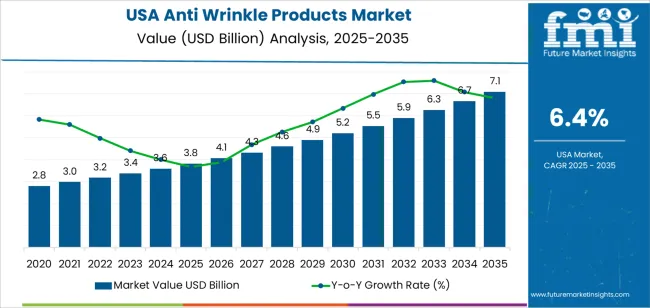

The demand for anti wrinkle products in the USA is expected to grow from USD 3.8 billion in 2025 to USD 7.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.4%. As the focus on anti-aging and skincare continues to rise, the demand for anti wrinkle products, which include creams, serums, and other topical treatments, will increase significantly. The growth of the industry is driven by factors such as the aging population, a greater awareness of skin health, and an increase in disposable income that allows consumers to spend more on premium skincare products.

Advancements in skincare technology, including the development of products with more potent active ingredients like retinoids, peptides, and antioxidants, are further driving industry growth. As consumers become more informed about the effectiveness of various ingredients, the demand for scientifically-backed products is increasing. The popularity of preventative anti-aging treatments among younger consumers is expanding the industry, creating sustained demand for anti wrinkle products across different age groups.

From 2025 to 2030, the industry will grow from USD 3.8 billion to USD 5.5 billion, contributing an additional USD 1.7 billion in value. During this period, strong demand will be driven by the continued interest in anti-aging treatments, especially as the aging demographic in the USA seeks to maintain youthful skin. The industry will see steady growth as consumers focus on prevention and enhancing their skincare routines with specialized products.

From 2030 to 2035, the industry will grow from USD 5.5 billion to USD 7.1 billion, contributing an additional USD 1.6 billion in value. While growth continues, this phase will experience slower acceleration compared to the earlier years, as the industry matures. Innovations in product formulations, including the development of more effective, long-lasting anti wrinkle solutions, will help sustain industry expansion. Increasing consumer demand for holistic beauty solutions, including skin health supplements and more personalized skincare treatments, will keep the demand for anti wrinkle products high during this period.

| Metric | Value |

|---|---|

| Demand for Anti Wrinkle Products in USA Value (2025) | USD 3.8 billion |

| Demand for Anti Wrinkle Products in USA Forecast Value (2035) | USD 7.1 billion |

| Demand for Anti Wrinkle Products in USA Forecast CAGR (2025-2035) | 6.4% |

The demand for anti wrinkle products in USA is growing as consumers increasingly focus on maintaining youthful skin and combating the visible signs of aging. The rising popularity of skincare routines, fueled by an aging population and a growing desire to preserve skin health, is driving the demand for anti wrinkle solutions. These products, which include creams, serums, and treatments designed to reduce the appearance of fine lines and wrinkles, have become integral to daily beauty and wellness regimens.

A significant factor contributing to this growth is the aging demographic in USA, with more individuals seeking ways to preserve their skin’s elasticity and appearance. As the population over 40 continues to grow, anti wrinkle products are becoming a key part of skincare routines for both men and women. Moreover, the growing awareness of the benefits of early intervention in skin care, such as preventing or reducing the appearance of aging signs, is further driving demand.

Advancements in cosmetic science and the development of more effective, clinically proven ingredients, such as retinoids, peptides, and hyaluronic acid, are contributing to the growing adoption of anti wrinkle products. As consumers continue to prioritize health and wellness, along with the desire for long-term beauty benefits, the demand for anti wrinkle products in USA is expected to see steady growth through 2035, supported by innovations in skincare formulations and a continued emphasis on maintaining youthful skin.

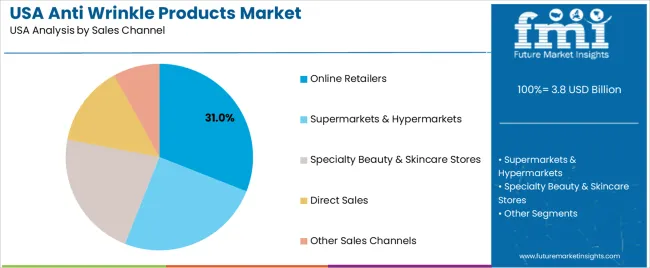

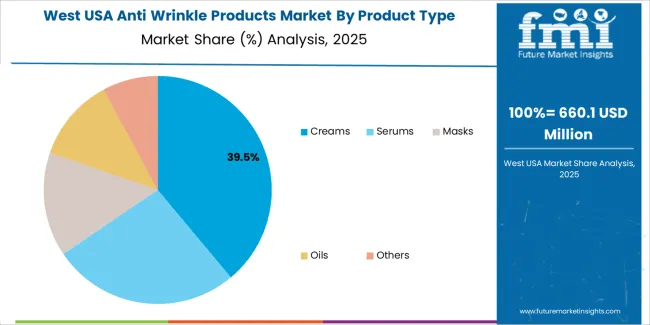

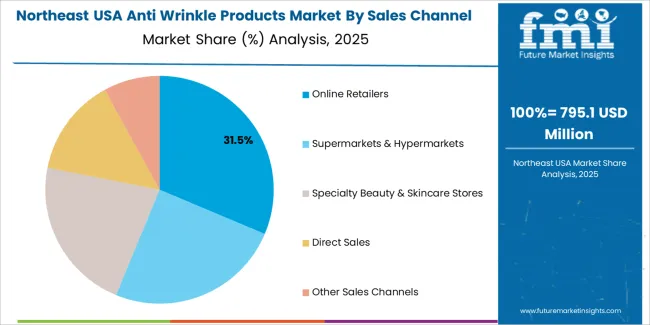

Demand for anti wrinkle products in the USA is segmented by product type and sales channel. By product type, demand is divided into creams, serums, masks, oils, and others, with creams holding the largest share at 38%. The demand is also segmented by sales channel, including online retailers, supermarkets & hypermarkets, specialty beauty & skincare stores, direct sales, and other sales channels, with online retailers leading the demand at 31%. Regionally, demand is divided into regions such as West USA, South USA, Northeast USA, and Midwest USA.

Creams account for 38% of the demand for anti wrinkle products in the USA. Their dominance is primarily driven by their accessibility, affordability, and ease of use. anti wrinkle creams are popular for their ability to hydrate and firm the skin while reducing the appearance of fine lines and wrinkles.

Formulated with active ingredients like retinol, peptides, and antioxidants, creams offer a versatile solution for people looking for both preventative and restorative skincare. They are widely available, ranging from drugstore to premium brands, making them accessible to a broad consumer base. The growing demand for anti-aging solutions, combined with an increasing awareness of skincare, ensures that creams remain the most popular choice for consumers seeking effective anti wrinkle treatments. As the anti-aging trend continues, creams remain an essential component of many skincare routines.

Online retailers account for 31% of the demand for anti wrinkle products in the USA. The rise of e-commerce has made online shopping the preferred choice for many consumers due to its convenience, broader selection, and the ability to compare prices. Consumers can easily browse a wide range of anti wrinkle products from various brands and read reviews, which helps them make informed decisions. Online retailers often provide detailed product descriptions, ingredients, and USAge instructions, making it easier for consumers to find products that suit their specific skin concerns.

The convenience of home delivery, along with the ability to purchase exclusive or hard-to-find products, further boosts the popularity of online shopping. As e-commerce continues to grow and consumers increasingly prioritize convenience, online retailers will remain a dominant sales channel for anti wrinkle products.

Demand for anti‑wrinkle products in USA is growing as more consumers seek effective solutions to signs of skin aging such as wrinkles, fine lines, and loss of elasticity. These products including creams, serums, lotions, and eye‑care treatments are increasingly used across age groups, especially among women aged 30 and above. Consumers are drawn by the promise of smoother, younger‑looking skin, often linked to rising self‑care, wellness awareness, and cosmetic standards. Growth is supported by an aging population, greater disposable income, and high acceptance of preventive skincare routines. Product innovation in dermatological science, such as peptide‑based creams, retinoid serums, and clinically tested formulations, is enhancing the appeal and perceived effectiveness of anti‑wrinkle offerings.

Demand is rising because many Americans view skincare and anti‑aging as part of overall health and well‑being rather than just cosmetic care. As the population ages, there is a growing base of middle‑aged and elderly consumers looking to maintain skin health and appearance. Younger demographics are also embracing preventive skincare starting anti‑aging routines earlier to delay visible signs of aging. Expansion of e‑commerce and direct‑to‑consumer beauty retail makes anti‑wrinkle products more accessible, affordable, and convenient to purchase. Accessibility, broader availability of dermatologist‑endorsed products, and increased consumer knowledge about skincare ingredients are driving this demand.

Advances in skincare science are pushing the development of more effective anti‑wrinkle solutions. Innovations in biotech‑driven formulations such as peptide‑based creams, stem-cell derived actives, retinoids, hyaluronic acid, and other dermatologist‑tested ingredients are improving skin elasticity, collagen support, and wrinkle reduction, boosting consumer confidence.

Growth of personalized skincare and clean‑label products is shaping preferences: consumers increasingly seek clinically validated, gentle, and effective products tailored to their skin type and age. The rise of e‑commerce and subscription‑based dispensing models enhances distribution and consumer convenience, allowing users to explore a wide range of products from mass‑market to premium brands. Such innovation both in product formulation and retail are broadening the reach and appeal of anti‑wrinkle products.

Despite strong growth, there are significant constraints. High cost of premium anti‑aging products reflecting expensive active ingredients, R&D, and marketing may deter price‑sensitive consumers, limiting adoption beyond affluent segments. Effectiveness of many products remains subjective and gradual, which may reduce consumer trust, especially given high expectations for visible results.

Regulatory scrutiny and demand for clean, safe ingredient sourcing and ethical practices can increase production costs and limit some formulations. Competition from alternative treatments such as non‑invasive dermatological procedures, injectables, or lifestyle and wellness‑based anti‑aging strategies may also reduce reliance on topical anti‑wrinkle products. Inconsistent consumer behaviour and shifting beauty standards may challenge long‑term demand stability.

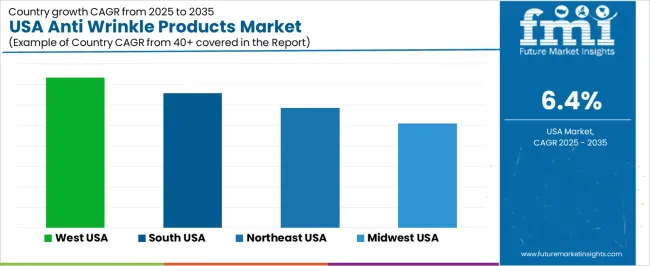

| Region | CAGR (%) |

|---|---|

| West USA | 7.3% |

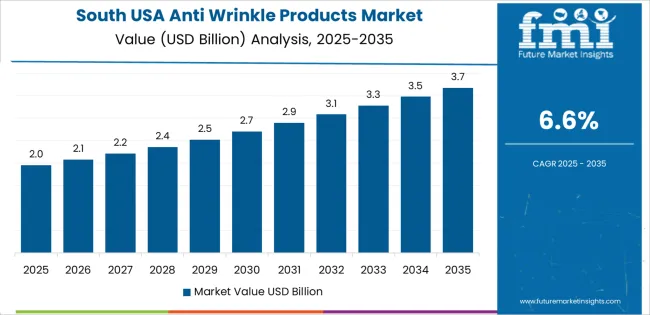

| South USA | 6.6% |

| Northeast USA | 5.9% |

| Midwest USA | 5.1% |

Demand for anti wrinkle products in the USA is growing steadily, with West USA leading at a 7.3% CAGR, driven by a strong focus on skincare, wellness, and natural beauty products. South USA follows with a 6.6% CAGR, supported by a growing interest in anti-aging solutions among middle-aged and older demographics, particularly in states with high sun exposure. Northeast USA shows a 5.9% CAGR, fueled by a strong consumer base that prioritizes premium skincare products for aging concerns. Midwest USA experiences a 5.1% CAGR, with steady demand from consumers focusing on skincare routines for aging prevention. As consumers across the country continue to seek effective, high-quality, and natural anti-aging solutions, the demand for anti wrinkle products is expected to rise consistently across all regions.

West USA leads the demand for anti wrinkle products, growing at a 7.3% CAGR. The region’s high focus on skincare and wellness, combined with a large population of health-conscious consumers, drives the demand for effective anti-aging solutions. States like California are known for their strong skincare industrys, where consumers are increasingly prioritizing premium products to maintain youthful appearance and skin health.

The region’s beauty and cosmetics industry is thriving, with consumers seeking natural, non-toxic anti wrinkle products. The growing trend of skincare routines and emphasis on prevention also contributes to this industry’s expansion. With a focus on technological innovations and the increasing availability of anti wrinkle creams, serums, and other treatments, West USA remains the leading region for anti wrinkle product sales.

South USA is seeing strong demand for anti wrinkle products, with a 6.6% CAGR. The region's growing beauty and skincare industry, fueled by an increasing awareness of anti-aging solutions, supports this growth. The demand is driven by consumers looking for effective skincare products that can combat the visible signs of aging caused by sun exposure, humidity, and other environmental factors. The popularity of anti wrinkle products among middle-aged and older demographics, especially in states like Florida and Texas, is rising, as consumers focus on maintaining skin health. The region’s growing interest in clean beauty products and natural ingredients supports the adoption of anti wrinkle creams and serums. As skincare routines become more focused on anti-aging, the demand for these products continues to grow steadily in South USA.

Northeast USA is experiencing steady growth in demand for anti wrinkle products, with a 5.9% CAGR. The region’s aging population, coupled with a strong culture of self-care, contributes to the growing demand for anti wrinkle solutions. In metropolitan areas like New York, where consumers are highly invested in skincare and beauty routines, the industry for anti-aging products is thriving. The demand is further fueled by an increasing interest in products that offer long-term anti-aging benefits, such as reducing fine lines, improving skin elasticity, and providing hydration. Consumers in Northeast USA are also increasingly opting for premium skincare products, which align with the region's focus on high-quality beauty solutions. As people continue to embrace skincare as part of their daily routines, the demand for anti wrinkle products in the Northeast remains strong and is expected to expand further.

Midwest USA is seeing steady growth in demand for anti wrinkle products, with a 5.1% CAGR. As consumers in the region become more aware of the importance of skincare and the effects of aging, anti wrinkle products are gaining popularity. The growing middle-aged population, particularly in states like Illinois and Michigan, is increasingly seeking effective skincare solutions to combat fine lines and wrinkles. As the beauty and wellness industry continues to expand, Midwest consumers are embracing anti wrinkle products, especially those that offer both prevention and treatment. The region’s rising focus on health and wellness, combined with the increasing use of anti-aging creams, serums, and treatments, drives this demand. Although growth in the Midwest is more moderate compared to other regions, the steady adoption of anti wrinkle products continues to increase as part of broader skincare trends.

The demand for anti wrinkle products in the USA is rising as consumers increasingly seek effective skincare solutions to combat signs of aging. As the population ages and the desire for youthful, radiant skin remains strong, the industry for anti wrinkle products continues to expand. These products, including creams, serums, and treatments, are designed to reduce the appearance of fine lines and wrinkles by improving skin elasticity, promoting hydration, and stimulating collagen production. The demand is further driven by growing awareness of skincare routines, with both luxury and drugstore brands competing for consumer attention.

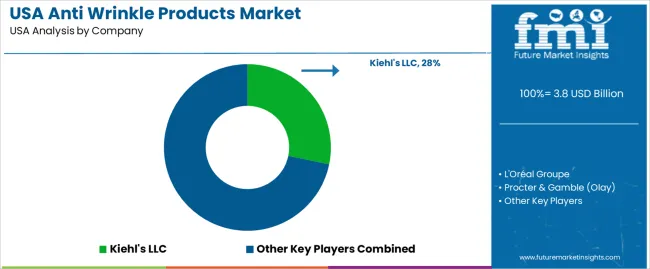

Leading companies in the anti wrinkle products industry in the USA include Kiehl's LLC, L'Oréal Groupe, Procter & Gamble (Olay), Unilever (CeraVe), and Johnson & Johnson (Neutrogena). Kiehl's LLC leads with a industry share of 28.2%, offering a wide range of anti-aging products known for their high-quality ingredients and dermatological benefits. L'Oréal Groupe is another significant player, offering anti wrinkle products under various brands, including Lancôme and L'Oréal Paris. Procter & Gamble (Olay) is a prominent provider of anti wrinkle creams and serums that focus on reversing the visible effects of aging. Unilever (CeraVe) and Johnson & Johnson (Neutrogena) are also major contributors, with their affordable and highly effective anti wrinkle products widely trusted by consumers.

The competitive dynamics in the anti wrinkle products industry are driven by factors such as product efficacy, brand reputation, and innovation. Companies compete by offering products that deliver visible results in reducing wrinkles and improving skin texture. The growing trend of using skincare routines and the increasing interest in both natural and scientifically backed ingredients further influence competition.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Creams, Serums, Masks, Oils, Others |

| Sales Channel | Online Retailers, Supermarkets & Hypermarkets, Specialty Beauty & Skincare Stores, Direct Sales, Other Sales Channels |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Kiehl's LLC, L'Oréal Groupe, Procter & Gamble (Olay), Unilever (CeraVe), Johnson & Johnson (Neutrogena) |

| Additional Attributes | Dollar sales by product type and sales channel; regional CAGR and adoption trends; demand trends in anti wrinkle products; growth in online retail and specialty beauty sectors; technology adoption for skincare solutions; vendor offerings including creams, serums, and other anti-aging products; regulatory influences and industry standards |

The demand for anti wrinkle products in USA is estimated to be valued at USD 3.8 billion in 2025.

The market size for the anti wrinkle products in USA is projected to reach USD 7.1 billion by 2035.

The demand for anti wrinkle products in USA is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in anti wrinkle products in USA are creams, serums, masks, oils and others.

In terms of sales channel, online retailers segment is expected to command 31.0% share in the anti wrinkle products in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Wrinkle Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Western Europe Anti-wrinkle Products Market Analysis – Size, Share & Trends 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Anti-Wrinkle Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Caking Products Market Size and Share Forecast Outlook 2025 to 2035

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

Japan Anti-wrinkle Product Market Analysis - Size, Share & Trends 2025 to 2035

Korea Anti-wrinkle Product Market Analysis - Size, Share & Trends 2025 to 2035

Anti-Puffiness Eye Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Caking Makeup Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Anti-Static Control Products Market Size and Share Forecast Outlook 2025 to 2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Anti-Static Hair Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Fatigue Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA