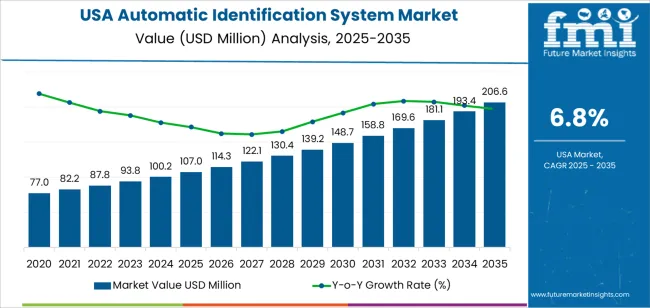

The demand for automatic identification systems (AIS) in the USA is expected to grow from USD 107.0 million in 2025 to USD 207.4 million by 2035, demonstrating a compound annual growth rate (CAGR) of 6.8%. AIS are critical technologies used for identifying and tracking objects, typically in maritime and logistics sectors, through advanced methods such as radio frequency identification (RFID), barcode scanning, and biometric verification. As industries across the country adopt smarter, more efficient tracking and identification technologies, the market for AIS will expand, particularly in sectors such as transportation, supply chain management, and security.

The market growth for AIS exhibits a steady but accelerating curve. The early years, from 2025 to 2030, show incremental growth driven by technology adoption in logistics and transportation. From 2030 to 2035, the growth curve steepens, reflecting a broader shift toward automation and enhanced security systems, alongside rising adoption of biometric and RFID technologies across industries. The growth will be shaped by technological advancements, industry regulations, and the evolving demands for more efficient and secure identification solutions across critical infrastructure.

From 2025 to 2030, the demand for AIS in the USA is expected to grow from USD 107.0 million to USD 114.3 million. This early phase will see steady growth driven by the continued adoption of RFID systems, smart tags, and inventory management tools in logistics, retail, and transportation. The increased focus on improving operational efficiency and security across industries will drive this trend. As the transportation sector continues to modernize and the e-commerce industry grows, AIS will become even more integral in managing the flow of goods, ensuring inventory accuracy, and streamlining supply chains.

From 2030 to 2035, demand is projected to experience stronger growth, increasing from USD 114.3 million to USD 207.4 million. This rapid acceleration will be fueled by the expanding use of biometric identification and advanced tracking systems across maritime industries, airports, and border control systems. As the demand for real-time asset tracking and automated identification continues to rise, industries will seek AIS solutions that improve efficiency, reduce human error, and increase operational transparency. Furthermore, the ongoing trend toward digital transformation and data analytics will contribute to the growing market for AIS as industries integrate advanced identification technologies into their operations.

| Metric | Value |

|---|---|

| Demand for Automatic Identification System in USA Value (2025) | USD 107.0 million |

| Demand for Automatic Identification System in USA Forecast Value (2035) | USD 207.4 million |

| Demand for Automatic Identification System in USA Forecast CAGR (2025-2035) | 6.8% |

The demand for automatic identification systems (AIS) in the USA is growing as industries increasingly adopt advanced technologies to enhance security, tracking, and efficiency. AIS, which uses radio frequency identification (RFID) and satellite communications to automatically identify and track ships, vehicles, cargo, and other assets, is becoming essential for applications in maritime transportation, logistics, and supply chain management. As the USA continues to expand its global trade and shipping operations, the need for reliable, real-time asset tracking and monitoring is driving the demand for AIS solutions.

A key driver of this growth is the increasing need for enhanced maritime safety and navigation. AIS technology plays a critical role in monitoring vessel movements, preventing collisions, and ensuring safe maritime operations. With the rise in global shipping activities and the complexity of modern logistics networks, AIS is becoming more integral to managing port operations, traffic control, and vessel tracking. As the USA’s maritime sector grows and modernizes, the adoption of AIS systems will continue to increase.

The logistics and supply chain industries are increasingly utilizing AIS technology to improve asset tracking, enhance inventory management, and reduce operational risks. AIS enables real-time visibility of cargo and vehicles in transit, allowing for better decision-making, more efficient operations, and improved customer service. As the demand for faster, more reliable supply chain management solutions grows, the demand for AIS technology in the USA is expected to continue rising through 2035, driven by its ability to improve security, efficiency, and operational control across various sectors.

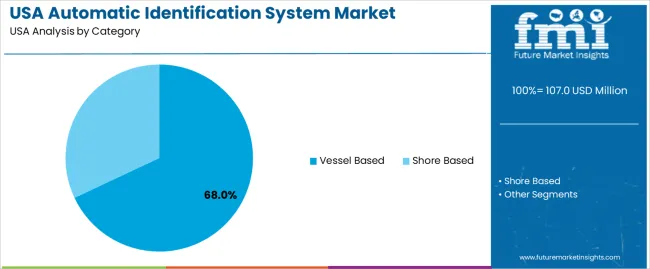

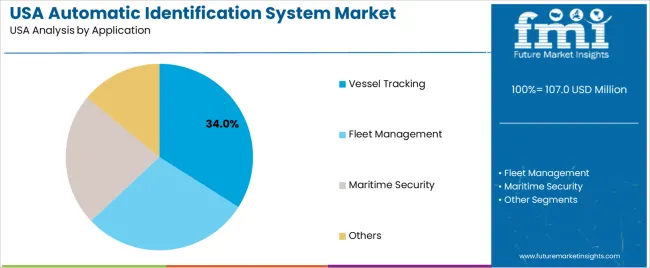

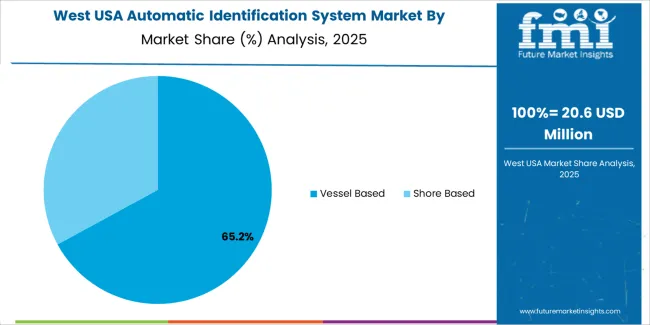

Demand for automatic identification systems (AIS) in the USA is segmented by category and application. By category, demand is divided into vessel-based and shore-based systems. These systems are primarily used for real-time tracking and identification of vessels, providing essential data for navigational safety and maritime operations. The demand is also segmented by application, including vessel tracking, fleet management, and maritime security. AIS is crucial for tracking the movement of vessels, ensuring safe navigation, and preventing collisions in busy waterways. Regionally, demand is distributed across the West USA, South USA, Northeast USA, and Midwest USA.

Vessel-based systems account for 68% of the demand for automatic identification systems (AIS) in the USA. These systems are integral for real-time tracking and identification of vessels, providing valuable data for navigation, collision avoidance, and maritime safety. Vessel-based AIS systems are installed directly on ships and transmit vital information such as location, speed, and direction, which can be monitored by both the vessel itself and shore-based systems.

These systems are crucial for ensuring safe passage through congested waterways and maintaining situational awareness. As the shipping industry faces increasing pressure to enhance safety, efficiency, and regulatory compliance, vessel-based AIS systems remain the primary choice for real-time tracking and data exchange. The growing demand for fleet management and enhanced maritime security continues to drive the dominance of vessel-based AIS solutions in the market.

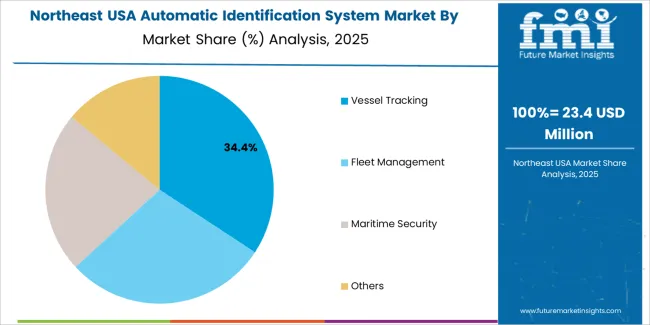

Vessel tracking accounts for 34% of the demand for automatic identification systems (AIS) in the USA. Vessel tracking is a critical application of AIS technology, enabling the real-time monitoring of vessel movements across oceans, rivers, and coastal areas. This data is essential for improving maritime safety, ensuring vessels follow safe routes, avoiding collisions, and monitoring compliance with shipping regulations.

As global shipping activities increase, the demand for reliable vessel tracking solutions continues to rise, making AIS an indispensable tool for the maritime industry. Vessel tracking helps fleet operators optimize routes, improve operational efficiency, and enhance overall fleet management. Vessel tracking is integral to maritime security, as it allows authorities to identify and track vessels in real-time, ensuring safer waters. With advancements in maritime technology and increasing concerns about shipping security, the demand for vessel tracking continues to lead the AIS application segment.

Demand for automatic identification systems in USA is rising as industries and consumers increasingly seek accurate, efficient, and reliable tracking and data capture solutions in sectors like healthcare, retail, logistics, food processing, and manufacturing. Growth in e-commerce, parcel delivery, and supply‑chain logistics drives the need for precise weighing and asset tracking. The rising focus on health and wellness increases demand for digital body‑weight scales and connected "smart" health devices for monitoring.

Technological advancements, such as better sensors and digital displays, are enhancing the accuracy, portability, and connectivity of these systems. Challenges like high costs, integration complexity, and regulatory compliance requirements for various industries (such as healthcare) may limit the widespread adoption of these systems in cost-sensitive sectors.

In USA, demand is growing as industries face increasing pressure to improve operational efficiency, reduce errors, and comply with regulatory standards. Automatic identification systems like RFID, barcode/QR scanning, and sensor technologies allow businesses to track assets and inventory, enhancing supply‑chain visibility, reducing manual errors, and speeding up operational processes. The healthcare industry, including pharmacies and medical facilities, also drives demand for these technologies to monitor and track patients and medication accurately. The growing demand for real‑time data, enhanced traceability, and improved safety in industries like logistics, food processing, and maritime sectors is contributing to the rising demand for advanced automatic identification systems.

Technological advances are boosting the demand for automatic identification systems. The development of more advanced RFID tags, sensor integration, cloud‑based data processing, and real‑time monitoring systems is improving the functionality and efficiency of AIDC solutions. These innovations make the systems more scalable and cost‑effective for a variety of industries.

For example, in logistics, automated identification systems streamline inventory management, reduce human errors, and optimize warehouse operations. Innovations in satellite and hybrid terrestrial AIS systems enhance real‑time tracking and monitoring, driving growth in sectors like maritime logistics and fleet management. These technologies also enable better compliance with industry standards and increase the operational efficiency of businesses across multiple industries.

Despite strong growth in demand, there are several challenges limiting the broader adoption of automatic identification systems. One key issue is the upfront cost of implementing these systems, especially for small and medium‑sized businesses. These systems require substantial investment in hardware, software, and infrastructure, which may deter smaller companies. Another challenge is the complexity of integrating automatic identification systems with existing legacy systems.

Data security and privacy concerns related to tracking individuals, assets, and inventory can create resistance from stakeholders, particularly in industries that handle sensitive information. The lack of standardization and interoperability between different AIDC technologies and systems can complicate implementation and reduce the return on investment for businesses adopting these technologies.

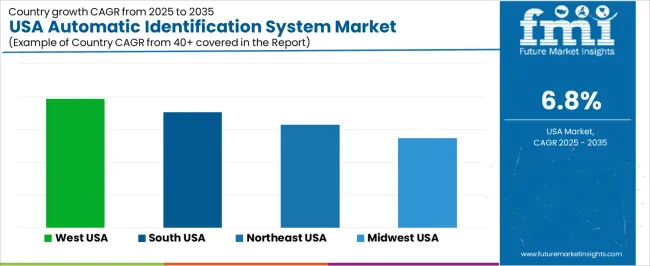

| Region | CAGR (%) |

|---|---|

| West USA | 7.9% |

| South USA | 7.0% |

| Northeast USA | 6.3% |

| Midwest USA | 5.5% |

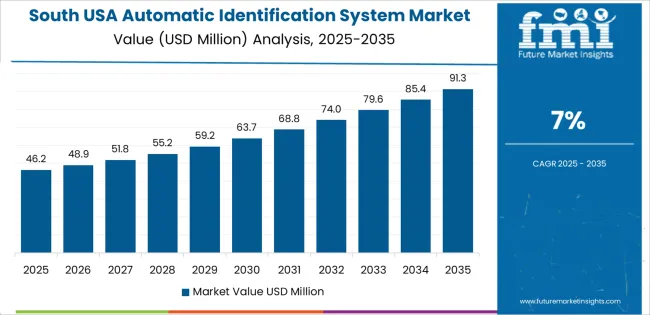

Demand for Automatic Identification Systems (AIS) in the USA is growing steadily, with West USA leading at a 7.9% CAGR, driven by its large maritime, logistics, and transportation sectors. The region’s extensive coastline, busy ports, and focus on technological advancements make AIS essential for efficient vessel tracking and navigation. South USA follows with a 7.0% CAGR, supported by major port operations like those in Houston and Miami, which rely heavily on AIS for traffic management and maritime safety.

Northeast USA shows a 6.3% CAGR, with demand driven by busy harbors such as New York and Boston, where AIS plays a key role in port efficiency and vessel safety. Midwest USA experiences a 5.5% CAGR, with growing demand for AIS in inland waterways like the Great Lakes and river systems, supporting safe and efficient transportation.

West USA is leading the demand for Automatic Identification System (AIS), growing at a 7.9% CAGR. This growth is driven by the region's robust maritime, logistics, and transportation industries, which are major users of AIS technologies for tracking and identification of vessels in real-time. The region's extensive coastline, particularly along California, makes AIS systems essential for port management, maritime safety, and navigation. West USA's significant focus on advanced technologies, including automation, IoT, and smart ports, contributes to the increasing adoption of AIS for efficient vessel management, collision avoidance, and maritime security.

The region’s strong transportation and logistics sectors are also driving AIS demand, as the system plays a crucial role in managing the movement of goods and ensuring safety in high-traffic areas. With growing investments in port infrastructure and maritime innovation, the demand for AIS in West USA is expected to continue its upward trajectory, supporting the region's maritime operations.

South USA is experiencing steady demand for Automatic Identification Systems (AIS), with a 7.0% CAGR. The region’s maritime industry, particularly in states like Florida, Louisiana, and Texas, is a key driver of this growth. With busy ports such as the Port of Houston and Port of Miami, AIS systems are critical for managing vessel traffic, ensuring safe navigation, and providing real-time location tracking. The adoption of AIS is also growing in the oil and gas sector, where vessels and platforms rely on the system for tracking and communication.

The South’s thriving logistics and transportation industries are also contributing to the demand for AIS, as it helps improve the efficiency of freight movement and port operations. With increasing efforts to enhance port safety, reduce accidents, and improve traffic management, the demand for AIS in South USA is expected to continue rising, supported by both traditional maritime and emerging industrial applications.

Northeast USA is seeing moderate demand for Automatic Identification Systems (AIS), with a 6.3% CAGR. The region's key maritime hubs, including New York Harbor, Boston, and other coastal areas, rely heavily on AIS for safe vessel navigation and traffic management. The demand is driven by the increasing need for accurate, real-time vessel tracking and communication to enhance port operations, improve maritime safety, and avoid potential collisions. AIS is also essential for commercial shipping, recreational boating, and government vessels to comply with safety regulations and ensure efficient movement through busy waterways.

The Northeast's continued investment in port infrastructure and smart technology initiatives also contributes to the rising adoption of AIS systems. As the region’s port operations become more digitized and automated, the need for AIS will continue to grow. With the expansion of both domestic and international maritime trade, Northeast USA’s demand for AIS is expected to increase steadily, providing vital support to the region’s shipping and logistics industries.

Midwest USA is experiencing moderate growth in the demand for Automatic Identification Systems (AIS), with a 5.5% CAGR. Although the region does not have a significant coastline, it is home to vital inland waterways, including the Great Lakes and major river systems, which rely on AIS for vessel tracking and navigation. AIS is crucial for ensuring safe passage and efficient traffic management on these inland routes, which are essential for transporting goods throughout the Midwest and beyond.

The region’s demand for AIS is also being driven by the increasing need for improved logistics and transportation systems. As more goods are transported via water routes, particularly for industries such as agriculture, manufacturing, and energy, the demand for AIS to manage vessel movements and enhance safety continues to rise. The steady growth in the region’s logistics infrastructure, coupled with a push for smarter, more efficient systems, will ensure that AIS remains an important technology for inland navigation and waterway management in the Midwest.

The demand for automatic identification systems in the USA is rising steadily, driven by the need for efficient vessel tracking and navigation solutions in both commercial and military maritime operations. AIS plays a crucial role in enhancing marine safety by providing real-time data on vessel positions, movements, and identities, improving situational awareness, and preventing collisions. With increasing international shipping activities, stricter regulations, and advancements in marine technology, the AIS market is expected to grow at a healthy rate, especially in sectors like shipping, logistics, and maritime security.

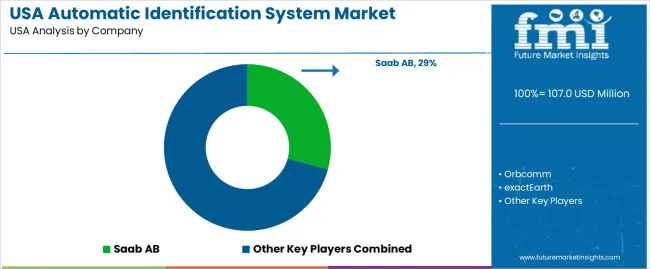

Leading providers in the AIS market in the USA include Saab AB, Orbcomm, exactEarth, Furuno Electric Co., Ltd., and Garmin Ltd.. Saab AB holds the largest market share of 29.3%, offering advanced AIS solutions for maritime safety, navigation, and communication. Orbcomm provides satellite-based AIS services that enable global vessel tracking and monitoring. exactEarth specializes in AIS satellite-based data services for maritime tracking, delivering real-time data for shipping logistics and security. Furuno Electric Co., Ltd. is a key player, offering a range of AIS products for both commercial and leisure maritime sectors. Garmin Ltd. provides AIS receivers and systems that cater to the recreational boating and commercial shipping industries.

Competition in the AIS market is driven by factors such as the increasing demand for real-time vessel tracking, growing concerns over maritime safety, and the push for regulatory compliance in the shipping industry. Companies compete by offering advanced AIS technologies that ensure higher accuracy, broader coverage, and improved integration with other maritime navigation systems. The growing reliance on satellite-based AIS for global vessel monitoring and the need for more user-friendly, reliable solutions in both commercial and recreational maritime applications are key differentiators.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Category | Vessel Based, Shore Based |

| Application | Vessel Tracking, Fleet Management, Maritime Security, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Saab AB, Orbcomm, exactEarth, Furuno Electric Co., Ltd., Garmin Ltd. |

| Additional Attributes | Dollar sales by category and application; regional CAGR and adoption trends; demand trends in automatic identification systems; growth in vessel tracking, fleet management, and maritime security; technology adoption for vessel tracking and fleet management systems; vendor offerings including AIS solutions and services; regulatory influences and industry standards |

The demand for automatic identification system in USA is estimated to be valued at USD 107.0 million in 2025.

The market size for the automatic identification system in USA is projected to reach USD 206.6 million by 2035.

The demand for automatic identification system in USA is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in automatic identification system in USA are vessel based and shore based.

In terms of application, vessel tracking segment is expected to command 34.0% share in the automatic identification system in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Identification System Market Analysis by Category, Application, and Region through 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Tire Inflation System Market Growth - Trends & Forecast 2025 to 2035

Automatic Clotting Timer Systems Market

Automatic Vehicle Washing System Market

Automatic Fire Suppression System Market Growth - Trends & Forecast 2025 to 2035

Automatic Message Handling System Market

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Checkweigher in USA Size and Share Forecast Outlook 2025 to 2035

Biometric Driver Identification System Market Growth - Trends & Forecast 2025 to 2035

Demand for Automatic Gearbox Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Cartridges for RT-PCR Automatic Systems Market

Demand for Automatic Dishwashing Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Palletizing Systems in USA Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA