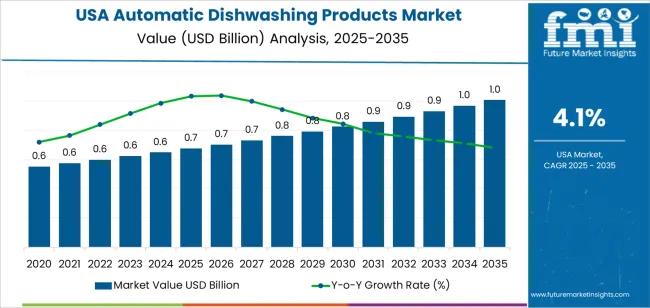

The USA automatic dishwashing products demand is valued at USD 0.7 billion in 2025 and is projected to reach USD 1.0 billion by 2035, reflecting a CAGR of 4.1%. Demand growth is influenced by higher household adoption of automatic dishwashers, increased time-saving preferences among working populations, and greater consumer focus on hygienic cleaning outcomes. Product selection is shaped by formulation advancements improving stain removal, reduced water hardness effects, and material compatibility with modern dishwasher interiors. Sustainability expectations and growth in e-commerce sales channels further support expansion.

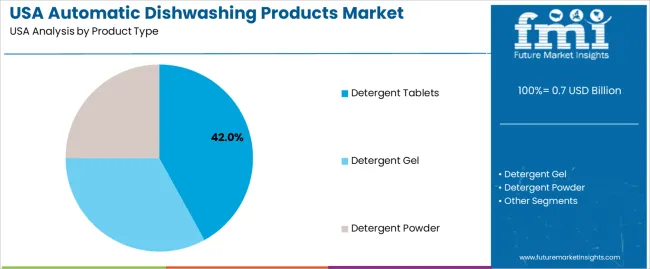

Detergent tablets lead the product landscape. These formats are preferred for ease of dosage, convenience, and compatibility with energy-efficient dishwasher cycles. Multi-enzyme technology, film-coated packaging, and rinse-aid combinations enhance adoption in both residential and small commercial settings. Expanding availability of low-waste and phosphate-free formulations also aligns with regulatory and environmental priorities.

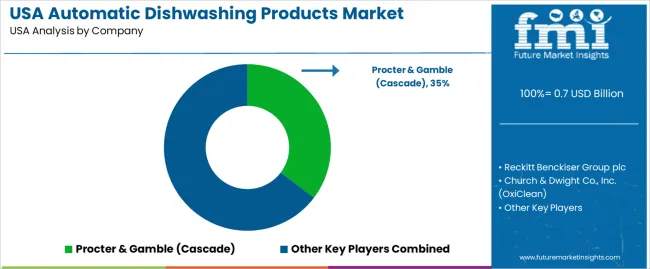

West USA, South USA, and Northeast USA record the highest utilization due to the concentration of dishwasher installations, higher disposable incomes, and consistent upgrades in modern kitchen appliances. Retail penetration through supermarkets, online grocery platforms, and subscription-based household-cleaning delivery services also supports demand in these regions. Key suppliers include Procter & Gamble (Cascade), Reckitt Benckiser Group plc, Church & Dwight Co., Inc. (OxiClean), Colgate-Palmolive Company, and Blueland. These companies offer detergent tablets, gels, powders, and eco-friendly cleaning solutions used in domestic and small commercial dishwashing applications across the United States.

The growth contribution index for automatic dishwashing products in the United States reflects a stable but increasing role in household and commercial cleaning expenditure. Penetration of dishwashers remains uneven across residential segments, yet usage frequency is rising among existing owners, supporting consistent chemical demand. Growth contributions are driven by concentrated formulations, pod-based units, rinse-aid combinations, and enzyme-enhanced cleaning solutions. Product upgrades linked to hard-water residue removal and low-temperature wash compatibility lift value addition relative to basic detergents.

Commercial sectors, particularly foodservice chains and institutional kitchens, provide secondary contributions through higher-volume cycle usage. Ecofriendly requirements accelerate the shift toward phosphate-free and biodegradable ingredients, supporting premium pricing. Packaged value growth outpaces volume growth due to portion-controlled formats. Contribution from first-time dishwasher adopters is modest, indicating that established user bases remain the primary driver. The index shows consistent medium-trajectory contribution without sharp accelerations. Innovation in convenience dosing, compatibility with energy-efficient appliances, and odor-management technologies remains central to incremental growth contribution over the next decade.

| Metric | Value |

|---|---|

| USA Automatic Dishwashing Products Sales Value (2025) | USD 0.7 billion |

| USA Automatic Dishwashing Products Forecast Value (2035) | USD 1.0 billion |

| USA Automatic Dishwashing Products Forecast CAGR (2025-2035) | 4.1% |

Demand for automatic dishwashing products in the USA is increasing because more households rely on dishwashers as a regular cleaning method, especially in suburban and multi-unit homes. Consumers prefer detergents, rinse aids and machine cleaners that deliver efficient cleaning in shorter cycles while reducing residue on dishes and glassware. Growth in energy-efficient and water-saving dishwashers also supports higher usage of compatible cleaning products formulated for low-temperature and quick-wash programs.

Convenience is a strong driver, with busy families and working professionals seeking time savings and reduced kitchen cleanup. Retailers expand availability of convenient formats such as tablets, pods and gels that simplify dosing and improve cleanliness. Concerns about hygiene since recent public health events have encouraged households to clean dishes more frequently using machine cycles rather than handwashing. Manufacturers respond by introducing products with improved grease removal, reduced spotting and fragrances aligned with consumer preferences. Environmental goals also shift demand toward phosphate-free formulations and packaging that supports recycling.

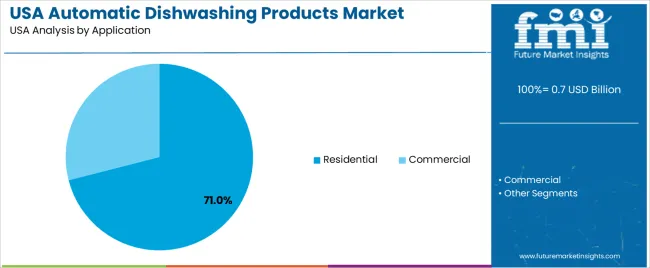

Demand for automatic dishwashing products in the United States is supported by high dishwasher penetration across households and increased reliance on quick cleaning solutions within commercial kitchens. USA consumers prioritize convenience, residue reduction, and compatibility with modern dishwasher systems. Residential USAge drives most consumption, while foodservice and hospitality sectors contribute steady demand for high-performance cleaners suitable for large-scale operations. Product selection is influenced by cleaning performance, formulation, and environmental compliance, including phosphate-free requirements.

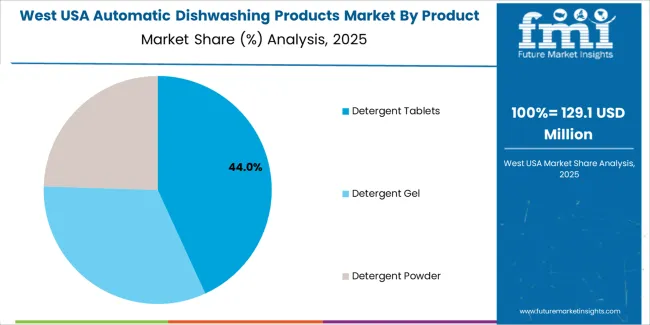

Detergent tablets account for 42.0%, reflecting their convenience, portion control, and strong cleaning stability. These units dissolve consistently and reduce the risk of under- or over-dosing, supporting widespread household use. Detergent gel represents 33.0%, used by consumers seeking adjustable dosing and quick-acting cleaning properties. Detergent powder holds 25.0%, with demand concentrated among users maintaining older dishwashing appliances or purchasing value-oriented formats. Product distribution in the United States follows a trend toward multi-functional tablets with rinse aids and film-reducing agents integrated into compact units. Adoption aligns with preferences for simplified cleaning routines and predictable performance across diverse dishwasher configurations and load sizes.

Key points:

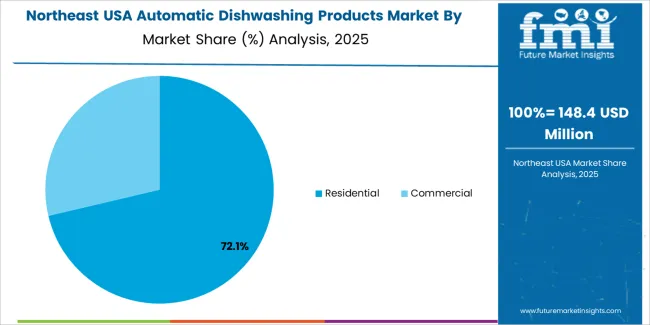

Residential applications hold 71.0%, driven by broad household dishwasher adoption and frequent cleaning cycles within USA homes. These users prioritize product availability, stain removal consistency, and compatibility with energy-efficient appliances. Commercial applications represent 29.0%, including restaurants, hotels, and institutional kitchens requiring controlled cleaning chemicals and predictable results across continuous operation. Commercial users often rely on procurement contracts and formulations designed for high-temperature wash programs. Application trends reflect the scale of household consumption compared to commercial operations, supported by retail accessibility and routine cleaning needs that maintain product turnover across diverse geographic regions and household sizes.

Key points:

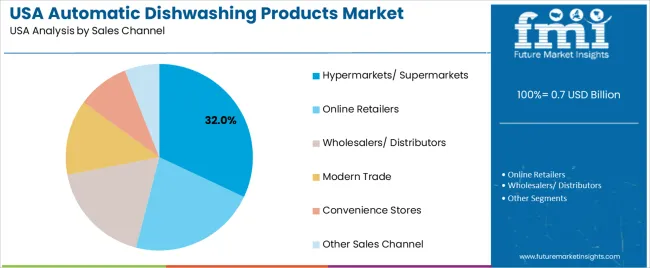

Hypermarkets and supermarkets account for 32.0%, serving as primary points of sale for household cleaning products in the United States. Online retailers represent 22.0%, driven by subscription ordering and home-delivery availability. Wholesalers and distributors hold 18.0%, supporting commercial and bulk purchasers. Modern trade stores represent 13.0%, followed by convenience stores at 9.0%, supplying immediate-need purchases. Other sales channels account for 6.0%, covering small-scale local retail formats. Channel distribution mirrors purchasing habits favoring high-volume retail chains and increasing digital ordering. Product replenishment cycles align with routine grocery shopping and e-commerce USAge that supports consistent household stock levels.

Key points:

Growth of dishwasher ownership in suburban households, expansion of multi-unit housing with built-in appliances and rising preference for time-saving cleaning solutions are driving demand.

In the United States, automatic dishwashing products gain steady traction as dishwasher penetration continues to rise in suburban regions where newly built homes typically include full-size dishwashers. Property developers increasingly equip multi-unit apartments with compact or drawer-style dishwashers, boosting recurring demand for detergents and rinse aids. Working adults and families with children turn to automatic dishwashing to save time on daily cleaning tasks, supporting strong household consumption. Bulk retail formats including club stores and mass-market chains provide cost-efficient multipack options that encourage frequent replenishment. Brands benefit from increased interest in products that deliver reliable cleaning of cookware and fast-drying performance without manual intervention.

Price sensitivity in lower-income households, limited dishwasher penetration in older urban apartments and environmental concerns about chemical formulations restrain adoption.

Many older apartments in dense USA cities lack space or plumbing to support built-in dishwashers, reducing detergent usage in those areas. Households without dishwashers rely on manual hand-washing products, which restricts overall category expansion. Price-sensitive shoppers may choose value formats or reduce usage frequency during economic pressure, affecting premium detergent sales. Environmental concerns about water hardness, phosphates, fragrances and packaging can also influence purchasing choices, especially among younger consumers. These factors create uneven demand growth across regions and income groups.

Shift toward tablet and pod formats, increased purchases of enzyme-based and fragrance-free detergents and rising demand for quick-cycle compatible solutions define key trends.

Manufacturers serving the USA industry report stronger consumer preference for single-dose tablets and pods that simplify dosing and reduce product waste. Formulations featuring enzymes, low-residue surfactants and reduced fragrance are gaining popularity among health-conscious buyers and households with sensitive-skin needs. Quick-cycle detergents that support shorter wash programs align with energy-saving appliances promoted by retailers and utility rebate programs. Online auto-replenishment services and subscription models expand convenient procurement for busy households. These trends reflect sustained modernization and premiumization in the automatic dishwashing products category across the United States.

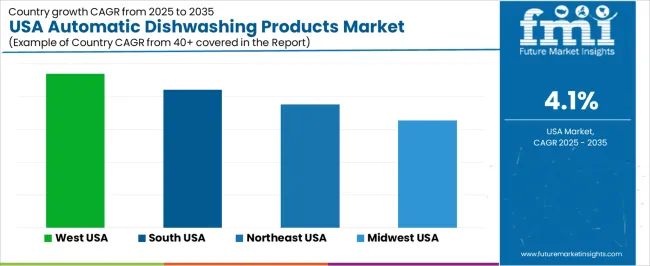

Demand for automatic dishwashing products in the United States reflects household penetration of dishwashers, cleaning-chemistry upgrades, detergent efficiency standards, and distribution through mass retail and online channels. Regional growth is influenced by appliance ownership rates, kitchen renovations, disposable income, and preferences for convenient cleaning formats. West USA leads at 4.7%, followed by South USA (4.2%), Northeast USA (3.8%), and Midwest USA (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 4.7% |

| South USA | 4.2% |

| Northeast USA | 3.8% |

| Midwest USA | 3.3% |

West USA, growing at 4.7% CAGR, remains the strongest regional contributor due to higher dishwasher penetration across California, Washington, Oregon, Colorado, and Nevada. Urban households favor low-water, energy-efficient appliances aligned with regional ecofriendly priorities. Renovation spending in cities, including Los Angeles, Seattle, and San Francisco, maintains consistent upgrades of built-in dishwashers, expanding USAge of automatic dishwashing detergents, gel packs, and rinse aids.

The region’s strong e-commerce fulfillment networks enable rapid delivery of consumables, improving product accessibility and replenishment frequency. Retail assortments in warehouse clubs and supermarket chains support adoption of concentrated and low-phosphate formulations used in water-restricted areas. Dining-out alternatives and increasing dual-income families reinforce reliance on automatic dish cleaning for home meals. Commercial demand from small restaurants and shared housing facilities adds incremental USAge where machine cycles replace handwashing.

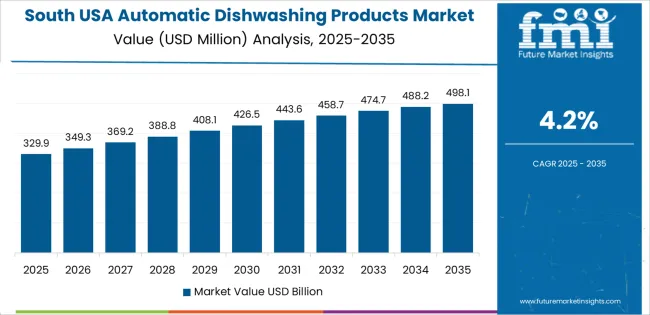

South USA grows at 4.2% CAGR, supported by expanding suburban housing, strong family household concentration, and increasing dishwasher installation in new homes. States like Texas, Florida, Georgia, and North Carolina show rising appliance adoption linked to population inflows and residential construction. Retailers across the region promote large-pack dishwashing consumables through discount chains and mass merchants, increasing volume sales.

Warm climates with higher cooking frequency contribute to greater load cycles and steady cleaning-product replacements. Consumer preference for pre-measured pods improves USAge consistency and drives value upgrades in the product mix. Commercial properties such as senior-living homes, school cafeterias, and hospitality environments adopt automatic machine cycles for operational efficiency.

Northeast USA expands at 3.8% CAGR, shaped by compact households in states including New York, New Jersey, and Massachusetts. Built-in dishwasher installations remain moderate due to older housing stock and limited kitchen space, yet ongoing renovations support gradual growth. Households rely on efficient consumables that improve cleaning performance at lower water temperatures used in many compact appliances.

Higher concentration of small restaurants and shared-kitchen facilities increases bulk demand for dishwashing solutions suited to frequent machine cycles. Regional consumers show greater trial adoption of environmentally oriented products with lower chemical loads and recyclable packaging. Retail and subscription-based replenishment models serve dense urban zones, maintaining consistent product turnover and reducing out-of-stock rates.

Midwest USA grows at 3.3% CAGR, reflecting steady appliance ownership across states including Illinois, Ohio, and Michigan. Detached homes with full kitchens support dishwasher USAge, though volume growth remains slower than coastal regions. Supermarkets and value-focused retailers supply concentrated powders, gels, and pod packs aligned with price-sensitive purchasing. Households prioritize reliable cleaning performance for mixed soil loads associated with home-cooked meals. Commercial operations in school systems and healthcare facilities use automatic dish systems consistently, maintaining institutional product demand. Rural counties rely on retail distribution rather than e-commerce dominance, affecting replenishment frequency but ensuring broad product reach through local store formats.

Demand for automatic dishwashing products in the USA is shaped by home-care suppliers that provide detergent tablets, gels, and rinse aids for residential dishwasher use. Procter & Gamble holds an estimated 35.3% share, led by Cascade products that deliver consistent stain-removal performance, controlled enzyme activity, and reliable dissolution in USA household water conditions. Distribution through major supermarkets and online channels supports sustained category leadership.

Reckitt Benckiser Group maintains strong participation with Finish dishwasher products. These formulations provide predictable hard-water tolerance and dependable glass-protection performance, reinforcing adoption across large retail chains. Church & Dwight Co., Inc. contributes meaningful share through OxiClean auto dish solutions positioned for stable cleaning efficiency and broad mid-tier retail placement.

Colgate-Palmolive Company supports domestic demand with Palmolive auto dish detergents, supplying retailers and wholesalers with consistent cleaning performance and established USA brand familiarity. Blueland serves a growing niche for eco-conscious households seeking reduced-plastic formats, offering tablet-based products that emphasize reliable detergent action and compact packaging aligned with ecofriendly preferences. Competition in the USA centers on tablet-dissolution reliability, enzyme efficacy, hard-water compatibility, machine-safety assurance, packaging durability, and national retail availability. Demand remains stable as dishwasher penetration in USA households supports continued use of automatic dishwashing detergents that deliver dependable wash results and streamlined handling across everyday cleaning routines.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Detergent Tablets, Detergent Gel, Detergent Powder |

| Application | Residential, Commercial |

| Sales Channel | Hypermarkets/Supermarkets, Online Retailers, Wholesalers/Distributors, Modern Trade, Convenience Stores, Other Sales Channel |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Procter & Gamble (Cascade), Reckitt Benckiser Group plc, Church & Dwight Co., Inc. (OxiClean), Colgate-Palmolive Company, Blueland |

| Additional Attributes | Dollar sales by product type, sales channel, and residential vs. commercial demand; regional penetration across West, South, Northeast, and Midwest USA; sustainability-driven product innovation such as eco-friendly tablets and refillable gel packs; performance differentiation for hard water and rapid-wash cycles; growth in e-commerce adoption for household cleaning products; competitive strategies including bundle packs and subscription-based replenishment. |

The demand for automatic dishwashing products in USA is estimated to be valued at USD 0.7 billion in 2025.

The market size for the automatic dishwashing products in USA is projected to reach USD 1.0 billion by 2035.

The demand for automatic dishwashing products in USA is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in automatic dishwashing products in USA are detergent tablets, detergent gel and detergent powder.

In terms of application, residential segment is expected to command 71.0% share in the automatic dishwashing products in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Dishwashing Products Market Insights – Growth & Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

USA and Canada Pet Care Products Market Analysis – Size, Share and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Demand for Automatic Checkweigher in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bamboo Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Gearbox Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Anti Wrinkle Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Baby Personal Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Professional Hair Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Tracheal Tubes and Airway Products in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA