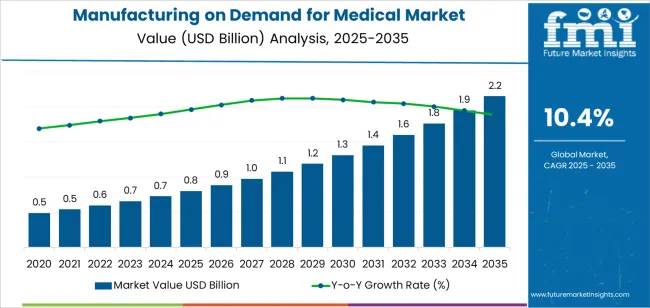

The global manufacturing on demand for medical market is projected to reach USD 2.3 billion by 2035, reflecting an absolute increase of USD 1.5 billion over the forecast period. The manufacturing on demand for medical market is valued at USD 0.8 billion in 2025 and is expected to grow at a robust CAGR of 10.4%. This growth is primarily driven by increasing demand for customized medical products, such as implants, prosthetics, and surgical instruments, as well as the trend toward personalized medicine. On-demand manufacturing enables medical companies to efficiently produce small batches of high-quality, patient-specific products, addressing the growing need for personalized healthcare solutions.

Manufacturing on demand for medical products is largely enabled by technologies like 3D printing, additive manufacturing, and digital platforms that enable rapid prototyping and low-volume production. This flexibility is particularly valuable in the medical field, where precise, customized devices are needed for individual patients. For example, in orthopedics, customized implants and prosthetics can be produced to match the unique anatomy of a patient, improving surgical outcomes and recovery times. The ability to quickly prototype and manufacture specific devices enables medical companies to respond more rapidly to emerging healthcare needs, especially in niche markets.

The increasing focus on patient-centric care and the move toward personalized healthcare are further propelling the adoption of on-demand manufacturing in the medical industry. The shift toward more efficient production methods, combined with regulatory advancements in the approval of 3D-printed medical devices, is enhancing the growth potential of this market. As medical companies continue to embrace on-demand manufacturing solutions, the ability to produce high-quality, specialized products without the need for large-scale production facilities will become increasingly valuable.

Between 2025 and 2030, the market is projected to grow from USD 0.8 billion to approximately USD 1.3 billion, adding USD 0.5 billion, which accounts for about 33.3% of the total forecasted growth for the decade. This growth will be driven by the increasing adoption of additive manufacturing technologies and the rising demand for personalized medical products. The ongoing push for more efficient production methods and faster response times in the medical sector will also contribute to the market's expansion.

From 2030 to 2035, the market is expected to expand from approximately USD 1.3 billion to USD 2.3 billion, adding USD 1.0 billion, which constitutes about 66.7% of the overall growth. This phase will be characterized by greater regulatory acceptance, advancements in medical technologies, and the expansion of personalized healthcare applications, driving further demand for on-demand manufacturing solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.8 billion |

| Market Forecast Value (2035) | USD 2.3 billion |

| Forecast CAGR (2025-2035) | 10.4% |

The manufacturing on demand for the medical market is growing due to the increasing need for personalized, flexible, and efficient production of medical devices, components, and supplies. On-demand manufacturing allows for the rapid, scalable production of medical products as needed, reducing waste and ensuring the timely availability of medical devices tailored to specific patient requirements. This model is particularly important in the medical industry, where customized and high-quality products are crucial for successful outcomes.

The rise of personalized medicine, as well as advances in 3D printing and digital technologies, is driving the demand for on-demand manufacturing in the healthcare sector. These technologies enable the creation of patient-specific implants, prosthetics, and surgical instruments, which are not easily achievable with traditional mass production methods. On-demand manufacturing offers a more flexible solution for producing complex medical devices quickly and cost-effectively.

The COVID-19 pandemic has underscored the importance of responsive manufacturing systems that can quickly adapt to urgent needs, such as the production of personal protective equipment (PPE) and medical devices. The growing focus on reducing production lead times and costs while meeting regulatory requirements is also fueling the adoption of on-demand manufacturing models. Although there are challenges, such as regulatory compliance and the initial investment in technology, the market is set to grow rapidly as healthcare systems look for more efficient and flexible manufacturing solutions.

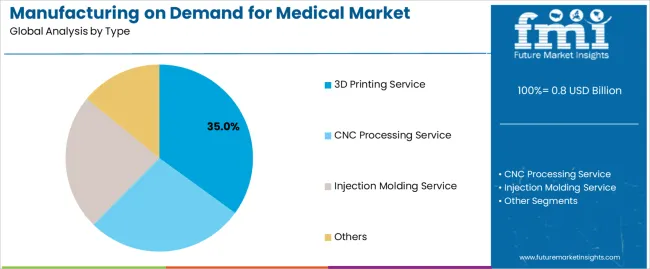

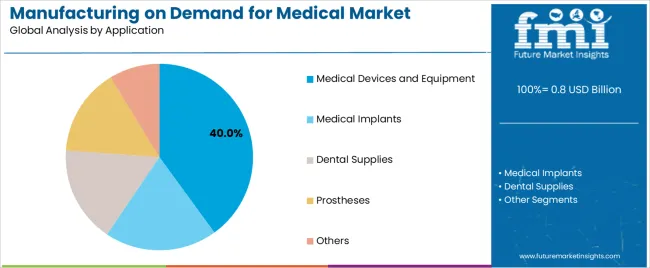

The market is segmented by type, application, and region. By type, the market is divided into 3D printing service, CNC processing service, injection molding service, and others, with 3D printing service leading the market. Based on application, the market is categorized into medical devices and equipment, medical implants, dental supplies, prostheses, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The 3D printing service segment leads the manufacturing on demand for medical market, accounting for 35.0% of the total market share. This growth is driven by the increasing demand for customized, complex, and high-precision medical products. 3D printing offers unique advantages in producing intricate components for medical devices, implants, and prostheses that traditional manufacturing methods cannot achieve as effectively. The ability to produce customized parts tailored to a patient’s specific needs has made 3D printing particularly valuable in the medical field, where personalization and precision are essential.

3D printing enables faster prototyping and lower production costs, reducing the time from design to implementation. It is increasingly used for producing medical models, surgical guides, and implants, all of which require high levels of accuracy. As the healthcare industry continues to prioritize individualized patient care and faster turnaround times for medical products, the 3D printing service segment is expected to maintain its leadership in the market.

The medical devices and equipment application dominates the manufacturing on demand for medical market, holding 40.0% of the total market share. This growth is fueled by the increasing demand for innovative and customized medical devices and equipment that meet specific patient needs and regulatory requirements. The manufacturing on demand model enables the production of complex medical devices with enhanced precision, shorter lead times, and reduced costs, making it ideal for the fast-evolving healthcare sector.

As healthcare systems worldwide continue to innovate and upgrade their equipment, the demand for on-demand manufacturing solutions, such as 3D printing and CNC processing, is growing. The ability to quickly produce prototypes and customized devices in small batches is driving manufacturers to adopt on-demand manufacturing services to keep up with advancements in medical technology. The rise of minimally invasive procedures and patient-specific medical solutions is further contributing to the demand for manufacturing on demand in the medical devices and equipment sector. This trend is expected to continue as the healthcare industry increasingly embraces digital and additive manufacturing technologies.

The market for manufacturing on demand in the medical sector is expanding due to the need for rapid production of customized medical devices, reducing lead times and minimizing waste. Key drivers include the rise of personalized medicine, 3D printing technologies, and the demand for flexible batch sizes in response to patient-specific needs. As supply chain resilience becomes a focus in healthcare, on-demand manufacturing offers improved responsiveness and cost-effectiveness. Challenges such as regulatory compliance, production scalability, and high initial setup costs remain.

How are Technological Advancements Driving Growth in Manufacturing on Demand for the Medical Market?

Advancements in 3D printing and additive manufacturing are driving growth in on-demand production by enabling the rapid prototyping of medical devices. These technologies allow for customization at scale, reducing material waste and improving precision. Manufacturers are increasingly adopting digital manufacturing platforms that allow for on-demand production tailored to the exact specifications of medical devices. Additionally, advancements in materials science are enabling the production of biocompatible and FDA-approved parts, further fueling demand for on-demand manufacturing in the medical industry. As these technologies evolve, they continue to enhance speed, efficiency, and cost-effectiveness, supporting the growth of the sector.

Why is On-Demand Manufacturing Gaining Popularity in the Medical Market?

On-demand manufacturing is gaining popularity in the medical market because it offers significant benefits, including the customization of medical devices tailored to individual patient needs and rapid prototyping. This is especially important in the growing field of personalized medicine and complex surgeries, where devices often need to be adjusted to unique specifications. Additionally, supply chain challenges and the desire for leaner inventories in the healthcare sector are driving the demand for on-demand manufacturing solutions. These methods improve flexibility, reduce waste, and provide cost-effective solutions, leading to greater adoption across medical device manufacturers, hospitals, and healthcare providers.

What are the Key Challenges Limiting the Adoption of Manufacturing on Demand in the Medical Market?

Despite its advantages, the adoption of on-demand manufacturing in the medical sector faces challenges. Regulatory approval for medical devices, particularly those that involve 3D printing or additive manufacturing, remains complex and time-consuming, raising costs and delaying production. Additionally, while on-demand manufacturing reduces inventory costs, it requires advanced equipment and high setup costs, which can be prohibitive for smaller companies. The lack of standardization in materials and designs further complicates the process, particularly in a regulated industry like healthcare. Additionally, scaling production for large batches or highly specialized devices can be difficult, limiting the widespread adoption of these technologies.

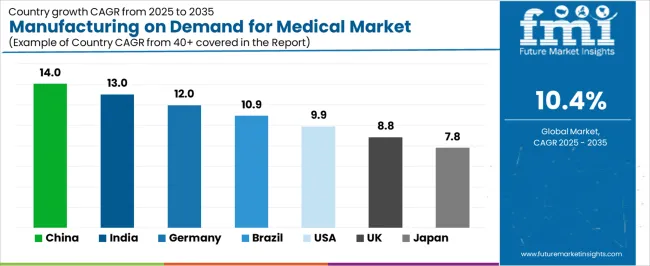

| Country | CAGR (%) |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| Brazil | 10.9% |

| USA | 9.9% |

| UK | 8.8% |

| Japan | 7.8% |

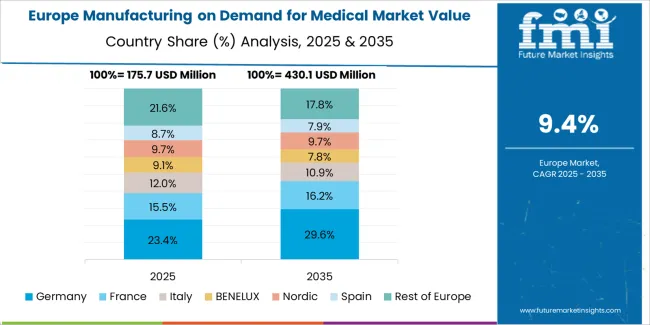

The manufacturing on demand for the medical market is experiencing strong global growth, with China leading at a 14.0% CAGR, driven by advancements in 3D printing, personalized products, and expanding healthcare infrastructure. India follows at 13.0%, supported by rising healthcare investments and growing medical device manufacturing. Germany, at 12.0%, benefits from its precision manufacturing capabilities, while Brazil shows 10.9% growth due to increased demand for healthcare services and product customization. The USA (9.9%), UK (8.8%), and Japan (7.8%) are also growing, driven by technological adoption, healthcare demand, and the shift to personalized medical devices.

China is leading the manufacturing on demand for the medical market with a 14.0% CAGR, propelled by its rapidly advancing healthcare sector, strong domestic manufacturing base, and increasing investments in digital fabrication technologies. The growing demand for personalized medical products, such as prosthetics, implants, and customized medical devices, is a key driver for on-demand manufacturing in China. The country’s significant strides in 3D printing, coupled with government support for technological innovation, are also contributing to this expansion.

China’s massive healthcare system, including its large hospital networks and medical device manufacturers, is increasingly turning to on-demand production to meet the demands of both domestic and international markets. Personalized healthcare products are becoming more accessible to the population due to reduced manufacturing times and costs. The increasing number of surgeries, rising demand for personalized care, and the push for affordable medical devices are all factors contributing to China’s dominance in this sector. As the country’s technological capabilities continue to evolve, it is well-positioned to remain a leader in the manufacturing on demand space for the medical market.

India is witnessing impressive growth in the manufacturing on demand for the medical market, with a 13.0% CAGR. Key drivers include increasing healthcare investments, a growing medical device industry, and rising consumer demand for personalized medical products. India’s expanding healthcare infrastructure, particularly in tier-2 and tier-3 cities, is creating opportunities for on-demand production of medical devices, implants, prosthetics, and diagnostic tools.

The Indian government’s initiatives to boost domestic manufacturing, such as the “Make in India” program, have encouraged the adoption of advanced manufacturing techniques, including 3D printing and digital prototyping, for medical applications. Additionally, rising healthcare costs, coupled with an increasing emphasis on personalized medicine, are driving the shift towards on-demand manufacturing models. India’s large population and its focus on affordable healthcare solutions further contribute to the market’s growth. With continuous improvements in technology and manufacturing processes, India’s manufacturing on demand for the medical market is expected to continue expanding as demand for personalized and cost-effective medical products rises.

Germany is contributing significantly to the manufacturing on demand for the medical market, with a 12.0% CAGR, driven by its reputation for high-quality, precision manufacturing in the medical device industry. The country’s advanced technology infrastructure, including state-of-the-art manufacturing facilities and adoption of digital manufacturing processes, has positioned it as a leader in on-demand medical product production. As the demand for customized medical devices, implants, and prosthetics grows, Germany’s ability to rapidly produce tailored solutions has become a key competitive advantage.

The use of 3D printing and additive manufacturing technologies in Germany’s medical sector allows for fast production cycles and a high degree of customization. With a strong emphasis on research and development, Germany’s medical manufacturers are continuously innovating to provide better solutions to the healthcare sector. The country’s well-established regulatory frameworks and strict quality standards also support the widespread adoption of on-demand manufacturing techniques, ensuring that the produced devices meet high safety and quality standards. As demand for personalized and efficient healthcare products increases, Germany’s role in the manufacturing on demand space will continue to expand.

Brazil is experiencing steady growth in the manufacturing on demand for the medical market with a 10.9% CAGR, driven by an expanding healthcare sector, increasing investments in medical technology, and the rising demand for personalized medical products. The country’s healthcare infrastructure is modernizing, and the need for customized medical devices, such as prosthetics and implants, is growing. As Brazil embraces digital manufacturing technologies like 3D printing, the demand for on-demand production of medical devices continues to rise.

Brazil’s healthcare system is undergoing significant improvements, including increased access to medical services in both urban and rural areas. As more people require specialized medical devices, the demand for personalized products that meet individual patient needs is growing. The government’s efforts to expand the healthcare sector, along with a rising middle class and an increase in healthcare insurance coverage, contribute to this trend. With increasing interest in affordable and customized healthcare products, Brazil is well-positioned to continue its growth in the on-demand manufacturing space for the medical market.

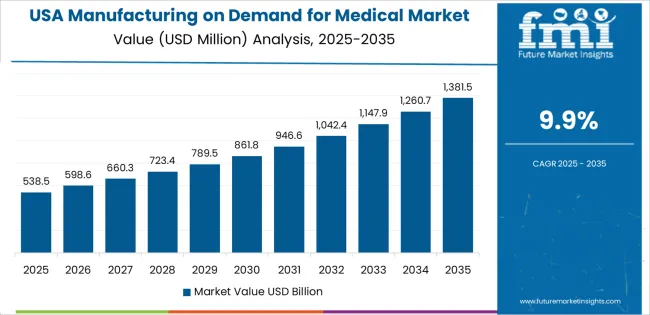

The USA is experiencing solid growth in the manufacturing on demand for the medical market with a 9.9% CAGR. The country’s healthcare sector is known for its innovation, with high demand for personalized medical products driving the need for on-demand manufacturing solutions. The adoption of advanced manufacturing technologies, such as 3D printing and rapid prototyping, enables U.S. medical device manufacturers to produce customized products quickly and cost-effectively.

The USA’s large and diverse healthcare market, coupled with the increasing prevalence of chronic diseases, is pushing the demand for personalized medical devices, including implants, prosthetics, and surgical instruments. The rise in minimally invasive surgeries, which often require customized tools and implants, further boosts the demand for on-demand manufacturing. Additionally, U.S. manufacturers are focusing on reducing production costs and lead times to better serve both domestic and global markets. With continued advancements in technology and increasing healthcare needs, the U.S. market for on-demand manufacturing in the medical sector will continue to expand.

The UK is experiencing steady growth in the manufacturing on demand for the medical market with an 8.8% CAGR, driven by the rising demand for personalized medical products and the country’s strong healthcare system. The UK’s healthcare infrastructure, including both the National Health Service (NHS) and the private sector, is increasingly adopting on-demand manufacturing methods to meet the demand for customized medical devices such as surgical tools, implants, and prosthetics.

The focus on precision medicine and patient-specific treatment plans is contributing to the rise in demand for personalized devices. Advances in 3D printing and additive manufacturing are making it possible to produce medical devices faster and with greater customization, meeting the needs of patients more effectively. Government policies aimed at improving healthcare access and reducing production costs are also playing a role in encouraging the adoption of these manufacturing techniques. As the UK continues to invest in healthcare technology and personalization, the demand for manufacturing on demand in the medical market will continue to grow.

Japan is experiencing steady adoption of manufacturing on demand for the medical market with a 7.8% CAGR. Known for its technological advancements and high-quality healthcare system, Japan is increasingly incorporating on-demand manufacturing techniques into the medical sector. With a rapidly aging population and a high demand for personalized medical devices, Japan is turning to technologies like 3D printing and digital manufacturing to produce customized products efficiently and affordably.

The country’s focus on precision and innovation in medical device production, coupled with its desire to meet the specific needs of patients, is accelerating the use of on-demand manufacturing solutions. Japan’s strong regulatory environment ensures that products meet the highest quality standards, contributing to the growing adoption of these advanced manufacturing methods. As Japan continues to deal with a rising incidence of chronic and age-related health conditions, the demand for personalized medical products and efficient production methods will continue to rise, ensuring steady growth in the sector.

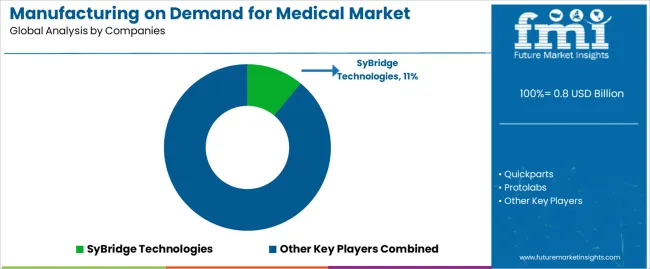

The manufacturing on demand for the medical market is a rapidly growing segment, offering customized production solutions for medical devices, components, and prototypes. SyBridge Technologies leads the market with an 11% share, known for its expertise in providing on-demand manufacturing services for the medical industry. SyBridge focuses on offering advanced engineering solutions, precision manufacturing, and regulatory compliance, making it a preferred partner for companies in the medical device sector.

Other key players include Quickparts, Protolabs, and Xometry, which provide high-quality, rapid prototyping and on-demand manufacturing services. Protolabs is recognized for its ability to quickly deliver functional prototypes and low-volume production runs with a focus on precision and efficiency. Xometry offers a comprehensive suite of manufacturing services, including CNC machining, injection molding, and 3D printing, serving a wide range of industries, including medical. Quickparts provides fast, cost-effective solutions for medical device prototyping, with an emphasis on quality and speed.

Companies like Jabil, Fathom Manufacturing, and Igus are also significant competitors, offering customized manufacturing services with a focus on innovation, efficiency, and scalability. Fictiv, Prototek, and Stratasys are recognized for their strengths in additive manufacturing and 3D printing, offering on-demand services for rapid prototyping and production of complex medical components. Shapeways, TenX Manufacturing, and 3ERP further diversify the market with their specialized offerings, addressing unique medical production needs.

The competition in the manufacturing on demand for the medical market is driven by the growing need for quick, cost-effective, and high-precision manufacturing solutions. As the demand for personalized and custom medical devices increases, companies in this space are leveraging advanced technologies like 3D printing, CNC machining, and rapid prototyping to meet the evolving requirements of the medical industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Market Forecast Value (2035) | USD 2.3 Billion |

| Forecast CAGR (2025-2035) | 10.4% |

| Type | 3D Printing Service, CNC Processing Service, Injection Molding Service, Others |

| Application | Medical Devices & Equipment, Medical Implants, Dental Supplies, Prostheses, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | SyBridge Technologies, Quickparts, Protolabs, Xometry, Jabil, Fathom Manufacturing, Igus, Fictiv, Prototek, Stratasys, Shapeways, TenX Manufacturing, 3ERP, LEADRP, TriMech, WayKen, RapidMade |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in manufacturing technologies for medical applications, integration with medical device and equipment manufacturing. |

The global manufacturing on demand for medical market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the manufacturing on demand for medical market is projected to reach USD 2.2 billion by 2035.

The manufacturing on demand for medical market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in manufacturing on demand for medical market are 3d printing service, cnc processing service, injection molding service and others.

In terms of application, medical devices and equipment segment to command 40.0% share in the manufacturing on demand for medical market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manufacturing Scale Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Logistics Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Test Systems Market

Manufacturing Analytics Market

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Wafer Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Micro Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

India Manufacturing Execution System Market – Industry 4.0 & Smart Factories

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Battery Manufacturing Machines Market

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Satellite Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Manufacturing Market Trends – Growth & Industry Outlook 2024-2034

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Electronic Manufacturing Services Market Analysis by Industry and Region, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA