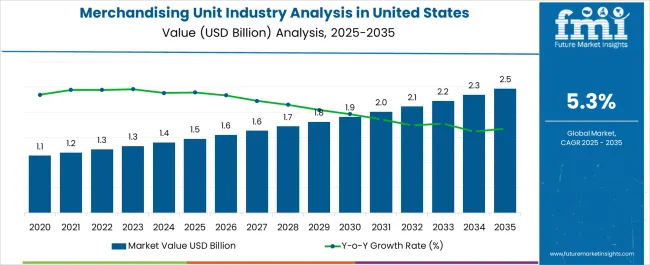

The Merchandising Unit Industry Analysis in United States is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Merchandising Unit Industry Analysis in United States Estimated Value in (2025 E) | USD 1.5 billion |

| Merchandising Unit Industry Analysis in United States Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The merchandising unit industry in the United States is expanding steadily, supported by the evolving retail landscape, growing consumer expectations, and increased demand for product visibility across multiple formats. Current market dynamics are characterized by strong adoption of display solutions that enhance customer engagement and optimize point-of-sale effectiveness. Manufacturers are focusing on modular, sustainable, and cost-efficient designs that cater to both large-scale retail chains and independent outlets.

Shifts in consumer behavior toward convenience and personalized experiences are driving innovation in unit design and functionality. The future outlook is positive, with steady demand growth expected from diverse end-user industries including retail, commercial spaces, and institutions.

Growth rationale is reinforced by technological enhancements in display manufacturing, investments in sustainable materials, and the increasing need for flexible merchandising solutions that align with changing product cycles and marketing strategies The industry is expected to continue expanding as businesses emphasize branding, operational efficiency, and enhanced shopper experience across various retail and institutional environments.

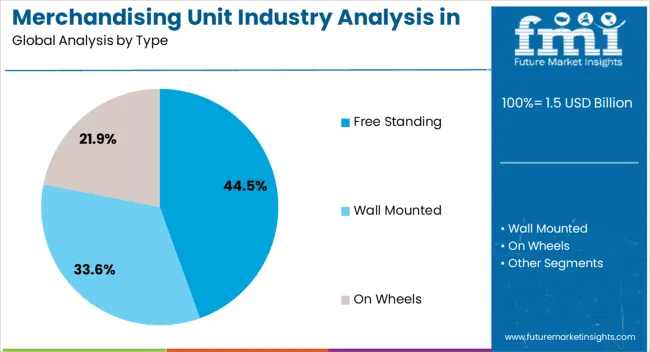

The free standing segment, accounting for 44.50% of the type category, is leading due to its versatility, mobility, and adaptability across multiple retail formats. Its strong presence has been sustained by the ability to offer high visibility and flexible placement, making it suitable for both temporary promotions and permanent displays.

Retailers and brand owners prefer this segment as it supports efficient space utilization and can be customized to align with specific marketing campaigns. Manufacturing innovations, including lightweight structures and recyclable materials, have improved operational ease and reduced costs.

The segment’s leadership is further supported by its compatibility with evolving digital integrations such as interactive displays Continued adoption across supermarkets, convenience stores, and specialty outlets is expected to maintain the segment’s prominence and contribute significantly to market growth in the United States.

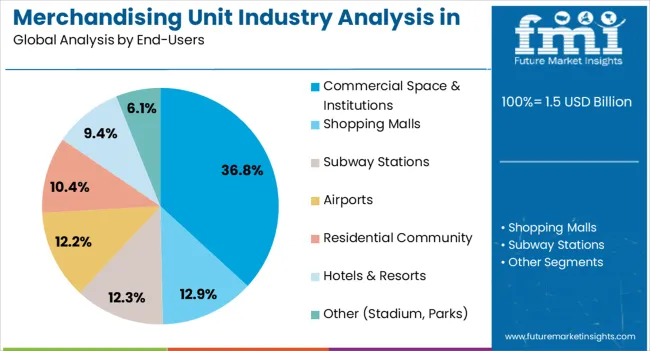

The commercial space and institutions segment, holding 36.80% of the end-users category, has emerged as the largest contributor due to widespread adoption of merchandising units in corporate campuses, educational institutions, and public facilities. This dominance has been driven by the growing requirement to create structured product visibility and effective brand communication in non-retail environments.

Strong demand has been supported by institutional procurement strategies emphasizing durability, functionality, and cost efficiency. Integration of modular and customized units has enhanced usability, while compliance with safety and sustainability standards has ensured wider acceptance.

The segment’s growth trajectory is reinforced by increasing investment in institutional infrastructure and branding initiatives aimed at enhancing consumer engagement Expansion of multifunctional spaces across the United States is expected to further consolidate this segment’s share, making it a key driver of the merchandising unit industry.

The United States merchandising unit business revenue is projected to expand 1.7X through 2035. This is due to the rapid expansion of the retail sector in the country, rising retail sales, and the growing emphasis on visual merchandising.

Merchandising unit are expected to serve as dynamic business tools that engage customers, drive conversions, and enhance brand visibility through effective presentation, promotional displays, and seamless purchase pathways. These are becoming powerful business tools by conveying brand messages, product benefits, and promotional offers, thereby driving their demand.

They are increasingly being installed at shopping malls, hotels, retail stores, airports, and other places to showcase products. The growing adoption of merchandising unit in these places is expected to boost their sales and push the total revenue.

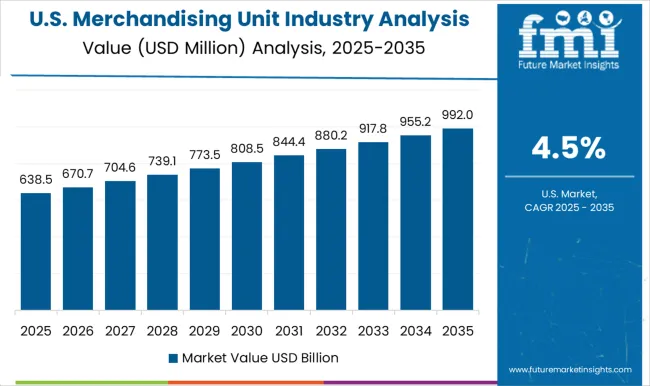

Sales of merchandising unit in the United States grew at a CAGR of 3.1% during the historical period. Total revenue in the country reached around USD 1,265.1 million in 2025. Over the assessment period, merchandising unit demand in the United States is anticipated to increase at a 5.3% CAGR.

| Historical CAGR (2020 to 2025) | 3.1% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.3% |

In recent years, the utilization of merchandising unit has witnessed a significant upsurge, particularly across airports and shopping malls. This can be attributed to the increasing footfall across top-tier malls in the country, as well as the persistent growth in the number of customers who prefer air travel owing to the lower costs.

Retailers are increasingly using a single, expansive merchandise unit to advertise all their brands. This strategy aims to optimize space utilization and provide a comprehensive array of brands and products under one location.

The integration enables cross-promotional opportunities and shared business initiatives that mutually benefit all involved stakeholders. Moreover, it is cost-effective from a retailer's perspective, especially in high-rent spaces or prime real estate locations with accessibility issues.

For instance, Stella McCartney, a United States-based firm, employs this multiple-store merchandising unit strategy to showcase a diverse range of products within a singular merchandising space. This approach not only minimizes resource use but also enhances the shopping experience for customers by offering a wide assortment of products and brands, all within one conveniently located destination.

Semi-annual Update

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2025 to 2035) |

| H2 | 5.4% (2025 to 2035) |

| H1 | 5.3% (2025 to 2035) |

| H2 | 5.5% (2025 to 2035) |

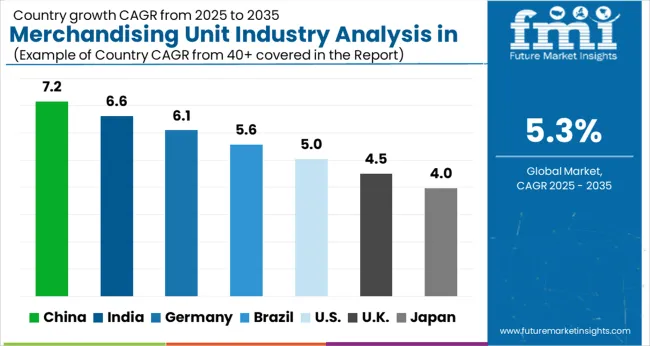

The Northeast region is poised to dominate the United States retail merchandising unit business in the forecast period. The general populace across several states in the North East boasts of higher disposable income, which consequently results in an increasing proportion of affluent consumers.

The region also boasts of a larger number of retailers in comparison, who extensively invest in merchandising unit to stand out from the competitive retail sector across the region. This is expected to stimulate sales of merchandising unit across the North East region during the forecast period.

The Western region of the United States is set to witness a considerable CAGR during the estimated period. As per the latest United States merchandising unit industry analysis, demand for merchandising unit in the Western United States will likely rise at a CAGR of 6.8% throughout the forecast period. This is attributable to the expansion of the retail sector, increasing consumer spending, and surging popularity of pop-up stores.

Western region is also witnessing rapid economic growth along with a constant flow of tourism. Such factors are expected to contribute to the growing demand for merchandising unit across the region during the assessment period.

The below section shows the free-standing segment to retain its dominance based on merchandising unit type. It is poised to thrive at 5.1% CAGR through 2035. By end-user, the shopping malls segment is anticipated to account for a prominent share, exhibiting a CAGR of 4.2% between 2025 and 2035.

| Type | Value CAGR |

|---|---|

| Free Standing | 5.1% |

| Wall Mounted | 6.3% |

Based on type, free-standing merchandising unit are anticipated to hold a significant value share of around 55.4% by 2035. Over the assessment period, sales of free-standing merchandising unit in the United States are expected to soar at a CAGR of 5.1%. This can be attributed to the rising adoption of free-standing merchandising unit (FSDUs) across diverse end-use sectors due to their multiple benefits.

Free-standing variants of merchandising unit are set to be utilized to increase product visibility and promote brand impact at the point of purchase. They would allow retailers the freedom to place them anywhere in a store, which makes it easy to change the layout as needed. This is especially useful in large retail stores, where the layout requires frequent changes.

Free-standing merchandising unit can be placed anywhere in the retail store, which makes them highly sought-after types among end-users. They are a versatile and effective means to promote products and boost sales. The growing usage of free-standing unit by retailers and manufacturers to increase product visibility, raise brand awareness, drive impulse purchases, and increase sales will likely boost the target segment.

| End-use | Value CAGR |

|---|---|

| Airports | 4.7% |

| Shopping Malls | 4.2% |

The shopping mall segment is estimated to dominate the United States merchandising unit business with a share of around 28.6% in 2025. It is poised to exhibit a CAGR of 4.2% between 2025 and 2035, generating lucrative revenue in the target business. Shopping malls mainly utilize retail merchandising unit that display a brand’s product offerings, encourage impulse purchases, and provide opportunities for cross-promotions.

Several shopping malls across the United States have witnessed a resurgence in customer traffic in recent years, especially in top-tier malls, where footfall has increased by over 10% in 2025, as compared to pre-COVID levels. This trend is further driving investments in merchandising unit as brands attempt to capture the new generation of offline shoppers.

Merchandising unit also allow shopping malls to increase their footfall and sales, promote new products and brands, and create a more dynamic and engaging shopping experience for their customers. As a result, the demand for retail merchandising unit in the shopping malls segment will continue to rise steadily through 2035.

Key manufacturers of merchandising unit are concentrating on increasing their production capacity to meet the demand from end users in the United States. The landscape is highly competitive, with several key players dominating the field. Prominent companies in the report include Smurfit Kappa, International Paper, WestRock, DS Smith Plc, Cart King International, Siffron Inc., and Frank Mayer and Associates, Inc.

Recent developments in the United States Merchandising Unit Business

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 1.5 billion |

| Projected Value (2035) | USD 2.5 billion |

| Anticipated Growth Rate (2025 to 2035) | 5.3% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Unit | Value (USD million) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, End-users, Sub-region |

| Key Companies Profiled | Smurfit Kappa; International Paper; WestRock; DS Smith Plc; Cart King International; Siffron Inc.; Frank Mayer and Associates, Inc.; Creative Display Now; Tilsner Carton Company; Nemco Food Company |

The global merchandising unit industry analysis in united states is estimated to be valued at USD 1.5 billion in 2025.

The market size for the merchandising unit industry analysis in united states is projected to reach USD 2.5 billion by 2035.

The merchandising unit industry analysis in united states is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in merchandising unit industry analysis in united states are free standing, wall mounted and on wheels.

In terms of end-users, commercial space & institutions segment to command 36.8% share in the merchandising unit industry analysis in united states in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Hangover Cure Product Industry Analysis in United States Growth, Trends and Forecast from 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA