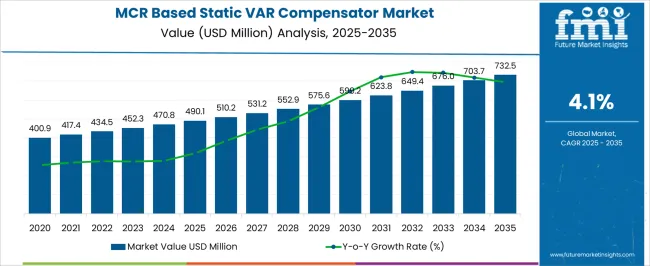

The MCR Based Static VAR Compensator Market is estimated to be valued at USD 490.1 million in 2025 and is projected to reach USD 732.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. From 2020 to 2024, the market grew steadily from USD 400.9 million to USD 470.8 million, with annual growth rates ranging between 4.0% and 4.3%. This period represents the early adoption phase, where demand increased gradually across power distribution and industrial segments. Year-on-year growth was driven by incremental expansion of electrical infrastructure and the need for voltage stability, with gradual investment in compensator systems and incremental capacity upgrades across utilities and industrial installations.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 490.1 million to USD 599.2 million, with YoY growth averaging 4.0–4.2%. Adoption spreads across broader industrial and utility segments, supported by increasing procurement of reactive power compensation equipment. From 2030 to 2035, growth continues steadily, reaching USD 732.5 million, with annual growth rates of approximately 4.1–4.3%. The YoY analysis indicates a predictable and stable expansion, with adoption becoming routine in power transmission and distribution networks. Demand stabilizes, and recurring procurement cycles support consistent revenue growth across key regions.

| Metric | Value |

|---|---|

| MCR Based Static VAR Compensator Market Estimated Value in (2025 E) | USD 490.1 million |

| MCR Based Static VAR Compensator Market Forecast Value in (2035 F) | USD 732.5 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The MCR based static VAR compensator market is experiencing steady expansion, supported by increasing investments in power grid modernization and the integration of renewable energy sources into transmission networks. These systems play a vital role in regulating reactive power, stabilizing voltage levels, and enhancing the overall reliability of electrical networks.

The market is benefiting from the rising demand for energy efficiency and the growing need to manage fluctuating load conditions, particularly in regions undergoing rapid industrialization and urbanization. Technological advancements in thyristor-controlled and hybrid compensation systems are improving response times, reducing losses, and extending equipment lifespan, making MCR based static VAR compensators more attractive to utilities and industrial operators.

Additionally, government-led initiatives aimed at strengthening grid resilience and meeting environmental compliance standards are influencing adoption trends As electricity demand continues to rise and renewable penetration increases, the requirement for advanced reactive power compensation solutions is expected to grow, positioning the market for sustained expansion over the coming decade.

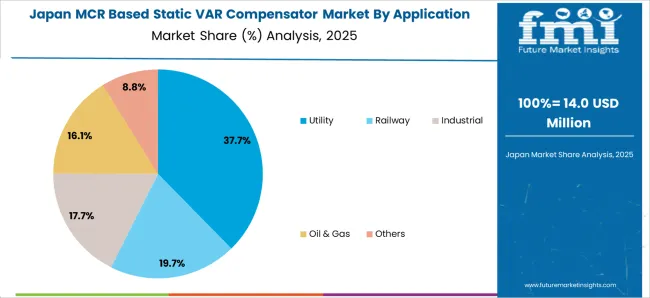

The MCR based static VAR compensator market is segmented by application and geographic regions. By application, MCR based static VAR compensator market is divided into Utility, Railway, Industrial, Oil & Gas, and Others. Regionally, the MCR based static VAR compensator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The utility application segment is projected to account for 37.6% of the MCR based static VAR compensator market revenue share in 2025, making it the leading application area. The critical need for voltage stabilization, power factor correction, and reactive power management across large-scale transmission and distribution networks is driving its dominance. Utilities are increasingly deploying MCR based static VAR compensators to improve grid reliability, reduce transmission losses, and accommodate the fluctuating output from renewable energy sources such as wind and solar.

The segment’s growth is further supported by ongoing grid expansion projects, the replacement of aging infrastructure, and the integration of smart grid technologies. Compliance with stringent power quality and efficiency regulations in multiple regions is also encouraging wider adoption.

The ability of these systems to provide fast, dynamic compensation without excessive maintenance requirements offers a cost-effective solution for utilities facing growing demand and operational challenges. As electricity consumption increases and grid complexity rises, the utility sector’s reliance on MCR-based static VAR compensators is expected to remain strong, ensuring continued leadership in the market.

The MCR (Thyristor Controlled) based Static VAR Compensator market is expanding due to the growing need for power quality management, reactive power compensation, and grid stability in electrical transmission and distribution systems. These compensators provide fast voltage regulation, reduce harmonic distortions, and improve overall power system efficiency. Asia-Pacific shows high adoption due to grid modernization and industrial demand. Europe and North America focus on high-performance, reliability-compliant solutions. Manufacturers are emphasizing compact designs, advanced control systems, and efficient cooling to enhance operational reliability.

MCR based SVCs are critical for maintaining stable voltage levels in high-voltage transmission and distribution networks. As grids integrate renewable energy sources such as wind and solar, voltage fluctuations increase, leading to potential equipment damage and power losses. SVCs dynamically absorb or inject reactive power, maintaining voltage stability and enhancing transmission efficiency. Utilities benefit from reduced transmission losses, improved system reliability, and optimized power flow. Manufacturers providing robust and responsive compensators gain preference in regions with fluctuating loads or renewable integration. Until alternative reactive power compensation methods achieve comparable performance, MCR based SVCs remain essential for grid operators, particularly in regions with growing industrial loads and renewable penetration.

Large industries such as steel, cement, chemical, and manufacturing require stable voltage and minimal harmonic distortion for equipment safety and operational efficiency. MCR based SVCs provide precise reactive power compensation, protecting sensitive machinery from voltage sags, swells, and harmonics. Continuous operation in high-demand industrial environments requires reliable cooling, durable components, and rapid response systems. Companies delivering customizable solutions for specific industrial load profiles gain a competitive edge. Until alternative power conditioning technologies become more cost-effective and reliable, MCR based SVCs will continue to play a central role in industrial power quality management, ensuring equipment longevity and uninterrupted operations.

The growing penetration of renewable energy introduces variability and instability into power grids due to fluctuating generation. MCR based SVCs help smooth voltage variations, maintain power factor, and minimize disturbances caused by intermittent solar and wind power. They are particularly effective in wind farms, solar parks, and hybrid energy systems where reactive power needs fluctuate rapidly. Manufacturers offering SVCs with advanced control algorithms and fast response capabilities enable efficient grid integration of renewables. Until new energy storage and grid-balancing technologies are widely deployed, MCR based SVCs will remain critical for supporting renewable energy adoption and ensuring reliable power system operation.

MCR based SVC systems require precise design to handle high voltages, large currents, and rapid reactive power adjustments. Proper selection of thyristors, reactors, and control modules is critical to maintain efficiency and prevent failures. Maintenance complexity, cooling system management, and component replacement cycles add operational costs. Manufacturers focusing on modular designs, predictive diagnostics, and remote monitoring capabilities gain an advantage by reducing downtime and maintenance challenges. Until standardized, low-maintenance designs are widely available, system complexity and maintenance requirements will continue to influence adoption, particularly among utilities and industrial clients seeking reliable and long-lasting voltage compensation solutions.

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| U.K. | 3.9% |

| U.S. | 3.5% |

| Brazil | 3.1% |

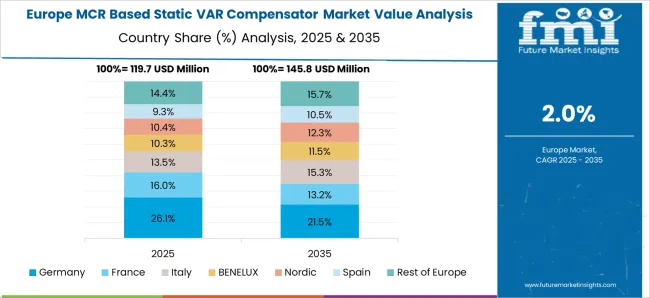

The global MCR based static VAR compensator market is projected to grow at a CAGR of 4.1% through 2035, supported by increasing demand across power transmission, industrial, and utility applications. Among BRICS nations, China has been recorded with 5.5% growth, driven by large-scale production and deployment in electrical grids and industrial systems, while India has been observed at 5.1%, supported by rising utilization in power infrastructure and industrial applications. In the OECD region, Germany has been measured at 4.7%, where production and adoption for industrial and utility power stabilization applications have been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting consistent use in power transmission and industrial systems, while the U.S. has been recorded at 3.5%, with production and utilization across electrical grids, industrial, and utility sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The MCR based static VAR compensator market in China is growing at a CAGR of 5.5%, driven by rising electricity demand, modernization of power grids, and increasing renewable energy integration. Industries and utility operators are adopting static VAR compensators to improve power quality, reduce voltage fluctuations, and maintain grid stability. China’s investments in smart grids, high-voltage transmission networks, and renewable energy projects accelerate market growth. Technological advancements, including compact designs, faster response times, and improved efficiency, enhance operational performance. The growing need for stable and reliable power in urban centers and industrial hubs supports adoption. Government initiatives to reduce power losses and enhance renewable energy integration further fuel market expansion. Continuous R&D efforts and partnerships between equipment manufacturers and energy providers strengthen the market’s future outlook in China.

The MCR based static VAR compensator market in India is expanding at a CAGR of 5.1%, supported by increasing industrial electricity consumption and grid modernization projects. Utilities and large industrial facilities deploy static VAR compensators to enhance power quality, minimize voltage instability, and maintain grid reliability. Renewable energy integration, particularly from solar and wind sources, drives demand for advanced reactive power compensation equipment. Technological developments, including compact and modular designs, rapid response capabilities, and improved efficiency, attract adoption in commercial and industrial sectors. Government initiatives for smart grid implementation, energy efficiency, and sustainable power infrastructure further support market growth. Continuous investment in transmission and distribution upgrades, along with rising industrialization, ensures steady demand for MCR based static VAR compensators in India.

The MCR based static VAR compensator market in Germany is growing at a CAGR of 4.7%, fueled by the country’s strong focus on renewable energy integration, energy efficiency, and grid stabilization. Industries and utility providers adopt static VAR compensators to mitigate voltage fluctuations, maintain power quality, and support the increasing share of wind and solar energy. Advanced technological features, including compact designs, rapid response times, and high efficiency, are enhancing operational performance and adoption rates. Germany’s stringent energy regulations, investment in smart grids, and renewable energy policies drive consistent demand. Industrial hubs and high-density urban areas require reliable reactive power compensation to maintain grid stability. Continuous R&D efforts and partnerships between manufacturers and energy operators strengthen the market outlook for MCR based static VAR compensators in Germany.

The MCR based static VAR compensator market in the United Kingdom is expanding at a CAGR of 3.9%, driven by growing electricity demand, grid modernization, and renewable energy adoption. Utilities and industrial facilities employ static VAR compensators to stabilize voltage, improve power quality, and ensure reliable grid operation. Technological improvements, such as modular designs, fast response capabilities, and higher efficiency, support widespread adoption. Government initiatives promoting renewable integration, energy efficiency, and smart grids further accelerate market growth. Industrial, commercial, and urban areas increasingly rely on reactive power compensation to reduce downtime and maintain electrical reliability. Partnerships between manufacturers, energy providers, and technology innovators strengthen the market’s future potential in the UK.

The MCR based static VAR compensator market in the United States is growing at a CAGR of 3.5%, with adoption supported by rising electricity consumption, renewable energy integration, and industrial expansion. Utilities and large-scale facilities implement static VAR compensators to enhance power quality, minimize voltage instability, and ensure reliable grid performance. Technological advancements, including compact designs, improved response times, and high efficiency, enhance market appeal. Renewable energy policies, smart grid development, and energy efficiency regulations encourage wider deployment. Industrial, commercial, and utility sectors increasingly depend on reactive power compensation to maintain stable operations. Continuous R&D and collaborations between equipment manufacturers and energy providers further strengthen market growth for MCR based static VAR compensators in the U.S.

The MCR (Metal-Oxide Controlled Reactor) based Static VAR Compensator (SVC) market is a key segment within the power quality and reactive power compensation industry. SVCs are essential for maintaining voltage stability, improving power factor, and enhancing the reliability of electrical grids in industrial, utility, and renewable energy applications. The growing demand for grid modernization, integration of renewable energy sources, and the need to manage reactive power efficiently are driving market growth globally.

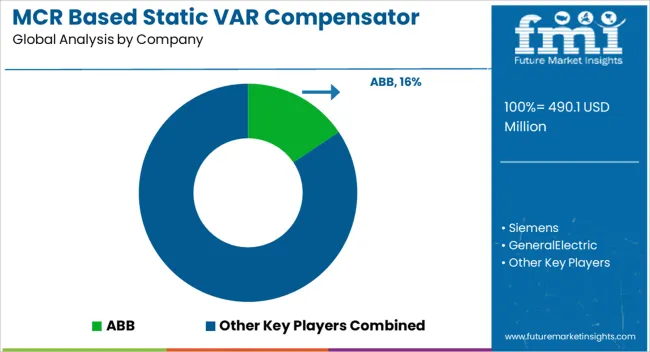

Prominent suppliers in this market include ABB, a global leader in power and automation technologies, providing advanced SVC solutions for large-scale industrial and utility applications. Siemens and General Electric offer comprehensive SVC systems with high reliability and integration capabilities, while Hitachi Energy Ltd. and Mitsubishi Electric Power Products Inc. focus on delivering tailored solutions for complex grid infrastructures. Toshiba Energy Systems & Solutions Corporation and Eaton are also significant players, offering innovative designs to optimize power system performance.

Other notable companies include Delta Electronics Inc., American Superconductor, Wärtsilä, NR Electric Co. Ltd., NISSiN Electric Co. Ltd., and Sieyuan Electric Co. Ltd., which provide modular and scalable SVC solutions for diverse applications. Companies such as Merus Power, JEMA Energy, Elco Power, Nidec Industrial Solutions, and Clariant Power System Limited are leveraging technology innovation to enhance grid stability, reduce losses, and enable efficient integration of renewable energy. With continued investment in R&D and increasing emphasis on smart grid solutions, MCR based SVC systems are poised to play a crucial role in modernizing electrical infrastructure worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 490.1 Million |

| Application | Utility, Railway, Industrial, Oil & Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, GeneralElectric, HitachiEnergyLtd., MitsubishiElectricPowerProductsInc., ToshibaEnergySystems&SolutionsCorporation, Eaton, DeltaElectronicsInc., AmericanSuperconductor, Wärtsilä, NISSiNELECTRICCo.Ltd., NR ElectricCo.Ltd., SieyuanElectricCo.Ltd., MerusPower, JEMA Energy, ElcoPower, NidecIndustrialSolutions, and ClariantPowerSystemLimited |

| Additional Attributes | Dollar sales vary by SVC type, including thyristor-controlled reactors (TCR) and thyristor-switched capacitors (TSC); by application, such as power transmission, renewable energy integration, industrial facilities, and grid stabilization; by end-use industry, spanning utilities, manufacturing, and infrastructure; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by increasing demand for grid stability, reactive power management, and renewable energy integration. |

The global MCR based static VAR compensator market is estimated to be valued at USD 490.1 million in 2025.

The market size for the MCR based static VAR compensator market is projected to reach USD 732.5 million by 2035.

The MCR based static VAR compensator market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in MCR based static VAR compensator market are utility, railway, industrial, oil & gas and others.

In terms of , segment to command 0.0% share in the MCR based static VAR compensator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

Biobased Transformer Oil Market

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Sky Based Communication Market Size and Share Forecast Outlook 2025 to 2035

MRI-based Quantitative Biomarkers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA