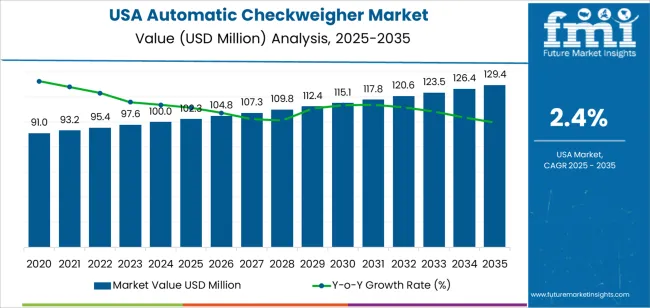

The USA automatic checkweigher demand is valued at USD 102.3 million in 2025 and is forecasted to reach USD 129.4 million by 2035, reflecting a CAGR of 2.4%. Implementation is supported by regulated weight accuracy requirements across food, beverage, pharmaceutical, and consumer-goods packaging operations. Adoption is influenced by the need to reduce material giveaway, maintain packaging compliance, and support automated inline inspection within high-throughput production environments. Integration with automated labelling, rejection, and quality-assurance subsystems also contributes to continued system upgrades.

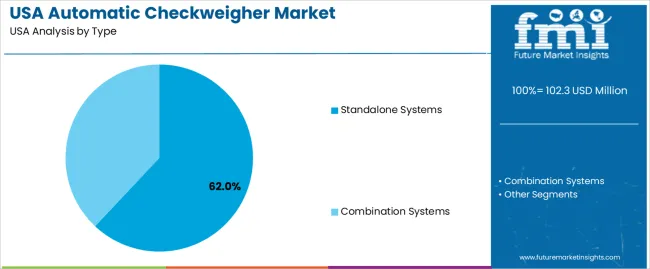

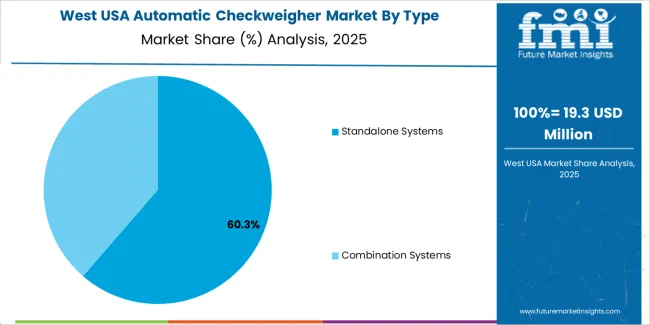

Standalone systems lead overall utilization. These units are selected for compliance-driven applications that require independent machine operation, accurate dynamic weighing, and flexible installation in existing conveyor layouts. Enhancements in load cell sensitivity, production-line connectivity, and digital monitoring capabilities support incremental efficiency improvements in real-time inspection functions.

West USA, South USA, and Northeast USA record the highest operational footprint. These regions maintain industrial production clusters with advanced food processing, logistics packaging, and regulated pharmaceuticals output. Replacement of ageing mechanical systems with digital weight-verification technologies strengthens procurement priorities in compliance-critical sectors. Key suppliers include METTLER TOLEDO, Ishida Co., Ltd., Anritsu Corporation, Bizerba, and A&D Company, Limited. Their systems provide integration with data-capture software, automated rejection modules, and instrumentation designed for continuous inspection in packaging and distribution workflows.

The growth rate volatility index for automatic checkweigher demand in the United States appears moderate, reflecting steady technology adoption across food processing, pharmaceuticals, consumer goods, and logistics environments. Demand expansion remains linked to operational accuracy requirements, automated packaging lines, and regulatory enforcement for weight compliance in commercial distribution. Year-to-year fluctuations are expected to remain contained because procurement decisions are typically driven by equipment replacement cycles and incremental capacity upgrades rather than rapid technological disruption.

Early-period growth reflects automation acceleration in medium-scale manufacturing units seeking throughput consistency. The mid-term period shows a stable incline supported by digital quality-control infrastructure and data-enabled verification systems integrated into Industry 4.0 frameworks. Late-period growth remains supported by traceability standards, but competitive pricing and maturity across installed equipment bases reduce volatility.

Volatility risk remains centered on capital spending sensitivity to economic uncertainty, supply-chain variability for industrial machinery components, and changing enforcement thresholds in weight-accuracy regulation. The demand trajectory shows a balanced progression with limited surges or sharp downward shifts, indicating a contained volatility profile supported by compliance-driven procurement and gradual automation upgrades across regulated production sectors in the United States.

| Metric | Value |

|---|---|

| USA Automatic Checkweigher Sales Value (2025) | USD 102.3 million |

| USA Automatic Checkweigher Forecast Value (2035) | USD 129.4 million |

| USA Automatic Checkweigher Forecast CAGR (2025-2035) | 2.4% |

Demand for automatic checkweighers in the USA is increasing because food, pharmaceutical and consumer goods manufacturers must ensure accurate package weights to comply with labeling regulations and maintain product consistency. These systems verify weight in real time on high speed production lines, which reduces waste and prevents under filled or overfilled products from reaching distributors. Automated weighing supports operational efficiency in facilities that face labour shortages and rising throughput requirements. Companies adopt checkweighers to strengthen quality control, minimize product giveaway and avoid penalties related to noncompliance with federal packaging standards.

Growth in prepared foods, nutraceuticals and e commerce shipping reinforces the need for reliable inline weight inspection across large SKU ranges. Integration with digital production systems allows checkweighers to provide data for analytics and process optimization, which appeals to plants modernizing their automation infrastructure. Constraints include capital expenditure for advanced models, space limits on older production lines and the requirement for trained staff to manage calibration and maintenance. Some small manufacturers rely on manual weighing until production volume justifies automation.

Demand for automatic checkweighers in the United States is supported by regulated packaging operations, automated quality control, and weight-based compliance standards. These systems ensure packaged units remain within allowable weight tolerance limits while enabling rejection of under filled or overfilled items. Adoption relates to conveyor integration, real-time monitoring, and inspection accuracy across diverse product shapes. USA facilities apply checkweighers to reduce product waste, maintain labeling compliance, and support traceability within regulated sectors.

Standalone systems represent 62.0%, used where individual weight inspection units attach directly to packaging lines without additional integrated sorting devices. These systems provide stable detection for packaged goods requiring independent compliance verification. Combination systems account for 38.0% and merge weighing with metal detection, X-ray inspection, or labeling functions to support consolidated quality checks. Their use increases in facilities managing limited floor space or multiple inspection needs within a single line segment. Type distribution reflects priorities in USA operations focused on regulatory weight confirmation alongside broader quality objectives. System choice depends on line complexity, contamination-control requirements, and product handling constraints across industrial environments.

Key points:

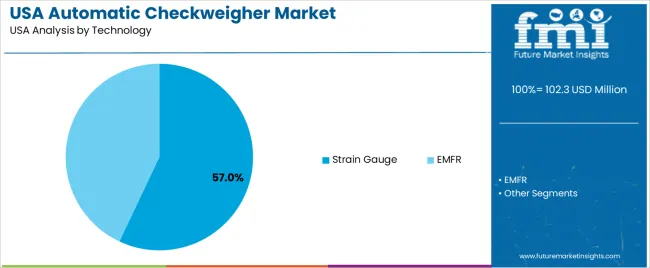

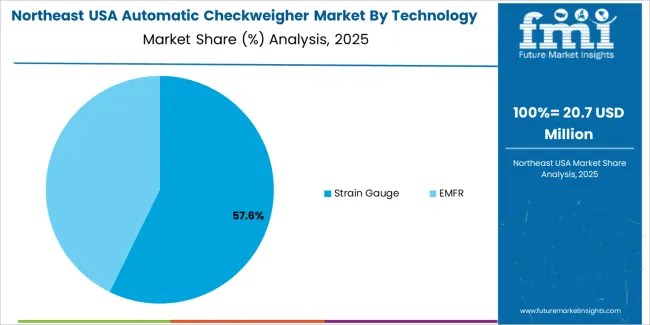

Strain gauge technology accounts for 57.0%, used in USA facilities requiring durable weighing sensors capable of maintaining performance across varied product weights and packaging formats. These systems support cost-efficient deployment with reliable readings under typical conveyor conditions. Electromagnetic force restoration (EMFR) represents 43.0%, applied in high-precision environments such as pharmaceuticals and specialty products that require narrow tolerance control. Technology selection reflects trade-offs between accuracy targets, environmental stability, and operational speeds. Strain gauge units remain widely adopted due to mechanical resilience and compatibility with many packaged items handled in mainstream manufacturing and distribution workflows across the country.

Key points:

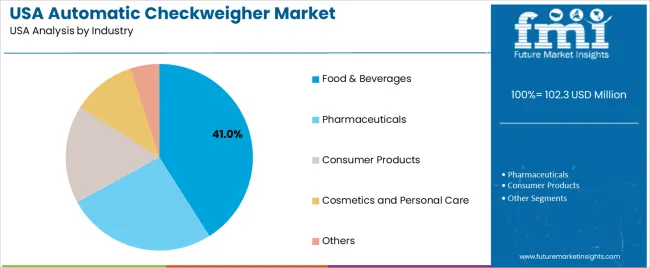

Food and beverages represent 41.0%, due to weight-marked packaging, high-volume throughput, and food-labeling compliance obligations in the United States. Pharmaceuticals account for 26.0%, where checkweighers verify dosing accuracy and sealed packaging integrity. Consumer products represent 17.0%, supporting weight consistency in goods such as personal accessories and household items. Cosmetics and personal care account for 11.0%, reflecting the need for precise fill control in tubes and bottles. Other industries represent 5.0%, covering electronics, hardware, and small packaged goods. Distribution reflects USA quality requirements across product categories with defined labeling and net-content rules enforced during commercial distribution.

Key points:

Expansion of automated packaging lines, compliance with federal weight-label rules and rising throughput requirements in food and pharmaceutical facilities are driving demand.

In the United States, automatic checkweighers are increasingly required in food and beverage plants because products must meet net weight accuracy under federal labeling standards that apply across national retail distribution. Packaging operations serving large grocery retailers adopt automated checkweighing to avoid rejected shipments and reduce rework costs. Pharmaceutical manufacturers use in-line checkweighers to verify fill levels and maintain compliance with dosage and packaging regulations. Labor scarcity in manufacturing and logistics encourages greater reliance on automation that verifies every package at high speed. Growth in meal kits, protein snacks and single-serve beverages sold in multi-state retail channels also supports consistent investment in checkweighing systems.

High equipment cost for small plants, integration challenges with legacy conveyors and sensitivity to vibration in high-density facilities restrain adoption.

Small and mid-sized processors may hesitate to invest in premium checkweigher models that include advanced rejection systems and high-resolution load cells. Older USA facilities built before continuous automation often require conveyor redesign or space relocation to integrate checkweighers, raising installation complexity. In compact industrial sites, floor vibration from adjacent machinery can disrupt accuracy unless additional stabilization hardware is installed, increasing project cost. These issues lead to selective implementation among resource-constrained operations.

Shift toward metal detection and vision integration, increased adoption in e-commerce fulfillment and rising focus on data analytics for quality assurance define key trends.

Manufacturers are expanding use of combined checkweighing, metal detection and vision-inspection systems to reduce footprint and improve retail compliance. E-commerce fulfillment centers handling health, personal care and packaged food shipments use checkweighers to verify order completeness and prevent mis-shipments. Production managers increasingly rely on weight-data analytics to monitor yield, track giveaway and identify upstream process deviations, supporting continuous improvement initiatives. Leasing models and modular platforms are making checkweighers more accessible for mid-tier plants. These trends show continued alignment between USA packaging automation and precision weight-control technology.

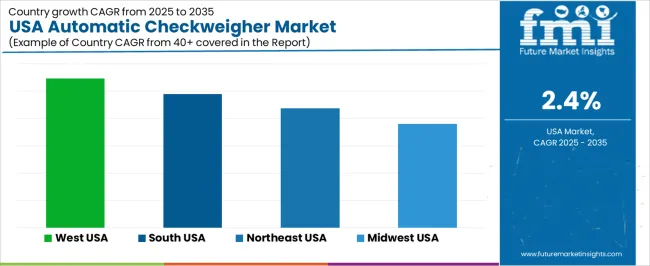

Demand for automatic checkweighers in the United States reflects adoption of weight-verification systems across food production, pharmaceuticals, consumer goods packaging, and parcel fulfillment. Compliance with labeling accuracy, waste reduction, and automated inspection drives procurement. Regional demand varies with manufacturing density and logistics intensity. West USA leads at 2.7%, followed by South USA (2.4%), Northeast USA (2.2%), and Midwest USA (1.9%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 2.7% |

| South USA | 2.4% |

| Northeast USA | 2.2% |

| Midwest USA | 1.9% |

West USA grows at 2.7% CAGR, supported by food processing, packaged produce handling, and expanding fulfillment networks across California, Washington, Oregon, Nevada, and Arizona. High regulatory attention to accurate product weights reinforces checkweigher installations in packaged fruits, bakery items, beverages, and meal kits. West Coast logistics hubs use integrated checkweighing to validate parcel grouping and maintain standardized shipping categories for e-commerce distribution.

Pharmaceuticals, including formulations from California’s biotechnology clusters, rely on checkweighers for precise dosing and packaged-unit monitoring. Packaging facilities adopt automated reject systems to limit rework and reduce labor intervention. Equipment distributors maintain strong service coverage supporting equipment uptime expectations in continuous-run environments.

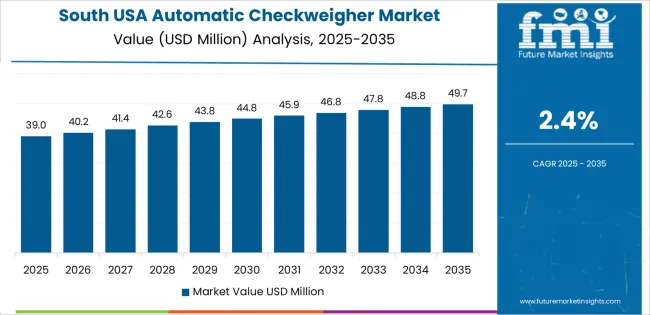

South USA grows at 2.4% CAGR, reflecting strong food and beverage manufacturing across Texas, Georgia, Florida, and North Carolina. Poultry processors integrate checkweighers to classify cut portions and control giveaway in fast throughput lines. Beverage and snack plants adopt automated weight-verification to align with retailer requirements. Large distribution infrastructures rely on precise weight capture for packaging documentation in outbound flow. Local packaging-equipment distributors offer accessible support services for plants operating extended shifts. Buyer priorities focus on equipment durability and smooth changeovers for varied SKU counts common in consumer packaged goods.

Northeast USA expands at 2.2% CAGR, shaped by dairy, baked goods, and ready-meal production in states including New York, New Jersey, and Pennsylvania. Urban fulfillment centers integrate checkweighers to manage dense parcel flow and reduce overpayment on shipping weight brackets. Pharmaceutical packaging requires continuous accuracy for regulated product labeling and unit consistency. Smaller footprint manufacturing sites prioritize compact checkweighing equipment with reliable reject mechanisms for limited-space lines. Food producers maintain mixed-SKU packaging, increasing reliance on auto-calibration and real-time adjustments.

Midwest USA grows at 1.9% CAGR, driven by packaged meat processing, ingredient handling, and manufacturing for durable consumer goods across Illinois, Ohio, Michigan, and Wisconsin. Plants adopt checkweighers to manage waste control targets and maintain efficient packaging throughput. Buyer decisions emphasize equipment lifespan and compatibility with existing conveyors and reject systems. Distribution networks are widely spread, creating structured procurement cycles tied to modernization rather than rapid upgrades. Workforce stability in industrial regions supports predictable operations with standardized inspection routines.

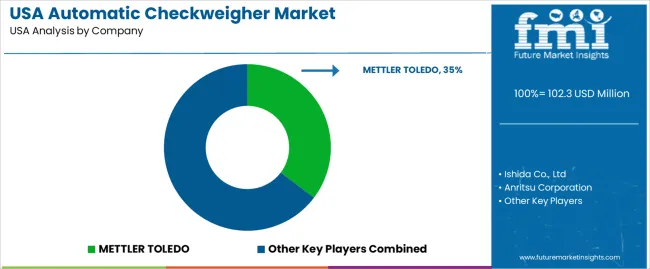

Demand for automatic checkweighers in the USA is shaped by weighing and inspection-technology suppliers serving food processing, pharmaceuticals, consumer goods, and industrial production. METTLER TOLEDO holds an estimated 35% share, supported by controlled dynamic-weighing performance, consistent compliance with USA packaging standards, and strong integration with conveying and rejection systems.

Its equipment provides reliable accuracy across high-speed production lines and broad service coverage nationwide. Ishida Co., Ltd., operating through its USA subsidiary, maintains strong participation in food and protein-processing facilities. Its checkweighers deliver predictable throughput stability and durable construction suited to continuous-duty environments. Anritsu Corporation contributes meaningful share through metal-detection and checkweighing systems that provide consistent data-capture performance and integration with quality-control routines in USA food and pharmaceutical plants.

Bizerba supports domestic demand with weighing systems designed for automated packaging and logistics operations. Its equipment offers stable measurement precision and dependable interface compatibility for production-line monitoring. A&D Company, Limited, through A&D Weighing, adds capacity in mid-scale industrial operations, supplying checkweighers with reliable rejection control and compact footprint options that suit mixed-product lines.

Competition in the USA centers on weighing accuracy, sanitation-compliant design, rejection-system reliability, equipment durability, data-integration capability, and nationwide technical support. Demand continues to grow as manufacturers prioritize weight-control consistency, regulatory compliance, and reduced product giveaway across high-volume packaging operations in food, pharmaceutical, and consumer-goods production environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Type | Standalone Systems, Combination Systems |

| Technology | Strain Gauge, EMFR (Electromagnetic Force Restoration) |

| Industry | Food & Beverages, Pharmaceuticals, Consumer Products, Cosmetics and Personal Care, Others |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | METTLER TOLEDO, Ishida Co., Ltd., Anritsu Corporation, Bizerba, A&D Company, Limited |

| Additional Attributes | Revenue breakdown by system type, load cell technology, and industry use; deployment trends in automated packaging and inline inspection; adoption driven by FSMA and quality compliance requirements; integration with vision inspection, rejection mechanisms, and advanced analytics in high-throughput manufacturing environments across the United States. |

The demand for automatic checkweigher in USA is estimated to be valued at USD 102.3 million in 2025.

The market size for the automatic checkweigher in USA is projected to reach USD 129.4 million by 2035.

The demand for automatic checkweigher in USA is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in automatic checkweigher in USA are standalone systems and combination systems.

In terms of technology, strain gauge segment is expected to command 57.0% share in the automatic checkweigher in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Checkweigher Market Growth & Outlook 2025 to 2035

Demand for Automatic Gearbox Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Dishwashing Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA