The Japan insurtech demand is valued at USD 1.4 billion in 2025 and is forecasted to reach USD 8.4 billion by 2035, recording a CAGR of 19.6%. Demand is influenced by the digital transformation of policy administration, underwriting, and claims processes across major insurance providers. Increased use of online enrolment channels, automated risk-assessment tools, and data-driven servicing frameworks continues to support adoption. Growth is further reinforced by rising integration of identity-verification technologies, telehealth-linked workflows, and cloud-based insurance platforms designed to streamline customer interactions.

Health insurance represents the leading insurance type. This segment shows strong uptake of digital claims processing, remote eligibility checks, and structured benefits management tools. Platforms in this category support secure data exchange, automated validation, and analytics used to improve case-handling efficiency. Broader use of health-monitoring data and digital documentation systems also contributes to sustained investment in insurtech solutions.

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, where insurers, corporate benefit administrators, and digital service providers rely on integrated platforms for enrolment and claims support. Key suppliers include Entrust, Onfido, IDEMIA, Transmit Security, and Secret Double Octopus, offering identity and security technologies that underpin insurance onboarding and policy-servicing environments.

Peak-to-trough analysis shows a pronounced early peak between 2025 and 2029 as insurers accelerate digital-workflow adoption, expand automated underwriting, and integrate data-driven risk-assessment tools. Strong uptake of API-based distribution and online policy servicing will reinforce this early upward phase. Growth during these years is also supported by greater use of telematics in motor coverage, remote-inspection tools in property lines, and digitised claims workflows across major carriers.

A moderate trough is expected between 2030 and 2032 as insurers consolidate platforms, standardise data infrastructure, and adjust investment cycles following rapid digital expansion. Temporary slowdowns may also occur as firms rationalise overlapping tools and negotiate long-term licensing structures. After 2032, the segment is expected to return to a sustained upward trajectory, driven by deeper use of AI-supported risk scoring, cyber-insurance analytics, and embedded-insurance integrations across e-commerce and mobility services. The peak-to-trough pattern reflects a sector experiencing strong early transformation, followed by a rationalisation period, before advancing into a more mature and operationally stable digital-insurance environment in Japan.

| Metric | Value |

|---|---|

| Japan Insurtech Sales Value (2025) | USD 1.4 billion |

| Japan Insurtech Forecast Value (2035) | USD 8.4 billion |

| Japan Insurtech Forecast CAGR (2025 to 2035) | 19.6% |

The demand for insurtech in Japan is rising because insurers, brokers and fintech companies are pursuing digital transformation to streamline underwriting, claims processing and customer engagement. Japan’s ageing population and evolving risk profiles drive interest in new insurance products delivered through digital channels and data-driven platforms. Smartphone penetration, high internet usage and growing comfort with mobile transactions support rollout of on-demand policies and simplified customer experiences.

Regulatory encouragement of innovation, including support for startup partnerships and advanced analytics, further underpins the trend toward adoption of insurtech. Growth is constrained by conservative legacy systems, the need to ensure strong data protection and cybersecurity in insurance operations and the requirement for significant investment to integrate new technology within established insurers. Some insurers may delay full transformation due to risk-management concerns or cultural preference for personal interaction.

Demand for insurtech in Japan reflects ongoing investment in digital tools that support underwriting, claims handling, customer authentication, and policy administration. Adoption patterns differ across insurance categories, user groups, and technology types, shaped by organisational priorities and national regulatory frameworks. Japanese insurers rely on digital platforms to reduce manual workloads, improve risk assessment, and enhance service reliability across both individual and commercial policies. These patterns highlight how digital transformation influences the structure of insurance operations across the country.

Health insurance holds 35.5% of Japan’s insurtech demand and represents the largest insurance category. Digital tools support claims automation, eligibility verification, remote interaction, and faster assessments for routine and chronic-care cases. Life insurance holds 21.5%, reflecting increased adoption of automated underwriting modules and digital identity verification during policy issuance. Auto insurance accounts for 17.0%, supported by telematics adoption and digital claims evaluation. Property and casualty insurance represents 14.0%, using analytics platforms for risk scoring and loss assessment. Commercial insurance holds 12.0%, incorporating digital tools for business-policy administration and structured claims workflows. Insurance-type distribution reflects the scale of claims volume, regulatory involvement, and digital-service maturity across Japanese insurance products.

Key drivers and attributes:

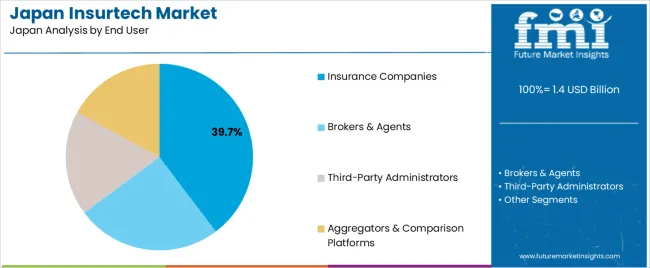

Insurance companies represent 39.7% of Japan’s insurtech demand and form the largest user group. They invest in digital platforms to streamline internal workflows, support regulatory compliance, and improve policyholder servicing. Brokers and agents account for 25.1%, using quoting tools, CRM systems, and digitised comparison processes to manage client advisory tasks. Third-party administrators represent 18.2%, applying automation for claims intake, document handling, and eligibility review. Aggregators and comparison platforms hold 17.0%, relying on real-time data integration to provide accurate product comparison and routing. End-user distribution reflects the structure of Japan’s insurance ecosystem, where insurers lead digital adoption while intermediaries use platforms to expand customer reach.

Key drivers and attributes:

Artificial intelligence holds an estimated 32.0% share and is the leading technology segment in Japan’s insurtech adoption. AI supports predictive modelling, fraud detection, document processing, and automated decision-making across underwriting and claims. Machine learning and data analytics represent 27.0%, used for risk scoring, pricing models, and portfolio assessment. Cloud computing holds 21.0%, providing scalable infrastructure for policy administration and customer-interaction platforms. Internet of Things (IoT) accounts for 12.0%, supporting telematics-based auto insurance and sensor-driven monitoring in commercial lines. Blockchain and smart contracts represent 8.0%, used in secure policy validation and data-exchange use cases. Technology distribution reflects the maturity of digital infrastructure and integration priorities across Japanese insurers.

Key drivers and attributes:

Demographic shifts, regulatory encouragement, and digital‐service expansion are boosting demand.

Japan’s ageing population and rising health and wellness needs are compelling insurers to adopt digital Insurtech solutions that support preventive care, health tracking, and wellness‐linked insurance. Regulatory frameworks, including sandbox schemes by the Financial Services Agency (FSA), are encouraging innovation and partnerships between traditional insurers and tech firms. High smartphone penetration and mature digital infrastructure enable wider consumer access to mobile insurance applications, on-demand covers, and embedded insurance models linked to lifestyle and mobility services. These factors combine to strengthen uptake of Insurtech across life, health, property & casualty, and specialty insurance segments.

Legacy systems, low startup ecosystem scale, and cultural risk aversion limit rapid growth.

Many Japanese insurers operate on long-established IT systems and rely on traditional agent-based sales channels, which creates inertia when adopting new Insurtech platforms. The domestic startup Insurtech ecosystem remains smaller relative to other major industries, which restricts the pace of disruptive new entrants and drives many innovations via incumbent-startup alliances rather than full platform disruption. Japanese consumers and corporate buyers often prioritise reliability and brand trust over novel digital offerings, which slows full transition to purely digital insurance models. These conditions moderate adoption of Insurtech solutions despite strong underpinning demand.

Embedded and usage-based insurance models, AI-enabled underwriting and claims, and growth of health-tech Insurtech tie-ins are shaping the industry.

Embedded insurance models where cover is built into non-insurance digital services such as mobility platforms, e-commerce check-outs and IoT subscription services are gaining traction in Japan as insurers seek new distribution channels. Artificial intelligence and machine learning are increasingly used for underwriting risk, detecting fraud, automating claims workflows and personalising premiums based on data analytics. Health-tech tie-ins, including wellness apps, wearable sensor integration and remote care platforms, support Insurtech growth especially given larger elderly segments and rising chronic-care costs. These developments are positioning the Insurtech industry in Japan for sustained expansion and wider service adoption.

Demand for insurtech in Japan is rising through 2035 as insurers, brokers, financial platforms, and service providers adopt digital tools to improve underwriting, claims handling, fraud detection, and customer onboarding. Growth is influenced by regulatory requirements, cloud-system adoption, integration of analytics-based pricing, and expansion of online insurance distribution.

Digital identity verification, automated documentation processing, and API-linked insurance modules continue to shape operational workflows. Insurtech also supports hybrid interactions across customer-service units, field operations, and bancassurance networks. Regional growth reflects differences in enterprise density, digital maturity, and insurance-industry penetration. Kyushu & Okinawa leads with a 24.5% CAGR, followed by Kanto (22.5%), Kinki (19.8%), Chubu (17.4%), Tohoku (15.3%), and the Rest of Japan (14.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 24.5% |

| Kanto | 22.5% |

| Kinki | 19.8% |

| Chubu | 17.4% |

| Tohoku | 15.3% |

| Rest of Japan | 14.5% |

Kyushu & Okinawa grows at 24.5% CAGR, supported by rising digital adoption across insurance branches, financial institutions, and service platforms operating in Fukuoka, Kumamoto, and Kagoshima. Regional insurers integrate automated underwriting tools, risk-scoring models, and digital onboarding systems to reduce processing times and improve accuracy. Call-center operations in Kyushu use cloud-based service modules for claims communication and customer support. Local banks adopt API-linked insurance connectors to streamline bancassurance workflows. E-commerce platforms operating in the region use embedded-insurance modules for consumer protection programs. Okinawa’s distributed population depends on digital channels for policy servicing, fueling ongoing adoption of remote-verification and automated claims systems.

Kanto grows at 22.5% CAGR, driven by Japan’s highest concentration of insurance headquarters, financial institutions, and technology companies. Organizations in Tokyo, Kanagawa, and Chiba adopt automated policy-administration systems, AI-supported claims assessment, digital KYC workflows, and predictive-risk analytics. Major life and non-life insurers integrate cloud-native platforms to scale customer operations and regulatory processes. Digital-marketplace operators rely on insurtech APIs to distribute microinsurance and bundled-protection products. Commercial insurers implement workflow automation to support high-volume corporate clients. Large metropolitan populations accelerate adoption of self-service insurance applications and mobile-based claim submission. High enterprise density ensures consistent demand for scalable digital insurance solutions.

Kinki grows at 19.8% CAGR, supported by digital transformation across regional insurers, banks, and service providers in Osaka, Kyoto, and Hyogo. Companies deploy automated policy-servicing platforms, document-processing engines, and risk-evaluation tools for both personal and commercial insurance segments. Regional banks adopt embedded-insurance modules integrated into financial applications. Retailers and e-commerce operators use digital protection plans that rely on remote verification systems. Healthcare-linked insurers adopt electronic-claims tools to streamline reimbursement procedures. Academic institutions and technology centers in Osaka encourage adoption of analytics-driven pricing models. Steady growth in digital financial services supports expanding demand for scalable insurtech solutions.

Chubu grows at 17.4% CAGR, supported by manufacturing-heavy economies in Aichi, Shizuoka, and Mie that require structured risk-management and digital insurance processes. Insurers adopt automated underwriting systems to assess industrial-risk profiles and manage commercial policies efficiently. Logistics companies deploy telematics-based policy models, using insurtech tools for driver-behavior monitoring and claims documentation. Financial institutions adopt identity-verification and digital servicing platforms to streamline policy distribution. E-commerce companies use embedded-insurance tools to offer consumer protection products. Although the region has fewer insurance headquarters than Kanto, broad industrial and logistics activity maintains strong demand for digital insurance workflows.

Tohoku grows at 15.3% CAGR, supported by increasing digital transformation across regional banks, insurance cooperatives, healthcare networks, and municipal service platforms. Financial institutions adopt remote verification and automated onboarding tools for policy issuance. Public-sector insurance programs integrate digital claims-processing modules to streamline administrative workflows. Healthcare providers use electronic claims and validation systems linked to insurer networks. Retail and hospitality businesses adopt simple protection products distributed through digital platforms. While the region has smaller insurance industries than Kanto or Kinki, essential-service modernization sustains dependable growth.

The Rest of Japan grows at 14.5% CAGR, supported by dispersed financial institutions, cooperative insurers, and municipal services that require digital policy management and verification systems. Rural banks use automated onboarding workflows to comply with regulatory requirements. Local governments rely on digital insurance modules for public-benefit program administration. Retail networks adopt simple device-protection and warranty products delivered through online platforms. Healthcare centers use electronic-claims tools to manage patient reimbursements. Although enterprise concentration is lower than in metropolitan regions, increasing reliance on digital channels ensures consistent adoption of insurtech systems.

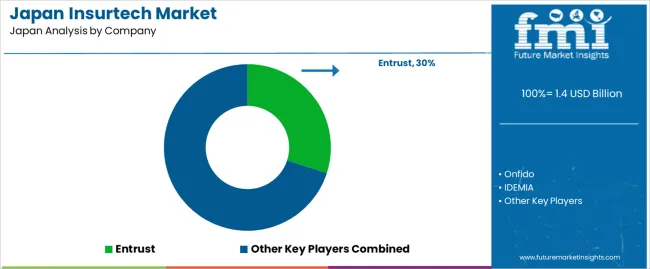

Demand for insurtech solutions in Japan is shaped by a concentrated group of digital-identity and authentication providers supporting underwriting, customer onboarding, fraud control, and policy-servicing activities. Entrust holds the leading position with an estimated 30.0% share, supported by established credentialing systems, strong cryptographic infrastructure, and stable performance across high-assurance environments used by Japanese insurers. Its position is reinforced by reliable certificate management and consistent alignment with domestic security requirements.

Onfido and IDEMIA follow as significant participants, supplying document-verification, biometric-authentication, and identity-proofing tools widely used in digital onboarding and claim authorization. Their strengths include scalable machine-learning models, dependable document-recognition capability, and adherence to Japan’s eKYC standards. Transmit Security maintains a notable presence with passwordless authentication and orchestration frameworks that help insurers reduce friction during customer access while strengthening identity assurance.

Secret Double Octopus contributes additional capability through multi-factor and credential-resilience solutions designed for enterprise environments seeking to limit identity-driven fraud and enhance internal security controls. Competition across this segment centers on fraud-detection accuracy, biometric stability, orchestration flexibility, regulatory alignment, and predictable verification performance. Demand continues to expand as Japanese insurers accelerate digital transformation, automate customer onboarding, and integrate secure, low-friction authentication and identity-proofing systems into policy administration and claims workflows.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Insurance Type | Health Insurance, Life Insurance, Auto Insurance, Property & Casualty Insurance, Commercial Insurance |

| End User | Insurance Companies, Brokers & Agents, Third-Party Administrators, Aggregators & Comparison Platforms |

| Technology | Artificial Intelligence, Machine Learning & Data Analytics, Blockchain & Smart Contracts, Internet of Things, Cloud Computing |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Entrust, Onfido, IDEMIA, Transmit Security, Secret Double Octopus |

| Additional Attributes | Dollar sales by insurance type, end user, and technology categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of insurtech solution providers; advancements in underwriting automation, blockchain-based policy administration, AI claims analytics, IoT-enabled risk monitoring, and cloud-native insurance systems; integration with insurers, brokers, TPAs, and digital comparison platforms across Japan. |

The global demand for insurtech in japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the demand for insurtech in japan is projected to reach USD 8.4 billion by 2035.

The demand for insurtech in japan is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key product types in demand for insurtech in japan are health insurance, life insurance, auto insurance, property & casualty insurance and commercial insurance.

In terms of end user, insurance companies segment to command 39.7% share in the demand for insurtech in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insurtech Market Analysis by Component, by Deployment and by Industry Through 2035

Demand for Insurtech in USA Size and Share Forecast Outlook 2025 to 2035

Real Estate InsurTech Market Growth - Trends & Forecast 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA