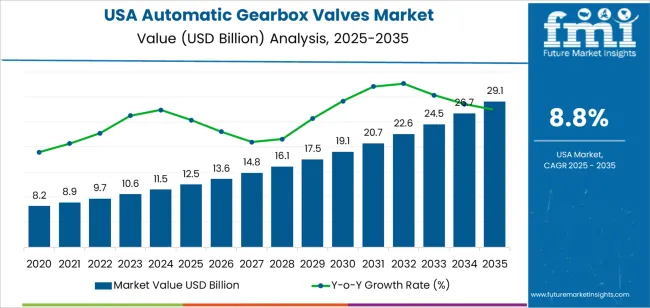

The demand for automatic gearbox valves in USA is expected to grow from USD 12.5 billion in 2025 to USD 29.1 billion by 2035, reflecting a CAGR of 8.8%. The growth in the automatic gearbox valves industry is driven by several factors, including the accelerating shift toward automatic transmission adoption in passenger cars, the rising production volumes of light commercial vehicles equipped with advanced powertrains, and the growing complexity of multi-speed transmission architectures. With automakers becoming more focused on fuel efficiency optimization, automatic gearbox valves provide critical functionality that ensures precise hydraulic pressure modulation within transmission control modules, allowing drivers to experience smooth gear transitions under varying load conditions.

The growth is also driven by advancements in valve body machining technologies, increased consumer preference for seamless shifting performance in urban driving scenarios, and the broadening of valve applications from traditional hydraulic automatics to dual-clutch and continuously variable transmission platforms. The rising integration of electronic transmission control units (TCUs) that rely on solenoid-actuated valves will further support expansion. The increasing focus on regulatory compliance with Corporate Average Fuel Economy (CAFE) standards and the preference for refined drivability characteristics among vehicle buyers also add to the demand for gearbox valves, which offer both hydraulic precision and response time advantages without the harshness associated with manual gear engagement.

The share gain analysis for automatic gearbox valves in USA reveals that the industry is expected to experience significant expansion over the forecast period from 2025 to 2035. The industry will grow from USD 12.5 billion in 2025 to USD 29.1 billion in 2035, reflecting an increase of USD 16.6 billion over the next decade. This growth indicates a strong expansion of the automatic gearbox valves industry, with more transmission manufacturers opting for advanced valve body designs rather than conventional hydraulic control configurations that may compromise shift quality or fuel efficiency.

From 2025 to 2030, the industry will grow from USD 12.5 billion to USD 18.5 billion, contributing USD 6 billion in growth. This phase will see an initial gain as more automakers adopt multi-valve transmission architectures with solenoid-actuated pressure control, driven by an increasing focus on meeting EPA fuel economy targets and the need for refined shifting characteristics in 8-speed, 9-speed, and 10-speed automatic transmissions. The demand for gearbox valves in passenger cars, particularly for sedans, crossover SUVs, and pickup trucks, will contribute significantly to this growth.

From 2030 to 2035, the industry will expand further from USD 18.5 billion to USD 29.1 billion, contributing USD 10.6 billion in growth. This phase will see stronger gains as the adoption becomes more widespread, with more powertrain suppliers choosing to integrate adaptive valve control algorithms in dual-clutch transmissions and continuously variable transmission platforms for hybrid vehicles.

With more transmission remanufacturers and independent repair facilities embracing the replacement of worn valve body assemblies in high-mileage vehicles, the industry is expected to capture a larger portion of the overall automotive powertrain components sector, particularly among performance-oriented vehicle owners and commercial fleet operators seeking to restore original shift quality. The strong growth momentum in the latter half of the forecast period reflects the maturation of the industry, where gearbox valves become a standard component of modern electronically controlled transmission systems in USA.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 12.5 billion |

| Industry Forecast Value (2035) | USD 29.1 billion |

| Industry Forecast CAGR (2025-2035) | 8.8% |

Demand for automatic gearbox valves in USA is rising as transmission engineers and vehicle manufacturers increasingly prioritize shift quality optimization over cost reduction, driven by consumer expectations for refined drivability and the technical requirements of fuel-efficient powertrain designs. Many automakers, especially those producing light trucks and crossover vehicles for the North American consumer base, prefer advanced solenoid valve assemblies for new transmission platforms or when upgrading from 6-speed to 8-speed automatic configurations that improve highway fuel economy.

Tier 1 transmission suppliers offering integrated valve body modules, pressure regulator valves and electronically controlled shift solenoids support this shift by providing precise hydraulic flow management, rapid response times, and compatibility with adaptive transmission control strategies. Commercial vehicle manufacturers and transmission rebuilders are collaborating with valve suppliers to extend the service life of automatic gearboxes and enhance shift consistency under heavy-duty operating conditions, which further fuels adoption. Industry figures show that the USA automatic gearbox valves segment is valued at approximately USD 12.5 billion and is expected to grow steadily.

Another key factor is the convergence of vehicle electrification trends, the integration of stop-start systems for urban fuel economy and the heightened consumer sensitivity to transmission shift quality. Fleet buyers increasingly seek to prevent harsh gear changes, reduce powertrain vibrations during acceleration and minimize warranty claims related to transmission performance, which make high-precision gearbox valve systems attractive. Advances in solenoid coil design, proportional valve technology and corrosion-resistant valve body materials reduce hydraulic leakage risks and improve long-term reliability, which encourages broader acceptance.

Challenges remain: managing cost pressures from automakers seeking lower component pricing, ensuring valve compatibility with diverse transmission fluid formulations across OEM specifications, and maintaining operational profitability amid fluctuating raw material costs for steel valve bodies and copper solenoid windings. Despite these headwinds, as automakers and transmission specialists shift toward enhanced fuel economy compliance and improved customer satisfaction scores, the demand for automatic gearbox valves in USA is projected to continue its upward trajectory.

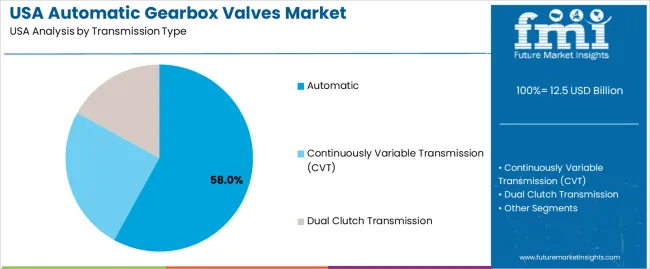

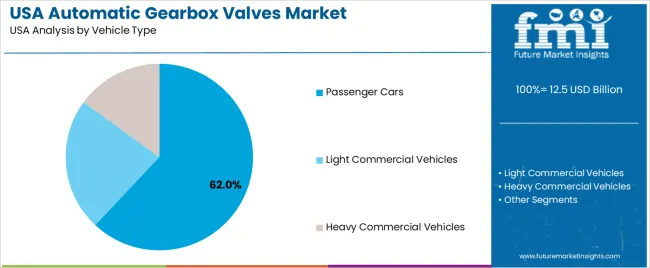

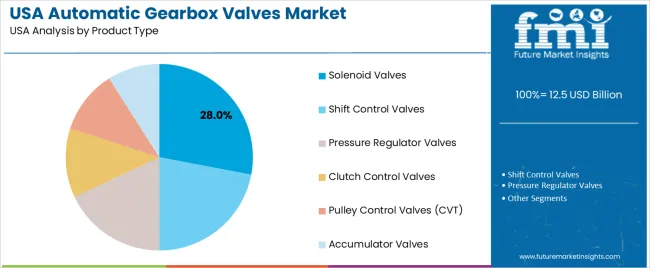

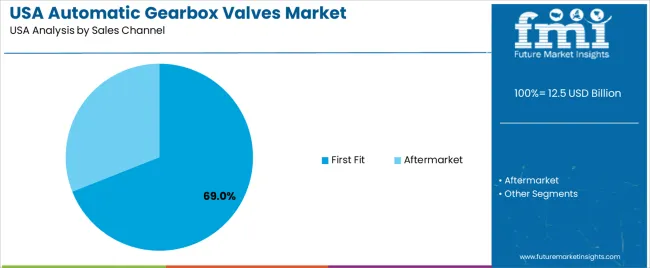

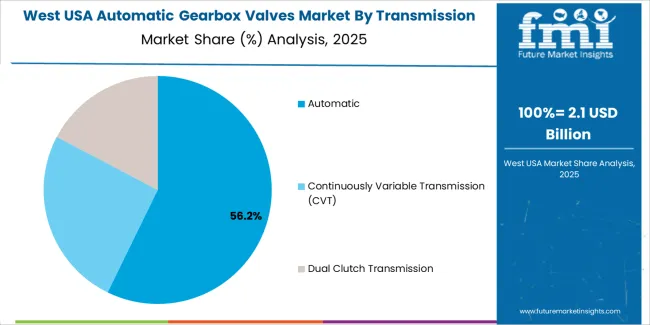

The demand for automatic gearbox valve systems in USA is primarily driven by transmission type, vehicle type, product type, and sales channel. The leading transmission type is automatic, which holds 58% of the industry share, while passenger cars is the dominant vehicle type segment, accounting for 62% of the demand, solenoid valve is the leading product type with 28% of the volume, and first fit is the dominant sales channel with 69% of installations.

Automatic gearbox valves have gained significant traction in both the original equipment and remanufacturing sectors due to their critical role in hydraulic pressure regulation within planetary gear sets, torque converter lockup control, and clutch pack engagement timing. The valve configuration allows transmission manufacturers and rebuild specialists to deliver precise shift scheduling that accommodates driver throttle inputs, vehicle speed profiles, and engine torque characteristics, which appeals to various customer bases.

Automatic transmission is the leading transmission type in the automatic gearbox valves industry, capturing 58% of the industry share. The increasing preference for conventional automatic transmissions among North American vehicle buyers stems from their proven reliability, smooth operation in stop-and-go traffic conditions, and widespread service network familiarity compared to dual-clutch or continuously variable transmission alternatives. Automatic transmissions equipped with modern valve body assemblies incorporate multiple solenoid valves that enable adaptive shift logic, grade-braking functions, and sport mode calibrations that enhance driver engagement.

In USA, where pickup trucks and full-size SUVs represent a substantial portion of vehicle sales, automatic transmission configurations have become the preferred powertrain choice for both personal transportation and commercial applications. The adoption of 8-speed, 9-speed, and 10-speed automatic transmissions by Detroit automakers such as General Motors, Ford Motor Company, and Stellantis necessitates the use of sophisticated valve body designs with increased valve counts to manage the hydraulic complexity of additional gear ratios. The integration of electronic pressure control solenoids within automatic transmission valve bodies also supports the growing emphasis on fuel economy optimization through torque converter lockup strategies and rapid downshift response for passing maneuvers.

Passenger cars is the leading vehicle type segment for automatic gearbox valves in USA, capturing 62% of the industry share. The high volume of passenger car production, including sedans, hatchbacks, and crossover vehicles, drives substantial demand for valve assemblies that meet stringent performance and durability requirements across diverse driving conditions. Automakers such as Honda, Toyota, and Nissan specify valve body configurations that deliver smooth shifts during urban commuting, highway cruising, and spirited driving scenarios while maintaining compliance with EPA fuel economy ratings.

Passenger car operators benefit from reliable gearbox valve systems that ensure imperceptible gear changes, responsive kickdown behavior when overtaking, and efficient torque converter lockup engagement that reduces fuel consumption at steady-state highway speeds. The growing installed base of passenger vehicles equipped with automatic transmissions, combined with the increasing complexity of hybrid powertrains that integrate electric motor assistance with conventional gearboxes, creates ongoing demand for both OEM production valve bodies and remanufactured valve assemblies for high-mileage vehicles. The increasing adoption of driver-selectable transmission modes such as Eco, Normal, and Sport requires valve control algorithms that adjust hydraulic line pressures and shift timing to match driver preferences.

Solenoid valve is the leading product type in the automatic gearbox valves industry, capturing 28% of the industry share. The increasing reliance on electronically controlled solenoid valves within transmission control modules stems from their ability to provide precise hydraulic pressure modulation, rapid response to electronic control unit commands, and compatibility with adaptive transmission calibration strategies. Solenoid valves enable transmission engineers to implement complex shift schedules that optimize fuel economy, enhance shift quality, and protect transmission clutch packs from excessive wear during aggressive driving.

In USA, where transmission performance expectations are high and warranty cost containment is a priority for automakers, solenoid valve technology has become the foundational element of modern automatic transmission valve body design. The adoption of proportional solenoid valves that allow infinitely variable pressure control, rather than simple on-off solenoid operation, supports the growing emphasis on eliminating shift shock and delivering seamless power delivery during gear changes. As vehicle manufacturers continue to prioritize transmission refinement through electronic control sophistication and transmission suppliers seek to differentiate their products through superior shift quality, the demand for solenoid valves is expected to remain strong, positioning it as a dominant product category in the automatic gearbox valves industry.

First fit is the leading sales channel for automatic gearbox valves in USA, capturing 69% of the industry share. In the first fit channel, transmission manufacturers and vehicle assembly plants are the primary customers for valve body assemblies that are integrated during new transmission production. First fit clients benefit from gearbox valve systems by ensuring factory-specified hydraulic circuit layouts, precise valve bore tolerances, and pre-calibrated solenoid characteristics that enable optimal transmission performance without the need for post-assembly adjustments or field recalibration.

Automatic gearbox valve suppliers also offer first fit customers the flexibility to support new transmission platform launches, accommodate mid-cycle product updates with revised shift calibrations, and scale production volumes to match vehicle assembly schedules, which can enhance supply chain efficiency without the financial burden of maintaining excessive valve body inventories. The growing emphasis on transmission warranty cost reduction and the avoidance of early-life shift quality concerns has driven many automakers to source gearbox valves exclusively from qualified suppliers that demonstrate statistical process control capabilities, meet IATF 16949 quality system requirements, and have validated valve durability through extensive bench testing and vehicle validation programs.

Demand for automatic gearbox valves in the USA is rising as powertrain engineers and transmission manufacturers increasingly prioritize shift quality refinement over basic functionality, driven by consumer expectations for smooth drivability and the technical demands of fuel economy regulations. Growth stems from production volumes of 8-speed and 10-speed automatic transmissions, the proliferation of electronic transmission control systems and the adoption of adaptive shift algorithms that require proportional valve control.

Operational challenges like cost pressures from automotive OEMs, the technical complexity of multi-valve hydraulic circuits and competition from alternative transmission technologies such as continuously variable transmissions are restraining expansion. Key trends include the integration of pressure sensor feedback loops within valve bodies, the adoption of lightweight aluminum valve body castings to reduce transmission mass and the increasing use of corrosion-resistant coatings on valve spools to ensure long-term hydraulic performance in synthetic transmission fluids.

Several factors support growth in the USA industry. First, the continued dominance of automatic transmissions in the North American light vehicle fleet, with penetration rates exceeding 95% in passenger cars and light trucks, drives consistent OEM demand for valve body assemblies that meet performance and durability expectations. Second, the shift toward multi-speed transmissions with 8, 9, or 10 forward gears by domestic automakers such as General Motors and Ford Motor Company generates substantial demand for complex valve bodies containing multiple shift solenoids, pressure control valves, and hydraulic switching elements.

Third, the enforcement of fuel economy standards by the Environmental Protection Agency and the California Air Resources Board boost demand for transmission designs that incorporate torque converter lockup strategies and aggressive shift scheduling, both of which depend on precise valve control. Fourth, the expansion of transmission remanufacturing operations, driven by the high cost of new transmission assemblies and the growing installed base of high-mileage vehicles requiring transmission overhauls, continues to fuel demand for replacement valve body components and solenoid valve repair kits.

Despite momentum, several restraints inhibit growth. Automotive OEMs express concerns about the cost of advanced solenoid valve technology and complex valve body machining operations, which may limit adoption among value-oriented vehicle segments where transmission cost targets are aggressive. The cost structure of producing high-precision valve bodies, including CNC machining of aluminum castings, automated assembly of solenoid valves, hydraulic flow testing, and validation of electronic control interfaces, can reduce margin and raise component prices, making the offering less compelling versus simpler valve body designs for some applications.

The gearbox valves segment faces competition from continuously variable transmissions and dual-clutch transmissions that utilize different actuation mechanisms, which can limit the addressable installation base. Operational complexity, including the need to manage tight geometric tolerances for valve spool fit, coordinate with multiple transmission control module suppliers across different vehicle platforms, and maintain extensive testing infrastructure to validate valve performance across temperature extremes, adds risk for manufacturers.

Major trends include the move from simple on-off shift solenoids to proportional pressure control valves that enable infinitely variable line pressure modulation and clutch pack engagement control. There is increasing integration of diagnostic capabilities such as solenoid resistance monitoring, valve position feedback sensing, and hydraulic pressure transducers within valve body assemblies, improving transmission control precision and enabling predictive maintenance alerts. The transmission supply chain is experiencing consolidation, with large Tier 1 suppliers acquiring specialized valve manufacturers to internalize critical component production and reduce supply chain complexity.

Vehicle manufacturers and transmission engineers are also adopting modular valve body designs that allow configuration flexibility across multiple transmission platforms, offering hybrid cast-aluminum and stamped-steel valve body constructions, and promoting compatibility with both conventional automatic transmissions and hybrid powertrain applications to appeal to customers navigating the transition toward electrified vehicles.

The demand for automatic gearbox valves in USA is growing as transmission manufacturers, vehicle assembly plants, and powertrain engineers increasingly seek precise, responsive, and durable components for hydraulic control systems. Automatic gearbox valve systems allow transmission designers to implement sophisticated shift strategies that optimize fuel consumption while delivering the smooth, confident gear changes that American drivers expect in daily commuting scenarios. This configuration is particularly attractive to automotive OEMs who want to differentiate their vehicles through superior transmission refinement and avoid costly warranty claims associated with harsh shifts or delayed engagement.

Factors driving this demand include the proliferation of multi-speed automatic transmissions in pickup trucks and SUVs, the technical requirements of meeting Corporate Average Fuel Economy standards, and the growing integration of electronic transmission control modules that rely on solenoid-actuated hydraulic valves. The increasing focus on transmission longevity and the reduction of total vehicle ownership cost is encouraging automakers to invest in premium valve body assemblies that resist wear and maintain hydraulic seal integrity throughout extended service intervals.

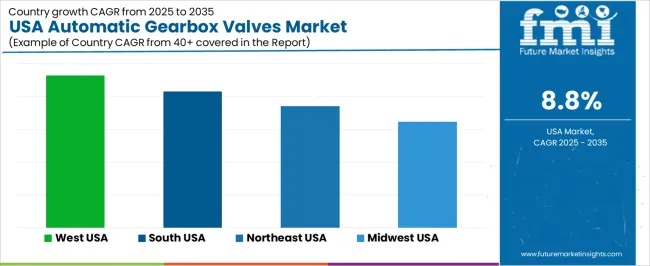

Regional demand varies depending on factors such as vehicle production volumes, transmission architecture preferences, and the concentration of powertrain manufacturing facilities. The West leads in demand, supported by high vehicle ownership rates and the presence of automotive engineering centers in California, while the South, Northeast, and Midwest show steady adoption driven by diverse vehicle production footprints and the concentration of transmission assembly plants. This analysis explores the factors shaping the demand for automatic gearbox valves across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 9.3% |

| South USA | 8.3% |

| Northeast USA | 7.4% |

| Midwest USA | 6.5% |

The West region leads the USA in the demand for automatic gearbox valves with a CAGR of 9.3%. The region's substantial vehicle population, particularly in states like California, Nevada, and Washington, combined with stringent emissions regulations and fuel economy requirements, drives the demand for advanced transmission technologies that incorporate sophisticated valve control. California, known for its leadership in vehicle emissions standards through the California Air Resources Board and its influence on national automotive regulations, is a key geography where the demand for fuel-efficient automatic transmissions with precise valve control is growing.

The West also has a higher concentration of automotive research and development facilities, powertrain testing laboratories, and engineering centers operated by both domestic and international automakers that are actively developing next-generation automatic transmissions.

With the region's focus on environmental compliance and the strong consumer preference for refined vehicle drivability, automatic gearbox valve systems offer essential functionality for both fuel economy optimization and shift quality enhancement, enabling automakers to meet regulatory requirements and satisfy customer expectations without the performance compromises associated with less sophisticated transmission designs. As the demand for technologically advanced and fuel-efficient automatic transmissions continues to rise in the West, the region remains the leading geography for gearbox valve systems.

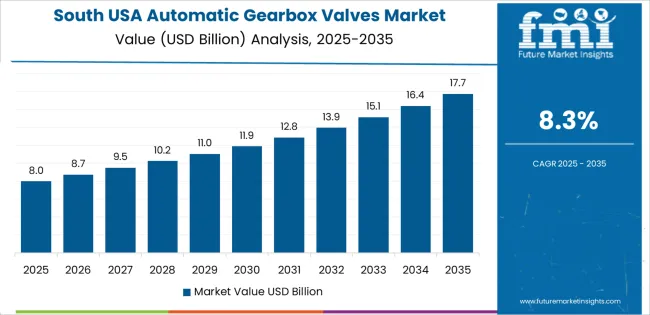

The South shows strong demand for automatic gearbox valves with a CAGR of 8.3%. The region's expanding automotive manufacturing footprint, combined with substantial production volumes of pickup trucks, full-size SUVs, and crossover vehicles at assembly plants operated by Toyota, Hyundai, Mercedes-Benz, and other manufacturers, contributes to the rising adoption of valve body systems. States like Texas, Alabama, and Tennessee have become major automotive production hubs, making them key drivers of demand for transmission components that meet both performance and cost targets.

The growing presence of transmission assembly facilities in the South, including operations by ZF, Aisin, and Hyundai Transys, with their direct integration into regional vehicle production networks, further supports the demand for automatic gearbox valve assemblies. The logistics efficiency factor, coupled with the preference for localized sourcing of critical powertrain components to reduce transportation costs and improve supply chain responsiveness, is appealing to many automotive manufacturers in the South. With the continued expansion of vehicle production capacity and shifting assembly patterns that favor Southern states for new plant investments, the South is expected to continue to see strong demand for valve body systems.

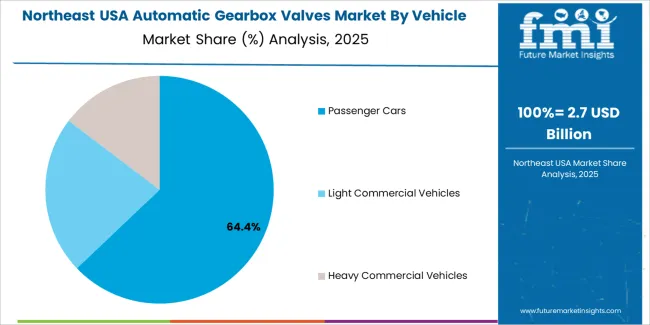

The Northeast demonstrates steady demand for automatic gearbox valves with a CAGR of 7.4%. The region, home to transmission remanufacturing clusters in states like Pennsylvania and New York, along with automotive component distribution networks serving dealership service departments throughout the Mid-Atlantic corridor, has sustained demand for both original equipment valve bodies and remanufactured valve assemblies. The Northeast's emphasis on vehicle longevity, combined with higher average vehicle ages in certain demographics, is driving the adoption of transmission rebuild services that incorporate replacement valve body components.

The concentration of automotive engineering expertise and transmission testing facilities in Michigan, though geographically classified in different census regions, influences the broader Northeast corridor through technology transfer and supplier relationships. This makes gearbox valve technology adoption an attractive option for transmission specialists seeking to restore factory shift quality in high-mileage vehicles without the substantial financial outlay of complete transmission replacement. While growth is steady compared to the West and South, the Northeast's combination of technical sophistication in transmission servicing and established automotive aftermarket infrastructure ensure that the demand for automatic gearbox valves remains a meaningful component of the region's powertrain service landscape.

The Midwest shows moderate growth in the demand for automatic gearbox valves with a CAGR of 6.5%. While the region may not have the same regulatory intensity as the West or the rapid manufacturing expansion of the South, there is a substantial concentration of transmission engineering expertise and component manufacturing capacity. Cities like Detroit, where General Motors, Ford Motor Company, and Stellantis maintain major powertrain engineering operations, along with transmission plants operated by these manufacturers in Ohio and Indiana, create consistent demand for valve body development and production.

The Midwest's steady adoption of gearbox valve systems is driven by the region's legacy as the center of American automotive manufacturing, the presence of established Tier 1 transmission suppliers, and the ongoing development of advanced automatic transmissions for trucks and SUVs that remain core products for domestic automakers. As awareness of the performance benefits associated with electronically controlled valve body designs increases and transmission engineers seek more sophisticated hydraulic control solutions to meet future fuel economy regulations, demand for these systems will continue to grow in the Midwest, albeit at a slower pace compared to other regions.

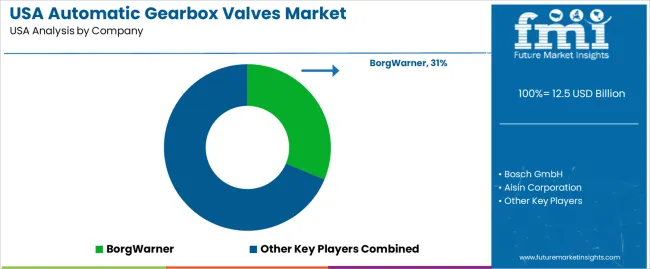

The automatic gearbox valves industry in the United States is growing as transmission manufacturers, automotive OEMs, and powertrain engineers increasingly seek more precise and reliable hydraulic control solutions. Companies such as BorgWarner (holding approximately 31.3% industry share), Bosch GmbH, Aisin Corporation, ZF Friedrichshafen, and Magna Powertrain are key players in this industry, providing customers with access to high-quality, engineered valve body assemblies and electronic solenoid valve systems for both production transmissions and remanufacturing applications. The shift toward multi-speed automatic transmissions, growing expectations for refined shift quality, and the need for compliance with fuel economy regulations are all driving factors behind the industry's expansion.

Competition in the automatic gearbox valves industry is centered around technological sophistication, manufacturing precision, and integration capabilities with electronic control systems. Companies focus on offering comprehensive valve body solutions, from basic shift valve assemblies to advanced proportional solenoid valves with integrated pressure sensors, and expanding their engineering support services to assist transmission manufacturers with hydraulic circuit optimization.

Another competitive advantage is manufacturing capability, with many companies offering in-house CNC machining of valve body castings, automated solenoid assembly lines, and extensive hydraulic flow testing infrastructure that ensures consistent valve performance. Some players are also emphasizing systems integration expertise, such as the co-development of valve control strategies with transmission control module suppliers, and the availability of global manufacturing footprints that enable regional supply chain optimization.

Technical communications typically highlight valve response time characteristics, hydraulic leakage performance across temperature ranges, and the availability of application-specific valve body designs that address unique transmission architecture requirements. By aligning their offerings with the growing demand for transmission refinement, fuel efficiency optimization, and long-term durability, these companies are positioning themselves to lead the USA automatic gearbox valves industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Transmission Type | Automatic, Continuously Variable Transmission, Dual Clutch Transmission |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Product Type | Solenoid Valve, Shift Control Valve, Pressure Regulator Valve, Throttle Valve, Pulley Control Valve, Accumulator Valve |

| Sales Channel | First Fit, Aftermarket |

| Key Companies Profiled | BorgWarner, Bosch GmbH, Aisin Corporation, ZF Friedrichshafen, Magna Powertrain |

| Additional Attributes | Dollar sales by transmission type, vehicle type, product category, and sales channel are assessed alongside USA demand for multi-speed automatics across passenger and commercial fleets, with competition driven by fuel-efficiency refinement, electronic valve control, solenoid innovation, and hydraulic optimization. |

The demand for automatic gearbox valves in USA is estimated to be valued at USD 12.5 billion in 2025.

The market size for the automatic gearbox valves in USA is projected to reach USD 29.1 billion by 2035.

The demand for automatic gearbox valves in USA is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in automatic gearbox valves in USA are automatic, continuously variable transmission (cvt) and dual clutch transmission.

In terms of vehicle type, passenger cars segment is expected to command 62.0% share in the automatic gearbox valves in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Demand for Automatic Checkweigher in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Slide Gate Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Dishwashing Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hand Towel Automatic Folding Machine in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Thermostatic Radiator Valves in USA Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Glue Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA