The medical face shield market is expanding steadily as healthcare institutions continue to prioritize enhanced protection standards, infection control measures, and regulatory compliance across clinical environments. Increasing awareness of occupational safety, coupled with ongoing exposure risks from infectious diseases, is driving consistent product demand. Technological improvements in material quality, ergonomic design, and visibility have improved wearer comfort and functionality, encouraging higher adoption across medical and laboratory settings.

Market participants are focusing on scalable production, lightweight composites, and reusable designs to balance cost efficiency with performance. The future outlook is defined by sustained demand from hospitals, ambulatory care centers, and emergency services, as well as rising procurement by government and private organizations for pandemic preparedness.

Growth rationale is supported by continuous innovation in anti-fog coatings, optical clarity, and impact resistance, along with global investments in healthcare infrastructure These factors are collectively positioning the medical face shield market for stable long-term expansion and improved penetration across both developed and emerging healthcare systems.

| Metric | Value |

|---|---|

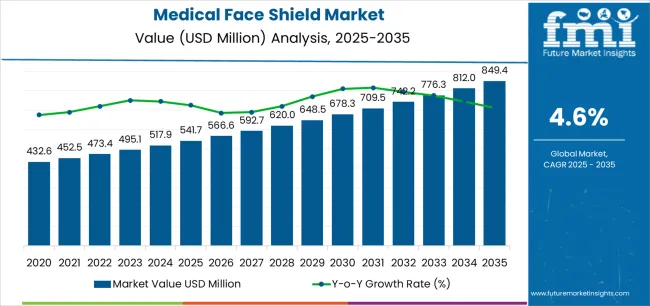

| Medical Face Shield Market Estimated Value in (2025 E) | USD 541.7 million |

| Medical Face Shield Market Forecast Value in (2035 F) | USD 849.4 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The market is segmented by Material, Type, Usage, and Distribution Channel and region. By Material, the market is divided into Polycarbonate, Polyethylene Terephthalate glycol, Propionate, and Acetate. In terms of Type, the market is classified into Anti-Fog, Anti-Glare, and Others. Based on Usage, the market is segmented into Disposable and Reusable. By Distribution Channel, the market is divided into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

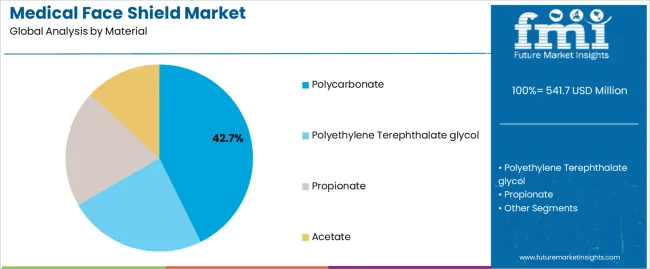

The polycarbonate segment, representing 42.70% of the material category, has been leading the market due to its superior strength, optical transparency, and impact resistance, which make it ideal for medical-grade protective equipment. Its dominance is being reinforced by widespread use in face shields designed for frontline healthcare workers who require durable and clear protection during extended use.

Polycarbonate’s resistance to heat and chemicals has improved product longevity and sterilization efficiency, further enhancing its adoption in hospitals and laboratories. Continuous product development focused on lightweight variants and scratch-resistant coatings has elevated performance standards.

Manufacturers are optimizing molding and extrusion techniques to achieve higher output consistency, while regulatory certifications for medical-grade materials are strengthening its competitive advantage These factors are ensuring the continued prominence of polycarbonate within the medical face shield market.

The anti-fog segment, holding 39.40% of the type category, has emerged as a key segment due to the necessity for clear visibility in critical medical operations. Its leadership is driven by increasing integration of advanced coatings that prevent condensation under high-humidity or long-duration use.

Healthcare workers prefer anti-fog shields for uninterrupted vision and comfort during surgical and diagnostic procedures. Market players are incorporating nano-coating technologies and hydrophilic films to improve durability and clarity, which has enhanced overall product performance.

Supply chain integration with coating material manufacturers has reduced costs and improved production efficiency Continuous focus on compliance with safety and optical clarity standards is supporting the segment’s market share, ensuring strong growth momentum across institutional and personal protective equipment channels.

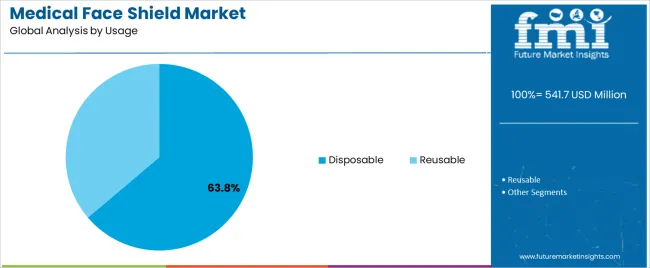

The disposable segment, accounting for 63.80% of the usage category, remains the dominant type due to its convenience, cost-effectiveness, and hygiene benefits. Single-use shields have gained preference among healthcare facilities seeking to minimize cross-contamination risks, particularly in high-turnover environments such as emergency departments and testing centers.

Demand has been supported by large-scale procurement programs and public health initiatives aimed at infection prevention. Ease of mass production and simplified logistics have also contributed to the segment’s strong presence.

Manufacturers are developing biodegradable and recyclable disposable variants to align with sustainability goals, expanding the appeal of the category The segment’s growth is expected to remain stable as infection control remains a top priority and disposable medical protective equipment continues to be widely adopted across healthcare ecosystems.

Polycarbonate is the foremost material in the medical face shield industry. Disposable medical face shields top the usage segment.

| Attributes | Details |

|---|---|

| Top Material | Polycarbonate |

| Market Share (2025) | 74.6% |

For 2025, polycarbonate is expected to account for 74.6% of the market share by material. Some of the key drivers for the increasing use of polycarbonate in medical face shields are:

| Attributes | Details |

|---|---|

| Top Usage | Disposable |

| Market Share (2025) | 68.6% |

Disposable medical face shields are anticipated to account for 68.6% of the market share by usage in 2025. Some of the key drivers for the progress of disposable medical face shields include:

The ever-increasing number of patients being admitted to hospitals, owing to the large population of the region, is propelling the market in the Asia Pacific. Government initiatives to technologically improve the healthcare sector are also playing a prominent role in the market’s expansion in the Asia Pacific.

| Countries | CAGR |

|---|---|

| India | 5.9% |

| Thailand | 5.7% |

| Malaysia | 5.1% |

| Indonesia | 5.0% |

| Spain | 4.6% |

European tendency to secure the utmost protection for medical professionals is guiding the market’s progress in the region. Greater consciousness about the risks of negligence in medical procedures is driving the market in the region.

The market is set to register a CAGR of 5.9% in India for the forecast period. The key drivers for growth are:

The CAGR for medical face shields in Thailand is tipped to be 5.7% over the forecast period. Some of the key factors driving the growth are:

The CAGR for medical face shields in Malaysia is tipped to be 5.1% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 5.0% in Indonesia for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 4.6% in Spain over the forecast period. Some of the key trends include:

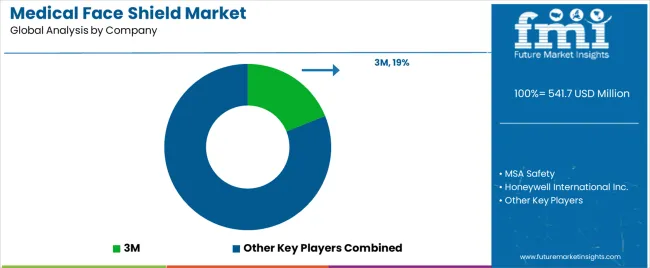

Market players focus on technological development. As such, collaborations are common between market players as they look to fuse technological capabilities.

Acquisitions of small-scale players by leading medical equipment companies is an observable strategy. These leading medical companies, sensing the opportunity in the market and through means of acquisition or collaboration, are entering the market.

Recent Developments in the Medical Face Shield Market

The global medical face shield market is estimated to be valued at USD 541.7 million in 2025.

The market size for the medical face shield market is projected to reach USD 849.4 million by 2035.

The medical face shield market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in medical face shield market are polycarbonate, polyethylene terephthalate glycol, propionate and acetate.

In terms of type, anti-fog segment to command 39.4% share in the medical face shield market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA