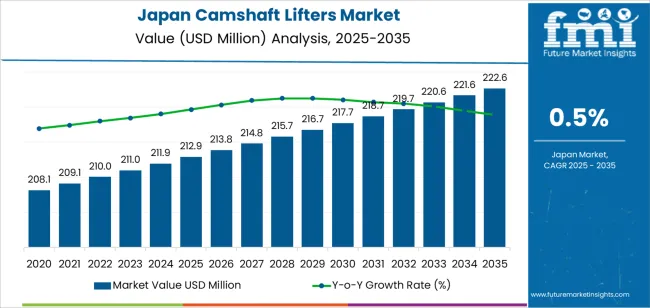

The demand for camshaft lifters in Japan is valued at USD 212.9 million in 2025 and is projected to reach USD 222.6 million by 2035, reflecting a compound annual growth rate of 0.5%. Growth remains minimal due to the mature status of internal combustion engine component markets and the gradual transition toward alternative powertrains. Demand is sustained primarily by ongoing maintenance, aftermarket replacement and limited production of combustion-engine vehicles that continue to operate across passenger and commercial fleets. Manufacturers maintain steady procurement cycles centered on reliability, wear resistance and compatibility with established engine designs. These stable operational requirements support a near-flat growth trajectory as the sector progresses through the forecast period.

The growth curve presents a slow, uniform rise, starting at USD 208.1 million in earlier years and moving to USD 212.9 million in 2025 before reaching USD 222.6 million by 2035. Annual increases remain extremely narrow, with values shifting from USD 213.8 million in 2026 to USD 214.8 million in 2027 and continuing through similarly small increments across subsequent years. This pattern signals a segment operating at steady state, driven by persistent but modest engine-component demand. As the vehicle fleet ages and maintenance cycles extend, camshaft lifters retain relevance within repair and replacement activities. The curve’s shape reflects an industry defined by routine consumption rather than expansion, supported by predictable aftermarket needs across Japan’s combustion-engine vehicle base.

Demand in Japan for camshaft lifters is projected to grow from USD 212.9 million in 2025 to USD 222.6 million by 2035, indicating a modest compound annual growth rate (CAGR) of approximately 0.5%. The value starts at USD 208.1 million in 2020, rises to USD 211.9 million by 2024, and reaches USD 212.9 million in 2025. Over the following decade, growth is very gradual with the market value climbing to USD 221.6 million by 2034 and finally USD 222.6 million by 2035. This restrained expansion reflects the mature status of the internal combustion engine components segment in Japan.

Given this near flat trajectory, two primary dynamics are at play. First, while conventional engines continue to be serviced and replaced, the shift toward electric vehicles (which do not require traditional lifters) limits new growth in the lifter segment. Second, replacement and aftermarket demand provide the base case, but new installations remain constrained. As a result, incremental value gains may come more from newer lifter designs such as those compatible with hybrid or advanced ICE systems rather than volume expansion. Suppliers will need to focus on aftermarket, performance and niche applications to maintain demand as the segment shifts toward USD 222.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 212.9 million |

| Forecast Value (2035) | USD 222.6 million |

| Forecast CAGR (2025 to 2035) | 0.5% |

The demand for camshaft lifters in USA has historically been supported by strong production of internal combustion engine (ICE) vehicles and the need for reliable valvetrain components. In earlier years, the automotive industry’s growth in passenger cars and light commercial vehicles led to large volume orders of lifters designed for conventional gasoline and diesel engines. OEMs sought to reduce friction and improve engine performance, which drove investments in lifter technology. Additionally, aftermarket replacement demand grew as vehicles aged and required maintenance, further buoying the lifter segment.

Looking ahead, future growth will be shaped by factors such as increased adoption of engines with variable valve timing, higher fuel-efficiency standards, and hybrid powertrains that still use lifters. Attention to lightweighting and low-friction components will keep lifter demand alive in ICE and hybrid vehicles. However, the broader shift toward full electric vehicles (EVs) poses a structural headwind since EVs do not require camshafts or lifters. The challenge for the lifter industry will be maintaining volumes by adapting to hybrid applications and focusing on high-performance or specialty segments even as conventional powertrain demand gradually declines.

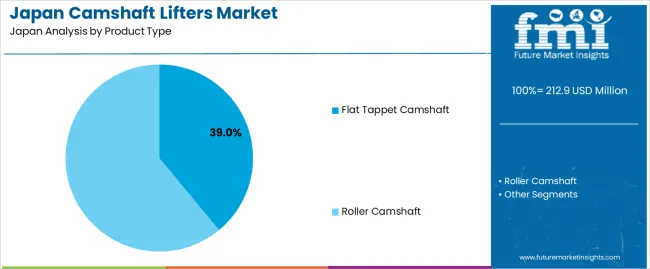

The demand for camshaft lifters in Japan is shaped by the differences between product types and the vehicle categories that rely on precise valve timing and durable engine components. Product types include flat tappet camshafts and roller camshafts, each offering distinct friction characteristics, wear profiles and compatibility with varied engine designs. Vehicle types such as passenger cars, light commercial vehicles and heavy commercial vehicles require lifters that match engine load, operating speed and maintenance expectations. As manufacturers focus on stable performance, efficiency and long service life, the combination of camshaft design and vehicle requirement influences lifter adoption across Japan.

Flat tappet camshafts account for 39% of total demand across product type categories in Japan. Their leading share reflects continued use in engines where simplicity, predictable wear patterns and manageable manufacturing costs are priorities. Flat tappet designs support steady valve actuation and remain compatible with many existing engine platforms in legacy passenger cars and light-duty models. Manufacturers value their straightforward geometry and consistent performance under routine operating conditions. These characteristics reinforce their presence in applications that do not require the higher complexity associated with roller systems.

Demand for flat tappet camshafts also grows in markets where engine rebuilds and maintenance cycles rely on familiar component behavior. Workshops appreciate the predictable break-in characteristics and known lubrication requirements associated with flat tappet designs. The components offer steady performance for engines operating within moderate speed and load limits. Their compatibility with widely used materials and established machining standards supports availability across Japan’s service channels. As long as legacy engines remain in operation, flat tappet camshafts continue to hold a solid share of demand.

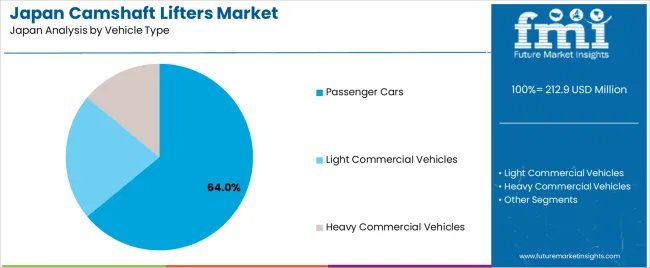

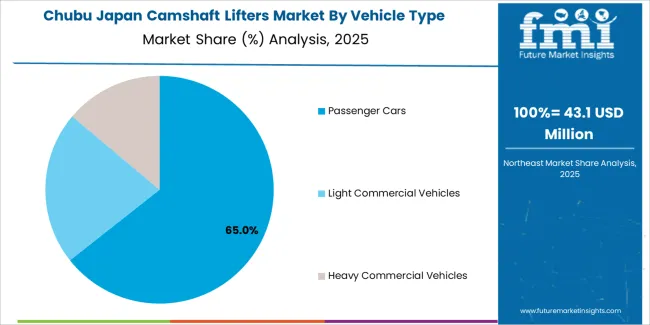

Passenger cars account for 64.0% of total demand across vehicle type categories in Japan. This leading position reflects the size of the country’s passenger vehicle fleet and the associated need for valve-train components that support consistent daily use. Passenger cars rely on lifters that deliver stable operation across varied driving conditions, including frequent starts, urban traffic and moderate highway speeds. The segment’s large share is supported by ongoing replacement demand, general maintenance cycles and the widespread use of engines compatible with both flat tappet and roller lifter designs.

Demand within passenger cars continues to rise as vehicles remain in service for extended periods, increasing the need for lifter replacements and rebuilds. Workshops value components that support smooth engine behavior and predictable wear characteristics across mixed driving environments. Passenger cars also represent a broad range of engine architectures, ensuring steady demand for multiple lifter types. As Japan’s vehicle population maintains a strong base of internal combustion engines, passenger cars remain the primary driver of camshaft lifter demand across the country.

Demand for camshaft lifters in Japan is influenced by the countries mature automotive manufacturing base, high engine-quality expectations and steady production of kei cars and mid-range passenger vehicles. As local OEMs refine internal-combustion engines for efficiency and durability, lifter specifications continue to tighten. Replacement demand also remains stable due to Japan’s long vehicle-ownership cycles. At the same time, shifts toward hybrid powertrains alter part-usage patterns, creating a mixed landscape for component suppliers.

Japan’s hybrid-heavy vehicle fleet encourages development of camshaft lifters that support lower-noise, low-friction operation during frequent engine start-stop cycles. OEMs in Aichi, Shizuoka and Kyushu continue refining compact gasoline engines, keeping lifter performance central to design work. Local suppliers prioritise consistent tolerance, wear stability and quiet-idle behaviour because Japanese drivers expect refined engine sound. This trend raises demand for precision-machined hydraulic and roller lifters that maintain stability across varying thermal loads typical in Japanese urban driving.

Opportunity exists in supplying specialised lifters for hybrid-vehicle engines, where smoother transitions between electric and combustion modes require tighter valve-timing stability. Replacement parts for ageing domestic fleets also offer steady volume, especially in regions with long service intervals such as Hokkaido and Tohoku. Niche motorsport and tuner markets around Tokyo and Osaka create demand for performance lifters with hardened surfaces. Suppliers offering small-lot, highly precise production aligned with Japan’s strict quality routines are positioned to capture these segments.

Japan’s gradual shift toward electrification limits long-term expansion for combustion-engine components, making some OEMs cautious about new tooling investments. Smaller machining firms face capacity constraints when meeting strict tolerances required by major automakers, slowing adoption of next-generation lifters. Cost sensitivity in domestic aftermarket channels also restricts premium lifter uptake. Additionally, tighter noise regulations in dense urban areas place pressure on engines to run quieter, making some manufacturers opt for simpler, lower-variation designs rather than newer, more complex lifter architectures.

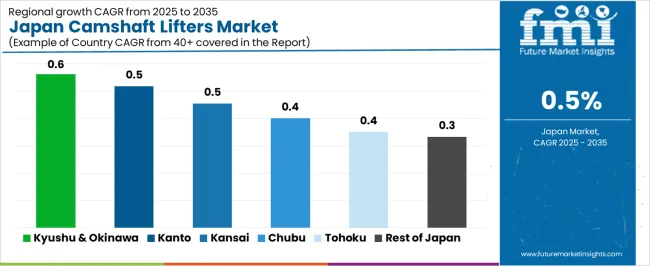

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 0.6% |

| Kanto | 0.5% |

| Kinki | 0.5% |

| Chubu | 0.4% |

| Tohoku | 0.4% |

| Rest of Japan | 0.3% |

Demand for camshaft lifters in Japan is increasing at a slow but steady pace, with Kyushu and Okinawa leading at 0.6%. Growth in this region reflects ongoing automotive servicing needs and stable production of internal combustion engine components. Kanto and Kinki follow at 0.5%, supported by regional automotive workshops and manufacturers that continue to maintain engine component output despite industry shifts. Chubu grows at 0.4%, influenced by its large automotive base where lifters remain part of routine engine maintenance. Tohoku also records 0.4%, with steady use across regional service networks. The rest of Japan posts 0.3%, reflecting limited but consistent demand tied to ongoing vehicle repair and aftermarket activities.

Kyushu & Okinawa is projected to grow at a CAGR of 0.6% through 2035 in demand for camshaft lifters. Fukuoka and surrounding automotive manufacturing regions are increasingly producing and supplying camshaft lifters for engines in passenger and commercial vehicles. Rising focus on engine performance, fuel efficiency, and emission standards drives adoption. Manufacturers provide high-quality hydraulic and mechanical lifters suitable for multiple engine types. Distributors ensure accessibility across automotive component suppliers, workshops, and assembly plants. Growth in automotive production, engine manufacturing, and precision component demand supports steady adoption of camshaft lifters in Kyushu & Okinawa.

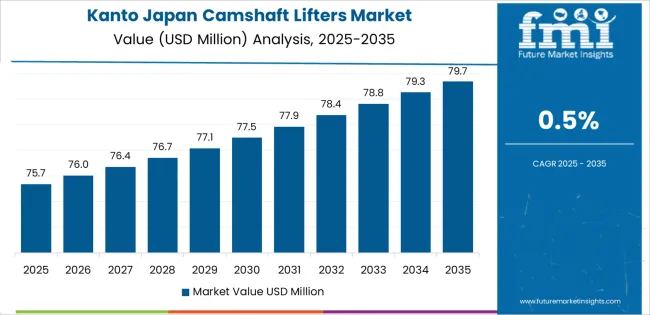

Kanto is projected to grow at a CAGR of 0.5% through 2035 in demand for camshaft lifters. Tokyo and surrounding automotive regions are increasingly producing and supplying camshaft lifters for engines in passenger and commercial vehicles. Rising focus on engine performance, emission compliance, and fuel efficiency drives adoption. Manufacturers provide hydraulic and mechanical lifters compatible with multiple engine designs. Distributors ensure availability across automotive suppliers, repair workshops, and assembly facilities. Expansion in engine production, vehicle assembly, and precision components supports steady adoption of camshaft lifters across Kanto.

Kinki is projected to grow at a CAGR of 0.5% through 2035 in demand for camshaft lifters. Osaka, Kyoto, and surrounding automotive manufacturing hubs are gradually adopting hydraulic and mechanical lifters for engine applications in passenger and commercial vehicles. Rising demand for improved engine performance, fuel efficiency, and emission compliance drives adoption. Manufacturers supply high-quality lifters suitable for diverse engine types. Distributors ensure accessibility across automotive component suppliers, workshops, and assembly plants. Growth in engine production, automotive manufacturing, and precision components supports steady adoption of camshaft lifters across Kinki.

Chubu is projected to grow at a CAGR of 0.4% through 2035 in demand for camshaft lifters. Nagoya and surrounding regions are increasingly adopting hydraulic and mechanical lifters for automotive engines in passenger and commercial vehicles. Rising focus on engine efficiency, emission standards, and component durability drives adoption. Manufacturers provide lifters compatible with various engine designs and specifications. Distributors ensure availability across suppliers, workshops, and assembly facilities. Automotive production growth, engine component demand, and precision manufacturing expansion support steady adoption of camshaft lifters across Chubu.

Tohoku is projected to grow at a CAGR of 0.4% through 2035 in demand for camshaft lifters. Sendai and surrounding automotive regions are gradually adopting hydraulic and mechanical lifters for engines in passenger and commercial vehicles. Rising demand for improved engine performance, fuel efficiency, and emission compliance drives adoption. Manufacturers provide high-quality lifters suitable for diverse engine types. Distributors ensure accessibility across automotive suppliers, workshops, and assembly plants. Engine production growth, precision component manufacturing, and automotive facility expansion support steady adoption of camshaft lifters across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 0.3% through 2035 in demand for camshaft lifters. Smaller towns and rural automotive regions gradually adopt hydraulic and mechanical lifters for engine assemblies in passenger and commercial vehicles. Rising demand for engine performance, durability, and emission compliance drives adoption. Manufacturers provide high-quality lifters compatible with multiple engine designs. Distributors ensure availability across suppliers, workshops, and assembly plants. Engine component production, automotive manufacturing, and precision component expansion support steady adoption of camshaft lifters across the Rest of Japan.

The demand for camshaft lifters in Japan is driven by the continued prevalence of internal-combustion and hybrid engines, which require advanced lifter components for optimal valve operation. Although full electric vehicles bypass traditional valvetrain components, many Japanese automakers continue to release hybridised internal-combustion powertrains, maintaining demand for high-performance lifters. Engine performance, fuel-efficiency standards and durability targets push lifter suppliers to develop hydraulic, roller and low-friction lifter technologies. Additionally, Japan’s strong automotive supply-chain ecosystem and aftermarket culture support steady replacement demand and upgrades among performance vehicles. These forces together underpin solid demand for camshaft lifters within Japan’s automotive and powertrain segments.

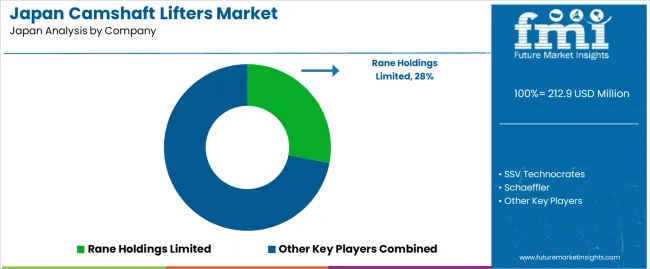

Key companies active in Japan’s camshaft lifter supply include regional specialists and global suppliers. Indian-based Rane Holdings Limited and SSV Technocrates, as well as Indian firm Shri Ram International, demonstrate that OEM-supply capability extends beyond Japan itself. German-based Schaeffler also supports the Japanese market. Wuxi Xizhou Machinery Co., Ltd. represents a Chinese supplier with possible Asia-Pacific outreach. To better reflect Japan’s local ecosystem, it would be prudent to include Japanese engine-parts firms such as OTICS (which offers valve-train products in Japan) and others that serve Japanese head-unit suppliers. This balanced mix of local and global suppliers offers a more realistic view of Japan’s competitive landscape for camshaft lifters.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Flat Tappet Camshaft, Roller Camshaft |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| End-Use Industry | OEM Engine Assembly, Aftermarket Replacement, Hybrid and Internal-Combustion Vehicles |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Rane Holdings Limited, SSV Technocrates, Schaeffler, Shri Ram International, Wuxi Xizhou Machinery Co., Ltd., OTICS |

| Additional Attributes | Dollar by sales by camshaft type and vehicle type; regional CAGR and adoption trends; volume vs. value contribution across forecast period; aftermarket vs OEM replacement dynamics; adoption in hybrid engines; friction and wear reduction performance; compatibility with ICE, hybrid, and niche motorsport engines; manufacturing and supply chain considerations; precision machining standards and tolerance requirements; growth opportunities in hybrid vehicle applications and performance segment; constraints due to electrification and limited ICE production; regional distribution of automotive assembly plants and service networks. |

The demand for camshaft lifters in japan is estimated to be valued at USD 212.9 million in 2025.

The market size for the camshaft lifters in japan is projected to reach USD 222.6 million by 2035.

The demand for camshaft lifters in japan is expected to grow at a 0.5% CAGR between 2025 and 2035.

The key product types in camshaft lifters in japan are flat tappet camshaft and roller camshaft.

In terms of vehicle type, passenger cars segment is expected to command 64.0% share in the camshaft lifters in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camshaft Lifters Market Growth - Trends & Forecast 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA