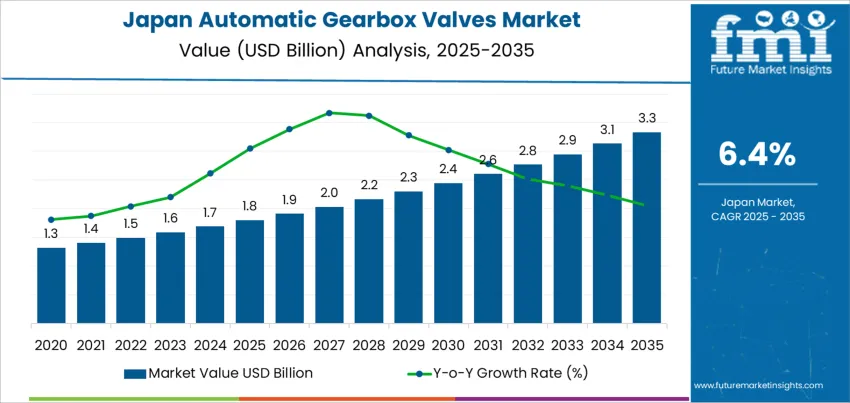

In 2025, automatic gearbox valve demand in Japan stands at USD 1.8 billion and is forecast to reach USD 3.3 billion by 2035 at a CAGR of 6.4%. Expansion during the early forecast years is tied to stable domestic vehicle production, firm export volumes to Asia and North America, and the rising share of multi speed automatic transmissions in compact and mid size vehicles. Japanese manufacturers continue to refine shift response, fuel efficiency, and drivability, which raises the technical value of hydraulic control systems. Valve bodies used in torque regulation, pressure modulation, and gear actuation gain higher precision requirements. Replacement demand from aging automatic transmission fleets also sustains baseline volumes across independent service networks.

After 2030, market activity reflects drivetrain restructuring linked to hybridization and advanced power control systems. Hybrid vehicles account for the largest installed base of automatic gearbox valves due to complex torque coordination between motors and internal combustion engines. Battery electric vehicles reduce transmission diversity, though export driven production and aftermarket servicing preserve steady demand. Leading suppliers include Japanese motion control specialists and global transmission component groups with domestic operations. Competitive strategy centers on miniaturized solenoids, tighter machining tolerances, and integrated electro hydraulic control units. Automation in valve assembly, higher in line inspection standards, and long term platform supply agreements shape cost control and delivery reliability across OEM programs through 2035.

Unlike component categories driven by discretionary replacement cycles, automatic gearbox valves track tightly with transmission production stability, which shapes a distinct volatility profile. From 2020 to 2025, demand rises from USD 1.3 billion to USD 1.8 billion, with uniform year on year additions of roughly USD 0.1 billion. The Growth Volatility Index during this phase remains compressed, reflecting controlled expansion supported by consistent automatic transmission penetration in passenger vehicles. No deviation spikes appear across these five years, confirming that demand variance is structurally limited and closely aligned with predictable OEM output schedules rather than aftermarket fluctuation or export shock sensitivity.

From 2025 to 2035, volatility expands marginally but remains structurally disciplined as demand advances from USD 1.8 billion to USD 3.3 billion. Annual increments widen from USD 0.1 to near USD 0.2 billion after 2030, reflecting rising automatic and hybrid transmission complexity rather than cyclical instability. The Growth Volatility Index signals moderate amplitude expansion driven by electronics integration and higher valve density per gearbox. Variability increases in magnitude but not in unpredictability. This pattern indicates that long term growth is being shaped by platform engineering upgrades rather than macro demand swings, keeping downside exposure low and forecast confidence high.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.8 billion |

| Forecast Value (2035) | USD 3.3 billion |

| Forecast CAGR (2025–2035) | 6.4% |

Historical demand for automatic gearbox valves in Japan has been shaped by the long transition from manual to automatic transmissions across passenger cars, commercial vehicles, and urban mobility fleets. Domestic automakers prioritized smooth shifting, durability, and compact drivetrains, which increased reliance on precisely machined hydraulic and solenoid valves inside valve bodies and mechatronic units. Growth in hybrid vehicles further reinforced demand because these platforms still depend on complex hydraulic control for torque management and regenerative braking coordination. Tier one transmission suppliers and precision component makers built stable production programs around platform life cycles, while steady replacement demand emerged from ageing vehicle fleets, thermal fatigue of valve assemblies, and contamination related failures in high mileage gearboxes.

Future demand for automatic gearbox valves in Japan will be shaped less by pure unit growth and more by rising technical complexity. Electrification increases demands on transmission efficiency, thermal control, and compact packaging, which raises performance requirements for valves rather than eliminating them. Multi speed hybrid gearboxes, electronically controlled continuously variable transmissions, and integrated drive units will require highly responsive, low leakage and sensor integrated valve systems. Export oriented vehicle platforms will push Japanese suppliers to meet global durability standards and tighter cost structures at the same time. Aftermarket demand will increasingly depend on owner preference for transmission rebuilding over full replacement as repair costs rise and vehicle service life extends.

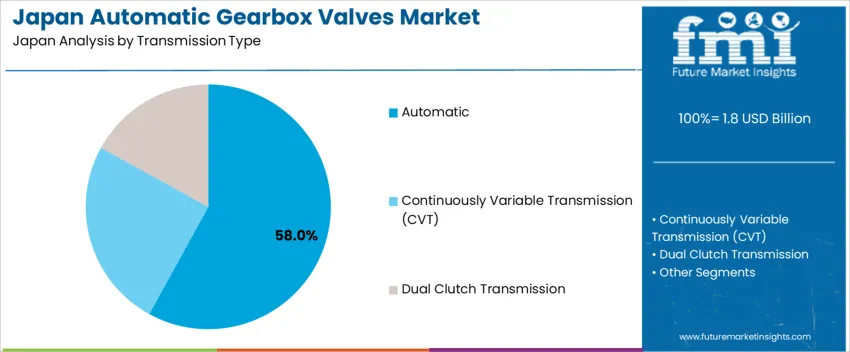

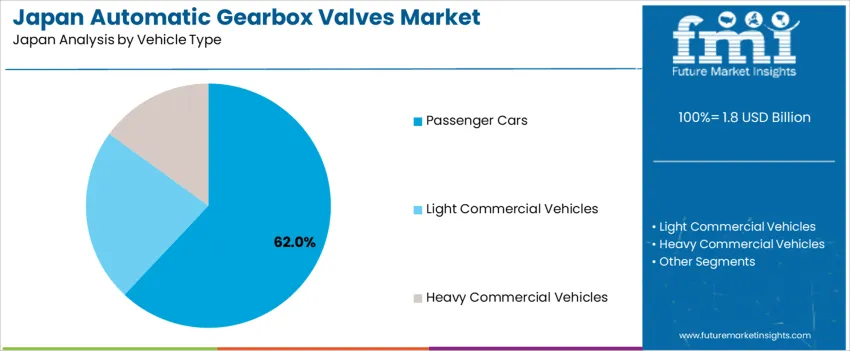

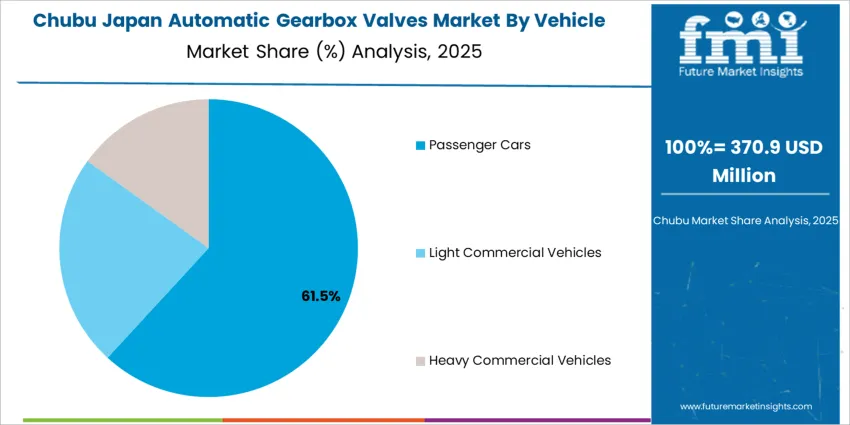

The demand for automatic gearbox valves in Japan is influenced by both transmission type and vehicle type. The key transmission types include automatic, continuously variable transmission (CVT), and dual-clutch transmission (DCT), with automatic transmissions accounting for 58% of the total demand. In terms of vehicle type, passenger cars dominate, representing 62% of the total demand, followed by light and heavy commercial vehicles. Transmission choice is determined by factors such as vehicle performance, fuel efficiency, and cost considerations, while vehicle type is influenced by consumer preferences, vehicle usage patterns, and the Japanese automotive market’s ongoing shift towards more fuel-efficient and technologically advanced systems.

Automatic gearboxes account for 58% of the total demand for gearbox valves in Japan. This dominance is driven by the widespread adoption of automatic transmissions in passenger vehicles, which are increasingly favored for their ease of use, comfort, and growing fuel efficiency. Automatic gearboxes provide smoother shifting and are less demanding for drivers, making them a popular choice in urban environments with heavy stop-and-go traffic. Japanese automakers have incorporated automatic transmissions into a wide range of vehicles, from compact cars to luxury sedans, further driving the demand for automatic gearbox valves, which play a critical role in regulating fluid flow within the transmission system.

The growing trend towards hybrid and electric vehicles in Japan, which often incorporate advanced automatic transmission systems, also contributes to the rising demand for automatic gearbox valves. As the automotive industry continues to innovate with more fuel-efficient and performance-oriented transmissions, the demand for high-quality gearbox valves in automatic transmissions is expected to remain strong. Furthermore, the increasing demand for comfort and ease of driving, coupled with stricter emission standards, continues to drive the preference for automatic transmissions in the Japanese automotive market.

Passenger cars represent 62% of the total demand for automatic gearbox valves in Japan. This demand is primarily driven by the increasing popularity of automatic transmissions in consumer vehicles, especially in urban areas where ease of driving and comfort are prioritized. Automatic gearboxes are particularly favored in Japan’s dense traffic conditions, where they provide smoother driving experiences without the need for manual shifting. Additionally, with growing emphasis on fuel efficiency and environmental considerations, modern automatic transmissions are designed to optimize performance, further enhancing their appeal in passenger vehicles.

The demand for automatic gearbox valves in passenger cars is also driven by the continued development of advanced transmission technologies, including hybrid and electric vehicle models. These vehicles often incorporate automatic transmission systems or CVTs to improve fuel efficiency and reduce carbon emissions. As more consumers seek environmentally friendly vehicles, automakers in Japan are increasingly incorporating automatic transmissions into their offerings. This shift towards automatic and hybrid systems, along with consumer preferences for comfort and ease, is expected to sustain and grow the demand for automatic gearbox valves in the passenger car segment.

Demand for automatic gearbox valves in Japan is tied closely to domestic transmission production, export-oriented vehicle assembly, and the country’s high penetration of automatic and hybrid vehicles. Automatic and continuously variable transmissions dominate passenger car output, which sustains consistent OEM demand for precision hydraulic control valves. At the same time, rising production of hybrid vehicles increases valve system complexity inside electronically controlled gearboxes. Cost pressure from precision machining, slower domestic vehicle ownership growth, and long transmission replacement cycles act as stabilizers rather than accelerators of volume growth. These forces collectively define the pace and structure of automatic gearbox valve demand in Japan.

Japan’s passenger vehicle mix is dominated by automatic, CVT, and hybrid powertrains, which rely heavily on finely tuned hydraulic valve bodies for smooth shifting and torque control. Urban congestion across Tokyo, Yokohama, Osaka and Nagoya leads to constant low-speed gear changes, placing heavy cycling loads on gearbox valves. Kei cars and compact hybrids use densely packed transmissions where valve precision is critical for shift quality and durability. Export models built in Japan follow global performance standards, which reinforces tight tolerance requirements. These local driving and transmission preferences sustain recurring demand for high-precision automatic gearbox valves.

Automatic gearbox valve growth in Japan is restrained by the gradual transition toward electric vehicles that eliminate multi-speed transmissions entirely. Hybrid platforms still require advanced valve systems, but pure battery electric vehicles reduce long-term demand potential. Precision machining, heat treatment, and surface finishing of valve components drive high production costs, while competition among tier-one supplier’s compresses margins. Extended vehicle lifespans and declining private vehicle ownership in major cities reduce replacement demand for transmission components. These structural and powertrain shifts limit aggressive capacity growth for automatic gearbox valve suppliers within Japan.

Automatic gearbox valve design in Japan is moving toward tighter dimensional control, improved wear coatings, and higher resistance to contamination from modern low-viscosity transmission fluids. Valve bodies increasingly integrate with electro-hydraulic control modules for faster response and improved fuel efficiency. Pre-assembled valve blocks with embedded sensors are gaining adoption to simplify gearbox assembly and reduce calibration time. Lightweight aluminum valve housings with hardened steel internals are replacing older fully steel structures. These trends reflect a shift toward compact, electronically integrated, high-precision valve systems aligned with Japans evolving transmission architecture.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.0% |

| Kanto | 7.3% |

| Kinki | 6.4% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.7% |

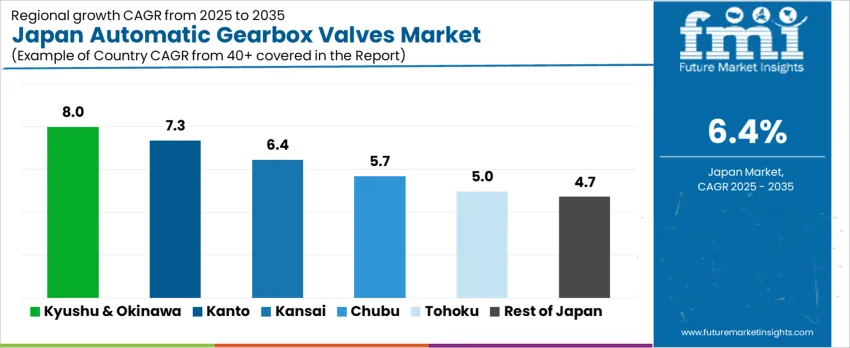

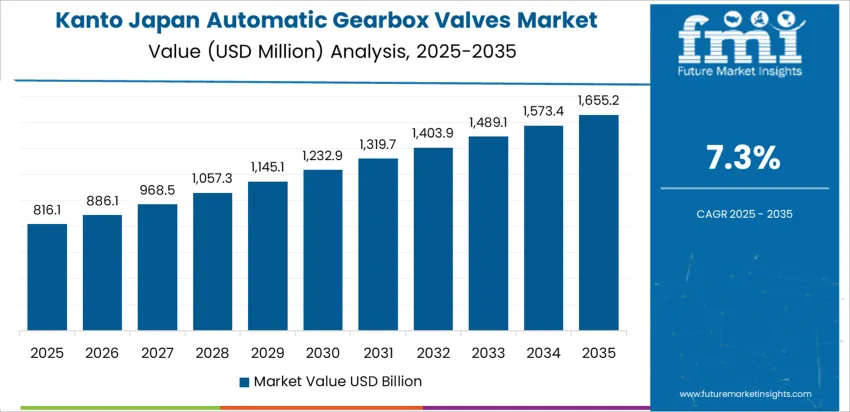

The demand for automatic gearbox valves in Japan is expected to grow at different rates across regions. Kyushu & Okinawa lead with an 8.0% CAGR, reflecting robust automotive manufacturing activity in that region and increasing production of vehicles outfitted with automatic transmissions. The Kanto region follows with 7.3%, supported by its dense concentration of automotive suppliers and extensive vehicle assembly operations. The Kinki region registers 6.4% growth, benefiting from industrial clusters and component manufacturing ecosystems. In Chubu the 5.7% rate reflects moderate growth linked to established auto industry zones. The Tohoku and Rest of Japan regions show lower growth at 5.0% and 4.7% respectively, possibly due to smaller scale automotive production and lower concentration of gearbox valve manufacturing and installation activities.

Kyushu and Okinawa are experiencing a robust growth in the demand for automatic gearbox valves, with a projected CAGR of 8.0% through 2035. This is driven by the increasing vehicle production in the region’s growing automotive sector, particularly in light commercial vehicles and passenger cars. The demand is further supported by local supply chain networks, which provide essential components like gearbox valves. Proximity to coastal areas, where vehicles face harsher environmental conditions, boosts the need for durable components that can withstand corrosion, thereby increasing replacement demand.

As Japan’s largest automotive manufacturing region, Kanto is seeing a significant demand for automatic gearbox valves, growing at a CAGR of 7.3% through 2035. The automotive industry in Kanto is shifting towards advanced transmission systems in both hybrid and fuel-efficient vehicles. With major manufacturers and suppliers based in this region, the demand for high-quality, performance-driven gearbox components remains strong. The continued growth of Kanto’s vehicle production and high export volume also ensures consistent demand for gearbox valves across both OEM and aftermarket channels.

Kinki, home to significant automotive production hubs like Osaka and Kyoto, is projected to see a CAGR of 6.4% in the demand for automatic gearbox valves through 2035. The region’s automotive sector is increasingly focusing on high-performance and fuel-efficient vehicles, driving the need for advanced gearbox systems. In addition to passenger vehicles, commercial vehicles are also contributing to the demand for durable and efficient gearbox components. The combination of cutting-edge manufacturing techniques and high standards for automotive safety continues to fuel growth in the gearbox valve market in Kinki.

Chubu is experiencing steady growth in the demand for automatic gearbox valves, with a projected CAGR of 5.7% through 2035. The region’s central role in Japan's automotive industry, particularly in Aichi Prefecture, has made it a key player in vehicle production, including electric and hybrid models. As manufacturers push for improved transmission performance, there is growing demand for high-quality gearbox valves. The region’s focus on producing vehicles with superior efficiency and reliability in transmission systems further propels the demand for these components in both the OEM and aftermarket sectors.

In Tohoku, the demand for automatic gearbox valves is expected to grow at a CAGR of 5.0% through 2035, driven by a stable automotive industry focused on mid-range vehicle production. Although the region’s automotive sector is smaller compared to other regions, steady production and increasing vehicle fleet maintenance contribute to consistent demand for gearbox components. Additionally, the region’s emphasis on eco-friendly vehicles and efficient transmission systems is promoting the use of advanced gearbox valves, particularly in commercial and personal vehicles that prioritize fuel efficiency.

In the rest of Japan, the demand for automatic gearbox valves is growing at a CAGR of 4.7% through 2035. Although the automotive sector outside major hubs is smaller, steady replacement and maintenance demands from regional markets continue to support the growth. Rural and non-metropolitan areas rely heavily on both passenger and commercial vehicles, driving the consistent need for gearbox components. As vehicle fleets age and the demand for fuel-efficient systems rises, the demand for automatic gearbox valves remains stable, supported by local distributors and regional manufacturers.

Demand for automatic gearbox valves in Japan is rising as the national automotive transmission market expands, especially for automatic, continuously variable and hybrid gearbox types. The shift toward hybrid and fuel efficient vehicles increases use of valves that control hydraulic fluid flow, shift operations and torque management. As domestic automakers adopt advanced gearboxes for smooth shifting, fuel economy and emission compliance, demand for high performance valves grow. The broader transmission market in Japan is forecast to grow steadily, reflecting consistent demand for modern transmission components.

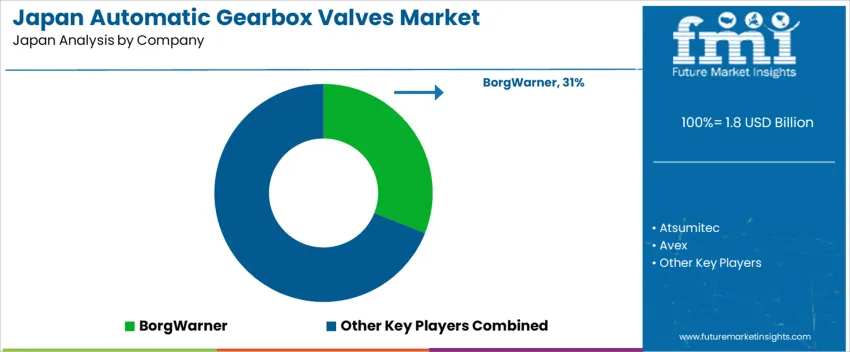

Major firms active in supplying gearbox valves and related components in Japan include global and domestic players such as BorgWarner, Atsumitec, Avex, Hikari Seiko and Bosch GmbH. BorgWarner offers transmission valve systems designed for reliability and high volume production. Atsumitec and Hikari Seiko as domestic suppliers have established ties with Japanese automakers, providing valves and components tailored to local gearbox specs. Avex supplies niche or specialized valve solutions. Bosch brings global engineering expertise and advanced valve control technology. These firms shape the market by combining global know how and domestic integration to address Japan’s demand for efficient gearbox systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Transmission Type | Automatic, Continuously Variable Transmission (CVT), Dual Clutch Transmission |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Product Type | Solenoid Valves, Shift Control Valves, Pressure Regulator Valves, Clutch Control Valves, Pulley Control Valves (CVT), Accumulator Valves |

| Sales Channel | First Fit, Aftermarket |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BorgWarner, Atsumitec, Avex, Hikari Seiko, Bosch GmbH |

| Additional Attributes | Dollar by sales by application and product type; regional CAGR and incremental growth; volume and value expansion forecasts; competitive landscape of key suppliers in Japan; material trends (solenoid valves, shift control valves); OEM vs aftermarket demand distribution; electrification impact on drivetrain complexity; regulatory influence on performance specifications; integration of electronic and hydraulic systems; adoption of advanced transmission technologies (hybrids, CVTs); price stability and supply chain considerations. |

The demand for automatic gearbox valves in Japan is estimated to be valued at USD 1.8 billion in 2025.

The market size for the automatic gearbox valves in Japan is projected to reach USD 3.3 billion by 2035.

The demand for automatic gearbox valves in Japan is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in automatic gearbox valves in Japan are automatic, continuously variable transmission (cvt) and dual clutch transmission.

In terms of vehicle type, passenger cars segment is expected to command 62.0% share in the automatic gearbox valves in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Demand for Automatic Gearbox Valves in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Checkweigher in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Banding Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Dishwashing Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automatic Identification System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Thermostatic Radiator Valves in Japan Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA