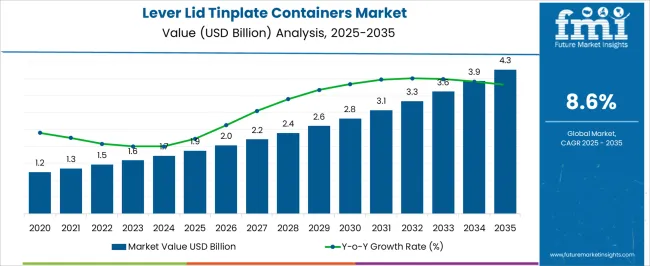

The Lever Lid Tinplate Containers Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Lever Lid Tinplate Containers Market Estimated Value in (2025E) | USD 1.9 billion |

| Lever Lid Tinplate Containers Market Forecast Value in (2035F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The lever lid tinplate containers market is witnessing consistent growth as industries prioritize secure and durable packaging solutions that ensure product stability, extended shelf life, and transport efficiency. Tinplate containers with lever lids are increasingly being adopted due to their ability to offer tamper-evident sealing, resistance to contamination, and compatibility with solvent-based contents.

The market outlook is supported by regulatory emphasis on recyclable and non-reactive packaging formats, particularly in sectors handling volatile chemicals, paints, and food-grade materials. Advancements in sealing mechanisms, digital printing on tinplate surfaces, and ergonomic design are influencing customer retention and expanding product appeal across regional markets.

Furthermore, the ease of resealing and potential for multiple reuses make these containers ideal for circular packaging initiatives As industries continue to migrate toward sustainable yet performance-driven solutions, lever lid tinplate containers are expected to maintain steady demand due to their functional superiority, environmental benefits, and wide end-use adaptability across both bulk and retail packaging landscapes.

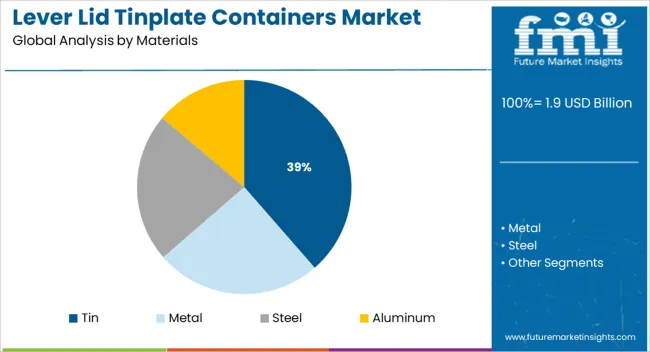

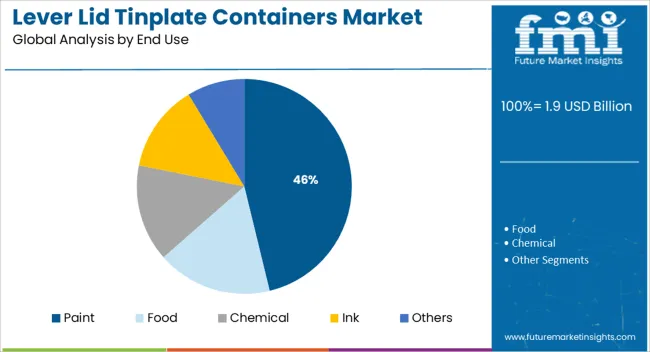

The market is segmented by Materials, Capacity (Ml), and End Use and region. By Materials, the market is divided into Tin, Metal, Steel, and Aluminum. In terms of Capacity (Ml), the market is classified into 750 - 2500, 125 - 250, 250 - 500, 500 - 750, 2500 - 5000, and 5000 - 15000. Based on End Use, the market is segmented into Paint, Food, Chemical, Ink, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tin material segment is projected to account for 38.6% of the total revenue share in the lever lid tinplate containers market in 2025. This dominance is attributed to the superior corrosion resistance, strength-to-weight ratio, and recyclability characteristics of tin, which have made it a preferred choice in long-term storage applications. Tin's compatibility with both oil-based and water-based contents has allowed manufacturers to deploy it across diverse product lines without compromising safety or quality.

The segment's growth has also been supported by regulatory compliance requirements that favor non-toxic and food-safe metal compositions. In addition, improvements in tin coating technologies and surface lacquering have enhanced container durability under harsh environmental conditions.

Tin materials offer optimal sealing with lever lid mechanisms, ensuring product integrity while allowing easy resealing for repeated use These attributes have reinforced its widespread acceptance, particularly in high-volume applications such as paints, coatings, and chemical packaging, where durability, compliance, and visual appeal remain essential.

.webp)

The 750 to 2500 ml capacity segment is expected to represent 31.9% of the total revenue share in the lever lid tinplate containers market by 2025. This capacity range has gained preference due to its suitability for medium-scale industrial and consumer packaging needs, particularly in applications requiring efficient storage without excessive bulk. The segment's growth is being driven by its adaptability in both retail and professional environments where a balance between quantity and portability is essential.

These container sizes are widely used for paints, adhesives, lubricants, and food concentrates, offering ease of handling while minimizing waste. Their compatibility with automated filling systems and shelf-stacking logistics further enhances operational efficiency for manufacturers.

Additionally, the growing demand for refillable and reuse-friendly packaging formats aligns with the practical dimensions of this capacity range The segment continues to benefit from consumer and distributor preferences for manageable volumes that do not compromise durability or product protection in transportation and storage.

The paint segment is forecast to contribute 46.2% of the overall revenue share in the lever lid tinplate containers market in 2025, marking it as the most significant end-use industry. This segment’s growth is being influenced by the stringent storage requirements of solvent-based and water-based paints, where air-tight, non-reactive packaging is crucial. Lever lid tinplate containers have become the standard in the paint industry due to their ability to prevent leakage, evaporation, and contamination, ensuring product consistency throughout the supply chain.

The compatibility of these containers with industrial mixing, tinting, and dispensing systems has further driven their widespread use in paint manufacturing and distribution networks. Their robust structure supports stacking and transportation under heavy loads, while the reusability factor contributes to cost-efficiency and sustainability goals.

In addition, aesthetic labeling and branding opportunities on tinplate surfaces enhance product visibility in retail spaces These performance advantages have positioned lever lid tinplate containers as the optimal packaging solution in both commercial and decorative paint applications.

The need for increasing the shelf life of the products has led to the innovations lever tinplate containers. Lever lid tinplate containers are ideal choices for packaging of goods which are to be used over a prolonged period. As the levered lid offers the perfect solution for packaging of a product which is to be frequently used over a long duration.

Being made of metal lever lid tinplate containers are 100% nonporous which allows zero penetration of water vapors and gasses hence improving the shelf life of the product. Tensile strength offered by such form of packaging is highly efficient in protecting the packed product from external shocks during the transit.

Printing area provided by such packaging is overwhelming which attracts many manufacturers as it is a sustainable form of packaging so it can be used by manufacturers to build brand image among the consumers.

Lever lid tinplate containers are a rigid form of packaging. Rigid packaging Container is extremely efficient in the handling of products and increasing the shelf life of the products due to their high barrier properties. Rigid packaging market is estimated to be around USD 589 Million and is anticipated to grow at a CAGR of over 3.4% over the forecast period.

On the backdrop of convenience offered on the use lever lid tinplate containers the demand for lever lid tinplate containers market is expected to grow over the forecast period. Another important factor responsible for boosting the demand in lever lid tinplate containers market is its high barrier properties which enable manufacturers to increase the shelf-life of the products.

Some other factors such as the ability to protect products from physical damages and high printability are expected to support the growth in lever lid tinplate containers market. However, due recent technological advancements packaging industry is shifting from rigid packaging to flexible packaging which may limit the scope for lever lid tinplate containers market.

Using lever lid tinplate may increase the packaging cost for manufacturers hence resisting the growth in lever lid tinplate containers market. However, being a sustainable and eco-friendly form of packaging lever lid tinplate containers market is expected to gain momentum in future.

Regionally global lever lid tinplate containers market is segmented into:

APEJ region is expected to be the most attractive region regarding value and growth rate in lever lid tinplate containers market as the region is densely populated.

North America and Western Europe are expected to follow APEJ region regarding value as both the region are driven by the consumer based economy. Eastern Europe and MEA are expected to grow moderately over the forecast period while Japan is expected to contribute significant value share in lever lid tinplate market.

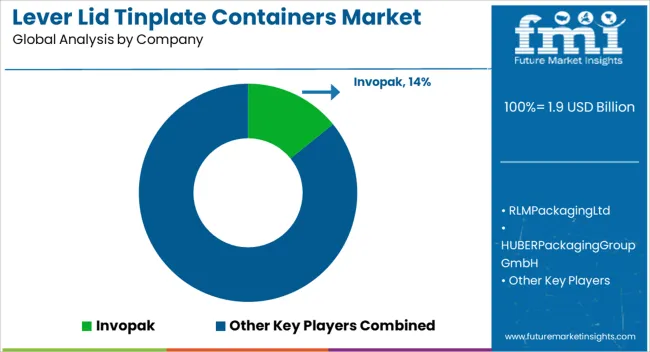

Some major players of the lever lid tinplate containers market are Invopak, R L M Packaging Ltd, HUBER Packaging Group GmbH, Taylor Davis Ltd, Central Tin Containers Ltd., Dongguan Suno Packing Co.,Ltd, CAPTEL INTERNATIONAL PVT LTD, Pirlo GmbH & Co. KG, Sota Packaging Pty Ltd, MANUPAK, Zhongshan Randa Metal Material Co., Ltd., quitmann o'neill and Tongxiang Fengming Can Manufacturing Plant

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, type of product and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The lever lid tinplate containers market is segmented by the types of materials used, by capacity and by end use.

The global lever lid tinplate containers market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the lever lid tinplate containers market is projected to reach USD 4.3 billion by 2035.

The lever lid tinplate containers market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in lever lid tinplate containers market are tin, metal, steel and aluminum.

In terms of capacity (ml), 750 – 2500 segment to command 31.9% share in the lever lid tinplate containers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lever Lid Cans Market Size and Share Forecast Outlook 2025 to 2035

Boat Control Lever Market Growth - Trends & Forecast 2025 to 2035

Bicycle Brake Lever Market Size and Share Forecast Outlook 2025 to 2035

Automotive Park Brake Lever Market Growth – Trends & Forecast 2024-2034

LiDAR Pulsed Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

LiDAR in Mapping Market Size and Share Forecast Outlook 2025 to 2035

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Lid Laminates Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Foil Market

Lid Applicator Machine Market

Slide Gate Valves Market Size and Share Forecast Outlook 2025 to 2035

Sliding Patio Glass Door Market Size and Share Forecast Outlook 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Slide Top Tins Market Size and Share Forecast Outlook 2025 to 2035

Sliding Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Sliding Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Slideway Oil Market Size and Share Forecast Outlook 2025 to 2035

Sliding Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Slider Pouches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA