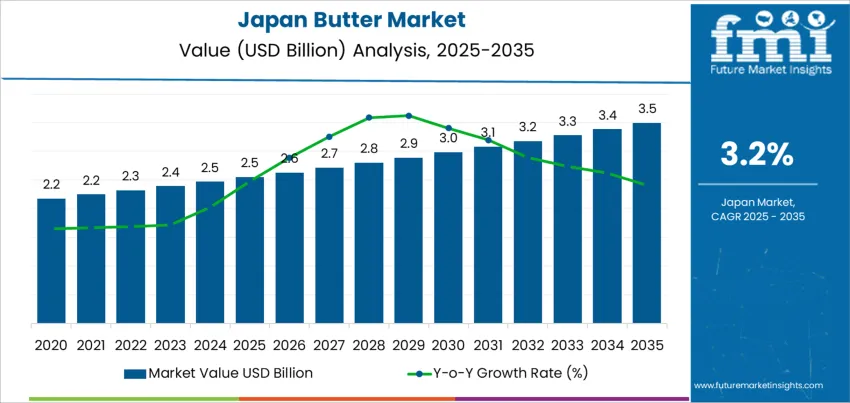

The demand for butter in Japan is valued at USD 2.5 billion in 2025 and is projected to reach USD 3.4 billion by 2035, reflecting a compound annual growth rate of 3.2%. Growth is shaped by expanding use of butter across bakery production, dairy processing and home cooking applications. Bakery operations, food service establishments and household consumers continue to integrate butter into recipes that require authentic dairy flavor and functional fat properties. As culinary professionals refine baking techniques and incorporate more premium dairy ingredients, demand strengthens across a widening set of food preparation scenarios. These adoption patterns support a stable and consistent rise throughout the forecast horizon.

The growth curve shows a clear upward trajectory, beginning at USD 2.2 billion in earlier years and increasing to USD 2.5 billion in 2025 before progressing toward USD 3.4 billion by 2035. Yearly values advance in steady increments, with demand rising from USD 2.6 billion in 2026 to USD 2.7 billion in 2027 and continuing through USD 3.0 billion in 2032 and USD 3.3 billion in 2034. This pattern reflects predictable expansion driven by regular dairy procurement, broader application in bakery and food service settings and the growing use of butter across culinary innovation and traditional cooking practices. The curve highlights consistent growth supported by the combination of routine consumption need and extended adoption across Japan's bakery, food service and household cooking landscape.

Demand in Japan for butter is projected to increase from USD 2.5 billion in 2025 to USD 3.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.2%. Starting at USD 2.2 billion in 2020, the value rises steadily: USD 2.4 billion in 2022, USD 2.5 billion in 2024, and USD 2.5 billion in 2025. From 2025 to 2030, demand climbs to around USD 2.8 billion, and by 2035 it reaches USD 3.4 billion. Growth is driven by expanding applications of butter in bakery manufacturing, food service cooking, household meal preparation and premium dairy product consumption in Japan's food-oriented commercial context.

Over the forecast period, the value uplift from USD 2.5 billion to USD 3.4 billion translates into an incremental opportunity of USD 0.9 billion. Early growth (2025 2030) is primarily volume driven as more bakery chains and food service operators adopt butter for authentic taste delivery. In the latter years (2030 2035), value growth becomes increasingly significant: premium butter variants with enhanced flavor profiles, grass-fed sourcing credentials, cultured butter characteristics and artisan production methods elevate average selling prices. Suppliers who innovate in butter quality, sourcing transparency and functional performance are best positioned to capture the full breadth of this demand growth in Japan.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.5 billion |

| Forecast Value (2035) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The demand for butter in Japan has historically been shaped by the strength of domestic bakery operations, where authentic dairy fat dominated croissant lamination, cake formulations and premium bread enrichment. Japanese bakery chains focused on delivering superior texture, authentic butter aroma and consumer-preferred mouthfeel characteristics, which supported steady procurement of salted and unsalted butter blocks. Premium confectionery expansion accelerated demand as Japan's gift culture required high-quality butter cookies, shortbread and seasonal sweets with recognizable dairy richness. Historical growth was reinforced by consistent Western culinary adoption, since Japanese home cooks increasingly incorporated butter into pasta dishes, gratin preparations and Western-style baking at home. These conditions created predictable, long-term demand for butter tied closely to the production volumes of premium baked goods and the adoption rates of Western cooking styles across households within the country.

Future growth will be influenced by Japan's shift toward artisan bakery experiences, grass-fed dairy preferences and the need for functional dairy fats in plant-butter hybrid formulations. Premium croissant production, which requires precise lamination with high-fat butter that delivers flaky layers, creates opportunities for specialty butter grades that maintain plasticity across temperature ranges. This creates a continuing but more specialized demand. Long-term challenges arise from the expansion of margarine and plant-based spreads that compete on price and health positioning. As Japan navigates dietary diversification, butter demand will rely increasingly on premium bakery applications, authentic cooking traditions and specialty dairy segments rather than broad, commodity-grade butter consumption.

The demand for butter in Japan is shaped by the product types used for culinary applications and the physical forms that determine handling convenience. Product categories include salted, cultured butter, clarified butter, spreadable butter and unsalted variants, each offering different flavor profiles and functional characteristics. Forms such as processed butter and unprocessed butter support varied manufacturing and consumer preparation requirements. As bakery operators and home cooks focus on consistent flavor delivery and practical usage scenarios, the combination of product type and physical form influences purchasing decisions across Japan's bakery ingredient, food service supply and household retail settings.

Salted type accounts for 40% of total demand across product type categories in Japan. Its leading share reflects straightforward flavor enhancement, predictable shelf stability and suitability for table use applications. Many households value salted butter for consistent taste delivery that supports spreading on bread, finishing cooked vegetables and general cooking purposes without additional seasoning. These products offer manageable storage requirements and easy integration into existing kitchen routines. Their flavor profile suits environments that prioritize convenience and multipurpose usage without specialized culinary technique, reinforcing steady use across household consumption patterns.

Demand for salted butter also grows as consumers adopt ready-to-use dairy products that require minimal preparation. Households appreciate the reduced decision-making complexity and predictable flavor outcomes associated with these products. Their pre-seasoned characteristics support straightforward cooking applications, making them practical for busy home kitchens. The product provides sufficient taste impact for typical family meals, meeting expectations for convenient dairy fat usage. As households continue seeking efficient cooking ingredients, salted butter maintains a strong presence in Japan.

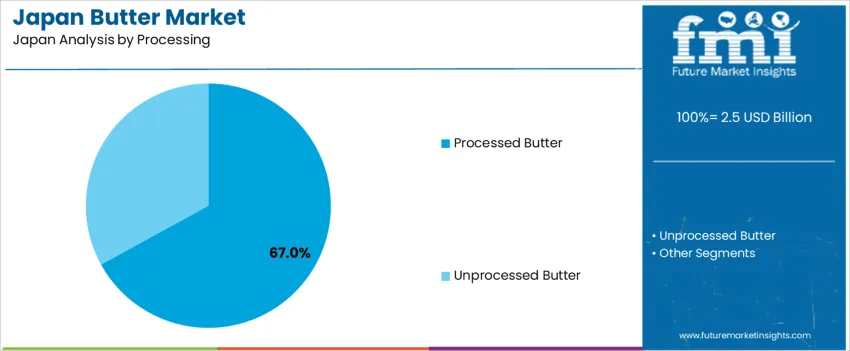

Processed form accounts for 67.0% of total demand across form categories in Japan. Its leading position reflects clear advantages in extended shelf life, consistent texture and year-round availability. Processed butter products support reliable supply chains in retail distribution, food service procurement and bakery ingredient sourcing, enabling manufacturers to deliver uniform performance across seasonal variations in milk supply. Their standardized composition allows predictable baking results, precise recipe scaling and simplified inventory management. Food service operators rely on these products for applications that require consistent melting behavior and stable emulsification properties.

Demand for processed form butter grows as commercial users emphasize supply chain reliability. The form classification supports procurement strategies that minimize seasonal price volatility and availability disruptions. Product developers value the material's compatibility with automated processing equipment and extended storage capabilities. Quality control teams appreciate the reduced variability that emerges from standardized manufacturing processes and composition controls. As Japan continues to emphasize operational efficiency, processed form butter remains central to commercial dairy ingredient adoption.

Demand for butter in Japan is influenced by robust bakery consumption, strong Western culinary adoption and a consumer base that values authentic dairy richness in premium food experiences. Japan's food preparation ecosystem favors ingredients that offer consistent performance across varied cooking methods, recognizable dairy flavor without masking and compatibility with both traditional Japanese and Western culinary techniques, which positions butter well for croissant production, cake baking and sauté cooking applications. At the same time, ingredient selection remains quality-conscious, and butter products must meet strict domestic standards for dairy authenticity, freshness indicators and compatibility with Japanese cooking vessel characteristics across preparation operations.

How Are Japan's Culinary Evolution and Premium Food Culture Encouraging New Applications?

Butter gains traction because Japan's culinary landscape increasingly values authentic Western ingredients that deliver restaurant-quality results in home cooking. Professional chefs and home cooks rely heavily on butter for signature dishes that require dairy fat complexity, and authentic butter products align with this long-standing preference for ingredient integrity. Japanese cooking shows and recipe media also favor ingredients that perform predictably within demonstrated techniques, making butter useful in demonstrated sauté methods, baking tutorials and finishing applications. These patterns reflect Japan's emphasis on culinary education and recognizable ingredient quality across food preparation contexts.

Where Are Practical Growth Opportunities for Butter in Japan?

Opportunities exist in premium artisan bakery operations, high-end restaurant cooking, home baking enthusiast segments and grass-fed butter variants that command premium positioning. Japan's established food quality consciousness creates openings for specialized butter products that integrate with local dairy sourcing narratives, regional production stories and transparent farm-to-table connections. As cooking education platforms expand content offerings, demand increases for butter products with clear application guidance, recipe integration and technique compatibility. Ingredient suppliers offering Japan-specific butter grades, culinary application support and freshness assurance may find strong adoption.

What Local Factors Are Constraining Wider Adoption of Premium Butter in Japan?

Constraints stem from price sensitivity among budget-conscious households, strong margarine presence in value retail segments and dietary fat reduction trends among health-conscious demographics. Some consumer segments rely on established margarine usage patterns rather than switching to more expensive butter, limiting category expansion. Integration challenges with traditional Japanese cooking methods that historically used minimal dairy fats and the need for alignment with space-constrained refrigerator storage further delay uptake. In addition, smaller independent bakeries may hesitate due to limited access to specialty butter grades, creating uneven adoption across Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.1% |

| Kanto | 3.4% |

| Kinki | 2.7% |

| Chubu | 2.4% |

| Tohoku | 2.3% |

| Rest of Japan | 2.0% |

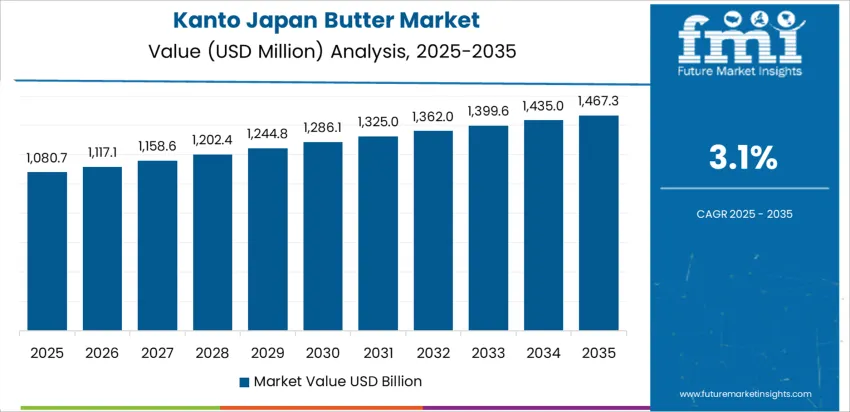

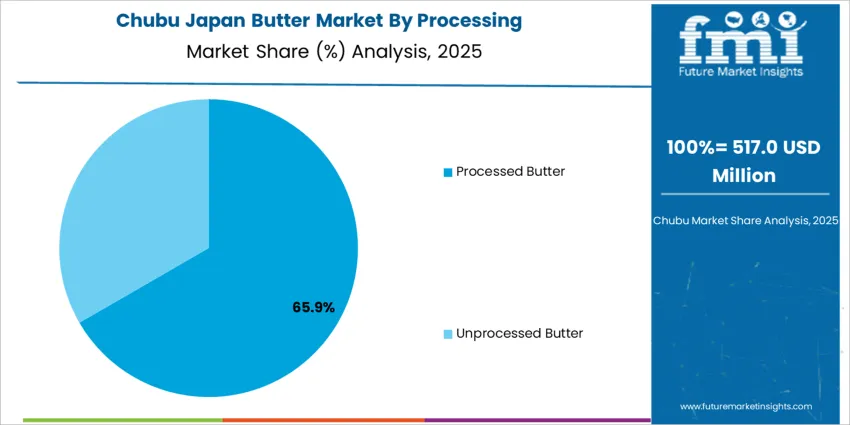

Demand for butter in Japan is rising across regions, with Kyushu and Okinawa leading at 5.1%. Growth in this region reflects expanding use of butter in bakery chains, Western restaurants and household cooking that embraces dairy-rich preparations. Kanto follows at 3.4%, supported by dense bakery concentration and steady adoption in food service and home baking segments. Kinki records 2.7%, shaped by active confectionery operations and restaurant cooking applying butter in both Western and fusion applications. Chubu grows at 2.4%, influenced by regional bakery chains and food service operators integrating butter into menu offerings. Tohoku reaches 2.3%, showing gradual but consistent adoption. The rest of Japan posts 2.0%, reflecting broader interest in butter across smaller bakery and food service operations.

Kyushu & Okinawa is projected to grow at a CAGR of 5.1% through 2035 in demand for butter. Fukuoka bakery operations and surrounding food service establishments are increasingly adopting butter for croissant production, Western cooking and premium baking applications. Rising demand for artisan bakery experiences, restaurant-quality home cooking and dairy-rich flavor profiles drives adoption. Suppliers provide high-fat-content, fresh and premium-grade butter products suitable for bakery chains and restaurant kitchens. Distributors ensure accessibility across urban, semi-urban and commercial facilities. Growth in artisan bakery production, Western restaurant expansion and home baking enthusiasm supports steady adoption of butter in Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 3.4% through 2035 in demand for butter. Tokyo and surrounding regions are increasingly using butter for bakery production, fine dining cooking and household Western-style meal preparation. Rising focus on authentic ingredients, culinary education content and premium food experiences drives adoption. Suppliers provide consistent-quality, reliable-supply and application-appropriate butter products suitable for large bakery chains and food service distributors. Distributors ensure accessibility across urban, semi-urban and food service networks. Expansion in premium bakery operations, restaurant cooking diversity and home cooking skill development supports steady adoption of butter across Kanto.

Kinki is projected to grow at a CAGR of 2.7% through 2035 in demand for butter. Osaka, Kyoto and surrounding regions are increasingly adopting butter for confectionery production, restaurant cooking and household baking applications. Rising demand for authentic dairy flavor, fusion cuisine development and traditional Western baking drives adoption. Suppliers provide quality-assured, application-tested and commercially-viable butter products suitable for confectionery makers and restaurant kitchens. Distributors ensure accessibility across urban and semi-urban food preparation centers. Growth in confectionery manufacturing, fusion cuisine innovation and household baking supports steady adoption of butter across Kinki.

Chubu is projected to grow at a CAGR of 2.4% through 2035 in demand for butter. Nagoya and surrounding areas are increasingly adopting butter for bakery operations, food service cooking and home meal preparation in residential areas. Rising focus on consistent quality, cost-effective sourcing and standard culinary applications drives adoption. Suppliers provide reliable, commercially-viable and standard-grade butter products suitable for regional bakery chains and food service operators. Distributors ensure availability across urban and semi-urban commercial facilities. Expansion in bakery production, food service operations and household cooking supports steady adoption of butter across Chubu.

Tohoku is projected to grow at a CAGR of 2.3% through 2035 in demand for butter. Sendai and surrounding food preparation operations are gradually adopting butter for bakery production, restaurant cooking and household Western-style cooking. Rising focus on authentic ingredients, basic Western cooking adoption and gradual culinary diversification drives adoption. Suppliers provide dependable, accessible and functionally-adequate butter products suitable for local bakery operations and food service establishments. Distributors ensure accessibility across urban, semi-urban and regional commercial facilities. Expansion in regional bakery operations, restaurant diversity and household cooking experimentation supports steady adoption of butter across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 2.0% through 2035 in demand for butter. Smaller towns and rural food preparation operations gradually adopt butter for local bakery production, basic cooking needs and occasional Western-style meal preparation. Rising demand for basic dairy ingredients, affordable cooking fats and gradual Western recipe adoption drives adoption. Suppliers provide accessible, straightforward and functionally-adequate butter products suitable for small-scale bakeries, local restaurants and household consumers. Distributors ensure accessibility across urban, semi-urban and rural retail centers. Expansion in local bakery operations, basic food service and household cooking diversification supports steady adoption of butter across the Rest of Japan.

The demand for butter in Japan is driven by the country's vibrant bakery culture, increasing Western culinary adoption and growing appreciation for authentic dairy ingredients in both commercial and home cooking contexts. Bakery operators seek high-quality butter to create signature products, deliver consistent texture and meet consumer expectations for authentic dairy richness. Concurrently, premium and grass-fed dairy segments expand, pushing interest in butter products capable of providing natural credentials, superior flavor complexity and transparent sourcing narratives. Quality improvements such as cream sourcing optimization, churning technique refinements and cold-chain logistics enhancements further enhance suitability of butter in Japanese bakery plants, restaurant kitchens and household refrigerators.

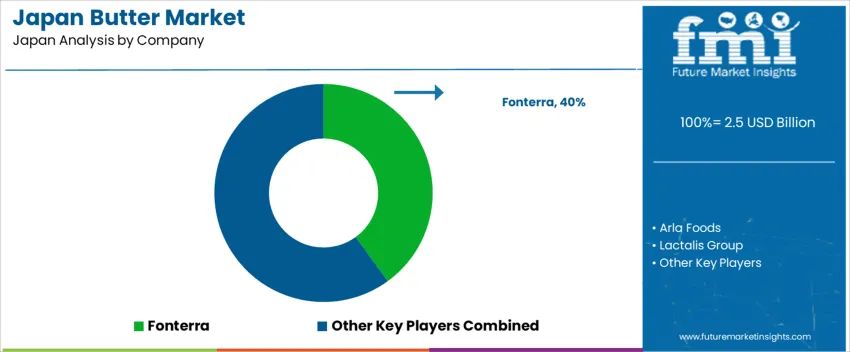

Key companies active in Japan's butter space include New Zealand dairy cooperative Fonterra, Danish-Swedish dairy group Arla Foods and French dairy giant Lactalis Group. Fonterra commands a 40.0% share of the Japanese butter landscape, supplying commercial butter grades through established import channels serving food manufacturers and bakery operations. The company's strong position reflects its reliable supply capacity, consistent quality standards and deep integration with Japanese food processing networks. Arla Foods maintains retail presence with consumer butter brands positioned for quality-conscious households, while Lactalis provides both bulk and packaged butter products through distribution partnerships. This mix of international dairy cooperatives and commercial suppliers reflects the competitive landscape in Japan, ensuring that butter adoption is shaped by global dairy expertise and established import distribution networks capable of meeting Japan's strict quality requirements and seasonal demand fluctuations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Salted, Cultured Butter, Clarified Butter, Spreadable, Unsalted |

| Form | Processed, Unprocessed |

| Nature | Spreadable, Non-Spreadable |

| Application | Bakery, Dairy and Frozen Desserts, Food Processing, Dressings and Spreads, Others |

| End Use | Indirect, Direct |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Fonterra, Arla Foods, Lactallis Group |

| Additional Attributes | Dollar sales by product type and form, regional CAGR trends, and value–volume shares are assessed alongside bakery vs. household adoption, salted vs. unsalted penetration, premium bakery alignment, growth opportunities, price barriers, and competition between international dairy cooperatives and Japanese commercial suppliers. |

The demand for butter in Japan is estimated to be valued at USD 2.5 billion in 2025.

The market size for the butter in Japan is projected to reach USD 3.5 billion by 2035.

The demand for butter in Japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in butter in Japan are cultured butter, salted butter, uncultured butter, whipped butter and others.

In terms of processing, processed butter segment is expected to command 67.0% share in the butter in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Butter Flavor in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA