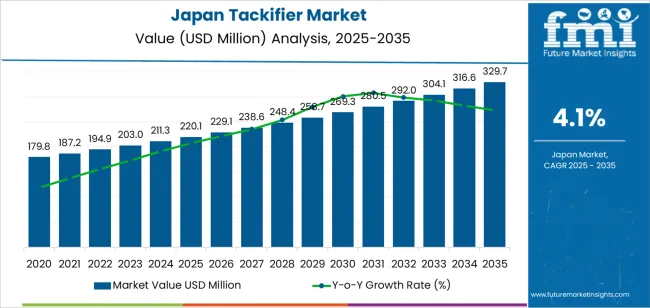

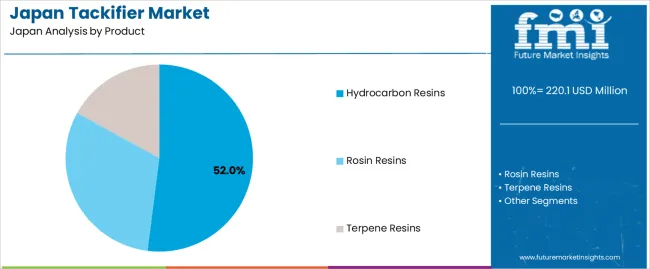

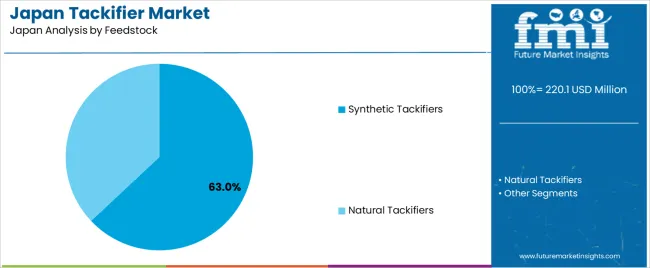

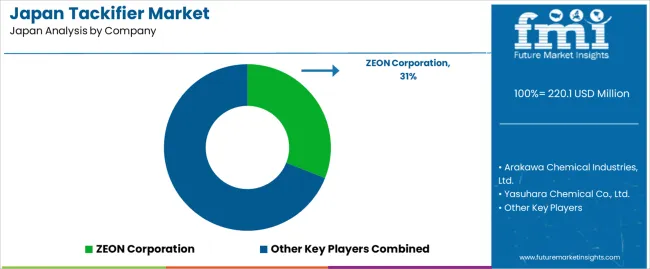

The Japan tackifier demand is valued at USD 220.1 million in 2025 and is forecasted to reach USD 329.7 million by 2035, reflecting a CAGR of 4.1%. Increasing adhesive consumption in packaging, woodworking, construction, and hygiene applications supports ongoing demand. Requirements for stronger bonding strength, heat resistance, and compatibility with diverse polymer systems influence procurement decisions across end-use sectors. Hydrocarbon resins lead product utilization because of their cost efficiency, stable performance characteristics, and suitability for pressure-sensitive adhesives used in tapes and labels. Synthetic tackifiers record high adoption due to consistent quality, improved supply security, and superior tailoring options for adhesive formulation. These materials support continuous-process coating lines for high-volume production of consumer and industrial adhesive products.

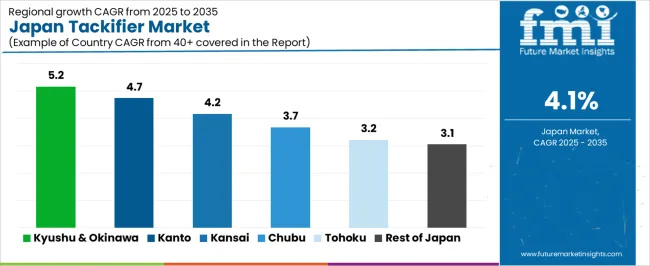

Kyushu & Okinawa and Kanto represent priority growth regions due to strong activity in packaging conversion, automotive manufacturing, and electronics assembly. These areas also maintain adhesive-focused chemical production clusters and distribution infrastructure to supply diverse converting segments. Key suppliers include ZEON Corporation, Arakawa Chemical Industries, Ltd., Yasuhara Chemical Co., Ltd., Eastman Chemical (Japan), and Kolon Industries (Japan). They provide material portfolios spanning C5/C9 hydrocarbon resins, rosin derivatives, and hybrid tackifiers used in paper lamination, non-wovens, labeling applications, and sealant support operations.

Demand for tackifiers in Japan shows a moderate peak-to-trough spread due to the close link with adhesives used in packaging, automotive components, electronics assembly, and construction materials. Peak demand typically aligns with strong production cycles in automotive and consumer-electronics output, where high-performance bonding is required for lightweight structural parts and component miniaturization. The food and consumer-goods packaging segment provides additional lift during periods of elevated manufacturing throughput.

Trough phases emerge when industrial activity softens, particularly during slowdowns in export manufacturing or construction delays. Environmental compliance and substitution toward lower-emission adhesive systems can temporarily reduce volume growth while producers transition to bio-based or safer-handling tackifier chemistries. Despite these dips, the trough depth remains limited because essential packaging adhesives sustain baseline consumption even in weaker economic periods. The overall pattern indicates measured fluctuations rather than sharp cyclical swings, with industrial output acting as the primary determinant of peak levels and regulatory adjustment shaping the trough points within the demand cycle.

| Metric | Value |

|---|---|

| Japan Tackifier Sales Value (2025) | USD 220.1 million |

| Japan Tackifier Forecast Value (2035) | USD 329.7 million |

| Japan Tackifier Forecast CAGR (2025-2035) | 4.1% |

Demand for tackifiers in Japan is increasing because adhesive manufacturers and product converters require reliable bonding performance across packaging, hygiene and automotive applications. Hot melt adhesives used in case sealing, labels and flexible packaging rely on tackifiers to achieve fast initial grab and stable adhesion during high speed production. Growth in convenience food packaging and e commerce logistics supports consistent usage in carton sealing and shipping materials. The hygiene sector strengthens demand for low odour and skin compatible tackifiers used in baby diapers, feminine care and adult incontinence products, which are significant categories in Japan’s ageing society. Automotive and electronics manufacturers also employ pressure sensitive adhesives that require tackifiers for bonding lightweight components and achieving clean assembly results.

Japanese chemical producers invest in hydrogenated and specialty tackifiers that offer improved heat stability and compatibility with modern polymer systems. Interest in bio based formulations supports early adoption in companies focused on green goals. Constraints include volatility in terpene and petroleum derived feedstocks, which affects pricing and procurement decisions. Some small converters postpone formulation upgrades until performance validation and cost alignment are achieved.

Demand for tackifiers in Japan is supported by adhesive consumption in packaging, automotive assembly, electronics, and hygiene product manufacturing. Buyers prioritize bond stability, compatibility with polymer systems, and thermal resistance suited to local climate and logistics environments. Domestic manufacturers emphasize reduced odor, controlled viscosity, and consistency in coating performance to support automated converting lines. Sustainability expectations encourage interest in bio-derived alternatives, though pricing and supply security continue to favor established synthetic options.

Hydrocarbon resins represent 52.0%, reflecting strong alignment with hot-melt adhesive systems used in packaging, labels, and hygiene goods. Their predictable tack performance and cost efficiency support continuous adoption in Japan’s high-volume converting operations. Rosin resins account for 31.0%, supported by partial renewability and performance on polar substrates in paper and hygiene applications. Terpene resins hold 17.0%, used in specialty consumer and automotive components requiring enhanced adhesion and controlled odor characteristics. Product selection remains tied to compatibility with local polymer formulations and high mechanical-precision requirements across industrial lines.

Key points:

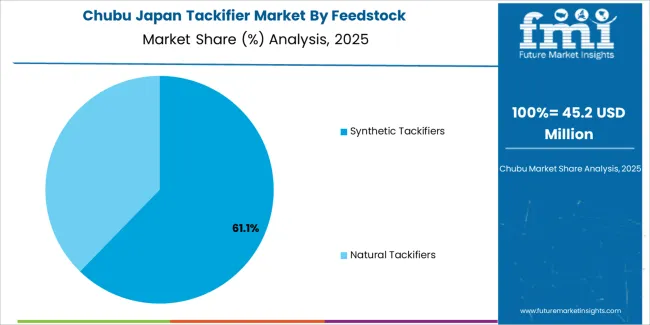

Synthetic tackifiers account for 63.0%, driven by supply stability, heat resistance, and cohesion control central to Japan’s packaging and automotive manufacturing sectors. These inputs support longer processing windows and durable end-use performance. Natural tackifiers represent 37.0%, expanding as brands respond to circular-materials initiatives and consumer expectations in personal-care packaging. Adoption depends on cost alignment, processing compatibility, and odor-management improvements for regulated applications. Feedstock selection reflects balancing durability with evolving ecofriendly standards across packaging and engineering adhesive systems.

Key points:

Growth of automotive adhesives, expansion of electronics assembly and rising demand for hygiene-product adhesives are driving demand.

In Japan, tackifiers support high-performance adhesive formulations used by automotive suppliers in Aichi, Hiroshima and Kyushu for interior trim, weatherstrips and bonding applications that require strong initial tack. Electronics assembly operations in Osaka and Nagano adopt specialty tackifiers for pressure-sensitive adhesives used in display panels, battery packs and flexible circuit mounting. Hygiene-product manufacturers rely on hot-melt adhesives for diaper and sanitary-product production, supporting consistent procurement of stable and skin-friendly tackifier systems. Packaging converters producing pressure-sensitive labels for food, cosmetics and pharmaceutical products maintain baseline consumption, driven by strong domestic retail distribution networks.

Raw-material import exposure, limited adoption in small converting facilities and sustainability pressure on solvent-based systems restrain demand.

Japan depends on imported pine-based resins and petroleum-derived feedstocks for many tackifier chemistries, making pricing sensitive to exchange rates and global supply fluctuations. Smaller adhesive converters may delay modernization of formulations if new tackifiers require equipment upgrades or increase procurement cost. Sustainability expectations in Japanese manufacturing encourage lower-VOC systems, placing pressure on high-solvent products and legacy formulations that need replacement. These factors contribute to measured adoption across industries with differing margins and technology readiness.

Shift toward low-odor and low-VOC grades, increased use in heat-resistant tapes and rising interest in recyclable-packaging compatibility define key trends.

Domestic producers are expanding low-odor, low-migration tackifiers that support adhesives used in hygiene and food-related packaging. High-performance adhesive tapes designed for automotive electronics, battery modules and structural applications require tackifiers with improved heat resistance and durability, reinforcing growth in specialized grades. Packaging suppliers focus on adhesives that bond effectively to paper-forward and monomaterial film structures to support recycling, increasing demand for tackifiers designed for fiber-based substrates. Collaboration between adhesive manufacturers and semiconductor supply chains is growing to align material specifications with advanced device assembly. These trends indicate continued diversification and steady modernization of tackifier demand across Japan.

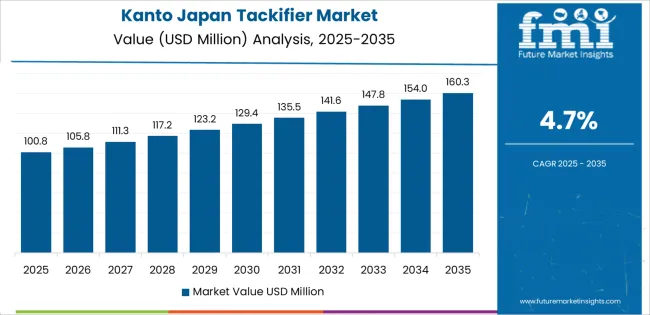

Demand for tackifiers in Japan is driven by adhesive requirements across packaging, hygiene products, woodworking, automotive assembly, and electronics bonding. Selection criteria focus on initial adhesion performance, substrate compatibility, and supply stability for hot-melt and pressure-sensitive adhesive formulations. Regional differences reflect industrial concentration, distribution exposure, and retail packaging use. Kyushu & Okinawa leads at 5.2% CAGR, followed by Kanto (4.7%), Kinki (4.2%), Chubu (3.7%), Tohoku (3.2%), and Rest of Japan (3.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

Kyushu & Okinawa posts 5.2% CAGR, supported by hygiene product manufacturing and distribution for household consumables. Adhesives containing tackifiers secure substrates in diapers and sanitary products used in humid climates where bonding must maintain performance under moisture exposure. Food packaging facilities rely on pressure-sensitive adhesives for label attachment and seal enhancement across retail channels. Port infrastructure supports reliable inbound resin logistics for compounders supplying regional filling plants. Logistics centers handling consumer goods use adhesive tapes with stable tack to maintain packaging integrity during short-haul distribution across island networks. Procurement decisions evaluate tack consistency, low-odor behavior, and thermal stability across warehouse conditions.

Kanto records 4.7% CAGR, guided by Tokyo-area converters supplying pressure-sensitive adhesives for consumer-goods packaging. Retail density drives demand for reliable label tack across high-touch environments. Pharmaceutical distributors require controlled bonding in tamper-evident sealing formats. Electronics assembly adopts modified adhesives utilizing tackifiers to stabilize small component attachment in consumer devices. Manufacturing sites demand formulation consistency for high-speed coating lines. Ecofriendly programs influence interest in terpene-based tackifiers compatible with recycling standards.

Kinki grows at 4.2% CAGR, supported by Osaka and Kyoto industrial operations producing adhesive products for domestic retail and automotive supply. Pressure-sensitive tapes for logistics and merchandise handling use tackifiers for grip stability on varied surfaces. Manufacturers serving personal-care product lines require smooth peel performance to preserve packaging aesthetics. Cost checks influence incremental formulation improvements rather than rapid changeovers. Buyers focus on tack strength that remains consistent through extended warehouse storage and consumer use.

Chubu shows 3.7% CAGR, linked to automotive supply and woodworking manufacturing across Aichi and Shizuoka. Interior components rely on adhesive bonding stability where vibration exposure requires durable tackifier-modified adhesives. Wood products and cabinetry apply hot-melt adhesives where dependable tack supports production throughput. Bulk procurement aligns with standardized compound specifications to maintain operational reliability.

Tohoku posts 3.2% CAGR, driven by agricultural packaging, household goods distribution, and printed-material protection. Long shipping routes require tackifiers delivering reliable adhesion across temperature differences. Regional converters produce tape and label solutions used for seasonal goods. Procurement teams assess durability for shelf presence in areas with narrower retail footprints.

Rest of Japan registers 3.1% CAGR, supported by modest packaging and consumer adhesive usage in distributed retail environments. Standard hot-melt formulations dominate demand where bond reliability outweighs rapid innovation. Buyers evaluate cost alignment with continuous product availability. Recycling considerations shape material interest in simplified adhesive systems.

Demand for tackifiers in Japan is supported by resin producers supplying hot-melt, pressure-sensitive, and rubber-based adhesive systems used in packaging, woodworking, hygiene products, and automotive interiors. ZEON Corporation holds about 31.0% share, driven by controlled synthetic-elastomer compatibility and consistent softening-point behaviour required in Japanese industrial bonding lines. Its materials provide predictable cohesion and stable tack under humidity variations common in local logistics environments. Arakawa Chemical Industries, Ltd. maintains strong participation through rosin-based and hydrogenated grades that offer colour stability and oxidation resistance, supporting high-speed tape and label conversion. Yasuhara Chemical Co., Ltd. contributes significant supply in terpene-based tackifiers produced from Japanese forestry by-products, delivering reliable adhesion performance across flexible-packaging and assembly applications.

Eastman Chemical Japan supports selective demand via hydrogenated hydrocarbon resins used where bond durability and clarity are required. Kolon Industries Japan provides stable resin availability through import-supported supply chains serving hygiene and construction adhesives. Competition in Japan focuses on resin purity, consistency of adhesion, formulation compatibility with domestic elastomers, and reliable regional distribution. Demand continues in packaging and automotive applications where stable bonding properties must be maintained through controlled processing and end-use performance across Japan’s regulated manufacturing environment.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product | Hydrocarbon Resins, Rosin Resins, Terpene Resins |

| Feedstock | Synthetic Tackifiers, Natural Tackifiers |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | ZEON Corporation, Arakawa Chemical Industries, Ltd., Yasuhara Chemical Co., Ltd., Eastman Chemical (Japan), Kolon Industries (Japan) |

| Additional Attributes | Usage in adhesives, sealants, and rubber compounding sectors; growth driven by automotive and electronics manufacturing; regulatory momentum toward bio-based resins; regional demand concentration in Kanto and Kinki industrial clusters; competitive supply based on feedstock availability and resin performance such as tack strength, durability, and compatibility with polymer matrices. |

The demand for tackifier in Japan is estimated to be valued at USD 220.1 million in 2025.

The market size for the tackifier in Japan is projected to reach USD 329.7 million by 2035.

The demand for tackifier in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in tackifier in Japan are hydrocarbon resins, rosin resins and terpene resins.

In terms of feedstock, synthetic tackifiers segment is expected to command 63.0% share in the tackifier in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Tackifier Market Analysis by Product, Feedstock, and Region 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA