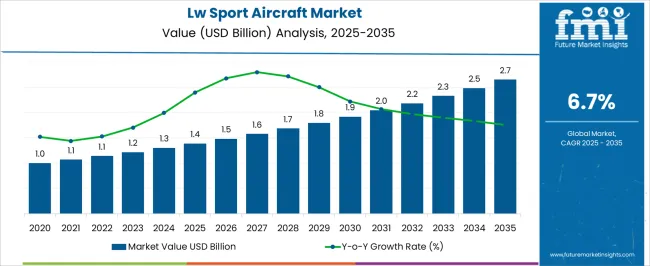

The LW sport aircraft market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

From 2021 to 2025, the market expands from USD 1.0 billion to USD 1.4 billion, with annual increments clustered around 5–7%. This early block reflects steady adoption among private owners, pilot training academies, and recreational flying communities. Growth remains moderate, underpinned by incremental fleet additions and stronger certification pipelines. Between 2026 and 2030, value climbs from USD 1.5 billion to USD 1.9 billion. The incremental rise of USD 0.5 billion over this block underscores widening acceptance of LSAs as cost-effective alternatives to traditional general aviation aircraft. Growth is linked to expanding training fleets, rising interest in sport aviation tourism, and more competitive financing options that lower entry barriers.

The final block from 2031 to 2035 contributes the highest absolute gain, rising from USD 2.0 billion to USD 2.7 billion. This USD 0.7 billion addition larger than the prior blocks—signals stronger late-cycle demand, supported by technological improvements such as composite materials, lightweight avionics, and hybrid-electric propulsion systems. The block-wise view highlights a balanced early phase and sharper value capture in the final five years, suggesting a growth curve that matures gradually before accelerating as LSAs move beyond niche recreational roles toward broader adoption in pilot training and regional mobility.

| Metric | Value |

|---|---|

| LW Sport Aircraft Market Estimated Value in (2025 E) | USD 1.4 billion |

| LW Sport Aircraft Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The lightweight sport aircraft (LW) segment holds a distinctive position across its parent markets, accounting for varied levels of share depending on end-use orientation and spending dynamics. Within the broader general aviation market, LW sport aircraft represent about 6 to 7%, reflecting their niche role compared to larger piston and turboprop aircraft. In the recreational aircraft market, their influence is more pronounced at nearly 35 to 38%, since these models are central to leisure flying and low-cost ownership. In the aircraft manufacturing market, they form a modest 2 to 3% slice, as the sector is dominated by commercial jets, defense planes, and business aviation. Within the pilot training and flight school market, LW sport aircraft contribute close to 18 to 20%, being widely chosen for primary training due to low operating costs and ease of handling.

The aviation leasing and rental market accounts for around 10 to 12%, driven by flying clubs, charter operators, and training centers that lease such aircraft to entry-level pilots. This distribution highlights a dual positioning: strong relevance in recreational and training ecosystems, while their share remains limited in larger aviation domains. Their affordability, certification frameworks, and accessibility continue to sustain their niche, ensuring a steady flow of adoption across enthusiast-driven and training-oriented aviation sectors.

The market is experiencing significant momentum as demand for affordable, versatile, and recreational flying solutions continues to rise. Advances in lightweight materials, aerodynamic design, and safety technologies are driving the adoption of modern sport aircraft across multiple regions. Regulatory support in the form of simplified pilot licensing and operational requirements is further enabling market penetration.

Growth is also being supported by the increasing popularity of leisure aviation and sport flying clubs, along with expanding interest from hobbyists seeking personal mobility in rural and semi-urban areas. Technological developments in propulsion systems, including improved fuel efficiency and lower emissions, are enhancing operational economics and reliability.

Moreover, the market is benefiting from a growing network of service providers and training institutions, which is making ownership and operation more accessible As innovation continues to reshape performance standards and cost structures, the LW Sport Aircraft market is expected to see sustained expansion across both developed and emerging economies.

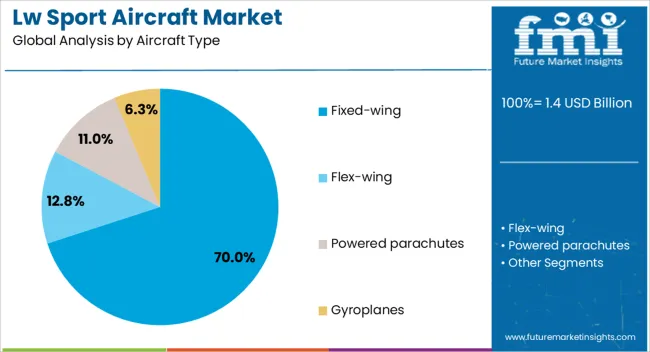

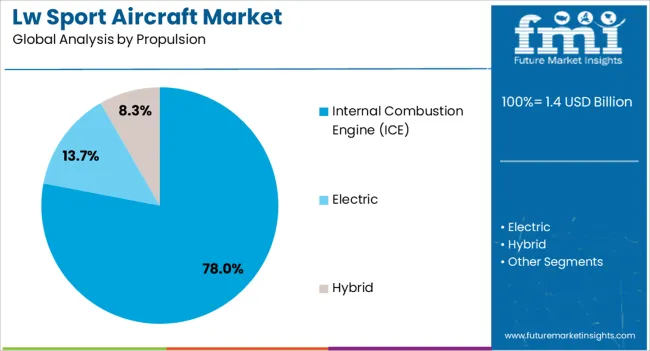

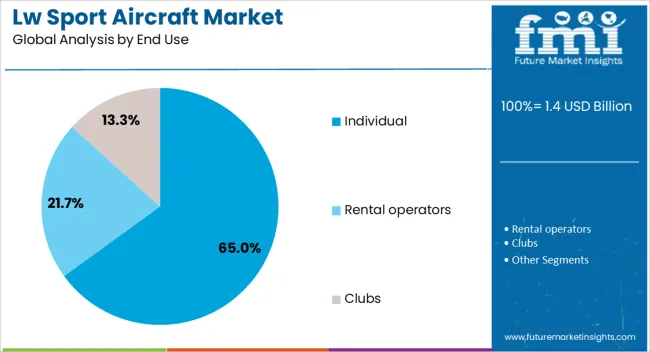

The LW sport aircraft market is segmented by aircraft type, propulsion, end use, and geographic regions. By aircraft type, LW sport aircraft market is divided into fixed-wing, flex-wing, powered parachutes, and gyroplanes. In terms of propulsion, LW sport aircraft market is classified into internal combustion engine (ICE), electric, and hybrid. Based on end use, LW sport aircraft market is segmented into individual, rental operators, and clubs. Regionally, the LW sport aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed-wing segment is projected to hold 70% of the LW sport aircraft market revenue share in 2025, establishing it as the leading aircraft type. Its dominance has been driven by superior aerodynamic efficiency, higher cruising speeds, and better fuel economy compared to other aircraft configurations. The fixed-wing design allows for longer flight ranges and enhanced stability, making it suitable for both recreational and training purposes. This segment has also benefited from well-established manufacturing processes and a wide availability of parts, ensuring ease of maintenance and reduced operational downtime. The adaptability of fixed-wing aircraft to various mission profiles, from leisure flights to pilot training, has strengthened its market appeal. Furthermore, the segment has leveraged advancements in lightweight composites and avionics integration, which have improved performance and safety As demand for reliable and cost-efficient sport aircraft continues to increase, fixed-wing models are expected to maintain their leadership in the market.

The internal combustion engine segment is expected to command 78% of the market revenue share in 2025, making it the dominant propulsion choice. This leadership is attributed to the mature technology base, proven reliability, and broad availability of ICE-powered systems. These engines offer a favorable balance between performance, operational cost, and ease of maintenance, which is particularly valued by private owners and training operators. The established infrastructure for fuel supply and servicing has also contributed to the segment’s resilience, especially in regions where alternative propulsion infrastructure remains limited. Continuous enhancements in ICE efficiency, emission control, and durability have further extended its market relevance. Additionally, the familiarity of pilots and maintenance crews with ICE technology has reduced adoption barriers and ensured operational consistency While electric propulsion is gaining attention, the internal combustion engine segment continues to be the preferred choice for most LW Sport Aircraft applications due to its performance reliability and cost advantages.

The individual segment is projected to hold 65% of the LW Sport Aircraft market revenue share in 2025, making it the largest end-use category. This dominance has been driven by growing interest in personal aviation for leisure, travel, and skill development. Affluent hobbyists and aviation enthusiasts are increasingly investing in sport aircraft as a lifestyle choice, supported by simplified licensing and operational regulations in several countries.

The segment has also been strengthened by expanding access to financing options and aircraft sharing programs, which have made ownership more attainable. Technological advancements in aircraft design, coupled with enhanced safety features, have encouraged first-time buyers to enter the market.

Furthermore, the ability to customize and upgrade aircraft through aftermarket modifications has appealed to individual owners seeking personalized performance and aesthetics As recreational flying gains cultural and social value, the individual end-use segment is anticipated to maintain its strong market position over the coming years.

Light sport aircraft are benefiting from rising interest in recreational flying and primary training, while regulatory updates expand the category and strengthen sport pilot privileges in the United States. Europe and the United Kingdom provide adjacent pathways that keep regional demand active. Complexity remains around consensus standards, conformity, and cross border rule differences, which raises costs and lengthens timelines for smaller producers. The opportunity lies in programs that fit the widened performance envelope and deliver training friendly economics. Providers that couple certification fluency with reliable support and clear documentation are positioned to win fleet and club decisions.

Light sport aviation is being buoyed by renewed interest in affordable personal flying, club rentals, and primary training. Demand is being shaped by licensing pathways that lower entry barriers relative to traditional private pilot routes, which supports growth in flight schools and aero clubs. Regulatory momentum is significant. In the United States, the MOSAIC final rule expands the light sport category and broadens sport pilot privileges, opening the door to a wider set of aircraft configurations and mission profiles. Europe maintains a defined envelope for light sport aeroplanes, while the United Kingdom regulates comparable microlight classes under national provisions. Together, these frameworks enlarge the pool of eligible aircraft and give manufacturers clearer targets for design and certification plans. As recreational flying and ab initio training gain attention, light sport platforms are positioned as practical gateways into general aviation for new and returning pilots.

Certification and continued airworthiness for special light sport aircraft rely on consensus standards, compliance audits, and quality system discipline, which adds documentation workload for smaller producers. Differences between national frameworks force rework on flight manuals, equipment lists, and operating limitations, complicating cross border sales and training fleet harmonization. Variance in maintenance privileges and pilot operating limits further affects resale planning for owners and schools. Suppliers also face sequencing challenges when avionics, engines, or propellers require separate standard acceptance or equivalency justifications. These requirements extend program timelines and raise working capital needs, especially for first time entrants. While the standards pathway reduces classic type certification burdens, the burden is not trivial, and missteps invite costly corrective actions. The result is a market where certification literacy, production conformity, and documentation rigor are treated as competitive differentiators rather than back office chores.

The MOSAIC final rule enables light sport category aircraft to encompass expanded performance, aircraft features such as new propulsion types and landing gear options, and a broader set of operations for sport pilots, subject to training and equipment conditions. That shift encourages OEM pipelines for modern trainers, adventure touring models, and utility oriented variants that previously sat outside the category. Flight schools are evaluating replacement of aging basic trainers with lighter platforms that offer contemporary cockpits, simplified maintenance, and lower hourly economics. Leasing firms and clubs can frame mixed fleets that step students from primary lessons into cross country experience without leaving the category. Partnerships between OEMs and avionics or powertrain suppliers are expected to concentrate on airframes that map cleanly to the updated performance based boundaries.

EASA maintains a specific technical definition for light sport aeroplanes, while the United Kingdom has drawn comparable microlight classes under national oversight, creating an adjacent route for factory built designs. In the United States, the FAA continues to recognize ASTM F37 consensus standards and updates acceptance notices as revisions are published, keeping the standards ecosystem active. Market behavior follows these signposts. Flight clubs and schools choose airframes that best navigate local training privileges, maintenance allowances, and insurance terms. Manufacturers prioritize variants whose equipment, stall margins, and weight ranges can be configured for multiple rule sets with minimal redesign. Documentation packages and conformity audits are being treated as sales enablers, since they shorten buyer approvals for fleet use and export.

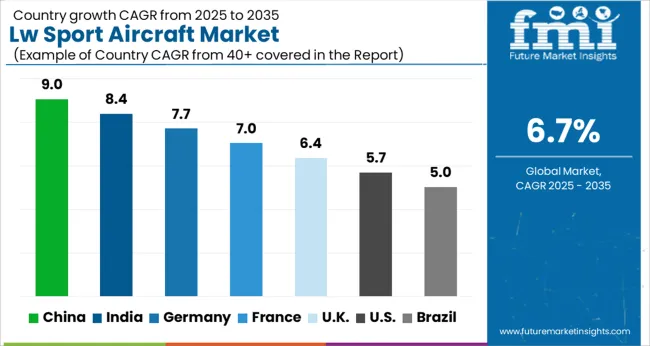

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

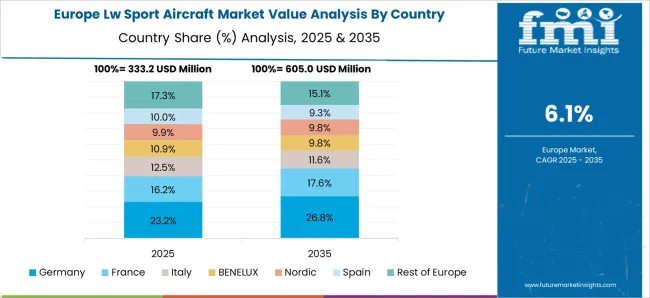

The light sport aircraft market is forecast to grow at a global CAGR of 6.7% between 2025 and 2035. China leads at 9.0%, followed by India at 8.4% and France at 7.0%, while the UK records 6.4% and the USA trails at 5.7%. China and India secure strong growth premiums of +2.3% and +1.7% above the baseline, supported by pilot training demand, air tourism, and recreational flying. France continues as Europe’s hub with aero clubs and aviation traditions fueling growth. The UK and USA show steady expansion, supported by recreational flying communities, flight schools, and aviation infrastructure. The analysis spans over 40+ countries, with the leading markets shown below.

The LW Sport Aircraft Market in China is projected to grow at a CAGR of 9.0% from 2025 to 2035, leading global growth. Recreational aviation, policy reforms, and the proliferation of private aviation clubs are propelling demand. Regional governments are investing heavily in general aviation airports and pilot training facilities, boosting infrastructure. Domestic manufacturers are focusing on lightweight, fuel-efficient models, while international companies are expanding through joint ventures to tap into rising demand. Training academies are a central demand driver, as LW sport aircraft offer affordable options for pilot instruction. Leisure flying, sport aviation, and air tourism are also gaining traction across scenic and coastal regions.

The LW Sport Aircraft Market in India is expected to advance at a CAGR of 8.4% between 2025 and 2035. Growth is driven by an expanding network of flight schools, recreational aviation clubs, and the rising popularity of private ownership. India’s aviation sector is experiencing increased interest in affordable pilot training solutions, where LW sport aircraft are ideally suited. Policies encouraging the establishment of new flying schools are boosting demand, while leisure flying and adventure tourism are also contributing to broader adoption. Imports play a critical role in meeting market requirements, but local assembly initiatives are gradually developing to reduce dependency and costs. Export potential is emerging, with Indian firms aiming to supply regional markets in Asia.

The LW Sport Aircraft Market in France is forecast to expand at a CAGR of 7.0% from 2025 to 2035. France’s aviation culture, supported by aero clubs and recreational aviation enthusiasts, continues to sustain demand. Light sport aircraft are extensively deployed for pilot training, leisure flying, and sports aviation events. Domestic manufacturers are innovating with composite materials and fuel-efficient aircraft designs to meet evolving needs. France’s aviation shows and exhibitions play a vital role in stimulating consumer interest, while the tourism sector is leveraging LW sport aircraft for aerial tours. The EU’s clear regulatory framework ensures streamlined certification and training standards, boosting investor confidence.

The LW Sport Aircraft Market in the United Kingdom is projected to grow at a CAGR of 6.4% between 2025 and 2035. Flight schools, aviation enthusiasts, and recreational clubs dominate market demand, with LW sport aircraft valued for cost-effective pilot instruction. Training institutions across urban and rural regions are adopting these aircraft due to affordability and operational efficiency. Private owners and recreational flyers continue to support steady adoption, particularly in scenic and countryside locations. Manufacturers are focusing on advanced avionics and lightweight models to meet evolving user preferences. The tourism industry is contributing as well, offering aerial leisure tours using LW sport aircraft. Imports remain the primary source of supply, although domestic assembly is gaining traction.

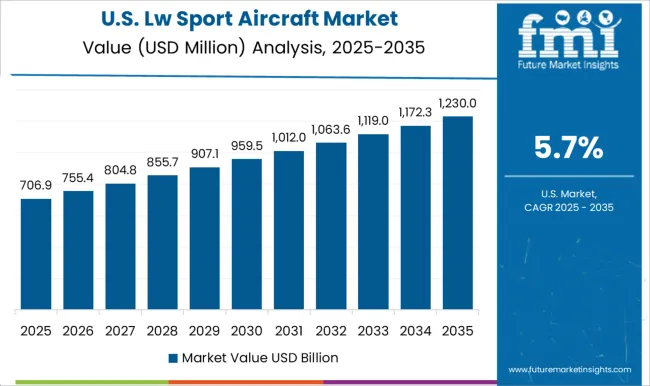

The LW Sport Aircraft Market in the United States is forecast to expand at a CAGR of 5.7%, making it the slowest-growing among profiled regions but still a high-value market. Recreational aviation clubs, training academies, and private pilots form the backbone of adoption. The FAA’s Light Sport Aircraft category offers a structured regulatory framework, encouraging consistent demand for pilot training and personal aviation. USA manufacturers are emphasizing advanced composite materials, digital cockpits, and lightweight structures to enhance efficiency. Recreational flying and coastal tourism continue to provide opportunities for adoption. Imports from Europe and Asia complement the domestic supply base, with USA firms focusing on premium, high-performance models.

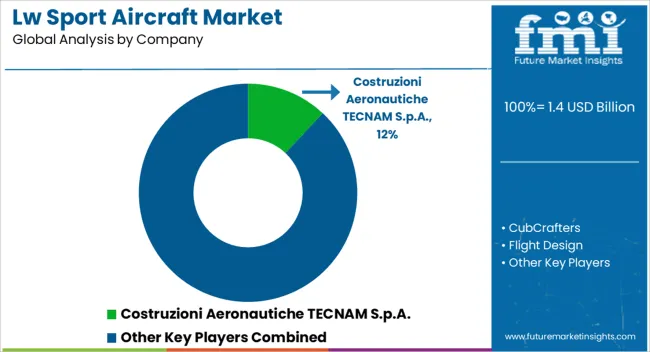

Competition in LW Sport Aircraft has been defined by STOL capability, amphibious versatility, composite efficiency, and training fleet readiness. Costruzioni Aeronautiche TECNAM is positioned with a wide LSA family and a global dealer footprint, giving the brand breadth across training and recreation. Pipistrel, now under Textron, is leveraged for efficient composite airframes and low fuel burn, with emphasis placed on fleet packages for schools. Flight Design competes through refined composites and ergonomics aimed at cross-country comfort. CubCrafters and American Legend Aircraft are anchored in taildragger and bush configurations where short field performance and useful load are decisive. ICON Aircraft occupies the amphibious niche, where water operations, corrosion protection, and ease of dock handling are valued. Zenith Aircraft Co. is concentrated in kit and quick-build paths, where configurability and community support carry weight. Strategy has centered on flight school partnerships, distributor depth, and option bundling. Fleet sales are targeted with training syllabi, maintenance programs, and parts availability pledges.

Operating cost is managed through Rotax centric propulsion, simplified inspection tasks, and standardization of avionics suites. Aftermarket revenue is pursued via retrofit avionics, propeller upgrades, and seasonal landing gear options. Residual value is protected by documentation discipline and broad service coverage. Brand visibility is pushed through demo tours, owner fly-ins, and financing offers. It works. Product brochure content is direct. High wing and low wing variants are listed with aluminum or composite structures, fixed tricycle or taildragger gear, and float or amphib packages. Rotax 912 or 915 series engines are commonly specified, paired with constant speed or ground adjustable propellers. Glass cockpits are shown with integrated PFD, MFD, ADS-B, two axis autopilot, and terrain awareness. Safety options include airframe parachute, energy absorbing seats, and four point restraints. Cabin notes highlight wide doors, baggage bays, ventilation, and adjustable seating. Typical claims emphasize short takeoff distance, low stall, efficient cruise, and low per hour fuel burn. Choices are clear.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Aircraft Type | Fixed-wing, Flex-wing, Powered parachutes, and Gyroplanes |

| Propulsion | Internal Combustion Engine (ICE), Electric, and Hybrid |

| End Use | Individual, Rental operators, and Clubs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Costruzioni Aeronautiche TECNAM S.p.A., CubCrafters, Flight Design, ICON Aircraft, Pipistrel, Zenith Aircraft Co., and American Legend Aircraft |

| Additional Attributes | Dollar sales by product type include ready to fly certified LSAs, experimental and kit built models, and amphibious categories, with segmentation by use cases such as pilot training, recreational sport, touring, and aerial utility. Dollar sales by propulsion system include conventional piston, hybrid trials, and electric demonstrators. Demand dynamics are supported by pilot training enrollments, recreational flying adoption, affordability relative to general aviation, and regulatory acceptance under LSA categories. Regional trends show strong demand in North America and Europe, with steady certification activity, while Asia Pacific is emerging with aero club expansions and government backed pilot training programs. |

The global LW sport aircraft market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the LW sport aircraft market is projected to reach USD 2.7 billion by 2035.

The LW sport aircraft market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in LW sport aircraft market are fixed-wing, land based, amphibious, flex-wing, powered parachutes and gyroplanes.

In terms of propulsion, internal combustion engine (ice) segment to command 78.0% share in the LW sport aircraft market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilwell Completion Tools Market Analysis - Size, Share & Forecast 2025 to 2035

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA