The demand for suspended ceiling systems in Japan is valued at USD 383.9 million in 2025 and is projected to reach USD 535.0 million by 2035, reflecting a compound annual growth rate of 3.4%. Growth is shaped by steady construction and renovation activity across commercial buildings, institutional facilities and transport hubs where acoustic control and concealed mechanical layouts are essential. As interior design standards advance, suspended ceiling systems remain central to creating uniform surfaces that support lighting, ventilation and fire-protection elements. Broader upgrades in office spaces and retail interiors also contribute to demand, particularly as operators prioritize adaptable layouts that accommodate future system changes. These factors reinforce a consistent rise in adoption throughout the forecast window.

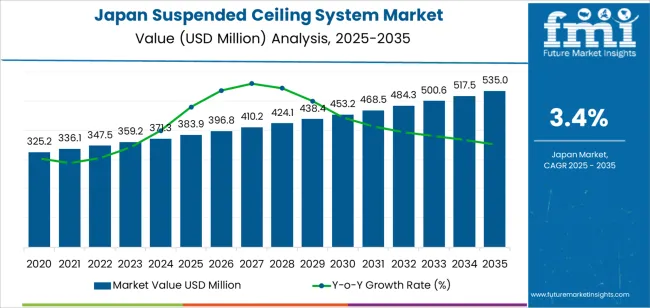

The growth curve shows uniform year-on-year expansion, beginning at USD 325.2 million in earlier years and rising to USD 383.9 million in 2025 before advancing to USD 535.0 million by 2035. Annual increments follow a predictable pattern, moving from USD 396.8 million in 2026 to USD 410.2 million in 2027 and continuing with similar spacing across later periods. This trajectory reflects stable use of suspended ceiling structures as building owners pursue noise reduction, accessible service routes and cleaner visual finishes. As refurbishment cycles progress across offices, schools and public buildings, suspended ceiling systems maintain consistent demand tied to their functional integration and ease of maintenance. The curve indicates a mature but steadily advancing segment supported by ongoing upgrades across Japan’s built environment.

Demand in Japan for suspended ceiling systems is projected to grow from USD 383.9 million in 2025 to USD 535.0 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.4%. Starting from USD 325.2 million in 2020, the value climbs steadily through USD 371.3 million in 2024, reaching USD 383.9 million in 2025. The forecast then advances to USD 438.4 million by 2030 and ultimately to USD 535.0 million by 2035. This growth is supported by ongoing renovation and retrofitting of commercial, institutional and industrial buildings, urban infrastructure upgrades, stricter acoustic and fire safety standards, and demand for modular ceiling solutions that integrate lighting and HVAC systems.

Over the decade from 2025 to 2035 the total value uplift is USD 151.1 million, moving from USD 383.9 million to USD 535.0 million. Early in the forecast period the increase is volume driven as renovation projects and new builds expand. In later years the value growth becomes more prominent through higher specification ceiling systems such as premium acoustic tiles, fire rated panels and integrated systems with lighting and sensors leading to higher average spending per unit area. Suppliers and installers that focus on these advanced product formats and retrofit opportunities are positioned to capture a significant portion of the forecasted growth.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 383.9 million |

| Forecast Value (2035) | USD 535.0 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The demand for suspended ceiling systems in Japan is increasing as building owners and developers pursue interior design upgrades, space flexibility and improved utility access in commercial, institutional and residential properties. Japan’s construction sector is seeing steady activity in office buildings, retail facilities, educational campuses and healthcare centres, where suspended ceilings are used to conceal mechanical systems, improve acoustics and enable easier maintenance. Renovation of older buildings and the rise of co-working spaces also support replacement of ageing ceiling structures with new suspended systems.

Another contributor is the emphasis on environmental performance, fire safety, and building code compliance in Japan’s architectural and construction practices. Suspended ceiling systems help manage airflow, reduce noise transfer and integrate lighting and fire-safety systems more effectively. The availability of premium finishes, modular panels and material options supports use in high-end interiors and urban apartments. At the same time, cost pressure from raw materials and labour, and limited space in dense urban settings, remain constraints. Overall, the growth in building refurbishments and interior quality expectations ensures demand for suspended ceiling systems in Japan remains on a positive trajectory.

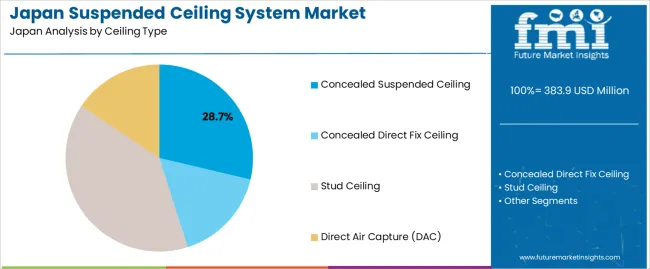

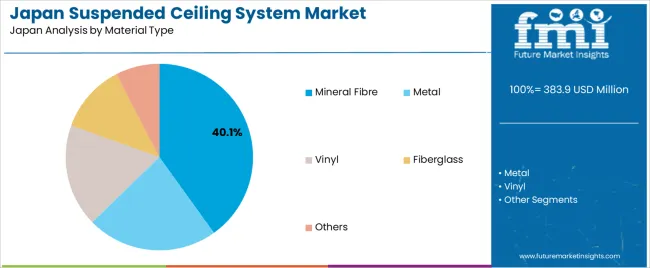

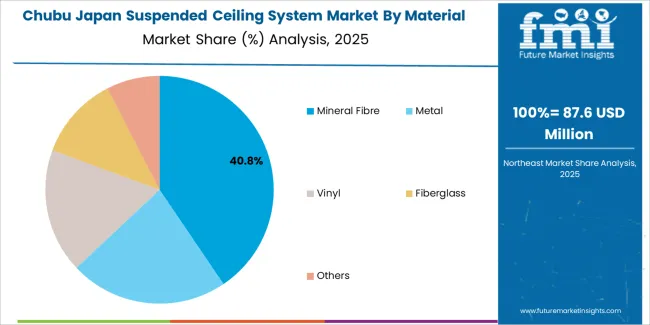

The demand for suspended ceiling systems in Japan is shaped by the types of ceiling structures in use and the materials selected for acoustic, thermal and aesthetic performance. Ceiling types include concealed suspended ceilings, concealed direct fix ceilings, stud ceilings and other specialized formats installed across commercial and institutional buildings. Material options include mineral fibre, metal, vinyl, fiberglass and other composite solutions that meet project requirements for durability and appearance. As building interiors prioritize clean finishes, sound control and straightforward maintenance, the combination of ceiling design and material performance guides demand across construction and renovation activities in Japan.

Concealed suspended ceilings account for 29% of total demand for ceiling types in Japan. These systems are selected for their ability to create uniform surfaces that hide mechanical and electrical components while supporting efficient access for maintenance. Their clean appearance suits offices, educational buildings and retail interiors where consistent visual presentation is important. Concealed suspended ceilings provide stable support for lighting and ventilation fixtures, which helps maintain orderly layouts. Their compatibility with modular tiles and integrated panels strengthens use in large developments seeking predictable installation and long-term performance across multiple floor plans.

Demand increases as building projects aim to manage acoustics and lighting distribution in high activity environments. Concealed suspended systems support acoustic panels that help reduce noise levels, which improves comfort in busy interiors. Their flexible grid structures allow designers to adapt ceiling layouts for different room functions without major structural changes. These qualities make concealed suspended ceilings a dependable option for facilities undergoing upgrades or space reconfiguration. As interior design continues to prioritize practical finishes and controlled aesthetics, this ceiling type maintains its role in Japan’s construction landscape.

Mineral fibre accounts for 40.1% of total demand for suspended ceiling materials in Japan. Its leading share reflects strong acoustic performance and insulation capabilities that support comfortable indoor environments. Mineral fibre tiles absorb sound effectively, which makes them suitable for offices, schools and public facilities where noise control is a priority. Their lightweight nature supports straightforward installation and routine replacement, allowing building operators to maintain ceiling quality over time. The material also offers stable fire resistance properties, which helps meet building safety requirements across a wide range of interior projects.

Demand for mineral fibre increases as interior designers seek materials that balance performance with visual flexibility. The tiles are available in smooth, textured and patterned surfaces that suit modern and traditional interior themes. Their ability to integrate with lighting fixtures and ventilation units helps maintain consistent ceiling appearance without complicated adjustments. Facilities managers also value the easy handling and predictable performance of mineral fibre tiles during maintenance cycles. As building interiors continue emphasizing comfortable acoustics and dependable materials, mineral fibre remains a preferred ceiling option across Japan.

The demand for suspended ceiling systems in Japan is being shaped by a steady stream of commercial, institutional and renovation projects where ceiling systems must deliver aesthetics, acoustic control, fire resistance and service access. Growth is supported by aging building stock undergoing refurbishment, stricter building codes for seismic and fire performance, and the rise of modular interiors in offices and retail spaces. At the same time, barriers include high installation costs, limited height clearance in older structures and competition from alternative ceiling formats. These factors together determine how rapidly suspended ceiling systems expand across Japanese construction.

How Are Construction Activity and Interior Design Expectations Influencing Demand for Suspended Ceiling Systems in Japan?

In Japan, commercial construction and interior refit programmes increasingly specify suspended ceiling systems to meet demands for clean finishes, integration of lighting/HVAC and sound insulation. Corporate headquarters, shopping centres, hospitals and educational institutions emphasise ceilings that hide services while maintaining design quality. Renovation of older buildings common in Japan due to long use cycles also favours modular suspended ceilings for quicker turnaround. These dynamics drive demand for high-performance ceiling systems in Japan’s built-environment sector.

Where Are Growth Opportunities Emerging for Suspended Ceiling Systems in Japan’s Market?

Growth opportunities exist in premium commercial interiors, upgrade of hotels/retail stores, healthcare facility refurbishments and transportation hubs where high acoustics and fire-rated ceilings matter. The increasing use of smart building systems also opens demand for suspended ceilings that integrate lighting sensors, air-flow ducts and IoT modules. Suppliers who provide lightweight, fire-resistant, easily installable ceiling components customised for compact Japanese spaces are well placed to capture this segment.

What Challenges Are Limiting Broader Adoption of Suspended Ceiling Systems in Japan?

Despite favourable demand conditions, adoption faces several challenges. Many existing buildings in Japan have low ceiling clearance, limiting installation of drop or suspended systems without major structural change. Installation labour and material costs remain elevated relative to simpler ceiling formats. Also, some projects may opt for exposed ceiling aesthetics or open-ceiling designs, reducing demand for traditional suspended systems. These issues moderate how rapidly suspended ceiling systems become standard in all facility types in Japan.

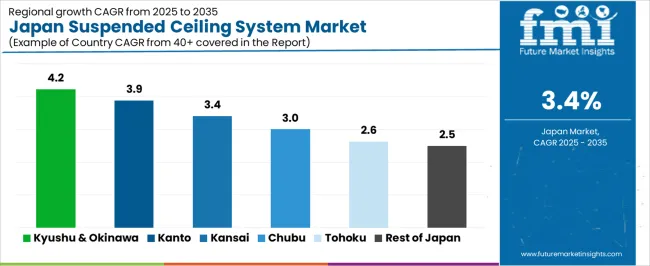

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.2% |

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Demand for suspended ceiling systems in Japan is rising at a steady pace, with Kyushu and Okinawa leading at 4.2%. Growth in this region reflects active commercial construction and steady renovation work across office and retail properties. Kanto follows at 3.9%, supported by dense urban development and ongoing upgrades to commercial interiors. Kinki records 3.4%, shaped by consistent demand from educational, healthcare, and corporate facilities. Chubu grows at 3.0%, influenced by regional construction projects and remodeling activity. Tohoku reaches 2.6%, where adoption increases gradually within public and private buildings. The rest of Japan posts 2.5%, reflecting stable but modest demand across smaller markets.

Kyushu & Okinawa is projected to grow at a CAGR of 4.2% through 2035 in demand for suspended ceiling systems. Construction projects, commercial offices, and institutional buildings in Fukuoka are adopting modular and acoustic ceiling solutions for aesthetics, noise reduction, and space management. Rising urban development, office modernization, and interior design trends drive adoption. Manufacturers provide lightweight, durable, and easy-to-install ceiling panels compatible with HVAC and lighting systems. Retailers and construction suppliers ensure accessibility. The combination of building renovation, architectural modernization, and functional interior design requirements supports steady growth in suspended ceiling system adoption in Kyushu & Okinawa.

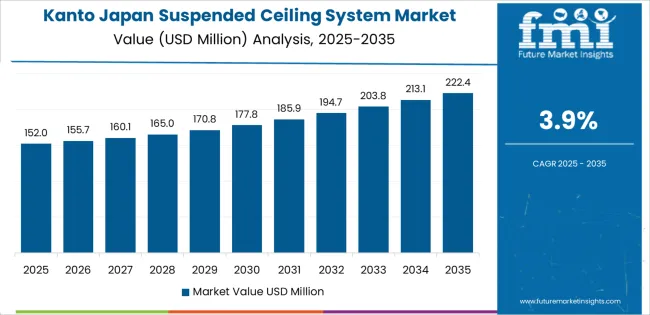

Kanto is projected to grow at a CAGR of 3.9% through 2035 in demand for suspended ceiling systems. Tokyo and surrounding urban centers increasingly adopt modular, acoustic, and functional ceiling panels in offices, hospitals, and commercial facilities. Rising demand for noise control, modern interiors, and energy-efficient lighting integration drives adoption. Manufacturers produce high-quality, easy-to-install, and durable ceiling solutions. Retailers and distributors expand access across urban construction and renovation projects. Office modernization, architectural aesthetics, and interior functionality ensure steady growth in suspended ceiling system usage throughout Kanto’s commercial and institutional sectors.

Kinki is projected to grow at a CAGR of 3.4% through 2035 in demand for suspended ceiling systems. Cities including Osaka and Kyoto are adopting modular, acoustic, and functional ceiling solutions for offices, hospitals, and commercial buildings. Rising demand for aesthetic interiors, noise reduction, and energy-efficient lighting integration drives adoption. Manufacturers provide durable, lightweight, and easy-to-install panels suitable for multiple applications. Retailers and construction suppliers ensure widespread availability. The combination of urban office expansion, commercial renovations, and interior functionality requirements ensures steady adoption of suspended ceiling systems across Kinki.

Chubu is projected to grow at a CAGR of 3.0% through 2035 in demand for suspended ceiling systems. Nagoya and surrounding urban areas are gradually adopting modular, acoustic, and functional ceiling panels in offices, hospitals, and commercial spaces. Rising focus on interior aesthetics, noise control, and lighting integration drives adoption. Manufacturers provide easy-to-install, durable, and lightweight ceiling solutions. Retail and construction distribution channels support product availability across urban and suburban regions. Office and commercial renovations, combined with architectural modernization, ensure steady growth in suspended ceiling system adoption across the Chubu region.

Tohoku is projected to grow at a CAGR of 2.6% through 2035 in demand for suspended ceiling systems. Hospitals, offices, and commercial facilities are gradually adopting modular, acoustic, and functional ceiling solutions. Rising awareness of interior design, noise reduction, and lighting efficiency drives adoption. Manufacturers supply lightweight, durable, and easy-to-install ceiling panels compatible with existing infrastructure. Retailers and suppliers ensure accessibility across urban and semi-urban areas. Office upgrades, small commercial renovations, and interior modernization contribute to steady adoption of suspended ceiling systems in Tohoku.

The Rest of Japan is projected to grow at a CAGR of 2.5% through 2035 in demand for suspended ceiling systems. Smaller towns and rural regions gradually adopt acoustic and modular ceiling panels for offices, clinics, and commercial facilities. Rising awareness of noise reduction, interior aesthetics, and energy-efficient lighting integration drives adoption. Manufacturers supply durable, lightweight, and easy-to-install panels. Retailers and distributors expand access to less urbanized areas. Steady renovations, smaller construction projects, and functional interior requirements ensure continuous growth in suspended ceiling system adoption across the Rest of Japan.

The demand for suspended ceiling systems in Japan is shaped by continuous renovation activity in commercial buildings, rising expectations for acoustic comfort, and the need for modern interiors that integrate lighting, ventilation and safety features. Urban office spaces, hospitals, schools and retail facilities are upgrading environments to improve occupant comfort and energy efficiency. Japan’s seismic conditions also influence adoption, as builders prefer ceiling systems designed to withstand vibration while maintaining structural stability and aesthetic appeal. Growing interest in modular, easily maintainable ceiling designs supports wider use in both new construction and refurbishment projects. These combined factors create steady demand for suspended ceiling solutions throughout the Japanese built environment.

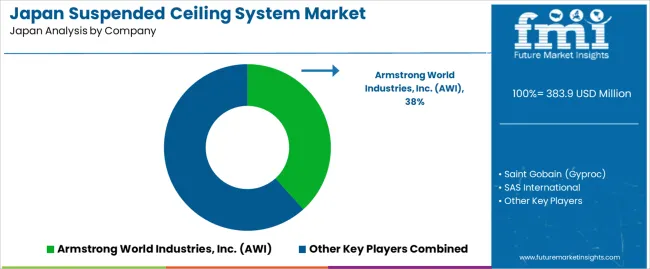

Key players shaping the suspended ceiling system landscape in Japan include Armstrong World Industries, Inc. (AWI), Saint Gobain (Gyproc), SAS International, Knauf and ROCKWOOL A/S (Rockfon). These companies offer ceiling panels, grid frameworks and acoustic solutions suited to Japan’s performance standards, design preferences and installation requirements. Their portfolios address needs for sound absorption, fire resistance, moisture control and seismic compatibility. By collaborating with architects, contractors and facility planners, they support the adoption of ceiling systems that deliver functionality and design consistency. Their presence and technical expertise enable them to influence how suspended ceiling systems are selected and deployed across Japan’s commercial and institutional sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Ceiling Type | Concealed Suspended Ceiling, Concealed Direct Fix Ceiling, Stud Ceiling, Direct Air Capture (DAC) |

| Material Type | Mineral Fibre, Metal, Vinyl, Fiberglass, Others |

| Application | Commercial Construction, Industrial Construction, Residential Construction |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Armstrong World Industries, Inc. (AWI), Saint Gobain (Gyproc), SAS International, Knauf, ROCKWOOL A/S (Rockfon) |

| Additional Attributes | Dollar by sales by ceiling type, material type, and region; regional CAGR and growth trends; market share dynamics between ceiling types and materials; adoption by commercial, industrial, and residential projects; retrofit versus new construction share; urban and semi-urban penetration; premium acoustic and fire-rated panels; modularity and integrated system demand; construction regulations and seismic compliance influence; installation complexity and cost considerations; supplier portfolio differentiation; repeat project adoption and refurbishment cycles. |

The demand for suspended ceiling system in japan is estimated to be valued at USD 383.9 million in 2025.

The market size for the suspended ceiling system in japan is projected to reach USD 535.0 million by 2035.

The demand for suspended ceiling system in japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in suspended ceiling system in japan are concealed suspended ceiling, concealed direct fix ceiling, stud ceiling and direct air capture (dac).

In terms of material type, mineral fibre segment is expected to command 40.1% share in the suspended ceiling system in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suspended Ceiling System Market Growth - Trends & Forecast 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Japan Visitor Management System Market Growth - Trends & Forecast 2025 to 2035

Japan Flare Gas Recovery System Market Outlook – Share, Growth & Forecast 2025–2035

Japan Battery Management System Market Growth – Trends & Forecast 2023-2033

Japan Building Automation System Market Analysis & Forecast by System, Application, and Region Through 2035

Japan Sleep Apnea Diagnostic Systems Market Report – Size, Demand & Outlook 2025-2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Demand for Palletizing Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Self-checkout Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Battery Management System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Turbomachinery Control System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Advanced Driver Assistance System (ADAS) Testing Equipment in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Ultra Short Base Line (USBL) Positioning Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA