The demand for canvas primer in Japan is valued at USD 180.5 billion in 2025 and is projected to reach USD 280.4 billion by 2035, reflecting a compound annual growth rate of 4.5%. Growth is anchored in Japan's deeply rooted fine arts education system, widespread amateur painting communities, and the country's institutional commitment to preserving traditional artistic practices alongside contemporary creative expression. Art supply retailers maintain dense distribution networks across urban centers, while specialized stores in districts like Tokyo's Kanda and Osaka's Nipponbashi cater to professional artists requiring premium preparation materials.

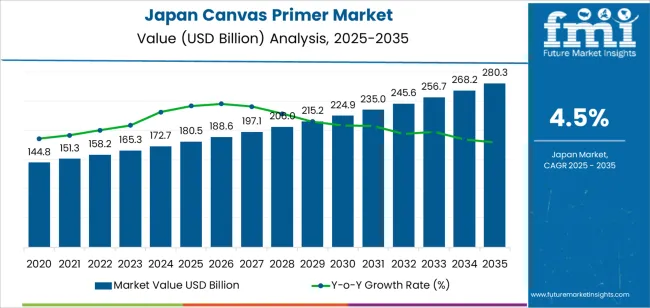

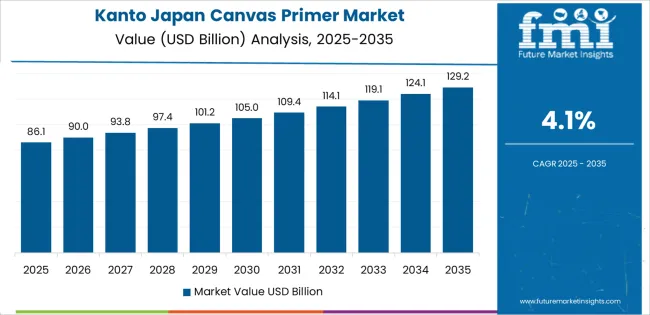

The valuation trajectory originates at USD 151.2 billion in 2020, climbing to USD 162.3 billion in 2022 and USD 174.2 billion in 2024 before establishing the 2025 baseline of USD 180.5 billion. Forward progression shows USD 187.0 billion in 2026, USD 193.7 billion in 2027, USD 200.7 billion in 2028, and USD 207.9 billion in 2029. The 2030 milestone reaches USD 215.4 billion, continuing through USD 223.2 billion in 2031, USD 231.2 billion in 2032, and USD 239.5 billion in 2033. Values advance to USD 248.1 billion in 2034 before culminating at USD 280.4 billion in 2035. This measured but persistent expansion reflects the mature nature of Japan's art supply sector, where growth derives less from explosive new demand and more from steady replacement cycles, gradual quality upgrades, and the ongoing vitality of artistic practice across demographic segments.

Demand in Japan for canvas primer is projected to increase from USD 180.5 billion in 2025 to USD 280.4 billion by 2035, reflecting a compound annual growth rate of approximately 4.5%. Starting at USD 151.2 billion in 2020, the value rises steadily: USD 156.7 billion in 2021, USD 162.3 billion in 2022, USD 168.2 billion in 2023, and USD 174.2 billion in 2024. From 2025 to 2030, demand climbs to around USD 215.4 billion, and by 2035 it reaches USD 280.4 billion. Growth is driven by Japan's extensive art education infrastructure, where elementary through university-level institutions maintain painting programs requiring proper canvas preparation, combined with a vibrant community of retired professionals who pursue painting as a primary leisure activity and invest in quality materials.

Over the forecast period, the value uplift from USD 180.5 billion to USD 280.4 billion translates into an incremental opportunity of USD 76.6 billion. Early growth (2025 2030) is primarily volume driven as art material consumption expands through increased participation rates in community art centers, cultural facility workshops, and home-based creative practices that surged during pandemic-influenced lifestyle changes. In the latter years (2030 2035), value growth becomes increasingly significant: premium primers formulated for specific techniques—such as alkyd-based preparations for traditional oil painting, fine-tooth acrylics for detailed illustration work, and archival-grade gesso for conservation-minded artists—command higher prices.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 180.5 billion |

| Forecast Value (2035) | USD 280.4 billion |

| Forecast CAGR (2025–2035) | 4.5% |

Demand for canvas primer in Japan has been shaped by the country's post-war emphasis on comprehensive arts education, which embedded painting instruction in national curricula and created generations of citizens familiar with proper canvas preparation techniques. Japan's unique cultural position—balancing reverence for traditional nihonga painting methods with enthusiastic adoption of Western oil and acrylic techniques—created dual demand streams that supported diverse primer formulations. The proliferation of community culture centers (kōminkan) across municipalities provided accessible venues where residents could pursue painting regardless of professional status, normalizing art supply purchases across broad demographic segments.

Future growth will be influenced by Japan's aging demographic structure, where retirees represent an expanding consumer base with time, disposable income, and cultural inclination toward traditional leisure pursuits including painting. This demographic shift supports premium primer demand, as older artists often prioritize material quality over price sensitivity. Offsetting factors include declining birth rates that reduce the population of school-age students participating in structured art education, potentially constraining entry-level primer consumption. The expansion of urban apartment living, which limits space for traditional easel painting, creates pressure toward smaller-format works and alternative surfaces that may require less primer per project.

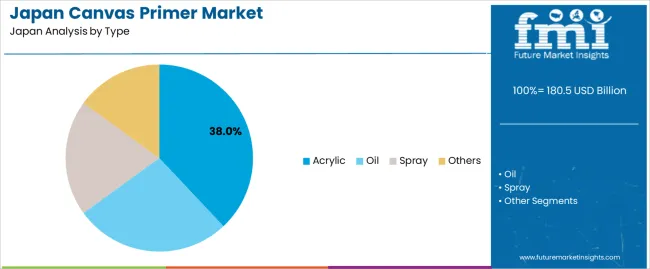

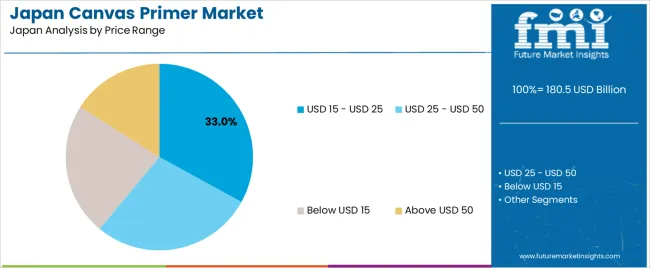

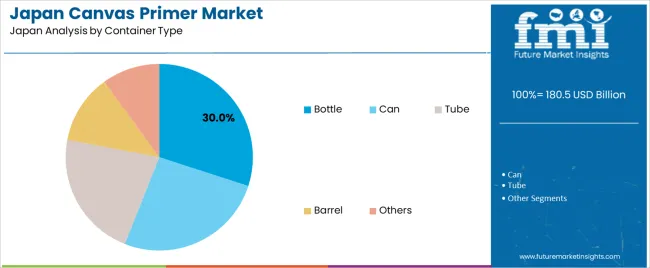

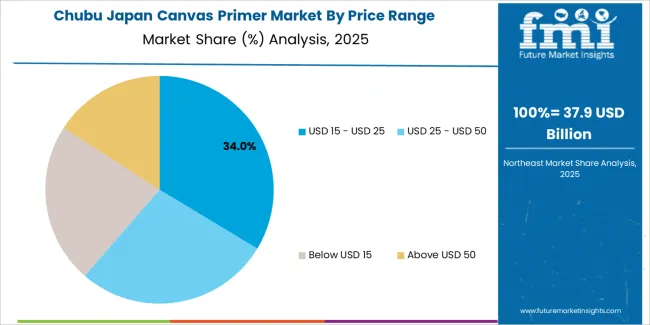

Demand for canvas primer in Japan is shaped by the formulation type selected for specific artistic techniques, the price positioning that reflects quality expectations and budget constraints, the container format that balances economy with preservation, and the sales channel through which artists access materials. Type categories include acrylic, oil, spray, and others, each serving distinct application methods and substrate requirements. Price ranges from USD 15 and under to above USD 50 reflect the spectrum from student-grade materials to professional archival formulations. Container types—bottle, can, tube, bucket, and others—address different volume needs and application preferences.

Acrylic primer accounts for 38% of total demand across type categories in Japan. This leading share reflects acrylic's versatility, which allows application on canvas, wood, paper, and synthetic surfaces without the extended drying times required by oil-based preparations. Japanese art educators favor acrylic primers for classroom settings, where quick turnaround between preparation and painting sessions is essential within limited instructional hours. The formulation's water-based nature aligns with Japan's stringent regulations regarding volatile organic compound emissions in educational and residential settings, making acrylic primers the default choice for schools and home studios in densely populated urban areas.

Demand for acrylic primer grows as younger artists entering the practice adopt techniques learned in contemporary art programs that emphasize rapid experimentation over traditional slow-build methodologies. The type's compatibility with both acrylic and oil paint layers—when properly sealed—provides technical flexibility that appeals to artists exploring multiple mediums. Manufacturers continually refine acrylic primer formulations to address historical weaknesses, such as tendency toward excessive absorbency or insufficient tooth for certain painting styles, through innovations in binder chemistry and filler selection.

The USD 15 and under price range accounts for 33.0% of total demand across pricing categories in Japan. This leading position reflects the substantial volume of student purchases, where elementary through high school art programs specify affordable primers that provide adequate performance without straining educational budgets. Amateur artists exploring painting as a new hobby also concentrate purchases in this range, where financial commitment remains modest during skill-building phases. The price point supports frequent experimentation, allowing artists to test different brands and formulations without significant economic risk.

Demand in this price range grows as manufacturers develop formulations that deliver acceptable quality at entry-level pricing through economies of scale and streamlined distribution. Japanese retailers, particularly chains like Tokyu Hands and Loft, maintain strong private-label primer offerings in this segment that leverage their purchasing power with contract manufacturers. The range also captures impulse purchases by casual painters who maintain supplies for occasional projects but lack the technical requirements or usage frequency that justify premium pricing.

Bottle container type accounts for 30.0% of total demand across container categories in Japan. This leading share reflects bottles' practical advantages for controlled dispensing, which minimizes waste and allows precise portion management during surface preparation. Japanese artists value the resealable design that preserves unused primer from oxidation and contamination across extended storage periods—particularly important in humid climates where exposed materials deteriorate rapidly. Bottles also suit the space constraints of Japanese urban living, where compact, stackable containers facilitate organized storage in limited studio areas.

Demand for bottle containers grows as manufacturers introduce ergonomic designs with pour spouts, flip-top caps, and graduated measuring marks that enhance usability during application. The format aligns well with modern squeeze-bottle application techniques, where artists dispense primer directly onto palettes or surfaces rather than decanting from larger vessels. Bottles also support portion control that matches typical project sizes in Japan, where artists frequently work on smaller canvases suited to residential display spaces.

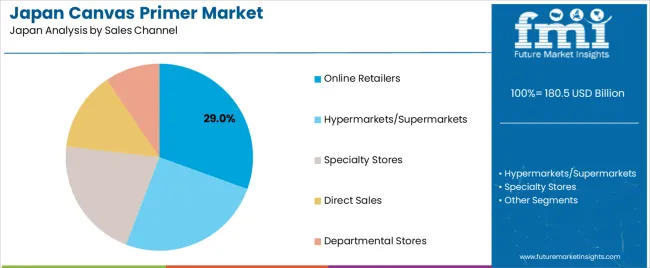

Online retail accounts for 29% of total demand across sales channel categories in Japan. This leading position reflects Japanese consumers' comfort with e-commerce for art supplies, where detailed product descriptions, customer reviews, and comparison shopping tools support informed purchasing decisions. Online channels provide access to international brands and specialized formulations not carried by local brick-and-mortar retailers, particularly important for professional artists seeking specific technical characteristics. The convenience of home delivery eliminates transportation challenges associated with carrying heavy primer containers on public transit—a significant consideration in urban areas where car ownership remains low.

Demand through online retail grows as platforms enhance their art supply categories with expert content, tutorial videos, and technique guides that help customers select appropriate primers for intended applications. The channel's 24/7 accessibility suits working adults pursuing painting as evening or weekend activities, who cannot easily visit specialty stores during business hours. Online retailers' ability to maintain broader inventory without physical display constraints allows them to stock diverse primer options including archival grades, tinted preparations, and specialty formulations that might represent slow-moving inventory for smaller physical stores.

Demand for canvas primer in Japan is influenced by sustained cultural investment in analog artistic practices, where painting retains prestige as both serious artistic pursuit and valued leisure activity despite digital alternatives. Japan's extensive infrastructure of private art schools (gakuin) and workshop spaces (atelier) creates continuous throughput of students requiring proper materials, while instructor recommendations strongly influence brand selection and product specifications. The country's tradition of gift-giving culture supports primer purchases as components of art supply sets presented for occasions such as retirement, milestone birthdays, and educational advancement. Social media platforms, particularly Instagram and YouTube, showcase finished paintings and increasingly include process documentation that highlights surface preparation, raising awareness of primer's role in achieving professional results and driving quality upgrades among hobbyist segments.

How Are Japan's Educational Systems and Demographic Patterns Encouraging New Use Cases?

Canvas primer gains traction because Japan's lifelong learning programs (shōgai gakushū) actively promote artistic activities for senior citizens, with municipalities operating subsidized workshops that require participants to acquire proper materials including primers. Corporate wellness programs increasingly incorporate creative workshops as stress-reduction initiatives, introducing white-collar workers to painting practices that many continue independently. The rise of social painting events-similar to Western "paint and sip" concepts but adapted to Japanese preferences with tea service and more structured instruction—creates new user cohorts who transition from shared materials to personal supply purchases. Art therapy applications in healthcare settings, particularly in geriatric care facilities and rehabilitation centers, generate institutional demand for primers as occupational therapists integrate painting into treatment protocols.

Where Are Practical Growth Opportunities for Canvas Primer in Japan?

Opportunities exist in developing formulations specifically optimized for manga and illustration practices that are transitioning from pure digital workflows to hybrid approaches incorporating traditional painting techniques. The expansion of textile art and fabric painting, driven by maker culture and sustainable fashion movements, creates demand for primers that bond to non-canvas substrates while maintaining flexibility. Regional tourism initiatives promoting "art tourism" in areas like Naoshima and Tokamachi introduce visitors to painting workshops that convert some participants into regular practitioners who continue purchasing supplies after returning home. Export opportunities emerge as Japanese primer brands gain recognition for quality formulations particularly suited to Asian climate conditions, appealing to growing art communities in Southeast Asian industries where Japanese art supply brands carry prestige associations.

What Local Factors Are Constraining Wider Adoption of Canvas Primer in Japan?

Constraints stem from space limitations in Japanese residences, where dedicated studio areas are uncommon and the strong odors associated with some primers create conflict in multi-generational households sharing compact living quarters. Economic pressures on younger demographics reduce discretionary spending for leisure materials, with digital art tools increasingly perceived as more economical since initial device investment eliminates ongoing material costs. The declining number of specialty art supply retailers in rural areas, as small family-owned shops close without succession, reduces physical access points and eliminates the expert guidance these establishments traditionally provided to local artists. Cultural shifts toward instant gratification and rapid skill acquisition, reinforced by social media culture, sometimes clash with traditional painting's requirement for methodical surface preparation, causing newer practitioners to skip priming steps or abandon the medium when immediate results prove elusive.

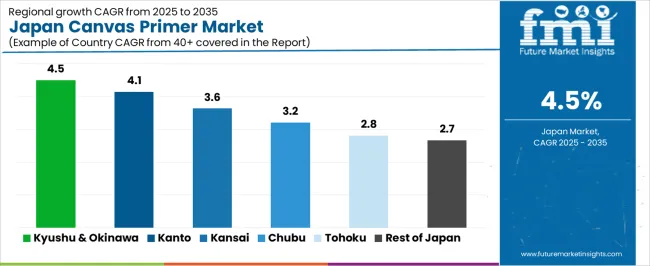

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.5% |

| Kanto | 4.1% |

| Kinki | 3.6% |

| Chubu | 3.2% |

| Tohoku | 2.8% |

| Rest of Japan | 2.7% |

Demand for canvas primer in Japan is rising across regions, with Kyushu and Okinawa leading at 4.5%. Growth in this region reflects expanding art education programs in Fukuoka's urban centers, Okinawa's thriving tourism-driven art scene, and regional cultural initiatives promoting traditional crafts alongside contemporary painting practices. Kanto follows at 4.1%, supported by Tokyo's concentration of art universities, commercial galleries, and the largest population of professional artists who maintain consistent primer consumption. Kinki records 3.6%, shaped by Osaka's active amateur art community and Kyoto's unique position as both traditional craft center and contemporary art hub. Chubu grows at 3.2%, influenced by Nagoya's established art supply retail infrastructure and regional painting circles with loyal material purchasing patterns. Tohoku reaches 2.8%, showing gradual adoption. The rest of Japan posts 2.7%, reflecting steady but modest engagement across smaller cities and rural areas.

Kyushu & Okinawa is projected to grow at a CAGR of 4.5% through 2035 in demand for canvas primer. Fukuoka functions as the region's cultural center, hosting multiple art schools and maintaining vibrant gallery districts in Tenjin and Daimyo neighborhoods where student and professional artists congregate. Okinawa's subtropical climate and distinctive landscape attract plein air painters who require weather-resistant primers suitable for outdoor work in humid conditions. The region's relatively lower cost of living compared to Tokyo or Osaka supports larger studio spaces, encouraging artists to work on bigger canvases that consume more primer per project. Local government cultural policies in cities like Kumamoto and Kagoshima actively subsidize community art facilities, creating accessible venues where residents pursue painting with proper material support.

Kanto is projected to grow at a CAGR of 4.1% through 2035 in demand for canvas primer. Tokyo's Musashino, Tama, and Tokyo University of the Arts represent major institutional purchasers maintaining consistent supply requirements. The capital's concentration of commercial galleries creates professional artist populations whose livelihood depends on regular output requiring proper materials. Wealthy residential areas in Tokyo, Yokohama, and surrounding cities support discretionary art spending among affluent hobbyists who favor premium primers. The region's extensive specialty retailer network—including flagship stores of Sekaido, Tools, and Pigment Tokyo—provides expert guidance that influences primer selection and encourages quality upgrades. International artist communities in Tokyo also introduce diverse technical approaches and material preferences that expand the range of primers demanded.

Kinki is projected to grow at a CAGR of 3.6% through 2035 in demand for canvas primer. Osaka's pragmatic commercial culture supports robust amateur art participation among merchants and small business owners who pursue painting as counterbalance to professional demands. Kyoto's art scene uniquely blends nihonga painting traditions with contemporary Western techniques, creating demand for diverse primer types that suit different artistic philosophies. Kobe's international history maintains connections to Western art practices, supporting oil painting traditions that rely on specific primer formulations. The region's educational institutions, including Kyoto City University of Arts and Osaka University of Arts, contribute institutional demand while graduates often remain in the region, building local professional communities.

Chubu is projected to grow at a CAGR of 3.2% through 2035 in demand for canvas primer. Nagoya's position as regional commercial hub supports established art supply retail chains serving steady customer bases. The region's industrial character fosters practical attitudes toward art materials, where purchasing decisions emphasize proven performance over experimental products. Chubu's relative affordability compared to Tokyo or Osaka enables hobbyists to maintain painting practices without excessive budget pressures. Regional painting circles and cultural associations in Shizuoka, Nagano, and Gifu organize regular exhibitions and workshops that sustain engagement. The area's natural beauty, particularly in mountainous regions, attracts landscape painters who require field-suitable primers for location work.

Tohoku is projected to grow at a CAGR of 2.8% through 2035 in demand for canvas primer. Sendai operates as the regional center, hosting art institutions and retail infrastructure serving northern Japan. The region's aging population includes retirees pursuing painting as primary retirement activity, though economic conditions may constrain premium purchases. Traditional crafts remain culturally important throughout Tohoku, and some artisans incorporate Western painting techniques into their practices, creating cross-disciplinary material demand. Post-disaster reconstruction emphasis on community building has included arts facilities as social anchors, though ongoing economic recovery limits expansion of discretionary art supply spending.

The Rest of Japan is projected to grow at a CAGR of 2.7% through 2035 in demand for canvas primer. Smaller cities and rural areas maintain painting traditions through local cultural centers and voluntary associations, though participation rates lag urban regions. Regional artists often exhibit strong loyalty to specific brands and retailers, creating stable if modest demand patterns. Economic challenges in depopulating areas constrain discretionary spending on art materials. Distance from specialty retailers means purchasing decisions often rely on general merchandise stores with limited selections or periodic trips to regional centers. Online retail increasingly serves these areas, providing access to broader product ranges but eliminating local expert guidance.

Demand for canvas primer in Japan is driven by the country's cultural valorization of artistic skill as legitimate pursuit regardless of professional status, extensive institutional infrastructure supporting arts education from childhood through retirement, and social acceptance of painting as respectable leisure activity deserving appropriate material investment. Government cultural policies at national and municipal levels provide funding for facilities, programs, and exhibitions that normalize artistic participation. The integration of art appreciation into general education creates baseline familiarity with painting processes, including proper surface preparation, across the population.

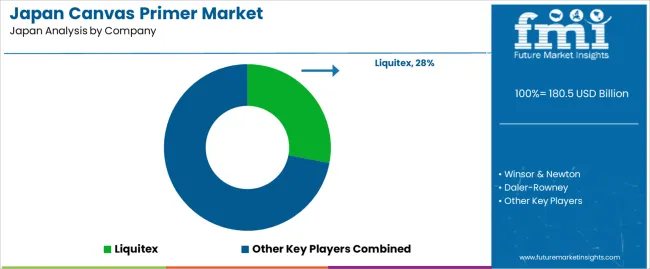

Key companies active in Japan's canvas primer space include American firm Liquitex, British manufacturer Winsor & Newton, UK-based Daler-Rowney, American supplier Golden Artist Colors, and American company Gamblin Artists Colors. Liquitex maintains strong presence in Japanese art supply stores through its pioneering role in acrylic paint development, with primers specifically formulated to work within their paint system. Winsor & Newton leverages its historical prestige as supplier to Western masters, positioning its primers as professional-grade preparations for serious artists.

Daler-Rowney serves both student and professional segments with tiered product lines addressing different budget points. Golden Artist Colors appeals to contemporary artists seeking technical innovation in formulations, while Gamblin focuses on oil painting traditions with primers addressing that medium's specific requirements. This competitive landscape ensures Japanese artists access both established legacy formulations and innovative contemporary preparations through specialized distribution networks.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Acrylic, Oil, Spray, Others |

| Price Range | USD 15 - Under, USD 25 - Under, Below USD 15, Above USD 50 |

| Container Type | Bottle, Can, Tube, Bucket, Others |

| Sales Channel | Online Retail, Hypermarket, Specialty Stores, Direct Sales, Department Stores |

| Region | Kanto, Kinki, Kyushu & Okinawa, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Liquitex, Winsor & Newton, Daler-Rowney, Golden Artist Colors, Gamblin Artists Colors |

| Additional Attributes | Dollar sales by type, price range, container, and sales channel, regional CAGR trends, and value–volume contributions are assessed alongside acrylic vs. oil primer penetration, student vs. professional usage, substrate compatibility, VOC and archival performance, Japan-specific humidity formulations, retail and e-commerce dynamics, and competition between domestic and international brands. |

The demand for canvas primer in Japan is estimated to be valued at USD 180.5 billion in 2025.

The market size for the canvas primer in Japan is projected to reach USD 280.3 billion by 2035.

The demand for canvas primer in Japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in canvas primer in Japan are acrylic, oil, spray and others.

In terms of price range, usd 15 - usd 25 segment is expected to command 33.0% share in the canvas primer in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canvas Primer Market Analysis - Growth, Demand & Trends 2025 to 2035

Demand for Canvas Bags in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Canvas Roll Market Size and Share Forecast Outlook 2025 to 2035

Canvas Bags Market Insights - Growth & Demand Forecast 2025 to 2035

Canvas and Muslin Bags Market Size, Share & Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA