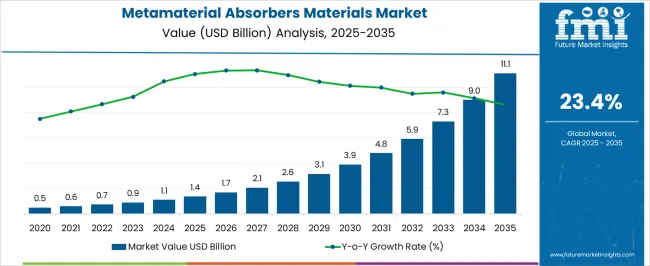

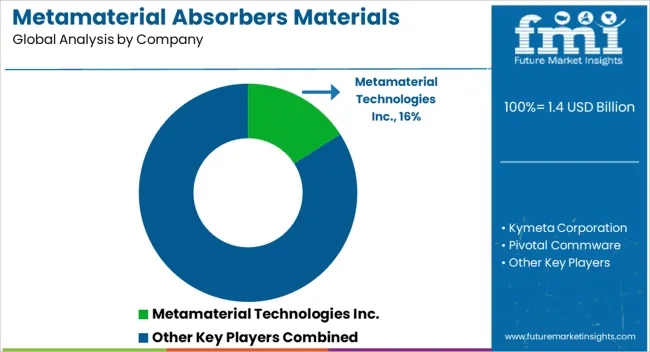

The metamaterial absorbers materials market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 23.4% over the forecast period.

Between 2020 and 2025, growth from USD 0.5 billion to USD 1.4 billion represents the early adoption cycle, fueled by initial integration into defense radar-evading structures and experimental applications in telecommunications. The sharp acceleration becomes evident from 2026 to 2030, where values escalate from USD 1.7 billion to USD 3.9 billion, more than doubling within five years as commercial aviation, satellite shielding, and next-gen communication networks drive scaled deployment.

This period captures the strongest momentum, reflecting breakthrough adoption across multiple industries. The trajectory steepens further between 2030 and 2033, advancing from USD 4.8 billion to USD 7.3 billion, highlighting widespread penetration of metamaterial absorbers in consumer electronics, automotive sensors, and advanced military programs. After 2033, while the pace remains strong, the curve displays early signs of moderated acceleration, with growth from USD 9.0 billion in 2034 to USD 11.1 billion in 2035. This deceleration signals the beginning of a transition from explosive adoption to structured replacement cycles, as key markets move from experimental to established use cases. Overall, the decade reflects strong acceleration with late-stage moderation.

| Metric | Value |

|---|---|

| Metamaterial Absorbers Materials Market Estimated Value in (2025 E) | USD 1.4 billion |

| Metamaterial Absorbers Materials Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 23.4% |

The metamaterial absorbers materials market occupies a specialized position within the broader advanced materials and electromagnetic components sector, accounting for roughly 18–21% of the overall electromagnetic materials category. Within the global radar and antenna materials industry, metamaterial absorbers represent around 10–12%, driven by growing demand from aerospace, defense, and telecommunications applications that require precise electromagnetic wave manipulation and signal absorption. In the wider electromagnetic shielding and radar-absorbing materials segment, they capture nearly 6–8% share, supported by adoption in stealth technology, 5G infrastructure, and high-frequency electronic devices. Growth is reinforced by innovations in carbon-based composites, metallic-dielectric multilayers, and flexible substrate integration, enhancing absorption efficiency, bandwidth control, and material durability.

Research in tunable and broadband metamaterials is expanding application potential across civilian and military sectors, while scalable fabrication techniques are improving production consistency and cost-effectiveness. Regional adoption is particularly strong in North America and Europe due to defense modernization programs, aerospace research, and high-tech industrial applications, whereas Asia-Pacific is witnessing increasing penetration from commercial 5G deployments, automotive radar systems, and university-led research initiatives. Despite challenges in raw material costs, fabrication complexity, and regulatory compliance for military-grade applications, the metamaterial absorbers materials market continues to evolve with new designs, layered structures, and adaptive functionalities, securing its strategic relevance in high-performance electromagnetic applications globally.

The market is experiencing accelerated growth as industries adopt advanced electromagnetic solutions for enhanced signal control, stealth, and energy absorption applications. The ability of these materials to manipulate electromagnetic waves with high precision has positioned them as critical components in defense, telecommunications, and aerospace sectors. Advancements in fabrication technologies and material engineering are enabling greater customization, higher efficiency, and broader frequency coverage.

Rising investment in research and development is fostering innovations that meet the evolving needs of radar evasion, wireless communication enhancement, and electromagnetic interference mitigation. Strategic collaborations between research institutions and industrial players are expanding the commercial viability of these solutions.

Increasing geopolitical focus on defense modernization, coupled with growing adoption in commercial communication infrastructure, is creating sustained demand As end-users seek materials that offer lightweight construction, superior performance, and adaptability across operational environments, the market is poised for significant expansion in the coming years.

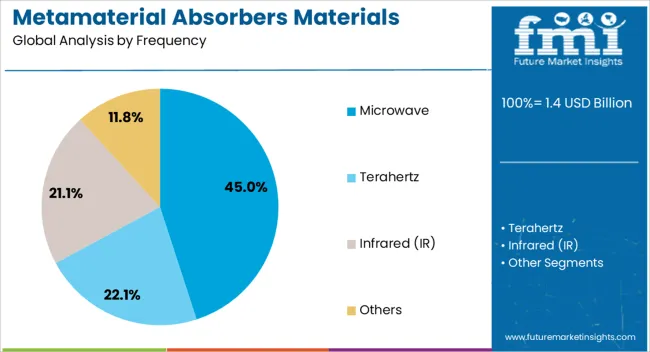

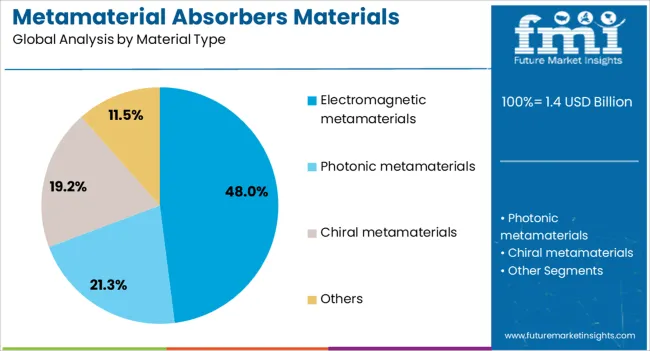

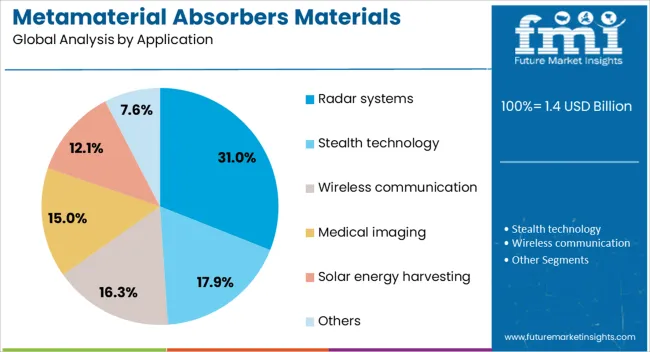

The metamaterial absorbers materials market is segmented by frequency, material type, application, and geographic regions. By frequency, metamaterial absorbers materials market is divided into microwave, terahertz, infrared (IR), and others. In terms of material type, metamaterial absorbers materials market is classified into electromagnetic metamaterials, photonic metamaterials, chiral metamaterials, and others. Based on application, metamaterial absorbers materials market is segmented into radar systems, stealth technology, wireless communication, medical imaging, solar energy harvesting, and others. Regionally, the metamaterial absorbers materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microwave frequency segment is projected to hold 45% of the Metamaterial Absorbers Materials market revenue share in 2025, making it the leading frequency category. This dominance has been supported by the segment’s ability to deliver high efficiency in absorbing electromagnetic waves within the microwave range, which is widely used in radar, communication, and sensing systems. Demand has been driven by the increasing need for stealth technologies and advanced signal control in defense and aerospace applications.

Microwave metamaterial absorbers are being preferred for their capacity to minimize detection and enhance operational security while maintaining lightweight and compact designs. The capability to fine-tune absorption characteristics through precise material structuring has further strengthened their adoption.

Additionally, integration into both fixed and mobile platforms has extended their application scope The sustained requirement for secure and efficient microwave communication links in military and commercial domains continues to reinforce the leadership of this segment within the overall market.

The electromagnetic metamaterials segment is anticipated to command 48% of the Metamaterial Absorbers Materials market revenue share in 2025, positioning it as the leading material type. The growth of this segment has been driven by its exceptional capability to control wave propagation and achieve tailored electromagnetic responses. These materials have been widely adopted for their ability to deliver high absorption rates across targeted frequency ranges while maintaining design flexibility.

The segment’s leadership is further reinforced by advancements in nanofabrication and composite material engineering, which enable superior performance and durability under varied environmental conditions. Their application in high-value areas such as defense stealth systems, satellite communications, and electromagnetic shielding has been a key driver of demand.

Additionally, the adaptability of electromagnetic metamaterials to integrate with different substrates and platforms has made them a preferred choice for next-generation absorber systems Continuous innovation in design methodologies is expected to sustain their dominance in the market.

The radar systems segment is expected to account for 31% of the Metamaterial Absorbers Materials market revenue share in 2025, making it the leading application area. The segment’s growth has been underpinned by the critical role of metamaterial absorbers in reducing radar cross-section and enhancing stealth capabilities for military and aerospace applications. Radar systems require materials that can effectively absorb and dissipate electromagnetic energy without compromising structural integrity, and metamaterial absorbers have met this requirement with precision.

Adoption has been supported by increased defense spending and modernization programs aimed at developing advanced surveillance and detection systems. The ability of these materials to perform consistently across a wide range of frequencies and environmental conditions has further strengthened their use in radar systems.

Integration with next-generation radar technologies and autonomous platforms is creating new opportunities for deployment The sustained emphasis on operational security and technological superiority continues to drive the leadership of this segment.

Metamaterial absorbers materials are expanding across defense, aerospace, and electronics applications, driven by platform-specific adoption and material innovations. Strategic partnerships, regional production growth, and scalable fabrication techniques are strengthening global market presence and future prospects.

The adoption of metamaterial absorbers materials is being accelerated by growing defense requirements, including radar cross-section reduction, stealth systems, and electronic warfare. Military aircraft, naval vessels, and unmanned platforms are increasingly integrating these materials to enhance survivability and operational efficiency. Governments in North America, Europe, and Asia-Pacific are investing heavily in advanced radar-absorbing solutions, leading to higher procurement volumes and long-term contracts. High-performance composites, multilayered absorbers, and tunable materials are being deployed to meet stringent defense specifications. Increased collaboration between material developers and defense integrators is optimizing electromagnetic absorption, weight reduction, and platform compatibility. Supply chain improvements and domestic production initiatives are reducing lead times while supporting the expansion of specialized material offerings in both governmental and private defense programs.

Metamaterial absorbers materials are witnessing rising application across commercial aerospace, satellite communication, and high-frequency electronic devices. Lightweight composites and broadband absorbers are being incorporated into aircraft panels, antenna systems, and radar shielding. Electronics manufacturers are leveraging these materials to minimize signal interference, improve reception, and support high-speed telecommunication networks. Growth is further supported by integration into unmanned aerial vehicles, drones, and emerging 5G infrastructure, where absorption efficiency and bandwidth control are critical. Collaboration between research institutions and industrial manufacturers is enhancing material performance, reliability, and customization for platform-specific requirements. Regional adoption is stronger in North America and Europe due to defense and aerospace investments, while Asia-Pacific is catching up with high-tech industrial adoption.

Material science advancements are expanding the functionality and accessibility of metamaterial absorbers materials. Novel carbon-based composites, dielectric-metal layers, and flexible substrates are being developed to enhance absorption range, tunability, and operational frequency. Scalable fabrication techniques, including additive manufacturing and thin-film deposition, are improving precision, consistency, and cost-effectiveness. Research on multilayer and gradient structures is enabling lightweight yet highly efficient solutions for complex electromagnetic environments. Manufacturers are increasingly focusing on high-throughput production, material standardization, and integration into modular systems. The push toward flexible and adaptable absorbers is opening applications in emerging platforms such as autonomous vehicles, advanced radar networks, and space-borne sensors, broadening market reach beyond traditional defense applications.

The metamaterial absorbers materials industry is marked by intense competition among global material innovators, defense contractors, and emerging regional players. Leading companies are focusing on product differentiation through higher absorption efficiency, broader bandwidth, and platform-specific customization. Strategic alliances with defense agencies, electronics manufacturers, and research institutions are enhancing product credibility and adoption. Investment in R&D, pilot production facilities, and intellectual property protection is driving long-term market positioning. Regional players in Asia-Pacific are expanding capabilities to meet growing domestic aerospace and defense needs, while North American and European companies are leveraging established supply chains and government contracts. Partnerships and licensing agreements are facilitating market entry and boosting global adoption of advanced absorptive materials.

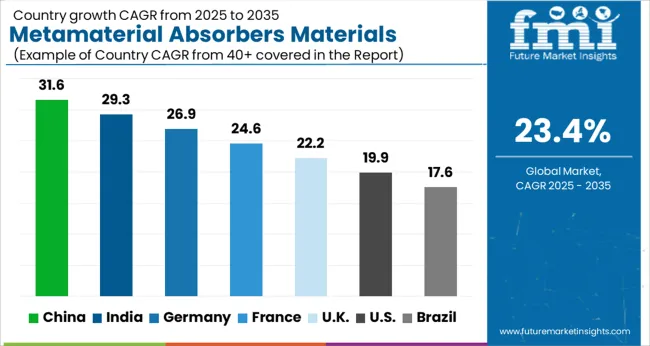

| Country | CAGR |

|---|---|

| China | 31.6% |

| India | 29.3% |

| Germany | 26.9% |

| France | 24.6% |

| UK | 22.2% |

| USA | 19.9% |

| Brazil | 17.6% |

The metamaterial absorbers materials market is projected to grow globally at a CAGR of 23.4% between 2025 and 2035, fueled by defense modernization, aerospace applications, and commercial electronics adoption. China leads with a CAGR of 31.6%, driven by significant investments in radar-absorbing technologies, next-generation stealth platforms, and domestic production capabilities. India follows at 29.3%, supported by defense sector expansion, indigenous fighter jet and UAV programs, and increasing procurement of advanced radar-absorbing solutions. France posts 24.6%, with adoption fueled by modernization of military aircraft, naval vessels, and collaboration with European defense contractors. The United Kingdom grows at 22.2%, shaped by naval and aerial stealth initiatives, experimental UAV projects, and integration of multilayer absorptive materials. The United States records 19.9%, reflecting steady adoption in defense platforms, commercial aerospace programs, and research-driven absorption technology development. The analysis spans over 40 countries, with these five serving as benchmarks for investment planning, production scaling, and strategic collaborations in the global metamaterial absorbers materials industry.

China is projected to post a CAGR of 31.6% for 2025–2035, significantly above the global baseline of 23.4%. During 2020–2024, the market grew at 27.1%, driven by early adoption in radar-absorbing composites for fighter jets, UAVs, and naval vessels. Domestic R&D programs, government-backed defense modernization, and collaborations with local materials manufacturers fueled initial uptake. The next decade will see higher growth due to increasing integration of multilayer metamaterial absorbers in stealth aircraft, electronic warfare platforms, and emerging commercial applications such as 5G infrastructure. Rising investments in production capacity, alongside technology transfers and scale-up of advanced composites, will support accelerated expansion.

India is expected to register a CAGR of 29.3% from 2025 to 2035, up from 24.1% during 2020–2024. Initial growth was supported by defense acquisitions for indigenous fighter jets and UAVs, limited stealth naval vessels, and tactical drones. Strategic partnerships with international contractors allowed technology transfer and local production scaling. The coming decade will see further acceleration as procurement volumes rise, absorption efficiency improves, and defense modernization drives higher integration across multiple platforms. Government policies emphasizing Make-in-India initiatives and offsets requirements encourage domestic adoption of radar-absorbing and metamaterial composites.

France is projected to achieve a CAGR of 24.6% between 2025 and 2035, compared with 20.5% during 2020–2024. Earlier growth arose from upgrades to fighter jets, naval stealth vessels, and experimental unmanned platforms, supported by domestic aerospace R&D. The acceleration in the next decade is expected due to broader adoption of multilayer absorptive coatings in next-generation defense aircraft and naval applications, integration of radar and infrared suppression systems, and scaling production for NATO-aligned export programs. The market benefits from close coordination with European defense consortia and advanced composite material suppliers.

The UK metamaterial absorbers materials market is projected to grow at a CAGR of 22.2% from 2025 to 2035, above the global 23.4% baseline in context but slightly lower than other top countries. Between 2020 and 2024, the CAGR was 18.7%, reflecting gradual adoption in stealth naval vessels, experimental UAVs, and defense R&D platforms. The subsequent decade shows acceleration due to expanded integration across air, land, and naval defense systems, stronger government procurement programs, and collaboration with European contractors to enhance absorptive performance. Technological refinements, higher volume production, and export opportunities are supporting growth.

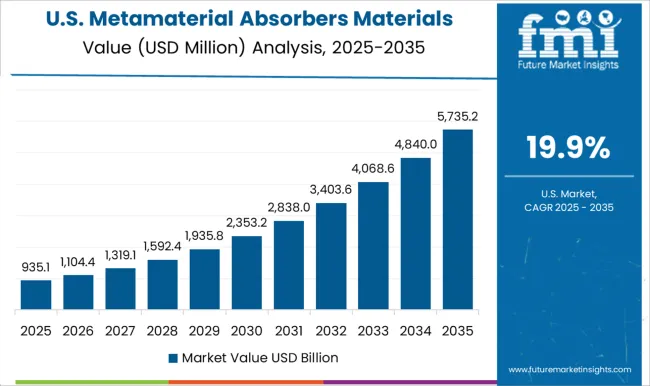

The United States is projected to grow at a CAGR of 19.9% during 2025–2035, up from 16.2% in 2020–2024. Initial growth was driven by adoption in legacy stealth aircraft, naval vessels, and defense contractor initiatives. Future growth is expected from next-generation fighter jets, UAVs, and strategic defense applications requiring multilayer absorptive materials. Large-scale domestic production, government R&D funding, and integration into experimental and tactical platforms will continue to accelerate market expansion. Exports of specialized stealth components to allied nations also contribute to overall dollar sales and share.

The metamaterial absorbers materials market features prominent players such as Metamaterial Technologies Inc., Kymeta Corporation, Pivotal Commware, Echodyne Corp., MetaShield LLC, Metalenz, Inc., Nanohmics Inc., TeraView Limited, and Metamagnetics, competing through proprietary designs, performance efficiency, and application versatility. Metamaterial Technologies Inc. leads with scalable radar-absorbing solutions for aerospace and defense, emphasizing high-performance, multi-layer absorptive composites. Kymeta Corporation focuses on satellite communication metamaterials, integrating electronically steerable antenna systems with lightweight absorptive coatings. Pivotal Commware leverages holographic beamforming and low-loss metamaterial designs to optimize signal control for defense and commercial communication platforms. Echodyne Corp. differentiates with compact radar systems enhanced by metamaterial arrays, supporting unmanned aerial systems and tactical applications.

MetaShield LLC provides advanced adaptive coatings for stealth and experimental platforms, emphasizing spectral selectivity and environmental resilience. Metalenz, Inc. specializes in optical metamaterials for sensor integration and imaging applications. Nanohmics Inc. delivers high-frequency metamaterial absorbers for radar and RF testing, while TeraView Limited focuses on terahertz-range metamaterials for spectroscopy and communications. Metamagnetics develops custom-engineered magnetic metamaterials for electromagnetic shielding and stealth applications. Competitive priorities include advancing material efficiency, scaling production, securing government contracts, and expanding adoption across defense, aerospace, and communication sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Frequency | Microwave, Terahertz, Infrared (IR), and Others |

| Material Type | Electromagnetic metamaterials, Photonic metamaterials, Chiral metamaterials, and Others |

| Application | Radar systems, Stealth technology, Wireless communication, Medical imaging, Solar energy harvesting, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Metamaterial Technologies Inc., Kymeta Corporation, Pivotal Commware, Echodyne Corp., MetaShield LLC, Metalenz, Inc., Nanohmics Inc., TeraView Limited, and Metamagnetics |

| Additional Attributes | Dollar sales, share, CAGR, application-wise adoption, regional demand, defense vs commercial usage, competitive landscape, new product launches, raw material costs, supplier networks, regulatory compliance, and technology integration trends. |

The global metamaterial absorbers materials market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the metamaterial absorbers materials market is projected to reach USD 11.1 billion by 2035.

The metamaterial absorbers materials market is expected to grow at a 23.4% CAGR between 2025 and 2035.

The key product types in metamaterial absorbers materials market are microwave, terahertz, infrared (ir) and others.

In terms of material type, electromagnetic metamaterials segment to command 48.0% share in the metamaterial absorbers materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metamaterial Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Shock Absorbers Market

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA