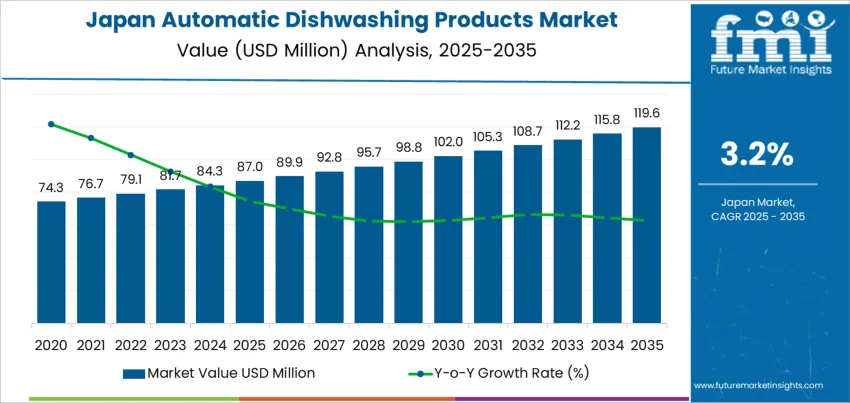

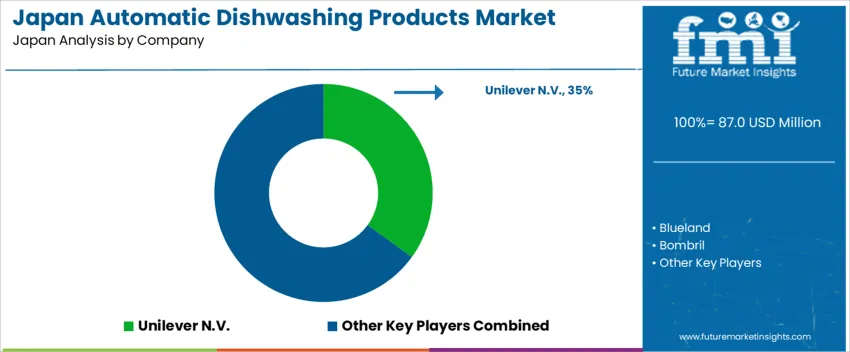

In 2025, the demand for automatic dishwashing products in Japan stands at USD 87.0 million and is forecast to reach USD 119.6 million by 2035 at a CAGR of 3.2%. The absolute dollar opportunity in the first half of the forecast totals about USD 15.0 million, as demand rises from USD 87.0 million in 2025 to nearly USD 102.0 million by 2030. This early value creation is closely linked to steady growth in household dishwasher penetration, rising usage in compact urban apartments, and wider placement in food service kitchens seeking labor efficiency. Product mix during this phase remains concentrated in powders and tablets, supported by stable retail distribution and consistent repeat purchase behavior.

From 2030 to 2035, the market generates an additional absolute opportunity of roughly USD 17.6 million as demand increases from about USD 102.0 million to USD 119.6 million. This latter block contributes the larger share of incremental value despite moderate volume expansion. Premiumization trends, rising use in commercial kitchens, and replacement of manual cleaning systems in small restaurants and institutional facilities shape growth in this phase. Manufacturers emphasize improved grease removal, shorter wash cycles, and compatibility with compact machines. Distribution remains weighted toward mass retail and wholesale supply for food service operators, which supports a steady value build through the final years of the forecast.

The long-term value accumulation curve for automatic dishwashing products in Japan shows a steady and compounding build-up rather than front-loaded expansion. From USD 74.3 million in 2020 to USD 87.0 million in 2025, the market adds USD 12.7 million, establishing the base layer of value accumulation driven mainly by gradual dishwasher penetration in urban households and stable usage in commercial kitchens. Each annual increment during this phase remains narrow, ranging between USD 2.4 million and USD 2.7 million, which indicates controlled adoption rather than rapid behavioral change. This creates a shallow but consistent accumulation slope, where value is added through usage frequency growth rather than sharp user base expansion.

From 2025 to 2035, the accumulation curve steepens in absolute value terms as the base expands from USD 87.0 million to USD 119.6 million, adding USD 32.6 million over the decade. Annual value additions gradually widen from about USD 2.9 million to nearly USD 3.8 million by the later years, showing how compounding works even under a modest 3.2% growth rate. The curve reflects a consumption-led accumulation pattern where long-term value is generated through repeat purchase behavior, household format shifts, and commercial volume growth. The absence of sharp jumps confirms that this is a structurally stable, habit-driven accumulation market rather than a trend-driven expansion cycle.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 87.0 million |

| Forecast Value (2035) | USD 119.6 million |

| Forecast CAGR (2025–2035) | 3.2% |

Demand for automatic dishwashing products in Japan emerged gradually as dishwashers moved from luxury appliances to standard fixtures in urban apartments and modern homes. Early adoption was limited by compact kitchen layouts and cultural preference for hand washing, which kept growth moderate for years. This began to shift as housing designs changed, dual income households increased, and expectations around hygiene rose. Automatic dishwashing products gained traction in households prioritising time efficiency and standardized cleaning results. Commercial demand also expanded across restaurants, hospitals, and food service facilities where labor availability tightened and sanitation controls became stricter. These historical changes built a steady user base for machine-specific detergents, rinse aids, and cleaning formulations.

Future demand in Japan will be shaped by different factors than in the past. Growth will rely less on first-time dishwasher adoption and more on replacement cycles, premium product upgrades, and commercial installations. Aging demographics will increase preference for low-effort household solutions, while urban living will continue to favor compact, high-efficiency appliances. Product development will shift toward low-residue, low-odor, and equipment-safe formulations suited to water-saving machines. Institutional demand will strengthen as food safety audits tighten. While hand washing will remain culturally rooted, automatic dishwashing products will expand through practical necessity rather than lifestyle aspiration.

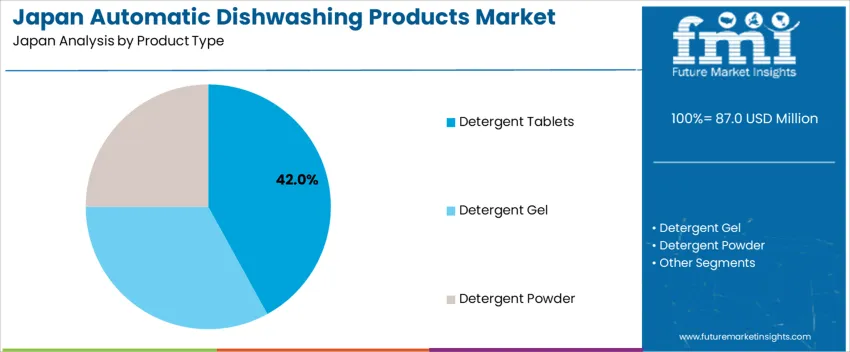

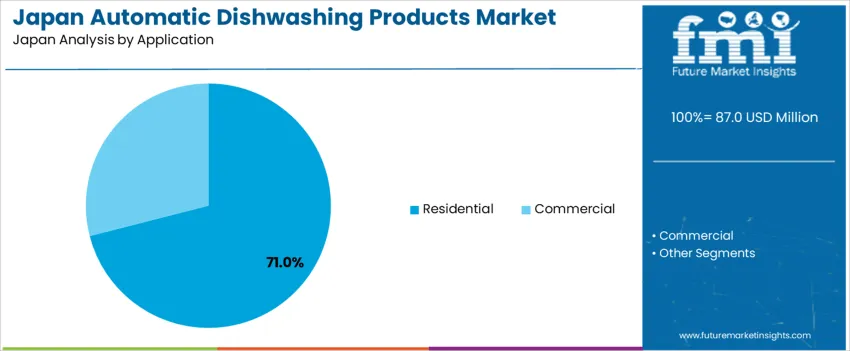

The demand for automatic dishwashing products in Japan is shaped by product type and application. Detergent tablets account for 42% of total demand, followed by detergent gels and detergent powders. By application, residential use dominates with a 71% share, while commercial use serves institutional kitchens and foodservice outlets. Product selection is influenced by cleaning efficiency, dosing convenience, machine compatibility, and water conditions. Application demand reflects household appliance penetration, lifestyle patterns, and kitchen automation adoption. These combined factors determine volume distribution across formats and usage environments within the automatic dishwashing products sector in Japan.

Detergent tablets account for 42% of automatic dishwashing product demand in Japan, making them the leading product type. Their dominance is driven by precise dosing, ease of storage, and consistent cleaning performance. Single use tablets eliminate the need for manual measurement, which reduces product waste and aligns with household preferences for convenience. Tablets dissolve in controlled stages, allowing sequential release of cleaning and rinsing agents during wash cycles. This improves performance across grease removal, stain control, and glass clarity under varying water temperatures and hardness levels common in domestic systems.

Packaging stability and shelf life further support tablet adoption in retail distribution. Tablets handle well during transport and show limited leakage risk compared with gel formats. Manufacturers also promote multi-function tablets that combine detergent, salt, and rinse aid actions into a single unit. This reduces the need for multiple additives. These functional advantages strengthen tablet penetration among households upgrading to compact automatic dishwashers in urban apartments and mid density residential developments across Japan.

Residential use accounts for 71% of total demand for automatic dishwashing products in Japan. This leadership reflects steady growth in dishwasher ownership within urban housing and multi-unit residences. Space efficient compact dishwashers are increasingly integrated into modern kitchens, especially in newly constructed apartments. Time saving demand from dual income households supports regular usage frequency. Residential consumers prioritize ease of use, consistent cleaning results, and low residue performance on glassware and cookware.

Replacement cycles for manual washing habits continue to shift toward automated solutions as appliance energy and water efficiency improves. Manufacturers design residential formulas to balance cleaning power with surface safety for ceramics, stainless steel, and delicate glass. Retail availability across supermarkets and online platforms supports recurring purchase behavior. As household labor efficiency remains a priority across major cities, residential demand continues to anchor overall consumption volumes for automatic dishwashing products in Japan.

Demand grows as households increasingly aim for convenience and time savings in daily chores. Rising numbers of dual-income families and single-person households make manual dishwashing less practical. The prevalence of small kitchens and limited living space drives interest in compact automatic dishwashing tablets or detergents compatible with small countertop dishwashers. Growing hygiene awareness and concern for cleanliness encourage consumers to choose effective cleaning solutions that remove grease and sanitize dishes with minimal effort. These lifestyle and demographic shifts underpin rising uptake of automatic dishwashing products across Japanese homes.

Urban living trends in Japan, marked by smaller apartments and busy schedules, make traditional dishwashing inconvenient and time-consuming for many. Shared facilities in multi-family housing sometimes discourage lengthy dish-washing routines. Automatic dishwashing detergents and tablets allow quicker washing cycles and reduced water use, which suits urban households. Younger professionals and older adults with limited mobility value solutions that reduce manual effort. Thus structural aspects of housing and changing household composition support broader acceptance of automatic dishwashing products in Japan’s domestic market.

Although demand is rising, some households remain resistant due to price sensitivities and ingrained habits. Automatic dishwashing detergents and tablets tend to be more expensive than traditional hand-washing soaps, which deters price-conscious consumers. Some users prefer hand-washing to better control water use or to clean delicate tableware. Limited penetration of home dishwashers due to space constraints or cost reduces the addressable market for automatic-grade detergents. These cost and habit-related factors constrain expansion of automatic dishwashing product use across all household segments.

Manufacturers are responding by launching concentrated detergents, tablet formats, and more environmentally oriented formulations that appeal to Japanese consumers concerned with waste, water usage, and chemical exposure. Products offering grease-cutting, quick-rinse cycles, and lower residue after washing are growing in popularity. Packaging size reduction and refillable formats match urban consumers’ small-space needs. As awareness of eco-friendliness and skin sensitivity grows, detergent variants with mild surfactants or natural ingredients see increased interest. These formulation and packaging trends are shaping how automatic dishwashing products evolve to fit Japanese lifestyle demands.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.0% |

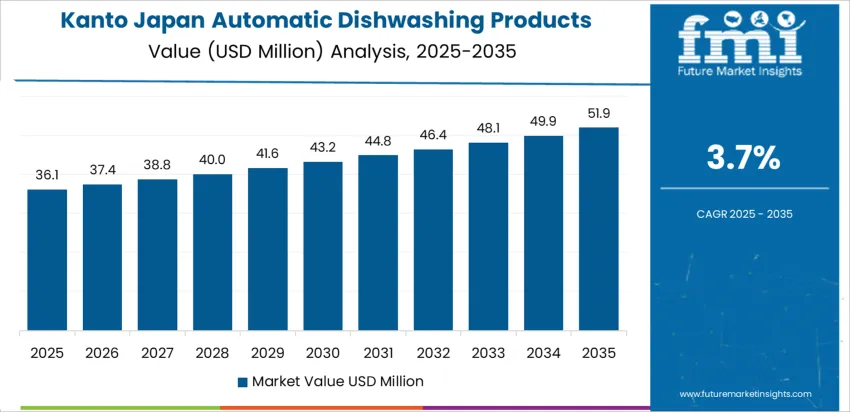

| Kanto | 3.7% |

| Kinki | 3.3% |

| Chubu | 2.9% |

| Tohoku | 2.5% |

| Rest of Japan | 2.4% |

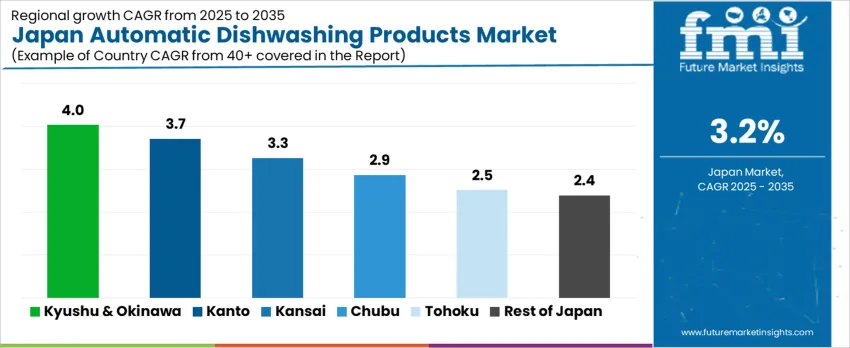

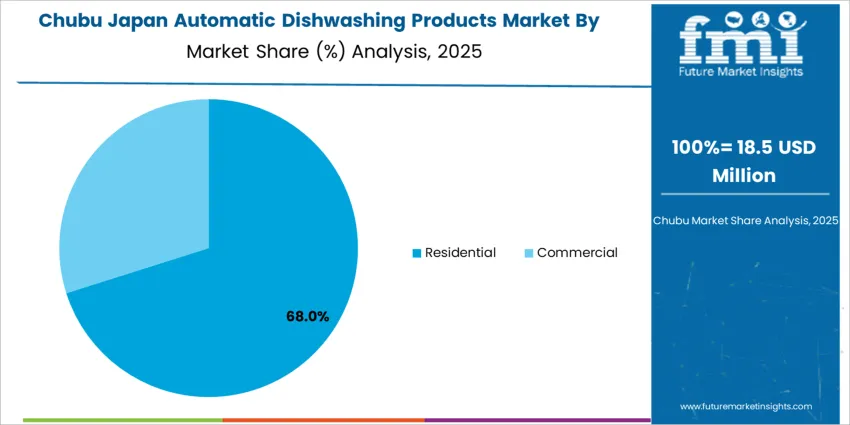

The demand for automatic dishwashing products in Japan is projected to grow at different rates across regions. Growth is strongest in Kyushu & Okinawa at a 4.0% CAGR, likely supported by rising adoption of dishwashers among households and increasing demand for efficient cleaning solutions. The Kanto region, at 3.7%, benefits from high urbanization, busy lifestyles and growing uptake of compact dishwashers and concentrated detergents. In Kinki the 3.3% growth reflects moderate demand tied to urban household penetration. Chubu at 2.9%, Tohoku at 2.5%, and Rest of Japan at 2.4% show slower growth, possibly due to lower urban density and slower pace of dishwasher adoption. Overall the trend points to gradual but steady growth driven by changing lifestyle patterns, household convenience needs, and hygiene awareness in Japan.

Growth across Kyushu and Okinawa reflects a CAGR of 4.0% through 2035 for automatic dishwashing product demand, supported by rising appliance penetration and gradual lifestyle shifts toward time saving household solutions. Urban households in cities such as Fukuoka adopt compact dishwashers at a growing pace. Tourism linked residential rentals and serviced apartments also contribute to steady detergent consumption. Retail distribution remains oriented toward mass merchants and regional supermarkets. Limited kitchen space still restricts full scale adoption, but replacement cycles and trial usage continue to support incremental volume growth across domestic consumption channels.

Kanto advances at a CAGR of 3.7% through 2035 for automatic dishwashing product demand, driven by dense urban households, higher disposable income, and wider appliance ownership across metropolitan zones. Tokyo apartment developments increasingly integrate built in dishwashers, supporting consistent detergent usage. Dual income households favor automated cleaning for daily kitchen routines. Product demand also benefits from frequent retail promotions and private label expansion through large format stores and online platforms. High population density ensures steady consumption flow, with repeat purchases anchored in convenience oriented household purchasing behavior.

Kinki records a CAGR of 3.3% through 2035 for automatic dishwashing product demand, shaped by balanced appliance adoption and stable household income levels. Osaka and surrounding urban areas lead product consumption through apartment based living arrangements. Traditional kitchen layouts in older housing still slow full penetration. Demand remains centered on liquid detergents and compact tablet formats suited for smaller machines. Retail pharmacies and neighborhood supermarkets anchor distribution. Volume growth reflects gradual appliance replacement cycles rather than rapid first time adoption across the regional household base.

Chubu expands at a CAGR of 2.9% through 2035 for automatic dishwashing product demand, influenced by practical household spending patterns and moderate appliance ownership. Suburban family homes favor manual dishwashing, limiting rapid category expansion. Demand arises mainly from higher income households and newly built residential developments. Manufacturing workforce communities show steady but conservative adoption behavior. Retail distribution relies on general merchandise stores and home centers. Product sales track appliance installation trends more closely than promotional activity, leading to predictable but gradual growth across regional consumer markets.

Tohoku shows a CAGR of 2.5% through 2035 for automatic dishwashing product demand, supported by slow but steady appliance adoption and replacement driven usage. Lower household incomes and rural settlement patterns constrain rapid growth. Demand centers on urban prefectural capitals and institutional housing. Retail access remains focused on mass merchants rather than specialty outlets. Winter climate conditions encourage indoor appliance usage but do not significantly alter penetration levels. Growth follows gradual lifestyle transitions rather than structural shifts in household cleaning behavior.

The rest of Japan reflects a CAGR of 2.4% through 2035 for automatic dishwashing product demand, supported by low volume replacement purchases and selective appliance adoption in secondary cities and rural prefectures. Manual dishwashing remains the dominant method across most households. Product demand originates from premium home segments, aging populations seeking labor reduction, and limited rental housing adoption. Distribution remains dependent on regional supermarkets and cooperative retail outlets. Growth stays restrained due to conservative spending behavior and lower priority assigned to automated kitchen appliances outside core urban centers.

Demand for automatic dishwashing products in the USA is rising because consumers increasingly value convenience, hygiene, and time savings in household chores. The prevalence of dishwashers in urban and suburban homes supports growth in demand for detergents, gels, and tablets designed for automated cleaning. Rising awareness about kitchen hygiene and sanitation encourages use of products that deliver effective grease removal and sanitisation. Growing preferences for ready to use formulations and water efficient cleaning solutions also favour automatic dishwashing products over manual hand washing detergents.

Major companies shaping the US automatic dishwashing segment include Unilever N.V., Blueland, Bombril, Reckitt Benckiser Group plc, and Church & Dwight Co. Inc. These firms offer a mix of traditional and modern dishwashing detergents, including enzyme based, eco conscious, and convenience oriented products. Unilever and Reckitt Benckiser leverage wide retail reach and brand recognition to secure broad household penetration. Church & Dwight supplies formulations that appeal to consumers seeking reliable cleaning for varied dishware types. Blueland and Bombril focus on niche positioning and alternative formulations that target sustainability conscious buyers. These companies steer the market by offering diversified product formats and adjusting to evolving consumer preferences.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Detergent Tablets, Detergent Gel, Detergent Powder |

| Application | Residential, Commercial |

| Sales Channel | Hypermarkets/Supermarkets, Online Retailers, Wholesalers/Distributors, Modern Trade, Convenience Stores, Other Sales Channel |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Unilever N.V., Blueland, Bombril, Reckitt Benckiser Group plc, Church & Dwight Co. Inc. |

| Additional Attributes | Dollar by sales by product type and application; regional CAGR and volume growth projections; residential vs commercial share; tablet vs gel vs powder consumption distribution; channel contribution to total sales; urban vs suburban household penetration; influence of appliance adoption rates; replacement vs first-time usage; premiumization and commercial kitchen adoption; eco-conscious product influence; retail vs online channel dynamics; repeat purchase patterns and seasonality; product performance attributes including grease removal and low residue formulation; cost and price sensitivity; household demographics and urbanization impact. |

The demand for automatic dishwashing products in Japan is estimated to be valued at USD 87.0 million in 2025.

The market size for the automatic dishwashing products in Japan is projected to reach USD 119.6 million by 2035.

The demand for automatic dishwashing products in Japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in automatic dishwashing products in Japan are detergent tablets, detergent gel and detergent powder.

In terms of application, residential segment is expected to command 71.0% share in the automatic dishwashing products in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Dishwashing Products Market Insights – Growth & Forecast 2025 to 2035

Demand for Automatic Dishwashing Products in USA Size and Share Forecast Outlook 2025 to 2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Japan Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Automatic Checkweigher in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Gearbox Valves in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Baby Personal Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Tracheal Tubes and Airway Products in Japan Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA