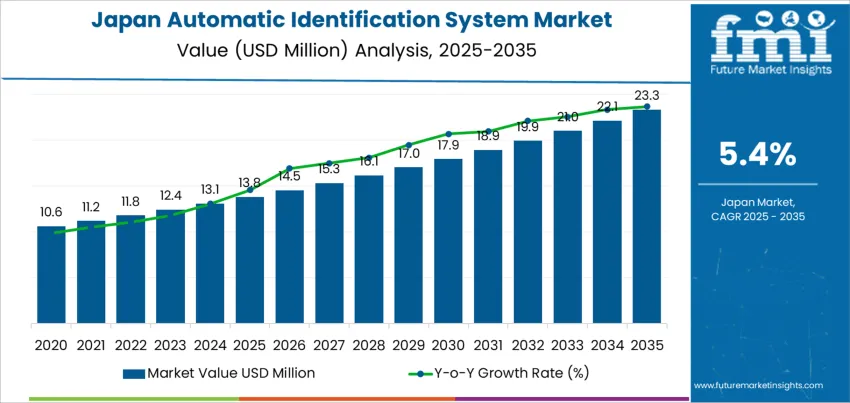

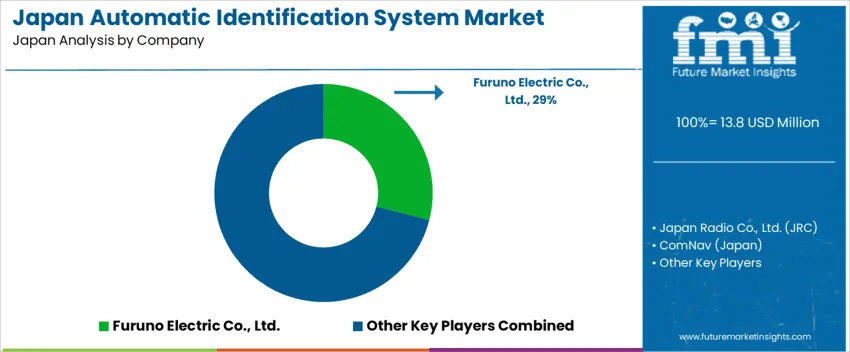

The Japan automatic identification system demand is valued at USD 13.8 million in 2025 and is forecasted to reach USD 23.3 million by 2035, reflecting a CAGR of 5.4%. Growth is shaped by the requirement for improved maritime navigation safety, compliance with vessel-tracking regulations, and increased coastal monitoring efficiency. Adoption strengthens as ports, fisheries, and maritime-security agencies reinforce digital oversight and collision-avoidance measures in congested waterways. Vessel-based AIS systems lead adoption. These units enable continuous transmission of vessel identity, heading, and operational status, supporting safe passage and incident prevention. Demand also gains from upgrades to legacy AIS equipment and integration with radar, electronic chart displays systems, and satellite-supported surveillance.

Kyushu & Okinawa, Kanto, and Kinki record the highest utilization due to significant shipping routes, dense port activities, and strong investments in maritime infrastructure. These areas maintain large fleets engaged in freight logistics, passenger transport, coastal fishing, and offshore operations. Key suppliers include Furuno Electric Co., Ltd.; Japan Radio Co., Ltd. (JRC); ComNav (Japan); Saab AB (Japan); and Garmin (Japan). Their systems support vessel-based tracking, enhanced situational awareness, and communication accuracy across commercial fleets and coastal transport networks.

Demand for Automatic Identification Systems in Japan shows a stronger growth pace in the later years of the forecast period. Early growth is guided by compliance-based deployments across commercial shipping fleets and designated coastal-monitoring zones. Installations support maritime safety tracking, collision-avoidance functions, and harbor-traffic coordination. The baseline expansion remains modest in the initial years due to the already well-equipped status of major ports and large vessels.

The second half of the decade reflects a broader installation footprint. Growth is supported by expanded monitoring policies for small and mid-size vessels, greater data-integration requirements for maritime logistics, and upgraded shore-based tracking systems. Digital modernization of Japan’s maritime infrastructure contributes to higher annual increments as data accuracy and situational-awareness improvements drive replacement demand. As a result, the later period contributes a larger share to cumulative gains, with adoption shifting from regulatory minimums to enhanced operational visibility. The comparison indicates a transition from steady foundational expansion to more technology-driven deployments as integration with navigation analytics and fleet-management systems becomes standardized.

| Metric | Value |

|---|---|

| Japan Automatic Identification System Sales Value (2025) | USD 13.8 million |

| Japan Automatic Identification System Forecast Value (2035) | USD 23.3 million |

| Japan Automatic Identification System Forecast CAGR (2025-2035) | 5.4% |

Demand for automatic identification systems in Japan is increasing because maritime operators, port authorities and coastal surveillance units require accurate vessel tracking to support navigation safety. Japan has busy shipping routes for commercial cargo, fishing fleets and passenger transport, which drives adoption of AIS transceivers and monitoring software that provide continuous vessel identification, heading and speed information. Ports and harbor administrations use AIS data to improve traffic coordination, detect congestion and manage docking schedules more efficiently. Offshore infrastructure, including energy facilities and undersea communication lines, relies on AIS monitoring to prevent vessel collisions in restricted zones.

Coast Guard and security agencies integrate AIS with radar and satellite data to support search and rescue and early response to unauthorized vessel entry. Fishing cooperatives also rely on AIS to demonstrate compliance with maritime rules and maintain transparency in catch operations. Constraints include high equipment cost for small fishing boats, limited digital skills in older fleets and patchy signal quality in areas with complex coastlines. Some vessels avoid AIS transmission due to privacy concerns or maintenance issues, which creates gaps that authorities must address through additional monitoring systems.

Demand for Automatic Identification Systems (AIS) in Japan is supported by maritime traffic density, coastal surveillance requirements, and international compliance with navigational safety standards. The technology strengthens collision avoidance, real-time vessel monitoring, and port-management efficiency across Japan’s extensive commercial shipping and fishing sectors. Government initiatives reinforce continuous tracking to protect territorial waters and ensure secure trade passage. Adoption aligns with the modernization of maritime logistics, automation in fleet coordination, and risk mitigation for high-value cargo routes. Integration with satellite AIS and enhanced communication systems supports data reliability under varying maritime conditions.

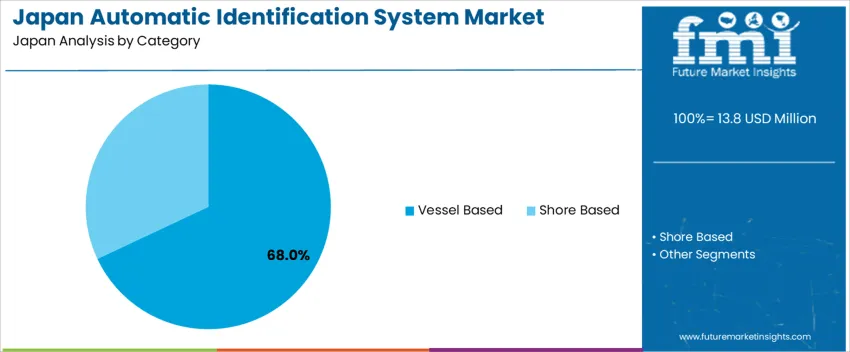

Vessel-based systems account for 68.0%, driven by regulatory enforcement for commercial ships, passenger ferries, and large fishing vessels navigating domestic and international waters. These systems transmit dynamic and static positioning data to prevent collisions and improve route planning. Shore-based systems hold 32.0%, supporting coastal monitoring, port-operations control, and maritime domain awareness. Port authorities and coastal security agencies rely on land-based infrastructure to detect non-compliant vessel activity. Category adoption reflects vessel-level responsibility for identification and communication, supported by national oversight enhancing situational awareness across busy Japanese waterways.

Key points:

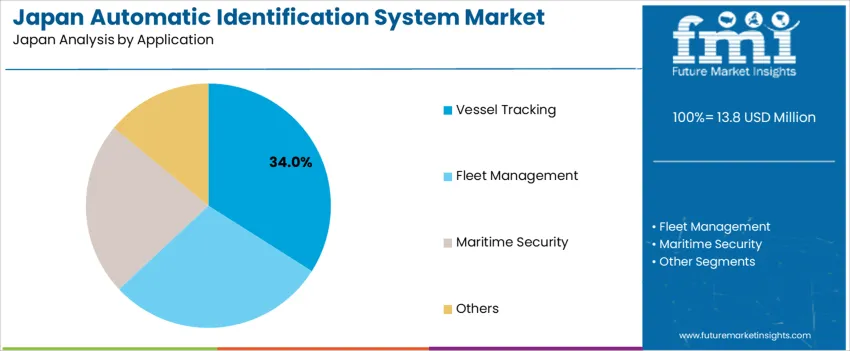

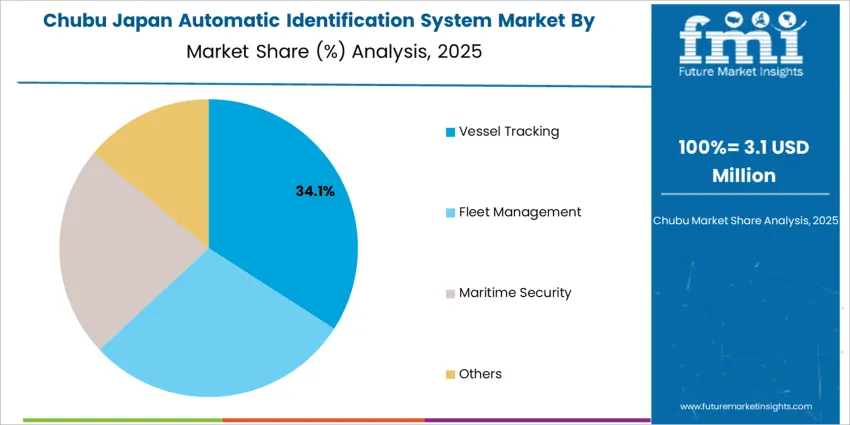

Vessel tracking accounts for 34.0%, ensuring safe navigation and optimized movement across trade lanes. Fleet management holds 29.0%, supporting fuel-efficiency monitoring and operational scheduling for commercial operators. Maritime security represents 23.0%, used to identify suspicious activity and enforce protective surveillance. Other applications hold 14.0%, involving search-and-rescue coordination and environmental monitoring. Application trends highlight AIS as a core element in Japan’s maritime governance strategy, enhancing operational efficiency and safety standards within regional and global shipping routes.

Key points:

Growth of maritime traffic monitoring, expansion of coastal safety enforcement and increased use of AIS in port logistics are driving demand.

In Japan, AIS demand is shaped by the dense concentration of commercial shipping around major ports such as Tokyo Bay, Osaka Bay and Nagoya, where continuous vessel tracking is required for traffic management and collision prevention. The Japan Coast Guard uses AIS data to strengthen maritime patrol operations, particularly around territorial boundaries and busy fisheries in Hokkaido and Kyushu. Port logistics operators adopt AIS-integrated navigation tools to optimize berthing schedules and reduce congestion during container handling. Coastal ferry networks serving remote islands rely on AIS to maintain safe routing in narrow channels and weather-affected waters. These operational requirements support consistent procurement of AIS transponders and monitoring infrastructure nationwide.

Aging vessel fleets, limited digital capabilities in small fishing boats and cost sensitivity among regional operators restrain adoption.

Many small fishing boats and older domestic cargo vessels continue operating with dated navigation systems, making AIS upgrades slower without targeted support programs. Smaller operators in rural prefectures prioritize engine and hull maintenance over electronic modernization, limiting uptake despite safety benefits. Initial installation cost and training requirements create hesitation for boat owners with low seasonal income variance, especially in local fisheries. These financial and technology gaps contribute to uneven adoption across vessel categories.

Shift toward Class B AIS upgrades, increased integration with coastal radar networks and rising demand for data analytics in port operations define key trends.

Fishing cooperatives and community-based maritime associations are encouraging upgrades to Class B AIS units to improve vessel visibility in shared fishing zones. Port authorities strengthen situational awareness by integrating AIS feeds with radar and weather systems to support route optimization and incident response. Logistics operators are adopting AIS-based analytics to track turnaround time, fuel consumption and waiting periods, contributing to data-driven efficiency improvements. Research groups working on autonomous shipping trials also rely on AIS for communication between crewed and remotely operated vessels. These trends indicate steady, safety-oriented expansion of AIS use throughout Japan’s maritime and port ecosystems.

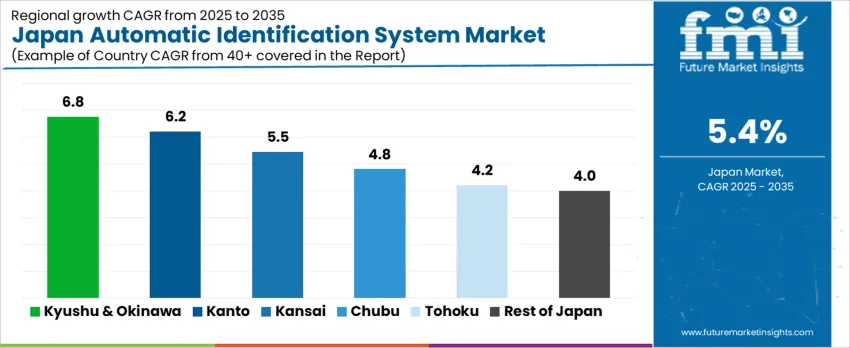

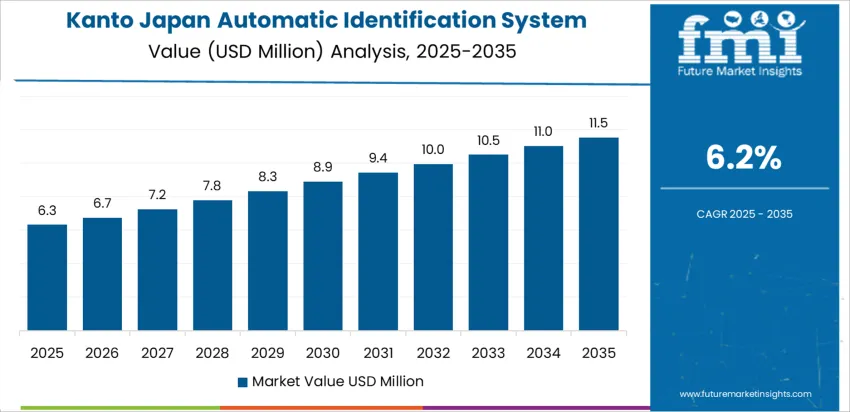

Automatic Identification Systems support maritime traffic monitoring, vessel identification, collision avoidance, and coastal logistics coordination in Japan’s operational waters. Demand follows port activity, coastal shipping volumes, and adoption of electronic navigation standards within fishing and commercial fleets. Procurement emphasizes signal reliability, integration with onboard communication, and stable data exchange with coastal monitoring infrastructure. Kyushu & Okinawa leads at 6.8% CAGR, reflecting dense maritime operations, followed by Kanto (6.2%), Kinki (5.5%), Chubu (4.8%), Tohoku (4.2%), and Rest of Japan (4.0%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.8% |

| Kanto | 6.2% |

| Kinki | 5.5% |

| Chubu | 4.8% |

| Tohoku | 4.2% |

| Rest of Japan | 4.0% |

Kyushu & Okinawa posts 6.8% CAGR, supported by busy coastal routes, fishery operations, and port handling at Hakata and Kagoshima. Smaller fishing vessels upgrade AIS to improve collision avoidance and regulatory compliance near traffic-dense straits. Cargo and passenger ferries traveling between islands require tracking systems that maintain stable broadcasting in varied weather conditions. Maritime distribution of fuel, materials, and food products relies on accurate vessel identification to coordinate port slots and reduce delay risk. Procurement emphasizes device durability, low-power functionality, and compatibility with existing radar and onboard systems. Regional monitoring stations expand digital mapping coverage to reduce blind zones near small ports. Growing tourism movement through ferry networks maintains consistent equipment renewal when fleets undergo modernization cycles.

Kanto records 6.2% CAGR, driven by the Tokyo Bay shipping corridor where commercial vessel movements require continuous identification and stable tracking. Port operations in Yokohama and Chiba depend on AIS for queue management and berthing coordination. Large logistical vessels and container carriers maintain compliance with updated tracking protocols. Procurement focuses on integration with electronic chart display systems used in cargo fleets. Coastal patrol agencies rely on AIS data to monitor harbor safety and vessel routing. Upgrades replace earlier-generation transceivers with units offering improved range and signal processing to manage high-density maritime movement.

Kinki expands at 5.5% CAGR, shaped by maritime activities around Osaka Bay, Kobe, and Wakayama ports. Cargo terminals and regional distribution operations require AIS to support safe entry and departure scheduling. Fishing fleets operating in offshore zones adopt identification devices to align with modern surveillance systems. Vessel operators favor equipment that withstands vibration and exposure associated with frequent docking movements. Training centers for maritime navigation in Osaka increase awareness of digital tracking requirements among new crew.

Chubu posts 4.8% CAGR, reflecting industrial exports through Nagoya Port and smaller cargo movements servicing regional manufacturing supply chains. AIS supports routing transparency for vessels carrying automotive and machinery shipments. Buyers evaluate compatibility with digital port-management tools used for schedule synchronization. Fishing communities use AIS for spatial awareness during coastal operations. Incremental modernization replaces older units based on maintenance cost reviews.

Tohoku posts 4.2% CAGR, influenced by regional fishing activity, seasonal offshore navigation, and modernization of coastal safety systems across Miyagi, Aomori, and Iwate. Long-distance fishing routes in the Pacific require continuous visibility to coordinate separation from cargo carriers traveling near major transit paths. Cold-season weather patterns create operational risks that require AIS transceivers with stable signal recovery and moisture-resistant build quality. Seafood distribution hubs depend on reliable vessel data for receiving schedules, enabling more predictable harbor entry and turnaround cycles. Smaller transport operators seek AIS upgrades when renewing vessel components to preserve safety compliance. Public-sector initiatives support digital mapping in coastal zones, introducing greater coverage in locations previously affected by blind spots. Maritime response teams use AIS data to support search operations and infrastructure monitoring.

Rest of Japan records 4.0% CAGR, reflecting ongoing compliance upgrades in commercial fleets, cargo barges, and smaller passenger vessels operating away from Japan’s primary seaports. Demand is driven by adherence to safety protocols rather than fleet expansion, as vessel turnover remains gradual in regional waters. Procurement cycles prioritize durable AIS transceivers with standard functionality, limiting compatibility risks with existing navigation consoles. Operators focus on solutions that maintain appropriate transmission range for cross-coast and near-shore travel patterns, supporting communication with maritime authorities. Local shipyards integrate AIS during periodic retrofits when replacing antennas, power controls, or radar-adjacent installations. Training programs reinforce operational familiarity, ensuring crews manage identification workflows without advanced configurations. Coastal monitoring systems expand data reception capacity, enhancing oversight in developing ports and fishing zones.

Demand for automatic identification systems in Japan is supported by suppliers providing Class-A and Class-B AIS transceivers to commercial fleets, coastal patrol vessels, and regulated fishing operations. Furuno Electric Co., Ltd. holds about 29.0% share, supported by stable signal reliability, consistent GNSS integration, and long-standing supply relationships with Japanese shipbuilders. Its terminals deliver precise vessel-position broadcasting and dependable reception under congested coastal tracking conditions.

Japan Radio Co., Ltd. (JRC) maintains strong participation with AIS equipment designed for commercial bridge systems where uninterrupted maritime communications and rigorous certification compliance are required. ComNav Japan supports selective deployment in fishing and coastal-cargo vessels through transceivers offering predictable transmission accuracy and straightforward onboard integration.

Saab AB Japan contributes presence in ports, pilot services, and government operations using AIS solutions that support port-traffic management and maritime-safety monitoring. Garmin Japan provides equipment suited to smaller vessels requiring stable AIS messaging and clear situational-awareness interfaces. Competition in Japan focuses on transmission reliability, VHF-band clarity, installation compatibility, signal-processing integrity, and long-term service availability. Demand remains steady where navigation-safety systems must ensure consistent vessel tracking throughout Japan’s dense coastal shipping environment.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Category | Vessel Based, Shore Based |

| Application | Vessel Tracking, Fleet Management, Maritime Security, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Furuno Electric Co., Ltd., Japan Radio Co., Ltd. (JRC), ComNav (Japan), Saab AB (Japan), Garmin (Japan) |

| Additional Attributes | Dollar demand by AIS technology category and maritime applications; adoption supported by compliance with IMO and Japanese Coast Guard regulations; integration with navigation systems, radar, and coastal surveillance networks; key deployment in high-traffic zones including Kanto and Chubu ports; rising use in fisheries monitoring, marine safety, and vessel automation programs. |

The demand for automatic identification system in Japan is estimated to be valued at USD 13.8 million in 2025.

The market size for the automatic identification system in Japan is projected to reach USD 23.3 million by 2035.

The demand for automatic identification system in Japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automatic identification system in Japan are vessel based and shore based.

In terms of application, vessel tracking segment is expected to command 34.0% share in the automatic identification system in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Identification System Market Analysis by Category, Application, and Region through 2035

Demand for Automatic Identification System in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Automatic Tire Inflation System Market Growth - Trends & Forecast 2025 to 2035

Japan Visitor Management System Market Growth - Trends & Forecast 2025 to 2035

Japan Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

Japan Battery Management System Market Growth – Trends & Forecast 2023-2033

Automatic Clotting Timer Systems Market

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

Automatic Vehicle Washing System Market

Automatic Fire Suppression System Market Growth - Trends & Forecast 2025 to 2035

Automatic Message Handling System Market

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Demand for VRF Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Checkweigher in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA