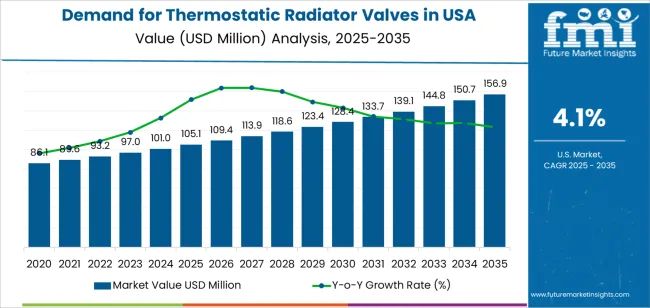

The demand for thermostatic radiator valves (TRVs) in the USA is expected to grow from USD 105.1 million in 2025 to USD 156.9 million by 2035, reflecting a CAGR of 4.1%. TRVs are essential components in heating systems that control radiator temperature by regulating the flow of hot water. They are widely used in both residential and commercial buildings to optimize energy efficiency and improve comfort. The market for TRVs is driven by the increasing need for energy-saving solutions in building heating systems and the growing demand for smart heating technologies that can be remotely controlled and adjusted.

Government energy-efficiency standards, coupled with the growing adoption of sustainable building practices, are expected to drive TRV adoption in both new construction and existing buildings. As more consumers and businesses seek to reduce energy consumption and carbon footprints, the demand for thermostatic radiator valves will continue to grow. Additionally, the rise of smart thermostats and the increasing integration of IoT in HVAC systems will further boost the market for advanced TRVs that offer automated temperature control and integration with home automation systems.

The Growth Contribution Index (GCI) for thermostatic radiator valves in the USA over the 2025 to 2035 period shows the relative contribution of each segment of the forecast period to the overall market expansion. From 2025 to 2030, the market will grow from USD 105.1 million to USD 128.4 million, contributing USD 23.3 million in growth. This segment represents 43.4% of the total forecasted growth. The initial growth phase is characterized by steady adoption, driven by increasing awareness of energy efficiency and the need for better heating control in homes and commercial buildings.

From 2030 to 2035, the market will expand from USD 128.4 million to USD 156.9 million, adding USD 28.5 million in value. This second phase accounts for 56.6% of the total growth, with stronger demand expected as smart heating technologies gain traction. The latter half of the forecast period reflects an increased shift towards integrated heating solutions and smart home systems, which will contribute significantly to the market acceleration. The GCI indicates that the second half of the forecast period will see an exponential growth contribution, driven by technological innovations and stronger demand for energy-efficient home automation systems.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 105.1 million |

| Forecast Value (2035) | USD 156.9 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Demand for thermostatic radiator valves in the USA is increasing as heating systems in residential and commercial buildings become more efficiencyoriented and individually controllable. These valves allow users to regulate temperature at individual radiator units, supporting lower energy consumption and enhanced comfort. With U.S. building codes and incentives emphasising energy savings and carbon reduction, adoption of these valves is becoming more relevant during new builds and retrofits. Advanced models that integrate smarthome features, wireless connectivity and zone control appeal to property owners seeking optimized heating schedules and operational cost reductions.

Another contributing factor is the growing renovation activity in older buildings with hydronic heating systems and the trend toward HVAC upgrades. Building operators and homeowners are replacing manual radiator controls with thermostatic radiator valves to improve control and comply with efficiency standards. Technological development is also shaping demand; valves with digital controllers, connectivity to buildingmanagement systems and compatibility with smart sensors offer enhanced value. Nevertheless, challenges include the upfront cost of advanced valve installations, the need to train technicians on new systems, and the presence of simpler temperature controls in many existing systems. Overall, given energyefficiency mandates and user demand for comfort and control, the thermostatic radiator valve market in the USA is positioned for steady growth.

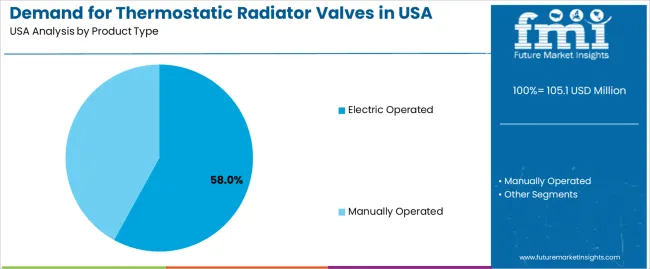

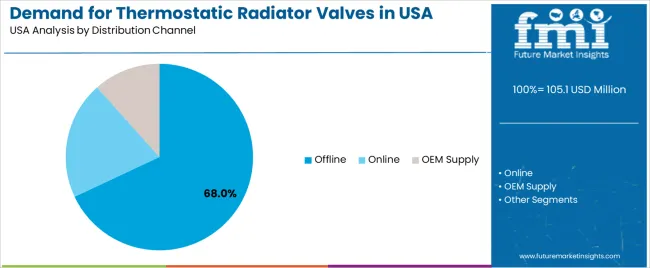

The demand for thermostatic radiator valves (TRVs) in the USA is driven by product type and distribution channel. Electric operated TRVs dominate the market, holding 58% of the share, while the leading distribution channel is offline sales, accounting for 68% of the market. These valves are essential for regulating the temperature in heating systems, providing comfort and energy efficiency in both residential and commercial buildings. As the demand for smart home systems and energy-efficient solutions increases, electric operated TRVs continue to gain traction in the market.

Electric operated thermostatic radiator valves lead the market with 58% of the share due to their precision and integration with modern smart heating systems. These valves allow for automatic temperature control based on external temperature changes, and they can be adjusted remotely, making them ideal for consumers looking for convenience and energy savings. Electric operated TRVs are often part of smart home systems, where they can be connected to Wi-Fi or integrated with smart thermostats, providing greater control over individual room temperatures and improving overall heating efficiency.

The growing demand for energy-efficient solutions in both residential and commercial spaces is a key factor driving the preference for electric operated TRVs. These valves can help reduce energy consumption by optimizing heating based on real-time room conditions, which is particularly important in the USA, where energy efficiency is a major concern. As consumers continue to adopt smart home technologies and demand more automated solutions, the electric operated TRV market is expected to grow, reinforcing its leadership in the sector.

Offline sales hold the largest share of the distribution channel market for thermostatic radiator valves in the USA, accounting for 68%. Offline channels include direct sales through hardware stores, plumbing retailers, and specialized heating and cooling distributors. The strong presence of offline sales is driven by the traditional retail model, where consumers prefer to visit physical stores to inspect products, receive expert advice, and make immediate purchases.

The offline channel also benefits from the extensive network of professionals involved in the installation and maintenance of heating systems, who often purchase TRVs for their clients. As home heating systems require expert installation and maintenance, many consumers continue to rely on offline sales channels to source thermostatic radiator valves from trusted suppliers. The demand for these valves in both residential and commercial sectors further supports the offline channel’s dominance. Despite the growth of online shopping, the offline distribution model remains dominant, providing valuable customer service and immediate product availability.

Demand for thermostatic radiator valves (TRVs) in the USA is shaped by increasing focus on energyefficiency in heating systems, retrofit and newbuild opportunities in residential and commercial buildings, and the drive toward smarter controls in HVAC systems. TRVs allow roombyroom temperature regulation which aligns with sustainability goals and stricter buildingefficiency standards. At the same time, regionspecific factors such as older hydronic heating infrastructure, the pace of building renovation, and awareness of TRV benefits govern how rapidly uptake occurs.

Key growth drivers include: the push for lower heating energy consumption and decarbonisation targets in USA states and local building codes; increased renovation of older buildings with hydronic radiator systems where TRVs are costeffective upgrades; greater adoption of smart HVAC systems and connected controls, which make TRVs more attractive; and rising investments in multifamily residential and hospitality constructions, which create scale opportunities for TRV installation.

The market faces constraints such as: the relatively moderate prevalence of older radiator systems compared with regions where TRVs are standard (for example Europe), limiting total addressable market size; higher upfront cost for advanced TRV products (smart, connected valves) compared with basic manual valves, which can slow decisionmaking in costsensitive retrofit scenarios; and competition from other heating control measures (zone dampers, smart thermostats) which may be chosen instead of, or in addition to, TRVs.

Emerging trends include: increasing integration of TRVs with building management systems and IoT platforms, enabling remote monitoring and optimisation of heating zones; growth in smart home compatibility (WiFi/Bluetooth enabled TRVs) which expands appeal in residential upgrades; greater focus on retrofitfriendly TRVs that minimise disruption in buildings; and stronger emphasis on energysavings and certification (green building, LEED) which highlight TRVs as a valueadd for heating efficiency.

The demand for thermostatic radiator valves (TRVs) in the USA is growing as energy efficiency and smart home technologies continue to gain importance. TRVs, which help regulate room temperature by adjusting the flow of water or steam into a radiator, are increasingly being used in both residential and commercial buildings to enhance energy conservation and improve comfort. As the focus on reducing energy consumption and optimizing heating systems increases, TRVs are being adopted for their ability to provide precise temperature control and reduce heating costs.

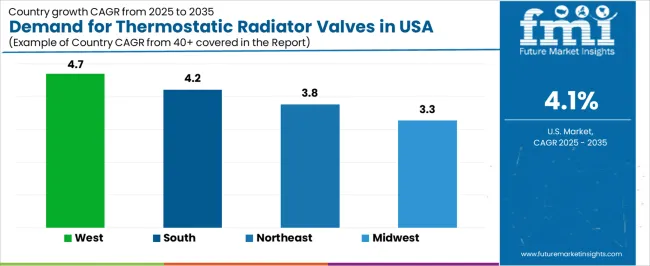

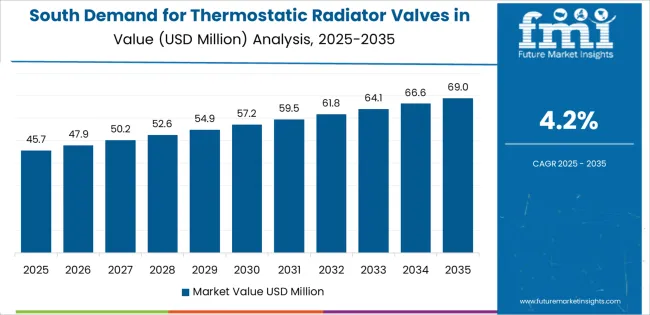

Regional demand for TRVs is influenced by local climate conditions, energy regulations, and the adoption of smart home technologies. The West leads in demand, driven by building energy efficiency regulations and the growth of smart home systems, while other regions such as the South, Northeast, and Midwest show steady demand supported by heating system modernization and energy-saving initiatives. This analysis explores the regional drivers of thermostatic radiator valve demand in the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.7% |

| South | 4.2% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The West region leads the USA thermostatic radiator valve (TRV) market with a CAGR of 4.7%. The demand in this region is primarily driven by the growing focus on energy efficiency in residential and commercial buildings. States like California have stringent energy-saving building codes that encourage the adoption of energy-efficient heating systems, including TRVs, to reduce overall heating energy consumption. Additionally, the West has a strong presence of smart home technologies, with an increasing number of consumers investing in advanced home automation systems, which integrate TRVs for smart temperature control.

The climate in the West also plays a role in the adoption of TRVs, as variable temperatures and the need for efficient heating in both residential and commercial buildings drive demand. As building owners and homeowners continue to prioritize energy-efficient systems, the demand for TRVs in the West will remain high, fueled by both regulatory requirements and consumer interest in energy savings.

The South region shows a solid CAGR of 4.2%. Although the South generally experiences milder winters compared to other regions, there is still growing interest in TRVs due to their potential for energy savings and increased comfort. As energy costs rise and consumers become more aware of their heating system efficiency, TRVs are increasingly being adopted to regulate indoor temperatures more effectively.

In addition, the growing construction industry in the South, particularly in new homes and commercial buildings, contributes to the rising demand for TRVs as part of modern HVAC (heating, ventilation, and air conditioning) systems. The South’s relatively newer buildings, along with advancements in heating technologies, are pushing the demand for energy-saving products like TRVs. Furthermore, the increasing trend toward energy-efficient, smart homes and eco-friendly construction practices supports the ongoing growth of TRV demand in the South.

The Northeast region demonstrates a steady CAGR of 3.8%. The region's colder climate makes energy-efficient heating systems critical for homeowners and businesses, driving steady demand for thermostatic radiator valves. TRVs offer an ideal solution for controlling temperature room by room, which is especially important in areas with long winters, such as New York and Massachusetts.

The Northeast also has a high concentration of older buildings, many of which are upgrading their heating systems to improve energy efficiency and meet modern comfort standards. TRVs are increasingly being incorporated into these upgrades to provide more precise control over heating and reduce energy consumption. As the region continues to focus on energy efficiency and the reduction of heating costs, the demand for TRVs will continue to grow steadily.

The Midwest region shows a moderate CAGR of 3.3%. Similar to the Northeast, the Midwest experiences cold winters, making effective heating systems essential. However, the adoption rate of TRVs in the Midwest is slower compared to other regions due to the higher reliance on more traditional heating systems, such as forced-air heating, which may not be as compatible with TRVs.

That said, there is still growing demand for TRVs, particularly in newly built homes and commercial buildings looking to improve heating efficiency. As energy costs continue to rise and consumers become more conscious of their energy USAge, the demand for thermostatic radiator valves in the Midwest is expected to rise. Additionally, the increasing focus on home automation and smart homes in the Midwest will likely boost adoption of TRVs as part of comprehensive energy-saving systems.

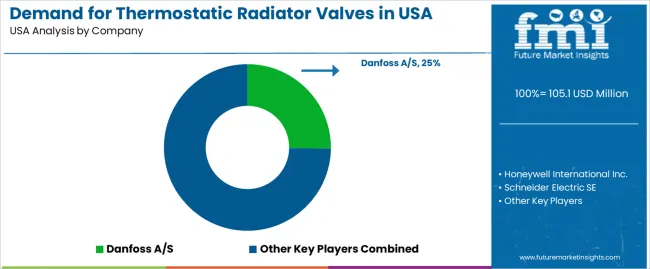

Demand for thermostatic radiator valves (TRVs) in the United States is growing as residential and commercial buildings increasingly adopt energy-efficient heating solutions. Companies such as Danfoss A/S (holding approximately 25.2% market share), Honeywell International Inc., Schneider Electric SE, IMI Hydronic Engineering, and Siemens AG are key players in this market, which is driven by the growing need for smarter heating systems that allow for better temperature control and reduced energy consumption. The adoption of TRVs is particularly high in markets where energy efficiency is a priority, such as in green building projects, government-regulated housing, and the growing retrofit market for older properties.

Competition in this market focuses on innovation in valve design, connectivity, and energy-saving features. Companies differentiate themselves by offering TRVs that integrate with smart home systems, providing remote control and automation capabilities. For example, valves that can be connected to Wi-Fi or smart thermostats allow users to set different temperatures for individual rooms, optimizing comfort and reducing energy waste. Another competitive advantage lies in product reliability and ease of installation, with manufacturers focusing on user-friendly designs that simplify setup and maintenance. Marketing materials typically highlight key features such as ease of adjustment, long-term durability, temperature accuracy, and compatibility with various heating systems. By aligning their products with the growing demand for energy-efficient, customizable heating solutions, these companies aim to maintain and expand their share in the USA thermostatic radiator valve market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America |

| Product Type | Electric Operated, Manually Operated |

| Distribution Channel | Offline, Online, OEM Supply |

| Key Companies Profiled | Danfoss A/S, Honeywell International Inc., Schneider Electric SE, IMI Hydronic Engineering, Siemens AG |

| Additional Attributes | The market analysis includes dollar sales by product type and distribution channel categories. It also covers regional demand trends in the United States, particularly driven by residential and commercial applications. The competitive landscape highlights major players focusing on innovations in both electric and manually operated thermostatic radiator valves. Trends in the growing demand for energy-efficient heating systems and smart thermostatic solutions are explored, along with advancements in digital and automation technologies for HVAC systems. |

The global demand for thermostatic radiator valves in USA is estimated to be valued at USD 105.1 million in 2025.

The market size for the demand for thermostatic radiator valves in USA is projected to reach USD 156.9 million by 2035.

The demand for thermostatic radiator valves in USA is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for thermostatic radiator valves in USA are electric operated and manually operated.

In terms of distribution channel, offline segment to command 68.0% share in the demand for thermostatic radiator valves in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA