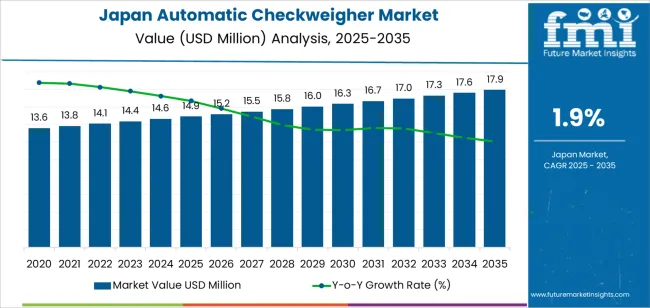

In 2025, automatic checkweigher demand in Japan is valued at USD 14.9 million and is projected to reach USD 17.9 million by 2035 at a CAGR of 1.9%. Growth momentum in the first half of the forecast remains controlled rather than rapid, with market value rising to about USD 16.3 million by 2030. This measured pace reflects the already high level of automation in Japanese food, pharmaceutical, and consumer goods packaging lines. Demand in this phase is driven mainly by replacement of aging systems, tighter weight accuracy requirements, and steady upgrades in hygiene grade equipment for ready to eat meals and medical packaging. Smaller processors adopt compact checkweighers for compliance rather than throughput expansion.

After 2030, momentum remains positive but restrained as the market advances from roughly USD 16.3 million to USD 17.9 million by 2035. Growth in this later stage comes less from new factory builds and more from technology refresh cycles, software driven inspection accuracy, and integration with vision and labeling systems. Snack foods, frozen meals, and over the counter pharmaceuticals remain the core demand centers. Domestic equipment makers and a limited number of global inspection specialists dominate supply. Competitive focus rests on higher weighing speed at lower vibration, improved rejection accuracy, and reduced floor space requirements. This steady momentum profile reflects a mature automation segment where gains are incremental and reliability driven.

The inflection point mapping for the automatic checkweigher demand curve in Japan shows a slow accumulation phase from 2020 to 2025, where the market rises from USD 13.6 million to USD 14.9 million. Yearly increments remain tightly compressed between USD 0.2 million and USD 0.3 million, indicating a pre inflection environment dominated by routine equipment replacement in food processing and pharmaceuticals. This phase reflects capacity maintenance rather than throughput expansion. The absence of step changes confirms that automation penetration was already mature in large factories, with limited new facility creation. The curve remains shallow, showing that demand drivers are operational continuity and compliance stability rather than structural industry expansion.

The inflection zone begins to emerge after 2028 and becomes statistically visible between 2030 and 2035. Demand moves from USD 16.0 million in 2030 to USD 17.9 million by 2035, with annual increments widening consistently toward USD 0.4 million. This shift reflects a change in demand quality rather than volume shock, driven by tighter quality control thresholds, higher SKU complexity, and increased integration of checkweighers into fully automated inspection lines. The slope of the curve steepens modestly but persistently, signaling a transition from maintenance-led purchasing to performance and compliance driven system upgrades. This inflection indicates structural upgrading, not cyclical acceleration.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 14.9 million |

| Forecast Value (2035) | USD 17.9 million |

| Forecast CAGR (2025–2035) | 1.9% |

Demand for automatic checkweighers in Japan arises from rising pressure on manufacturers across food & beverage, pharmaceutical, cosmetics, and consumer-goods sectors to ensure weight consistency, product safety, and compliance with strict quality standards. As production lines output large volumes, manual weighing becomes inefficient and error-prone. Automatic checkweighers make it possible to weigh each package dynamically on a conveyor line, rejecting units that fall outside target weight tolerances. This reduces product giveaway and waste, improves throughput, and helps companies maintain trust in product labeling and regulatory compliance. The increasing adoption of automation across packaging lines in Japan’s manufacturing industries has systematically expanded the base of potential users.

Future growth of automatic checkweighers in Japan is likely to be driven by several converging industry trends. The expansion of the food processing, pharmaceuticals, and e-commerce packaging markets will demand precise, high-speed weighing and inspection at scale. Advances in automation, robotics, and smart manufacturing (including integration with IoT and data analytics) will encourage manufacturers to upgrade legacy lines with combination systems that merge weighing with metal- or X-ray inspection. Growing labour constraints and a drive for efficiency will further sustain uptake of fully automatic systems over semi-automatic or manual alternatives. As quality assurance and regulatory compliance standards increase, automatic checkweighers will become an essential part of packaging machinery portfolios in Japan.

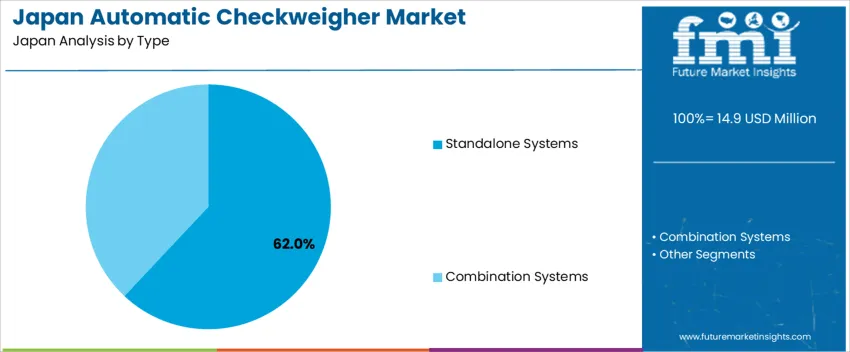

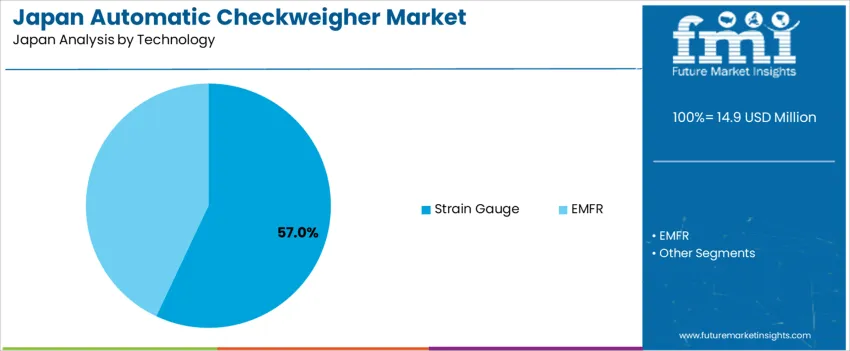

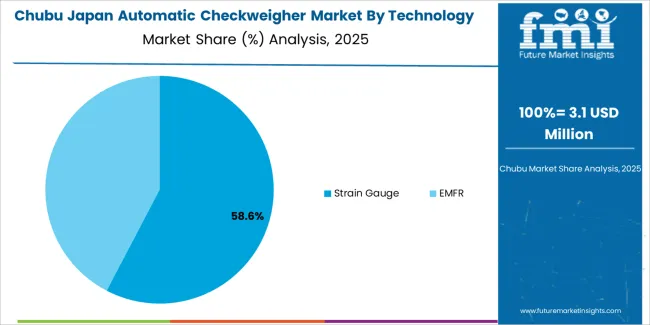

The demand for automatic checkweighers in Japan is shaped by system type and weighing technology. Standalone systems account for 62% of total demand, while combination systems serve integrated inspection and packaging lines. By technology, strain gauge checkweighers hold a 57% share, followed by electromagnetic force restoration systems. Equipment selection is guided by line speed, product weight variability, regulatory requirements, and integration needs with metal detection and vision inspection systems. These segments reflect how accuracy standards, automation levels, and production throughput targets influence adoption across food processing, pharmaceuticals, logistics, and consumer goods manufacturing environments nationwide.

Standalone automatic checkweigher systems account for 62% of total demand in Japan. Their dominance reflects flexibility, lower capital cost, and ease of deployment across existing production lines. Standalone units are commonly installed at critical weight verification points without requiring full line reconfiguration. This allows manufacturers to improve quality control while maintaining current layout structures. These systems are widely used in food, pharmaceutical, and packaged consumer goods facilities where frequent product changeovers require adaptable equipment configurations.

Standalone systems also support independent performance validation and faster maintenance schedules. Downtime on weighing functions does not disrupt upstream or downstream inspection equipment. This improves operational resilience. Calibration routines are simpler, which supports consistent regulatory compliance during audits. Smaller manufacturers favor standalone systems for space efficiency and scalable investment planning. These operational advantages sustain their leading position across both original equipment installations and replacement purchases in Japan manufacturing facilities.

Strain gauge technology accounts for 57% of total automatic checkweigher demand in Japan. This leadership reflects proven reliability, consistent accuracy across wide weight ranges, and lower system cost compared with electromagnetic alternatives. Strain gauge sensors perform well in high speed packaging lines handling lightweight to mid weight products. These systems deliver stable weight readings under vibration and continuous motion conditions typical of automated conveyor environments.

The technology supports long service life with predictable calibration behavior. Parts availability and service familiarity across domestic maintenance providers further strengthen adoption. Strain gauge systems integrate efficiently with control units, rejection mechanisms, and data logging platforms used for compliance reporting. Installation complexity remains lower than EMFR systems, which supports rapid deployment across multiple production sites. These cost and performance advantages align with the operational priorities of Japanese manufacturers focused on throughput reliability and consistent product weight compliance.

Demand for automatic checkweighers in Japan is shaped by strict weight compliance standards, high consumer sensitivity to underweight packaging, and dense high-speed manufacturing environments. Food, pharmaceuticals, cosmetics, and ready-to-eat meal producers rely on precise in-line weight inspection to avoid recalls and brand damage. Japan’s retail culture places strong emphasis on uniformity and accuracy, which reinforces investment in weight control systems. At the same time, export-oriented manufacturers must meet overseas packaging tolerances. These structural quality expectations turn checkweighers into essential production assets rather than optional inspection tools.

Japanese production lines operate at high speeds with minimal tolerance for error. Ready-to-eat meals, bento boxes, confectionery, beverages, and pharmaceutical blister packs move through compact, tightly synchronized lines. Automatic checkweighers ensure every unit complies with declared weight while maintaining throughput. Japans food safety culture emphasizes preventive control rather than post-production correction, which reinforces in-line inspection adoption. Central kitchens, convenience-store food suppliers, and contract manufacturers increase reliance on continuous automated weight control. These operating conditions make real-time checkweighing indispensable across large portions of the Japanese processing sector.

Despite strong fundamentals, automatic checkweigher adoption faces several constraints in Japan. Factory floor space is limited, especially in older urban plants, which restricts installation of large inspection frames. Smaller food processors and regional manufacturers struggle with capital cost justification, especially where production volumes fluctuate seasonally. Frequent product changeovers in Japan’s small-batch production model require flexible systems, and not all machines justify reconfiguration cost. Aging factory infrastructure also complicates electrical upgrades and digital integration. These structural and investment constraints slow the pace of checkweigher penetration beyond core high-volume manufacturers.

Automatic checkweighers in Japan are evolving from simple weight inspection tools into integrated quality-control nodes. Manufacturers demand automated rejection systems, production data logging, and connectivity with MES and traceability platforms. Weight data is increasingly used for yield optimization, material waste reduction, and audit readiness. Compact modular checkweighers suited for space-constrained lines are gaining preference. Dual-function systems combining metal detection and weight inspection also see rising demand. These trends show that Japanese users now view checkweighers as part of digital production control infrastructure rather than isolated quality devices.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.3% |

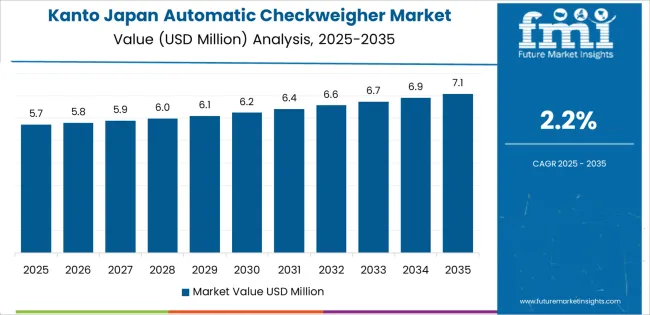

| Kanto | 2.2% |

| Kinki | 1.9% |

| Chubu | 1.7% |

| Tohoku | 1.5% |

| Rest of Japan | 1.4% |

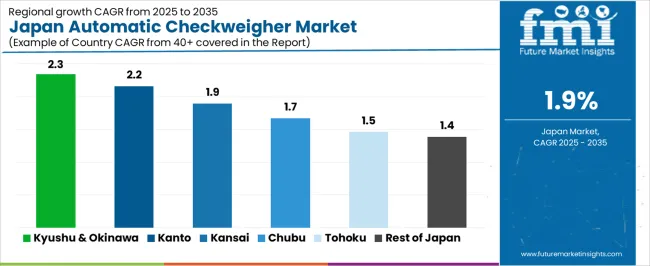

The demand for automatic checkweighers in Japan shows modest growth across regions, with the highest growth in Kyushu & Okinawa at 2.3% CAGR. This growth reflects gradual adoption of automated weighing systems by food, beverage, pharmaceutical, and logistics sectors aiming to ensure packaging compliance and quality control. In Kanto and Kinki regions the 2.2% and 1.9% CAGRs represent established manufacturing zones where incremental upgrades of packaging lines are occurring. Chubu, Tohoku, and Rest of Japan record lower growth (1.7% to 1.4%) possibly due to smaller scale operations, limited investment in automation, and slower expansion of packaged-goods manufacturing. Overall the trend indicates steady but conservative uptake of checkweighing automation across Japan, driven by regulatory compliance, efficiency gains, and growing emphasis on quality control in manufacturing.

Expansion across Kyushu and Okinawa reflects a CAGR of 2.3% through 2035 for automatic checkweigher demand, supported by food processing, seafood packaging, and regional beverage bottling operations. Weight compliance requirements in export oriented products sustain baseline equipment usage. Small and mid scale processors invest in compact checkweighing systems to meet retail packaging standards. Port based logistics also drive secondary demand for carton verification. Growth remains tied to quality control needs rather than production scale expansion, keeping equipment purchases focused on replacement and limited incremental automation across regional packaging lines.

Kanto advances at a CAGR of 2.2% through 2035 for automatic checkweigher demand, driven by dense packaged food production, pharmaceutical filling lines, and ecommerce fulfillment packaging. High regulatory oversight strengthens adoption for in line weight inspection. Tokyo based manufacturing clusters integrate checkweighers into high speed conveyor systems. Equipment utilization remains high due to continuous production cycles. Leasing and service contracts reduce capital barriers for smaller co packers. Demand aligns with compliance automation needs rather than capacity addition, maintaining steady but controlled equipment expansion across metropolitan production networks.

Kinki records a CAGR of 1.9% through 2035 for automatic checkweigher demand, shaped by steady food, cosmetics, and household product packaging activity. Osaka area manufacturers deploy checkweighers mainly for legal metrology compliance rather than process optimization. Line speeds remain moderate, limiting the need for advanced high capacity systems. Equipment purchasing follows structured replacement cycles tied to inspection schedules. Local distributors support calibration and service needs. Demand remains stable due to strict labeling accuracy requirements across consumer goods rather than aggressive manufacturing expansion.

Chubu expands at a CAGR of 1.7% through 2035 for automatic checkweigher demand, influenced by automotive parts packaging, industrial components, and regional food processors. Weight verification focuses on kit assembly accuracy and packaged spare parts for export supply chains. Equipment adoption reflects manufacturing quality assurance programs rather than packaging volume growth. Investment priorities favor upstream production automation rather than end of line inspection equipment. Demand remains concentrated among tier one and tier two suppliers maintaining compliance with OEM packaging specifications for shipment accuracy and traceability.

Tohoku shows a CAGR of 1.5% through 2035 for automatic checkweigher demand, supported by agricultural produce packaging, dairy processing, and regional ready meal producers. Manual weight checks still dominate small facilities, limiting automation speed. Adoption occurs mainly where regulatory audits require documented weight control. Cold chain distribution supports limited but consistent equipment use. Machine purchases remain conservative due to small production batches. Growth reflects incremental compliance upgrades rather than throughput driven expansion across rural food processing and cooperative packaging operations.

The rest of Japan reflects a CAGR of 1.4% through 2035 for automatic checkweigher demand, supported by dispersed food producers, municipal packaging units, and secondary manufacturing clusters. Most users operate on low throughput lines, favoring semi-automatic or refurbished equipment. Compliance with net weight labeling rules sustains baseline inspection needs. Equipment access relies heavily on regional distributors and service agents. Growth remains restrained due to limited capital budgets and low automation urgency in non-metropolitan processing zones compared with central industrial regions.

Demand for automatic checkweighers in Japan is rising as manufacturers and packagers place greater emphasis on weight accuracy, quality control and regulatory compliance. Producers in food, beverage and pharmaceuticals increasingly rely on in line weighing systems to ensure each package meets target weight specifications, reduce overfill and limit waste. Automated checkweighers enable high speed inspection and rejection of non conforming items, which supports efficient production under tight margins. Heightened consumer expectations for consistency and the need for greater throughput in modern packaging lines further drive adoption of dynamic checkweigher solutions.

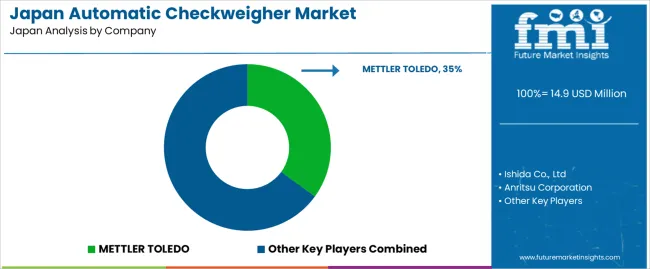

Among suppliers active in Japan, the global leader METTLER TOLEDO accounts for roughly 35 % of market share. Other notable players include Ishida Co., Ltd., Anritsu Corporation, Bizerba and A&D Company, Limited. Ishida and Anritsu supply locally tailored solutions suited to Japan’s food and packaging sectors. Bizerba and A&D offer precision weighing systems for industrial and consumer goods applications. These firms compete along dimensions of weighing accuracy, speed, system integration and reliability. Their combined presence shapes the checkweigher market in Japan by offering a mix of global standard and domestically adapted solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Standalone Systems, Combination Systems |

| Technology | Strain Gauge, EMFR (Electromagnetic Force Restoration) |

| Industry | Food & Beverages, Pharmaceuticals, Consumer Products, Cosmetics and Personal Care, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | METTLER TOLEDO, Ishida Co., Ltd., Anritsu Corporation, Bizerba, A&D Company, Limited |

| Additional Attributes | Dollar by sales by system type and technology; regional CAGR and adoption rate; standalone vs combination system penetration; leading technology adoption (strain gauge); industry-wise usage patterns; equipment replacement cycles; integration with metal detection, vision, and labeling systems; throughput and line speed optimization; floor space and compactness considerations; modular and dual-function systems; adoption by small vs large processors; regulatory compliance and quality assurance influence; automation integration with MES and data logging platforms; equipment service and maintenance trends; incremental vs new installation demand. |

The demand for automatic checkweigher in Japan is estimated to be valued at USD 14.9 million in 2025.

The market size for the automatic checkweigher in Japan is projected to reach USD 17.9 million by 2035.

The demand for automatic checkweigher in Japan is expected to grow at a 1.9% CAGR between 2025 and 2035.

The key product types in automatic checkweigher in Japan are standalone systems and combination systems.

In terms of technology, strain gauge segment is expected to command 57.0% share in the automatic checkweigher in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Checkweigher Market Growth & Outlook 2025 to 2035

Demand for Automatic Checkweigher in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Gearbox Valves in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Dishwashing Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in Japan Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Impact Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA