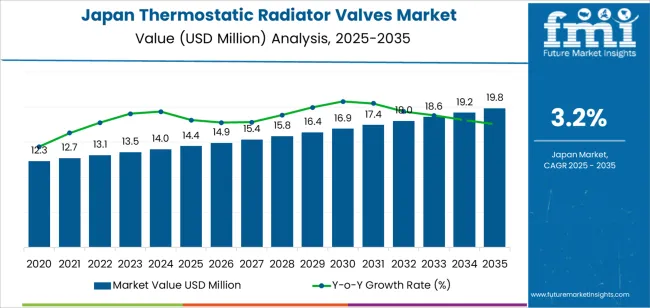

The demand for thermostatic radiator valves (TRVs) in Japan is projected to grow from USD 14.4 million in 2025 to USD 19.8 million by 2035, reflecting a CAGR of 3.2%. TRVs are essential components of heating systems that regulate the flow of hot water to radiators, helping maintain optimal room temperature and improve energy efficiency. The growing focus on sustainable building practices, energy-efficient solutions, and smart home technologies is driving the adoption of TRVs across residential and commercial buildings. As Japan continues to prioritize eco-friendly and cost-effective heating solutions, the demand for TRVs is expected to remain steady.

The expansion of the smart thermostat market and the growing trend towards smart home automation further boosts the demand for TRVs. As more consumers and businesses focus on reducing energy consumption and lowering heating costs, thermostatic radiator valves will become an integral part of energy-efficient heating systems in Japan. Additionally, regulations pushing for better temperature control and energy use optimization in buildings will contribute to the steady growth of the market.

The demand for thermostatic radiator valves in Japan will increase from USD 14.4 million in 2025 to USD 19.8 million by 2035, reflecting a total increase of USD 5.4 million over the 10-year period. This represents a moderate yet steady growth in demand for TRVs, primarily driven by the ongoing need for energy-efficient solutions in both heating systems and smart home devices.

Between 2025 and 2030, the demand will grow from USD 14.4 million to USD 16.9 million, adding USD 2.5 million in value. This early phase of growth reflects a steady increase driven by growing adoption in residential and commercial buildings focused on improving energy efficiency and comfort. The increasing use of smart home technologies and integrated temperature control systems will push the demand for TRVs during this period.

From 2030 to 2035, the market will grow from USD 16.9 million to USD 19.8 million, contributing USD 2.9 million in value. The latter half of the forecast period will see continued growth, albeit at a slower pace, as saturation in the adoption of TRVs in new construction projects begins. However, ongoing efforts to improve energy consumption and heating efficiency, alongside upgrades in older systems and replacement demand, will sustain the market growth through this period.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 14.4 million |

| Forecast Value (2035) | USD 19.8 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

Demand for thermostatic radiator valves in Japan is growing as energy-efficiency mandates and smart home trends influence the heating systems market. Hydronic heating systems remain prevalent in older commercial and residential buildings, and valve upgrades allow for improved room-level control and operational savings. The focus on reducing electricity and gas usage under Japan’s climate-change goals encourages installers and property owners to replace manual radiator controls with thermostatic options. Advanced models that integrate with building-management systems or smart-home platforms are gaining traction among tech-savvy consumers and commercial operators seeking both comfort and efficiency.

Another factor underpinning demand is the expansion of renovation activity and the adoption of mixed heating systems in Japan. As property owners retrofit existing hydronic systems or convert to hybrid solutions, installation of thermostatic radiator valves becomes part of broader efficiency upgrades. Japanese manufacturers are introducing valves with digital controls, wireless connectivity and self-adjusting sensors to appeal to high-end residential and commercial markets. Challenges persist, such as the upfront cost of advanced valve systems, the limited awareness of advanced features among some end-users and competition from simpler valve designs. Despite these factors, given the alignment with energy-conservation objectives and increasing retrofit investment, demand for thermostatic radiator valves in Japan is expected to expand steadily.

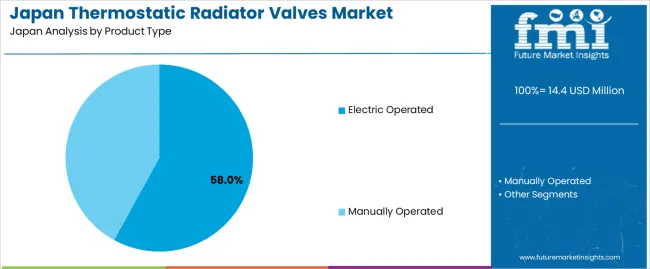

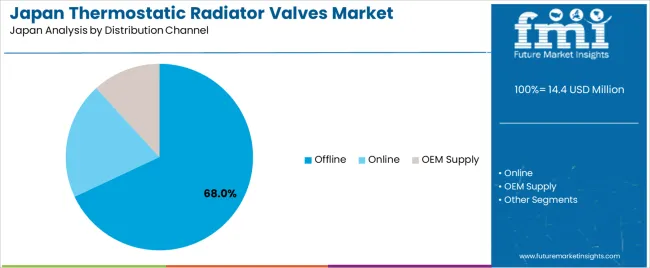

The demand for thermostatic radiator valves (TRVs) in Japan is driven by two main factors: product type and distribution channel. The leading product type is electric operated TRVs, holding 58% of the market share, while the dominant distribution channel is offline, which accounts for 68% of the demand. TRVs are essential in regulating the temperature of radiators in heating systems, and the growing focus on energy-efficient solutions and smart home technologies has spurred the demand for electric operated valves. The offline sales channel continues to lead, as many consumers and businesses still prefer in-store purchases where they can receive expert advice and immediate product availability.

Electric operated thermostatic radiator valves dominate the market with 58% of the demand. These valves are increasingly popular due to their integration with modern smart home systems, offering enhanced control over room temperatures and energy consumption. Electric operated TRVs allow users to automate temperature adjustments based on room conditions or through remote access via mobile apps. This feature is particularly valued in residential and commercial spaces where comfort and energy efficiency are top priorities.

The growing demand for smart home solutions and the focus on reducing energy costs have significantly boosted the adoption of electric operated TRVs. These valves not only offer convenience but also provide significant energy savings by optimizing heating based on actual room requirements. As the demand for automation and energy-efficient solutions continues to rise in Japan, electric operated thermostatic radiator valves are expected to maintain their leadership in the market.

The offline distribution channel leads the market with 68% of the demand for thermostatic radiator valves in Japan. Offline sales are the preferred method for purchasing TRVs, particularly due to the traditional nature of the home heating and construction industries. Many consumers and businesses visit physical stores or suppliers to inspect products in person, receive expert advice, and ensure compatibility with existing heating systems.

The strong presence of offline sales is further supported by the expertise provided by in-store professionals who assist customers in selecting the appropriate valves for their needs. Additionally, offline channels ensure immediate product availability, which is important for contractors and businesses requiring quick replacements or installations. While online sales are growing, offline channels remain dominant in Japan for purchasing thermostatic radiator valves, particularly in sectors where personal consultation and immediate availability are crucial. As demand for TRVs continues to rise in both residential and commercial markets, offline distribution will continue to lead.

Demand for thermostatic radiator valves (TRVs) in Japan is influenced by a combination of energy efficiency initiatives, building renovation cycles and the presence of hydronic heating systems in older residential and commercial stock. Japanese building standards and retrofit programmes are enhancing interest in zone-based temperature control. At the same time, factors such as limited central heating prevalence in many buildings, supply chain cost pressures and competition from other HVAC control technologies shape market dynamics.

Several factors are supporting growth in Japan. First, energy-savings and carbon-reduction policies encourage installation of TRVs in existing heating systems to optimise fuel usage and improve comfort control. Second, refurbishment of older buildings (especially multi-unit residential and commercial properties) provides opportunities for TRV retrofit installations. Third, rising interest in smart home and smart building technologies is generating demand for electronic or IoT-enabled TRVs that can integrate within building management systems. Fourth, growth in niche heating systems-especially where hydronic radiator or base-board heating remains in use-supports steady demand for TRVs in Japan.

Despite positive demand factors, the market faces some constraints. The prevalence of hydronic radiator systems in Japan is lower than in certain European markets, which limits potential penetration of TRVs in newer buildings. The higher upfront cost of advanced electronic or smart TRVs compared with manual valves may deter some retrofit projects focused purely on cost. Some property owners may prefer central control systems or other HVAC zoning solutions instead of individual radiator-level valves. Additionally, the slow growth of new residential construction and the dominance of alternative heating systems in many regions reduce the base growth potential for TRVs.

Emerging trends in the Japanese TRV market include increased adoption of smart and electronic TRVs that can connect to Wi-Fi or building automation platforms, enabling remote control and energy-monitoring features. There is a shift toward retrofit-friendly valve solutions, designed for minimal disruption and fast installation in occupied buildings. Lightweight, compact and aesthetically refined valve bodies are becoming more common to align with Japanese market preferences for interior design and space efficiency. Sustainability-driven certification and energy performance labelling are also encouraging broader acceptance of TRVs as part of efficient heating system upgrades.

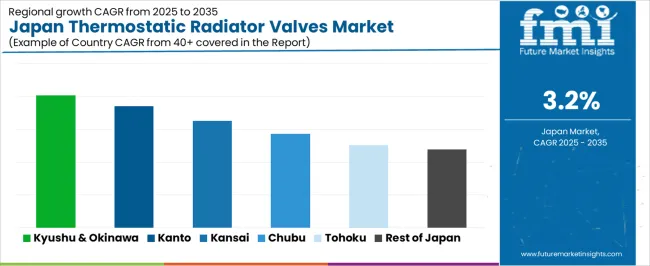

The demand for thermostatic radiator valves (TRVs) in Japan is rising as the country places increasing importance on energy efficiency and climate control in residential, commercial, and industrial buildings. TRVs are used to regulate room temperature by controlling the flow of water or steam into radiators, offering enhanced comfort and reducing energy consumption. Japan’s focus on reducing energy use, combined with growing demand for sustainable building technologies, is driving the adoption of TRVs. Additionally, Japan’s climate, with colder winters in many regions, makes temperature regulation essential, further supporting the need for TRVs. Demand varies across regions, with areas like Kyushu & Okinawa and Kanto showing higher growth due to industrialization, urbanization, and building upgrades. This analysis explores the regional factors shaping the demand for TRVs in Japan.

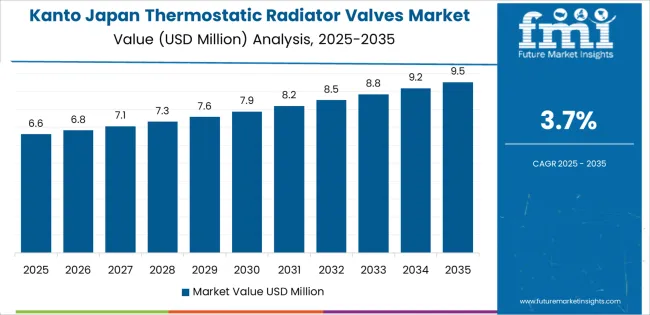

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.0 |

| Kanto | 3.7 |

| Kinki | 3.3 |

| Chubu | 2.9 |

| Tohoku | 2.5 |

| Rest of Japan | 2.4 |

Kyushu & Okinawa leads Japan in the demand for thermostatic radiator valves (TRVs) with a CAGR of 4.0%. The region's strong focus on energy efficiency, particularly in the context of home and industrial heating systems, is a key driver for the increased adoption of TRVs. Kyushu & Okinawa also have a significant construction sector, with many new buildings being designed with modern, energy-efficient systems that incorporate TRVs to control room temperatures more precisely.

The region’s increasing commitment to environmental sustainability, combined with rising consumer awareness of energy consumption, further boosts demand. As more homes and businesses in Kyushu & Okinawa install advanced HVAC systems that include TRVs, the region is experiencing robust growth in this market. The region's warm climate also drives the need for efficient climate control systems in homes, particularly during the colder months.

The Kanto region shows strong demand for thermostatic radiator valves (TRVs) with a CAGR of 3.7%. As Japan’s largest and most densely populated economic hub, Kanto includes Tokyo, where building upgrades, especially in older homes and commercial buildings, are a key driver of TRV adoption. The demand is largely driven by the region's focus on energy efficiency and the modernization of heating systems, particularly in residential and commercial buildings.

Kanto's colder winters also contribute to the need for efficient heating systems, with TRVs being widely adopted in new construction and renovation projects. The increasing trend of smart homes, with integrated HVAC systems that include TRVs, further supports market growth in Kanto. The region’s emphasis on reducing energy consumption and adopting sustainable building practices will continue to drive the demand for TRVs.

The Kinki region shows steady demand for thermostatic radiator valves (TRVs) with a CAGR of 3.3%. Kinki, which includes cities like Osaka and Kyoto, has a well-established construction and manufacturing sector. The demand for TRVs in this region is driven by the need for energy-efficient solutions in both residential and commercial buildings. In urban centers like Osaka, where the density of buildings and heating systems is high, the demand for climate control solutions such as TRVs is growing.

In addition to residential applications, the Kinki region has a strong focus on industrial energy efficiency, which further supports TRV adoption. As buildings continue to be upgraded and newer, more energy-efficient heating systems are installed, the demand for TRVs in Kinki will remain stable, driven by both residential and commercial sectors.

The Chubu region shows moderate growth in TRV demand with a CAGR of 2.9%. Chubu, home to major industrial cities like Nagoya, has a strong manufacturing base that requires efficient climate control solutions in both residential and industrial buildings. The region’s focus on energy-efficient building technologies and sustainable infrastructure continues to support the adoption of TRVs in newer constructions and building renovations.

Chubu's cold winters further contribute to the need for efficient heating systems in homes and businesses, driving demand for TRVs. While the growth rate is slower than in Kyushu & Okinawa and Kanto, Chubu's industrial base and ongoing efforts to improve energy efficiency in both commercial and residential buildings ensure continued demand for TRVs.

Tohoku shows a CAGR of 2.5%, while the Rest of Japan follows with 2.4%. These regions experience slower growth in TRV demand compared to more industrialized and urbanized areas like Kyushu & Okinawa and Kanto. In Tohoku, which has colder winters, the demand for TRVs is more focused on residential buildings that require efficient heating solutions. However, the slower adoption in these regions is partly due to their more rural characteristics and less dense industrial development.

Similarly, in the Rest of Japan, which encompasses more rural and suburban areas, the demand for TRVs is steady but not as fast-growing as in larger urban centers. However, as awareness of energy efficiency grows and more homes and businesses seek sustainable solutions for temperature control, the adoption of TRVs will continue to gradually increase in these regions.

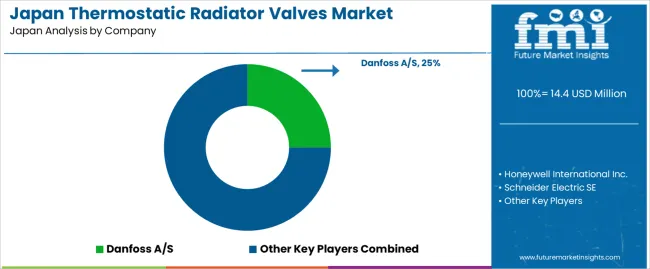

Demand for thermostatic radiator valves (TRVs) in Japan is rising as the country increasingly adopts energy-efficient heating systems in both residential and commercial buildings. Companies like Danfoss A/S (holding approximately 25% market share), Honeywell International Inc., Schneider Electric SE, IMI Hydronic Engineering, and Siemens AG are key players in this market. Japan's focus on reducing energy consumption and improving building automation systems, along with the country's stringent energy efficiency standards, is driving the demand for TRVs, which allow for better temperature control and reduced energy waste in heating systems.

Competition in the TRV market is driven by product innovation, smart technology integration, and the ability to meet Japan's specific regulatory and environmental needs. One area of focus is the integration of TRVs with smart home systems and building automation, allowing users to control individual room temperatures remotely and optimize energy use. Another key area is the development of highly efficient, durable valves that offer precise temperature control and are easy to install and maintain. Companies are also working to enhance the reliability and lifespan of TRVs to ensure long-term performance, particularly in regions with extreme temperature variations.

Marketing materials typically highlight key features such as compatibility with smart home systems, ease of installation, energy savings, and compliance with local energy regulations. By aligning their products with the demand for energy-efficient and smart solutions, these companies aim to strengthen their position in the Japanese thermostatic radiator valve market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Product Type | Electric Operated, Manually Operated |

| Distribution Channel | Offline, Online, OEM Supply |

| Key Companies Profiled | Danfoss A/S, Honeywell International Inc., Schneider Electric SE, IMI Hydronic Engineering, Siemens AG |

| Additional Attributes | The market analysis includes dollar sales by product type and distribution channel categories. It also covers regional demand trends in Japan, driven by residential and commercial heating applications. The competitive landscape highlights major players focusing on energy-efficient and smart thermostatic radiator valves. Trends in growing demand for wireless, digitally controlled valves and advancements in HVAC systems are explored, along with innovations in valve design and integration with smart home technologies. |

The global demand for thermostatic radiator valves in japan is estimated to be valued at USD 14.4 million in 2025.

The market size for the demand for thermostatic radiator valves in japan is projected to reach USD 19.8 million by 2035.

The demand for thermostatic radiator valves in japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for thermostatic radiator valves in japan are electric operated and manually operated.

In terms of distribution channel, offline segment to command 68.0% share in the demand for thermostatic radiator valves in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA