding manufacturing sector, growing anti-counterfeiting awareness, and significant investment in security printing technologies and holographic film production capabilities. India follows at 5.6%, supported by rapid industrial development, increasing brand protection requirements, and growing adoption of security technologies in consumer goods and pharmaceutical industries. Germany shows growth at 5.2%, emphasizing precision manufacturing and advanced security printing technologies. Brazil records 4.7%, focusing on consumer goods protection and anti-counterfeiting initiatives in the tobacco and alcohol sectors. The USA demonstrates 4.3% growth, supported by an established brand protection infrastructure and an emphasis on product authentication. The UK exhibits 3.8% growth, emphasizing security printing excellence and anti-counterfeiting technologies. Japan shows 3.4% growth, supported by advanced manufacturing technologies and precision holographic systems.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

The holographic transfer film market in China is projected to grow at a CAGR of 6.1% from 2025 to 2035. The country remains a dominant player in the production of holographic films, driven by the booming packaging and labeling industries. As the demand for premium packaging continues to rise, especially for consumer electronics, luxury goods, and cosmetics, the application of holographic films has expanded. These films are used for creating visually dynamic, counterfeit-resistant labels, enhancing brand visibility and consumer engagement. China's strong manufacturing base allows for the mass production of holographic films at competitive prices, further expanding the market reach. The rapid growth in e-commerce has also increased the need for differentiated packaging, which boosts demand for holographic films in retail and online sales. Advances in printing technology, such as digital printing and advanced laser techniques, are also driving innovation and adoption in various industries.

Demand for holographic transfer film in India is expected to expand at a CAGR of 5.6% from 2025 to 2035. As the packaging industry expands, especially in sectors like FMCG, cosmetics, and pharmaceuticals, the demand for visually appealing, tamper-evident, and counterfeit-resistant packaging has grown significantly. Holographic films are increasingly being used in labels, bottle wraps, and gift packaging due to their enhanced visual appeal and anti-counterfeit features. The growing middle class, increasing disposable income, and rising consumer spending on branded products further drive the market. The Indian government's push for anti-counterfeit measures in industries like pharmaceuticals supports the adoption of holographic films. Manufacturers are also shifting towards eco-friendly packaging, which is beginning to influence the types of materials used in holographic film production, although the focus remains on high-quality visuals and performance.

Sales of holographic transfer film in Germany are anticipated to grow at a CAGR of 5.2% over the forecast period. Known for its advanced manufacturing technologies, Germany is seeing increased adoption of holographic films in sectors such as automotive, electronics, and luxury goods. In these industries, the holographic films are used not only for security purposes but also to enhance product appeal, particularly in high-end packaging for automotive parts, consumer electronics, and cosmetics. The growing trend towards high-quality branding and product differentiation is driving the need for holographic films, as manufacturers seek innovative packaging solutions. German packaging standards are often stricter, thus influencing the demand for high-performance films that meet international certifications for quality.

The holographic transfer film market in Brazil is expected to grow at a CAGR of 4.7% from 2025 to 2035. The country’s expanding consumer goods and food packaging sectors are driving the demand for holographic films. As the Brazilian economy recovers and consumer spending increases, premium packaging solutions are becoming more widely adopted. Holographic films are commonly used in food and beverage packaging, pharmaceuticals, and personal care products, where product authenticity and branding are critical. The rise of organized retail and e-commerce in Brazil is also accelerating the demand for visually appealing packaging that can stand out on shelves. With increasing concerns over product counterfeiting, Brazil is focusing on enhancing security features in packaging, making holographic films an essential solution.

The USA market for holographic transfer films is expected to expand at a CAGR of 4.3% from 2025 to 2035. As a key player in the packaging market, the USA is witnessing steady demand for holographic films in premium product packaging, including electronics, cosmetics, and luxury goods. The need for secure, visually engaging packaging is pushing innovation in holographic film applications. The rise of e-commerce, particularly in consumer electronics, drives the need for unique packaging solutions that stand out and ensure brand protection. With the ongoing trend of consumer preference for high-quality, differentiated products, holographic films are increasingly seen as a tool for brand enhancement. Companies are also adopting holographic films to meet the growing demand for tamper-evident packaging, especially in pharmaceuticals and cosmetics.

The UK market is forecasted to grow at a CAGR of 3.8% over the next decade. In the UK, the demand for holographic transfer films is primarily driven by the fashion and luxury goods industries, where packaging plays a significant role in product appeal. With a strong market for high-end consumer products, the need for high-quality, eye-catching packaging solutions is increasing. Holographic films are also gaining traction in the food and beverage industry, as brands look for ways to differentiate their products on shelves. The UK is seeing a rising trend in the adoption of digital and automated production processes for holographic films, which is making production faster and more cost-effective. With the ongoing shift towards premium packaging and increased anti-counterfeit measures, holographic films are being increasingly integrated into packaging solutions.

The holographic transfer film market in Japan is expected to grow at a CAGR of 3.4%, supported by steady demand in the packaging of consumer electronics, luxury items, and pharmaceuticals. Japan is a leader in technological innovation, and this extends to the packaging industry, where holographic films are increasingly used for product branding, especially in premium electronics. The trend toward e-commerce is also increasing the need for visually distinctive and secure packaging. The Japanese government’s growing focus on anti-counterfeit measures has resulted in an increased adoption of holographic films in labeling and packaging. Japanese manufacturers are also investing in research and development to enhance the durability and performance of holographic films, focusing on heat-resistant properties and longer-lasting visuals.

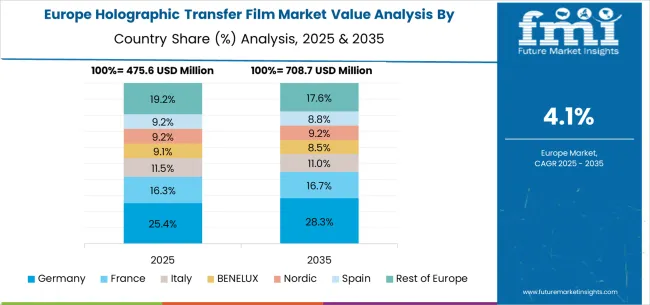

The holographic transfer film market in Europe is projected to grow from USD 713.6 million in 2025 to USD 1,047.8 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 27.0% market share in 2025, moderating slightly to 26.8% by 2035, supported by its strong security printing industry, advanced manufacturing sector, and comprehensive anti-counterfeiting infrastructure serving major European markets.

The United Kingdom follows with 20.0% in 2025, projected to reach 19.8% by 2035, driven by established security printing excellence, a comprehensive intellectual property protection framework, and advanced anti-counterfeiting technology programs. France holds 18.5% in 2025, rising to 18.7% by 2035, supported by luxury goods protection requirements and growing adoption of premium security technologies. Italy commands 14.0% in 2025, projected to reach 14.1% by 2035, while Spain accounts for 9.0% in 2025, expected to reach 9.1% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 7.5% by 2035, attributed to increasing manufacturing modernization and growing security technology adoption across emerging industrial markets implementing advanced brand protection standards.

The holographic transfer film market is characterized by competition among established security printing companies, specialized holographic technology manufacturers, and integrated packaging solution providers. Companies are investing in advanced holographic technology research, manufacturing innovation, quality excellence, and comprehensive product portfolios to deliver effective, reliable, and visually appealing holographic transfer film solutions. Innovation in digital holography, smart security features, and integrated authentication systems is central to strengthening market position and competitive advantage.

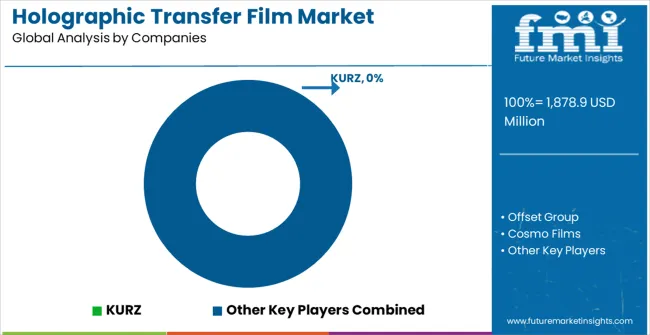

KURZ leads the market with comprehensive security printing solutions, offering advanced holographic transfer films with a focus on anti-counterfeiting effectiveness and premium visual appeal across diverse security applications. Offset Group provides specialized printing and packaging solutions with an emphasis on quality manufacturing and security printing capabilities. Cosmo Films delivers innovative packaging and lamination solutions with a focus on holographic applications and advanced film technologies. Holostik specializes in anti-counterfeiting technologies and holographic security solutions for brand protection applications. Uflex focuses on flexible packaging and security films with emphasis on innovation and comprehensive packaging solutions. Everest Holovisions Limited offers specialized holographic technologies with a focus on security applications and visual authentication.

Holographic transfer films represent a critical anti-counterfeiting segment within brand protection and security printing, projected to grow from USD 1,878.9 million in 2025 to USD 2,917.9 million by 2035 at a 4.5% CAGR. These specialized security films—primarily PET-based substrates with advanced holographic features—provide visual authentication and brand protection across cigarettes, alcohol, packaging, and document security applications. Market expansion is driven by escalating counterfeiting threats, increasing regulatory compliance requirements, growing brand protection investments, and rising adoption of smart authentication technologies that combine visual security with digital verification capabilities.

How Government Authorities Could Strengthen Anti-Counterfeiting and Intellectual Property Protection?

How Industry Associations Could Advance Security Standards and Best Practices?

How Holographic Technology Manufacturers Could Drive Innovation and Security Excellence?

How Brand Owners Could Optimize Product Protection and Authentication Systems?

How Security Printing and Packaging Companies Could Enhance Application Quality?

How Investors and Financial Enablers Could Support Market Development and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,878.9 million |

| Product | PET, PVC, BOPP(OPP), Others |

| Application | Cigarettes and Alcohol, Daily Sales, Packaging and Printing, Documents, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | KURZ, Offset Group, Cosmo Films, Holostik, Uflex, and Everest Holovisions Limited |

| Additional Attributes | Dollar sales by product and application category, regional demand trends, competitive landscape, technological advancements in holographic systems, digital security development, authentication innovation, and brand protection optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global holographic transfer film market is estimated to be valued at USD 1,878.9 million in 2025.

The market size for the holographic transfer film market is projected to reach USD 2,917.9 million by 2035.

The holographic transfer film market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in holographic transfer film market are pet, pvc, bopp(opp) and others.

In terms of application, cigarettes and alcohol segment to command 35.0% share in the holographic transfer film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Holographic Blister Foil Market Forecast Outlook 2025 to 2035

Holographic Labels Market Size and Share Forecast Outlook 2025 to 2035

Holographic Display Market Size and Share Forecast Outlook 2025 to 2035

Holographic Tear Tape Market

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Paper Market Analysis - Growth & Demand 2024 to 2034

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Heat Transfer Film Manufacturers

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Tacky Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

Lipid Transfer Proteins Market

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thermal Transfer Tapes Market

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA